Market Overview

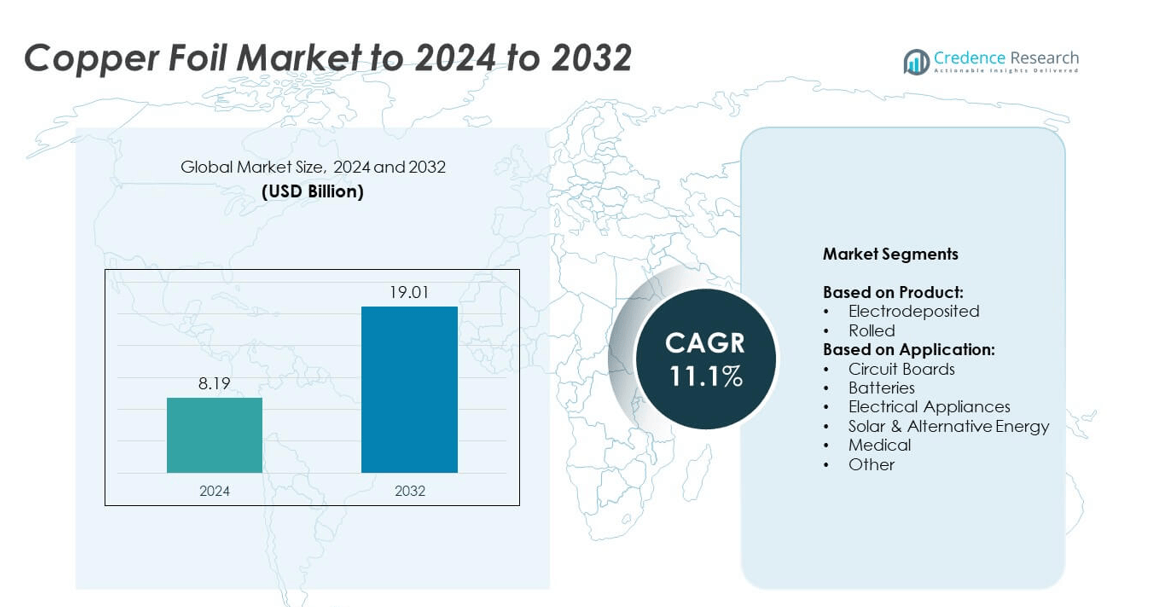

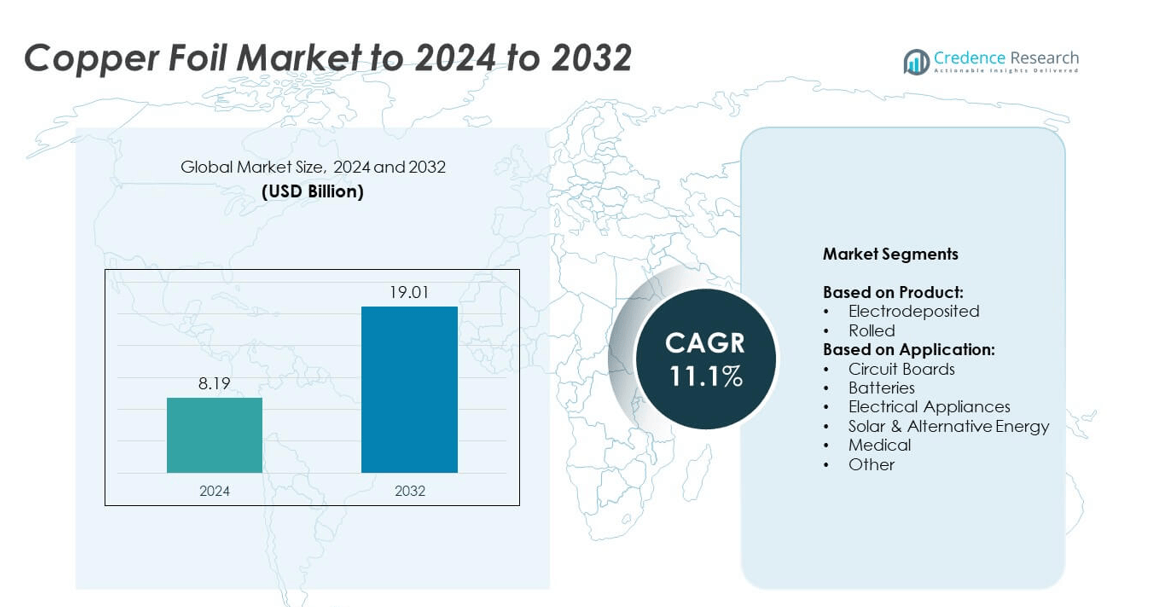

Copper Foil Market size was valued at USD 8.19 Billion in 2024 and is anticipated to reach USD 19.01 Billion by 2032, at a CAGR of 11.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Copper Foil Market Size 2024 |

USD 8.19 Billion |

| Copper Foil Market, CAGR |

11.1% |

| Copper Foil Market Size 2032 |

USD 19.01 Billion |

The copper foil market is characterized by strong competition among leading companies such as SK Nexilis, Doosan Corporation Electro-Materials, Furukawa Electric Co., Ltd., Circuit Foils, LS Mtron Ltd., Lotte Energy Materials, Nippon Denkai, Ltd., Solus, Chang Chun Group, UACJ Foil Corporation, and Lingbao. These players focus on expanding production capacity, enhancing product performance, and adopting sustainable manufacturing practices to strengthen their global presence. Asia-Pacific dominated the market in 2024, accounting for 48% of the total share, driven by large-scale PCB and EV battery production in China, Japan, and South Korea. North America and Europe followed, supported by strong renewable energy and automotive demand.

Market Insights

- The copper foil market was valued at USD 8.19 billion in 2024 and is projected to reach USD 19.01 billion by 2032, growing at a CAGR of 11.1%.

- Growing demand from electric vehicle batteries and printed circuit boards remains the key driver of market expansion, supported by rising investments in renewable energy and consumer electronics.

- Advancements in ultra-thin and high-purity copper foils are shaping market trends, enabling compact electronic designs and improved battery performance.

- The market is moderately competitive, with major players focusing on product innovation, regional capacity expansion, and sustainable production technologies to maintain market position.

- Asia-Pacific led the market with a 48% share in 2024, followed by North America at 22% and Europe at 19%; the electrodeposited foil segment dominated globally with over 65% share due to its extensive use in batteries and circuit boards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The electrodeposited copper foil segment dominated the market in 2024, holding over 65% share. This dominance is driven by its high conductivity, surface uniformity, and suitability for printed circuit boards and lithium-ion batteries. Electrodeposited foils are preferred in flexible and rigid PCBs due to their excellent adhesion and mechanical strength. Growing demand for EV batteries and consumer electronics further accelerates adoption. Manufacturers are improving electrodeposited foil thickness control and purity to meet advanced microcircuit and energy storage requirements, reinforcing its leadership across electronic and energy applications.

- For instance, Ventec International offers electrodeposited copper foils in nominal thicknesses of 9, 12, 18, 35, and 70 µm. The high-purity HTE copper foil, an IPC-4562 Grade 3 product sourced from Chang Chun Petrochemical Company (CCP), is used for applications like conventional FR-4 circuit boards.

By Application

The circuit boards segment accounted for more than 45% of the copper foil market share in 2024. Its growth is fueled by rising demand for smartphones, wearables, and IoT-enabled devices. Copper foil provides excellent electrical conductivity and durability, making it essential in multilayer PCBs and flexible circuits. The trend toward miniaturized, high-performance electronics boosts the use of ultra-thin foils in HDI (high-density interconnect) boards. Additionally, growing adoption of EVs and autonomous systems further strengthens the PCB segment’s position as the leading application area globally.

- For instance, in 2023, the printed circuit board segment held over 62 % of the electrodeposited copper foil revenue share

Key Growth Drivers

Rising Demand from Electric Vehicle Batteries

The surge in electric vehicle production is a major driver for the copper foil market. Copper foil is essential in lithium-ion battery anodes, offering high conductivity and thermal stability. The expansion of EV manufacturing in China, South Korea, and Europe is fueling large-scale foil demand. With automakers increasing battery capacity installations, manufacturers are investing in ultra-thin, high-strength foils to enhance battery efficiency. This growing dependence on copper foil in EV batteries remains the strongest catalyst for market expansion.

- For instance, Defu Technology reported shipments exceeding 140 metric tons of copper foil used for semi-/all-solid-state batteries in the first half of 2025.

Expansion of Consumer Electronics and PCB Manufacturing

The growing production of smartphones, tablets, and connected devices significantly boosts copper foil consumption. Printed circuit boards (PCBs) rely heavily on copper foil for electrical conductivity and heat dissipation. Increasing miniaturization of devices requires finer, high-quality foil layers. Asia-Pacific remains the manufacturing hub for PCBs, supported by favorable government incentives and infrastructure. This continuous rise in consumer electronics and PCB applications solidifies the segment as a core growth pillar for the copper foil industry.

- For instance, Civen Inc. offers electrodeposited copper foils, including Very Low Profile (VLP) and High Temperature Elongation (HTE) grades. The VLP foils are available in nominal thicknesses from 9 µm to 105 µm, while HTE foils are offered from 9 µm to 70 µm. Additionally, Civen manufactures “Super Thick ED Copper Foils” with nominal thicknesses that can extend to 420 µm for specialized applications.

Adoption in Renewable and Alternative Energy Systems

Rising adoption of solar and wind power systems is accelerating copper foil usage in energy storage components. Foils are critical in photovoltaic cells and inverter systems for efficient current transfer. As renewable installations expand globally, the demand for durable and conductive copper foil rises. Energy storage manufacturers increasingly adopt rolled foils for superior flexibility and heat resistance. The shift toward sustainable energy infrastructure positions this segment as a key long-term growth driver for the global market.

Key Trends & Opportunities

Advancements in Ultra-Thin and High-Purity Foil Technologies

Manufacturers are focusing on ultra-thin and high-purity foil production to meet evolving electronic design needs. These foils enhance miniaturization and enable high-density circuitry in advanced devices. Companies are investing in precision rolling and plating technologies to achieve uniform thickness and higher mechanical strength. This innovation trend aligns with the rising demand for next-generation semiconductors, flexible displays, and compact batteries, creating strong opportunities for premium-grade copper foil suppliers.

- For instance, ongoing research is focused on developing copper foils with bimodal grain structures to enhance the mechanical properties of materials for flexible electronics. This involves optimizing ultra-thin foils, with some studies preparing foils as thin as 9 µm for high-performance applications

Increasing Localization of Foil Production Facilities

Global supply chain challenges are encouraging manufacturers to establish regional copper foil production facilities. Countries in Asia and North America are witnessing new capacity expansions to meet localized demand from EV and electronics manufacturers. This localization reduces import dependency and stabilizes lead times. It also promotes regional partnerships with battery and PCB producers, driving new investment and collaboration opportunities across the copper foil supply chain.

- For instance, in November 2020, JX Nippon Mining & Metals began shipping samples of new products, including a high-strength rolled copper foil for lithium-ion batteries and several high-performance copper alloys. Among the new alloys was C1995 ultra-high-strength titanium copper, which achieved a tensile strength of 1,500 MPa for use in high-performance electronic connectors.

Key Challenges

Volatility in Raw Material Prices

Fluctuating copper prices pose a significant challenge for foil producers, affecting production costs and profit margins. Market volatility driven by mining disruptions, global trade shifts, and fluctuating demand impacts supply stability. Manufacturers face difficulty in maintaining pricing consistency for downstream industries like batteries and electronics. To mitigate these effects, companies are increasingly turning to long-term supply contracts and recycling initiatives to balance material costs and ensure sustainable sourcing.

Complex Manufacturing and Quality Control Requirements

Producing high-quality copper foil involves precision control over thickness, grain structure, and purity. Maintaining uniformity and adhesion properties for advanced electronic applications adds to production complexity. Strict quality standards from EV and electronics manufacturers increase operational pressure on producers. Achieving consistent performance while scaling production capacity remains a key hurdle. Continuous investment in advanced manufacturing technologies and process automation is required to address these technical and operational challenges.

Regional Analysis

North America

North America accounted for around 22% of the copper foil market share in 2024. Growth is driven by expanding EV battery manufacturing and robust electronics production in the U.S. and Canada. The region’s increasing focus on renewable energy projects and data center infrastructure supports higher foil demand. Government incentives for electric mobility and domestic battery production further strengthen market growth. Major industry players are investing in local manufacturing capabilities to reduce import dependence and ensure high-quality supply for automotive, electronics, and power generation sectors.

Europe

Europe held approximately 19% of the global copper foil market share in 2024. Rising investments in electric mobility and renewable energy systems fuel regional demand. Germany, France, and the U.K. lead in automotive electrification and PCB manufacturing. The European Union’s focus on green technologies and sustainable materials encourages copper foil adoption in energy-efficient electronics. Battery production initiatives under the European Battery Alliance continue to drive consumption. Increasing local capacity and collaborations with Asian suppliers enhance supply chain resilience across the European market.

Asia-Pacific

Asia-Pacific dominated the copper foil market with a 48% share in 2024. The region’s leadership stems from large-scale manufacturing bases in China, Japan, South Korea, and Taiwan. Rapid growth in consumer electronics, PCB production, and electric vehicles underpins strong demand. China remains the largest producer and exporter of copper foil, supported by cost-efficient manufacturing and government subsidies. South Korea and Japan continue investing in high-performance foils for advanced batteries and semiconductors. Expanding renewable energy infrastructure and industrial digitization further enhance regional market momentum.

Latin America

Latin America captured around 6% of the copper foil market share in 2024. The region benefits from abundant copper resources, especially in Chile and Peru, supporting raw material availability. Demand is rising from renewable energy and electronics assembly sectors in Brazil and Mexico. Growth in automotive component manufacturing and government-backed solar projects is improving regional market potential. However, limited refining and processing infrastructure constrain large-scale production. Investments in energy storage and sustainable industries are expected to gradually strengthen Latin America’s position in the global market.

Middle East & Africa

The Middle East & Africa region accounted for nearly 5% of the copper foil market share in 2024. Increasing investments in solar power projects and industrial electrification are key growth factors. The United Arab Emirates and Saudi Arabia are focusing on local production of electronic components and battery materials. Rising infrastructure development and renewable energy adoption in South Africa also boost market opportunities. Although still emerging, the region is witnessing growing interest from international manufacturers establishing partnerships and distribution networks to serve future demand.

Market Segmentations:

By Product:

By Application:

- Circuit Boards

- Batteries

- Electrical Appliances

- Solar & Alternative Energy

- Medical

- Other

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The copper foil market features strong competition among leading players such as SK Nexilis, Doosan Corporation Electro-Materials, Furukawa Electric Co., Ltd., Circuit Foils, LS Mtron Ltd., Lotte Energy Materials, Nippon Denkai, Ltd., Solus, Chang Chun Group, UACJ Foil Corporation, and Lingbao. These companies focus on advanced manufacturing technologies, product purity, and process optimization to strengthen their market position. Innovation in ultra-thin foils, enhanced conductivity, and heat resistance remains central to their strategies. Producers are expanding production capacity across Asia, Europe, and North America to meet rising demand from EV batteries and electronics. Strategic partnerships with battery and semiconductor manufacturers help secure long-term supply contracts. Growing investment in recycling technologies and sustainable sourcing is further shaping competition. The market is witnessing continuous R&D efforts aimed at improving foil durability and flexibility for next-generation applications in renewable energy, electric vehicles, and high-density electronic devices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SK Nexilis

- Doosan Corporation Electro-Materials

- Furukawa Electric Co., Ltd.

- Circuit Foils

- LS Mtron Ltd.

- Lotte Energy Materials

- Nippon Denkai, Ltd.

- Solus

- Chang Chun Group

- UACJ Foil Corporation

- Lingbao

Recent Developments

- In 2023, SK Nexilis began mass production of ultrathin copper foil (4 microns thick) at a new facility in Malaysia.

- In 2023, Solus Advanced Materials broke ground on a new battery foil plant in Quebec, Canada, under its subsidiary Volta Energy Solutions Canada.

- In 2023, Lotte Energy Materials Announced plans to build a copper foil plant in the U.S. to supply North American EV battery makers.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The copper foil market will grow steadily, driven by rising EV battery demand.

- Advancements in ultra-thin foil technology will enhance electronic component performance.

- Expansion of renewable energy systems will boost foil use in solar and storage applications.

- Increasing regional manufacturing will reduce supply chain dependency on imports.

- Demand for high-purity foils will rise with growth in semiconductors and flexible circuits.

- Recycling initiatives will support sustainable copper sourcing and lower production costs.

- Integration of automation and AI in production will improve foil quality and yield.

- Growing adoption of 5G and IoT devices will sustain demand for copper foils in PCBs.

- Strategic partnerships between battery and foil manufacturers will strengthen supply reliability.

- Governments’ focus on energy efficiency and electrification will continue driving long-term growth.