Market Overview

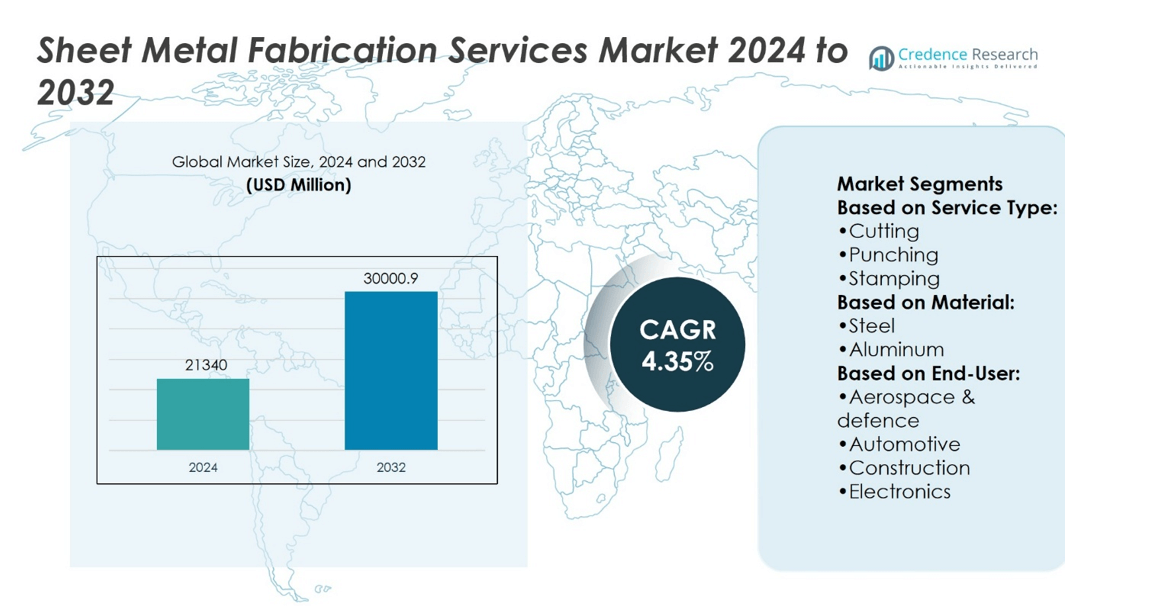

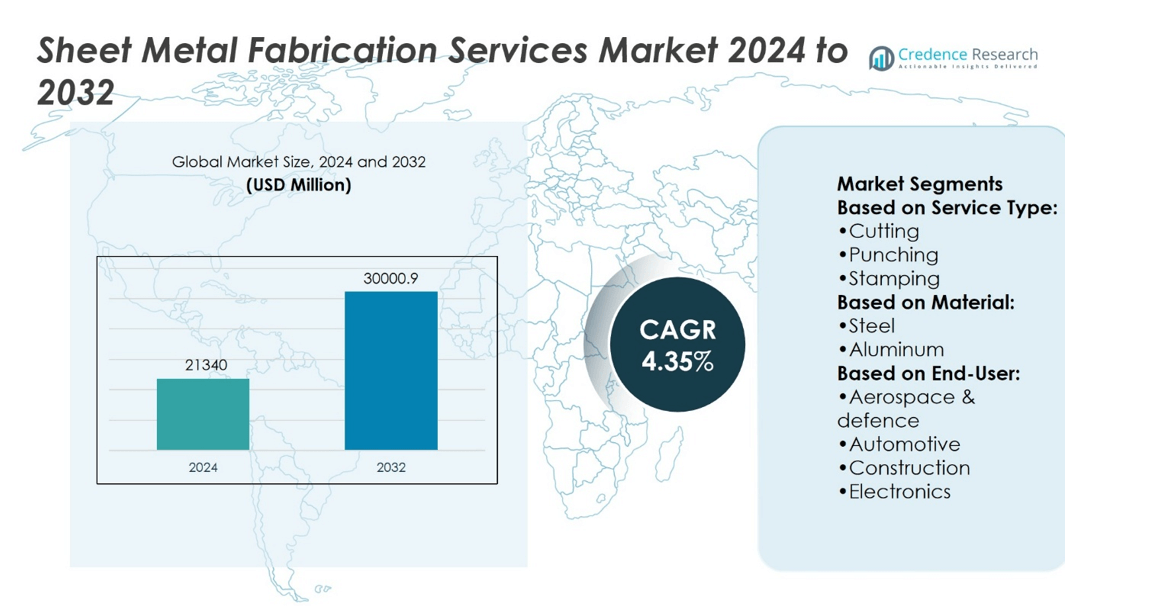

Sheet Metal Fabrication Services Market size was valued at USD 21340 million in 2024 and is anticipated to reach USD 30000.9 million by 2032, at a CAGR of 4.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sheet Metal Fabrication Services Market Size 2024 |

USD 21340 million |

| Sheet Metal Fabrication Services Market, CAGR |

4.35% |

| Sheet Metal Fabrication Services Market Size 2032 |

USD 30000.9 million |

The Sheet Metal Fabrication Services Market grows due to rising demand for precision components across automotive, aerospace, construction, and electronics industries. It benefits from adoption of advanced technologies, including CNC machines, laser cutting, robotic welding, and digital design tools, which improve efficiency and accuracy. The market trends highlight expansion into emerging regions, increasing demand for lightweight and high-strength materials, and integration of Industry 4.0 solutions. It also experiences growth from renewable energy projects, infrastructure development, and customized fabrication requirements. Continuous focus on quality, speed, and cost optimization drives both market adoption and competitive differentiation.

North America leads the Sheet Metal Fabrication Services Market with strong aerospace, automotive, and electronics demand, followed by Europe with advanced manufacturing and construction projects. Asia-Pacific shows rapid growth due to industrialization and low-cost production, while Latin America and the Middle East & Africa present emerging opportunities in infrastructure and energy sectors. Key players driving the market include Amada America, Inc., BTD Manufacturing, Dalsin Industries, Hogge Precision Parts Co., Inc., Jorgenson Metal Rolling & Forming, Inc., Mayville Engineering Company, Inc. (MEC), and O’Neal Manufacturing Services (OMS).

Market Insights

- Sheet Metal Fabrication Services Market size was valued at USD 21340 million in 2024 and is expected to reach USD 30000.9 million by 2032, at a CAGR of 4.35%.

- Rising demand for precision components in automotive, aerospace, construction, and electronics drives market growth.

- Adoption of CNC machines, laser cutting, robotic welding, and digital design tools improves efficiency and accuracy.

- Expansion into emerging regions and focus on lightweight, high-strength materials represent key market trends.

- Competitive pressure encourages innovation, cost optimization, and faster turnaround services among manufacturers.

- Challenges include skilled labor shortages, high equipment costs, and supply chain constraints.

- North America leads the market, Europe and Asia-Pacific follow, while Latin America and Middle East & Africa offer emerging growth opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rapid Industrialization and Expanding Manufacturing Activities Driving Demand

The Sheet Metal Fabrication Services Market benefits from growing industrialization and increased manufacturing activities worldwide. It supports the production of components for automotive, aerospace, and construction sectors, where precision and durability are crucial. Rising investments in infrastructure and industrial plants propel the need for custom metal parts. Manufacturers focus on adopting advanced machinery to meet complex design requirements efficiently. It enables shorter production cycles and higher output without compromising quality. Growing urbanization further stimulates demand for fabricated metal products in construction and commercial projects. Industries seek reliable suppliers to ensure timely delivery and consistent standards.

- For instance, Miller Metal Fabrication expanded its Bridgeville facility by 60,000 square feet, completing construction around 2022. The facility is equipped with fiber lasers capable of high-speed cutting for various metals, which enhances efficiency for industrial projects.

Technological Advancements Enhancing Efficiency and Product Quality

Modern sheet metal fabrication employs advanced laser cutting, CNC punching, and robotic welding systems. The Sheet Metal Fabrication Services Market leverages these innovations to improve accuracy and reduce material waste. It allows fabrication of intricate designs with tighter tolerances and consistent performance. Companies integrate automation to optimize production workflows and minimize human error. High-speed machinery reduces lead times while maintaining uniform quality across large-scale projects. It supports customization for specialized industrial applications, meeting stringent client specifications. Investment in cutting-edge technology strengthens competitiveness in global supply chains.

- For instance, Hogge Precision Parts Co., Inc. operates a 42,000-square-foot facility housing horizontal and vertical CNC milling centers with up to 4 axes, 330-tool capacity, 44-inch tables, 500 mm pallets, and spindle speeds reaching 20,000 RPM, delivering tight tolerances within ±0.0005 inches.

Rising Demand from Automotive and Aerospace Sectors

Automotive and aerospace industries require lightweight and strong components, boosting the Sheet Metal Fabrication Services Market. It provides structural and functional parts for vehicles, aircraft, and defense equipment. Manufacturers focus on materials that combine strength, corrosion resistance, and thermal stability. Increasing vehicle production and aircraft deliveries drive consistent demand for fabricated sheets and assemblies. It ensures compliance with safety and regulatory standards while optimizing performance. Collaboration with OEMs and tier-1 suppliers enhances innovation and product quality. These sectors remain major contributors to the overall market growth trajectory.

Expansion of Customized Solutions and Small-Batch Production

Customer demand for tailored metal parts encourages flexibility in fabrication services. The Sheet Metal Fabrication Services Market offers short-run production, rapid prototyping, and specialty designs. It supports diverse applications across industrial, commercial, and consumer segments. Manufacturers implement flexible processes to adapt quickly to varying specifications. Strong focus on quality control maintains high standards for small and large orders alike. It enables businesses to address niche markets efficiently while maintaining cost-effectiveness. Growing emphasis on personalized solutions strengthens client relationships and market presence.

Market Trends

Adoption of Automation and Robotics for Streamlined Production

The Sheet Metal Fabrication Services Market increasingly incorporates automation and robotics in production lines. It enables higher precision and faster turnaround in cutting, bending, and welding processes. Manufacturers deploy CNC machines and robotic arms to maintain consistency across large-volume orders. It reduces dependency on manual labor while improving workplace safety. Integration of automated systems allows real-time monitoring and error detection during fabrication. It supports rapid scaling of production to meet growing industrial demand. Companies gain competitive advantage through enhanced efficiency and lower operational costs.

- For instance, Amada America, Inc. operates a 180,000-square-foot manufacturing facility in Brea, California. This site produces sheet metal fabrication machines, including laser systems ranging from 3 kW to 12 kW models.

Emphasis on Lightweight and High-Strength Materials for Advanced Applications

Demand for lightweight and high-strength metals drives innovation in the Sheet Metal Fabrication Services Market. It facilitates development of components that balance durability with reduced weight for automotive, aerospace, and electronics sectors. Fabricators experiment with alloys and composite metals to meet performance requirements. It ensures compliance with regulatory standards for safety and structural integrity. Adoption of advanced materials supports energy efficiency and improved product lifespan. It strengthens market relevance in industries focusing on high-performance solutions. Manufacturers invest in material research to expand product offerings.

- For instance, BTD Manufacturing’s Lakeville location added a TRUMPF TruLaser 5030 10K fiber laser in late 2020. This system doubles production output when processing medium-thickness sheets and uses a CoolLine nozzle to mist water, minimizing heat and allowing cleaner, finer-cut entry into small contours.

Shift Towards Customized and Small-Batch Production Solutions

Customization and small-batch production trends influence the Sheet Metal Fabrication Services Market significantly. It provides tailored solutions for unique industrial and commercial applications. Manufacturers accommodate varying design specifications and complex geometries with flexible processes. It enhances client satisfaction by delivering precise components for niche requirements. Short-run fabrication allows companies to test new designs without large capital investment. It encourages innovation and rapid prototyping across multiple sectors. Strong focus on personalized services improves relationships with OEMs and end-users.

Integration of Digital Technologies for Design and Process Optimization

Digital tools shape the Sheet Metal Fabrication Services Market by improving design accuracy and process efficiency. It supports CAD and CAM software for virtual modeling and simulation of components. Manufacturers leverage digital systems for production planning and resource optimization. It enables seamless communication between design and fabrication teams, reducing errors. Data-driven insights improve decision-making and quality assurance. It promotes predictive maintenance to avoid downtime and maintain consistent output. Companies adopting digital solutions achieve faster time-to-market and higher reliability.

Market Challenges Analysis

High Capital Investment and Maintenance Costs Limiting Smaller Players

The Sheet Metal Fabrication Services Market faces challenges from substantial capital requirements for advanced machinery. It demands significant investment in CNC equipment, laser cutting systems, and robotic welding units. Smaller manufacturers struggle to maintain competitiveness due to limited financial resources. It also incurs ongoing maintenance and calibration costs to ensure precision and quality. Fluctuations in energy and raw material prices increase operational expenses. It pressures companies to balance cost management with technological adoption. High entry barriers restrict new players and slow market diversification.

Skilled Labor Shortage and Complex Regulatory Compliance Hindering Growth

Shortage of skilled technicians and operators constrains efficiency in the Sheet Metal Fabrication Services Market. It relies on experienced personnel for accurate machine programming and quality control. Stringent safety, environmental, and industry-specific regulations impose additional compliance obligations. It requires continuous training and investment in workforce development. Delays or errors in meeting regulatory standards can result in penalties and production setbacks. It challenges companies to maintain high-quality output while managing operational risks. Skill gaps and compliance pressures limit rapid expansion and market scalability.

Market Opportunities

Expansion in Automotive, Aerospace, and Renewable Energy Sectors Driving New Prospects

The Sheet Metal Fabrication Services Market gains opportunities from growth in automotive, aerospace, and renewable energy industries. It supports production of lightweight, high-strength components for electric vehicles and aircraft structures. Rising adoption of wind turbines and solar installations increases demand for fabricated metal assemblies. It enables manufacturers to supply specialized parts for energy-efficient and high-performance applications. Collaboration with OEMs and tier-1 suppliers opens long-term contracts and repeat business. It encourages innovation in materials and design to meet evolving industry standards. Expansion into these high-growth sectors strengthens market relevance and revenue potential.

Adoption of Advanced Manufacturing Technologies and Digital Solutions Creating Growth Potential

Integration of automation, robotics, and digital engineering presents significant opportunities in the Sheet Metal Fabrication Services Market. It allows faster production cycles and higher precision, enhancing overall efficiency. Investment in CAD/CAM software and virtual simulation supports complex design requirements and reduces errors. It promotes customized solutions and short-batch production for specialized applications. Adoption of predictive maintenance and IoT-enabled machinery improves reliability and reduces downtime. It enables companies to differentiate through quality, speed, and flexibility. Leveraging these technologies strengthens competitive positioning and attracts new clients across diverse industries.

Market Segmentation Analysis:

By Service Type

The Sheet Metal Fabrication Services Market includes diverse service types such as cutting, punching, stamping, forming, bending, welding, finishing, and others. Cutting services dominate due to high demand for precision components in automotive and electronics sectors. It enables accurate shaping of metal sheets with minimal material waste. Welding and bending services play a crucial role in assembling structural and mechanical parts. Punching and stamping support high-volume production of standardized components. Finishing services enhance surface quality, corrosion resistance, and aesthetic appeal. The variety of services allows manufacturers to cater to both large-scale industrial projects and specialized custom orders efficiently.

- For instance, OMS’s Indianapolis facility spans 203,000 square feet and offers multistep metal fabrication with laser cutting, plasma cutting, oxy-fuel cutting, tube processing, CNC machining, punching, welding, and CNC angle line processing—all under ISO 9001:2015 and Canadian Weld Bureau certification.

By Material

Steel, aluminum, silver, and other metals represent the key material segments in the Sheet Metal Fabrication Services Market. Steel maintains a leading position due to its strength, durability, and versatility across automotive, aerospace, and construction applications. It supports heavy structural components and load-bearing assemblies. Aluminum gains traction for lightweight applications, particularly in electric vehicles and aircraft, due to its corrosion resistance and high strength-to-weight ratio. Silver and specialty metals serve niche electronics and decorative applications, where precision and conductivity are critical. It enables fabricators to meet diverse industry requirements with tailored material solutions.

- For instance, Cedar Falls, Iowa location covers 162,000 square feet and includes multi-step processing with 5‑axis laser cutting, tube laser cutting, laser welding, metal forming, CNC milling, and robotic welding—supporting intricate profiles, tight tolerances, and high-speed production.

By End User

Aerospace and defense, automotive, construction, and electronics sectors constitute the primary end-user segments of the Sheet Metal Fabrication Services Market. Aerospace and defense demand high-strength, lightweight components for aircraft, satellites, and defense systems. It ensures strict compliance with safety and regulatory standards. Automotive industries require structural, functional, and aesthetic parts for vehicles, including electric models. Construction projects use fabricated metal for structural frameworks, roofing, and architectural components. Electronics manufacturing relies on precision metal parts for housings, connectors, and circuit assemblies. It allows manufacturers to deliver industry-specific solutions with consistent quality and reliability.

Segments:

Based on Service Type:

- Cutting

- Punching

- Stamping

Based on Material:

Based on End-User:

- Aerospace & defence

- Automotive

- Construction

- Electronics

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for approximately 32% of the Sheet Metal Fabrication Services Market. The region benefits from well-established manufacturing infrastructure, advanced technologies, and strong presence of aerospace, automotive, and electronics industries. It supports high demand for precision components and custom fabrication services. The United States drives the market with investments in electric vehicles, defense systems, and industrial automation. Canada contributes through construction and industrial manufacturing sectors requiring fabricated metal assemblies. It allows manufacturers to adopt innovative processes like laser cutting, robotic welding, and digital fabrication tools. Strong regulatory standards and quality certifications further strengthen the market position in North America.

Europe

Europe captures around 27% of the Sheet Metal Fabrication Services Market. Germany, France, and the United Kingdom lead demand due to their robust automotive, aerospace, and construction sectors. It emphasizes high-quality, durable, and lightweight components for electric vehicles and industrial machinery. The region invests heavily in automation, CNC technology, and Industry 4.0 solutions to improve productivity and reduce production time. It also promotes sustainability by integrating eco-friendly manufacturing processes and materials. Rising construction projects and infrastructure modernization further support demand for fabricated metal products. Europe remains highly competitive, with major manufacturers focusing on technology adoption and process optimization.

Asia-Pacific

Asia-Pacific holds approximately 29% of the Sheet Metal Fabrication Services Market and exhibits the fastest growth rate. China, Japan, and India drive the market due to expanding automotive, electronics, and aerospace industries. It leverages low-cost manufacturing, skilled labor, and large-scale production capabilities. Rising demand for electric vehicles, consumer electronics, and industrial equipment boosts the need for precision metal components. The region also attracts foreign investments in advanced fabrication facilities and automation technologies. It allows companies to balance cost efficiency with quality and volume requirements. Growing industrialization, infrastructure development, and export-oriented manufacturing support the market’s sustained expansion in Asia-Pacific.

Latin America

Latin America represents roughly 6% of the Sheet Metal Fabrication Services Market. Brazil and Mexico lead due to automotive production, industrial equipment manufacturing, and infrastructure projects. It focuses on meeting growing regional demand for fabricated metal solutions while improving technological capabilities. Manufacturers are increasingly adopting semi-automated and CNC-based systems to enhance efficiency. It allows local companies to serve both domestic and export markets effectively. Infrastructure investments and industrial modernization continue to drive demand for quality metal fabrication services.

Middle East & Africa

Middle East & Africa account for about 6% of the Sheet Metal Fabrication Services Market. It benefits from construction growth, energy projects, and defense sector investments. The region encourages local manufacturers to adopt modern fabrication techniques to meet high-performance standards. It supports fabrication of structural components, pipelines, and industrial machinery. Government initiatives for infrastructure development and energy diversification further enhance market demand. Companies expanding in the region leverage low competition and high-value projects to establish a strong presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Prototek Sheetmetal Fabrication

- Miller Metal Fabrication

- Dalsin Industries

- R&D Manufacturing Inc.

- Hogge Precision Parts Co., Inc.

- Jorgenson Metal Rolling & Forming, Inc.

- Amada America, Inc.

- BTD Manufacturing

- O’Neal Manufacturing Services (OMS)

- Mayville Engineering Company, Inc. (MEC)

Competitive Analysis

The Sheet Metal Fabrication Services Market features include Amada America, Inc., BTD Manufacturing, Dalsin Industries, Hogge Precision Parts Co., Inc., Jorgenson Metal Rolling & Forming, Inc., Mayville Engineering Company, Inc. (MEC), Miller Metal Fabrication, O’Neal Manufacturing Services (OMS), Prototek Sheetmetal Fabrication, and R&D Manufacturing Inc. The Sheet Metal Fabrication Services Market experiences intense competition driven by technology adoption, service diversification, and operational efficiency. Companies focus on advanced CNC machines, laser cutting systems, robotic welding, and digital design solutions to enhance precision and reduce production time. It emphasizes maintaining high-quality standards and certifications to meet requirements of aerospace, automotive, and electronics industries. Expansion into emerging regions such as Asia-Pacific, Latin America, and the Middle East & Africa provides access to new business opportunities and client bases. Investment in research and development supports the creation of lightweight materials, customized fabrication solutions, and high-performance components. It also encourages adoption of automation and Industry 4.0 practices to improve throughput and reduce costs. Competitive pressures drive innovation, cost optimization, and faster delivery times, ensuring companies remain agile and responsive to evolving market demands.

Recent Developments

- In February 2025, Meviy introduced an aluminum composite plate for sheet metal processing. These lightweight yet rigid materials are ideal for those looking to reduce part weight while maintaining structural integrity.

- In October 2024, Amada opened its new Welding Technical Center at the premises of AMADA ITALIA. This center serves as a shared hub for Amada Group companies across Europe, supporting sales activities by promoting and validating advanced welding technologies.

- In October 2023, JSPl Angul unit, located in Odisha, was set to become India’s biggest single-location steel manufacturing plant. The capacity of the current Angul plant.

- In July 2023, ArcelorMittal Nippon Steel India a joint venture between ArcelorMittal and Nippon Steel, two of the world’s leading steelmakers – and Festo India, the world’s leading manufacturer and supplier of automation technology and specialized education, announced signing an MoU at the Festo Corporate Center in Stuttgart, Germany.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will benefit from increasing adoption of automation and robotics in fabrication processes.

- Demand for lightweight and high-strength components in automotive and aerospace will grow.

- Expansion into emerging regions will create new business opportunities.

- Companies will focus on digital design tools and simulation for faster prototyping.

- Renewable energy projects will drive need for specialized metal assemblies.

- Integration of Industry 4.0 technologies will improve production efficiency and accuracy.

- Customized and short-batch fabrication services will see higher demand.

- Investment in workforce training will address skilled labor shortages.

- Sustainable and eco-friendly manufacturing practices will influence market strategies.

- Collaboration with OEMs and tier-1 suppliers will strengthen long-term contracts and partnerships.