Market overview

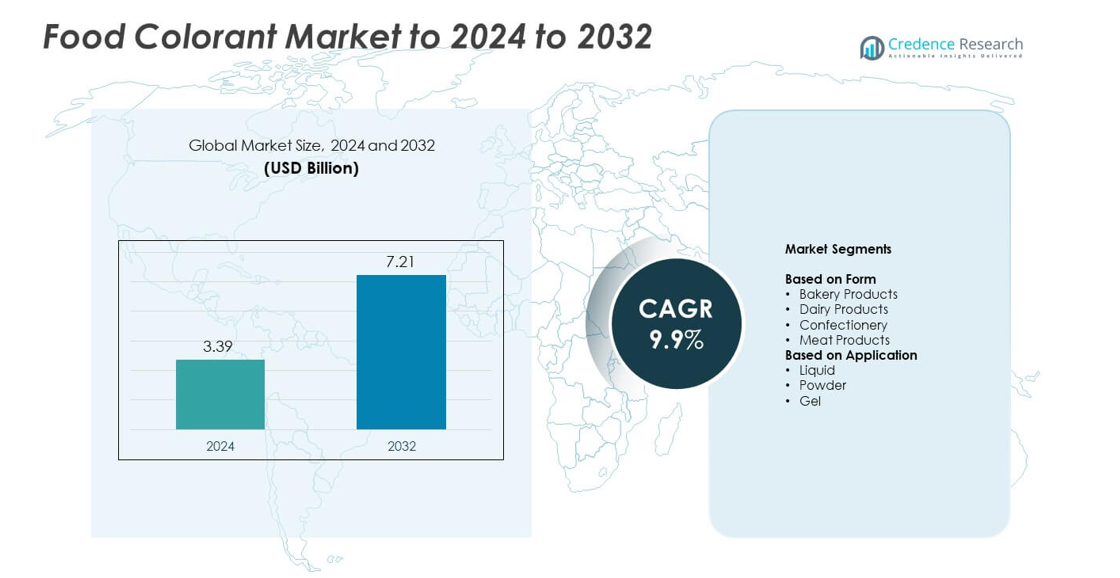

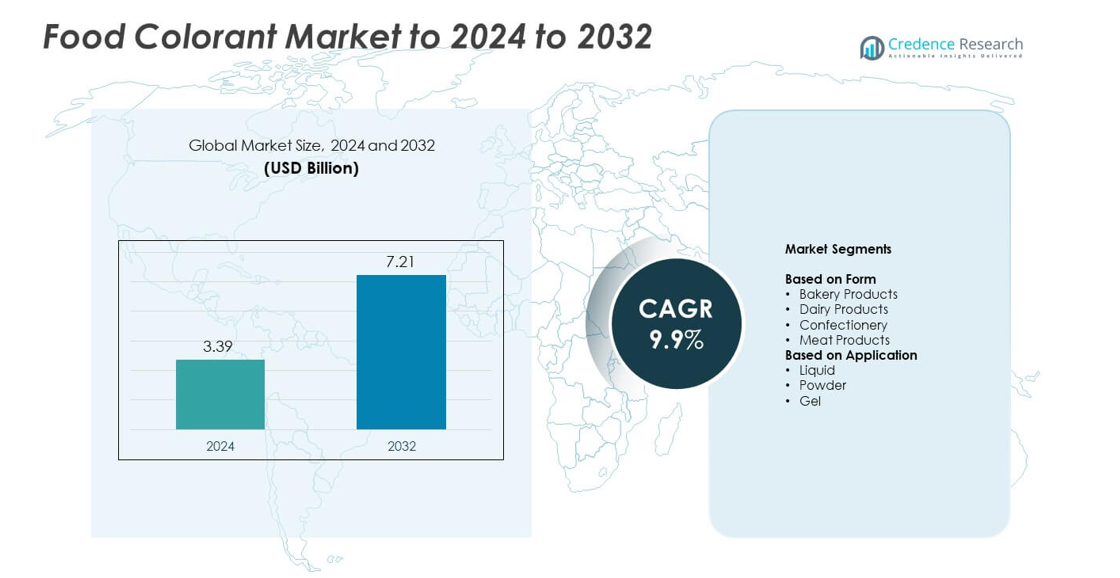

Food Colorant Market size was valued USD 3.39 Billion in 2024 and is anticipated to reach USD 7.21 Billion by 2032, at a CAGR of 9.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Colorant Market Size 2024 |

USD 3.39 Billion |

| Food Colorant Market, CAGR |

9.9% |

| Food Colorant Market Size 2032 |

USD 7.21 Billion |

The food colorant market is driven by major players such as DSM-Firmenich, Sensient Technologies, Kerry Group, McCormick and Company, Givaudan, Chr. Hansen, BASF, Roha Dyechem, Oterra, and Tate and Lyle. These companies lead through innovation in natural pigment extraction, sustainable sourcing, and clean-label formulations. They focus on expanding production capabilities, strategic mergers, and regional distribution to strengthen global reach. North America dominated the market with a 33% share in 2024, supported by advanced food processing industries and strong consumer demand for natural colorants, followed by Europe and Asia-Pacific as key growth regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The food colorant market was valued at USD 3.39 billion in 2024 and is projected to reach USD 7.21 billion by 2032, expanding at a CAGR of 9.9% during the forecast period.

- Market growth is driven by rising demand for natural and plant-based colorants in processed foods and beverages, supported by clean-label consumer preferences.

- Key trends include technological advances in microencapsulation, bio-based pigment production, and expansion of functional food applications using natural colors.

- The market is highly competitive, with players focusing on sustainable sourcing, strategic acquisitions, and regional manufacturing expansion to strengthen market presence.

- North America led with a 33% share in 2024, followed by Europe with 29% and Asia-Pacific with 27%; bakery products held the largest segment share of 36%, supported by strong consumption across both developed and emerging economies.

Market Segmentation Analysis:

By Form

The bakery products segment dominated the food colorant market with a 36% share in 2024. This leadership is driven by rising demand for vibrant and visually appealing bakery goods such as cakes, pastries, and biscuits. The growing use of natural pigments like carotenoids, anthocyanins, and chlorophyll in baked items supports clean-label trends. Manufacturers are expanding product lines with organic and plant-based colorants to meet consumer preference for natural ingredients. Increased bakery production in emerging economies and premiumization in confectionery-style baked foods further strengthen segment growth.

- For instance, Sensient’s SupraRed kept red shades in bakery at pH 5–7 during heat steps, addressing anthocyanin shift in that range.

By Application

The liquid segment held the largest share of 41% in the food colorant market in 2024. Its dominance stems from wide adoption in beverages, dairy, and processed food applications that require uniform color dispersion. Liquid colorants offer superior solubility, easy blending, and consistent hue, making them preferred in large-scale food manufacturing. The rising demand for ready-to-drink beverages and dairy-based desserts enhances liquid usage. Ongoing innovation in water-soluble natural extracts and stable emulsions supports broader application across clean-label and plant-based product categories.

- For instance, Lycored’s GoldHold A Dry held color for 12 months (extended to 18+ months) at 0.1% dosage and remained acceptable up to 37.5% alcohol in beverage tests.

Key Growth Drivers

Rising Demand for Natural and Clean-Label Ingredients

The shift toward natural food colorants is a key growth driver. Consumers are increasingly rejecting synthetic additives in favor of plant-based pigments like beetroot red, turmeric, and spirulina blue. Food manufacturers are reformulating products to meet regulatory and consumer expectations for clean labels. The growing use of natural dyes in bakery, beverages, and dairy sectors supports higher market adoption. Continuous innovation in extraction and stabilization technologies further enhances the performance and shelf life of natural colorants.

- For instance, Kalsec’s Durabrite high-stability technology significantly extends the shelf life of its natural colorants. When compared to competitor samples in accelerated light-exposure tests, Kalsec’s Carrot Oleoresin Durabrite has been shown to offer up to 6 times longer shelf life in certain applications.

Expansion of Processed and Packaged Food Consumption

Rapid urbanization and lifestyle changes have driven a surge in demand for packaged and processed foods, supporting colorant usage. Food colorants enhance visual appeal and consistency across large-scale production, making them vital in snacks, ready meals, and confectionery products. The growth of quick-service restaurants and e-commerce food delivery platforms further accelerates consumption. The need for attractive, shelf-stable, and high-quality food products continues to boost colorant integration in processed food formulations.

- For instance, Sethness Roquette’s Class II caramel color (2100) shows alcohol solubility up to 65%, and its Class IV options are used for low-pH soft drinks—supporting high-volume processed beverages.

Technological Advancements in Formulation and Stability

Advancements in microencapsulation, emulsification, and extraction techniques are improving color stability, solubility, and thermal resistance. These innovations allow manufacturers to use natural pigments in a wider range of applications, including high-temperature processing. Developments in water-dispersible and oil-soluble colorants also enhance compatibility across different food matrices. Improved formulation efficiency and cost optimization make premium natural colors more accessible to mainstream brands, further strengthening market expansion.

Key Trends & Opportunities

Shift Toward Plant-Based and Functional Products

The rising popularity of plant-based and functional foods presents a major opportunity for food colorant suppliers. Natural pigments derived from fruits, vegetables, and algae align with consumer preference for sustainable and health-oriented products. Colorants are being used not only for aesthetics but also for nutritional benefits, such as antioxidant properties in anthocyanin-based colors. This convergence of health and visual appeal is driving innovation and product diversification across multiple food categories.

- For instance, GNT’s EXBERRY® portfolio draws from more than 30 fruits, vegetables, and plants, aligning plant-based launches with broad shade coverage.

Expansion in Emerging Markets and Regulatory Support

Emerging economies in Asia-Pacific and Latin America are creating strong growth opportunities due to expanding food manufacturing bases and changing dietary patterns. Government initiatives supporting natural ingredient adoption are accelerating market penetration. The easing of import regulations and increased investment in local production facilities enable global colorant brands to strengthen regional presence. Expanding retail networks and growing consumer awareness of natural ingredients further amplify demand in these regions.

- For instance, Oterra opened a color blending and application center in Kochi in February 2025, staffing 120 roles to serve India, APAC, and Middle East demand.

Key Challenges

High Production Costs of Natural Colorants

The production and extraction of natural pigments involve complex and costly processes compared to synthetic alternatives. Factors such as limited raw material availability, seasonality, and sensitivity to heat and light increase manufacturing expenses. These costs restrict scalability and pose challenges for small and mid-sized food companies. Ongoing R&D aims to lower production costs through sustainable sourcing and biotechnological synthesis, but pricing remains a major market restraint.

Regulatory and Stability Constraints

Regulatory variations across countries and stability issues under different processing conditions hinder market expansion. Natural colorants often exhibit lower pH and heat stability, limiting their use in certain applications. Compliance with food safety standards such as FDA and EFSA approvals adds complexity for manufacturers. Maintaining color consistency in global supply chains also presents challenges. Addressing these factors through improved formulations and harmonized regulations is crucial for sustainable market growth.

Regional Analysis

North America

North America held the largest share of 33% in the food colorant market in 2024. The region’s growth is supported by high consumption of processed foods, confectionery, and dairy products. Rising adoption of natural and plant-based colorants, driven by consumer health awareness and FDA-approved formulations, boosts market demand. Strong investments by food manufacturers in clean-label product lines and technological improvements in pigment stabilization enhance the market presence. The U.S. dominates regional growth due to its established food processing sector and rapid adoption of sustainable colorant innovations across bakery and beverage applications.

Europe

Europe accounted for a 29% share of the global food colorant market in 2024. The region’s strict regulatory framework from EFSA promotes the use of natural ingredients, reducing reliance on synthetic additives. Growing consumer preference for organic and additive-free foods has encouraged food processors to invest in plant-derived pigments. Major food manufacturing hubs in Germany, France, and the U.K. contribute to significant consumption. The increasing use of carotenoids and anthocyanins in bakery, dairy, and confectionery sectors supports continuous market expansion across Europe.

Asia-Pacific

Asia-Pacific captured a 27% share of the food colorant market in 2024, driven by rising demand from emerging economies like China, India, and Japan. Expanding processed food industries and shifting consumer preferences toward packaged and functional foods strengthen regional growth. Rapid industrialization and growing urban populations enhance consumption of bakery and beverage products, increasing colorant demand. The region benefits from abundant natural pigment sources and low-cost production capabilities, attracting international investments. Innovation in algae-based and fruit-derived colorants further fuels the regional market expansion.

Latin America

Latin America held an 8% share in the global food colorant market in 2024. The region benefits from the expanding food and beverage processing industry and growing export of natural pigments. Countries such as Brazil and Mexico are key contributors, supported by increasing adoption of clean-label and natural formulations. Favorable climatic conditions for cultivating raw materials like annatto and paprika enhance regional pigment production. Rising consumer awareness about food quality and visual appeal continues to drive the demand for both natural and synthetic food colorants in Latin America.

Middle East & Africa

The Middle East & Africa accounted for a 3% share of the global food colorant market in 2024. Market growth is driven by rising urbanization, increasing consumption of processed foods, and expanding retail networks. The region is witnessing growing imports of natural colorants due to limited local production capabilities. GCC countries are leading adoption, supported by a surge in bakery, confectionery, and beverage demand. Investments in food processing infrastructure and government initiatives promoting food manufacturing diversification further contribute to regional growth opportunities.

Market Segmentations:

By Form

- Bakery Products

- Dairy Products

- Confectionery

- Meat Products

By Application

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The food colorant market is highly competitive, with key players such as DSM-Firmenich, Sensient Technologies, Kerry Group, McCormick and Company, Givaudan, Chr. Hansen, BASF, Roha Dyechem, Oterra, Tate and Lyle, Naturex, ColorMaker, Eckart, Mayang, Sethness Greenleaf, and Feminex driving innovation and global presence. The competition focuses on product innovation, sustainable sourcing, and clean-label formulation to meet rising demand for natural ingredients. Companies are investing in R&D to develop advanced pigment extraction, encapsulation, and stabilization technologies that enhance performance in varied food applications. Strategic mergers, acquisitions, and partnerships are strengthening market reach and manufacturing capabilities. Firms are expanding regional production facilities to optimize cost efficiency and ensure consistent supply. The shift toward bio-based and regulatory-compliant colorants is reshaping strategies, with manufacturers prioritizing eco-friendly and plant-derived alternatives. Continuous product diversification and adherence to global food safety standards remain central to sustaining competitiveness in this dynamic market landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DSM-Firmenich

- Sensient Technologies

- Kerry Group

- McCormick and Company

- Givaudan

- Hansen

- BASF

- Roha Dyechem

- Oterra

- Tate and Lyle

- Naturex

- ColorMaker

- Eckart

- Mayang

- Sethness Greenleaf

- Feminex

Recent Developments

- In 2025, Oterra opened a new color blending and application center in Kerala, India, to better serve customers in the Indian, Asia-Pacific, and Middle East markets.

- In 2024, Givaudan launched Amaize orange-red, a natural, corn-based anthocyanin color, at IFT 2024 to mimic the shade of the synthetic Red 40.

- In 2024, DSM-Firmenich Announced Peach+ as its “Flavor of the Year,” a concept inspired by the Pantone Color of the Year.

Report Coverage

The research report offers an in-depth analysis based on Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for natural and plant-based colorants will continue to rise globally.

- Clean-label food trends will drive innovation in extraction and stabilization technologies.

- Manufacturers will invest in cost-effective production of natural pigments through biotechnology.

- Expanding processed and functional food consumption will sustain steady colorant demand.

- Asia-Pacific will emerge as the fastest-growing regional market due to rising food processing activities.

- Regulatory harmonization across regions will support smoother product approvals and trade.

- Advancements in microencapsulation will enhance pigment stability and heat resistance.

- Strategic mergers and partnerships will strengthen global supply chain capabilities.

- Increasing consumer preference for sustainable and organic ingredients will shape new product launches.

- Growth in e-commerce and packaged food distribution will expand market penetration for colorant applications.