Market Overview

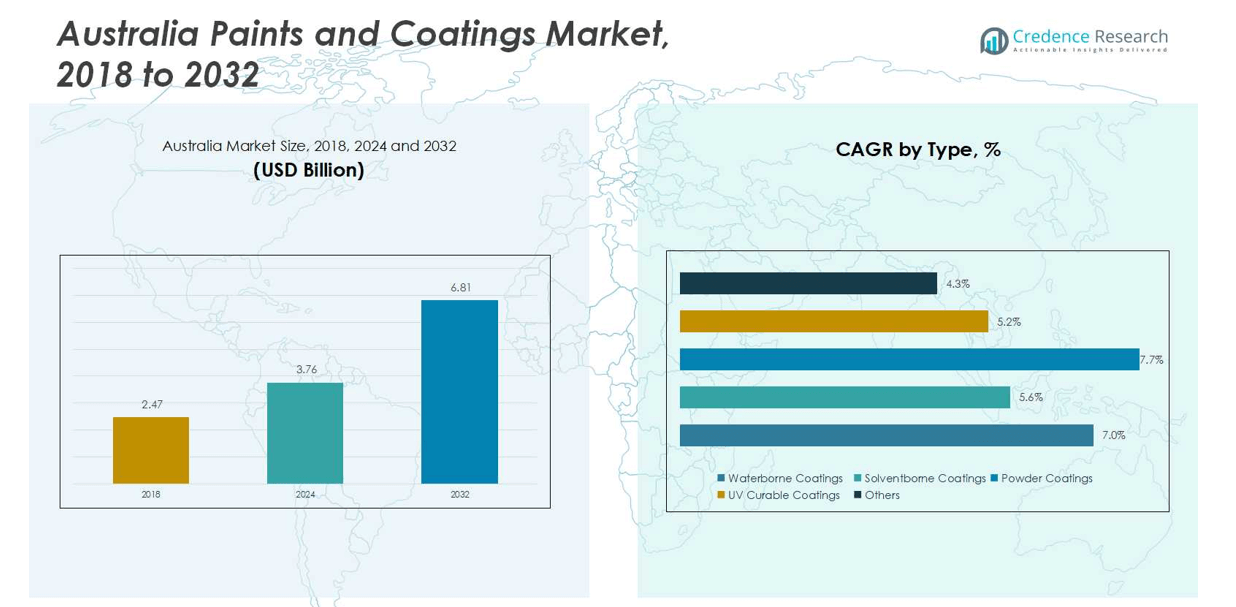

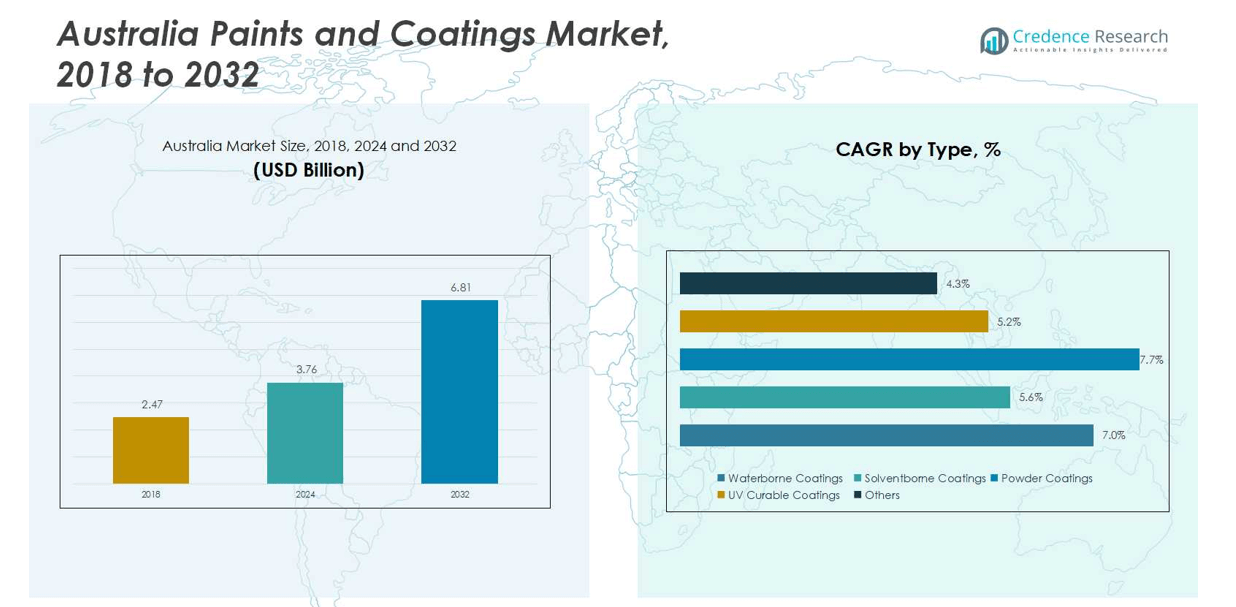

Australia Paints and Coatings market size was valued at USD 2.47 billion in 2018, rising to USD 3.76 billion in 2024, and is anticipated to reach USD 6.81 billion by 2032, at a CAGR of 7.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Paints and Coatings Market Size 2024 |

USD 3.76 billion |

| Australia Paints and Coatings Market, CAGR |

7.18% |

| Australia Paints and Coatings Market Size 2032 |

USD 6.81 billion |

The Australia Paints and Coatings market is dominated by key players such as DuluxGroup Limited, Wattyl, Taubmans (PPG Industries), Bristol Paint, British Paints, Muralo Coatings, Jotun Australia, Resene Paints, Haymes Paint, and Sherwin-Williams Australia. These companies lead through product innovation, eco-friendly formulations, and a diverse portfolio of decorative, industrial, and specialty coatings. New South Wales emerges as the leading region, commanding 28% of the market share, driven by strong residential, commercial, and infrastructure development. Victoria follows with 22%, supported by urban construction and industrial activities. Queensland holds 18%, fueled by urbanization, residential projects, and industrial applications. The strategic presence of these top players across key regions ensures robust distribution, localized marketing, and sustained growth, reinforcing their dominance in the national paints and coatings landscape.

Market Insights

- The Australia Paints and Coatings market was valued at USD 3.76 billion in 2024 and is projected to reach USD 6.81 billion by 2032, growing at a CAGR of 7.18%, with waterborne coatings holding the largest type segment share of 45% and acrylic coatings dominating the technology segment at 35%.

- Growth is driven by rising residential and commercial construction, stringent environmental regulations promoting low-VOC and eco-friendly coatings, and increasing demand from industrial and automotive sectors for durable, high-performance finishes.

- Key trends include the adoption of smart and functional coatings such as self-cleaning and anti-corrosion solutions, as well as the shift toward eco-friendly waterborne and UV curable coatings, creating opportunities in premium and mid-tier product lines.

- The market is competitive, with leading players such as DuluxGroup Limited, Wattyl, Taubmans (PPG Industries), Bristol Paint, and Sherwin-Williams Australia leveraging product innovation, regional expansion, and sustainable formulations to maintain market leadership.

- Regionally, New South Wales leads with 28% market share, followed by Victoria at 22% and Queensland at 18%, driven by urbanization, infrastructure projects, and strong demand for decorative, industrial, and automotive coatings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

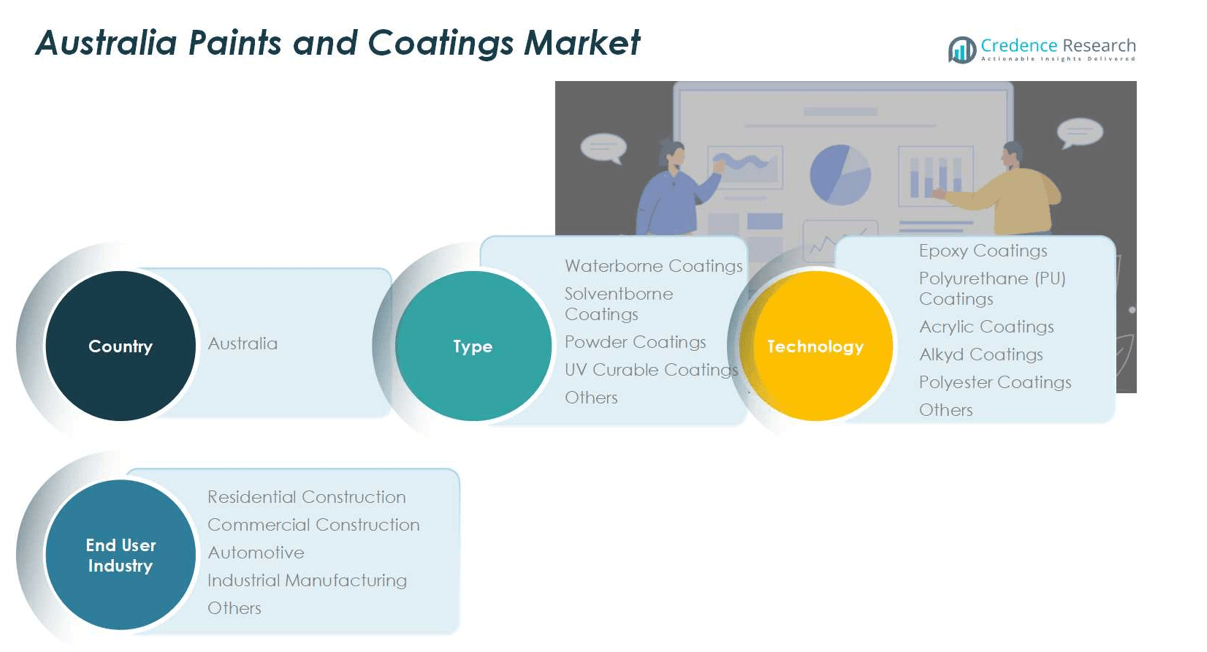

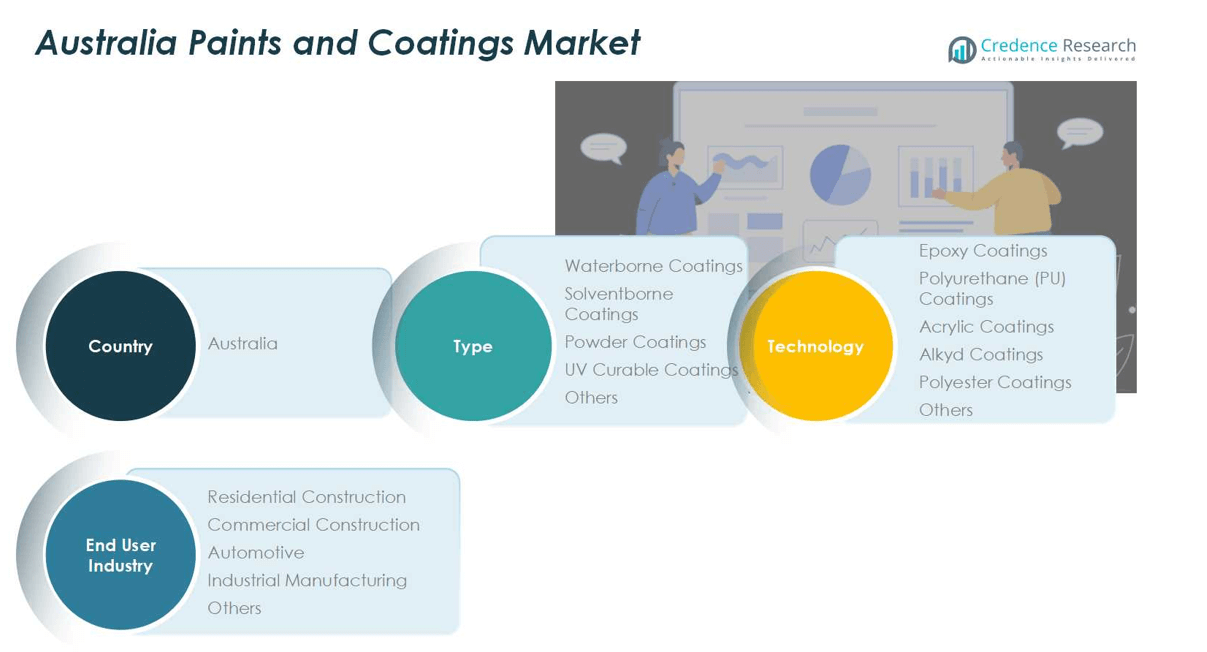

Market Segmentation Analysis:

By Type:

In the Australia Paints and Coatings market, waterborne coatings dominate the type segment, accounting for approximately 45% of the market share in 2024. Their growth is driven by increasing environmental regulations, low VOC emissions, and strong demand for eco-friendly solutions in residential and commercial construction. Solventborne coatings and powder coatings follow, benefiting from durability and industrial applications. The rising adoption of UV curable coatings in high-performance sectors, coupled with innovations in specialty coatings, is expected to further diversify demand in the ‘others’ category, supporting overall segment growth.

- For instance, Birla Opus is heavily investing in innovations in coating technologies, including UV-curable options, driven by regulatory pressures and market needs.

By Technology:

Within the technology segment, acrylic coatings hold the largest share at around 35%, owing to their versatility, weather resistance, and aesthetic appeal in both decorative and protective applications. Epoxy and polyurethane (PU) coatings are also significant, driven by industrial and automotive demand for corrosion-resistant and high-performance finishes. Alkyd and polyester coatings maintain steady adoption due to cost-effectiveness and application flexibility. Technological advancements and formulation improvements continue to fuel market expansion across other niche technologies, particularly in commercial and industrial applications.

- For instance, Sherwin-Williams has developed advanced epoxy coatings used in industrial flooring and corrosion-resistant pipelines, emphasizing durability and chemical resistance to meet industrial standards.

By End User Industry:

The residential construction sector is the dominant end-user segment, capturing roughly 40% of the market share in 2024, supported by ongoing housing projects and renovation activities. Commercial construction and industrial manufacturing follow closely, with demand for durable, aesthetic, and protective coatings driving segment growth. The automotive industry remains a critical consumer of high-performance coatings, while the ‘others’ category, including furniture and marine applications, is expanding due to specialized coating requirements. Overall, urbanization and infrastructure development remain key drivers across all end-user segments.

Key Growth Drivers

Rising Residential and Commercial Construction Activities

The Australia paints and coatings market is driven by the surge in residential and commercial construction projects. Growing urbanization, infrastructure development, and housing demand have significantly increased the need for decorative and protective coatings. Residential construction, in particular, accounts for a substantial portion of the market, while commercial and industrial projects further boost demand. The focus on aesthetic finishes, durability, and regulatory compliance continues to propel investments in high-performance coatings, supporting steady growth across waterborne, solventborne, and specialty coating segments.

- For instance, Glasurit’s October 2023 launch of AraClass, a range of eco-friendly clearcoats that reduce CO2 emissions, exemplifies how product innovation is aligning with the rising demand for sustainable coatings in automotive and industrial sectors.

Stringent Environmental Regulations

Environmental regulations aimed at reducing VOC emissions and promoting eco-friendly products are major growth drivers. Manufacturers are increasingly adopting waterborne, UV curable, and low-VOC coatings to comply with Australian standards. These regulations not only ensure sustainability but also drive innovation in green formulations, prompting expansion in the environmentally conscious consumer base. Companies investing in compliant technologies gain a competitive advantage, accelerating adoption across residential, industrial, and automotive sectors, while aligning with the broader global push for sustainable and low-impact paint solutions.

- For instance, allnex has developed the UCECOAT® range of waterborne UV curable resins that merge ecological benefits with robust coating performance for industrial wood coatings in Australia.

Industrial and Automotive Demand

High-performance coatings for industrial manufacturing and the automotive sector fuel market growth. The demand for corrosion-resistant, weatherproof, and durable coatings supports epoxy, polyurethane, and acrylic product adoption. Rapid industrialization and automotive production, along with rising aftermarket requirements for vehicle refinishing, further contribute to segment expansion. Technological advancements in specialty coatings, such as powder and UV curable formulations, address specific performance needs, ensuring long-term growth across industrial and automotive applications and reinforcing the importance of innovation-driven strategies.

Key Trends & Opportunities

Adoption of Smart and Functional Coatings

The market is witnessing increased adoption of smart and functional coatings, including self-cleaning, anti-corrosion, and antimicrobial solutions. These coatings offer added value to end users by enhancing durability, hygiene, and efficiency in residential, commercial, and industrial applications. Rising awareness of performance-driven and sustainable coatings presents opportunities for manufacturers to develop advanced products. The integration of nanotechnology and innovative formulation techniques further opens new avenues, allowing companies to differentiate their offerings and capture high-value market segments across Australia.

- For instance, Sika’s Rustop is a two-component anti-corrosion coating designed for protecting steel and concrete reinforcement by preventing corrosion and chloride ingress, widely used in construction rehabilitation projects.

Expansion of Eco-friendly and Waterborne Solutions

Eco-friendly waterborne coatings continue to gain traction, driven by environmental awareness and regulatory compliance. Manufacturers are shifting from solventborne to waterborne and UV curable coatings to reduce VOC emissions and improve indoor air quality. This transition creates growth opportunities for premium and mid-tier product lines, catering to construction, industrial, and automotive sectors. The increasing preference for sustainable and energy-efficient solutions positions the market for long-term expansion, while investments in R&D and innovative production methods help companies capitalize on this green coatings trend.

- For instance, Nippon Paint has developed Aqua Epoxy paint, an environmentally friendly waterborne coating designed for interior masonry surfaces with no pungent odor, catering to both residential and commercial construction uses.

Key Challenges

High Raw Material Costs

Volatility in raw material prices, including resins, pigments, and solvents, poses a significant challenge to market growth. Rising costs impact profit margins and can slow production scaling, particularly for high-performance and specialty coatings. Manufacturers face pressure to balance quality, pricing, and sustainability requirements, which may constrain investments in innovation and expansion. This challenge necessitates strategic procurement, efficient supply chain management, and adoption of alternative raw materials to maintain competitiveness and ensure stable growth in Australia’s paints and coatings market.

Intense Competition and Market Fragmentation

The Australia paints and coatings market is highly competitive, with numerous domestic and international players vying for market share. Price competition, brand loyalty, and regional fragmentation create challenges for new entrants and smaller manufacturers. Additionally, rapid technological advancements require constant innovation, increasing operational costs. To remain competitive, companies must differentiate through product performance, eco-friendly formulations, and service quality. Navigating this competitive landscape while maintaining profitability continues to be a key challenge for market participants.

Regional Analysis

New South Wales (NSW)

New South Wales holds the largest share in the Australia paints and coatings market at 28%, driven by strong residential and commercial construction activities in Sydney and surrounding urban centers. High demand for decorative, industrial, and automotive coatings supports growth, while infrastructure development projects fuel the adoption of high-performance and eco-friendly coatings. Waterborne and acrylic coatings dominate the region due to environmental regulations, low VOC requirements, and preference for durable finishes. The presence of major manufacturers and distributors in the region enhances product availability, making NSW a key contributor to the national paints and coatings market growth.

Victoria

Victoria captures a 22% share of the Australia paints and coatings market, propelled by expanding urban infrastructure and housing projects in Melbourne and regional cities. Residential construction, commercial developments, and industrial manufacturing drive strong demand for waterborne, solventborne, and powder coatings. Eco-friendly and low-VOC formulations are gaining traction due to strict environmental regulations, influencing buyer preferences. Growth is further supported by automotive refinishing and high-performance industrial coatings. The state’s active construction sector and concentrated distribution network for paints and coatings ensure sustained market expansion, positioning Victoria as a vital regional contributor to the overall national market.

Queensland

Queensland accounts for 18% of the Australia paints and coatings market, fueled by rapid urbanization, residential and commercial construction, and mining-related industrial applications. Coastal cities like Brisbane and Gold Coast drive demand for weather-resistant and protective coatings. The adoption of waterborne and epoxy coatings is increasing due to environmental standards and durability requirements. Additionally, the state benefits from industrial manufacturing and automotive aftermarket activities, supporting high-performance coatings. Expansion of residential housing, infrastructure development, and government initiatives further stimulate demand, making Queensland a significant regional market with strong growth potential in both decorative and functional coatings.

Western Australia

Western Australia represents 14% of the paints and coatings market, largely driven by mining, industrial manufacturing, and commercial construction activities. Protective coatings, including epoxy, polyurethane, and powder coatings, dominate due to the need for corrosion resistance and high durability in harsh climatic conditions. Residential construction also contributes to demand for decorative waterborne and acrylic coatings. The region’s mineral-rich economy supports industrial coatings adoption, while stringent environmental regulations encourage low-VOC and eco-friendly formulations. Expansion in urban infrastructure and industrial facilities ensures consistent growth, positioning Western Australia as an important regional market in Australia’s overall paints and coatings landscape.

South Australia

South Australia holds a 10% share in the paints and coatings market, with demand largely driven by residential renovations, commercial construction, and industrial applications in Adelaide and surrounding areas. Waterborne and solventborne coatings dominate due to regulatory compliance and increasing consumer preference for environmentally safe products. Automotive refinishing and industrial coatings further support market growth. The state’s stable construction and industrial sectors, coupled with government initiatives promoting sustainable building practices, are key factors driving demand. South Australia continues to present opportunities for high-performance and eco-friendly coating manufacturers, contributing steadily to the national market.

Tasmania

Tasmania accounts for 4% of the Australia paints and coatings market, with growth primarily fueled by residential and small-scale commercial construction projects. The demand for waterborne and acrylic coatings is increasing due to environmental regulations and consumer preference for low-VOC products. Industrial applications, including manufacturing and marine coatings, also contribute to market activity. Limited urbanization and population density moderate overall market share, yet the state presents opportunities for specialty coatings and niche product adoption. Government-backed sustainability initiatives and infrastructure development further support the adoption of high-performance, eco-friendly coatings across residential and commercial segments.

Australian Capital Territory (ACT)

The ACT contributes 2% to the national paints and coatings market, largely driven by government infrastructure projects, commercial construction, and residential developments in Canberra. Waterborne and eco-friendly coatings dominate due to strict environmental regulations and growing demand for sustainable building solutions. Specialty coatings for industrial and automotive applications are also in steady demand. The region’s relatively small population limits overall market size, yet concentrated urban development ensures consistent demand for high-quality decorative and protective coatings. The ACT remains strategically important for premium product adoption and environmentally compliant solutions in the broader Australian paints and coatings market.

Northern Territory

Northern Territory holds 2% of the market share, driven by residential construction, infrastructure development, and industrial applications in Darwin and surrounding regions. Demand for protective and weather-resistant coatings, including epoxy, polyurethane, and powder coatings, is high due to extreme climatic conditions. Waterborne coatings are increasingly adopted to meet environmental regulations. The region’s smaller population and limited industrial base restrict market volume, yet government and private sector projects continue to create steady opportunities. The Northern Territory represents a niche but growing segment, particularly for high-performance, durable, and eco-friendly coatings across residential, commercial, and industrial applications.

Market Segmentations:

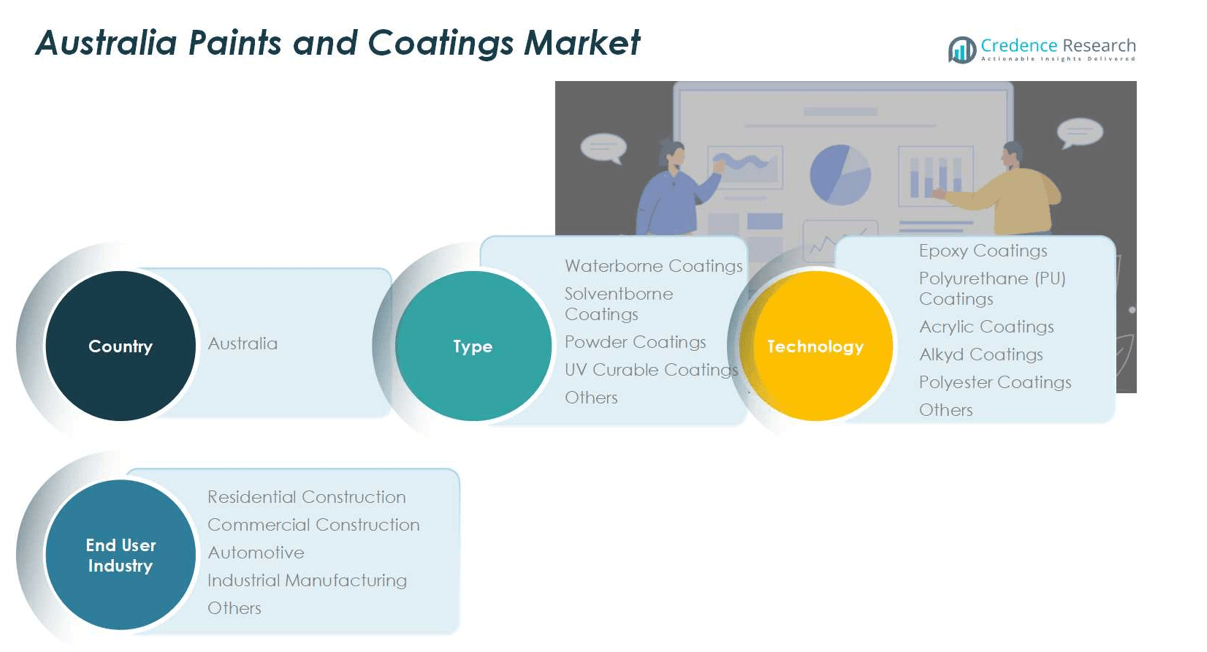

By Type:

- Waterborne Coatings

- Solventborne Coatings

- Powder Coatings

- UV Curable Coatings

- Others

By Technology:

- Epoxy Coatings

- Polyurethane (PU) Coatings

- Acrylic Coatings

- Alkyd Coatings

- Polyester Coatings

- Others

By End User Industry:

- Residential Construction

- Commercial Construction

- Automotive

- Industrial Manufacturing

- Others

By Region

- New South Wales

- Victoria

- Queensland

- Western Australia

- Southern Australia

- Tasmania

- Australian Capital Territory

- Northern Territory

Competitive Landscape

The competitive landscape of the Australia paints and coatings market is dominated by key players such as DuluxGroup Limited, Wattyl, Taubmans (PPG Industries), Bristol Paint, British Paints, Muralo Coatings, Jotun Australia, Resene Paints, Haymes Paint, and Sherwin-Williams Australia. These companies compete through product innovation, brand reputation, and a diverse portfolio of decorative, industrial, and specialty coatings. Strategic initiatives such as mergers, acquisitions, partnerships, and regional expansions help maintain market leadership. Increasing emphasis on eco-friendly and low-VOC formulations drives product differentiation, while investments in R&D enable the development of high-performance coatings for residential, commercial, and industrial applications. Distribution networks, customer support, and localized marketing strategies also influence competitive positioning. Overall, the market exhibits moderate to high fragmentation, with intense competition fostering innovation and growth while ensuring companies adapt to evolving consumer demands and regulatory requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DuluxGroup Limited

- Wattyl

- Taubmans (PPG Industries)

- Bristol Paint

- British Paints

- Muralo Coatings

- Jotun Australia

- Resene Paints

- Haymes Paint

- Sherwin-Williams Australia

Recent Developments

- In September 2023, Dulux Paints by PPG launched its 2024 Colour of the Year, “Limitless,” a warm neutral shade blending invigorating primary tones with versatility, aiming to complement various spaces.

- In November 2023, Taubmans, a PPG brand, released its 2024 Colour Trends collection, featuring four curated palettes designed to inspire interior and exterior design choices for Australian consumers.

- In October 2024, Dulux introduced its POP® Wood Effect powder coating range, offering a lifelike wood grain appearance through specialized application processes, catering to architectural and design needs.

- In May 2024, Sherwin-Williams launched the Ultra 9K premium paint system and the fully automated Pronto mixing system, enhancing efficiency and quality in automotive refinishing

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily, driven by increasing residential and commercial construction activities.

- Demand for eco-friendly and low-VOC coatings will continue to rise due to stringent environmental regulations.

- Waterborne and acrylic coatings will maintain dominance, supported by durability and aesthetic appeal.

- Industrial and automotive applications will drive growth for high-performance epoxy and polyurethane coatings.

- Technological advancements in UV curable and powder coatings will expand adoption across niche sectors.

- Urban infrastructure development will create consistent demand for protective and decorative coatings.

- Manufacturers will focus on R&D to develop innovative, sustainable, and smart coating solutions.

- Market competition will intensify, prompting strategic partnerships, acquisitions, and product diversification.

- Emerging trends like functional and self-cleaning coatings will offer new growth opportunities.

- Regional markets will continue to grow unevenly, with urbanized states contributing the largest share.