Market Overview

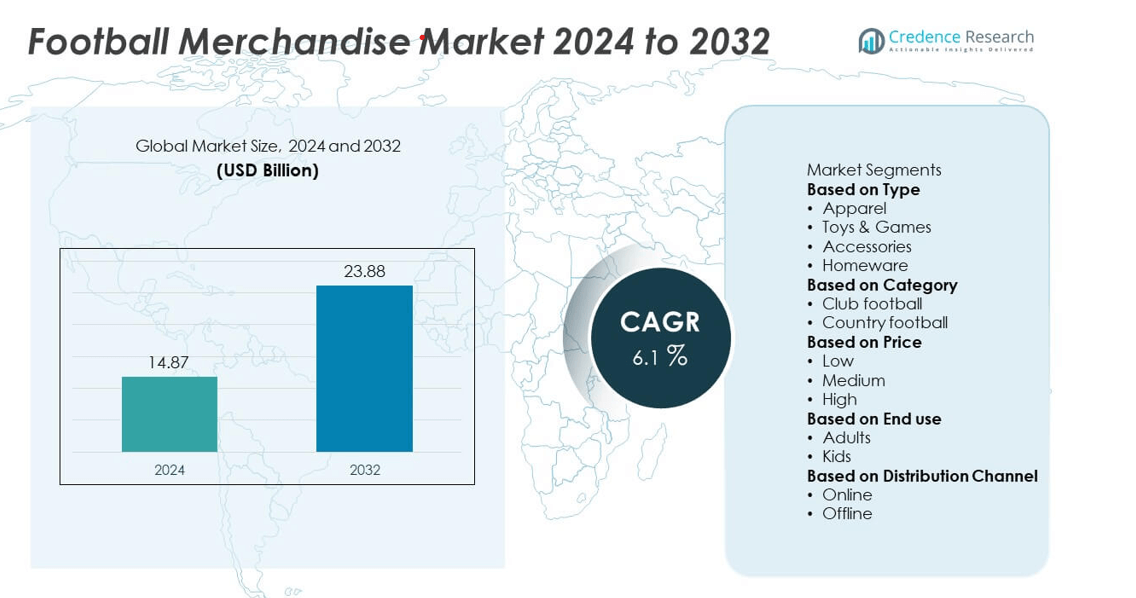

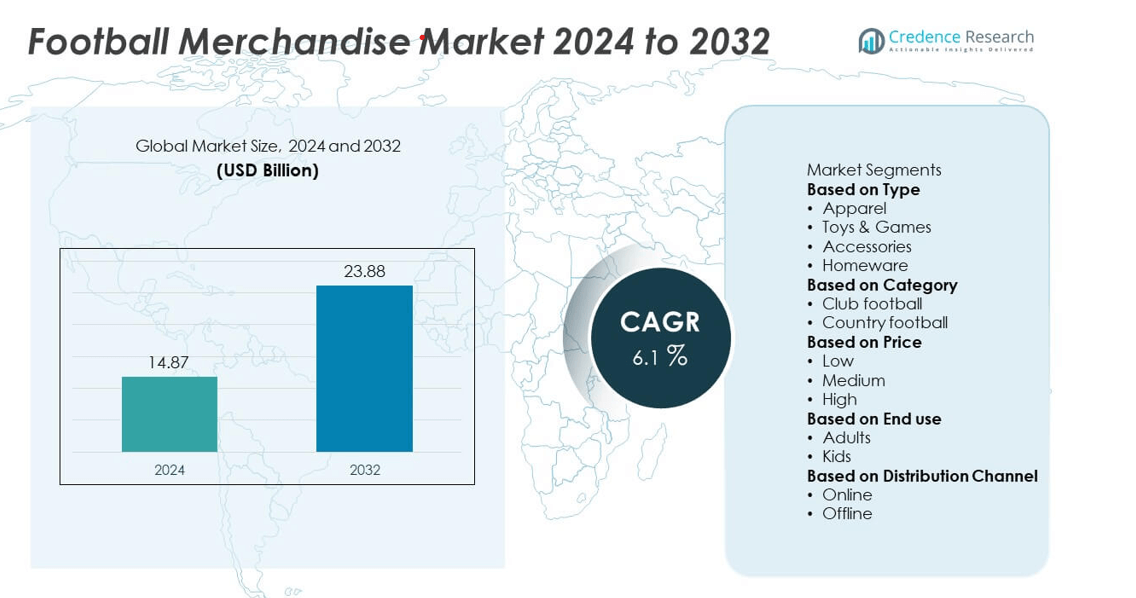

The Football Merchandise Market was valued at USD 14.87 billion in 2024 and is projected to reach USD 23.88 billion by 2032, expanding at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Football Merchandise Market Size 2024 |

USD 14.87 billion |

| Football Merchandise Market, CAGR |

6.1% |

| Football Merchandise Market Size 2032 |

USD 23.88 billion |

The football merchandise market is driven by top players including Joma Sport, Nike, Inc., Fanatics, Inc., Mitre Sports International, Adidas AG, Kappa, Hummel International, New Era Cap Co., Inc., Le Coq Sportif, and Diadora. These companies strengthen their positions through official kit deals, licensed partnerships, and strong global retail networks. Europe led the market in 2024 with 35% of global share, supported by the dominance of major leagues and club followership. North America accounted for 28% share, driven by growing fan engagement and e-commerce adoption, while Asia Pacific captured 22% share, emerging as the fastest-growing region due to rising disposable incomes, youth participation, and increasing accessibility to licensed merchandise.

Market Insights

- The football merchandise market was valued at USD 14.87 billion in 2024 and is projected to reach USD 23.88 billion by 2032, growing at a CAGR of 6.1% during the forecast period.

- Rising global popularity of football and strong fan engagement through leagues, tournaments, and sponsorships drive merchandise demand, with apparel holding over 50% share in 2024.

- Key trends include the surge of e-commerce platforms, eco-friendly merchandise launches, and collaborations between sportswear and fashion brands to attract younger consumers.

- The competitive landscape is led by Joma Sport, Nike, Adidas, Fanatics, Kappa, Hummel, Mitre Sports, New Era, Le Coq Sportif, and Diadora, who focus on licensed products, digital retail, and sustainability initiatives.

- Regionally, Europe led with 35% share, North America followed with 28%, and Asia Pacific accounted for 22%, positioning itself as the fastest-growing region due to rising disposable incomes and increasing accessibility to licensed merchandise.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Apparel dominated the football merchandise market in 2024, holding over 50% of total market share. Jerseys, training kits, and footwear remain the most purchased items, driven by fan loyalty and the growing popularity of football worldwide. Major clubs and national teams generate significant revenue through apparel sales, particularly during tournaments and league seasons. Collaborations with global sportswear brands and limited-edition releases further enhance demand. Toys & games, accessories, and homeware continue to expand, but apparel remains the core revenue generator due to its strong cultural and emotional connection with fans.

- For instance, Fanatics generated an estimated $7 billion in total revenue in 2023, with its core Fanatics Commerce division being the largest contributor.

By Category

Club football led the market in 2024 with around 65% share, supported by the global popularity of major leagues such as the English Premier League, La Liga, and Bundesliga. Fans consistently purchase club jerseys, scarves, and memorabilia to showcase loyalty and affiliation. Marketing campaigns, global fan bases, and sponsorship deals further boost demand in this segment. Country football, while smaller in share, sees spikes during international tournaments such as the FIFA World Cup and UEFA European Championship, where national pride drives significant merchandise sales.

- For instance, Nike provided the kits for the France national team at the 2022 FIFA World Cup, with reports highlighting a high demand for French football merchandise. The team’s strong performance likely contributed to this demand, with one analysis of U.S. sales during the tournament suggesting that Nike was selling merchandise faster and at a higher price point than Adidas.

By Price

The medium price range dominated the football merchandise market in 2024, capturing over 45% share. This segment balances affordability with quality, appealing to the largest base of football fans across developed and emerging economies. Official club kits and licensed products in this range remain accessible while retaining authenticity, which strengthens consumer trust. Low-priced merchandise continues to attract younger and cost-conscious buyers, while high-priced categories, including premium memorabilia and limited-edition collectibles, cater to niche consumers and collectors. The medium segment’s mass appeal ensures its continued leadership in the market.

Key Growth Drivers

Rising Popularity of Football Worldwide

The growing global fan base of football is a primary driver of the football merchandise market. Major leagues such as the English Premier League, La Liga, and international tournaments like the FIFA World Cup and UEFA Champions League attract millions of fans, boosting demand for jerseys, accessories, and memorabilia. Clubs and federations leverage broadcasting rights and sponsorship deals to expand their reach, creating consistent demand for merchandise. The rise of youth participation in football further strengthens long-term market growth and merchandise consumption.

- For instance, Adidas sold more than 2 million Germany national team jerseys during the 2014 FIFA World Cup, which was the highest-selling national team jersey. The company sold more than 8 million jerseys in total across all sponsored teams that year, demonstrating how major tournaments drive apparel demand on a global scale.

Expanding E-Commerce and Online Retail Channels

The rapid growth of e-commerce platforms has transformed access to football merchandise globally. Fans now purchase official products directly from club websites, online sports retailers, and global e-commerce platforms. This accessibility enables international supporters to engage with their favorite clubs and national teams. Exclusive online launches, digital marketing campaigns, and direct-to-consumer strategies further boost sales. With increasing smartphone penetration and secure digital payment systems, online retail is expected to remain a key growth driver for the football merchandise market.

- For instance, Manchester United achieved record e-commerce revenues in fiscal year 2022, alongside generating over 2.8 billion digital interactions across all platforms and reaching more than 220 markets with its app, highlighting how e-commerce and digital engagement extend global reach for football merchandise.

Increased Fan Engagement and Brand Collaborations

Rising collaborations between football clubs, national teams, and global sportswear brands fuel merchandise demand. Partnerships with Nike, Adidas, and Puma result in limited-edition kits, fanwear, and collectible items. Clubs also partner with lifestyle and fashion brands to diversify product ranges, attracting younger and style-conscious consumers. Social media campaigns and celebrity endorsements further drive fan engagement and merchandise sales. This growing intersection between sport, fashion, and entertainment continues to push the football merchandise market forward, expanding both reach and consumer appeal.

Key Trends & Opportunities

Shift Toward Licensed and Authentic Products

Consumers are increasingly demanding officially licensed and authentic football merchandise to ensure quality and brand association. Clubs and federations have responded with improved distribution strategies, hologram tagging, and exclusive retail partnerships to reduce counterfeit risks. This trend creates opportunities for official partners to strengthen brand loyalty and increase revenue streams. Licensed products, particularly jerseys and collectibles, dominate sales during major tournaments, reflecting the rising importance of authenticity in consumer purchasing behavior.

- For instance, Nike uses RFID-enabled tags in its apparel and footwear to track inventory and ensure authenticity, as confirmed by its then-CEO in a June 2019 conference call. This technology helps manage supply chains and verify products.

Sustainability and Eco-Friendly Merchandise

The trend toward sustainable products is reshaping the football merchandise market. Leading sportswear brands are developing eco-friendly jerseys made from recycled polyester and organic cotton. Clubs are increasingly marketing sustainability initiatives, appealing to environmentally conscious fans. This opportunity aligns with global climate action goals while opening new consumer segments. Eco-friendly fanwear, accessories, and packaging are expected to grow, creating a competitive edge for clubs and brands that prioritize sustainability in their merchandise portfolios.

- For instance, Adidas manufactured more than 5.5 million football jerseys using recycled ocean plastic under its Parley for the Oceans initiative, including kits for Real Madrid and Bayern Munich, proving large-scale adoption of sustainable materials in sports merchandise.

Key Challenges

High Prevalence of Counterfeit Merchandise

The widespread availability of counterfeit products remains a significant challenge in the football merchandise market. Fake jerseys and accessories are often sold at lower prices, undermining official sales and damaging brand reputation. Despite anti-counterfeiting measures like holograms and exclusive licensing agreements, counterfeit trade continues to thrive, especially in developing markets. This issue impacts revenue generation for clubs and official partners while limiting the growth potential of licensed merchandise. Combating counterfeits requires stricter enforcement, consumer awareness, and stronger retail partnerships.

Seasonal and Tournament-Dependent Sales Fluctuations

The football merchandise market experiences strong seasonality, with sales peaking during major tournaments and league seasons but dropping significantly in off-season periods. Demand heavily relies on club performance, player transfers, and international competitions. This creates unpredictability in revenue streams for manufacturers and retailers. Smaller clubs and regions with fewer international tournaments face greater challenges in maintaining consistent merchandise sales. Developing year-round engagement strategies and lifestyle-oriented products is essential to address this seasonal dependency and stabilize market growth.

Regional Analysis

North America

North America held 28% of the global football merchandise market share in 2024, supported by growing fan bases of international leagues and rising popularity of Major League Soccer (MLS). The U.S. leads regional demand, with strong merchandise sales driven by global club followership and local league expansion. E-commerce channels play a vital role, allowing fans to access official products of European and South American clubs. Rising youth participation in football and upcoming events like the FIFA World Cup 2026 further strengthen merchandise demand. Canada and Mexico also contribute significantly, driven by active football cultures and international tournament participation.

Europe

Europe accounted for 35% of the football merchandise market share in 2024, making it the largest regional contributor. The presence of leading clubs in the Premier League, La Liga, Bundesliga, and Serie A drives robust merchandise sales. Fan loyalty, combined with club rivalries, fuels continuous demand for jerseys, scarves, and collectibles. The region also benefits from extensive retail networks and official club stores, supported by global sportswear partnerships. National team merchandise further spikes during major tournaments such as the UEFA European Championship. Europe’s strong football heritage ensures consistent growth, keeping the region at the forefront of merchandise revenues.

Asia Pacific

Asia Pacific captured 22% of the global football merchandise market share in 2024, emerging as the fastest-growing region. Rising football viewership in China, India, and Japan, along with the growing influence of European clubs in regional markets, drives merchandise demand. Increasing middle-class income levels and expanding online retail channels make official products more accessible. International clubs’ pre-season tours and marketing campaigns in Asia further strengthen fan engagement. The popularity of global tournaments, along with the rise of local football leagues, ensures continued growth. Asia Pacific’s large youth population provides a strong base for long-term merchandise expansion.

Latin America

Latin America represented 9% of the football merchandise market share in 2024, driven by the region’s deep-rooted football culture and passion for both club and national teams. Brazil and Argentina lead regional demand, with strong sales of jerseys and collectibles for both local clubs and global stars. Fan loyalty to national teams creates spikes during Copa América and FIFA World Cup events. Despite economic fluctuations, affordable merchandise and growing e-commerce adoption support steady growth. Local clubs are also enhancing partnerships with global brands, expanding product availability, and boosting official sales across regional and international markets.

Middle East & Africa

The Middle East & Africa accounted for 6% of the global football merchandise market share in 2024, fueled by rising interest in international football and hosting of high-profile events. Qatar’s hosting of the FIFA World Cup 2022 boosted regional merchandise sales and created long-term fan engagement. Countries like Saudi Arabia and the UAE are investing heavily in football clubs and international partnerships, driving increased merchandise adoption. In Africa, fan loyalty to European clubs such as Manchester United, Real Madrid, and Barcelona strengthens demand. Expanding online retail access and rising youth engagement further support steady growth in the region.

Market Segmentations:

By Type

- Apparel

- Toys & Games

- Accessories

- Homeware

By Category

- Club football

- Country football

By Price

By End use

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the football merchandise market is shaped by leading players such as Joma Sport, Nike, Inc., Fanatics, Inc., Mitre Sports International, Adidas AG, Kappa, Hummel International, New Era Cap Co., Inc., Le Coq Sportif, and Diadora. These companies maintain dominance through extensive product portfolios, global distribution networks, and strong partnerships with clubs, leagues, and national teams. Global giants like Nike and Adidas drive market leadership through official kit deals and high-profile sponsorships, while Fanatics focuses on digital retail platforms to expand accessibility. Regional brands such as Joma, Hummel, and Kappa strengthen their positions by serving niche markets and building partnerships with smaller clubs and federations. Companies are also prioritizing sustainability by introducing eco-friendly jerseys and merchandise lines. The market is further influenced by growing collaborations between sportswear brands and fashion labels, as well as rising investment in e-commerce and licensed merchandise to meet evolving consumer demand worldwide.

Key Player Analysis

- Joma Sport

- Nike, Inc.

- Nike, Inc.

- Fanatics, Inc.

- Mitre Sports International

- Adidas AG

- Kappa

- Hummel International

- New Era Cap Co., Inc.

- Le Coq Sportif

- Diadora

Recent Developments

- In August 2025, Adidas AG and Liverpool FC launched new home and away kits for the 2025/26 season, renewing their collaboration and bringing new designs to fans.

- In May 2025, Nike, Inc. launched its 2025 National Team football kits using Dri-FIT ADV material, with new mesh and ribbed zones tailored using body-mapping data.

- In 2025, Nike and the NFL introduced the 2025 Rivalries uniforms along with related fan merchandise (jerseys, hoodies, headwear), to be sold globally starting September 10.

Report Coverage

The research report offers an in-depth analysis based on Type, Category, Price, End use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising global fan engagement and football’s expanding reach.

- Apparel will remain the dominant merchandise category supported by official kit sales.

- E-commerce platforms will drive accessibility and boost international merchandise sales.

- Licensed and authentic products will gain more traction as consumers avoid counterfeits.

- Collaborations between sportswear and fashion brands will attract younger demographics.

- Sustainability will shape future merchandise with eco-friendly jerseys and accessories.

- Asia Pacific will remain the fastest-growing region due to rising incomes and youth participation.

- Europe will continue to lead the market, supported by strong club loyalty.

- Seasonal spikes during tournaments like the FIFA World Cup will boost revenues.

- Digital fan engagement and exclusive online launches will enhance brand visibility and sales.