Market Overview

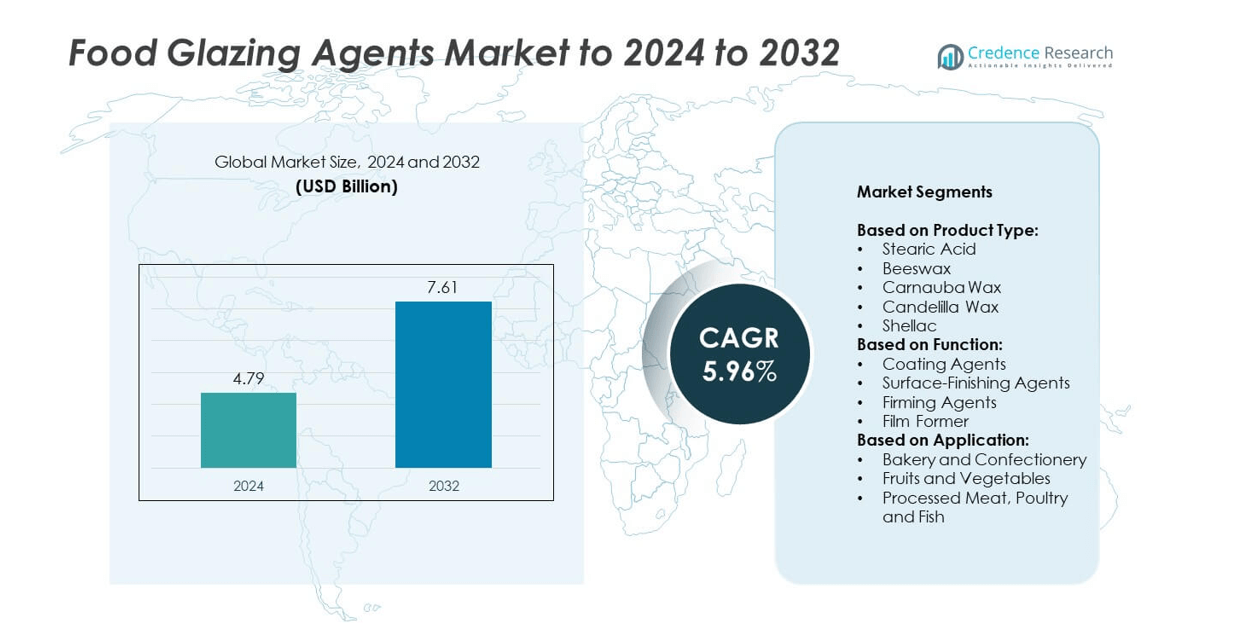

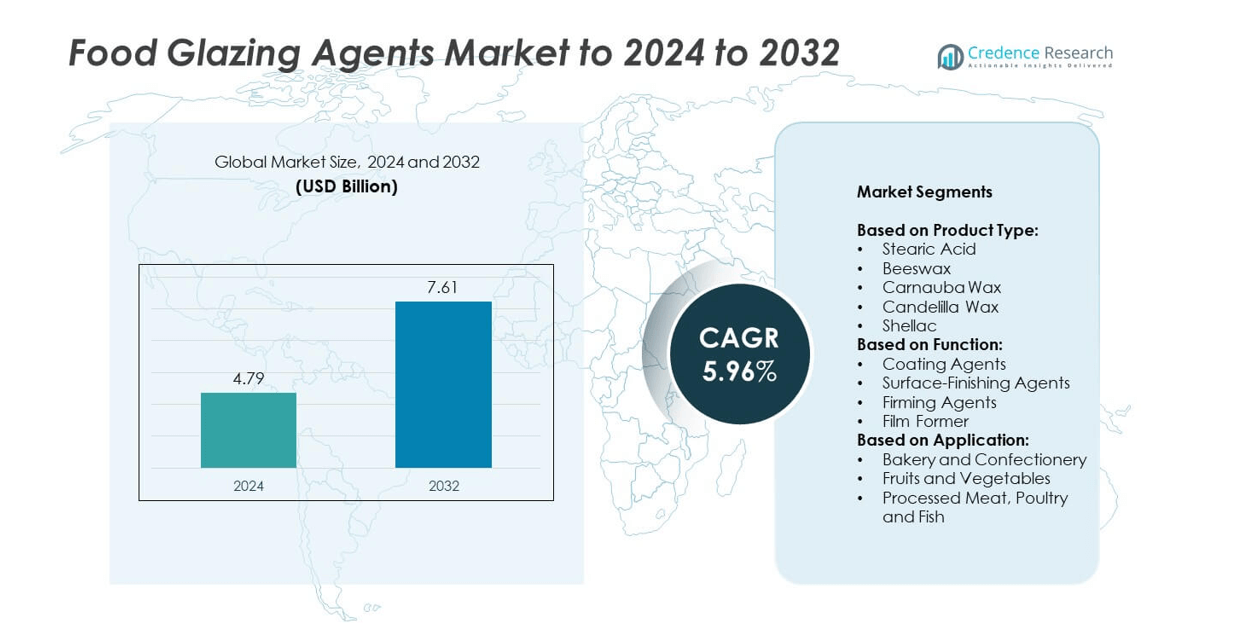

The Food Glazing Agents Market size was valued at USD 4.79 Billion in 2024 and is anticipated to reach USD 7.61 Billion by 2032, at a CAGR of 5.96% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Glazing Agents Market Size 2024 |

USD 4.79 Billion |

| Food Glazing Agents Market, CAGR |

5.96% |

| Food Glazing Agents Market Size 2032 |

USD 7.61 Billion |

The Food Glazing Agents Market is highly competitive, with leading players such as Puratos, Kerry Group, Capol GmbH, Colorcon, Mantrose-Haeuser Co. Inc., and Strahl & Pitsch Inc. driving innovation and market expansion. These companies focus on enhancing natural and plant-based glazing solutions to meet rising clean-label and sustainability demands. Strategic investments in R&D and regional distribution networks strengthen their market presence. North America emerged as the leading region in 2024, accounting for 34% of the global share, supported by high consumption of bakery, confectionery, and processed foods, along with advanced food processing infrastructure.

Market Insights

- The Food Glazing Agents Market was valued at USD 4.79 Billion in 2024 and is projected to reach USD 7.61 Billion by 2032, growing at a CAGR of 5.96%.

- Rising demand for processed foods, bakery, and confectionery products is a key driver, supported by consumer preference for attractive product appearance and extended shelf life.

- Trends highlight a strong shift toward natural, plant-based glazing solutions such as carnauba wax, reflecting clean-label and sustainability preferences in developed and emerging markets.

- The competitive landscape features global and regional players focusing on innovation, partnerships, and sustainable sourcing, with emphasis on compliance with stringent food safety regulations.

- North America led with 34% share in 2024, followed by Europe at 28% and Asia-Pacific at 24%, while bakery and confectionery applications dominated with 44% share, reinforcing their role as the largest segment driving global market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The Food Glazing Agents Market is segmented into stearic acid, beeswax, carnauba wax, candelilla wax, and shellac. Carnauba wax held the dominant share in 2024, accounting for nearly 32% of the market. Its widespread use in confectionery, bakery, and fruit coating is driven by superior gloss, high melting point, and plant-based origin. Rising consumer preference for natural and vegan-friendly glazing solutions further strengthens demand. Additionally, regulatory approvals for safe use in food applications continue to make carnauba wax a preferred glazing agent across global markets.

- For instance, Brazil is the world’s largest producer of carnauba wax, sourcing over 85% of the global supply from the leaves of the carnauba palm.

By Function

The market is categorized into coating agents, surface-finishing agents, firming agents, and film formers. Coating agents emerged as the largest segment with about 38% market share in 2024. Their strong adoption stems from their role in extending shelf life, providing moisture resistance, and enhancing product appearance. Increased demand in confectionery and processed meat applications supports their growth. Rising packaged food consumption and retail expansion globally continue to drive investments in coating solutions, making them the leading functional category within glazing agents.

- For instance, Capol GmbH states they offer over 250 innovative glazing, sealing and separating agents for confectionery finishing.

By Application

Food glazing agents are applied in bakery and confectionery, fruits and vegetables, and processed meat, poultry, and fish. Bakery and confectionery dominated with nearly 44% market share in 2024. This leadership is driven by the extensive use of glazing agents to provide shine, improve texture, and prevent moisture loss in chocolates, pastries, and candies. The global rise in confectionery consumption, premium bakery trends, and innovations in decorative finishes are fueling segment growth. Growing demand for appealing product presentation in retail chains further cements bakery and confectionery as the leading application segment.

Key Growth Drivers

Rising Demand for Processed and Packaged Foods

The growing consumption of processed and packaged foods is a major driver in the food glazing agents market. With rising urbanization and busy lifestyles, consumers are opting for ready-to-eat and visually appealing products. Glazing agents help improve product shelf life, enhance shine, and preserve freshness, making them essential in bakery, confectionery, and meat processing industries. This demand is reinforced by expanding retail channels and supermarkets, which require longer product preservation and attractive presentation to appeal to modern consumers globally.

- For instance, Mondelez International is a leading producer of snack foods, with 2023 net revenues of approximately $36 billion, and owns iconic brands such as Oreo, Ritz, and Cadbury Dairy Milk. Glazing coatings are applied to some of its chocolate products, like parts of the Cadbury range, to provide a glossy finish and protection.

Increasing Preference for Natural and Plant-Based Ingredients

Shifts in consumer preference toward clean-label, natural, and plant-based food ingredients are fueling glazing agent adoption. Natural sources such as carnauba wax and beeswax are increasingly replacing synthetic alternatives due to regulatory pressure and rising health awareness. Food manufacturers are focusing on vegan-friendly and sustainable glazing solutions to meet evolving dietary preferences. The trend toward eco-friendly production and ethical sourcing practices further drives demand for plant-based glazing agents, strengthening their role in bakery, confectionery, and fresh produce applications worldwide.

- For instance, ADM plans to add 1.5 million metric tons of annual soy crush capacity in Spiritwood, North Dakota by Q4 2023.

Expanding Confectionery and Bakery Industry

The confectionery and bakery sector remains a dominant end-use industry, driving consistent growth in glazing agents. The sector relies heavily on these agents for shine, moisture resistance, and product stability in chocolates, candies, pastries, and coated snacks. Rising disposable incomes, premium bakery consumption, and innovations in decorative finishes have created strong growth potential. Additionally, consumer inclination toward premium confectionery products with improved visual appeal reinforces the need for glazing agents, making this segment one of the key drivers of global demand.

Key Trends & Opportunities

Adoption of Innovative Coating Technologies

Technological advancements in food coatings, such as microencapsulation and edible films, are creating new opportunities. These innovations enhance product stability, reduce water loss, and improve ingredient release during processing. Manufacturers are increasingly investing in smart glazing technologies that improve cost-efficiency while maintaining compliance with food safety standards. Growing R&D in natural film-forming agents further strengthens opportunities, particularly in confectionery and fresh produce sectors. Such advancements expand application scope and open new avenues for high-performance glazing agents globally.

- For instance, Apeel Sciences launched a plant-based edible coating that doubled the shelf life of avocados in retail settings, reducing spoilage by up to 50 %.

Growing Demand in Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and the Middle East are witnessing strong growth opportunities. Rising middle-class populations, increasing consumption of processed foods, and expanding retail infrastructure support demand for food glazing agents. Local food manufacturers are adopting glazing solutions to meet evolving consumer expectations for quality and product appeal. Additionally, government support for domestic food processing industries is boosting investments, creating favorable conditions for market expansion. This rapid adoption in developing regions is expected to reshape global market dynamics.

- For instance, Barry Callebaut reported 1,602,458 tonnes sales volume in the first nine months of FY 2024/25. Scale enables fast rollout of finishing and glazing practices.

Key Challenges

Stringent Regulatory Frameworks

The food glazing agents market faces challenges due to strict international food safety regulations. Agencies such as the FDA and EFSA enforce detailed compliance guidelines on the use of glazing ingredients. This creates hurdles for manufacturers in terms of approvals, testing, and certifications. Adhering to varied regulations across regions also adds to cost and complexity. Companies must continuously adapt formulations to meet evolving safety standards, slowing down product launches and increasing overall operational expenses.

Fluctuations in Raw Material Supply and Costs

Dependence on natural sources like beeswax, carnauba wax, and shellac creates raw material supply challenges. Factors such as climate change, seasonal availability, and regional restrictions often disrupt production and raise procurement costs. These fluctuations increase pressure on manufacturers, especially when demand from bakery and confectionery industries remains high. Rising input costs can squeeze margins and limit competitiveness for small and mid-sized players. Addressing supply chain resilience has become a critical issue for ensuring steady availability of glazing agents.

Regional Analysis

North America

North America accounted for the largest share of the food glazing agents market in 2024, holding around 34%. The dominance is driven by strong demand from the bakery and confectionery industries, where glazing agents are widely used for product appearance and shelf-life enhancement. High consumption of processed meat, poultry, and packaged foods also supports growth. Regulatory frameworks ensuring food safety encourage the adoption of high-quality glazing agents. In addition, innovation in natural and vegan-friendly coatings is expanding market opportunities across the United States and Canada, making North America a leading hub for glazing agent consumption.

Europe

Europe held a market share of nearly 28% in 2024, making it the second-largest region in the food glazing agents market. The region benefits from strong bakery traditions and premium confectionery demand, especially in countries like Germany, France, and the United Kingdom. Strict food safety regulations and rising consumer preference for clean-label and natural glazing agents are shaping the market dynamics. Growing use of carnauba wax and beeswax as plant-based and sustainable solutions further supports market adoption. Continuous innovations and established food processing industries contribute significantly to Europe’s strong presence in the global market.

Asia-Pacific

Asia-Pacific captured about 24% of the global food glazing agents market in 2024, showing rapid growth potential. The expansion is driven by increasing consumption of packaged foods, confectionery, and processed meat in countries like China, India, and Japan. Rising disposable incomes and urbanization are fueling demand for visually appealing bakery and confectionery products. Government initiatives supporting food processing industries are also driving regional growth. In addition, local manufacturers are increasingly adopting glazing technologies to enhance competitiveness. With growing awareness of natural and plant-based ingredients, Asia-Pacific is expected to emerge as one of the fastest-growing regional markets.

Latin America

Latin America held a market share of around 8% in 2024, supported by expanding bakery and confectionery sectors in Brazil, Mexico, and Argentina. Rising consumer preference for packaged foods and premium confectionery products is creating demand for glazing agents. The increasing use of carnauba wax, sourced locally from Brazil, offers the region a competitive advantage. Growing middle-class populations and supermarket penetration are strengthening processed food adoption, boosting glazing agent applications. Despite facing economic fluctuations, the demand for affordable yet appealing food products continues to drive growth across the Latin American market.

Middle East and Africa

The Middle East and Africa accounted for nearly 6% of the food glazing agents market share in 2024. Growth is supported by rising consumption of bakery, confectionery, and packaged meat products across Gulf countries and South Africa. Increasing urbanization and changing dietary habits are expanding demand for processed foods, thereby driving glazing agent use. The preference for visually attractive products in premium food categories further enhances adoption. However, limited local manufacturing and reliance on imports present challenges. Nonetheless, rising investment in food processing industries is expected to gradually strengthen the market in this region.

Market Segmentations:

By Product Type:

- Stearic Acid

- Beeswax

- Carnauba Wax

- Candelilla Wax

- Shellac

By Function:

- Coating Agents

- Surface-Finishing Agents

- Firming Agents

- Film Former

By Application:

- Bakery and Confectionery

- Fruits and Vegetables

- Processed Meat, Poultry and Fish

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Food Glazing Agents Market features a competitive landscape shaped by both global corporations and specialized regional manufacturers, including Puratos, Masterol Foods Pty Ltd., Capol GmbH (Freudenberg & Co. KG), Strahl & Pitsch Inc., Kerry Group, Mantrose-Haeuser Co. Inc. (RPM International Inc.), The British Wax Refining Company Ltd., Colorcon (Berwind Corporation), Stéarinerie Dubois, Koster Keunen, and Poth Hille & Co. Ltd. Competition is largely driven by product innovation, sustainable sourcing, and compliance with international food safety regulations. Companies focus on expanding natural and plant-based glazing portfolios to meet consumer demand for clean-label and eco-friendly solutions. Investments in advanced coating technologies and regional distribution networks help strengthen market positioning. Strong relationships with bakery, confectionery, and processed food industries ensure steady growth opportunities. Furthermore, global players are leveraging acquisitions and partnerships to enhance technological capabilities and expand into emerging markets, while regional players emphasize cost competitiveness and niche offerings to sustain relevance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Puratos

- Masterol Foods Pty Ltd.

- Capol GmbH (Freudenberg & Co. KG)

- Strahl & Pitsch Inc.

- Kerry Group

- Mantrose-Haeuser Co. Inc. (RPM International Inc.)

- The British Wax Refining Company Ltd.

- Colorcon (Berwind Corporation)

- Stéarinerie Dubois

- Koster Keunen

- Poth Hille & Co. Ltd.

Recent Developments

- In 2025, Capol completed two significant acquisitions to expand its flavor portfolio. It acquired Curt Georgi GmbH & Co. KG in June and Blue Pacific Flavors in September.

- In 2025, Kerry Group Published its “2025 Taste Charts,” a comprehensive guide to future flavor trends, and likely launched new glazing products designed to complement these flavor profiles and deliver innovative food experiences.

- In 2024, Colorcon formed a global partnership with LOTTE Fine Chemical, a cellulose ether manufacturer, to broaden its excipient offerings for the pharmaceutical and nutraceutical industries.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Function, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing demand for processed and packaged foods.

- Natural and plant-based glazing agents will gain higher adoption across applications.

- Confectionery and bakery industries will remain the leading consumers of glazing agents.

- Emerging economies in Asia-Pacific and Latin America will drive strong growth.

- Technological innovations in edible films and coatings will enhance market opportunities.

- Regulatory compliance will shape product development and formulation strategies.

- Sustainable sourcing of raw materials like carnauba wax will gain importance.

- Premium and decorative bakery products will boost demand for glazing solutions.

- Supply chain resilience will be critical to balance costs and availability.

- Rising consumer focus on product appearance and freshness will sustain market growth.