Market Overview

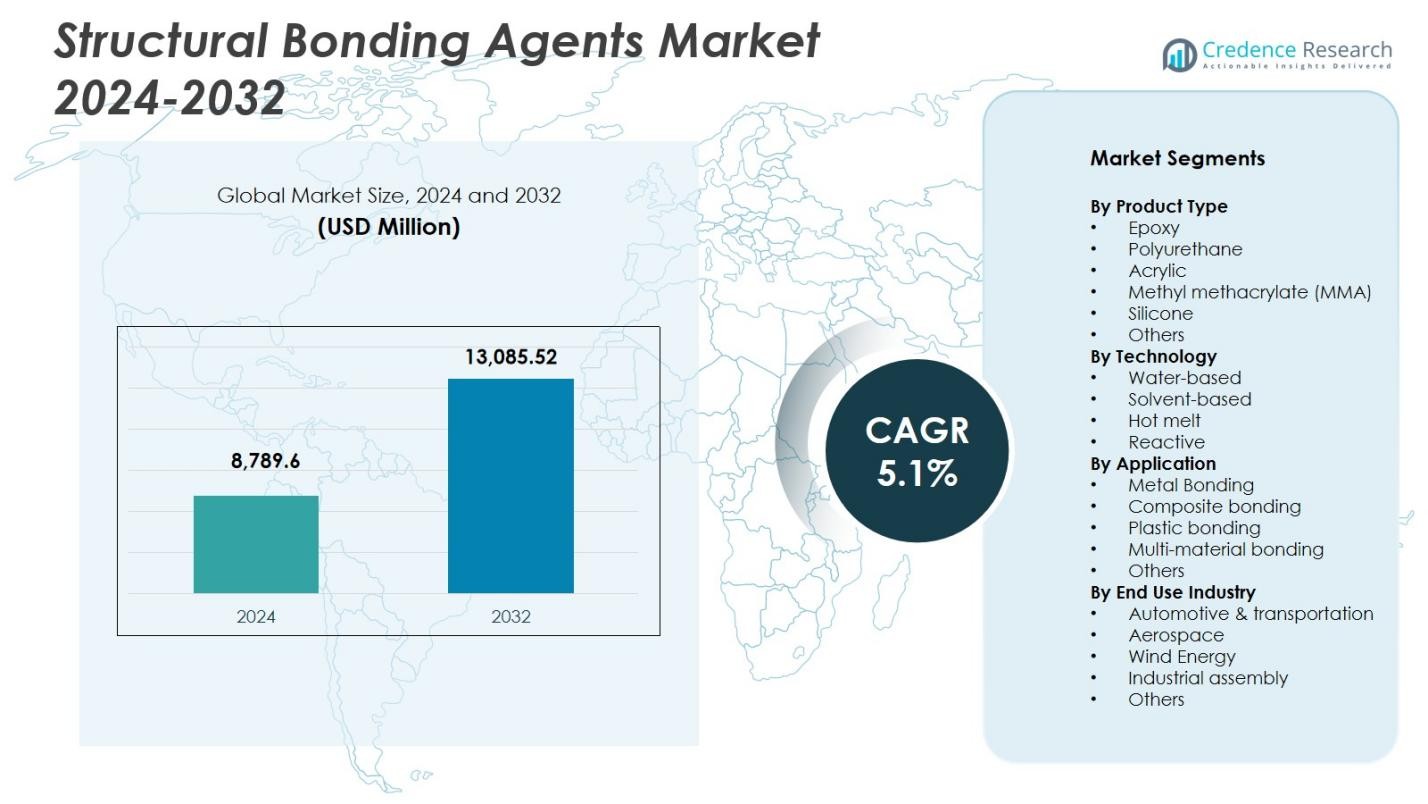

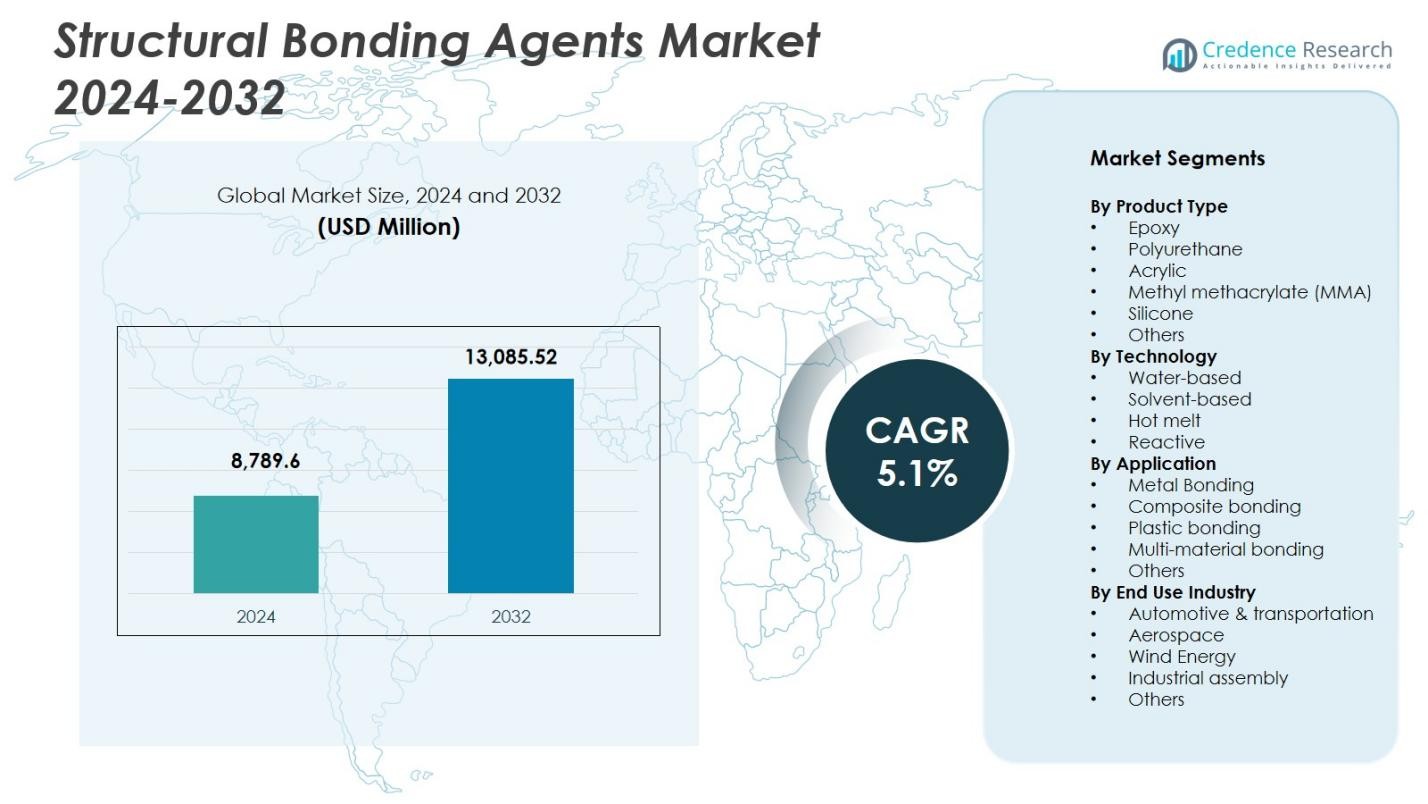

Structural Bonding Agents Market size was valued at USD 8,789.6 Million in 2024 and is anticipated to reach USD 13,085.52 Million by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Structural Bonding Agents Market Size 2024 |

USD 8,789.6 Million |

| Structural Bonding Agents Market, CAGR |

5.1% |

| Structural Bonding Agents Market Size 2032 |

USD 13,085.52 Million |

Structural Bonding Agents Market is shaped by leading players such as 3M Company, Sika AG, Henkel AG & Co. KGaA, The Dow Chemical Company, H.B. Fuller, Scott Bader Co., Uniseal Inc., Huntsman Corporation, Ashland Inc., and RPM International Inc., all focusing on advanced adhesive chemistries to meet rising industrial bonding needs. These companies strengthen their presence through innovations in epoxy, polyurethane, acrylic, and reactive systems that support high-strength, lightweight assemblies across automotive, aerospace, construction, and wind energy sectors. Asia-Pacific leads the market with a 37.2% share, supported by rapid industrialization and expanding manufacturing operations across major economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Structural Bonding Agents Market is valued at USD 8,789.6 Million in 2024 and grows at a CAGR of 5.1% through the forecast period.

- Rising demand for lightweight materials in automotive, aerospace, and industrial assembly drives market expansion, supported by wider adoption of epoxy adhesives holding a 38.6% share in product segmentation.

- Increasing shift toward sustainable, low-VOC formulations and strong uptake of reactive technologies, which lead with a 41.2% share, highlight key market trends driven by regulatory and performance requirements.

- Leading players enhance market positioning through innovations in hybrid chemistries, strategic partnerships, and expanded application capabilities across metal, composite, and multi-material bonding segments.

- Asia-Pacific dominates with a 37.2% regional share, followed by North America at 31.4% and Europe at 29.7%, supported by large-scale manufacturing, infrastructure development, and high adoption of advanced bonding solutions.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

The Structural Bonding Agents Market by product type is led by epoxy adhesives, holding a 38.6% share due to their exceptional mechanical strength, thermal resistance, and suitability for demanding industrial assemblies. Polyurethane and acrylic adhesives follow, driven by rising applications in automotive lightweighting and consumer goods manufacturing. MMA and silicone adhesives witness steady adoption for flexible bonding needs, while other specialized chemistries serve niche applications. The dominance of epoxy is primarily driven by its reliability in metal, composite, and structural component bonding, especially across automotive, aerospace, and construction sectors requiring long-term durability.

- For instance, Sika’s SikaPower epoxy-based adhesives bond metal types and carbon fiber reinforced plastics (CFRP) in vehicle body shop applications, curing via electro-coat oven heat for crash-durable structural joints.

By Technology

In technology segmentation, reactive bonding technology dominates the Structural Bonding Agents Market with a 41.2% share, supported by strong adhesion performance, chemical crosslinking capability, and suitability for high-stress structural joints. Water-based systems gain momentum due to sustainability regulations, while solvent-based formulations retain relevance where rapid curing is essential. Hot-melt adhesives support high-speed manufacturing processes and packaging-oriented applications. Reactive technology leads because industries such as transportation, wind energy, and electronics increasingly prioritize long-lasting bonds, enhanced fatigue resistance, and compatibility with multi-material assemblies, ensuring its continued market leadership.

- For instance, Bostik’s VINYLEX 115R water‑based adhesive is promoted for automotive applications, combining high green strength with low VOC emissions to support faster assembly and regulatory compliance on interior components.

By Application

The Structural Bonding Agents Market by application is led by metal bonding, accounting for a 33.4% share, driven by expanding automotive production, aerospace component assembly, and industrial equipment manufacturing. Composite bonding follows closely as lightweight materials penetrate vehicle, wind turbine, and construction applications. Plastic and multi-material bonding segments grow with the shift toward modular product designs and EV battery systems. Metal bonding remains dominant due to its critical role in replacing welding and mechanical fasteners, enabling improved structural integrity, reduced weight, and enhanced corrosion resistance across high-performance end-use industries.

Key Growth Drivers

Rising Demand for Lightweight Materials Across Industries

The increasing adoption of lightweight materials in automotive, aerospace, and industrial manufacturing strongly drives the Structural Bonding Agents Market. As OEMs replace traditional mechanical fastening with high-performance adhesives, structural bonding agents enable superior strength-to-weight ratios, improved crash performance, and enhanced energy efficiency. Their ability to join dissimilar substrates such as metals, composites, and plastics further accelerates demand. This shift supports greater design flexibility, reduces assembly costs, and aligns with global sustainability targets, reinforcing the market’s long-term growth trajectory.

- For instance, Volkswagen integrated body‑in‑white adhesive bonding in several Audi models to replace certain welded joints, with structural adhesives able to withstand over 1,000 psi in lap‑shear tests while enhancing crash safety performance.

Expansion of Infrastructure and Construction Activities

Rapid urbanization, large-scale infrastructure upgrades, and increased investment in modern building materials significantly contribute to market growth. Structural bonding agents are widely used in façade systems, glass installations, flooring, panel bonding, and prefabricated structures, offering high adhesion, durability, and weather resistance. Their role in improving structural integrity and reducing lifecycle maintenance strengthens their adoption in both residential and commercial projects. As governments emphasize green construction and energy-efficient buildings, demand for adhesive technologies with superior thermal and mechanical performance continues to rise.

- For instance, Saint-Gobain employs high-performance silicone solutions in façade systems, such as securing ORAÉ low-carbon glass with Hydro CIRCAL 75R aluminum for sustainable building envelopes that enhance energy efficiency.

Advancements in Adhesive Chemistry and Application Technologies

Continuous innovation in reactive systems, hybrid formulations, and environmentally friendly chemistries enhances performance capabilities and broadens industrial application scope. Modern bonding agents now deliver improved curing speed, chemical resistance, and compatibility with complex substrates, making them suitable for EV batteries, wind turbine blades, and next-generation consumer electronics. Automation-ready adhesive dispensing and precision application technologies further accelerate operational efficiency for manufacturers. These advancements collectively create new growth pathways by supporting high-performance bonding requirements across technologically evolving industries.

Key Trends & Opportunities

Growing Shift Toward Sustainable and Low-Emission Adhesives

A major trend shaping the market is the transition toward water-based, solvent-free, and bio-based adhesive systems with lower VOC profiles. Regulatory pressure, corporate sustainability goals, and rising environmental awareness encourage manufacturers to develop greener structural bonding solutions without compromising bond strength. This trend opens strong opportunities in green construction, consumer goods, and electric mobility where eco-compliance is critical. Companies focusing on carbon-neutral formulations, recyclable materials, and circular-economy-aligned adhesives stand to benefit significantly from this market shift.

- For instance, Henkel developed Loctite HB S ECO, a one-component polyurethane adhesive free of solvents and volatile organic compounds. It incorporates 63% bio-based materials via ISCC PLUS certified mass balance, reducing CO2eq emissions by 66% compared to fossil-based versions while maintaining identical performance for load-bearing timber construction.

Increasing Adoption in Electric Vehicles and Renewable Energy

The rapid growth of EV production and renewable energy infrastructure creates expanding opportunities for high-performance bonding agents. Structural adhesives support lightweight EV chassis, battery enclosures, composite body structures, and thermal management components. In the wind energy sector, they play a vital role in bonding large turbine blades, ensuring fatigue resistance and long-term durability. As manufacturers scale up advanced composite usage and adopt multi-material designs, demand for robust bonding technologies that enhance efficiency and reduce manufacturing complexity continues to accelerate.

- For instance, DuPont’s BETAFORCE elastic structural adhesives bond EV battery packs at room temperature, incorporating 30% bio-based raw materials without primers or pretreatments. This enables sustainable assembly while maintaining design flexibility and corrosion protection.

Key Challenges

Fluctuating Raw Material Prices and Supply Chain Constraints

The market faces persistent challenges from volatility in petrochemical-based raw materials, which directly impacts production costs for epoxy, polyurethane, and acrylic adhesive systems. Geopolitical disruptions, logistics bottlenecks, and supply shortages further strain procurement stability for manufacturers. These fluctuations reduce profit margins and create pricing uncertainty for end users. Companies must adopt strategic sourcing, invest in alternative chemistries, and enhance supply chain resilience to mitigate the impact of unpredictable cost variations and maintain consistent product availability.

Complex Regulatory Compliance and Performance Testing Requirements

Stringent global regulations governing VOC emissions, chemical safety, and environmental impact present a major challenge for adhesive manufacturers. Compliance with REACH, EPA, and regional building standards requires continuous reformulation, rigorous testing, and costly certification processes. Additionally, structural bonding applications demand high reliability, mandating extensive mechanical, durability, and aging tests before market approval. These requirements lengthen development timelines and increase operational costs, posing barriers for smaller players and necessitating substantial R&D investment for long-term competitiveness.

Regional Analysis

North America

North America holds a 31.4% share of the Structural Bonding Agents Market, driven by strong demand from automotive manufacturing, aerospace production, and advanced construction activities. The region benefits from the presence of major adhesive manufacturers, high adoption of lightweight materials, and increasing use of composite bonding technologies. Growing investments in electric vehicle platforms and infrastructure refurbishment further support market growth. The U.S. leads due to robust industrial output and stringent performance standards that favor high-strength bonding agents. Continued innovation in reactive adhesives and sustainable chemistries strengthens the region’s long-term demand outlook.

Europe

Europe accounts for a 29.7% share of the Structural Bonding Agents Market, supported by stringent environmental regulations, advanced automotive production, and strong emphasis on sustainable construction practices. Germany, France, and the U.K. lead adoption as manufacturers shift toward bonding solutions that improve fuel efficiency and structural durability. The region’s growing wind energy sector, which relies heavily on composite bonding, further reinforces demand. Adoption of water-based and low-VOC formulations accelerates due to the EU’s environmental policies. Continuous innovation in hybrid adhesive chemistries positions Europe as a key hub for technologically advanced bonding solutions.

Asia-Pacific

Asia-Pacific dominates the Structural Bonding Agents Market with a 37.2% share, driven by rapid industrialization, expanding automotive and electronics manufacturing, and large-scale infrastructure development. China, Japan, South Korea, and India significantly contribute to demand as manufacturers increasingly adopt adhesives for metal, composite, and multi-material bonding applications. The region benefits from cost-efficient production capabilities and growing EV manufacturing investments. Rising use of advanced materials in construction and transportation further strengthens market expansion. Strong government support for renewable energy installations, particularly wind and solar, enhances the need for high-performance structural bonding technologies.

Latin America

Latin America holds a 5.6% share of the Structural Bonding Agents Market, led by growing construction activities, expanding automotive assembly operations, and rising demand for durable bonding solutions in industrial applications. Brazil and Mexico remain the largest contributors due to increasing investments in infrastructure modernization and consumer goods manufacturing. Adoption of reactive and polyurethane-based adhesives is rising as industries shift from traditional mechanical fastening to advanced bonding technologies. Although economic volatility poses challenges, improving manufacturing competitiveness and regional industrial growth continue to support long-term market potential across key segments.

Middle East & Africa

The Middle East & Africa region accounts for a 6.1% share of the Structural Bonding Agents Market, driven by expanding construction projects, infrastructure development, and increasing adoption of composite materials in automotive, marine, and industrial sectors. GCC countries lead demand due to large-scale commercial and residential building projects requiring high-strength adhesive solutions. Rising industrial diversification efforts support the use of advanced bonding agents across manufacturing applications. While the market is still developing compared to other regions, investments in renewable energy, transportation, and smart infrastructure create significant opportunities for high-performance adhesive technologies.

Market Segmentations:

By Product Type

- Epoxy

- Polyurethane

- Acrylic

- Methyl methacrylate (MMA)

- Silicone

- Others

By Technology

- Water-based

- Solvent-based

- Hot melt

- Reactive

By Application

- Metal Bonding

- Composite bonding

- Plastic bonding

- Multi-material bonding

- Others

By End Use Industry

- Automotive & transportation

- Aerospace

- Wind Energy

- Industrial assembly

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Structural Bonding Agents Market features leading companies such as 3M Company, Sika AG, Henkel AG & Co. KGaA, The Dow Chemical Company, H.B. Fuller, Scott Bader Co., Uniseal Inc., Huntsman Corporation, Ashland Inc., and RPM International Inc., which collectively shape technology, innovation, and global supply capabilities. These players focus on expanding adhesive performance through advancements in epoxy, polyurethane, acrylic, and hybrid chemistries to meet the rising demand for high-strength, lightweight bonding solutions across automotive, aerospace, construction, and industrial applications. Strategic initiatives such as product innovation, acquisitions, capacity expansion, and sustainability-driven developments strengthen their market positioning. Companies increasingly invest in reactive and low-VOC formulations to align with global environmental standards, while partnerships with OEMs and composite manufacturers enhance application-specific solutions. Continuous R&D efforts, strong distribution networks, and integration of automation-friendly adhesive technologies further reinforce their competitive edge in a market driven by performance, durability, and evolving material engineering requirements.

Key Player Analysis

- 3M Company

- Sika AG

- Henkel AG & Co. KGaA

- The Dow Chemical Company

- H.B. Fuller

- Scott Bader Co.

- Uniseal, Inc.

- Huntsman Corporation

- Ashland Inc.

- RPM International Inc.

Recent Developments

- In October 2025, Henkel Adhesive Technologies and The Dow Chemical Company expanded their strategic partnership to reduce emissions across their adhesive portfolio, advancing sustainability initiatives.

- In September 2025, Huntsman Advanced Materials launched a new range of reformulated ARALDITE® epoxy adhesives, including ARALDITE® 2014-3, free from intentionally added BPA and CMR substances under EU regulations.

- In April 2024, Henkel AG & Co. KGaA completed the acquisition of Seal for Life Industries, expanding its protective and sealing coatings portfolio to enhance adhesive technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience rising demand as industries accelerate adoption of lightweight and multi-material assemblies.

- Advancements in reactive and hybrid adhesive chemistries will strengthen performance and expand application scope.

- Electric vehicle manufacturing will create strong long-term opportunities for high-strength bonding solutions.

- Construction and infrastructure modernization will continue driving the use of durable, weather-resistant bonding agents.

- Sustainability goals will push manufacturers toward water-based, solvent-free, and low-VOC formulations.

- Automation in industrial processes will increase the need for adhesives compatible with high-speed dispensing systems.

- Composite-intensive sectors such as aerospace and wind energy will drive continuous innovation in structural bonding technologies.

- Supply chain optimization and raw material diversification will become strategic priorities for manufacturers

- Digital simulation and predictive bonding performance tools will support faster product development cycles.

- Strategic partnerships between adhesive suppliers and OEMs will strengthen customized bonding solutions for emerging applications.

Market Segmentation Analysis:

Market Segmentation Analysis: