Market Overview

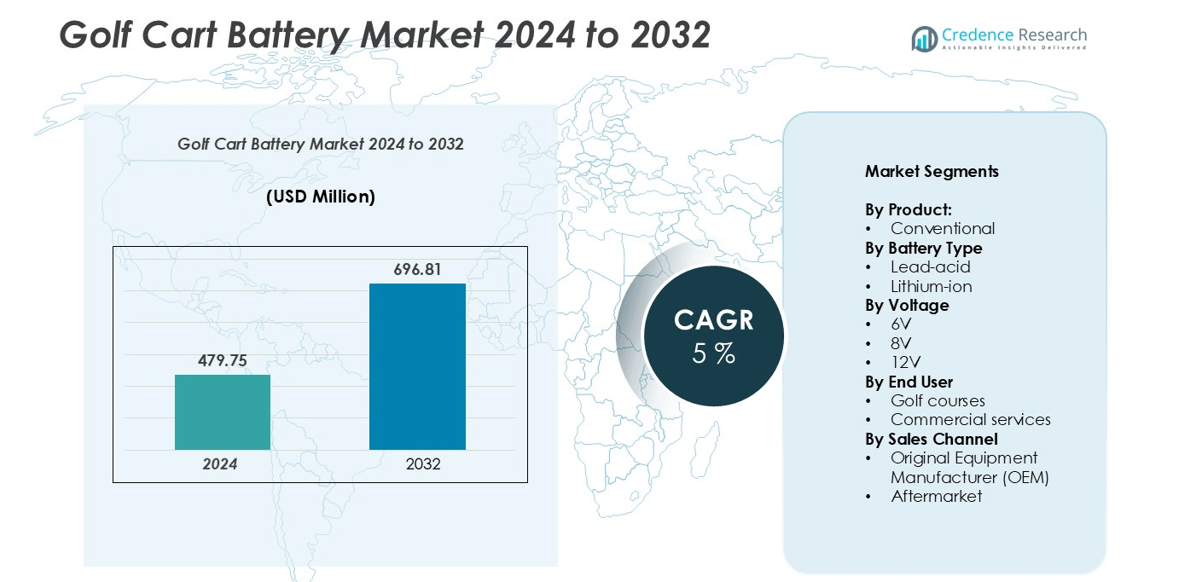

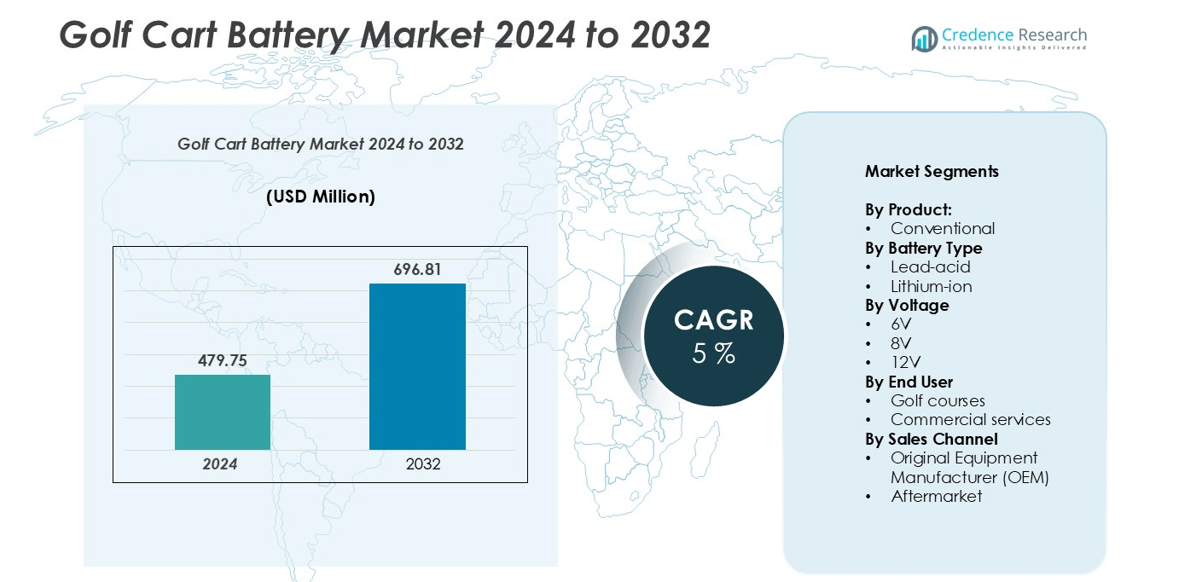

The golf cart battery market size was valued at USD 479.75 million in 2024 and is anticipated to reach USD 696.81 million by 2032, at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Golf Cart Battery Market Size 2024 |

USD 479.75 million |

| Golf Cart Battery Market CAGR |

5% |

| Golf Cart Battery Market Size 2032 |

USD 696.81 million |

The golf cart battery market is led by prominent companies including Clarios, Crown Battery Manufacturing, Duracell, East Penn Manufacturing, EnerSys, Exide Technologies, Interstate Batteries, Fullriver Battery USA, Leoch International Technology, Lifeline Batteries, CloudEnergy, and Continental Battery Systems. These players maintain competitive advantage through technological innovation, diverse product portfolios, and strategic partnerships. North America dominates the market with approximately 35% share, driven by high adoption of electric golf carts and advanced golf course infrastructure. Europe follows with a 25% share, supported by electrification trends and sustainability initiatives, while Asia-Pacific captures 20% share due to rapid urbanization and expanding golf courses. Latin America (12%) and MEA (8%) are emerging regions, benefitting from tourism infrastructure and increasing demand for eco-friendly fleet solutions. Collectively, these regions shape the global market landscape, offering growth opportunities for leading manufacturers.

Market Insights

- The golf cart battery market was valued at USD 479.75 million in 2024 and is projected to reach USD 696.81 million by 2032, growing at a CAGR of 5% during the forecast period.

- Growth is driven by rising adoption of electric golf carts, demand for low-maintenance and high-performance batteries, and expansion of golf courses and commercial fleets globally.

- Key trends include the shift from lead-acid to lithium-ion batteries, integration of smart battery management systems, and increased focus on eco-friendly and energy-efficient solutions.

- The market is competitive, led by players such as Clarios, Crown Battery Manufacturing, Duracell, East Penn Manufacturing, EnerSys, and Exide Technologies, who focus on innovation, strategic partnerships, and regional expansion to strengthen their presence.

- North America leads with 35% market share, followed by Europe (25%), Asia-Pacific (20%), Latin America (12%), and MEA (8%), with lead-acid batteries dominating, while lithium-ion adoption grows rapidly.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Battery Type

The golf cart battery market is primarily segmented into lead-acid and lithium-ion batteries. Lead-acid batteries currently dominate the market, accounting for a significant share due to their cost-effectiveness, established supply chain, and reliability for standard golf cart operations. However, lithium-ion batteries are witnessing rapid adoption driven by advantages such as longer lifespan, faster charging, and lighter weight, which enhance vehicle performance and reduce maintenance costs. The increasing demand for high-performance and eco-friendly golf carts is expected to further propel the growth of the lithium-ion segment over the forecast period.

- For instance, the Trojan Battery’s T-1275 is a 12V flooded lead-acid battery that offers a 150Ah capacity at a 20-hour rate, and is widely used in golf carts for its durability and performance.

By Voltage

The market is segmented into 6V, 8V, and 12V battery types. Among these, 12V batteries hold the largest market share as they are compatible with a wide range of golf carts and offer optimal power output for both commercial and recreational use. The 6V and 8V batteries remain relevant for smaller carts or specific low-power applications. Growing adoption of electric golf carts and rising investments in golf course infrastructure are key drivers for higher-voltage battery segments, supporting improved efficiency, longer runtime, and enhanced vehicle performance.

- For instance, Trojan offers its T-105 6 V deep-cycle model rated at 225 Ah at the 20-hour rate, showing how 6 V batteries still provide high amp-hour capacity for extended use in smaller carts.

By End User

End-user segmentation includes golf courses and commercial services. Golf courses constitute the dominant segment, holding the majority of market share due to the extensive use of golf carts for player mobility, maintenance activities, and facility operations. Commercial services, including resorts, theme parks, and campus transportation, are emerging as a significant growth driver owing to rising electrification trends and demand for sustainable transportation solutions. Increasing awareness of low-emission alternatives and operational efficiency requirements are fueling battery adoption across both segments, with specialized service providers seeking higher-capacity and durable battery solutions.

Key Growth Drivers

Increasing Adoption of Electric Golf Carts

The rising shift from conventional fuel-powered golf carts to electric models is a primary driver of market growth. Golf courses and commercial service providers are increasingly prioritizing eco-friendly and low-emission vehicles to meet sustainability goals and reduce operational costs. Electric golf carts require efficient and durable batteries, stimulating demand for both lead-acid and lithium-ion options. Advancements in battery technology, including higher energy density, faster charging, and extended lifecycle, further enhance the appeal of electric carts. Additionally, government incentives and environmental regulations promoting electric mobility are encouraging operators to invest in battery-powered fleets, thereby expanding the overall golf cart battery market during the forecast period.

- For instance, Yamaha Motor Co., Ltd. launched its G30Es and G31EP electric five-seater golf carts with an in-house lithium-ion battery offering 4 kWh and 6 kWh options.

Rising Demand for Low-Maintenance and High-Performance Batteries

Market growth is driven by the need for low-maintenance, high-performance batteries that improve operational efficiency. Lithium-ion batteries, in particular, are gaining traction due to their longer lifespan, reduced charging time, and lighter weight compared to traditional lead-acid batteries. Golf course operators and commercial fleet managers are increasingly adopting batteries that minimize downtime, lower maintenance costs, and deliver consistent power output. Enhanced battery technologies also improve cart speed, range, and reliability, which are crucial for both recreational and commercial applications. This demand for superior performance batteries is expected to accelerate market expansion, encouraging manufacturers to invest in research and development of innovative battery solutions.

- For instance, Club Car’s official website and product pages confirm that the Onward High Performance (HP) Lithium models are equipped with lithium-ion batteries up to 7.0 kWh, which are maintenance-free and offer superior hill-climbing capabilities.

Expansion of Golf Courses and Commercial Fleet Services

The growing number of golf courses globally, especially in North America and Asia-Pacific, is a significant market growth driver. Expansion in tourism, hospitality, and resort services is simultaneously increasing demand for golf carts and commercial fleets, such as shuttle services and recreational transportation. These end-users require reliable and long-lasting batteries to maintain operational efficiency and reduce replacement costs. Additionally, modernization of golf courses with eco-friendly and electrically powered carts enhances demand for technologically advanced batteries. The combined effect of industry growth, urban development, and rising consumer spending is expected to sustain robust demand for golf cart batteries over the forecast period.

Key Trends & Opportunities

Shift Toward Lithium-Ion Batteries

A prominent trend in the market is the transition from lead-acid to lithium-ion batteries, driven by performance and sustainability considerations. Lithium-ion batteries offer higher energy efficiency, faster charging, longer life cycles, and lighter weight, which contribute to enhanced golf cart performance and reduced operational costs. Manufacturers are increasingly developing cost-effective lithium-ion solutions to address price concerns and widen adoption. This trend presents opportunities for technological innovation, strategic partnerships, and market penetration in regions with growing demand for premium golf carts. Additionally, rising awareness of environmental sustainability is accelerating the preference for lithium-ion over traditional batteries.

- For instance, Trojan’s OnePack-High Performance 48 V 171 Ah lithium-ion battery delivers full charge in under 4 hours and uses LiFePO₄ chemistry with four levels of safety redundancy and five internal temperature sensors.

Integration of Smart Battery Technologies

The integration of smart battery management systems (BMS) is emerging as a significant opportunity. Advanced BMS enables real-time monitoring of battery health, temperature control, and predictive maintenance, improving safety and operational efficiency. Golf courses and commercial fleet operators are increasingly adopting smart batteries to reduce downtime, prevent failures, and optimize energy usage. The opportunity lies in developing intelligent solutions compatible with diverse golf cart models, enhancing user convenience, and reducing lifecycle costs. As digitalization and connected vehicle trends expand across the industry, smart battery adoption is expected to become a key differentiator for manufacturers.

- For instance, a smart 13S 48V BMS can include features such as Bluetooth or CAN communication for real-time monitoring and parameter adjustment, with the continuous current capacity varying by model. The original claim of a 300A current capacity and 3A active balancing is extremely high for a standard unit.

Key Challenges

High Initial Cost of Lithium-Ion Batteries

One of the main challenges limiting market growth is the high upfront cost of lithium-ion batteries compared to traditional lead-acid options. Despite offering better performance, longevity, and reduced maintenance, the higher purchase price can deter cost-sensitive operators, especially in emerging markets. Golf course operators and commercial service providers often weigh the long-term benefits against the initial capital investment, slowing widespread adoption. Manufacturers need to address cost barriers through scalable production, government subsidies, and financing options. Until price parity or affordability solutions are achieved, the high initial cost remains a significant market restraint.

Battery Disposal and Environmental Concerns

Proper disposal and recycling of golf cart batteries, particularly lead-acid variants, pose environmental and regulatory challenges. Improper handling can lead to soil and water contamination, creating compliance issues for operators and manufacturers. Environmental regulations are becoming increasingly stringent, requiring investments in safe recycling infrastructure and eco-friendly practices. These factors can increase operational costs and slow market growth. Additionally, the lack of standardized recycling systems in certain regions limits the adoption of batteries with higher environmental impact. Addressing sustainability and regulatory compliance remains a critical challenge for market players.

Regional Analysis

North America

North America holds the largest share of the golf cart battery market at approximately 35%, driven by a mature golf industry, high adoption of electric carts, and stringent environmental regulations promoting low-emission vehicles. The United States leads regional demand, supported by advanced golf course infrastructure and extensive commercial fleet services. Both lead-acid and lithium-ion batteries see strong adoption, with technological advancements and strategic partnerships enhancing product offerings. Rising investments in recreational and commercial transportation sectors further fuel market growth, solidifying North America’s position as the dominant regional contributor to the global golf cart battery market.

Europe

Europe accounts for around 25% of the global golf cart battery market, supported by electrification trends and increased adoption of eco-friendly recreational vehicles. Germany, the UK, and France lead in modernization of golf courses and deployment of electric carts. Rising awareness of sustainability, stringent emission standards, and growing demand for high-performance lithium-ion batteries drive growth. The expanding hospitality and tourism sectors further enhance regional demand. Manufacturers are investing in smart battery management systems and innovative battery technologies to meet evolving customer needs and comply with environmental policies, reinforcing Europe’s strong market presence.

Asia-Pacific

Asia-Pacific contributes roughly 20% of the global golf cart battery market and is among the fastest-growing regions. Growth is driven by urbanization, rising leisure activities, and the expansion of golf courses in China, Japan, and India. Electric and lithium-ion battery-powered carts are gaining popularity in both recreational and commercial sectors. Increased disposable income, government initiatives promoting clean energy, and tourism infrastructure development boost market adoption. Manufacturers are leveraging strategic partnerships and localized production to meet regional demand efficiently. The focus on eco-friendly mobility and low-maintenance, high-performance batteries ensures sustained growth in Asia-Pacific.

Latin America

Latin America represents about 12% of the golf cart battery market, driven by tourism development and recreational infrastructure in Brazil, Mexico, and Argentina. Golf courses and commercial operators are increasingly adopting electric carts to enhance operational efficiency and reduce environmental impact. Lead-acid and lithium-ion batteries are both in demand, with reliability and durability as key considerations. Government incentives supporting sustainable transportation and investments in leisure facilities encourage market expansion. Strategic collaborations between local distributors and global manufacturers further strengthen battery availability and adoption across Latin America.

Middle East & Africa (MEA)

MEA accounts for an estimated 8% of the global golf cart battery market, supported by luxury resorts, golf tourism, and commercial fleet services in the UAE, Saudi Arabia, and South Africa. Infrastructure development and the growing preference for electrically powered golf carts drive battery adoption. Lead-acid batteries remain dominant due to affordability, while lithium-ion uptake is gradually rising. Market players focus on partnerships, after-sales service, and localized solutions to enhance market penetration. Increasing disposable income, sustainability initiatives, and the expansion of recreational facilities contribute to steady growth in the MEA region.

Market Segmentations:

By Battery Type

By Voltage

By End User

- Golf courses

- Commercial services

By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The golf cart battery market is highly competitive, with key players focusing on technological innovation, strategic partnerships, and regional expansion to strengthen market presence. Leading manufacturers such as Clarios, Crown Battery Manufacturing, Duracell, East Penn Manufacturing, EnerSys, Exide Technologies, and Interstate Batteries dominate the market by offering a diverse portfolio of lead-acid and lithium-ion batteries tailored for both recreational and commercial applications. Companies are increasingly investing in research and development to improve energy density, battery lifespan, and charging efficiency, responding to rising demand for high-performance and eco-friendly solutions. Strategic initiatives such as mergers, acquisitions, and collaborations with distributors enhance geographic reach and after-sales support. Competitive differentiation is also achieved through product reliability, cost-effectiveness, and compliance with environmental regulations, positioning these players to capitalize on growing adoption of electric golf carts across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Crown Battery Manufacturing

- Duracell

- Clarios

- East Penn Manufacturing

- EnerSys

- Exide Technologies

- Fullriver Battery USA

- Interstate Batteries

- Leoch International Technology

- Lifeline Batteries

- CloudEnergy

- Continental Battery Systems

Recent Developments

- In October 2024, Clarios invested in Altris to accelerate software-enhanced sodium-ion battery systems for vehicles, targeting pilot production in 2026.

- In September 2024, Clarios signed a development pact with a European truck maker to co-produce 24 V lithium-ion packs, expanding its high-voltage portfolio.

- In September 2024, CloudEnergy launched a 48 V 105 Ah lithium battery for golf carts with 5,376 Wh capacity and screw-fastened housing for easier servicing.

Source: https://www.mordorintelligence.com/industry-reports/golf-cart-battery-market

Report Coverage

The research report offers an in-depth analysis based on Battery Type, Voltage, End-User, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Electric golf carts will continue to replace fuel-powered models across global markets.

- Lithium-ion batteries are expected to gain higher adoption due to performance and eco-friendly advantages.

- Demand for smart battery management systems will increase to optimize efficiency and maintenance.

- Growth in golf course infrastructure and commercial fleets will drive battery consumption worldwide.

- Manufacturers will focus on R&D to improve battery lifespan, energy density, and charging speed.

- Sustainability initiatives and emission regulations will encourage the use of low-maintenance, environmentally friendly batteries.

- Strategic partnerships and regional expansion will remain key competitive strategies for leading players.

- Asia-Pacific and Latin America will emerge as high-growth regions for electric golf carts and battery adoption.

- Technological innovations will support cost reduction and make lithium-ion batteries more accessible.

- Integration of connected and intelligent battery solutions will shape future market demand.