Market Overview

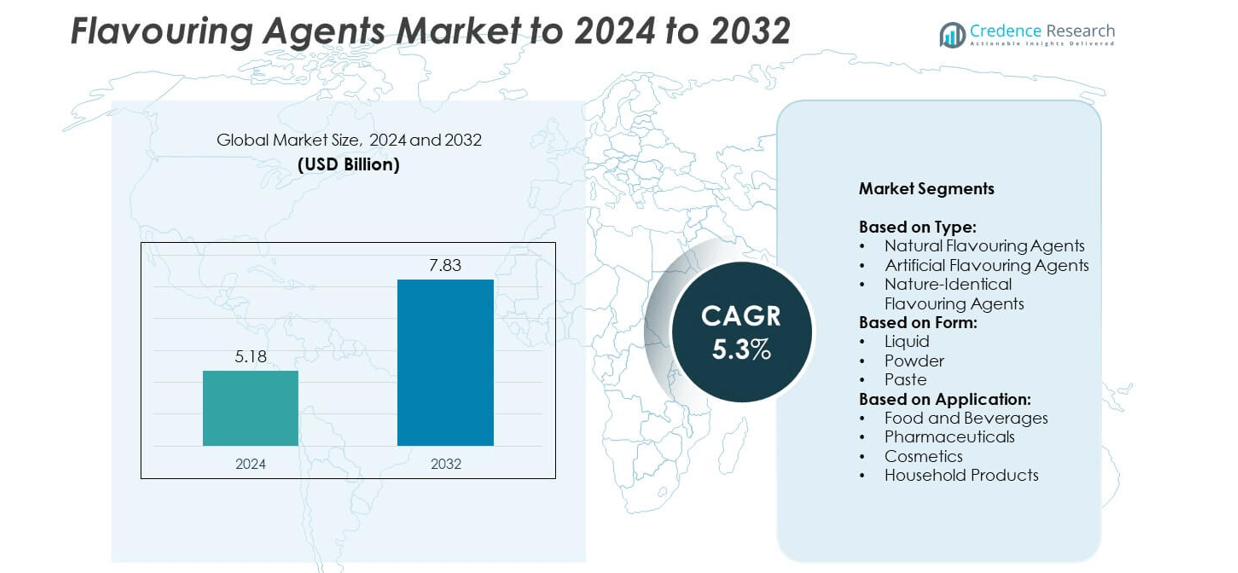

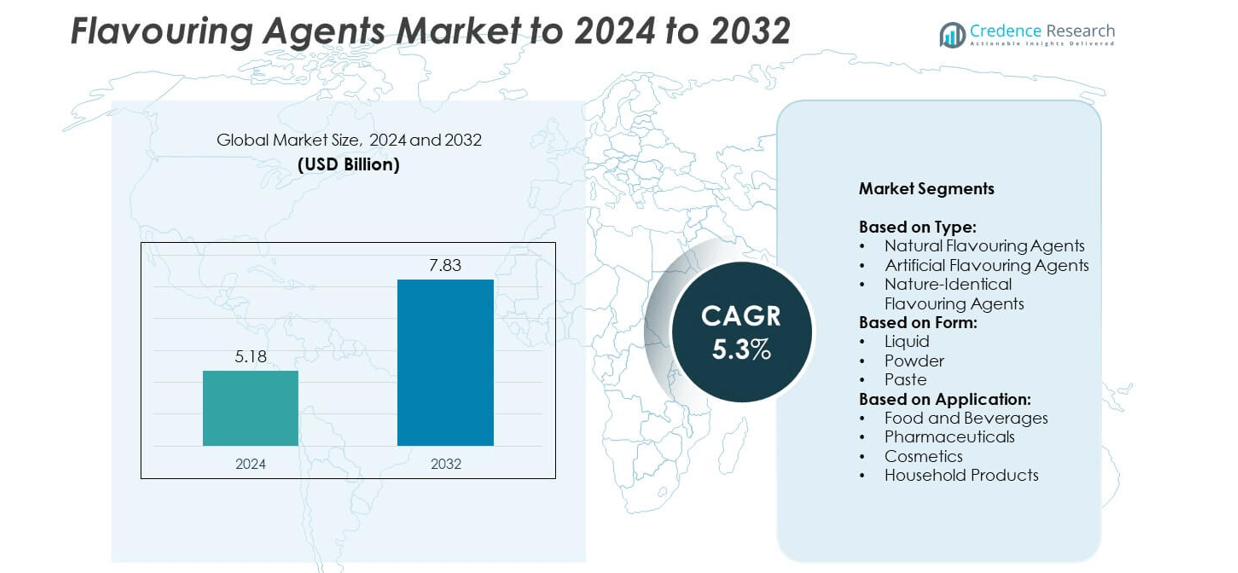

The flavouring agents market size was valued at USD 5.18 billion in 2024 and is anticipated to reach USD 7.83 billion by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flavouring Agents Market Size 2024 |

USD 5.18 billion |

| Flavouring Agents Market, CAGR |

5.3% |

| Flavouring Agents Market Size 2032 |

USD 7.83 billion |

The flavouring agents market is shaped by major players such as Firmenich, Givaudan, Symrise, IFF, Takasago International, Mane, Sensient Technologies, Bell Flavors and Fragrances, Robertet, Kalsec, Flavorchem, Wild Flavors, Austenal, and AVT Natural Products. These companies focus on innovation, expanding natural and sustainable flavour solutions, and strengthening their presence across global markets. North America emerged as the leading region in 2024, holding 34% of the market share, supported by strong demand for clean-label and plant-based ingredients. Europe followed with a 29% share, while Asia Pacific accounted for 23%, driven by rising consumption of processed foods and beverages.

Market Insights

- The flavouring agents market size was USD 5.18 billion in 2024 and will reach USD 7.83 billion by 2032 at a CAGR of 5.3%.

- Rising demand for natural flavouring agents, which held 48% share in 2024, is a key driver fueled by clean-label and plant-based food trends.

- Trends such as biotechnology-based flavour production, functional flavourings, and plant-derived innovations are shaping product development and creating opportunities for sustainable growth.

- The market is highly competitive with leading companies investing in R&D, sustainability, and global expansion strategies to strengthen their market positions.

- North America led the market with 34% share in 2024, followed by Europe with 29% and Asia Pacific at 23%, while food and beverages remained the largest application segment with 62% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Natural flavouring agents dominated the market in 2024 with a 48% share, driven by growing consumer demand for clean-label and plant-based ingredients. Rising awareness of health risks linked to synthetic additives is pushing food manufacturers to reformulate products using natural alternatives. Regulatory support in Europe and North America further boosts this segment. Artificial flavouring agents remain widely used due to cost efficiency, while nature-identical flavouring agents are gaining momentum for balancing affordability with a natural profile. Strong demand for organic and botanical extracts sustains the leadership of natural flavouring agents.

- For instance, Symrise reports having about 35,000 products mainly manufactured using natural raw materials (vanilla, citrus, herbs etc.).

By Form

Liquid flavouring agents held the largest market share at 55% in 2024, supported by their versatility and ease of blending in beverages, dairy, and confectionery. Liquids provide stronger solubility, consistent dosing, and better integration in large-scale production lines, which attracts manufacturers in the food and beverage sector. Powder forms are gaining traction in packaged snacks and dry mixes due to longer shelf life and easier transportation. Paste flavourings occupy niche applications in bakery and processed food segments. The dominance of liquid forms is further fueled by demand for ready-to-drink products.

- For instance, Givaudan’s 2024 Integrated Report mentions it had 62 creation and research centres and 78 production sites, figures which apply to the 2023 performance year. This extensive network and comprehensive product portfolio, which includes over 128,400 products, supports the creation of flavors and fragrances in multiple forms.

By Application

Food and beverages remained the leading application with a 62% market share in 2024, reflecting the rising consumption of processed and convenience foods. Growing demand for flavored dairy, carbonated drinks, bakery items, and savory snacks continues to drive this segment. Pharmaceuticals use flavouring agents to improve palatability of syrups and chewable tablets, while cosmetics adopt them in oral care and personal care products. Household products like detergents and air fresheners represent a smaller but growing market. The expansion of global beverage brands strongly supports the dominance of food and beverage applications.

Key Growth Drivers

Rising Demand for Natural Ingredients

The growing preference for clean-label and plant-based food products has become a major growth driver in the flavouring agents market. Consumers increasingly reject synthetic additives, pushing manufacturers to integrate natural flavours sourced from fruits, herbs, and spices. Stringent regulatory frameworks in North America and Europe further accelerate the shift toward natural formulations. This trend not only boosts the adoption of botanical and organic extracts but also strengthens the competitive positioning of companies that focus on health-oriented innovations.

- For instance, Symrise works with about 7,000 farmers in Madagascar and has 52 UEBT-certified ingredients from that origin, strengthening stable natural-vanilla sourcing.

Expansion of Processed and Convenience Foods

The rising consumption of packaged and ready-to-eat meals has significantly driven the use of flavouring agents. Increasing urbanization, busy lifestyles, and the growth of quick-service restaurants fuel this demand. Food manufacturers are reformulating products to enhance taste profiles while meeting evolving consumer expectations. Flavouring agents in beverages, snacks, and bakery goods play a key role in creating distinct product differentiation. As global processed food demand expands, the reliance on both natural and artificial flavourings remains a critical driver of market growth.

- For instance, the Coca-Cola system operates on a global scale that necessitates massive volumes of ingredients to meet consumer demand for its diverse beverage portfolio, which includes brands like Coca-Cola, Sprite, and Minute Maid. In its full-year 2023 results, the company reported that its worldwide unit case volume grew by 2%.

Pharmaceutical and Personal Care Applications

Beyond food and beverages, the growing use of flavouring agents in pharmaceuticals and personal care products is emerging as a strong growth driver. Syrups, chewable tablets, toothpaste, and mouthwash rely on flavour enhancers to improve consumer acceptance. This expansion into non-food sectors diversifies market opportunities for manufacturers. Rising health awareness and personal care spending in emerging economies strengthen demand. The ability of flavouring agents to mask bitter tastes in drugs and enhance appeal in oral hygiene products ensures sustained growth across multiple end-use industries.

Key Trends & Opportunities

Adoption of Functional Flavourings

A key trend in the market is the growing demand for flavouring agents that deliver functional benefits beyond taste. Products enriched with botanical extracts, probiotics, or adaptogens are gaining traction, particularly in health-conscious markets. Beverages, sports nutrition, and fortified snacks are at the forefront of this trend. Manufacturers that combine health benefits with innovative flavours position themselves strongly in premium categories. This trend creates opportunities for collaborations between flavour houses and nutraceutical firms targeting holistic wellness consumers.

- For instance, Kerry’s BC30 sets a 500,000,000 CFU per daily serving guideline for food applications, supporting functional beverage and snack reformulations.

Advances in Biotechnology for Flavour Creation

Opportunities are also expanding with the use of biotechnology and fermentation-based methods to produce sustainable flavouring agents. These innovations enable manufacturers to replicate natural flavours at scale without depending heavily on crop yields or environmental conditions. Biotechnology also helps in reducing production costs and maintaining flavour consistency. This technological shift aligns with rising sustainability goals, offering opportunities to meet both regulatory and consumer demands. Companies investing in bio-based flavour production can capture growth by addressing natural and eco-friendly positioning.

- For instance, Solvay doubled its Rhovanil® Natural Crystal White capacity to 120 metric tons, scaling bio-based vanillin for natural flavour systems.

Key Challenges

Regulatory and Compliance Barriers

A major challenge in the flavouring agents market lies in navigating complex regulatory standards across regions. Stringent approvals for food safety, labelling, and ingredient sourcing increase compliance costs and slow product launches. For instance, the European Union maintains strict controls on artificial additives, limiting their adoption. Manufacturers must invest in continuous testing and certification to meet evolving safety norms. These challenges create barriers for smaller players and extend time-to-market for new formulations, affecting overall market agility.

Volatility in Raw Material Supply

Fluctuating availability and cost of raw materials used in natural flavouring agents remain a critical challenge. Dependence on agricultural produce such as fruits, herbs, and spices makes the industry vulnerable to seasonal variations, climate change, and supply chain disruptions. Price instability often impacts profit margins for manufacturers and raises end-product costs. Companies relying heavily on natural sources face greater risks, especially in maintaining consistent quality and volume. Addressing this issue requires diversification of supply chains and investment in alternative production methods.

Regional Analysis

North America

North America held the largest share of 34% in the flavouring agents market in 2024, supported by high demand for natural and clean-label ingredients. The strong presence of leading food and beverage manufacturers, along with advanced R&D capabilities, drives innovation in flavour formulations. Rising consumption of processed foods, beverages, and functional products further supports growth. The U.S. market benefits from strict regulatory standards encouraging safer and healthier flavouring solutions. The increasing popularity of plant-based and organic products also fuels the adoption of natural flavouring agents across multiple categories.

Europe

Europe accounted for 29% of the flavouring agents market in 2024, driven by regulatory emphasis on natural ingredients and reduced artificial additives. The region’s mature food industry, particularly in bakery, dairy, and beverages, supports steady demand. Countries like Germany, France, and the U.K. lead in adopting botanical and organic extracts to align with health-focused consumer preferences. Stringent EU labelling requirements and clean-label trends encourage reformulation with natural flavouring solutions. Pharmaceutical and personal care applications further add to demand, while sustainability concerns continue to push innovation in bio-based and eco-friendly flavouring technologies across Europe.

Asia Pacific

Asia Pacific captured a 23% share of the flavouring agents market in 2024, fueled by rapid urbanization, rising disposable incomes, and a growing processed food industry. Expanding middle-class populations in China, India, and Southeast Asia are increasingly adopting packaged and convenience foods. Local and international manufacturers are investing in innovative flavour profiles to meet diverse regional preferences. Demand is further supported by the rising popularity of ready-to-drink beverages, bakery, and snack categories. Pharmaceutical applications also see strong growth, driven by expanding healthcare infrastructure and increasing consumer acceptance of flavoured medicines and supplements across the region.

Latin America

Latin America held a 9% market share in the flavouring agents industry in 2024, driven by increasing demand for affordable processed and packaged foods. Brazil and Mexico serve as key markets, with growing investments in beverage, dairy, and snack industries. Rising health awareness has boosted interest in natural flavours, although artificial flavouring agents remain widely used due to cost advantages. The region benefits from abundant availability of raw materials like tropical fruits and herbs, creating opportunities for natural flavour production. Growth is further supported by expanding distribution networks and increasing penetration of international flavouring manufacturers.

Middle East and Africa

The Middle East and Africa accounted for a 5% share of the flavouring agents market in 2024, reflecting steady but slower adoption compared to other regions. Growing urban populations and rising disposable incomes drive demand for processed foods, beverages, and personal care products. Countries like South Africa, the UAE, and Saudi Arabia are leading adopters, supported by expanding retail sectors. Limited domestic production capacity leads to high reliance on imports, particularly for natural flavouring agents. Increasing investments in food processing and a shift toward healthier lifestyle choices are expected to gradually boost regional demand over the forecast period.

Market Segmentations:

By Type:

- Natural Flavouring Agents

- Artificial Flavouring Agents

- Nature-Identical Flavouring Agents

By Form:

By Application:

- Food and Beverages

- Pharmaceuticals

- Cosmetics

- Household Products

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The flavouring agents market is highly competitive, with leading players such as Firmenich, Kalsec, Robertet, Takasago International, Mane, Sensient Technologies, Bell Flavors and Fragrances, Givaudan, AVT Natural Products, Austenal, Flavorchem, Symrise, Wild Flavors, and IFF driving innovation and market expansion. Competition is shaped by continuous investment in research and development to create natural, sustainable, and clean-label flavour solutions. Companies are expanding their global footprint by strengthening production capacities, entering new markets, and forming partnerships with food and beverage manufacturers. Advancements in biotechnology, fermentation, and plant-based flavour extractions are emerging as critical differentiators, while cost management and supply chain efficiency remain central strategies. Consumer demand for organic, health-oriented, and functional flavours further intensifies innovation efforts. Regional diversification and product customization are also key tactics enabling players to meet diverse regulatory standards and consumer preferences. The competitive environment is expected to remain dynamic, driven by sustainability, innovation, and expanding application sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Firmenich

- Kalsec

- Robertet

- Takasago International

- Mane

- Sensient Technologies

- Bell Flavors and Fragrances

- Givaudan

- AVT Natural Products

- Austenal

- Flavorchem

- Symrise

- Wild Flavors

- IFF

Recent Developments

- In 2024, dsm-firmenich company opened two new production facilities in France for fragrance ingredients, demonstrating its post-merger expansion strategy.

- In 2023, IFF launched a new flavor enhancer for cheese manufacturing, CHOOZIT VINTAGE, in the North American market.

- In 2023, Givaudan S.A. Opened the Tropical Food Innovation Lab in Brazil in partnership with other companies. The lab aimed to develop sustainable food and beverages using local biodiversity.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness rising demand for natural and clean-label flavouring agents.

- Biotechnology and fermentation-based flavour production will gain wider adoption.

- Functional flavours combining health benefits with taste will expand in beverages and snacks.

- Asia Pacific will emerge as the fastest-growing regional market with increasing urban demand.

- Sustainability and eco-friendly sourcing will shape product development strategies.

- Innovation in plant-based flavours will align with the global shift toward vegan diets.

- E-commerce expansion will boost accessibility of flavoured food and beverage products.

- Pharmaceutical applications will grow with higher use of flavoured oral medicines.

- Artificial flavours will remain relevant due to cost efficiency despite regulatory pressure.

- Collaborations between flavour houses and food manufacturers will accelerate customized solutions.