Market Overview

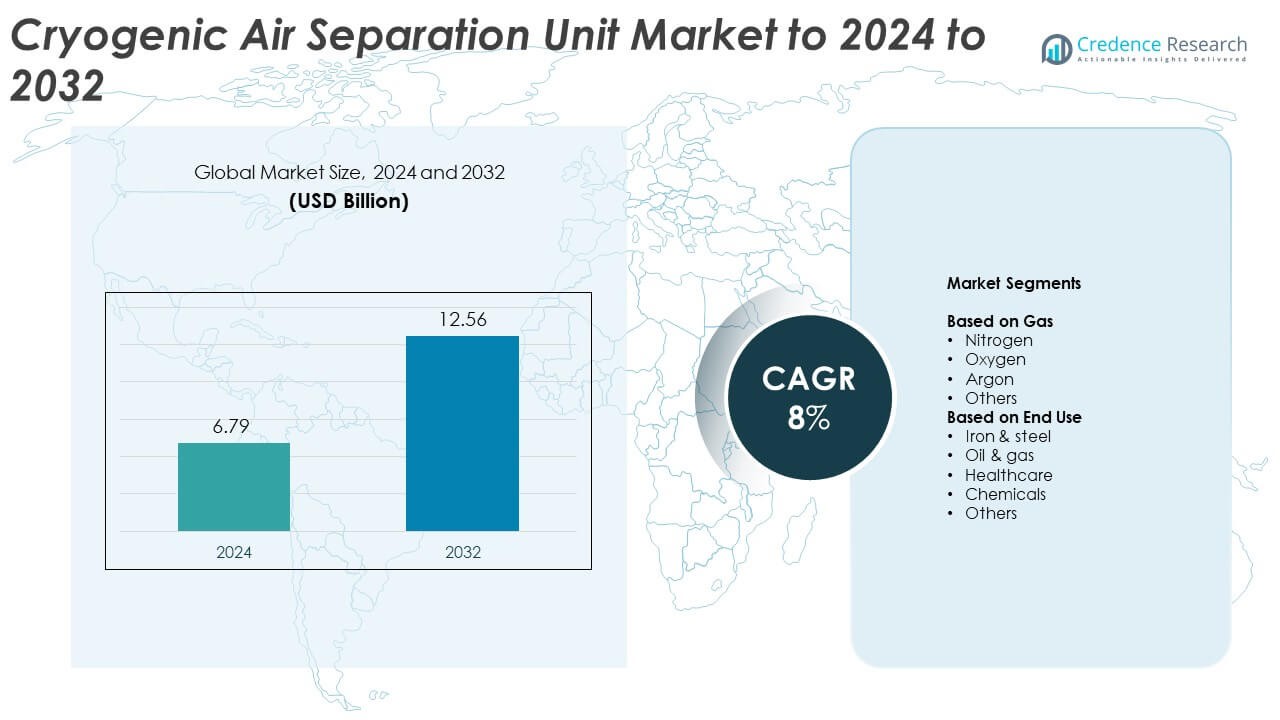

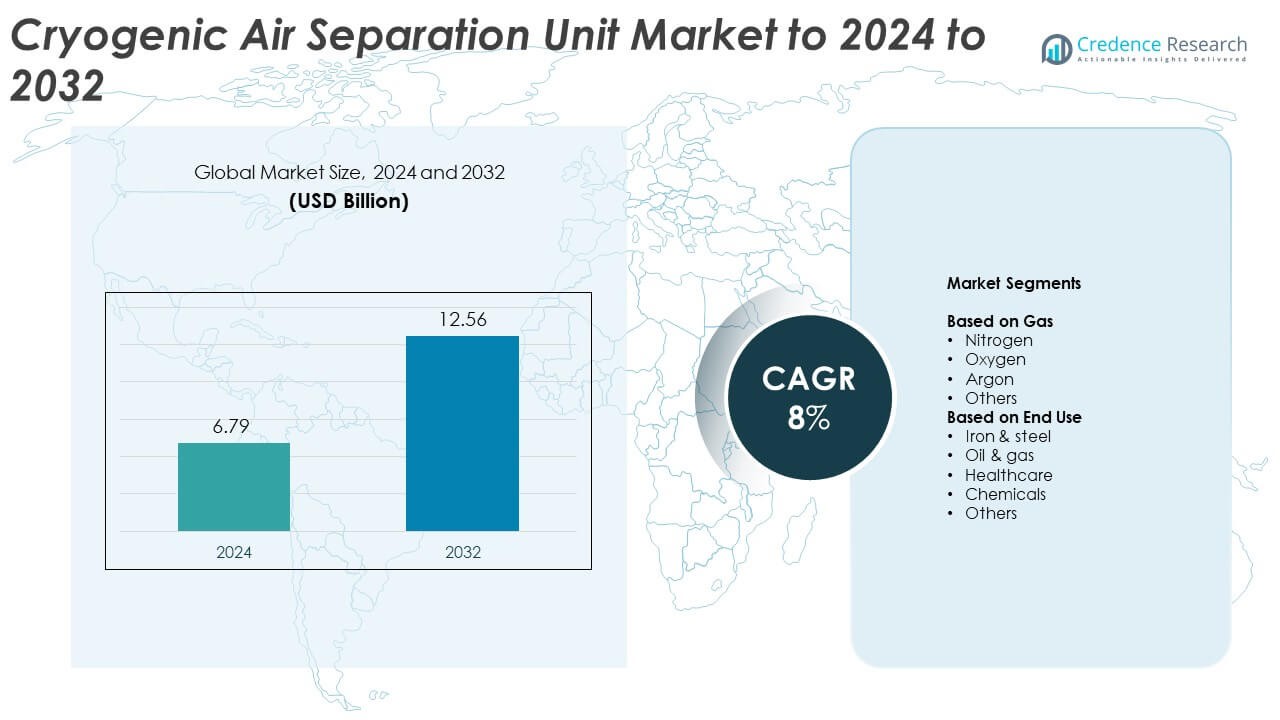

Cryogenic Air Separation Unit market size was valued USD 6.79 billion in 2024 and is anticipated to reach USD 12.56 billion by 2032, at a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cryogenic Air Separation Unit Market Size 2024 |

USD 6.79 Billion |

| Cryogenic Air Separation Unit Market, CAGR |

8% |

| Cryogenic Air Separation Unit Market Size 2032 |

USD 12.56 Billion |

The cryogenic air separation unit market is led by major players such as Linde plc, Air Liquide, Air Products and Chemicals, Inc., TAIYO NIPPON SANSO CORPORATION, and Messer. These companies focus on developing energy-efficient and large-scale air separation systems to meet rising industrial gas demand. Their strategies include investments in automation, regional expansion, and partnerships with process industries to enhance operational performance. Asia-Pacific dominated the global market with a 34% share in 2024, driven by expanding steel, chemical, and energy sectors, while North America and Europe followed with strong adoption of advanced ASU technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The cryogenic air separation unit market was valued at USD 6.79 billion in 2024 and is projected to reach USD 12.56 billion by 2032, growing at a CAGR of 8%.

- Growing demand for high-purity oxygen and nitrogen from steelmaking, healthcare, and chemical industries is driving market expansion.

- Energy-efficient, modular, and automated ASU systems are emerging as key trends, improving process flexibility and reducing operational costs.

- The market is highly competitive, with major players investing in digitalization and regional capacity expansion to strengthen their presence.

- Asia-Pacific led the market with a 34% share in 2024, followed by North America at 31% and Europe at 27%, while the oxygen segment dominated with a 46% share among gases.

Market Segmentation Analysis:

By Gas

The oxygen segment dominated the cryogenic air separation unit market with a 46% share in 2024. Its leadership stems from extensive use in steelmaking, chemical synthesis, and medical applications. Oxygen supports combustion in blast furnaces and improves reaction efficiency in chemical plants. Increasing demand from healthcare for high-purity medical oxygen further strengthens the segment. Nitrogen follows, driven by applications in electronics and food preservation. Argon and other rare gases continue to find growing adoption in welding, lighting, and specialty gas mixtures.

- For instance, Air Liquide’s Naoshima ASU is rated at 1,400 tpd oxygen with nitrogen and argon output.

By End Use

The iron and steel segment held the largest 39% share of the cryogenic air separation unit market in 2024. This dominance is due to the heavy oxygen demand for steel refining and smelting processes. Air separation units are integral for ensuring a continuous oxygen supply, enhancing energy efficiency, and reducing impurities during production. Expanding steel output in Asia-Pacific further boosts deployment. The chemicals and oil and gas sectors follow, driven by nitrogen and oxygen usage in refining and synthesis operations, while healthcare shows steady growth in medical gas applications.

- For instance, the INOX Air Products complex at Hazira reached a combined production capacity of over 10,000 tons per day (tpd) of industrial gases following the commissioning of a new 1,000 tpd plant in April 2025.

Key Growth Drivers

Rising Demand from Steel and Industrial Manufacturing

The increasing consumption of oxygen and nitrogen in steelmaking and metal fabrication is a key growth driver for the cryogenic air separation unit market. Steel plants rely heavily on oxygen-enriched environments to enhance furnace efficiency and reduce carbon emissions. Rapid expansion of steel production in countries such as China and India continues to create strong demand for large-capacity air separation units. The shift toward high-purity gases for metallurgical and cutting applications further accelerates market adoption.

- For instance, Linde will start an on-site ASU for H2 Green Steel by 2026, supplying oxygen, nitrogen, and argon.

Expanding Applications in Healthcare and Medical Gases

Growing use of medical-grade oxygen in hospitals and homecare supports the installation of cryogenic air separation units. Healthcare facilities depend on these systems for stable and high-purity gas supply for respiratory treatments and surgical procedures. The rise in chronic respiratory diseases and increasing medical infrastructure investments in developing nations continue to strengthen demand. Government healthcare programs promoting oxygen supply security also play a critical role in supporting long-term growth.

- For instance, Air Products is building 2 new ASUs in Georgia and North Carolina, projected onstream in 2026, producing LOX, LIN, and LAR.

Rising Energy and Chemical Industry Investments

The chemical and energy industries are witnessing strong investment in air separation technology for process optimization. Cryogenic units provide oxygen, nitrogen, and argon required for refining, ammonia production, and gasification processes. The expansion of LNG terminals and hydrogen projects globally further enhances adoption. Continuous innovation in modular and energy-efficient air separation systems also supports industrial scalability and operational cost reduction.

Key Trends & Opportunities

Integration of Energy-Efficient and Modular Designs

Manufacturers are focusing on developing modular and low-energy cryogenic systems to improve cost efficiency and flexibility. Advanced heat exchangers, turbo-expanders, and optimized compressors reduce power consumption while maintaining gas purity. Modular ASUs are increasingly adopted by small and mid-scale industries for quick deployment and scalability. This trend aligns with the industry’s shift toward sustainable and distributed gas generation models.

- For instance, SIAD Macchine Impianti lists oxygen capacities from 500 to 110,000 Nm³/h and nitrogen from 1,500 to 330,000 Nm³/h.

Adoption of Digital and Automation Technologies

The integration of digital control systems and real-time monitoring is reshaping air separation operations. Smart sensors and IoT-enabled platforms allow predictive maintenance and performance optimization, reducing downtime. Automation also enhances process stability and energy management. Industrial players are investing in AI-based systems to forecast gas demand and optimize production schedules, creating new efficiency benchmarks across end-use sectors.

- For instance, Yokogawa’s MIRROR PLANT predicted plant behavior 30 minutes ahead at 90-second intervals in a Mitsui Chemicals case, supporting control of two series distillation columns and enabling feed-forward testing.

Key Challenges

High Capital and Operational Costs

The substantial investment required for plant setup and maintenance remains a major challenge in market expansion. Cryogenic air separation units involve complex equipment, high energy use, and extensive safety systems. Rising electricity costs further impact operational expenses. Smaller companies often face financial constraints in adopting large-scale systems, limiting penetration in emerging industries. Manufacturers are addressing this through energy-efficient upgrades and flexible leasing models.

Technical Complexity and Long Commissioning Time

The design and installation of cryogenic air separation plants demand specialized expertise and long commissioning periods. Maintaining consistent purity levels under varying operating conditions adds to the technical burden. Delays in project execution often result from intricate engineering requirements and supply chain dependencies. Companies are increasingly investing in prefabricated modules and standardized configurations to minimize installation time and technical risks.

Regional Analysis

North America

North America accounted for a 31% share of the cryogenic air separation unit market in 2024. Growth is driven by strong demand from the steel, oil and gas, and healthcare sectors. The United States leads the region with significant adoption of large-capacity air separation plants to support refining and energy applications. Expansion of LNG terminals and renewable hydrogen projects further contributes to market demand. Continuous investments in digitalized and energy-efficient ASU systems enhance regional competitiveness and operational reliability.

Europe

Europe held a 27% share of the cryogenic air separation unit market in 2024. The region’s growth is supported by stringent emission norms and increased adoption of industrial gases for clean energy production. Germany, France, and the United Kingdom lead due to advanced steel and chemical industries. Expanding green hydrogen initiatives and industrial decarbonization efforts boost demand for oxygen and nitrogen production. Continuous modernization of existing air separation infrastructure under energy efficiency programs also supports market stability.

Asia-Pacific

Asia-Pacific dominated the cryogenic air separation unit market with a 34% share in 2024. China, India, and Japan are key contributors due to strong manufacturing and steelmaking activity. Rising healthcare needs and chemical production capacity expansion further drive gas demand. The rapid industrialization and infrastructure development across emerging economies support installation of high-capacity air separation units. Increasing investment in LNG and hydrogen sectors enhances regional growth potential.

Middle East & Africa

The Middle East and Africa region captured a 5% share of the cryogenic air separation unit market in 2024. Growth is primarily fueled by the oil and gas sector’s requirement for nitrogen and oxygen in refining operations. The UAE, Saudi Arabia, and Qatar lead with major industrial gas expansion projects. Ongoing diversification into chemical and energy-intensive industries under national development plans contributes to sustained demand for ASU systems.

Latin America

Latin America accounted for a 3% share of the cryogenic air separation unit market in 2024. Brazil and Mexico are the primary markets, supported by increasing steel and petrochemical production. Rising healthcare infrastructure development has also enhanced oxygen demand across hospitals and clinics. Local manufacturers are adopting modular and energy-efficient ASU technologies to reduce operating costs. Continued investment in industrial gas supply chains supports gradual regional market growth.

Market Segmentations:

By Gas

- Nitrogen

- Oxygen

- Argon

- Others

By End Use

- Iron & steel

- Oil & gas

- Healthcare

- Chemicals

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cryogenic air separation unit market features prominent players such as Linde plc, Air Liquide, Air Products and Chemicals, Inc., TAIYO NIPPON SANSO CORPORATION, Messer, Praxair Technology, Inc., AIR WATER INC, INOX Air Products, KaiFeng Air Separation Group Co., LTD., Sichuan Air Separation Plant Group, Yingde Gases, Technex, Universal Industrial Gases, Inc., AMCS Corporation, Enerflex Ltd., CRYOTEC Anlagenbau GmbH, and Ranch Cryogenics, Inc. The competitive landscape is shaped by continuous technological innovation, large-scale production capabilities, and expanding global service networks. Companies are investing in energy-efficient designs, automation, and digital control systems to enhance operational reliability and reduce power consumption. Strategic partnerships with industrial gas distributors and process industries support long-term contracts and recurring revenues. Manufacturers are focusing on regional production hubs and modular ASU systems to meet the growing demand from steel, chemical, and healthcare sectors while maintaining strong emphasis on cost optimization and process efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Linde plc

- Air Liquide

- Air Products and Chemicals, Inc.

- TAIYO NIPPON SANSO CORPORATION

- Messer

- Praxair Technology, Inc.

- AIR WATER INC

- INOX Air Products

- KaiFeng Air Separation Group Co., LTD.

- Sichuan Air Separation Plant Group

- Yingde Gases

- Technex

- Universal Industrial Gases, Inc.

- AMCS Corporation

- Enerflex Ltd.

- CRYOTEC Anlagenbau GmbH

- Ranch Cryogenics, Inc.

Recent Developments

- In 2025, Taiyo Nippon Sanso (Nippon Sanso Holdings) Announced the construction of a new ASU in Las Vegas, Nevada, scheduled for completion in 2027.

- In 2025, INOX Air Products Successfully commissioned India’s largest on-site ASU at the Steel Authority of India’s Bokaro plant.

- In 2024, Linde India has commissioned a new 250 metric tonnes per day air separation unit (ASU) at Ludhiana, Punjab.

Report Coverage

The research report offers an in-depth analysis based on Gas, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity industrial gases will continue rising across steel and chemical industries.

- Energy-efficient and modular ASU designs will gain higher adoption among mid-scale users.

- Integration of digital monitoring and automation will enhance process reliability and performance.

- Expansion of green hydrogen and LNG projects will create new growth opportunities.

- Healthcare sector demand for medical-grade oxygen will strengthen long-term installations.

- Asia-Pacific will remain the leading region due to industrial and infrastructure expansion.

- Partnerships between gas producers and equipment manufacturers will increase system efficiency.

- Technological advances in cryogenic compression will reduce operational energy consumption.

- Governments promoting industrial decarbonization will boost ASU adoption in clean energy sectors.

- Continuous plant modernization and automation upgrades will sustain market competitiveness globally.