Market Overview

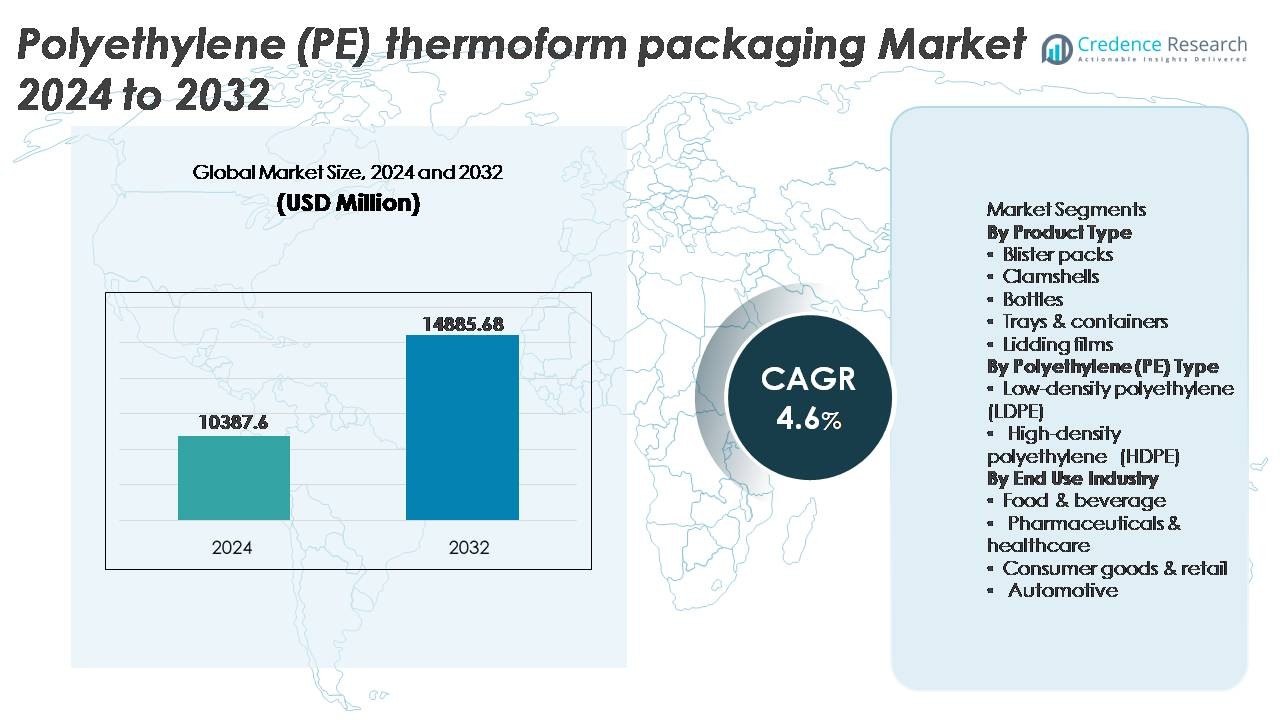

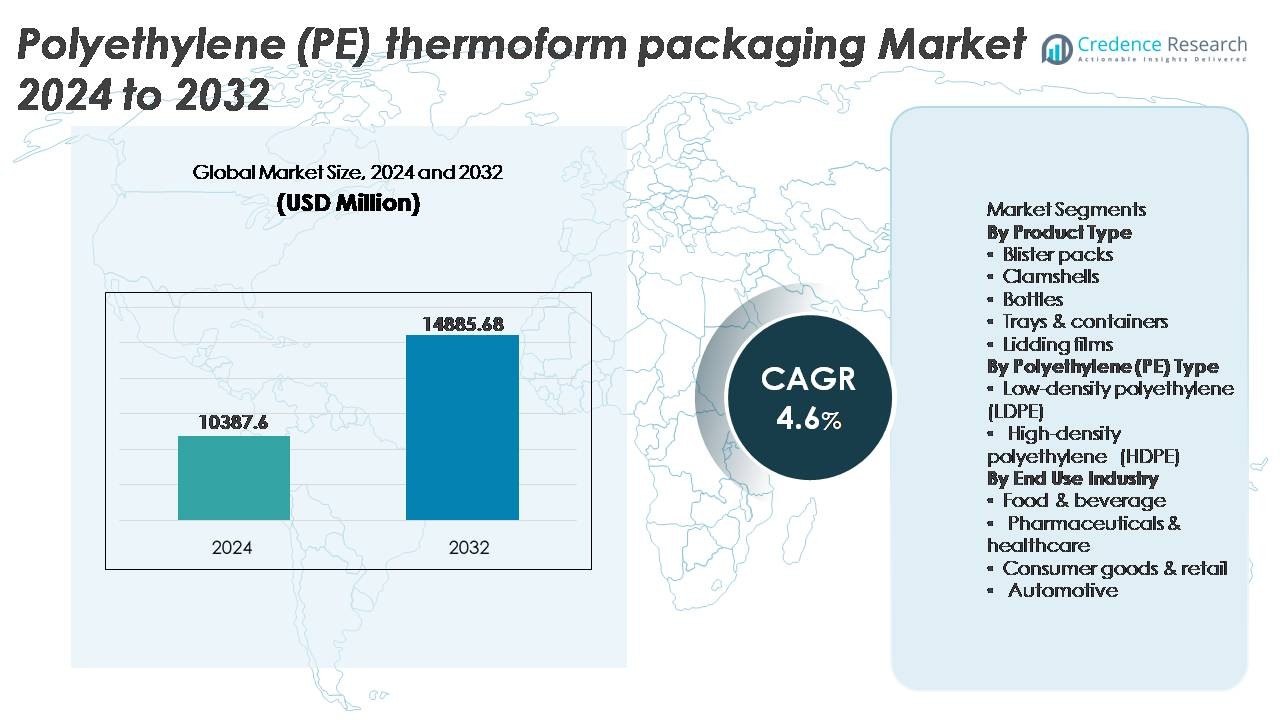

The global Polyethylene (PE) thermoform packaging market was valued at USD 10,387.6 million in 2024 and is projected to reach USD 14,885.68 million by 2032, registering a CAGR of 4.6% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyethylene (PE) Thermoform Packaging Market Size 2024 |

USD 10,387.6 Million |

| Polyethylene (PE) Thermoform Packaging Market, CAGR |

4.6% |

| Polyethylene (PE) Thermoform Packaging Market Size 2032 |

USD 14,885.68 Million |

The Polyethylene (PE) thermoform packaging market is shaped by major global players including Sonoco Products Company, Constantia Flexibles, Amcor plc, Sealed Air, and Berry Global Inc., each leveraging advanced thermoforming capabilities, sustainable resin integration, and application-focused packaging solutions for food, healthcare, and consumer goods. These companies compete through lightweight designs, recyclable mono-material formats, and value-added customization aligned with brand and regulatory requirements. Asia Pacific leads the market with approximately 35% share, driven by large-scale manufacturing, retail expansion, and rising packaged food consumption, followed by North America and Europe, where sustainability mandates and automation-compatible packaging innovations reinforce market competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global Polyethylene (PE) thermoform packaging market was valued at USD 10,387.6 million in 2024 and is projected to reach USD 14,885.68 million by 2032, registering a CAGR of 4.6% during the forecast period.

- Rising demand for packaged, convenience, and ready-to-eat foods, coupled with expanding pharmaceutical distribution, is driving accelerated adoption of PE thermoformed trays, containers, and blister formats.

- Market trends indicate growing momentum toward recyclable mono-material PE designs, lightweight structures, and automation-ready packaging compatible with high-speed filling and sealing lines.

- The market remains highly competitive, with global players optimizing cost, customization, and sustainability, while volatility in resin prices and evolving regulatory measures pose restraints.

- Asia Pacific leads with nearly 35% share, followed by North America at 32% and Europe at 28%; within product segmentation, trays & containers hold the dominant share due to extensive food and medical packaging applications.

Market Segmentation Analysis:

By Product Type

Within the product type segmentation, trays & containers account for the dominant market share, driven by widespread use in ready-to-eat meals, fresh produce, and meat packaging. Their durability, lightweight structure, and compatibility with automated filling and sealing lines support large-scale food processing operations. Blister packs and clamshells also maintain significant adoption in pharmaceuticals, personal care, and retail displays due to product visibility and tamper resistance. Meanwhile, lidding films gain traction as manufacturers shift toward peelable and recyclable film structures. Bottles and other specialty formats cater to niche liquid and single-serve applications.

- For instance, Sealed Air’s CRYOVAC® Darfresh® vacuum skin trays, when used with high-speed industrial packaging machinery like the Mondini Trave system, are designed to handle sealing speeds of up to 200 packs per minute while maintaining product shelf-life and package integrity.

By Polyethylene (PE) Type

High-density polyethylene (HDPE holds the largest share owing to its superior rigidity, impact resistance, and suitability for thermoformed bottles, medical trays, and industrial-grade containers. HDPE’s recyclability and barrier properties further elevate its preference among sustainability-focused brands and regulatory-compliant packaging formats. Low-density polyethylene (LDPE), while more flexible, is favored for lidding films and lightweight food pouches, emphasizing sealability and clarity. The shift toward circular packaging and post-consumer resin integration strengthens demand across both types, however HDPE’s performance advantages sustain its dominance in high-strength and long-shelf-life packaging applications.

- For instance, Berry Global’s packaging solutions are advancing toward increased circularity through various initiatives. The company is committed to increasing the use of recycled content across its portfolio.

By End Use Industry

The food & beverage sector represents the leading end-use market, supported by escalating consumption of packaged and convenience foods, extended shelf-life requirements, and stringent hygiene standards. PE thermoform packaging plays a critical role in dairy, frozen foods, bakery items, and fresh produce distribution. Pharmaceuticals and healthcare remain another high-growth area owing to sterile barrier compliance and precision-fit blister and tray packaging. Consumer goods and retail adopt clamshells and display packaging to enhance product visibility, while automotive applications leverage thermoformed PE for lightweight, durable protective housings and components used across supply chains.

KEY GROWTH DRIVERS

Rising Demand for Packaged and Convenience Food

The surge in consumption of ready-to-eat meals, frozen products, and fresh produce is a significant driver for the Polyethylene (PE) thermoform packaging market. Growth in urban populations, dual-income households, and fast-paced lifestyles are reshaping global food consumption patterns, increasing the dependence on packaging that enhances convenience, portability, and shelf-life. PE thermoform solutions, such as trays and containers, address the essential requirements of lightweight structure, cost efficiency, and hygienic storage. Their compatibility with high-speed filling lines supports mass-scale food distribution. The expansion of quick-service restaurants, cloud kitchens, and retail food chains further amplifies demand for standardized portion-controlled packaging formats. Additionally, evolving hygiene awareness and stricter safety measures in food handling and preservation are accelerating the shift toward sealed, tamper-evident packaging. As retailers focus on product visibility and longer display life, PE-based thermoforming remains a preferred solution across fresh, processed, and ready-to-cook offerings.

- “For instance, Huhtamaki offers multi-layer barrier trays used for heat-seal and MAP (Modified Atmosphere Packaging) applications which utilize high-performance barrier materials to support oxygen transmission rates (OTR) as low as around <0.1-0.2 cc/m²/day at 23°C, thereby extending the shelf-life of chilled food in distribution cycles exceeding 10 days.”

Growing Adoption of Lightweight and Recyclable Materials

Increasing environmental awareness and regulatory actions targeting plastic waste reduction are encouraging manufacturers to adopt recyclable material solutions. PE thermoform packaging supports circular economy goals as it remains one of the most widely recycled polymers globally. Lightweighting initiatives reduce transportation emissions and minimize material usage while maintaining structural performance. Governments and regulatory bodies are mandating minimum recycled content targets and extended producer responsibility, motivating companies to redesign packaging for easier recovery and reprocessing. Brand owners in food, healthcare, and consumer goods are incorporating PE thermoform formats to balance sustainability goals with operational practicality. Scaling availability of recycled PE and advancements in mono-material packaging formats further enhance market expansion. As sustainability certifications and carbon reporting standards become industry norms, the adoption of recyclable PE thermoform packaging is increasingly viewed as a strategic compliance and brand differentiation factor.

- “For instance, ExxonMobil’s Exceed™ XP performance PE grades enable significant film downgauging opportunitiesin various applications, including flexible food packaging, while preserving key performance characteristics such as puncture resistance and seal integrity.

Growth of Pharmaceutical and Healthcare Packaging

The expansion of global healthcare infrastructure, increased production of medical devices, and heightened safety standards are accelerating demand for PE thermoform packaging solutions. Blister trays, sterile barrier components, and precision-fit containers benefit from PE’s chemical resistance, strength, and hygienic properties. The rising volume of over-the-counter medications, diagnostic kits, and minimally invasive device shipments requires reliable protective packaging that safeguards products during storage and transit. Trends such as home diagnostics, telehealth-driven product distribution, and self-administered therapies are reshaping the packaging landscape toward secure, tamper-evident, and user-friendly designs. PE thermoform formats enable optimized sealing, product visibility, and customizable cavity structures that align with pharmaceutical validation requirements. As regulatory compliance and patient safety become increasingly prioritized, PE thermoforming continues to serve as a critical packaging technology across global healthcare supply chains.

KEY TRENDS & OPPORTUNITIES

Shift Toward Mono-Material and Recyclable PE Packaging

A notable industry trend is the transition from multi-layer structures to recyclable mono-material designs, aimed at reducing waste and improving resource recovery rates. PE thermoforming enables manufacturers to engineer packaging formats that maintain mechanical strength and barrier properties without reliance on non-recyclable layers. This shift is driven by sustainability frameworks, retailer commitments, and consumer preference for eco-labeled packaging. Investment in downgauging technologies, solvent-free adhesives, and improved seal layer compatibilities is opening new opportunities for innovation. As recycling infrastructure expands and closed-loop supply models emerge, mono-material PE thermoform packaging is positioned to gain greater adoption across food, healthcare, and industrial applications.

- For instance, Amcor’s AmSky™ mono-PE blister system eliminates aluminum foil and incorporates approximately 95% polyethylene content, reducing material complexity while maintaining barrier performance suitable for moisture-sensitive pharmaceuticals.

Automation-Compatible and Smart Packaging Integration

The rise of robotics and automated logistics across manufacturing and retail channels presents opportunities for packaging optimized for machine handling. PE thermoform designs provide consistency, dimensional accuracy, and rigidity essential for automated picking, stacking, and sealing lines. Additionally, integration of smart features such as QR-enabled traceability, freshness indicators, and anti-counterfeit identifiers is gaining traction in both food and pharmaceutical sectors. Digital printing advancements add value through personalization and supply chain transparency. As IoT-enabled packaging expands, PE thermoform platforms present a flexible substrate for embedding interactive, traceable, and regulatory-compliant solutions while improving operational efficiencies.

- For instance, MULTIVAC’s automated thermoforming platforms utilize precise servo drive technology and advanced process controls to ensure high quality and repeatable results. These systems are compatible with various automation solutions, including synchronized robotic loading systems designed for seamless integration and high efficiency.

KEY CHALLENGES

Environmental Pressure and Regulatory Restrictions

Despite advancements in recyclable formats, polyethylene-based packaging remains under scrutiny due to waste generation and marine pollution concerns. Stringent regulations focused on plastic usage bans, labeling requirements, recycling mandates, and disposal fees impose cost and compliance burdens on manufacturers. Public pressure and sustainability commitments from retailers, especially in Europe and North America, are pushing brands to justify plastic usage with measurable environmental benefits. The challenge intensifies in regions with limited collection and recycling infrastructure, where thermoformed items may end up in landfills. Achieving sustainability without compromising performance or affordability remains a complex balancing act for the industry.

Volatility in Raw Material Prices and Supply Chain Disruptions

Fluctuations in crude oil prices directly impact polyethylene production costs, creating unpredictability in profit margins for packaging manufacturers. Global supply chain vulnerabilities, including shipping delays, energy price swings, and geopolitical uncertainty, further challenge cost management and continuity of supply. Sudden spikes in resin pricing influence procurement strategies and may shift end users toward alternative materials. Small and medium enterprises face added pressure due to limited ability to hedge material contracts. As supply chains become more regionalized and competitive, cost stability and material planning continue to pose critical challenges for stakeholders in the PE thermoform packaging market.

Regional Analysis

North America

North America holds approximately 32% market share in the Polyethylene (PE) thermoform packaging market, driven by strong adoption across packaged food, pharmaceuticals, and medical device distribution. The region benefits from advanced recycling frameworks and adoption of post-consumer resin in thermoformed trays and clamshells. Demand is reinforced by regulatory emphasis on traceability, tamper evidence, and sustainability-aligned packaging formats. Growth in e-commerce grocery delivery and cold-chain logistics continues to expand consumption of PE-based containers and insulated packaging. The United States leads market demand due to large-scale retail networks, healthcare expenditure, and strong integration of automated packaging operations.

Europe

Europe accounts for around 28% market share, supported by strict environmental regulations and accelerated transition toward recyclable mono-material packaging structures. The region’s circular economy directives encourage brands to prioritize PE thermoform packaging with closed-loop recyclability. Strong pharmaceutical and nutraceutical manufacturing hubs in Germany, Switzerland, and the U.K. drive specialized blister and sterile tray demand. Expansion of private-label food brands and sustainability-certified packaging further stimulates market adoption. Although regulatory compliance imposes cost pressures, it also promotes innovation in downgauging and bio-attributed PE solutions, positioning Europe as a leading ecosystem for sustainable thermoform packaging development and commercialization.

Asia Pacific

Asia Pacific leads the market with approximately 35% share, fueled by rapid industrialization, expanding food processing industries, and rising packaged food consumption. China and India anchor demand through large-scale manufacturing hubs, cost-effective production ecosystems, and expanding pharmaceutical capacity. Increasing retail modernization, quick-service restaurant growth, and online grocery delivery strengthen the region’s requirement for durable trays, clamshells, and lidding films. Investments in flexible and rigid packaging plants enhance domestic supply availability. However, recycling infrastructure remains uneven, creating both opportunities for circular packaging solutions and challenges for waste management. Asia Pacific remains the fastest-growing market for PE thermoform adoption

Latin America

Latin America represents around 3% market share, influenced by growing consumption of packaged dairy, bakery products, and beverages across Brazil, Mexico, and Argentina. Food export industries increasingly incorporate PE thermoform packaging to preserve freshness and meet regulatory standards for destination markets. Pharmaceutical packaging demand is rising due to expanding generic drug manufacturing and public healthcare initiatives. However, economic fluctuations and limited collection infrastructure affect the adoption of advanced recyclable formats. Investments in local packaging plants and rising urban retail penetration support gradual market expansion as consumers shift toward packaged and convenience food options.

Middle East & Africa

The Middle East & Africa region holds about 2% market share, driven by steady developments in food processing, halal-certified packaging, and growing healthcare distribution. GCC countries are investing in modern retail and cold-chain logistics, boosting demand for PE trays and containers. Import dependence for packaged food and increasing pharmaceutical trade elevate the need for protective and temperature-resilient packaging solutions. However, limited recycling networks and cost-sensitive markets restrict adoption of premium thermoform formats. Emerging sustainability initiatives and industrial diversification programs signal opportunity for regional manufacturers to adopt recyclable PE thermoform packaging across food, medical, and consumer goods segments.

Market Segmentations:

By Product Type

- Blister packs

- Clamshells

- Bottles

- Trays & containers

- Lidding films

By Polyethylene (PE) Type

- Low-density polyethylene (LDPE)

- High-density polyethylene (HDPE)

By End Use Industry

- Food & beverage

- Pharmaceuticals & healthcare

- Consumer goods & retail

- Automotive

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Polyethylene (PE) thermoform packaging market is characterized by a mix of global packaging manufacturers, regional converters, and specialized thermoforming solution providers competing through material innovation, production scale, and customization capabilities. Leading companies focus on lightweighting, mono-material designs, and integration of recycled PE to align with sustainability mandates and retailer packaging standards. Investment in automation, high-speed thermoforming equipment, and digital printing enhances efficiency and enables rapid SKU customization. Strategic partnerships between resin producers, recyclers, and packaging converters are reshaping supply models to expand access to post-consumer resin streams. Meanwhile, mergers, capacity expansions, and geographic market entries strengthen competitive positioning, particularly across food, pharmaceutical, and consumer goods packaging. As brand owners prioritize circular economy frameworks and cost optimization, differentiation increasingly hinges on supply continuity, compliance readiness, performance consistency, and the ability to deliver recyclable, traceable, and regulatory-aligned PE thermoform solutions at scale.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Sealed Air installed the company’s 4,000th rotary-vacuum packaging system under its CRYOVAC® food-packaging brand reinforcing its long-standing commitment to high-throughput vacuum packaging and sealing performance for meat and processed-food customers.

- In October 2024, ExxonMobil with the association with its key partners, developed a fully recyclable thermoformed packaging with PE content around 95%. The aim of the company was to meet the modern packaging needs serving without sacrificing performance and catering the sustainability factor.

Report Coverage

The research report offers an in-depth analysis based on Product type, Polyethylene (PE) type, End use industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for PE thermoform packaging will expand with the rising consumption of packaged and convenience foods.

- Adoption of recyclable and mono-material PE structures will accelerate in response to sustainability mandates.

- Integration of post-consumer recycled resin will become standard practice across food and healthcare packaging lines.

- Automation-compatible PE packaging will gain importance as production lines shift toward robotics.

- Digital printing and traceability features will enhance customization and compliance in retail and pharmaceutical applications.

- Lightweighting innovations will reduce logistics costs while maintaining strength and barrier performance.

- Growth in e-commerce grocery and cold-chain logistics will increase demand for durable PE trays and containers.

- Regulatory pressure will reshape material selection and push for higher recycling targets globally.

- Emerging markets will witness new thermoforming capacities and localization of packaging production.

- Collaboration between resin manufacturers, recyclers, and converters will strengthen circular economy frameworks.