Market Overview

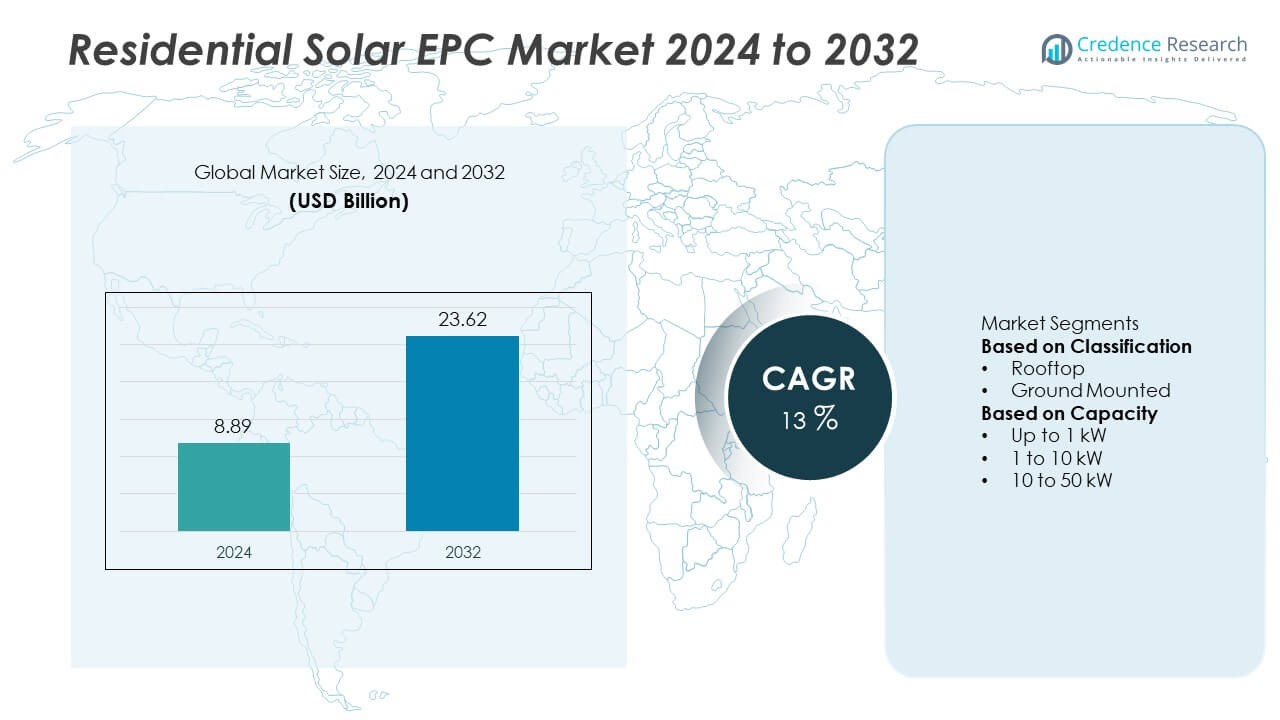

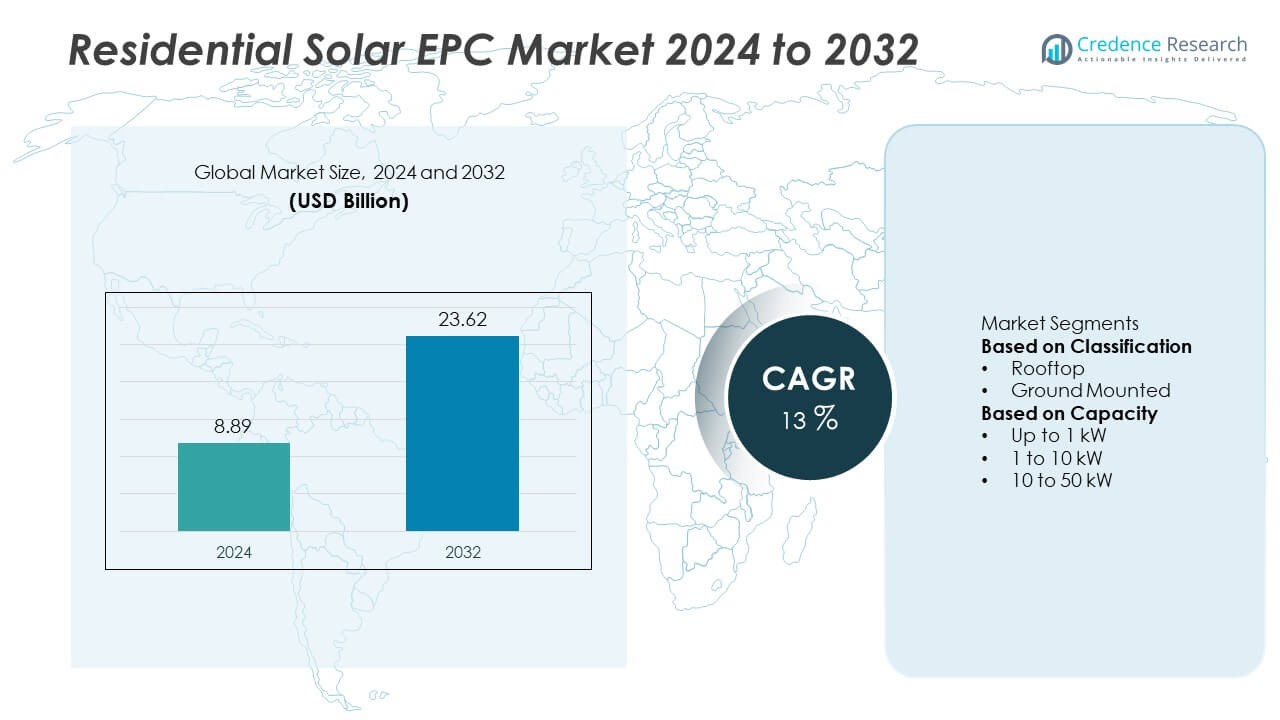

The Residential Solar EPC Market was valued at USD 8.89 billion in 2024 and is projected to reach USD 23.62 billion by 2032, growing at a CAGR of 13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Solar EPC Market Size 2024 |

USD 8.89 Billion |

| Residential Solar EPC Market, CAGR |

13% |

| Residential Solar EPC Market Size 2032 |

USD 23.62 Billion |

The Residential Solar EPC market is dominated by key players including Tata Power Solar Systems Ltd., Trina Solar Limited, SunPower Corporation, Canadian Solar Inc., JA Solar Technology Co., Ltd., JinkoSolar Holding Co., Ltd., First Solar, Inc., Enphase Energy, Inc., Sungrow Power Supply Co., Ltd., and REC Solar Holdings AS. These companies lead through technological innovation, strong project execution capabilities, and global EPC experience. North America held the largest market share of 38% in 2024, driven by supportive policies and widespread rooftop installations. Asia-Pacific followed with 33%, supported by large-scale solar initiatives in China and India, while Europe captured 21%, propelled by energy transition goals and residential subsidy programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The residential solar EPC market was valued at USD 8.89 billion in 2024 and is projected to reach USD 23.62 billion by 2032, growing at a CAGR of 13% during the forecast period.

- Rising demand for rooftop solar installations and declining solar panel costs are driving large-scale adoption in residential sectors.

- Integration of smart inverters, battery storage, and digital monitoring systems is a key trend improving project efficiency and energy management.

- Leading companies such as Tata Power Solar, SunPower, Trina Solar, and JinkoSolar are expanding EPC services through technological innovation and strategic partnerships.

- North America held a 38% share in 2024, followed by Asia-Pacific with 33% and Europe with 21%, while rooftop systems dominated with a 64% share due to strong residential adoption and favorable government incentives.

Market Segmentation Analysis:

By Classification

The rooftop segment dominated the residential solar EPC market in 2024 with a 74% share. Its leadership stems from increasing adoption of rooftop solar systems in urban and suburban households for on-site power generation. Supportive government incentives, such as tax credits and net metering policies, encourage homeowners to install rooftop panels. Advances in lightweight photovoltaic modules and efficient inverters have simplified installation and reduced costs. The segment continues to grow due to energy independence goals, declining solar panel prices, and rising awareness of sustainable energy solutions among residential consumers.

- For instance, Enphase Energy ships IQ8 microinverters, enabling real-time grid-independent operation during power outages when part of a complete Enphase system with an IQ System Controller.

By Capacity

The 1 to 10 kW capacity segment held the largest market share of 62% in 2024, driven by its suitability for standard residential energy needs. These systems provide a balance between cost-efficiency and energy generation, making them ideal for single and multi-family homes. Increasing rooftop area optimization and favorable financing options are fueling installations in this range. The growing trend of decentralized power generation and government-backed solar subsidy programs further support segment growth, enhancing adoption in both developed and developing residential markets worldwide.

- For instance, Tata Power Solar surpassed 200,000 rooftop solar installations with a cumulative capacity of over 3.4 GW across India. The company added 45,589 of these installations during the first quarter of the 2026 financial year alone.

Key Growth Drivers

Rising Residential Adoption of Solar Power

Increasing awareness of clean energy and declining solar panel costs are driving adoption of residential solar EPC projects. Homeowners are seeking energy independence and lower electricity bills, boosting demand for turnkey solar installations. Government initiatives such as tax credits, net metering, and renewable energy subsidies further encourage investments. Expanding rooftop installation programs and the availability of affordable financing options continue to strengthen growth in residential solar deployment worldwide.

- For instance, Vivint Solar, now part of Sunrun, deployed 1.29 gigawatts of solar power for over 188,000 customers on rooftops, enhancing distributed generation capacity across the U.S. residential sector.

Government Incentives and Policy Support

Supportive government policies remain a major growth catalyst for the residential solar EPC market. Incentives such as feed-in tariffs, rebates, and investment tax credits make solar energy more accessible for homeowners. Countries like the U.S., India, and Germany are expanding rooftop solar targets under national renewable energy missions. These measures attract EPC contractors to scale up operations, improve installation efficiency, and develop localized service networks to meet rising consumer demand.

- For instance, IBC Solar, a leading provider of solar energy solutions, has implemented numerous residential and commercial rooftop systems across Germany, including in states like Bavaria and North Rhine-Westphalia.

Advancements in Solar Technology and System Efficiency

Technological innovations in photovoltaic modules, inverters, and energy storage systems are boosting residential solar EPC adoption. High-efficiency monocrystalline panels and smart monitoring solutions enhance system performance and lifespan. Integration of AI-driven energy management tools allows real-time optimization of energy use. EPC firms are leveraging automation, digital design platforms, and advanced mounting systems to reduce project timelines and costs, thereby improving overall market competitiveness.

Key Trends & Opportunities

Integration of Energy Storage and Smart Management Systems

The growing use of battery storage solutions alongside solar installations is transforming residential EPC offerings. Integrated energy systems enable homeowners to store surplus power and achieve grid independence. Companies are adopting AI-powered smart inverters and energy management software to improve reliability. This trend creates opportunities for EPC providers to deliver end-to-end solutions, combining solar, storage, and digital energy optimization in a unified platform.

- For instance, the SonnenCommunity connects thousands of residential batteries to create a virtual power plant, which uses a self-learning software platform to enable automated energy balancing by monitoring member data in real-time.

Expansion of Financing and Leasing Models

Flexible financing and solar leasing programs are making residential installations more accessible. Power purchase agreements (PPAs) and zero-down financing options attract cost-sensitive homeowners. Financial institutions are collaborating with EPC companies to simplify credit approvals and reduce upfront costs. These models are expected to accelerate market penetration in emerging regions where affordability remains a key challenge.

- For instance, Tata Power Solar partnered with SIDBI to offer financing for Micro, Small & Medium Enterprises (MSMEs) adopting rooftop solar. SIDBI provides loans covering a significant portion of project costs for MSMEs.

Key Challenges

High Initial Installation and Maintenance Costs

Despite declining module prices, high upfront investment in installation, permits, and maintenance remains a challenge for many homeowners. Limited access to financing in developing regions further restricts adoption. EPC firms face pressure to optimize costs without compromising system quality. The development of cost-efficient supply chains and modular installation techniques is essential to address this constraint and expand residential adoption.

Grid Integration and Technical Constraints

Integrating residential solar systems with existing power grids presents technical and regulatory challenges. Voltage fluctuations, grid instability, and limited net metering infrastructure hinder seamless energy exchange. EPC contractors must navigate complex interconnection standards and local permitting regulations. Investments in grid modernization, smart metering, and standardized connection protocols are critical to overcoming these operational hurdles and ensuring reliable solar energy integration.

Regional Analysis

North America

North America held a 38% share of the residential solar EPC market in 2024, driven by strong policy support and widespread rooftop solar adoption. The U.S. leads the region due to federal tax incentives, state-level rebates, and net metering programs. High household electricity costs and growing environmental awareness are boosting demand for residential solar systems. Canada is also witnessing increased installations supported by provincial renewable energy targets. Expanding partnerships between EPC contractors and financing firms, alongside technological innovations in panel efficiency, continue to strengthen North America’s position in the global residential solar EPC market.

Europe

Europe accounted for a 29% share in 2024, supported by stringent carbon reduction targets and widespread adoption of distributed solar energy systems. Germany, the Netherlands, and the United Kingdom are leading markets due to favorable feed-in tariffs and green home incentives. The European Green Deal and national renewable energy directives promote large-scale residential solar installations. EPC providers are leveraging digital project management tools and modular system designs to meet increasing residential demand. Rising energy prices and growing consumer focus on sustainability continue to accelerate the adoption of residential solar EPC services across Europe.

Asia-Pacific

Asia-Pacific dominated the residential solar EPC market with a 27% share in 2024, driven by rapid urbanization, expanding renewable energy investments, and government-backed solar missions. China leads regional installations through large-scale rooftop deployment programs, while India’s residential solar incentives under PM-KUSUM and state subsidies enhance growth. Japan, South Korea, and Australia are also major contributors, with rising adoption of smart solar-plus-storage systems. Growing awareness of energy self-sufficiency and cost-saving benefits is driving demand. Increasing participation of local EPC firms and supportive net metering policies further strengthen Asia-Pacific’s position in the global solar EPC landscape.

Latin America

Latin America represented a 4% share in 2024, fueled by expanding solar installations in Brazil, Mexico, and Chile. Government-led renewable energy programs and falling solar module costs are improving project viability. Residential consumers are increasingly adopting rooftop solar to offset rising electricity tariffs. EPC providers are focusing on localized construction expertise and affordable financing solutions to enhance accessibility. Despite economic constraints, supportive policies like distributed generation regulations in Brazil are encouraging small-scale installations. The region’s favorable solar potential and growing private sector involvement continue to create opportunities for residential EPC market expansion.

Middle East & Africa

The Middle East & Africa accounted for a 2% share in 2024, driven by growing solar adoption in the UAE, Saudi Arabia, and South Africa. Rising residential demand for clean and cost-effective power solutions aligns with national sustainability initiatives such as Saudi Vision 2030 and Dubai’s Clean Energy Strategy. EPC contractors are investing in rooftop installations and hybrid solar-storage systems for urban housing. In Africa, Kenya and Egypt are emerging markets due to improving access to financing and rural electrification projects. Expanding policy support and high solar irradiance levels position the region for steady long-term growth.

Market Segmentations:

By Classification

By Capacity

- Up to 1 kW

- 1 to 10 kW

- 10 to 50 kW

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the residential solar EPC market includes key players such as Tata Power Solar Systems Ltd., SunPower Corporation, First Solar, Trina Solar Limited, Canadian Solar Inc., JA Solar Technology Co., Ltd., JinkoSolar Holding Co., Ltd., Enphase Energy, Inc., Sungrow Power Supply Co., Ltd., and REC Solar Holdings AS. These companies dominate the market through extensive EPC networks, technological innovation, and strategic partnerships. Leading firms focus on developing integrated solar solutions combining design, procurement, and installation services. Continuous investments in high-efficiency solar modules, smart inverters, and energy storage integration enhance project performance and reliability. Players are also expanding their geographic presence through government tenders and residential subsidy programs. With rising solar adoption and decreasing module costs, competition is intensifying around service quality, installation efficiency, and digital project management solutions, positioning EPC providers to play a central role in global residential solar expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tata Power Solar Systems Ltd.

- SunPower Corporation

- First Solar, Inc.

- Trina Solar Limited

- Canadian Solar Inc.

- JA Solar Technology Co., Ltd.

- JinkoSolar Holding Co., Ltd.

- Enphase Energy, Inc.

- Sungrow Power Supply Co., Ltd.

- REC Solar Holdings AS

Recent Developments

- In January 2025, Vikram Solar, announced the supply order of 1 GW of solar modules. Under the contract, the company will supply its advanced Hypersol N-Type Glass-to-Glass Modules with capacity 580 Wp and above to complete the order.

- In 2025, SunPower Corporation closed its acquisition of Sunder Energy, thereby achieving the U.S. residential solar industry’s No. 5 position in installed megawatts.

- In May 2024, Sunel Group and Ameresco entered in an agreement on the Delfini project of Cero Generation in north Greece. The 100 MW project showcases both innovation and sustainability, fitting solar PV modules into challenging terrain.

Report Coverage

The research report offers an in-depth analysis based on Classification, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for residential solar EPC services will grow as global clean energy adoption accelerates.

- Rooftop solar systems will dominate due to rising consumer preference for decentralized power generation.

- Integration of battery storage with residential solar systems will enhance energy reliability and self-consumption.

- Digital monitoring and AI-based performance analytics will improve operational efficiency in EPC projects.

- Falling module and inverter prices will make solar installations more affordable for homeowners.

- Government subsidies and net metering policies will continue to boost residential solar adoption.

- Asia-Pacific will emerge as the fastest-growing regional market driven by large-scale urbanization.

- EPC companies will focus on turnkey solar solutions combining design, installation, and maintenance.

- Collaboration between solar manufacturers and EPC providers will strengthen project execution capabilities.

- Sustainability targets and carbon-neutral housing initiatives will accelerate long-term growth in residential solar EPC.