Market Overview

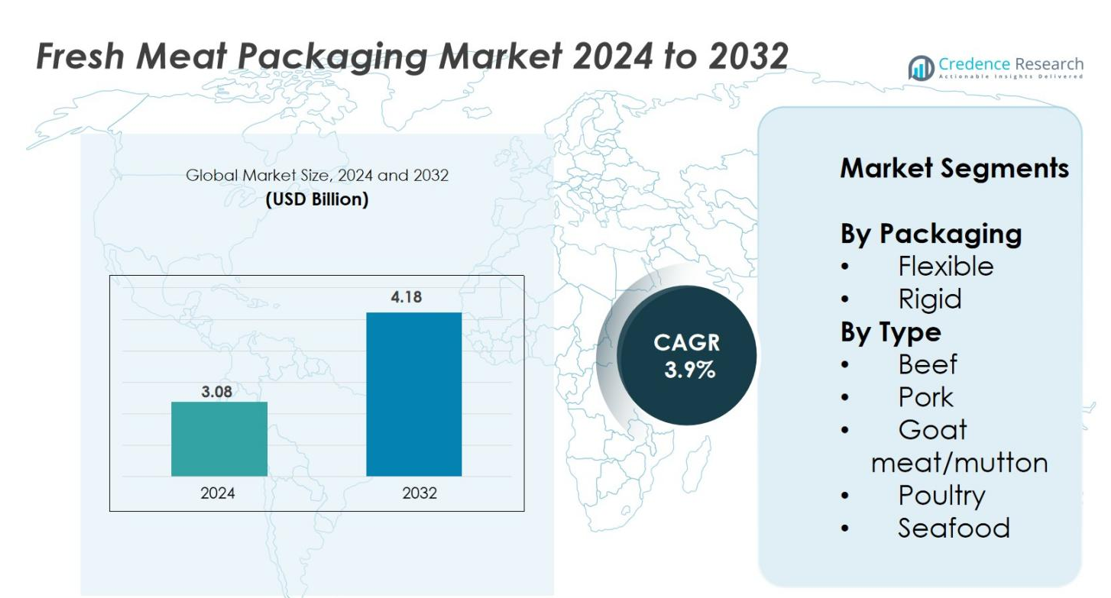

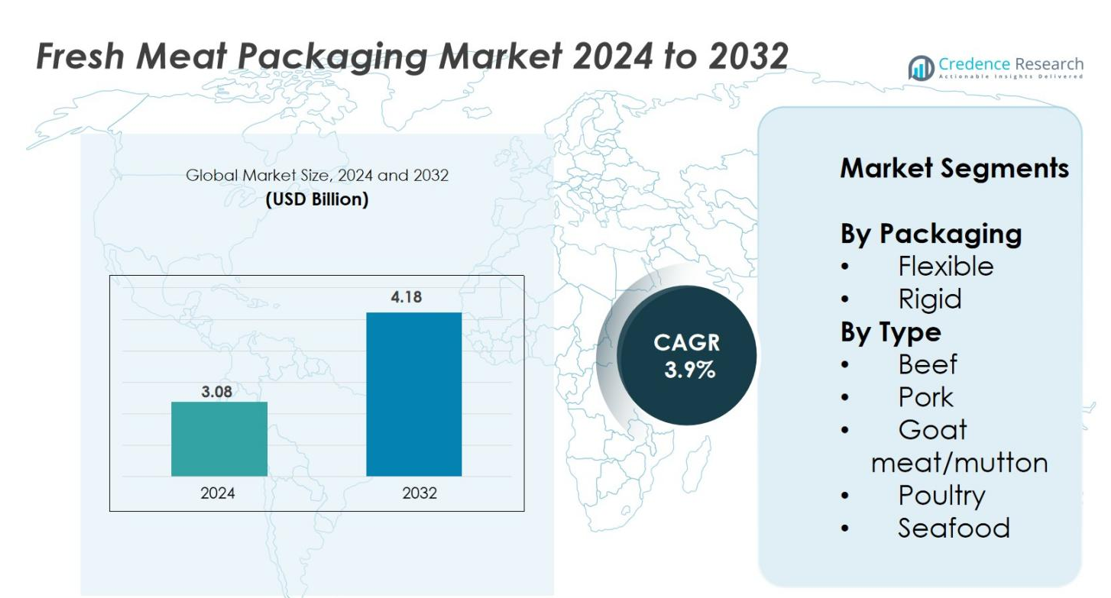

Fresh Meat Packaging Market size was valued at USD 3.08 Billion in 2024 and is anticipated to reach USD 4.18 Billion by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fresh Meat Packaging Market Size 2024 |

USD 3.08 Billion |

| Fresh Meat Packaging Market, CAGR |

3.9% |

| Fresh Meat Packaging Market Size 2032 |

USD 4.18 Billion |

The Fresh Meat Packaging market is shaped by prominent players such as Amcor plc, Mondi, Berry Global Inc., Sealed Air, Coveris, WINPAK LTD., Cascades Inc., Bolloré Group, Crown, and Reynolds Consumer Products, all of whom compete through advancements in high-barrier films, vacuum skin packaging, and recyclable mono-material solutions. These companies focus on extending shelf life, improving food safety, and enhancing sustainability to meet rising global demand. Regionally, North America leads the market with around 32% share in 2024, supported by strong meat consumption, advanced retail infrastructure, and rapid adoption of MAP and eco-friendly packaging technologies.

Market Insights

- The Fresh Meat Packaging market was valued at USD 3.08 Billion in 2024 and is projected to reach USD 4.18 Billion by 2032, growing at a CAGR of 3.9%.

- Market growth is driven by rising demand for extended shelf-life solutions, increased consumption of chilled meat, and the shift toward hygienic, ready-to-cook products influencing adoption of MAP, VSP, and high-barrier flexible films.

- Key trends include rapid movement toward recyclable mono-material packaging, bio-based films, and smart freshness indicators, supported by stricter sustainability regulations and consumer preference for eco-friendly solutions.

- The competitive landscape features major players such as Amcor plc, Mondi, Berry Global Inc., Sealed Air, WINPAK LTD., and Coveris, with flexible packaging dominating the segment at nearly 62% share in 2024.

- Regionally, North America leads with around 32% share, followed by Europe at 28% and Asia-Pacific at 26%, while regulatory complexity and raw material price volatility remain key restraints for market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Packaging

The Fresh Meat Packaging market is primarily dominated by the flexible packaging segment, holding around 62% market share in 2024, driven by its lightweight structure, lower material cost, extended shelf-life capabilities, and suitability for vacuum skin packaging (VSP) and modified atmosphere packaging (MAP). Flexible formats offer excellent barrier properties and adaptability for various meat cuts, enabling improved product visibility and reduced food waste. Rigid packaging, while accounting for the remaining share, continues to serve premium and bulk applications, particularly where structural strength, stackability, and enhanced protection against mechanical damage are essential.

- For instance, Winpak supplies vacuum-pouches and multi-layer films for fresh meat their high-barrier films help extend shelf life by minimizing oxygen and moisture ingress.

By Type

Within the Fresh Meat Packaging market, the beef segment leads the category with approximately 34% market share, supported by high global consumption rates, increased demand for premium cuts, and the rising use of MAP and vacuum packaging to retain freshness and reduce oxidation. Pork follows closely, benefitting from expanding commercial distribution channels and processed meat applications. Poultry packaging demand continues to rise due to affordability and widespread household consumption, whereas seafood and goat meat/mutton rely on enhanced barrier films and cold-chain expansion to maintain quality and safety during storage and transit.

- For instance, for beef, Amcor’s high-barrier vacuum skin packaging (VSP) films are widely adopted by meat processors because they reduce oxygen exposure and extend chilled beef shelf life by up to 28 days.

Key Growth Drivers

Growing Demand for Extended Shelf-Life Solutions

The Fresh Meat Packaging market expands significantly as consumers and retailers increasingly prefer packaging formats that extend shelf life and maintain product freshness. Rising demand for chilled and processed meat products intensifies the need for packaging that minimizes oxidation, discoloration, and microbial growth. Technologies such as modified atmosphere packaging (MAP), vacuum skin packaging (VSP), and high-barrier flexible films play a pivotal role in reducing spoilage and food waste while enhancing product safety. Retailers benefit from longer display times and reduced shrinkage, while consumers enjoy improved quality and freshness. Additionally, global cold-chain strengthening and increased meat exports further drive demand for advanced preservation technologies. This shift toward high-performance packaging solutions remains a key driver of sustained market growth.

- For instance, Amcor’s vacuum skin packaging films are documented to extend the shelf life of fresh red meat by reducing oxygen exposure, supporting retailers with longer display times and lower shrink rates.

Shift Toward Convenience and Ready-to-Cook Meat Products

Changing consumer lifestyles and rapid urbanization fuel strong demand for convenient, ready-to-cook, and portion-controlled meat products, thereby accelerating the need for innovative packaging. Consumers prioritize hygiene, ease of handling, and pre-portioned formats that ensure minimal preparation time and reduce contamination risks. Packaging innovations such as easy-peel films, resealable pouches, vacuum-sealed trays, and microwave-safe structures cater to these evolving preferences. Ret ailers rely on visually appealing and ergonomic packaging to differentiate products, enhance customer experience, and support efficient inventory management. The food-service sector also benefits from standardized packaging formats that improve operational efficiency. As convenience-driven consumption rises across developed and emerging markets, packaging manufacturers gain significant opportunities to introduce functional, user-friendly, and value-added solutions.

- For instance, Sealed Air’s CRYOVAC® Grip & Tear® easy-open vacuum packaging enables faster preparation in both households and food-service environments, reducing labor and minimizing contamination risks.

Growth in Meat Consumption and Expanding Global Trade

Increasing global consumption of beef, pork, poultry, and seafood continues to drive substantial growth in the Fresh Meat Packaging market. Population growth, rising incomes, expanding quick-service restaurant chains, and dietary shifts toward high-protein foods contribute to higher meat demand. International meat trade strengthens as exporters adopt advanced packaging to preserve safety, quality, and freshness during long-distance transportation. Packaging technologies that provide robust protection against contamination, mechanical damage, and temperature fluctuations are becoming indispensable. Government emphasis on food safety and stricter export regulations further stimulates adoption of certified, standardized packaging materials. As supply chains globalize and retail networks expand, the need for reliable, durable, and regulatory-compliant packaging solutions serves as a major growth accelerator.

Key Trends & Opportunities

Adoption of Sustainable and Recyclable Packaging Materials

Sustainability has emerged as a defining trend in the Fresh Meat Packaging market as brands seek to minimize plastic waste and meet tightening environmental regulations. Manufacturers increasingly adopt recyclable mono-material films, bio-based polymers, and lightweight flexible formats that reduce carbon footprint without compromising barrier performance. Consumers favor eco-friendly packaging with clearer labeling, pushing retailers to incorporate compostable trays, paper-based lids, and reduced-plastic laminates. Regulatory bodies promote circular packaging systems, opening new market opportunities for companies investing in advanced recycling technologies and biodegradable materials. This trend drives innovation across the supply chain, empowering producers to differentiate offerings while supporting global sustainability objectives and brand reputation enhancement.

- For instance, Coveris’ recyclable PE shrink films and reduced-plastic barrier solutions support retailers in meeting plastic-reduction commitments, enabling significant material savings without sacrificing shelf-life or product protection.

Technological Advancements in Smart and Active Packaging

Smart and active packaging solutions are gaining momentum as brands integrate technologies that enhance safety, traceability, and consumer engagement. Oxygen scavengers, antimicrobial coatings, freshness indicators, and time-temperature sensors improve meat preservation and reduce spoilage throughout the distribution cycle. Retailers and logistics operators benefit from real-time monitoring systems that ensure compliance with cold-chain requirements. QR codes and digital identifiers provide transparency and product information, strengthening consumer trust and supporting regulatory traceability mandates. These technologies also open new opportunities for premiumization, with brands offering enhanced safety assurances and differentiated experiences. As digital transformation accelerates, smart packaging becomes a strategic value driver for modern meat supply chains.

- For instance, Avery Dennison’s Freshmarx® time-temperature indicators and RFID-enabled labels are actively used in protein supply chains to monitor handling conditions and maintain cold-chain compliance.

Key Challenges

Stringent Food Safety and Regulatory Compliance Requirements

The Fresh Meat Packaging market faces ongoing challenges driven by rigorous global and regional food safety regulations. Compliance mandates related to material safety, chemical migration, labeling, and traceability require manufacturers to invest heavily in testing, certification, and quality control systems. Frequent updates to regulatory frameworks increase development costs and complicate cross-border trade. Packaging materials must also meet guidelines for sustainability, recyclability, and reduced environmental impact, creating additional compliance burdens. For small and medium-sized manufacturers, staying aligned with evolving requirements can hinder market participation. The complexity of multi-layer materials further intensifies regulatory scrutiny, making compliance a major challenge for industry players.

Volatility in Raw Material Prices and Supply Chain Disruptions

Fluctuations in the prices of polymers, films, resins, and other essential raw materials create significant cost pressures for Fresh Meat Packaging manufacturers. Petroleum-based materials remain particularly sensitive to global oil price instability. Supply chain disruptions—stemming from geopolitical tensions, transportation bottlenecks, or shortages of specialized materials—lead to increased lead times and reduced production efficiency. Manufacturers struggle to maintain profitability while meeting customer expectations for high-quality, sustainable packaging at competitive prices. These uncertainties force companies to diversify suppliers, optimize material usage, and explore alternative materials, yet volatility remains an ongoing operational challenge for the sector.

Regional Analysis

North America

North America holds a significant position in the Fresh Meat Packaging market, accounting for 32% of the global share in 2024, driven by strong consumption of beef, poultry, and processed meat products. High adoption of advanced packaging technologies such as MAP, vacuum skin packaging, and sustainable mono-material films supports market expansion. Well-established retail chains, stringent food safety regulations, and a mature cold-chain infrastructure further enhance demand for high-barrier and leak-proof packaging formats. The rising preference for convenient, portion-controlled, and ready-to-cook meat products continues to propel packaging innovation across the U.S. and Canada.

Europe

Europe represents 28% of the Fresh Meat Packaging market share in 2024, supported by strong regulatory emphasis on sustainability, food safety, and reduced plastic usage. Demand for recyclable materials, compostable trays, and mono-layer films is accelerating due to EU packaging directives. High per-capita meat consumption, particularly in Germany, the U.K., France, and Spain, boosts the need for premium, eco-friendly, and shelf-life-extending packaging. The region’s advanced retail infrastructure and preference for traceable and ethically sourced meat further stimulate adoption of smart labeling, freshness indicators, and high-barrier packaging solutions.

Asia-Pacific

Asia-Pacific leads as the fastest-growing regional market, holding 26% share in 2024, driven by rising meat consumption, expanding retail networks, and rapid urbanization in China, India, Indonesia, and Japan. Growing demand for hygienically packaged fresh meat and the shift from traditional open-market sales to organized retail significantly fuel packaging adoption. Cold-chain investments, expanding poultry and seafood production, and rising disposable incomes support the uptake of flexible, cost-effective, and high-barrier formats. Increased government focus on food safety and the rise of e-commerce grocery delivery further accelerate demand for durable, contamination-resistant packaging.

Latin America

Latin America contributes 8% of the global Fresh Meat Packaging market share in 2024, supported by strong beef and poultry production in Brazil, Argentina, and Mexico. The region’s growing meat export activities require high-performance packaging that ensures freshness during long-distance transportation. Adoption of MAP and vacuum packaging is increasing as processors prioritize shelf-life extension and reduced spoilage. Expanding supermarket penetration, improving cold-chain logistics, and rising consumer preference for hygienically packaged meat further strengthen market growth. However, cost sensitivity drives continued demand for economical yet reliable flexible packaging solutions.

Middle East & Africa

The Middle East & Africa region accounts for 6% of the Fresh Meat Packaging market share in 2024, with growth fueled by expanding urban populations, rising imports of chilled meat, and increasing adoption of modern retail formats. Gulf countries experience high demand for premium beef and poultry, boosting the need for advanced barrier films and leak-proof packaging. In Africa, improving cold-chain infrastructure and food safety awareness support gradual transition from unpackaged to hygienically packaged meat. The region also sees rising interest in sustainable and cost-efficient packaging materials as regulatory frameworks and consumer expectations evolve.

Market Segmentations

By Packaging

By Type

- Beef

- Pork

- Goat meat/mutton

- Poultry

- Seafood

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Fresh Meat Packaging market is characterized by the presence of global packaging leaders and specialized regional manufacturers competing through innovation, sustainability, and advanced preservation technologies. Key players such as Amcor plc, Mondi, Berry Global Inc., Sealed Air, Coveris, WINPAK LTD., Cascades Inc., Bolloré Group, Crown, and Reynolds Consumer Products focus on offering high-barrier films, recyclable mono-material structures, vacuum skin packaging, and modified atmosphere packaging solutions tailored to diverse meat formats. Companies increasingly invest in sustainable materials, lightweight flexible packaging, and smart technologies such as freshness indicators and antimicrobial coatings to differentiate their offerings. Strategic initiatives including capacity expansions, mergers, partnerships with meat processors, and product innovations strengthen market presence. As consumer demand for hygiene, convenience, and eco-friendly packaging continues to rise, competition intensifies, pushing manufacturers to enhance performance, reduce environmental impact, and meet evolving regulatory and customer requirements across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Mondi expanded its food packaging portfolio to include specialized high strength trays, leak proof boxes, sleeves and wraps for meat, poultry and seafood aiming to capture growth in the fresh meat packaging sector.

- In September 2025, Sealed Air Corporation (via its CRYOVAC® brand) installed its 4,000th rotary vacuum-chamber system at a facility of Cargill reinforcing its meat packaging footprint

- In March 2025, Sealed Air Corporation announced a strategic partnership with Danish Crown (a major European pork producer) to develop advanced packaging solutions for the fresh meat industry.

Report Coverage

The research report offers an in-depth analysis based on Packaging, Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt recyclable and mono-material packaging as sustainability regulations tighten globally.

- Demand for vacuum skin packaging and MAP solutions will rise as retailers prioritize extended shelf life and reduced food waste.

- Smart packaging technologies such as freshness indicators and time–temperature sensors will gain wider commercial adoption.

- Flexible packaging will continue to dominate due to its cost efficiency, lightweight structure, and strong barrier properties.

- Growth in organized retail and e-commerce grocery delivery will boost demand for durable, hygienic meat packaging formats.

- Manufacturers will invest more in antimicrobial films and active packaging to enhance food safety.

- Automation and digitalization in meat processing facilities will increase the use of standardized, high-performance packaging.

- Emerging markets in Asia-Pacific and Latin America will contribute significantly to volume growth as cold-chain infrastructure expands.

- Global meat trade expansion will heighten the need for robust, export-ready packaging solutions.

- Price volatility of raw materials will encourage innovation in alternative, bio-based, and cost-efficient packaging materials.