Market Overview

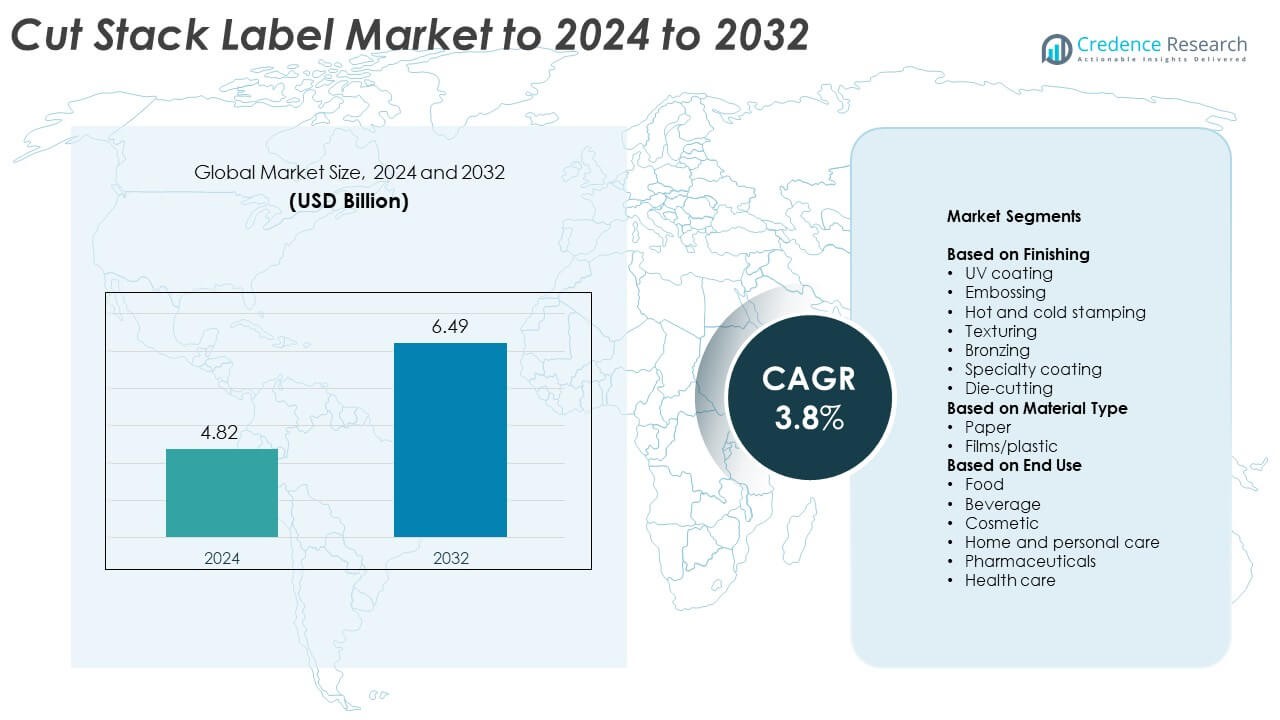

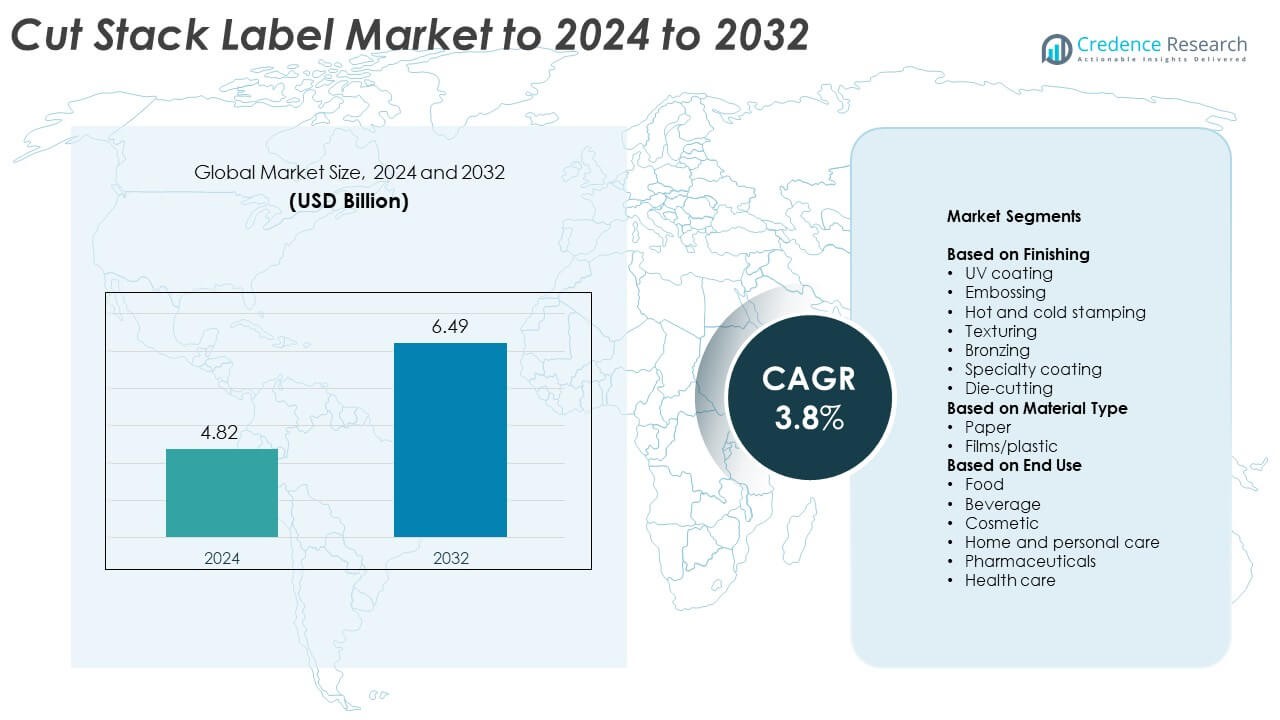

Cut Stack Label Market size was valued at USD 4.82 Billion in 2024 and is anticipated to reach USD 6.49 Billion by 2032, at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cut Stack Label Market Size 2024 |

USD 4.82 Billion |

| Cut Stack Label Market, CAGR |

3.8% |

| Cut Stack Label Market Size 2032 |

USD 6.49 Billion |

The Cut Stack Label Market is led by major players such as CCL Industries, Multi-Color Corporation, Fort Dearborn Company, Avery Dennison, and Constantia Flexible. These companies dominate through advanced printing technologies, sustainable material innovations, and wide product portfolios catering to food, beverage, and personal care sectors. They focus on high-quality coatings, efficient production systems, and strategic partnerships to strengthen their global presence. Regionally, North America led the market in 2024 with a 33.8% share, driven by strong FMCG demand and technological adoption, followed by Europe with 27.4% and Asia-Pacific with 25.6%, supported by industrial expansion and increasing packaged goods consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cut Stack Label Market was valued at USD 4.82 Billion in 2024 and is projected to reach USD 6.49 Billion by 2032, growing at a CAGR of 3.8%.

- Growth is driven by rising demand from the FMCG and beverage industries, supported by expanding packaged food consumption and branding needs.

- The market is witnessing trends such as the adoption of sustainable paper materials, digital printing, and premium finishes like UV coating and embossing.

- Competition remains strong among global and regional players focusing on eco-friendly innovations, automation, and cost-efficient production technologies.

- North America held 33.8% of the market share in 2024, followed by Europe at 27.4% and Asia-Pacific at 25.6%, while the UV coating segment dominated by finishing type with a 31.7% share.

Market Segmentation Analysis:

By Finishing

The UV coating segment dominated the cut stack label market in 2024, accounting for about 31.7% share. Its popularity stems from superior gloss, durability, and protection against moisture and fading. UV-coated labels offer enhanced visual appeal, making them ideal for food and beverage packaging. The increasing preference for premium and visually distinct labels among FMCG brands drives this segment. Embossing and hot or cold stamping are also growing, supported by demand for tactile and metallic effects that strengthen brand differentiation in retail shelves.

- For instance, Kurz transfer finishes use only 1.5–3 µm layer thickness and add ~1% to product mass.

By Material Type

The paper segment held the largest market share of around 57.4% in 2024, driven by its cost-effectiveness, recyclability, and strong print compatibility. Paper-based cut stack labels are widely used in food, beverages, and pharmaceuticals due to their eco-friendly nature and ease of customization. Growing sustainability trends and consumer preference for biodegradable packaging materials continue to boost this segment. Meanwhile, film and plastic materials gain traction in premium beverage and personal care applications for their water resistance and durability under varying temperature conditions.

- For instance, UPM Raflatac RAFNXT+ carries Carbon Trust verification and shows an 11% lower carbon footprint versus standard labels

By End Use

The beverage segment dominated the cut stack label market in 2024, capturing approximately 39.2% share. Its dominance is due to the high consumption of bottled water, soft drinks, and alcoholic beverages requiring durable and cost-efficient labeling. Beverage manufacturers prefer cut stack labels for large-volume production and easy application on glass and PET bottles. The food and personal care segments are also expanding rapidly due to increased branding efforts and demand for sustainable labeling materials aligned with regulatory and environmental standards.

Key Growth Drivers

Rising Demand from Beverage and FMCG Industries

The strong demand from beverage and FMCG industries drives the growth of the cut stack label market. Bottled water, soft drinks, and food packaging sectors widely adopt these labels due to their cost efficiency and adaptability to various container shapes. High-speed labeling lines and affordable printing technologies further support large-scale use. Increasing consumption of packaged goods, especially in emerging economies, continues to expand the market for durable and visually appealing labeling solutions.

- For instance, Sidel Roll-Fed platforms can output up to 72,000 containers per hour.

Shift Toward Sustainable Label Materials

Growing environmental awareness has encouraged manufacturers to adopt eco-friendly label materials such as recyclable paper and biodegradable coatings. Brands are increasingly replacing plastic-based labels with paper substrates to align with global sustainability goals. This transition enhances brand image and complies with tightening packaging regulations. The shift toward sustainable materials is also attracting investments in green production technologies, driving continuous innovation within the labeling sector.

- For instance, Avery Dennison demonstrates that switching to its rPET30 material, a label liner made with at least 30% recycled PET, can offer significant sustainability benefits. Based on internal life cycle assessment calculations, using 1,000,000 m² of rPET30 results in an estimated 15% lower GHG emissions and 11% lower energy usage compared to its standard alternatives.

Advancements in Printing and Finishing Technologies

Technological progress in digital and flexographic printing enhances print quality, design flexibility, and production speed for cut stack labels. Features such as UV coating, embossing, and hot stamping add premium appeal to consumer goods. Automation and hybrid printing solutions also help reduce waste and improve operational efficiency. These advancements enable cost-effective customization and faster turnaround, making cut stack labels more competitive against other labeling formats.

Key Trends & Opportunities

Growing Adoption of Premium Label Finishes

Manufacturers are increasingly using premium finishes such as metallic effects, specialty coatings, and textured embossing to enhance product appeal. This trend supports brand differentiation in highly competitive retail environments. Luxury beverage and cosmetic brands are leading adopters of these finishes to convey exclusivity and quality. The focus on aesthetics and shelf impact continues to generate opportunities for innovation in decorative label design.

- For instance, the HP Indigo 6900 delivers speeds up to 98 ft/min in 4-color mode, and can be configured with the HP Indigo GEM to support one-pass digital foil and tactile effects

Expansion in Emerging Markets

Expanding food and beverage production in emerging economies presents strong opportunities for cut stack label suppliers. Countries in Asia-Pacific, Latin America, and Africa are experiencing higher consumption of packaged goods. Local manufacturers are upgrading packaging quality to meet global standards, driving adoption of cost-efficient labeling options. Increasing urbanization and growing middle-class populations in these regions further strengthen market growth potential.

- For instance, Bisleri has a network of 122 operational plants, 4,500 distributors, and 5,000 distribution trucks across India and neighboring countries.

Key Challenges

Rising Competition from Pressure-Sensitive Labels

Pressure-sensitive labels are gaining traction due to their convenience, versatility, and minimal setup requirements. These alternatives pose a significant challenge to cut stack labels, especially for short-run production. Their ability to handle complex container shapes and high-end finishes makes them appealing to premium product segments. As a result, cut stack label manufacturers face pressure to innovate and maintain competitive pricing.

Fluctuating Raw Material Costs

Volatility in paper and printing ink prices affects production costs and profit margins for label manufacturers. Price fluctuations, driven by supply chain disruptions and rising energy costs, hinder stable long-term planning. Companies are increasingly focusing on optimizing procurement strategies and adopting cost-efficient raw materials to reduce dependency. Managing input cost variations remains a persistent challenge in maintaining consistent pricing and quality standards.

Regional Analysis

North America

North America held the largest share of around 33.8% in the cut stack label market in 2024. The region’s dominance is supported by strong demand from the food, beverage, and personal care sectors. Manufacturers in the U.S. and Canada prefer cut stack labels due to their cost efficiency and compatibility with high-speed production lines. The growing focus on sustainable packaging materials and premium labeling designs further enhances market adoption. Continuous innovation in printing technology and the expansion of packaged food exports strengthen the region’s leadership position.

Europe

Europe accounted for approximately 27.4% of the global market share in 2024. The region benefits from a mature packaging industry and a strong shift toward eco-friendly materials. Countries such as Germany, France, and Italy lead in adopting recyclable and biodegradable label solutions. Stringent EU regulations on sustainable packaging and consumer demand for visually appealing labels drive innovation. Growth in the beverage and pharmaceutical industries, supported by advanced printing and coating technologies, continues to sustain Europe’s market expansion.

Asia-Pacific

Asia-Pacific captured a 25.6% share of the cut stack label market in 2024, driven by rapid industrialization and expanding FMCG production. China, India, and Japan are major contributors due to strong growth in packaged food and beverage consumption. Increasing disposable income and urbanization are fueling demand for cost-effective labeling solutions. The region’s large-scale manufacturing capacity and adoption of advanced printing technologies are enhancing competitiveness. Government initiatives supporting local packaging industries also promote regional market expansion.

Latin America

Latin America held a 7.8% share of the global cut stack label market in 2024. The region’s growth is driven by rising consumption of packaged foods and beverages, particularly in Brazil, Mexico, and Argentina. Manufacturers are investing in affordable and flexible labeling solutions to meet growing regional demand. The expanding retail sector and shifting consumer preference for branded products support steady adoption. However, market growth is moderated by high import costs of printing materials and slower adoption of automation technologies.

Middle East & Africa

The Middle East & Africa region accounted for around 5.4% of the market share in 2024. Growth is supported by increasing packaging demand from food, beverage, and pharmaceutical sectors. The Gulf countries are witnessing higher investments in manufacturing and FMCG production, while Africa shows potential due to rising urbanization. Adoption of cost-effective and durable labeling materials is growing, especially among local producers. Limited access to advanced printing infrastructure remains a challenge, yet ongoing industrialization continues to create new opportunities for market penetration.

Market Segmentations:

By Finishing

- UV coating

- Embossing

- Hot and cold stamping

- Texturing

- Bronzing

- Specialty coating

- Die-cutting

By Material Type

By End Use

- Food

- Beverage

- Cosmetic

- Home and personal care

- Pharmaceuticals

- Health care

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The Cut Stack Label Market is driven by key players including CCL Industries, Multi-Color Corporation, Fort Dearborn Company, Avery Dennison, Hammer Packaging Corp., Constantia Flexible, WALLE Corporation, Smyth Companies, Epsen Hillmer Graphics Co., Oak Printing, Yupo Corporation, and Anchor Printing. The market remains highly competitive, with companies focusing on technological advancement, product innovation, and sustainable labeling solutions. Continuous improvements in digital and flexographic printing enhance production efficiency and design flexibility. Firms are also investing in eco-friendly materials and coatings to align with global sustainability goals. Strategic partnerships, mergers, and regional expansions help strengthen global presence and customer reach. The growing emphasis on customization, high-speed printing, and premium finishes supports strong market differentiation and long-term growth potential across key end-use industries such as food, beverages, and personal care.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CCL Industries

- Multi-Color Corporation

- Fort Dearborn Company

- Avery Dennison

- Hammer Packaging, Corp.

- Constantia Flexible

- WALLE Corporation

- Smyth Companies

- Epsen Hillmer Graphics Co.

- Oak Printing

- Yupo Corporation

- Anchor Printing

Recent Developments

- In 2025, MCC hosted a Packaging Summit in Italy where a dedicated sustainability panel took place. This provided a forum to highlight sustainable packaging and innovative labels, which would include high-performance, lightweight designs.

- In 2023, CCL Industries acquired Faubel & Co. Nachf. GmbH, a German pharmaceutical label business, strengthening its capabilities in Europe.

- In 2022, Multi-Color Corporation acquired LUX Global Label to expand its global label solutions portfolio, which included shrink sleeves, pressure-sensitive labels, and security solutions.

Report Coverage

The research report offers an in-depth analysis based on Finishing, Material Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by expanding FMCG and beverage industries.

- Demand for sustainable and recyclable paper-based labels will continue to rise.

- Advanced printing technologies such as digital and flexographic systems will enhance production efficiency.

- Manufacturers will focus on premium finishes like embossing and UV coating to improve visual appeal.

- Asia-Pacific will emerge as the fastest-growing region due to strong industrial development.

- Integration of eco-friendly coatings will align with global environmental regulations.

- Competition from pressure-sensitive labels will push innovation in cost efficiency.

- Automation in labeling lines will improve speed and reduce waste.

- Growing private-label product demand will increase usage of affordable labeling options.

- Strategic collaborations between material suppliers and printers will strengthen supply chain reliability.