Market Overview

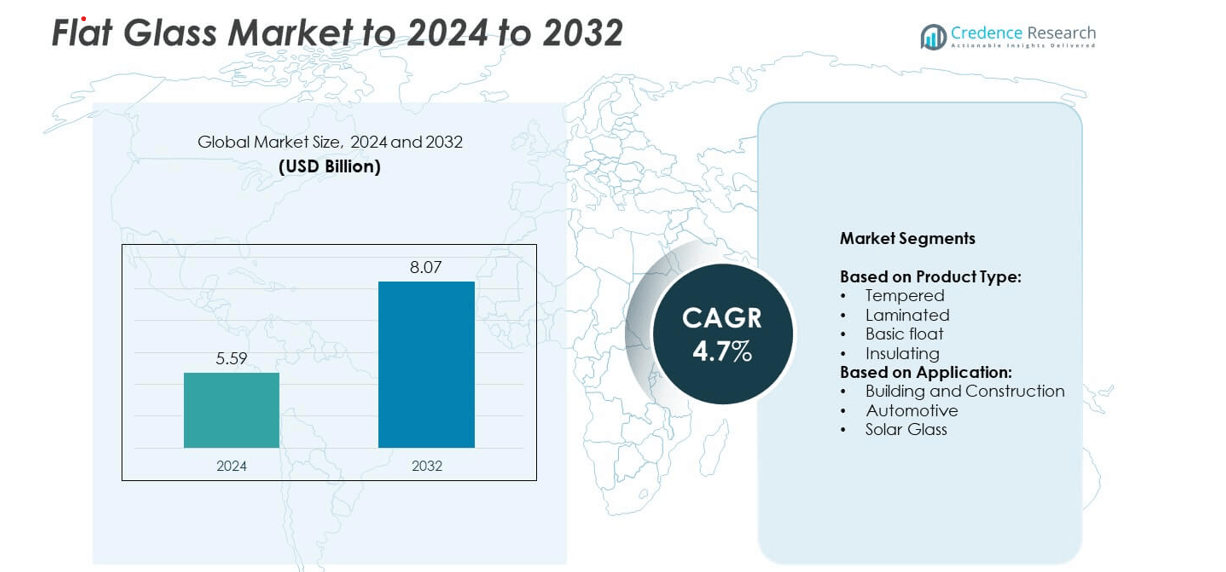

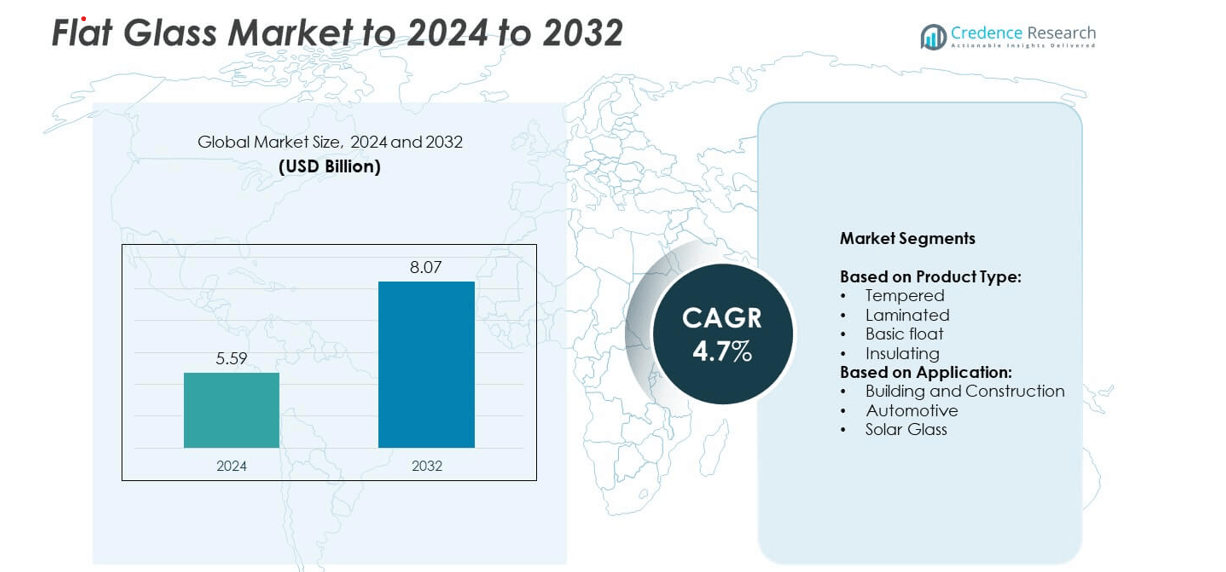

The Flat Glass Market size was valued at USD 5.59 Billion in 2024 and is anticipated to reach USD 8.07 Billion by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flat Glass Market Size 2024 |

USD 5.59 Billion |

| Flat Glass Market, CAGR |

4.7% |

| Flat Glass Market Size 2032 |

USD 8.07 Billion |

The flat glass market is shaped by leading players such as Saint-Gobain Glass, Guardian Group, AGC Glass Europe, PPG Industries, Asahi Glass, CSG Holding Co., Ltd., Xinyi Auto Glass, Asahi India Glass Ltd. (AIS), Duratuf Glass Industries Ltd., GSC Glass Ltd., and Independent Glass Co., Ltd. These companies strengthen their positions through advanced product portfolios, large-scale manufacturing, and innovation in energy-efficient and solar glass solutions. Regionally, Asia-Pacific dominated the market in 2024 with a 35% share, driven by rapid urbanization, infrastructure growth, and strong solar investments. Europe followed with 28%, supported by stringent energy regulations, while North America accounted for 23%, fueled by demand in construction and automotive industries.

Market Insights

- The flat glass market was valued at USD 5.59 Billion in 2024 and is projected to reach USD 8.07 Billion by 2032, growing at a CAGR of 4.7%.

- Growth is fueled by rising construction and infrastructure projects, increasing automotive safety standards, and expanding solar energy installations driving demand for advanced glass solutions.

- Trends include higher adoption of energy-efficient insulating glass, technological advancements in smart and coated glass, and growing preference for sustainable production practices across industries.

- The market is competitive with major players focusing on innovation, large-scale production, and regional expansion strategies, while smaller companies face challenges from high energy costs and raw material price fluctuations.

- Regionally, Asia-Pacific led the market with 35% share in 2024, followed by Europe at 28% and North America at 23%, while basic float glass dominated product segments with over 40% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The basic float glass segment held the largest share of the flat glass market in 2024, accounting for over 40% of total revenue. Its dominance comes from extensive use in residential and commercial buildings for windows, doors, and interior applications due to cost efficiency and uniform thickness. Tempered and laminated glass are also growing steadily, driven by rising demand for safety and durability in automotive and architectural projects. Insulating glass is expanding at a faster pace, supported by energy efficiency regulations that favor double- and triple-glazing in modern construction.

- For instance, Şişecam announced new flat/energy glass furnaces adding 244,000 t and 400,000 t annual capacity, plus a 200,000 t flat glass furnace for auto glass.

By Application

Building and construction dominated the flat glass market in 2024 with nearly 65% share, making it the primary growth driver. Widespread adoption in facades, windows, and interior designs has been supported by rapid urbanization and infrastructure development. Automotive applications contribute steadily, driven by the use of tempered and laminated glass in windshields, side windows, and sunroofs. Solar glass is experiencing strong growth, propelled by global investments in renewable energy projects and government incentives for solar installations, though its share remains smaller compared to construction-led demand.

- For instance, Fuyao is a major global supplier of automotive glass to OEMs. The company’s annual reports indicate substantial and growing production capacity, with sales reaching 156 million square meters of auto glass in 2024.

Key Growth Drivers

Rising Construction and Infrastructure Development

The construction sector is the key growth driver for the flat glass market, contributing the largest demand share. Rapid urbanization and large-scale infrastructure projects worldwide have fueled the use of flat glass in windows, facades, and interior applications. Government investments in smart cities and green buildings further support the adoption of energy-efficient glass products. Basic float and tempered glass remain the preferred choice in this segment due to cost efficiency and durability, ensuring sustained demand across both residential and commercial construction.

- For instance, Vitro reports more than 700 million ft² of Solarban® low-e glass shipped since 2005 for building envelopes.

Expanding Automotive Production and Safety Standards

The automotive industry significantly drives flat glass consumption through applications in windshields, side windows, and sunroofs. Rising vehicle production, particularly in Asia-Pacific, boosts the adoption of laminated and tempered glass for enhanced passenger safety. Stricter regulations mandating advanced glazing solutions to reduce injury risks have further accelerated growth. Increased demand for electric and luxury vehicles with larger panoramic glass roofs creates additional opportunities. Automotive manufacturers’ preference for lightweight yet durable glass solutions continues to expand the market footprint of advanced flat glass technologies.

- For instance, AGP’s eGlass 2.0 facility, which produces ultralight windshields and panoramic roofs, has a production capacity of up to 3,000,000 square meters of glass per year.

Growing Renewable Energy Adoption

Solar energy investments are another major growth driver, with flat glass essential for photovoltaic modules. Countries promoting renewable energy projects have increased demand for solar glass, especially in large-scale utility installations. Governments offering subsidies, tax benefits, and renewable energy targets support this trend. Manufacturers are innovating to enhance glass transparency and durability, improving solar panel efficiency. While building and construction remain dominant, the rapid adoption of solar glass provides a fast-growing niche, positioning it as a crucial segment in global energy transitions and sustainability agendas.

Key Trends and Opportunities

Shift Toward Energy-Efficient Glass Solutions

The market shows a strong trend toward insulating glass, supported by regulations promoting energy conservation in buildings. Double- and triple-glazing units reduce energy consumption and carbon emissions, making them highly attractive for residential and commercial spaces. Consumers and developers increasingly prefer low-emissivity coatings to improve indoor climate control. With global emphasis on sustainable construction and eco-friendly design, energy-efficient glass represents a major opportunity for manufacturers to expand offerings in advanced glazing solutions that align with climate policies and environmental standards.

- For instance, Saint-Gobain’s COOL-LITE® SKN 176 II lists a U-value of 1.0 W/m²K in an IGU configuration.

Technological Advancements in Glass Processing

Innovation in glass processing technologies is creating opportunities for high-performance products with better strength and functionality. Smart glass technologies, including switchable and electrochromic glazing, are gaining popularity in both automotive and construction sectors. These innovations enable dynamic control of light and heat transmission, enhancing user comfort and energy efficiency. Growing interest in digital printing and coated glass for architectural designs also adds value. The integration of advanced technologies positions flat glass as a key material in modern design and smart infrastructure development.

- For instance, View, Inc. reports installations exceeding 90 million ft² across 300+ projects.

Key Challenges

High Energy Costs in Manufacturing

Flat glass production is energy-intensive, requiring significant heat input for melting and processing raw materials. Volatile energy prices increase operational costs, directly impacting profit margins for manufacturers. Compliance with stricter environmental standards adds to production expenses, as companies invest in energy-efficient furnaces and emission control systems. This challenge makes it difficult for smaller players to compete and can hinder market expansion. Managing energy consumption and adopting sustainable manufacturing practices remain critical to maintaining competitiveness in this industry.

Fluctuating Raw Material Prices

The availability and cost of raw materials such as silica sand, soda ash, and limestone pose significant challenges. Price volatility in these inputs creates uncertainty in production planning and impacts pricing strategies. Supply chain disruptions further aggravate cost fluctuations, especially in regions dependent on imports. These variations reduce profit stability and pressure manufacturers to explore alternative sourcing options or recycling initiatives. Managing raw material risks remains a key concern for the industry to ensure consistent production and sustainable growth in the flat glass market.

Regional Analysis

North America

North America accounted for 23% of the flat glass market share in 2024, supported by strong demand in construction and automotive industries. The region benefits from high investment in energy-efficient buildings and infrastructure modernization. Regulations promoting insulating and laminated glass adoption in residential and commercial projects further drive growth. Automotive production, particularly in the United States, sustains consistent demand for safety and performance glass. Expanding use of solar panels in renewable energy projects also contributes to market expansion. Manufacturers in the region focus on advanced coatings and smart glass technologies to align with sustainability trends.

Europe

Europe held 28% of the flat glass market share in 2024, making it a leading regional contributor. The region is driven by stringent building energy regulations and widespread adoption of insulating glass units in construction. Renovation activities in older housing stock further stimulate demand for energy-efficient glazing solutions. Automotive applications also remain significant, with laminated and tempered glass essential for safety and design in premium vehicles. The region is at the forefront of innovation, with strong investments in smart glass and coated products. Additionally, solar glass demand is rising due to renewable energy policies across the European Union.

Asia-Pacific

Asia-Pacific dominated the flat glass market with 35% share in 2024, positioning it as the largest regional market. High demand comes from rapid urbanization, large-scale infrastructure development, and growing automotive production. China and India play leading roles, driven by investments in smart cities and renewable energy projects. The region is also a major hub for solar glass production, supported by aggressive solar energy installation targets. Automotive manufacturers increasingly adopt panoramic and safety glass, enhancing demand. Competitive manufacturing costs and high output capacities make Asia-Pacific a global production base, strengthening its influence in the flat glass market worldwide.

Latin America

Latin America represented 7% of the flat glass market share in 2024, with demand led by the construction sector. Brazil and Mexico drive growth through rising urban housing projects and expanding commercial infrastructure. Automotive applications add steady demand, particularly for laminated glass in vehicles produced domestically. Solar energy initiatives are gradually increasing, boosting the adoption of solar glass in select markets. However, the region faces challenges from economic volatility and limited manufacturing capacities. Despite these constraints, demand for cost-effective flat glass solutions continues to expand, with opportunities for growth in energy-efficient products across emerging cities.

Middle East and Africa

The Middle East and Africa accounted for 7% of the flat glass market share in 2024, primarily driven by large-scale construction and infrastructure projects. The Gulf countries lead demand with iconic commercial buildings and luxury developments that rely heavily on flat glass facades. Automotive demand is moderate, supported by rising vehicle imports and local assembly. Solar glass is expanding significantly in the Middle East due to high solar potential and government-backed energy diversification projects. While manufacturing bases remain limited, increasing investment in local production facilities is expected to strengthen the region’s role in the global flat glass market.

Market Segmentations:

By Product Type:

- Tempered

- Laminated

- Basic float

- Insulating

By Application:

- Building and Construction

- Automotive

- Solar Glass

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the flat glass market is shaped by leading players such as Saint-Gobain Glass, Guardian Group, Independent Glass Co., Ltd., AGC Glass Europe, CSG Holding Co., Ltd., GSC Glass Ltd., PPG Industries, Inc., Duratuf Glass Industries Ltd., Xinyi Auto Glass, Asahi India Glass Ltd. (AIS), and Asahi Glass. These companies compete through technological innovation, advanced product portfolios, and large-scale manufacturing capacities. Strategic investments in energy-efficient and solar glass products are expanding their market presence across construction, automotive, and renewable energy applications. Many focus on sustainable manufacturing practices, adopting low-carbon processes and recycling initiatives to meet global environmental standards. Expansion in emerging markets and localization of production facilities remain key strategies to strengthen supply chains and reduce costs. Continuous research and development in smart glass and coated products further enhance competitiveness, ensuring alignment with evolving customer preferences and regulatory frameworks across diverse industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Saint-Gobain Glass

- Guardian Group

- Independent Glass Co., Ltd.

- AGC Glass Europe

- CSG Holding Co., Ltd.

- GSC Glass Ltd.

- PPG Industries, Inc.

- Duratuf Glass Industries Ltd.

- Xinyi Auto Glass

- Asahi India Glass Ltd. (AIS)

- Asahi Glass

Recent Developments

- In 2024, AGC Glass Europe partnered with ROSI to recycle photovoltaic (PV) panel cover sheets into raw materials for new flat glass, promoting a circular economy.

- In 2024, PPG successfully divested its U.S. and Canada architectural coatings and silicas products businesses.

- In June 2023, Saint-Gobain Glass India launched the first production of low-carbon glass in India, a product that reduces its carbon footprint by approximately 40% compared to existing products by utilizing a high percentage of recycled glass and energy from renewable sources

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The flat glass market will see steady growth driven by rising construction activities.

- Demand for energy-efficient glass will expand due to stricter building regulations worldwide.

- Automotive applications will increase with higher adoption of laminated and tempered glass.

- Solar glass will grow rapidly, supported by global renewable energy investments.

- Technological advancements will drive adoption of smart and coated glass solutions.

- Asia-Pacific will remain the dominant production and consumption hub.

- North America and Europe will lead in advanced glazing innovations.

- Sustainability goals will push recycling and eco-friendly glass production practices.

- Fluctuating energy and raw material costs will influence manufacturing strategies.

- Emerging economies will offer new opportunities in residential and commercial infrastructure.