Market Overview

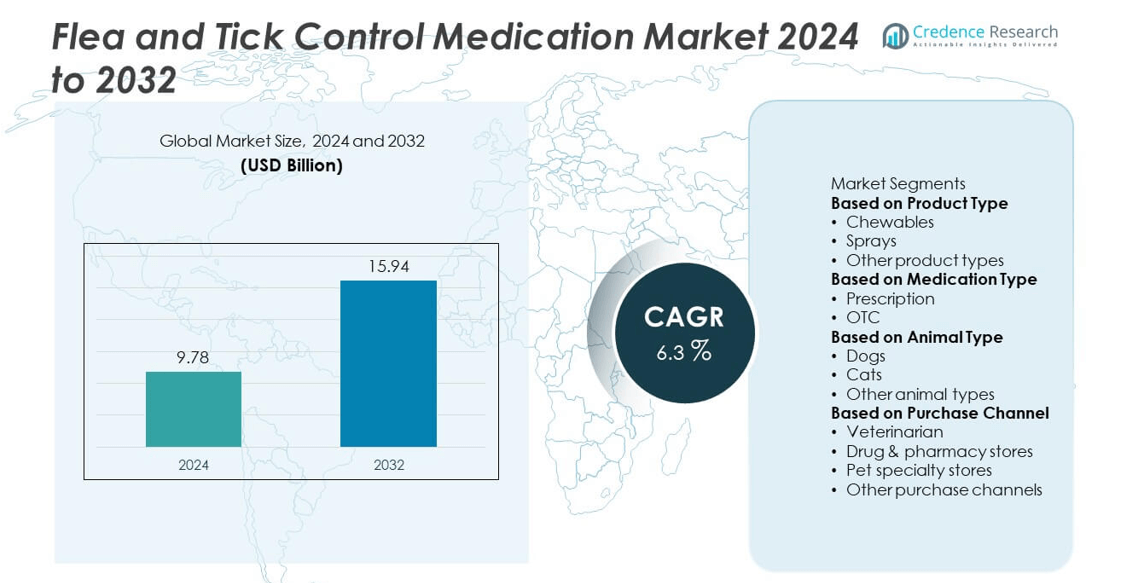

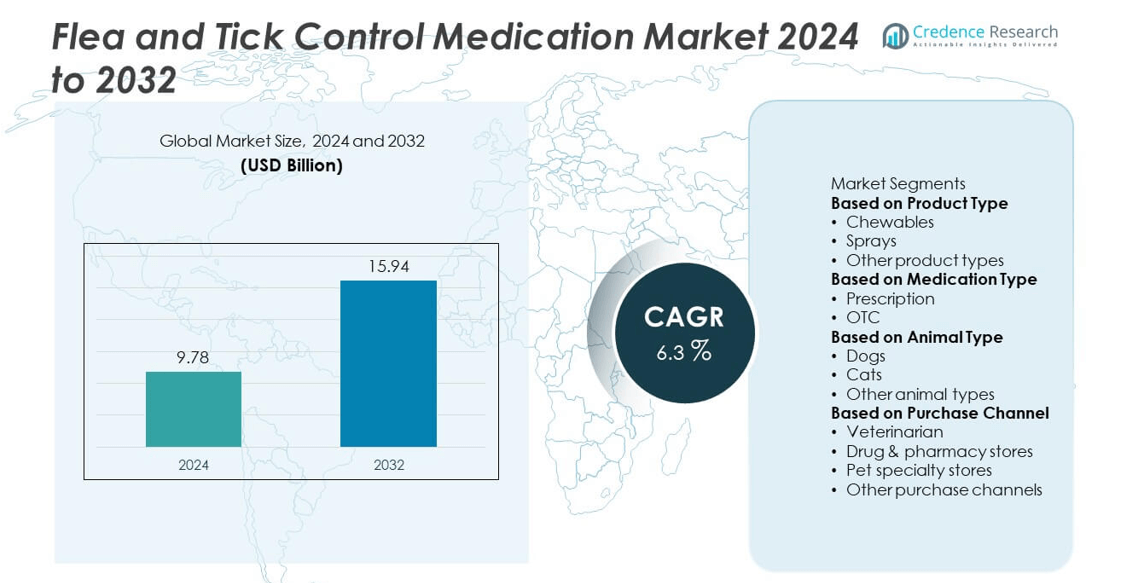

The global flea and tick control medication market was valued at USD 9.78 billion in 2024 and is projected to reach USD 15.94 billion by 2032, growing at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flea and Tick Control Medication Market Size 2024 |

USD 9.78 billion |

| Flea and Tick Control Medication Market, CAGR |

6.3% |

| Flea and Tick Control Medication Market Size 2032 |

USD 15.94 billion |

The flea and tick control medication market is driven by leading players including Bayer AG, Boehringer Ingelheim International GmbH, Elanco Animal Health Incorporated, Merck & Co., Inc., Ceva Santé Animale, Hartz Mountain Corporation, Central Garden & Pet Company, Central Life Sciences, Penn Veterinary Supply, Inc., and Ecto Development LLC. These companies dominate through extensive product portfolios, strong veterinary networks, and continuous innovation in chewable and long-acting formulations. Regionally, North America leads with over 40% share in 2024, supported by high pet ownership, advanced veterinary infrastructure, and strong consumer spending on premium pet care. Europe follows with more than 25% share, benefiting from stringent veterinary regulations and established preventive healthcare practices. Asia-Pacific, holding nearly 20% share, is the fastest-growing region, driven by rising disposable incomes, increasing pet adoption, and expanding e-commerce distribution channels. This combination of strong players and regional growth patterns underscores a highly competitive and expanding global market.

Market Insights

- The flea and tick control medication market was valued at USD 9.78 billion in 2024 and is projected to reach USD 15.94 billion by 2032, growing at a CAGR of 6.3% during the forecast period.

- Rising pet ownership, growing expenditure on pet health, and increasing awareness of zoonotic diseases are the key drivers fueling demand for effective flea and tick control solutions across both developed and emerging markets.

- Market trends highlight strong growth in chewables, which held over 45% share in 2024, and a shift toward prescription medications, which accounted for over 55% of revenue, supported by veterinarian recommendations and advanced formulations.

- The competitive landscape includes key players such as Bayer AG, Boehringer Ingelheim, Elanco Animal Health, Merck & Co., and Ceva Santé Animale, with a focus on product innovation, strategic alliances, and global distribution expansion.

- Regionally, North America led with over 40% share in 2024, followed by Europe with more than 25% and Asia-Pacific at nearly 20%, while Latin America and the Middle East & Africa together contributed the remaining market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Chewables dominated the flea and tick control medication market in 2024, accounting for over 45% share. Their leadership is driven by ease of administration, longer-lasting protection, and higher pet owner compliance compared to sprays and other products. Chewable formulations often provide month-long protection, reducing the risk of missed doses. Growing availability of flavored and palatable options further supports adoption. Sprays and other product types continue to serve niche needs, but rising preference for convenience and effectiveness strengthens chewables’ dominance in both developed and emerging pet care markets.

- For instance, Elanco’s Credelio Quattro is a monthly chewable tablet for dogs that protects against six types of parasites: ticks, fleas, heartworm disease, roundworms, hookworms, and three species of tapeworms. Clinical studies have shown its effectiveness against these parasites, with protection confirmed to last for 30 days.

By Medication Type

Prescription medications held the largest share of the market in 2024, contributing over 55% of revenue. Their dominance stems from stronger efficacy, veterinarian recommendations, and ability to address severe infestations in both dogs and cats. Prescription drugs also cover a broader spectrum of parasites, which enhances trust among pet owners. OTC products remain significant for preventative use and affordability, but increasing veterinary visits and advanced treatment needs sustain prescription medications’ lead. Regulatory approvals for new oral and topical formulations continue to reinforce this segment’s growth.

- For instance, Merck Animal Health’s Bravecto Quantum injectable offers 12-month flea and tick protection, with clinical trials confirming sustained efficacy across more than 600 treated dogs in the U.S. and Europe.

By Animal Type

Dogs represented the largest segment in 2024, capturing around 60% of the flea and tick control market. Their dominance reflects higher ownership levels, greater outdoor exposure, and more frequent parasite risks compared to cats and other animals. Dog owners also spend more on preventive care, driving strong demand for premium chewables and prescription solutions. Cats account for a notable share, but product administration challenges often limit uptake. Other animal types, such as small mammals, remain a minor category. Rising pet adoption rates and owner awareness continue to drive strong demand in the dog segment.

Key Growth Drivers

Rising Pet Ownership and Expenditure

The growing global pet population is a major driver for flea and tick control medications. Rising adoption of dogs and cats, particularly in urban households, has fueled demand for preventive healthcare solutions. According to pet industry associations, pet care spending has consistently increased, with a notable share allocated to parasite prevention. Owners are more willing to invest in premium and long-lasting treatments, boosting market growth. This trend is reinforced by the humanization of pets, where families treat companion animals as integral members requiring consistent healthcare.

- For instance, Boehringer Ingelheim’s NexGard portfolio, including its popular chewables for dogs, experienced strong growth in 2023, with net sales reaching €1.2 billion and contributing significantly to the company’s Animal Health business.

Increased Awareness of Zoonotic Diseases

Growing awareness of the risks posed by parasites, such as Lyme disease, ehrlichiosis, and tapeworm infections, drives demand for flea and tick control medications. Veterinarians emphasize early prevention, as parasite infestations can cause serious health risks for both pets and humans. Public campaigns and veterinary guidelines highlight the importance of year-round protection, not just during peak seasons. As consumers recognize the link between pet health and family well-being, adoption of effective flea and tick solutions continues to rise, strengthening this segment of the pet healthcare market.

- For instance, Ceva Santé Animale’s Vectra 3D has been tested on more than 700 dogs in controlled trials, proving rapid kill of vectors like Phlebotomus perniciosus, which transmit zoonotic leishmaniasis in Europe.

Advancements in Product Innovation

Innovations in formulations and delivery methods are a major growth driver in this market. Chewable tablets, topical spot-ons, and extended-release medications provide easier administration and longer protection compared to traditional sprays. Companies are introducing flavored, palatable chewables to improve compliance among pets, while also expanding combination treatments that target multiple parasites simultaneously. Continuous R&D investments support development of safer, more effective products, ensuring stronger market penetration. As consumer preference shifts toward convenience and efficacy, innovative product launches play a crucial role in boosting overall demand.

Key Trends and Opportunities

Shift Toward Oral and Long-Acting Formulations

Oral chewables and long-acting medications are gaining strong traction as they reduce dosing frequency and improve compliance. Pet owners increasingly prefer treatments that provide month-long or multi-month protection without the need for frequent reapplication. This trend also benefits veterinarians, who recommend long-duration solutions for better pet health outcomes. The convenience factor, combined with higher efficacy rates, makes chewables a leading product category. This opportunity is expected to expand further as manufacturers continue to innovate with safer and more palatable oral products for both dogs and cats.

- For instance, Bayer’s Seresto collar has been distributed in over 100 million units globally, offering up to eight months of continuous flea and tick protection through a controlled-release technology tested across multiple companion animal trials.

Expansion in Emerging Markets

Emerging markets such as Asia-Pacific and Latin America present significant opportunities for flea and tick control medication manufacturers. Rising disposable incomes, increasing pet adoption rates, and expanding veterinary infrastructure drive strong growth potential in these regions. Awareness campaigns and distribution network expansion by key companies are making advanced treatments more accessible. Market penetration in these regions remains relatively low compared to North America and Europe, highlighting untapped potential. Companies investing in localized manufacturing and affordable formulations stand to gain competitive advantages in these fast-growing markets.

- For instance, Elanco consolidated its Latin American manufacturing operations, moving production from a former Bayer site in Belford Roxo, Brazil, to its facility in Santa Clara, Mexico, and to a contract manufacturer in Brazil to meet regional demand.

Key Challenges

Regulatory Compliance and Approval Delays

The flea and tick control medication market faces challenges from stringent regulatory frameworks. Each new formulation must undergo extensive safety and efficacy testing, which extends approval timelines. Variations in regulations across different regions further complicate market entry for global players. Delays in product launches can hinder growth and limit responsiveness to evolving parasite resistance. Compliance costs also increase R&D investments, raising overall development expenses. Companies must balance innovation with strict adherence to safety standards, which remains a consistent challenge for market participants.

Parasite Resistance and Reduced Efficacy

The increasing resistance of fleas and ticks to certain active ingredients poses a major market challenge. Over time, widespread use of the same chemical classes has led to reduced efficacy in controlling infestations. Pet owners may switch brands or lose confidence in treatments when results decline, impacting sales. Addressing resistance requires continuous R&D to develop new compounds and combination therapies. However, the cost of developing novel active ingredients is high. Managing parasite resistance while maintaining affordability remains a critical challenge for manufacturers in this competitive market.

Regional Analysis

North America

North America held the dominant share of the flea and tick control medication market in 2024, accounting for over 40% of revenue. Strong pet ownership rates, advanced veterinary healthcare infrastructure, and high consumer spending on pet wellness support regional leadership. The U.S. leads with widespread adoption of chewable and prescription formulations, driven by continuous product innovations and strong veterinary recommendations. Canada contributes steadily, supported by rising awareness of zoonotic disease prevention. Government-backed pet health campaigns and robust distribution networks further strengthen market penetration, making North America the largest and most mature market for flea and tick control solutions.

Europe

Europe captured over 25% share of the global flea and tick control medication market in 2024. The region benefits from stringent veterinary regulations that emphasize preventive healthcare and parasite control. Countries like Germany, the U.K., and France drive demand, supported by high pet ownership and well-established veterinary networks. Prescription-based treatments dominate, as European pet owners often rely on veterinarian guidance for product selection. Rising awareness of zoonotic diseases and increasing adoption of premium, long-acting formulations fuel growth. Expanded product availability through online and retail channels also strengthens access, positioning Europe as a strong, second-leading market globally.

Asia-Pacific

Asia-Pacific accounted for nearly 20% share of the flea and tick control medication market in 2024 and is expected to witness the fastest growth. Rising disposable incomes, increasing pet adoption in urban centers, and improving access to veterinary services drive demand. Countries like China, Japan, and Australia lead adoption, with growing awareness of pet health and preventive care practices. The market is shifting toward chewables and OTC products, supported by affordability and accessibility. Expanding e-commerce platforms enhance product reach, while ongoing awareness campaigns on zoonotic disease prevention foster growth, making Asia-Pacific a key emerging market for future expansion.

Latin America

Latin America contributed over 8% share of the flea and tick control medication market in 2024. Brazil and Mexico are the largest markets, supported by strong pet ownership levels and increasing veterinary service availability. Economic growth and urbanization are encouraging pet owners to invest in preventive healthcare products, including chewables and sprays. However, affordability remains a key factor driving demand for OTC options across the region. Veterinary recommendations, rising awareness of zoonotic risks, and product availability through retail chains are strengthening adoption. With growing middle-class spending, Latin America presents significant opportunities for market expansion in the coming years.

Middle East & Africa

The Middle East & Africa held around 7% share of the global flea and tick control medication market in 2024. Market growth is supported by rising pet adoption in urban centers, particularly in South Africa, the UAE, and Saudi Arabia. The region relies heavily on imported products, with prescription and OTC medications both contributing to sales. Limited veterinary infrastructure and low awareness in rural areas restrict faster adoption, but increasing urbanization and growing pet care expenditure are boosting demand. As awareness campaigns and veterinary services expand, the region is gradually emerging as a potential growth frontier for global players.

Market Segmentations:

By Product Type

- Chewables

- Sprays

- Other product types

By Medication Type

By Animal Type

- Dogs

- Cats

- Other animal types

By Purchase Channel

- Veterinarian

- Drug & pharmacy stores

- Pet specialty stores

- Other purchase channels

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the flea and tick control medication market features major players such as Bayer AG, Boehringer Ingelheim International GmbH, Elanco Animal Health Incorporated, Merck & Co., Inc., Ceva Santé Animale, Hartz Mountain Corporation, Central Garden & Pet Company, Central Life Sciences, Penn Veterinary Supply, Inc., and Ecto Development LLC. These companies focus on expanding their product portfolios through innovations in chewables, topical solutions, and long-acting formulations to strengthen market presence. Strategic investments in R&D, veterinary partnerships, and regulatory approvals drive competitive advantages. Leading firms also emphasize global expansion, leveraging e-commerce and retail networks to increase accessibility across emerging markets. Mergers, acquisitions, and alliances remain a common strategy to enhance distribution capabilities and broaden geographic reach. Additionally, growing emphasis on pet owner education and preventive healthcare campaigns supports brand loyalty. With rising demand for premium and convenient solutions, competition is intensifying, pushing companies to continuously invest in differentiated and effective flea and tick control products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hartz Mountain Corporation

- Ceva Santé Animale

- Bayer AG

- Penn Veterinary Supply, Inc.

- Central Life Sciences

- Elanco Animal Health Incorporated

- Boehringer Ingelheim International GmbH

- Merck & Co., Inc.

- Ecto Development LLC

- Central Garden & Pet Company

Recent Developments

- In July 2025, Merck got U.S. FDA approval for Bravecto Quantum (extended-release injectable) providing year-long protection.

- In 2025, Merck Animal Health presented new data confirming safety, efficacy, and fast onset for its injectable Bravecto formulation.

- In October 2024, Elanco’s Credelio Quattro (monthly chewable for six parasites) gained FDA approval (including fleas and ticks).

- In 2024, Bayer won a U.S. jury verdict rejecting claims it blocked a startup from competing in the flea & tick treatment market

Report Coverage

The research report offers an in-depth analysis based on Product Type, Medication Type, Animal Type, Purchase Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium chewable and long-acting flea and tick medications will continue to rise.

- Prescription medications will maintain dominance, supported by veterinarian trust and broader treatment coverage.

- OTC product adoption will expand as affordability and accessibility improve in emerging markets.

- Rising pet adoption rates globally will fuel consistent growth in preventive healthcare solutions.

- Companies will invest heavily in R&D to develop safer and more effective formulations.

- E-commerce platforms will strengthen product availability and increase consumer convenience in purchasing.

- Asia-Pacific will emerge as the fastest-growing regional market due to rising incomes and awareness.

- North America and Europe will retain leadership positions with strong veterinary infrastructure and high pet spending.

- Resistance to existing active ingredients will encourage innovation in new compound development.

- Strategic mergers, acquisitions, and partnerships will shape competitive positioning and global market expansion.