Market Overview

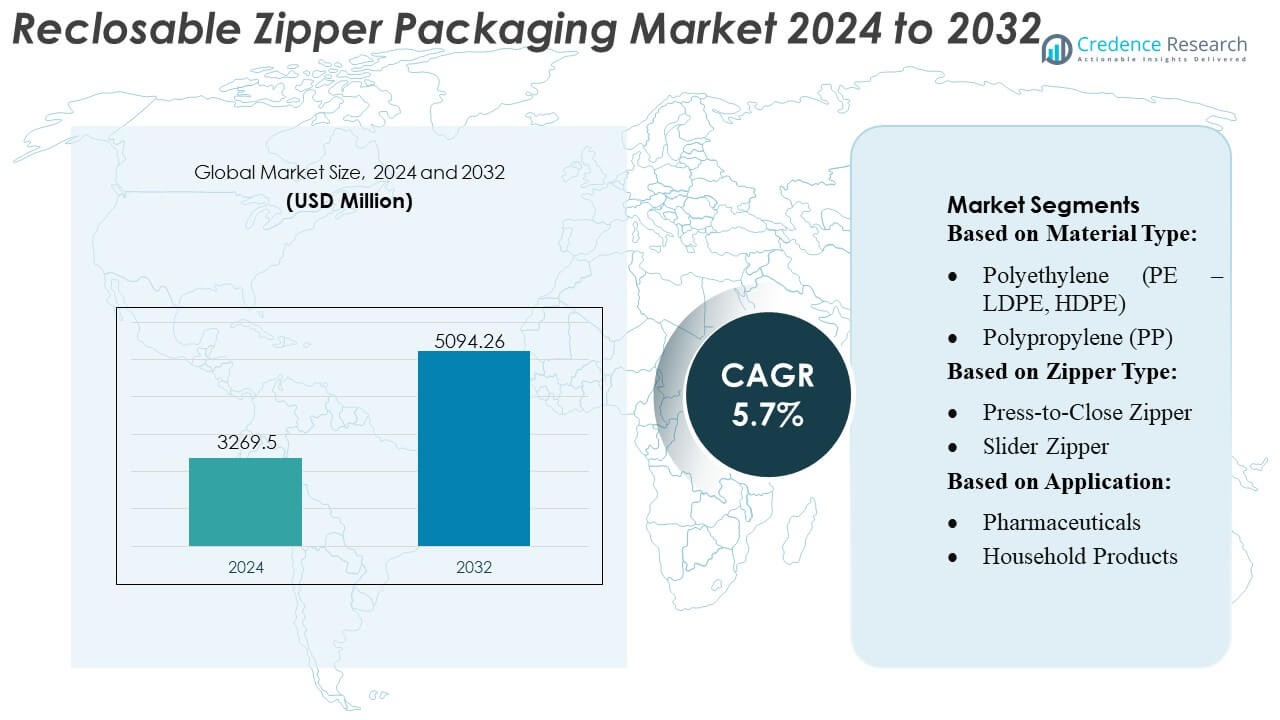

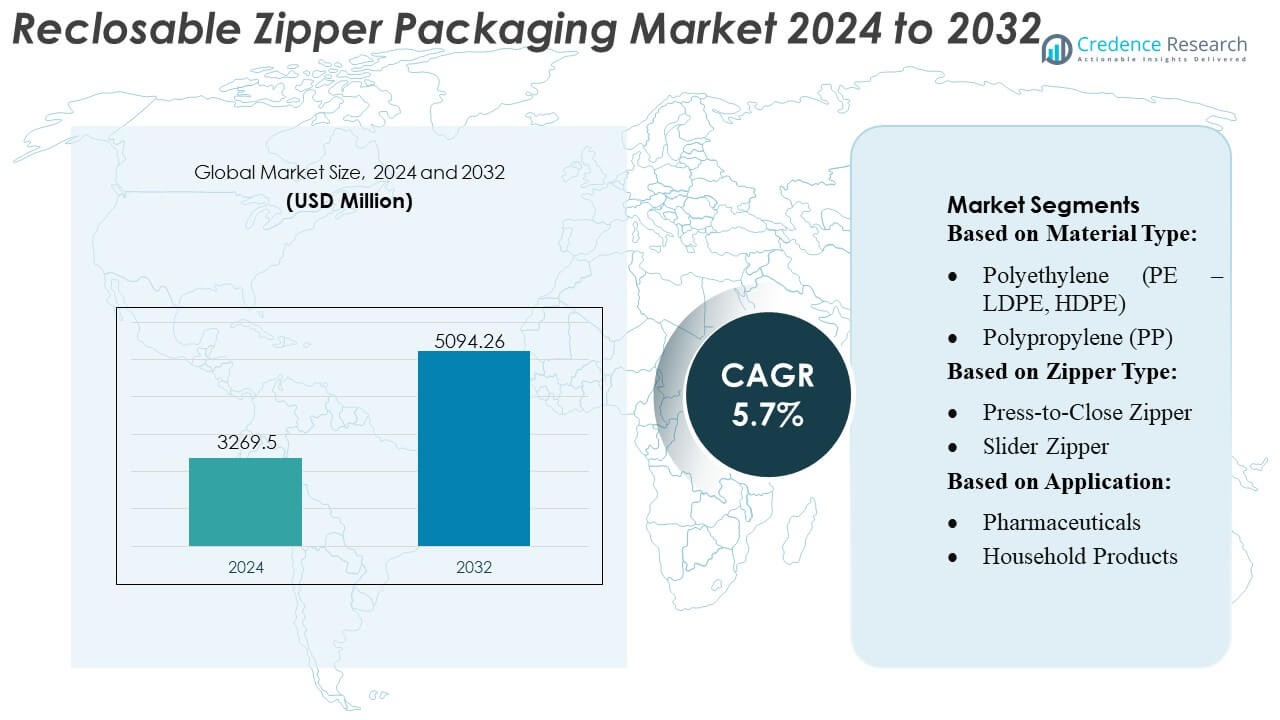

Reclosable Zipper Packaging Market size was valued USD 3269.5 million in 2024 and is anticipated to reach USD 5094.26 million by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Reclosable Zipper Packaging Market Size 2024 |

USD 3269.5 Million |

| Reclosable Zipper Packaging Market , CAGR |

5.7% |

| Reclosable Zipper Packaging Market Size 2032 |

USD 5094.26 Million |

The Reclosable Zipper Packaging Market is shaped by a diverse group of global packaging manufacturers that focus on material innovation, high-precision converting, and strong integration with food, personal care, and household product brands. These companies enhance competitiveness through advanced sealing technologies, multi-track zipper formats, and sustainable PE- and PP-based film structures that improve convenience and product protection. Strategic investments in lightweight films, mono-material designs, and high-speed pouching capabilities further strengthen market reach across e-commerce and retail channels. North America remains the leading region, holding an exact 38% market share, supported by strong consumer preference for resealable packaging, high adoption of flexible formats, and robust conversion infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 3269.5 million in 2024 and will rise to USD 5094.26 million by 2032 at a 7% CAGR.

- Rising demand for convenient and portion-controlled packaging drives adoption of PE- and PP-based reclosable zipper formats, with the food & beverages segment holding the largest share due to high use in snacks and frozen products.

- Material innovation, mono-material structures, and lightweight films shape market trends, supported by high-speed pouching technologies that improve sealing consistency and operational efficiency.

- Competitive activity intensifies as global players enhance converting capabilities, expand sustainable zipper designs, and strengthen partnerships with FMCG brands, while restraints emerge from fluctuating raw material prices and limited recyclability of multilayer structures.

- North America leads with an exact 38% regional share, followed by Europe and Asia-Pacific, supported by strong flexible packaging adoption and growing penetration of slider and press-to-close formats across key consumer goods categories.

Market Segmentation Analysis:

By Material Type

Polyethylene (PE – LDPE, HDPE) holds the dominant position with an estimated 42–45% market share, supported by strong adoption in food, household goods, and e-commerce packaging due to its flexibility, seal strength, and cost efficiency. PP follows with rising demand in high-clarity packaging, while PET and PA/Nylon gain traction in applications requiring high tensile strength and barrier performance. Bioplastics expand gradually as brands pursue compostable and low-carbon packaging formats. Other niche materials serve specialized industrial requirements. Growth in this segment is driven by sustainability mandates, lightweighting priorities, and the need for high-performance reclosure systems.

- For instance, ProAmpac’s ProActive Recyclable® R-2000 series (which includes the PRO-Flex designation for some applications) integrates proprietary high-density PE barrier technology engineered to deliver high performance on existing filling lines and durability in the supply chain.

By Zipper Type

Press-to-Close zippers dominate the market with an approximate 58–60% share, driven by their ease of sealing, low cost, and widespread integration across snacks, frozen foods, and dry grocery packaging. Their compatibility with automated filling systems further strengthens adoption among high-volume CPG manufacturers. Slider zippers, although representing a smaller share, continue to gain momentum in premium and large-format packaging where enhanced consumer convenience, tactile feedback, and reusability are essential. The segment’s growth is shaped by product differentiation needs, rising preference for user-friendly reclosures, and advancements in precision-molded zipper designs.

- For instance, SVP’s printed slider bags are specified with film thickness from 50 micron (for 200 g capacity bags) to 100 micron (for 400 g capacity bags), using either mono-layer or multi-layer PE/PP films providing flexibility for lighter vs heavier contents while maintaining structural integrity.

By Application

Food & Beverages represent the dominant application, accounting for 45–48% of total demand, driven by the need to maintain freshness, aroma retention, and moisture control in products such as snacks, frozen foods, coffee, tea, and bakery items. Snacks remain the fastest-growing sub-category due to expanding consumption of chips, nuts, and cookies in single-serve and family-size packs. Frozen foods adopt reclosable zippers to improve storage convenience, while coffee and bakery benefit from extended shelf life. Other applications including pet food, household products, and personal care grow steadily as brands emphasize reusability and improved customer experience.

Key Growth Drivers

1. Rising Demand for Convenience and Portion-Control Packaging

The market grows strongly as consumers prefer packaging that offers easy opening, secure reclosure, and convenient storage across snacks, frozen foods, and household products. Reclosable zipper formats support portion control, reduce product waste, and enhance on-the-go usability, making them essential for modern lifestyle consumption patterns. Brands adopt zipper systems to differentiate packaging and improve consumer satisfaction. Expanding single-serve and multi-use formats, combined with the surge in premium packaged foods, further accelerates adoption, strengthening demand across retail, e-commerce, and private-label segments.

- For instance, Sonoco’s ClearGuard™ flexible-film line offers transparent packaging with barrier performance levels that, per the company’s datasheet, deliver a water-vapor transmission rate (WVTR) as low as 0.01 gm/100 in²/24 hr and an oxygen transmission rate (OTR) as low as 0.02 cc/100 in²/24 hr (under standard test conditions: 73°F, 0% RH for OTR; 100°F, 90% RH for WVTR).

2. Expansion of Sustainable and Lightweight Packaging Solutions

Sustainability drives significant growth as manufacturers shift toward recyclable PE/PP monomaterial structures and bio-based zipper formats to meet regulatory and brand-led circularity goals. Reclosable zipper systems reduce the need for rigid containers, enabling material reduction and lower carbon footprints. The development of solvent-free adhesives, recyclable zipper tracks, and improved barrier capabilities strengthens adoption across food and non-food categories. Rising pressure from EPR policies and eco-conscious consumers encourages rapid substitution of non-recyclable multilayer formats with zipper-enabled flexible packaging solutions offering reduced environmental impact.

- For instance, Presto Products Company’s Fresh-Lock® 8000 Series includes a range of recyclable PE zipper profiles engineered to run effectively on high-speed form/fill/seal machinery and maintain reliable seal integrity.

3. Growth in E-Commerce and Extended Product Freshness Requirements

E-commerce expansion drives strong demand for reclosable zipper packaging due to its ability to protect products during transit, maintain freshness after delivery, and support resealability for repeated use. Food, pet food, beauty, and nutraceutical brands increasingly integrate zipper systems to enhance unboxing experiences and reduce product leakage. Improved barrier technologies extend shelf life and allow brands to offer larger pack sizes without compromising quality. As digital retail channels scale globally, the need for secure, durable, and consumer-friendly packaging significantly boosts zipper system penetration.

Key Trends & Opportunities

1. Advancements in High-Barrier and Functional Zipper Technologies

A key trend is the development of enhanced barrier zipper formats that maintain aroma, moisture balance, and oxygen control for sensitive products such as coffee, premium snacks, and specialty bakery. Innovations like double-lock tracks, tactile-feedback seals, and precision-molded zipper profiles improve reliability and consumer perception. Opportunities emerge as brands seek functional upgradesn such as easy-tear notches and antimicrobial zipper stripsn to differentiate offerings. Integration of zippers into recyclable monomaterial films unlocks new applications across premium food, nutraceutical, and personal-care packaging.

- For instance, Amcor plc documented that its AmLite Ultra Recyclable high-barrier film used with its proprietary zipper systems achieves an oxygen-transmission rate below 0.1 cc/m²/day and a moisture-vapour transmission rate under 0.1 g/m²/day, delivering superior product protection for demanding ambient products.

2. Rising Adoption of Monomaterial and Recyclable Structures

Growing global focus on circular packaging fuels rapid adoption of monomaterial PE/PP zipper solutions that simplify recycling without compromising barrier performance. Brands explore recyclable zipper tracks, downgauged films, and zipper-compatible bio-based materials to meet regulatory compliance and corporate sustainability commitments. Opportunity increases as packaging converters invest in advanced extrusion, reclosure track alignment, and energy-efficient sealing systems to support large-scale commercialization. Demand for packaging that balances sustainability, cost effectiveness, and convenience positions recyclable zipper systems as a preferred choice across multiple industries.

- For instance, Amcor plc documents that its AmPrima® PE Plus mono-material structure designed for zipper integration is engineered to be a high-performance, high-speed solution that is compatible with existing filling lines. The AmLite Ultra Recyclable films paired with Amcor zipper systems achieve oxygen-transmission rates below 0.1 cc/m²/day under standard testing, enabling recyclable high-barrier pouches without aluminum or mixed laminates.

3. Premiumization and Customization Across Consumer Goods

Premium and specialty brands increasingly leverage zipper packaging to improve product aesthetics and usability, creating opportunities for customization in track design, tactile experience, and color coding. Industries such as pet food, health supplements, and beauty care adopt premium zipper formats to strengthen shelf appeal and reinforce brand value. Multi-compartment zippers, printed tracks, and advanced slider mechanisms support differentiated packaging formats. Rising consumer expectations for premium convenience accelerate demand for personalized zipper solutions tailored to product category requirements.

Key Challenges

1. Recycling Complexity and Material Compatibility Issues

Despite sustainability momentum, recycling challenges persist due to mixed-material structures, incompatible zipper tracks, and contamination during disposal. Many flexible packages still combine PE, PET, and nylon layers, making mechanical recycling difficult. Achieving full monomaterial compatibility requires significant redesign, investment in new equipment, and coordination across the packaging value chain. Limited recycling infrastructure in emerging markets further restricts adoption. These hurdles slow progress toward circular packaging goals and increase development costs for manufacturers transitioning to recyclable zipper systems.

2. Fluctuating Raw Material Prices and Production Costs

Volatility in polymer prices particularly LDPE, HDPE, PP, and specialty resins creates cost uncertainty for packaging producers. Zipper manufacturing requires precision molds, consistent resin quality, and energy-intensive extrusion, making cost management challenging during supply disruptions. Price fluctuations impact margins, especially for high-volume food and e-commerce packaging where manufacturers operate with tight cost structures. Converters face added pressure to balance performance, sustainability, and affordability while investing in advanced equipment and maintaining competitive pricing in a rapidly expanding market.

Regional Analysis

North America

North America leads the reclosable zipper packaging market with an estimated 38% share, driven by strong adoption across snacks, frozen foods, pet food, and ready-to-eat categories. High consumer preference for convenient, resealable packaging reinforces widespread integration of press-to-close and slider mechanisms. Brand investments in recyclable PE/PP monomaterial pouches support sustainability mandates and expand zipper applications across retail and e-commerce. Advanced automation, strong converter capacity, and a mature CPG industry further strengthen demand. The region benefits from rapid product innovation, consistent quality standards, and rising premium packaging requirements across retail channels.

Europe

Europe holds approximately 30% market share, supported by strict environmental regulations, rapid adoption of recyclable flexible packaging, and strong demand from bakery, confectionery, and specialty food categories. The region’s emphasis on reducing single-use plastics accelerates development of monomaterial zipper formats and bio-based packaging solutions. Growth is reinforced by premiumization trends in snacks, pet nutrition, and organic foods, where reclosable formats enhance shelf appeal and storage convenience. Established packaging converters, advanced printing technologies, and retailer-led sustainability commitments drive continued market expansion across Western and Central European markets.

Asia-Pacific

Asia-Pacific accounts for nearly 42% market share, emerging as the fastest-growing region due to rising consumption of packaged foods, expanding modern retail, and rapid urbanization. Demand increases significantly across snacks, frozen foods, dairy, and personal-care segments, where reclosable zippers enhance product protection and multi-use convenience. Local and multinational FMCG brands increase investments in lightweight, cost-effective zipper pouches to capture expanding middle-class demand. Strong manufacturing capacity, competitive production costs, and increasing adoption of e-commerce packaging boost regional market penetration. Government support for sustainable packaging further accelerates adoption of recyclable zipper formats.

Latin America

Latin America holds an estimated 8–10% market share, driven by growing demand for packaged snacks, dairy products, and household supplies. Brazil, Mexico, and Argentina lead adoption as consumers prioritize convenience, freshness retention, and portion control. Rising penetration of modern retail formats and private-label products boosts uptake of zipper-enabled flexible packaging. Regional manufacturers gradually shift toward recyclable PE structures to meet emerging sustainability expectations, though infrastructure limitations temper progress. Increasing participation from multinational brands expands availability of high-quality zipper formats. Economic improvements and urban lifestyle shifts continue to support steady market growth.

Middle East & Africa

The Middle East & Africa region captures roughly 6–7% market share, supported by rising adoption of packaged foods, expanding supermarket networks, and increased demand for hygienic, resealable formats in dry foods, bakery, and personal-care categories. Gulf countries lead adoption with premium packaging preferences, while African markets show growing demand for affordable zipper pouches across essential goods. Local packaging capabilities improve gradually, increasing availability of press-to-close systems. Sustainability awareness is increasing, with interest in recyclable monomaterial solutions. Although growth is moderate, rising disposable incomes and expanding food-processing industries support long-term market development.

Market Segmentations:

By Material Type:

- Polyethylene (PE – LDPE, HDPE)

- Polypropylene (PP)

By Zipper Type:

- Press-to-Close Zipper

- Slider Zipper

By Application:

- Pharmaceuticals

- Household Products

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Reclosable Zipper Packaging Market include Zip-Pak, ProAmpac, Glenroy, Inc., SVP Packing Industry Pvt Ltd., Huhtamaki, CarePac, Mondi, Sonoco Products Company, Presto Products Company, and Amcor plc. the Reclosable Zipper Packaging Market is defined by rapid innovation, strong material advancements, and rising adoption of recyclable zipper formats across food, beverage, and personal-care categories. Manufacturers focus on developing high-barrier, monomaterial PE and PP zipper systems that support circular packaging goals while maintaining seal integrity, aroma protection, and durability. Competition intensifies as companies expand automation capabilities, precision-track molding, and slider-based designs to enhance consumer convenience and packaging consistency. The shift toward premium snack formats, growing e-commerce penetration, and increasing demand for portion-control features further drive differentiation. Strategic investments in sustainable materials, regional manufacturing hubs, and high-speed converting technologies enable producers to improve cost efficiency and accelerate global market reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, TIPA initiated a partnership with Presto Products Co. to launch home compostable closures that became available for Europe and Asia-Pacific markets. Tipa 8035 emerges as the introductory product from this series that TIPA offers to the market. The 11mm single-lock press-to-close zipper serves light to medium pouch solutions and operates with various legacy systems.

- In October 2024, Accredo Packaging collaborated with Fresh-Lock closures, a brand of Reynolds Consumer Products, to launch the first 100% biobased resin pouch with a zipper closure. This pioneering pouch is made entirely from sugarcane-derived resin, resulting in a fully renewable and in-store recyclable product that significantly reduces environmental impact by sequestering greenhouse gases.

- In May 2024, Amcor and AVON launched the AmPrima Plus recycle-ready refill pouch for AVON’s Little Black Dress shower gels in China, a collaboration highlighting significant environmental savings an 83% lower carbon footprint, plus reductions in water and renewable energy use (88% & 79% respectively) when recycled compared to the original container, confirmed by Carbon Trust analysis.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Zipper Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth as brands adopt reclosable formats to enhance convenience, freshness retention, and portion control across food and non-food categories.

- Recyclable monomaterial PE and PP zipper systems will gain wider acceptance as sustainability regulations tighten globally.

- High-barrier zipper technologies will expand in premium snacks, coffee, frozen foods, and nutraceuticals requiring extended shelf life.

- E-commerce packaging will drive demand for durable, leak-resistant, and resealable pouch formats optimized for repeated use.

- Automation-ready zipper tracks will see rising adoption as manufacturers upgrade filling and sealing lines for higher efficiency.

- Bio-based and compostable zipper solutions will gain traction as brands prioritize low-carbon packaging materials.

- Customizable zipper features, including tactile feedback and color-coded tracks, will expand to support premiumization.

- Emergence of intelligent packaging trends will encourage development of zippers integrated with QR codes or freshness indicators.

- Demand for large-format pouches with strong reclosure performance will increase in pet food, detergents, and home-care segments.

- Regional players will strengthen capabilities through investments in advanced extrusion, precision molding, and digital printing technologies.