Market Overview

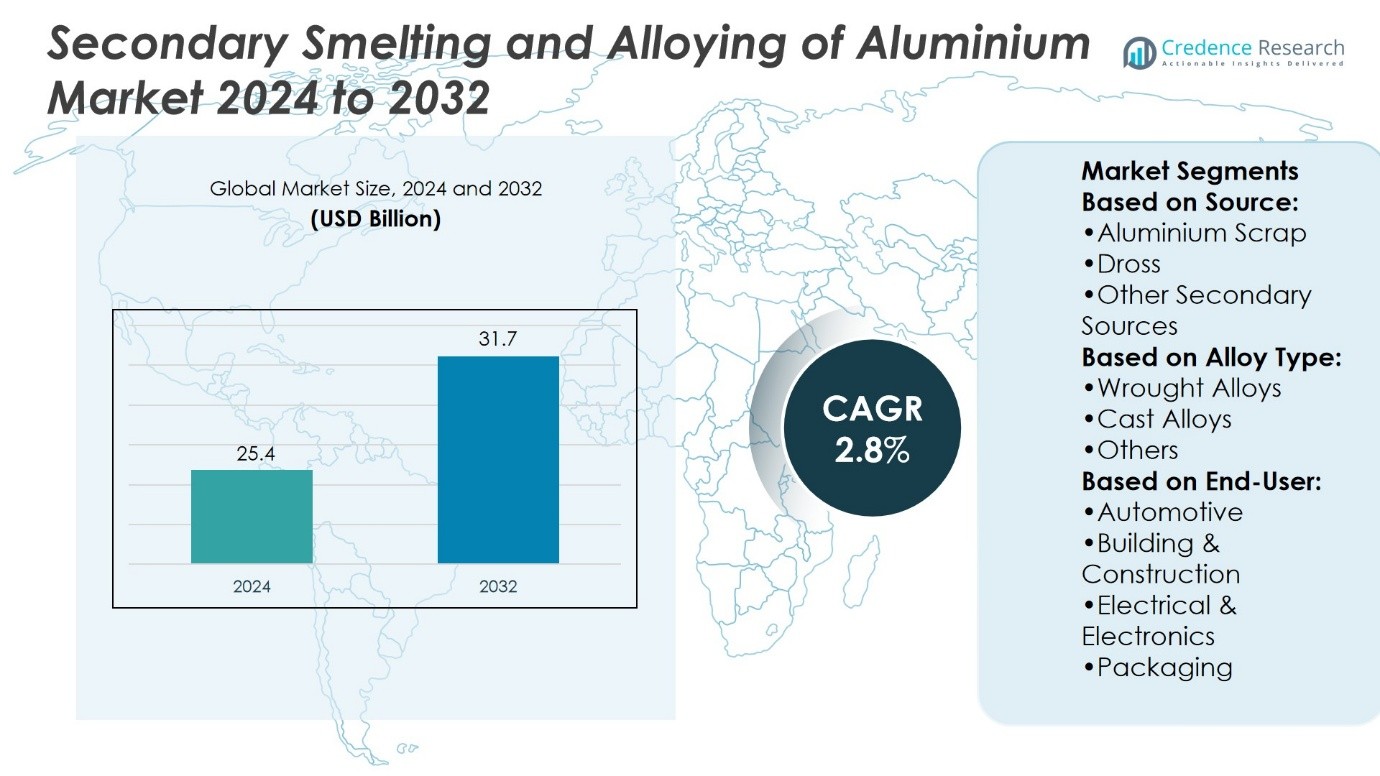

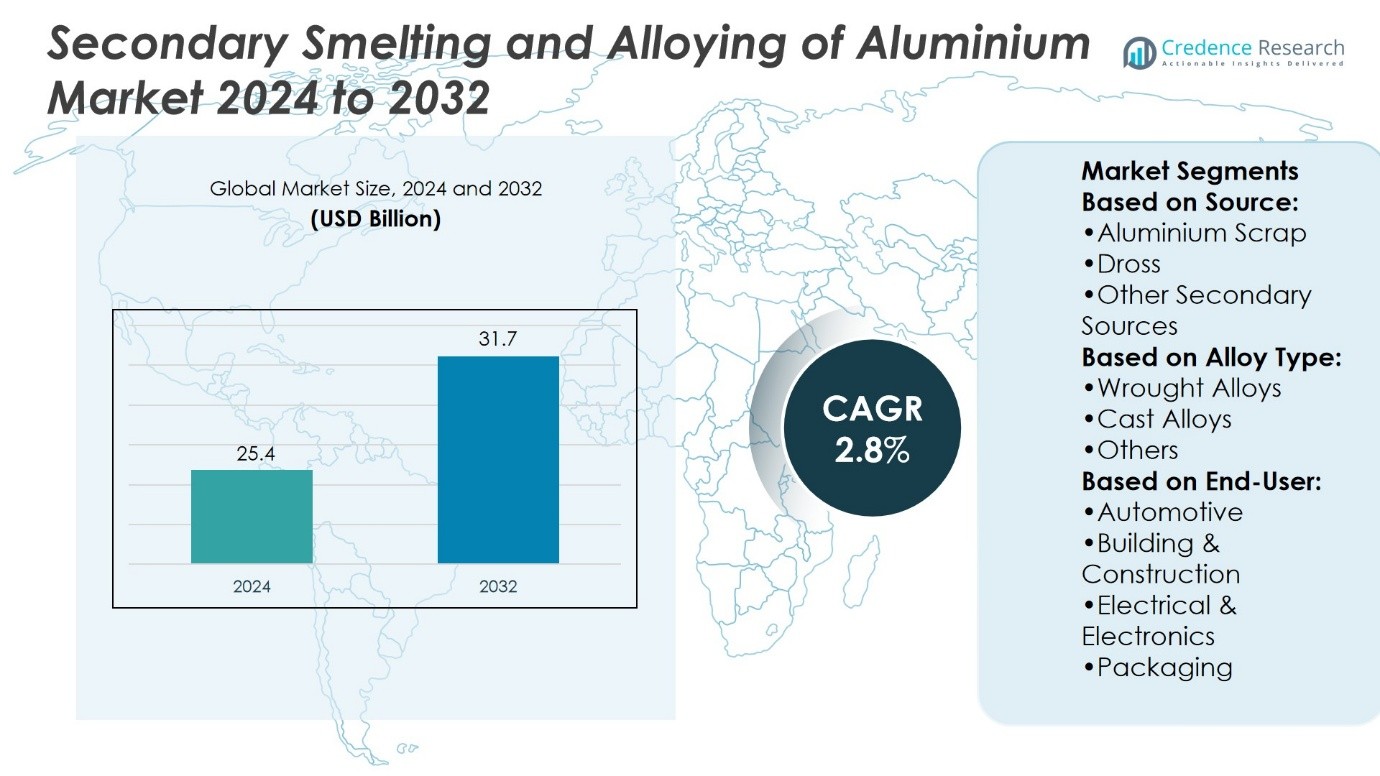

Secondary Smelting and Alloying of Aluminium Market size was valued at USD 25.4 billion in 2024 and is anticipated to reach USD 31.7 billion by 2032, at a CAGR of 2.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Secondary Smelting and Alloying of Aluminium Market Size 2024 |

USD 25.4 Billion |

| Secondary Smelting and Alloying of Aluminium Market, CAGR |

2.8% |

| Secondary Smelting and Alloying of Aluminium Market Size 2032 |

USD 31.7 Billion |

The Secondary Smelting and Alloying of Aluminium Market grows due to rising demand for lightweight, high-strength, and sustainable aluminium alloys across automotive, construction, and packaging sectors. Increasing industrial scrap availability and focus on recycling drive cost-effective production. Technological advancements in precision alloying, energy-efficient furnaces, and digital process control enhance product quality and operational efficiency. Growing adoption of circular economy practices and regulatory emphasis on emission reduction shape market trends. Expansion in Asia-Pacific and emerging regions supports global demand. Manufacturers focus on developing specialized alloys for high-performance applications, integrating automation, and improving yield to meet evolving industrial requirements.

The Secondary Smelting and Alloying of Aluminium Market shows strong presence in Asia-Pacific, North America, and Europe, with emerging demand in Latin America and the Middle East & Africa. Asia-Pacific leads due to rapid industrialization and abundant scrap availability, while North America and Europe focus on energy-efficient and sustainable production. Key players drive growth through technological innovation, capacity expansion, and alloy specialization, meeting diverse industrial demands across automotive, construction, electrical, and packaging sectors. Strategic investments enhance global competitiveness and operational efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Secondary Smelting and Alloying of Aluminium Market size was valued at USD 25.4 billion in 2024 and is projected to reach USD 31.7 billion by 2032, with a CAGR of 2.8%.

- Rising demand for lightweight and high-strength aluminium alloys across automotive, construction, and packaging sectors drives market growth.

- Increasing availability of industrial scrap and focus on recycling supports cost-effective and sustainable production.

- Technological advancements in precision alloying, energy-efficient furnaces, and digital process control improve product quality and operational efficiency.

- Circular economy adoption and regulatory emphasis on emission reduction influence market trends globally.

- Key players enhance competitiveness through capacity expansion, alloy specialization, and innovation in high-performance products.

- Asia-Pacific leads the market due to industrialization and scrap availability, while North America and Europe focus on sustainable production; emerging demand grows in Latin America and the Middle East & Africa.

Market Drivers

Growing Demand for Lightweight and High-Performance Materials in Automotive and Aerospace Industries

The Secondary Smelting and Alloying of Aluminium Market is driven by increasing use of lightweight, high-strength materials in automotive and aerospace sectors. Manufacturers prioritize aluminium alloys to reduce vehicle weight and improve fuel efficiency. It supports production of structural components, engine parts, and aircraft panels with enhanced corrosion resistance. Rising adoption of electric vehicles further boosts demand for aluminium components in battery casings and chassis. Companies report improvements in alloy quality and consistency, enabling broader industrial applications. Investment in precision alloying technologies ensures reliable mechanical properties and dimensional stability. Continuous innovation allows the sector to meet stringent performance standards across industries.

- For instance, Akita Zinc Co., Ltd., a DOWA subsidiary, produces approximately 200,000 tons of electrolytic zinc per year, enabling efficient recovery of indium and related metals used in aluminium alloys.

Expansion of Recycling Initiatives and Sustainability Efforts in Metal Production

Recycling initiatives accelerate market growth by reducing energy consumption and environmental impact. Secondary smelting uses scrap aluminium, which requires significantly less energy than primary production. It enables companies to recover millions of tons of aluminium annually while maintaining material properties. Governments and industries promote circular economy practices, creating steady feedstock availability. Improved sorting and purification technologies enhance efficiency and alloy quality. Industrial stakeholders implement closed-loop systems to minimize waste and maximize recovery rates. Sustainability drives encourage adoption of secondary smelting in large-scale manufacturing operations.

- For instance, Kaiser Aluminum and Boeing partnered on a closed-loop recycling program designed to capture about 22 million pounds of aluminum alloy scrap over the 2014-2015 production period, a move intended to reduce environmental impact and manufacturing waste.

Technological Advancements in Alloying and Purification Processes Enhancing Efficiency

Advanced alloying techniques and purification processes improve yield and product consistency. It allows production of complex aluminium grades suitable for automotive, construction, and packaging applications. Automation and digital monitoring optimize furnace performance and reduce energy losses. Companies adopt fluxes and degassing systems to maintain alloy homogeneity. Research focuses on reducing impurities while achieving precise chemical compositions. Enhanced process control supports production of specialty alloys with high strength-to-weight ratios. Technological progress enables faster throughput and lower operational costs.

Rising Industrial and Construction Activities Fueling Aluminium Consumption

The market benefits from growth in industrial infrastructure and urban development projects. Aluminium alloys provide structural integrity and corrosion resistance for buildings, bridges, and pipelines. It offers cost-effective solutions compared to alternative metals while maintaining strength and durability. Increasing demand for high-rise buildings and lightweight industrial equipment boosts secondary smelting output. Manufacturers align production capacity with construction material demand to ensure supply stability. Strong demand from industrial machinery and packaging sectors further reinforces market growth. Expanding applications of aluminium alloys across industries support sustained adoption of secondary smelting.

Market Trends

Increasing Adoption of Advanced Automation and Digital Monitoring Systems in Aluminium Production

The Secondary Smelting and Alloying of Aluminium Market shows a strong trend toward automation and digital process control. It allows precise temperature regulation and alloy composition monitoring, improving product quality. Companies implement sensor-based systems to track furnace performance and detect impurities in real time. Digital platforms support predictive maintenance, reducing downtime and operational costs. High-speed data analytics optimize batch cycles and energy consumption. Manufacturers integrate robotics for material handling to enhance safety and efficiency. The trend toward digitalization strengthens consistency and scalability across production facilities.

- For instance, Raffmetal S.p.A., Europe’s largest recycled‑alloy producer, operates two production plants with a capacity exceeding 350,000 tons of recycled aluminium per year and spans 145,000 m² of site area, including 76,800 m² under roof for its advanced continuous‑casting facilities.

Rising Preference for High-Strength and Specialty Aluminium Alloys Across Multiple Industries

Demand for high-strength, corrosion-resistant aluminium alloys continues to shape market trends. It supports automotive, aerospace, and construction applications where performance and durability are critical. Manufacturers focus on producing alloys with tailored chemical compositions to meet specific engineering requirements. Research emphasizes improving mechanical properties while maintaining recyclability. Market players introduce lightweight alloys suitable for electric vehicle components and structural frameworks. Increasing customization drives investment in precision alloying technologies. The trend ensures aluminium remains a preferred material for high-performance industrial applications.

- For instance, Novelis Inc. recycled over 2.3 million metric tons of aluminum scrap, including 82 billion used beverage cans, in fiscal year 2024. This was achieved through its operations in 11 countries

Integration of Environmentally Sustainable Practices in Aluminium Recycling and Production

Environmental sustainability drives adoption of secondary smelting technologies. It reduces energy usage compared to primary aluminium production and minimizes industrial waste. Companies implement closed-loop recycling systems and recover millions of tons of scrap annually. Advanced purification and degassing technologies maintain alloy quality while promoting green manufacturing. Regulatory policies encourage reduced carbon footprint in metal production. Industrial stakeholders focus on lifecycle management to support circular economy initiatives. The trend strengthens market positioning among environmentally conscious consumers and industries.

Expansion of Global Supply Chains and Regional Production Facilities to Meet Growing Demand

The market observes a trend of expanding production capacity and regional presence to meet increasing aluminium demand. It ensures timely supply of high-quality alloys for automotive, packaging, and industrial applications. Companies establish smelting and alloying facilities close to raw material sources and key end-user markets. Strategic partnerships enhance logistics efficiency and reduce lead times. Investment in modern furnaces supports high-volume production without compromising alloy consistency. The trend promotes resilient supply chains capable of responding to industrial growth and market fluctuations.

Market Challenges Analysis

High Energy Consumption and Operational Costs Limiting Profit Margins in Aluminium Production

The Secondary Smelting and Alloying of Aluminium Market faces challenges from significant energy requirements in smelting and alloying processes. It demands consistent power supply to maintain furnace temperatures and chemical consistency. Fluctuating energy prices increase operational costs and affect profitability. Companies invest in energy-efficient furnaces and process optimization to control expenses. Maintaining precise alloy composition requires skilled labor and continuous monitoring, adding to overhead. Small and medium producers struggle to balance production efficiency with cost constraints. Rising raw material prices and logistics expenditures further pressure profit margins.

Complexity in Quality Control and Management of Scrap Aluminium Feedstock

Ensuring consistent quality across secondary smelting operations remains a key challenge. It requires precise separation and purification of scrap aluminium to remove contaminants. Variability in feedstock composition affects alloy strength, corrosion resistance, and mechanical properties. Companies implement advanced testing and filtration systems to maintain uniformity, increasing capital investment. Handling large volumes of scrap demands efficient logistics and storage solutions. Regulatory standards for emissions and waste disposal add compliance complexity. The need for advanced technology and skilled workforce limits entry for smaller players and raises operational risks.

Market Opportunities

Expansion of Electric Vehicle Production and Demand for Lightweight Automotive Components

The Secondary Smelting and Alloying of Aluminium Market presents opportunities from the growing electric vehicle (EV) industry. It supports production of lightweight, high-strength aluminium components for battery casings, chassis, and structural parts. Manufacturers can develop specialized alloys that balance strength, conductivity, and corrosion resistance. Rising EV adoption creates steady demand for recycled aluminium, offering cost and energy advantages over primary production. Investment in alloy innovation allows companies to supply components with precise mechanical properties. Collaboration with automotive OEMs strengthens market presence and accelerates technology adoption. Increasing focus on vehicle efficiency and sustainability expands long-term growth potential.

Adoption of Advanced Recycling Technologies and Circular Economy Practices

Sustainable manufacturing drives market opportunities through efficient scrap aluminium utilization. It enables companies to recover millions of tons of aluminium annually while maintaining alloy quality. Advanced sorting, purification, and degassing systems improve yield and reduce energy requirements. Industrial stakeholders can establish closed-loop recycling programs to ensure consistent feedstock supply. Regulatory support for environmentally friendly production enhances market competitiveness. Companies investing in technology for high-quality secondary aluminium gain access to multiple industrial applications. Continuous innovation in recycling techniques positions the market for sustainable expansion and new revenue streams.

Market Segmentation Analysis:

By Source

The Secondary Smelting and Alloying of Aluminium Market primarily relies on aluminium scrap, dross, and skimmings for feedstock. It allows recovery of high-quality aluminium while reducing energy consumption compared to primary production. Aluminium scrap dominates due to its availability from end-of-life products and industrial offcuts. Dross and skimmings contribute significant volumes from primary aluminium operations and support alloying requirements. Other secondary sources, including defective castings and machining residues, offer additional feedstock for specialized applications. Manufacturers invest in sorting and purification technologies to maintain consistency across varying material sources. Efficient utilization of secondary feedstock enhances production flexibility and cost efficiency.

- For instance, Constellium SE opened its Neuf-Brisach recycling center in September 2024, adding 130,000 metric tons of annual recycling capacity. That brought its global recycling capability to approximately 735,000 metric tons per year across Europe and North America.

By Alloy Type

The market segments into wrought alloys, cast alloys, and other specialized aluminium grades. It produces wrought alloys widely used for structural applications due to high strength and corrosion resistance. Cast alloys find application in components requiring complex geometries, including automotive and machinery parts. Other alloys, including specialty and experimental grades, meet demands for lightweight and high-performance components. Advanced alloying technologies ensure precise chemical composition and uniform mechanical properties. Research in high-strength, low-density alloys expands the range of industrial applications. Companies focus on producing alloys that meet stringent standards for durability and processability. The diversity of alloy types supports the growing industrial adoption of secondary aluminium.

- For instance, Befesa S.A. operates around 24 plants globally, with a total annual recycling capacity exceeding 2 million tonnes of residues from the steel and aluminium industries. This includes processing salt slags and aluminium residues into custom secondary alloys.

By End-User

The market caters to multiple end-use industries with varying requirements. It supplies the automotive sector with lightweight alloys for chassis, battery casings, and body panels. Building and construction applications include structural frames, façade panels, and roofing materials. Electrical and electronics industries rely on aluminium alloys for conductors, housings, and heat sinks. Packaging applications benefit from corrosion-resistant and recyclable aluminium sheets and foils. Manufacturers customize alloy properties to meet performance and regulatory standards for each sector. Strong demand from automotive and construction sectors drives production volumes. The focus on lightweight, durable, and sustainable aluminium alloys underpins growth across all end-user segments.

Segments:

Based on Source:

- Aluminium Scrap

- Dross

- Other Secondary Sources

Based on Alloy Type:

- Wrought Alloys

- Cast Alloys

- Others

Based on End-User:

- Automotive

- Building & Construction

- Electrical & Electronics

- Packaging

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a significant share of the Secondary Smelting and Alloying of Aluminium Market, accounting for approximately 28% of global production. It benefits from well-established recycling infrastructure and advanced aluminium processing technologies. The region’s demand is driven primarily by automotive, aerospace, and construction industries, which require lightweight and high-strength aluminium alloys. Manufacturers focus on energy-efficient furnaces and precision alloying techniques to optimize production. High availability of aluminium scrap from industrial and consumer sources supports steady feedstock supply. Regulatory support for sustainable manufacturing and circular economy initiatives strengthens regional growth. Investment in research for high-performance wrought and cast alloys maintains North America’s leadership in the market.

Europe

Europe represents around 24% of the global Secondary Smelting and Alloying of Aluminium Market. It emphasizes sustainability and environmental compliance, pushing manufacturers to adopt low-emission and energy-saving technologies. The automotive and building sectors drive demand for high-quality aluminium alloys. Leading countries such as Germany, Italy, and France focus on integrating advanced recycling technologies to recover aluminium efficiently. It supports circular economy goals while maintaining consistent alloy quality for industrial applications. Collaboration between manufacturers and regulatory authorities ensures adherence to stringent emission standards. Growing adoption of lightweight alloys in EV production contributes to long-term market potential.

Asia-Pacific

Asia-Pacific holds the largest share in the Secondary Smelting and Alloying of Aluminium Market, contributing roughly 32% to global output. Rapid industrialization, urban infrastructure projects, and expanding automotive production fuel market growth. China, India, and Japan are the major contributors, providing abundant aluminium scrap and investing in modern smelting technologies. It emphasizes cost-efficient operations while maintaining alloy quality for automotive, electronics, and construction applications. Increasing demand for sustainable and recycled aluminium supports expansion of secondary smelting facilities. Technological upgrades in sorting, filtration, and alloying systems improve yield and production consistency. Regional growth is strengthened by government incentives for energy-efficient and low-carbon manufacturing processes.

Latin America

Latin America accounts for about 9% of the global Secondary Smelting and Alloying of Aluminium Market. Brazil and Mexico lead the region with growing industrial and automotive sectors. It relies on local aluminium scrap collection and processing for secondary smelting operations. Investments in modern furnaces and quality control systems enhance efficiency and product reliability. Growing infrastructure and construction projects increase demand for lightweight and durable aluminium alloys. Regulatory frameworks for environmental sustainability support market adoption. Regional players focus on improving recycling rates and reducing production costs to remain competitive in global markets.

Middle East & Africa

The Middle East & Africa contributes roughly 7% of the Secondary Smelting and Alloying of Aluminium Market. The region emphasizes aluminium production for construction, packaging, and electrical applications. It benefits from easy access to raw aluminium and rising industrialization in the Gulf Cooperation Council (GCC) countries. Manufacturers focus on energy-efficient smelting technologies and alloying techniques to optimize output. Growing urbanization and infrastructure development drive demand for recycled aluminium. Regulatory support for emission reduction and sustainable practices encourages market growth. Regional expansion depends on technology adoption, skilled workforce development, and efficient supply chain management.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Secondary Smelting and Alloying of Aluminium Market players include Novelis Inc., Hydro Aluminium AS, Constellium SE, Real Alloy, Kaiser Aluminum Corporation, Century Aluminum Company, Raffmetal S.p.A, ELVALHALCOR Hellenic Copper and Aluminium Industry S.A., Befesa S.A., and Dowa Holdings Co., Ltd. The Secondary Smelting and Alloying of Aluminium Market exhibits intense competition driven by technological innovation and process optimization. Companies focus on improving energy efficiency, reducing emissions, and enhancing alloy quality to meet industrial standards. Investment in advanced sorting, purification, and alloying technologies enables precise control over chemical composition and mechanical properties. Market participants prioritize expansion into high-demand regions and diversification across automotive, construction, electrical, and packaging sectors. Sustainability initiatives, including circular economy practices and scrap recovery, shape strategic decisions. Continuous research in lightweight and high-strength alloys supports the development of specialized products for emerging applications. Operational efficiency, quality assurance, and adaptation to evolving regulatory requirements define competitive dynamics across the global market.

Recent Developments

- In July 2025, ELVALHALCOR has invested in new advanced systems to optimize raw material mixing and boost the use of secondary metals. These technological upgrades enhance productivity and reduce environmental impact, supporting their sustainability commitments.

- In May 2025, Dowa Holdings Co., Ltd formulated a medium-DOWA diversifies end-use product functionality, improves its reliability, and extends its service life to prolong the end-use product lifecycle reflecting strategic investments in smelting technologies and market expansion.

- In April 2025, Novelis extended its agreement with Net Zero Lab Valais, advancing carbon-neutral aluminum manufacturing technologies to further reduce environmental impact and support circular economy goals.

Report Coverage

The research report offers an in-depth analysis based on Source, Alloy Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for recycled and lightweight aluminium alloys.

- Adoption of energy-efficient smelting technologies will increase across global facilities.

- Automotive and aerospace sectors will drive innovation in high-strength aluminium alloys.

- Companies will invest in advanced sorting and purification systems to improve yield.

- Sustainable and circular economy practices will shape production strategies.

- Regional expansion in Asia-Pacific and Latin America will support market growth.

- Development of specialized alloys will meet requirements of emerging industrial applications.

- Digitalization and process automation will enhance operational efficiency in smelting plants.

- Strong regulatory focus on emissions and environmental compliance will influence production.

- Collaboration between manufacturers and research institutions will accelerate alloy innovation.