Market overview

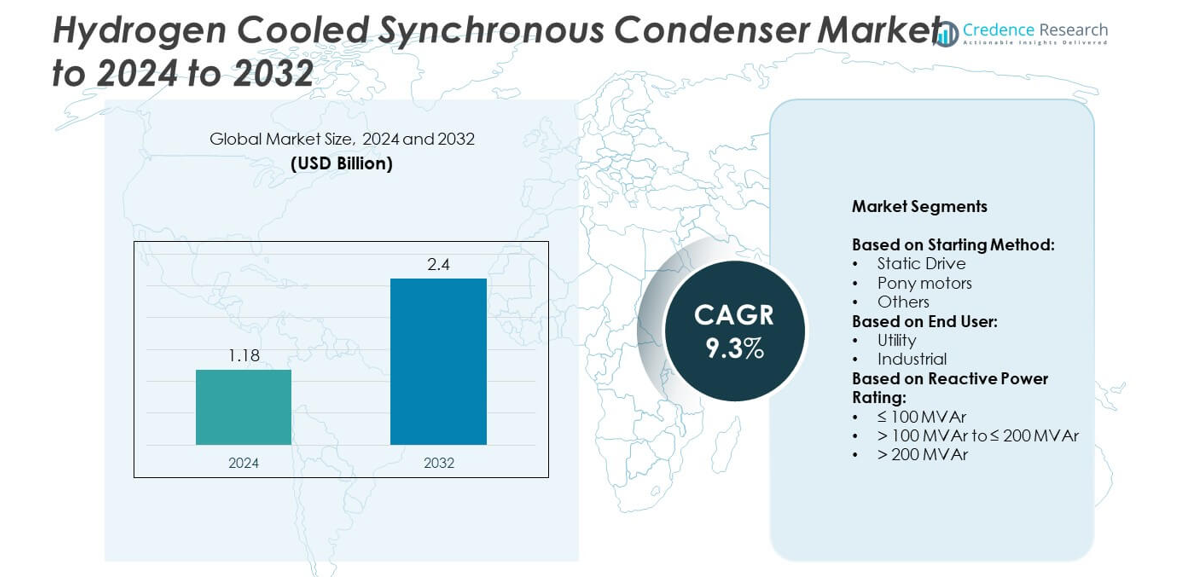

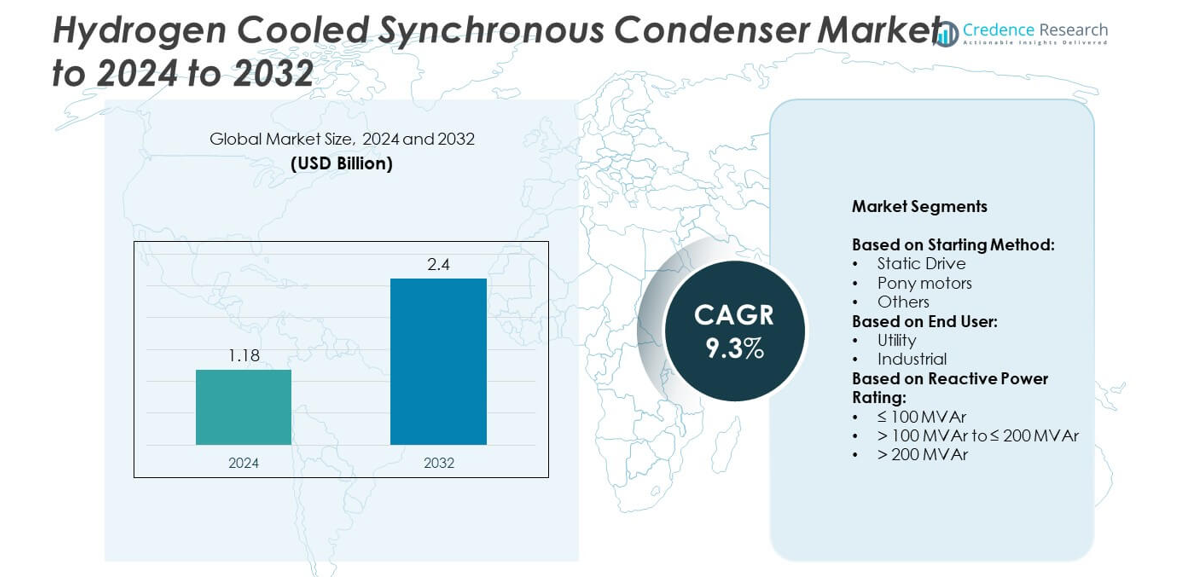

Hydrogen Cooled Synchronous Condenser Market size was valued USD 1.18 Billion in 2024 and is anticipated to reach USD 2.4 Billion by 2032, at a CAGR of 9.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hydrogen Cooled Synchronous Condenser Market Size 2024 |

USD 1.18 Billion |

| Hydrogen Cooled Synchronous Condenser Market, CAGR |

9.3% |

| Hydrogen Cooled Synchronous Condenser Market Size 2032 |

USD 2.4 Billion |

The hydrogen cooled synchronous condenser market is highly competitive, with top players including Nidec Corporation, WEG, General Electric, Shanghai Electric, Toshiba Energy Systems & Solutions Corporation, Siemens Energy, ABB, Eaton, Hitachi Energy Ltd., Doosan, Ansaldo Energia, Power Systems & Controls, Inc., and Mitsubishi Electric Power Products, Inc. These companies focus on delivering high-capacity systems, integrating digital monitoring solutions, and expanding their presence through large-scale utility projects. In 2024, North America emerged as the leading region, holding 34% of the global market share, driven by significant grid modernization programs and renewable integration. Europe followed with 28% share, supported by decarbonization initiatives and renewable energy investments, while Asia Pacific accounted for 25%, positioning it as the fastest-growing region.

Market Insights

- The hydrogen cooled synchronous condenser market was valued at USD 1.18 Billion in 2024 and is projected to reach USD 2.4 Billion by 2032, growing at a CAGR of 9.3%.

- Growing renewable energy integration and grid modernization are the key drivers, as utilities seek stable reactive power support and high operational reliability to manage fluctuating power supply.

- A major trend is the adoption of high-capacity units above 200 MVAr, supported by smart grid integration and digital monitoring solutions that enhance efficiency and predictive maintenance.

- The market is competitive, with global leaders investing in advanced designs, high-efficiency cooling, and strategic collaborations to secure large-scale contracts across utility and industrial segments.

- North America led the market with 34% share in 2024, followed by Europe with 28% and Asia Pacific with 25%, while the static drive segment dominated with over 45% share, reflecting strong preference for fast and efficient starting systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Starting Method

The static drive segment held the largest share of the hydrogen cooled synchronous condenser market in 2024, accounting for over 45% of installations. Its dominance is supported by faster start-up times, lower maintenance requirements, and reduced operational costs compared to pony motors. Static drives also enable smooth synchronization with power grids, making them highly suitable for modern utilities requiring stability and flexibility. Pony motors continue to serve smaller-scale or retrofit projects, while other starting methods remain niche. The rising integration of renewable energy sources further drives demand for static drive-based systems.

- For instance, Siemens Energy specifies SFC starting on its syncons and offers generators up to 1,300 MVA at full speed, aligning with utility-grade static-drive deployments.

By End User

Utilities represented the leading end-user segment in 2024, with a market share exceeding 60%. Grid operators are increasingly adopting hydrogen cooled synchronous condensers to enhance system reliability, voltage stability, and reactive power support as renewable penetration rises. Large-scale deployment in transmission networks highlights utilities’ preference for condensers with high efficiency and long operational lifespans. Industrial applications, though smaller in share, are growing steadily, particularly in heavy industries requiring stable power quality. The push for grid modernization and national decarbonization policies continues to strengthen utility demand for these condensers.

- For instance, ABB installed two high-inertia synchronous condensers at Statkraft’s Lister Drive site; one configuration couples a 67 MVAr condenser with a 40-ton flywheel for grid support.

By Reactive Power Rating

The >200 MVAr segment dominated the market in 2024, capturing nearly 50% share due to its ability to manage large grid-scale demands. These high-capacity units are preferred in regions with extensive renewable energy integration, where grid stability requires strong reactive power support. Their adoption is further driven by utilities investing in advanced solutions for frequency regulation and voltage control in transmission networks. While ≤100 MVAr and >100 MVAr to ≤200 MVAr segments serve smaller regional grids and industrial users, large-capacity systems remain the primary choice for expanding high-voltage networks globally.

Key Growth Drivers

Rising Renewable Energy Integration

The rapid expansion of renewable energy, particularly wind and solar, is a key growth driver for the hydrogen cooled synchronous condenser market. These energy sources create voltage fluctuations and grid instability, requiring advanced reactive power management. Hydrogen cooled synchronous condensers offer reliable support due to their high efficiency and ability to provide dynamic stability. Their use is increasing in transmission networks with high renewable penetration, where consistent performance is vital. Growing global investments in clean energy transition directly fuel demand for these advanced condensers.

- For instance, Omexom delivered the Kiamal synchronous condenser, rated 190 MVAr.

Grid Modernization and Infrastructure Investments

Ongoing grid modernization programs are another major growth driver. Utilities worldwide are upgrading transmission and distribution infrastructure to meet rising electricity demand and reduce outages. Hydrogen cooled synchronous condensers play a critical role in stabilizing power quality during this transition. Large-scale infrastructure projects in North America, Europe, and Asia-Pacific highlight the growing reliance on these systems. Government-backed funding and regulatory mandates for resilient grids further support adoption, positioning hydrogen cooled synchronous condensers as a central component of next-generation grid solutions.

- For instance, Transgrid plans to deploy a combination of ten synchronous condensers and 5 GW of grid-forming batteries.

High Efficiency and Operational Reliability

Efficiency and operational reliability remain significant growth drivers for hydrogen cooled synchronous condensers. Hydrogen cooling offers superior heat dissipation compared to air or water, ensuring consistent performance under high-load conditions. This technology supports longer equipment lifespan, reduced downtime, and lower operational costs. Utilities and industrial end users prefer these condensers for their ability to handle large reactive power loads with minimal maintenance. The focus on cost-effective grid solutions enhances the competitive edge of hydrogen cooled systems in global electricity markets.

Key Trends & Opportunities

Adoption of High-Capacity Units

A prominent trend in the market is the shift toward >200 MVAr hydrogen cooled synchronous condensers. These large-capacity units address growing demand for grid stability in regions with rapid renewable adoption. Their ability to provide strong reactive power support and frequency regulation positions them as essential components in high-voltage networks. Emerging economies investing in transmission upgrades also present opportunities for large-capacity condenser deployment, ensuring future demand remains strong.

- For instance, Quinbrook’s Stability Pathfinder assets are expected to provide 1,676 MVa short-circuit level and 8,326 MW·s inertia when operational, covering substantial ESO requirements.

Digital Monitoring and Smart Grid Integration

The integration of digital monitoring and IoT-enabled solutions is creating new opportunities. Utilities increasingly deploy hydrogen cooled synchronous condensers with remote diagnostics, predictive maintenance, and real-time performance monitoring features. These advancements align with broader smart grid initiatives, enabling utilities to optimize reactive power management and reduce unplanned outages. The trend of digitization not only improves reliability but also enhances the long-term value proposition of hydrogen cooled condensers for modern power systems.

- For instance, SP Energy Networks deployed the PHOENIX hybrid solution at Neilston: 140 MVA total with a 70 MVA synchronous condenser providing –34 to +70 MVAr reactive range under advanced control.

Key Challenges

High Capital and Installation Costs

One of the primary challenges in this market is the high capital investment required. Hydrogen cooled synchronous condensers involve complex design, specialized materials, and advanced cooling systems, which significantly increase upfront costs. Installation also demands skilled expertise and extensive infrastructure, limiting adoption among smaller utilities or industrial players. Despite long-term operational savings, the initial financial burden remains a barrier to wider market penetration, especially in developing regions with limited funding for advanced grid solutions.

Competition from Alternative Technologies

Competition from advanced power electronics such as STATCOMs poses a significant challenge. STATCOMs are compact, easier to install, and often more cost-effective for small and medium-sized grid projects. Their growing adoption in renewable-heavy regions challenges the market share of synchronous condensers. While hydrogen cooled systems maintain an edge in high-capacity and long-duration applications, continuous improvements in alternative technologies increase competitive pressure. This challenge requires manufacturers to focus on innovation, efficiency gains, and value-added digital features to sustain demand.

Regional Analysis

North America

North America accounted for the largest share of the hydrogen cooled synchronous condenser market in 2024, holding nearly 34% of the global revenue. The region’s leadership is driven by grid modernization projects, renewable integration, and government-backed initiatives to strengthen transmission networks. The United States dominates the regional demand, supported by investments in advanced grid stability solutions. Canada also contributes with renewable-focused projects, particularly in wind and hydro. The presence of key manufacturers and advanced technological infrastructure continues to support market expansion, with utilities prioritizing large-capacity condensers to handle increasing renewable energy penetration.

Europe

Europe held around 28% of the global market share in 2024, supported by ambitious decarbonization targets and large-scale renewable adoption. Countries such as Germany, the United Kingdom, and France are major contributors due to significant investments in wind and solar energy. The European Union’s regulatory push for cleaner and more stable grids has accelerated deployment of hydrogen cooled synchronous condensers. Utilities across the region are focusing on large-capacity systems to stabilize fluctuating renewable output. Strong government support and growing cross-border interconnections are expected to sustain Europe’s position as a critical market.

Asia Pacific

Asia Pacific captured nearly 25% of the global hydrogen cooled synchronous condenser market share in 2024, fueled by rapid urbanization and surging electricity demand. China and India lead regional adoption, driven by heavy renewable energy integration and grid expansion programs. Japan, South Korea, and Australia are also key contributors, investing in smart grid infrastructure to balance renewable fluctuations. High-capacity condensers dominate installations in this region, especially in China where large transmission networks are expanding. Rising government investments and industrial demand are expected to make Asia Pacific the fastest-growing regional market during the forecast period.

Latin America

Latin America represented about 7% of the market share in 2024, with Brazil and Mexico leading adoption. Growing renewable energy projects, especially in wind and solar, are creating opportunities for hydrogen cooled synchronous condensers to support regional grid stability. Utilities are focusing on strengthening high-voltage transmission infrastructure to meet rising power demand. While the overall adoption rate remains moderate, increasing foreign investments and supportive government programs are expected to drive gradual market growth. Industrial applications also contribute in specific sectors, though utility projects remain the main revenue source in the region.

Middle East & Africa

The Middle East & Africa accounted for roughly 6% of the market share in 2024, with demand primarily concentrated in Gulf countries and South Africa. Investments in renewable energy, including solar power projects in the UAE and Saudi Arabia, are driving adoption of hydrogen cooled synchronous condensers to support grid stability. Africa’s focus remains on expanding transmission capacity to reduce outages and integrate new generation sources. Although the region currently holds a smaller share, rising infrastructure investments and government-backed energy diversification programs provide strong potential for future market growth.

Market Segmentations:

By Starting Method:

- Static Drive

- Pony motors

- Others

By End User:

By Reactive Power Rating:

- ≤ 100 MVAr

- > 100 MVAr to ≤ 200 MVAr

- > 200 MVAr

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The hydrogen cooled synchronous condenser market is shaped by leading players such as Nidec Corporation, WEG, General Electric, Shanghai Electric, Toshiba Energy Systems & Solutions Corporation, Siemens Energy, Power Systems & Controls, Inc., Hitachi Energy Ltd., ABB, Eaton, Ansaldo Energia, Doosan, and Mitsubishi Electric Power Products, Inc. These companies compete through advanced product portfolios, strong global presence, and continuous investments in grid stability solutions. The competitive focus lies on delivering high-capacity units, integrating digital monitoring features, and offering long-term operational reliability. Manufacturers are also aligning with government-backed grid modernization programs and renewable energy integration projects to expand their market footprint. Strategic collaborations, technology innovations, and large-scale utility contracts are central to maintaining competitive advantage. With increasing demand for efficient reactive power management, companies are emphasizing hydrogen cooling systems that ensure durability and efficiency. The market remains highly competitive, driven by technological advancements, regulatory compliance, and expanding energy infrastructure needs worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nidec Corporation

- WEG

- General Electric

- Shanghai Electric

- Toshiba Energy Systems & Solutions Corporation

- Siemens Energy

- Power Systems & Controls, Inc.

- Hitachi Energy Ltd.

- ABB

- Eaton

- Ansaldo Energia

- Doosan

- Mitsubishi Electric Power Products, Inc.

Recent Developments

- In 2024, GE successfully commissioned a new hydrogen-cooled synchronous condenser for a renewable energy project in the United States.

- In 2024, Hitachi Energy won an order to design and deliver a grid stabilization solution for SP Energy Networks in the UK. The solution combines a STATCOM and a synchronous condenser system to increase grid stability and enable more renewable energy integration.

- In 2023, Siemens introduced a hybrid grid stabilization solution in Ireland that combined a synchronous condenser with flywheel technology and a battery.

Report Coverage

The research report offers an in-depth analysis based on Starting Method, End-User, Reactive Power Rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily, supported by rising renewable energy integration into grids.

- Demand for high-capacity condensers above 200 MVAr will remain the strongest.

- Utilities will continue leading adoption due to large-scale transmission upgrades.

- Industrial applications will expand gradually in heavy energy-intensive sectors.

- Asia Pacific will emerge as the fastest-growing regional market.

- Digital monitoring and IoT-enabled features will drive product innovation.

- Competition with STATCOMs will push manufacturers to enhance efficiency.

- Hydrogen cooling technology will be favored for its reliability and long lifespan.

- Government-backed grid modernization programs will accelerate deployment.

- Manufacturers will invest more in sustainable and cost-effective designs.