Market Overview

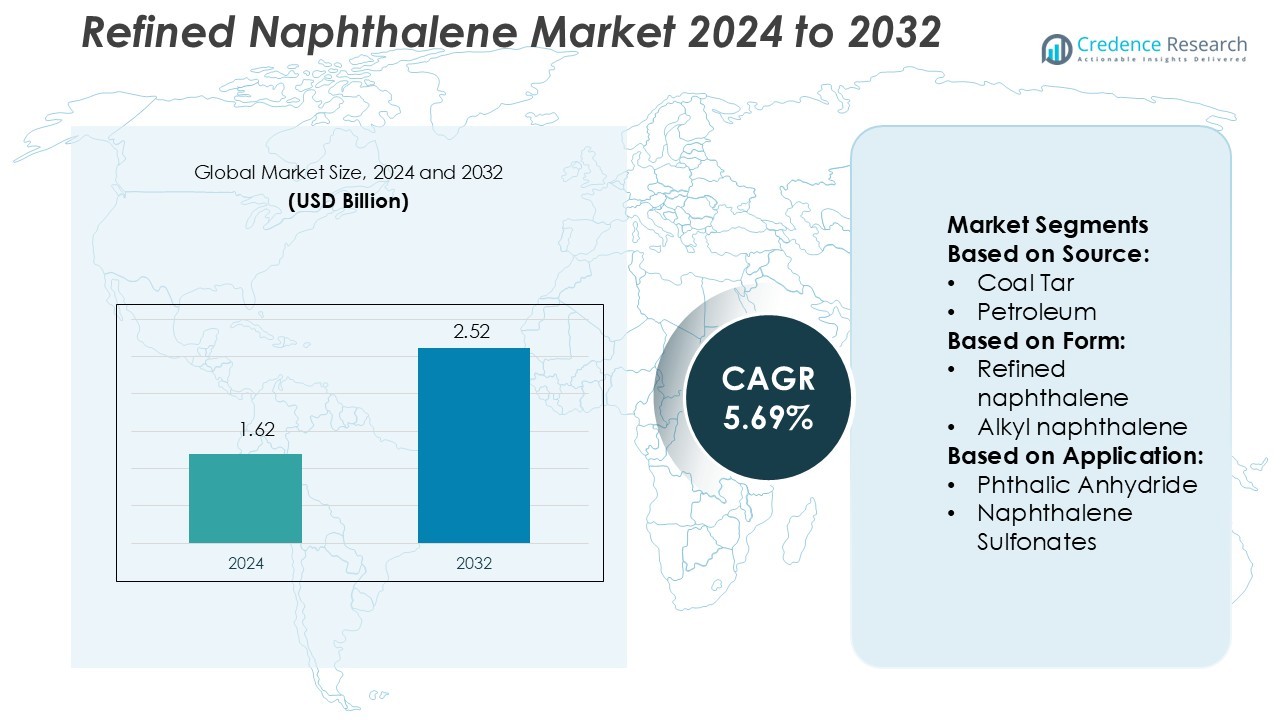

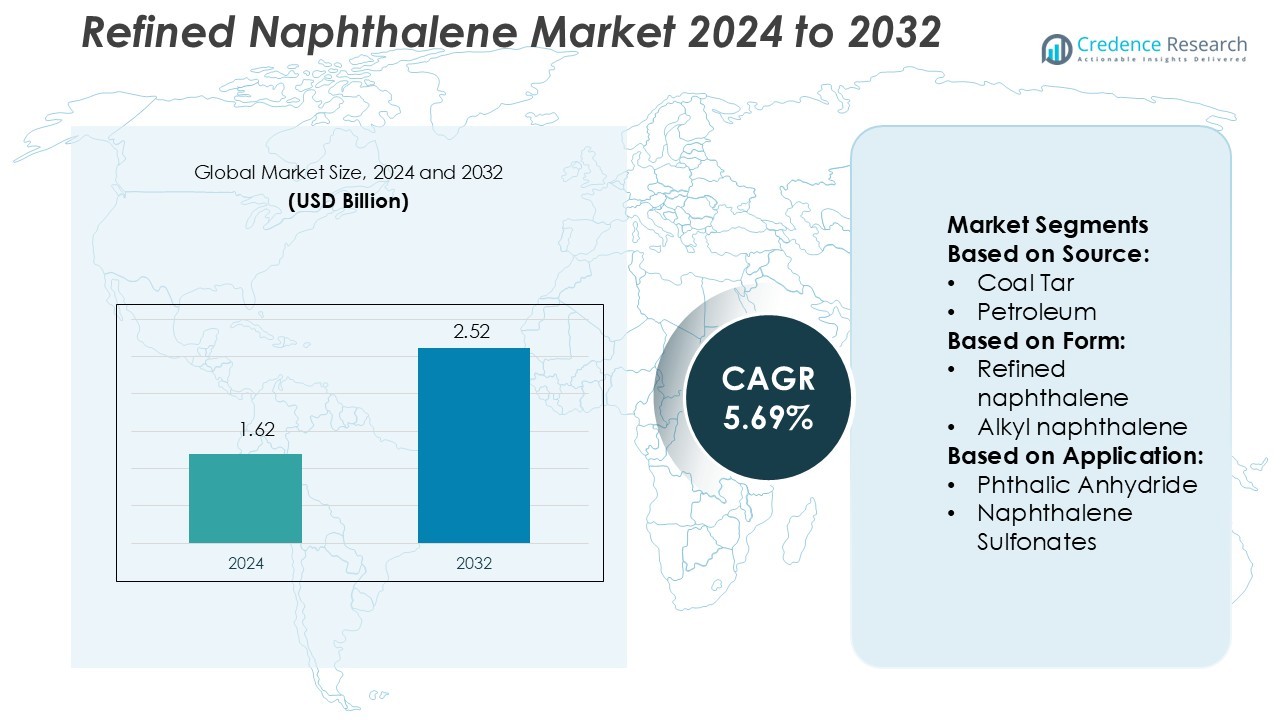

Refined Naphthalene Market size was valued USD 1.62 billion in 2024 and is anticipated to reach USD 2.52 billion by 2032, at a CAGR of 5.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Refined Naphthalene Market Size 2024 |

USD 1.62 Billion |

| Refined Naphthalene Market, CAGR |

5.69% |

| Refined Naphthalene Market Size 2032 |

USD 2.52 Billion |

The Refined Naphthalene Market is driven by leading players including Deza, King Industries, ExxonMobil Chemical, Dong-Suh Chemical Ind. Co., Ltd., Himadri Specialty Chemical Ltd., Atom Scientific, Koppers, JFE Chemical Corporation, China Steel Chemical, and CDH Fine Chemical. These companies focus on expanding refining capabilities, enhancing product purity, and developing sustainable derivatives to meet rising global demand. Advanced coal tar distillation and cleaner production methods remain key competitive strategies. Asia-Pacific leads the global market with a 39.8% share, supported by robust industrial growth, abundant coal tar availability, and strong demand from construction and chemical manufacturing sectors across China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Refined Naphthalene Market size was valued at USD 1.62 billion in 2024 and is projected to reach USD 2.52 billion by 2032, growing at a CAGR of 5.69% during the forecast period.

• Rising demand for phthalic anhydride and naphthalene sulfonates in construction and plastic manufacturing drives overall market growth.

• Increasing adoption of high-purity and eco-friendly derivatives defines current market trends, supported by technological advancements in coal tar refining.

• The market faces restraints from raw material price fluctuations and stringent environmental regulations affecting production efficiency and profitability.

• Asia-Pacific dominates with a 39.8% regional share, while the coal tar-based segment leads with 68.3% share, driven by large-scale chemical production in China, India, and Japan.

Market Segmentation Analysis:

By Source

Coal tar dominates the Refined Naphthalene Market with a 68.3% share due to its high aromatic hydrocarbon content and cost-efficient production. It offers superior purity and consistent yield, making it the preferred source for chemical intermediates. The petroleum-derived segment follows, benefiting from advancements in refining technologies that enable the extraction of naphthalene from heavy oil fractions. The strong demand from the plastics, dyes, and agrochemical industries further reinforces the coal tar segment’s leadership, supported by established suppliers and integrated processing facilities across Asia-Pacific and Europe.

- For instance, Deza a.s. operates an advanced distillation unit in the Czech Republic with a production capacity of 60,000 tons of refined naphthalene annually. The facility employs multi-stage vacuum distillation and automated impurity control systems capable of achieving purity levels above 99.8%, ensuring uniform quality for downstream applications in phthalic anhydride and naphthalene sulfonate manufacturing.

By Form

Refined naphthalene holds the leading position with a 52.7% market share, driven by its broad industrial applications and high solubility. Its purity level above 99% makes it ideal for producing phthalic anhydride and naphthalene sulfonates. Alkyl naphthalene and solid naphthalene forms serve specialized uses in lubricants and chemical synthesis. The growing focus on stable and low-volatility products also supports the use of refined forms in performance chemicals. Demand for improved product consistency and odor control further accelerates the adoption of refined grades across construction and textile sectors.

- For instance, King Industries has leveraged its alkylated naphthalene technology—specifically its NA-LUBE KR-006FG grade—which shows a viscosity at 100 °C of 5.6 cSt and a pour point of −33 °C, enabling enhanced stability in high-temperature chains and gear oils.

By Application

Phthalic anhydride dominates the application segment with a 41.5% market share, fueled by its essential role in plasticizers, resins, and coatings. Refined naphthalene acts as a key precursor for phthalic anhydride synthesis, ensuring process stability and high conversion rates. The naphthalene sulfonates segment grows steadily, driven by demand from concrete admixtures and dispersing agents. Expanding applications in low-volatility solvents, pesticides, and dyes further enhance overall market penetration. The increasing shift toward performance chemicals and sustainable production methods sustains long-term growth for these applications.

Key Growth Drivers

Rising Demand for Phthalic Anhydride Production

The growing use of refined naphthalene as a raw material for phthalic anhydride drives market expansion. Phthalic anhydride serves as a key intermediate in producing plasticizers, resins, and coatings across automotive and construction sectors. The rise in PVC and polyester resin manufacturing further fuels consumption. Increasing infrastructure and industrial activity in emerging economies reinforces steady demand. Companies are optimizing production processes to improve purity and yield efficiency, enhancing the value proposition of refined naphthalene in large-scale industrial applications.

- For instance, ExxonMobil’s Catalysts and Technology Licensing business reports that its proprietary catalyst technologies are used in over 150 commercial facilities worldwide.

Expansion of Construction Chemicals Sector

Refined naphthalene finds extensive use in naphthalene sulfonate-based superplasticizers, crucial for high-performance concrete. Growing infrastructure investments and smart city projects increase the adoption of these admixtures for durable and high-strength structures. The material improves workability and reduces water content, ensuring better concrete performance. Rapid urbanization and large-scale housing projects in Asia-Pacific and the Middle East support consumption growth. Manufacturers are developing high-purity grades to meet quality standards in concrete and cement formulations. This expansion remains a strong driver for sustained market growth.

- For instance, Dong-Suh Chemical’s “PNS (NSF)” product line is reported as containing 95 % naphthalene content as the raw material feedstock.

Advancements in Coal Tar Refining Technologies

Technological innovation in coal tar refining enhances the yield and purity of refined naphthalene. Advanced distillation and purification processes allow recovery of naphthalene with reduced contaminants, improving performance in downstream applications. Automation and process integration further reduce operational costs, benefiting large-scale producers. Major companies invest in refining upgrades to achieve environmental compliance and energy efficiency. These advancements support stable supply and consistent quality, enabling manufacturers to meet growing demand from the chemical, plastic, and agrochemical sectors while maintaining sustainability standards.

Key Trends & Opportunities

Shift Toward Eco-Friendly Derivatives

Manufacturers are focusing on developing environmentally sustainable naphthalene derivatives to reduce toxic emissions. Bio-based or low-emission substitutes for traditional naphthalene are gaining attention in specialty chemical applications. The growing preference for green materials in paints, coatings, and construction sectors accelerates this transition. Companies are investing in R&D for catalytic oxidation and cleaner recovery methods. This trend creates opportunities for players focusing on sustainable chemistry and circular economy models, enabling compliance with tightening global environmental regulations.

- For instance, Himadri states that its new product line of Durofresh™ naphthalene balls achieves a purity level of 99.5%, which enhances vapour strength and lowers residue levels for safer applications.

Increased Adoption in Performance Chemicals

Refined naphthalene’s versatility drives its use in producing dispersants, wetting agents, and surfactants. The rise in specialty chemical applications across textile, agriculture, and polymer industries supports steady market growth. Demand for high-performance formulations in water reducers and plasticizers further strengthens adoption. Continuous innovation in compound modification and blending enhances product stability and reactivity. This trend offers new opportunities for value-added formulations that meet industrial performance and environmental expectations, particularly in Asia-Pacific and Europe.

- For instance, JFE Chemical states that it supplies 95% grade naphthalene globally, using coal tar distillation from its parent JFE Steel Corporation’s coking operations as the feedstock.

R&D Focus on High-Purity Grades

Research efforts are centered on refining technologies to achieve ultra-high purity naphthalene exceeding 99.8%. These grades cater to industries demanding superior performance in dyes, pigments, and electronics. Improved crystallization and distillation methods enable consistent molecular structure and enhanced chemical stability. Manufacturers investing in precision refining systems gain a competitive edge in high-end applications. This opportunity is expected to accelerate with the growing requirement for precision-grade intermediates in advanced materials and specialty coatings.

Key Challenges

Volatility in Raw Material Supply

The dependency on coal tar and petroleum feedstock exposes manufacturers to supply fluctuations and pricing volatility. Any disruption in steel or petroleum production directly impacts raw material availability. Geopolitical factors and energy market instability further complicate procurement strategies. Producers face pressure to maintain consistent production despite variable input costs. This challenge encourages diversification of sourcing strategies and development of alternative extraction methods to stabilize long-term operations and ensure profitability.

Environmental and Regulatory Constraints

Stringent environmental regulations concerning polycyclic aromatic hydrocarbons (PAHs) in naphthalene products pose significant compliance challenges. Restrictions on emissions, waste disposal, and occupational exposure increase production costs. Manufacturers must adopt advanced purification technologies to meet safety standards. Non-compliance risks can lead to penalties and loss of market access, particularly in developed regions. Continuous investment in cleaner processes and eco-friendly technologies is essential to overcome these constraints and maintain regulatory alignment across multiple jurisdictions.

Regional Analysis

North America

North America holds a 26.4% share of the Refined Naphthalene Market, driven by strong demand from construction and chemical manufacturing sectors. The United States leads regional consumption due to the widespread use of naphthalene sulfonates in high-performance concrete admixtures and phthalic anhydride in plasticizer production. Growth in infrastructure renovation projects and the coatings industry supports consistent product uptake. The presence of established players with advanced refining technologies ensures supply reliability. Regulatory focus on eco-friendly production drives investments in cleaner processing systems, enhancing market competitiveness across key industrial hubs.

Europe

Europe accounts for 23.1% of the global market share, supported by a mature chemical sector and well-developed downstream applications. Germany, France, and the U.K. dominate consumption owing to strong production of phthalic anhydride, dyes, and resins. The region’s stringent environmental regulations encourage adoption of high-purity, low-emission naphthalene grades. Continuous advancements in refining technologies across Central and Western Europe improve process efficiency. Demand for sustainable and performance-based materials in coatings and polymers continues to strengthen, driving steady market growth despite high operational and compliance costs.

Asia-Pacific

Asia-Pacific leads the global Refined Naphthalene Market with a 39.8% share, fueled by rapid industrialization and urban expansion. China and India are major contributors due to rising consumption in construction chemicals, resins, and textile industries. Expanding manufacturing infrastructure and government-driven housing projects boost regional demand. Local producers benefit from abundant coal tar availability and cost-effective production. Japan and South Korea focus on developing high-purity naphthalene for specialty chemical applications. Increasing investments in refining capacity and environmental compliance strengthen Asia-Pacific’s dominance and position it as a key global export base.

Latin America

Latin America holds a 6.7% share of the Refined Naphthalene Market, primarily driven by the construction and paints industries in Brazil, Mexico, and Argentina. Demand for naphthalene sulfonate-based admixtures grows with expanding infrastructure and residential projects. The availability of coal tar as a byproduct from steel manufacturing supports regional supply. However, limited refining capacity and reliance on imports restrict faster market development. Growing partnerships with Asian suppliers and modernization of local production plants present future opportunities for increased competitiveness and regional self-sufficiency in the refined naphthalene segment.

Middle East & Africa

The Middle East & Africa region captures a 4% market share, supported by growth in infrastructure development, industrialization, and oil-based chemical production. Gulf countries like Saudi Arabia and the UAE drive demand for naphthalene sulfonates in high-performance concrete used in mega construction projects. African economies, including South Africa and Egypt, show rising interest in local production and downstream processing. Dependence on imported refined materials remains a key challenge. Strategic investments in coal tar refining and capacity expansion are expected to enhance market potential and reduce dependency on foreign suppliers.

Market Segmentations:

By Source:

By Form:

- Refined naphthalene

- Alkyl naphthalene

By Application:

- Phthalic Anhydride

- Naphthalene Sulfonates

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Refined Naphthalene Market is characterized by strong competition among major players such as Deza, King Industries, ExxonMobil Chemical, Dong-Suh Chemical Ind. Co., Ltd., Himadri Specialty Chemical Ltd., Atom Scientific, Koppers, JFE Chemical Corporation, China Steel Chemical, and CDH Fine Chemical. The Refined Naphthalene Market exhibits a competitive structure driven by technological innovation, production efficiency, and sustainability initiatives. Companies are focusing on upgrading refining technologies to achieve higher purity levels and reduce emissions. Continuous R&D investment supports the development of eco-friendly and high-performance derivatives used in construction, coatings, and plastics. Strategic collaborations, capacity expansions, and product diversification remain core growth strategies. Manufacturers are strengthening global supply chains and exploring new regional markets to reduce dependency on specific raw material sources. Increasing emphasis on regulatory compliance and circular manufacturing further enhances competitiveness across the global refined naphthalene industry.

Key Player Analysis

- Deza

- King Industries

- ExxonMobil Chemical

- Dong-Suh Chemical Ind. Co., Ltd.

- Himadri Specialty Chemical Ltd.

- Atom Scientific

- Koppers

- JFE Chemical Corporation

- China Steel Chemical

- CDH Fine Chemical

Recent Developments

- In January 2025, PolyCycl, a circular economy technology start-up based in Chandigarh, announced the launch of its patented technology that converts hard-to-recycle plastics into food-grade polymers, renewable chemicals, and sustainable fuels.

- In November 2024, BASF launched Easiplas, a new brand of high-density polyethylene, while also achieving significant construction milestones at its HDPE plant located at the Zhanjiang Verbund site. These developments highlight BASF’s commitment to providing customer-centric and high-quality products that meet the increasing demand for HDPE in the Chinese market.

- In September 2024, Dow introduced its first bio-circular product for the flooring industry, expanding its ENGAGE REN Polyolefin Elastomers (POE) product portfolio. This flooring innovation, designed for manufacturing carpet tile backing, offers enhanced dimensional stability and supports fiber adhesion.

- In July 2023, Kazuhito Tsukagoshi, Group Leader of the Thin Film Electronics Group, and a research team from Tokyo Institute of Technology’s Chemistry Department successfully identified a single dimer of naphthalene molecules in a nano-gap structure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Source, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity refined naphthalene will rise with expanding chemical manufacturing.

- Adoption of eco-friendly production processes will strengthen environmental compliance and brand value.

- Growth in construction chemicals will continue driving naphthalene sulfonate consumption globally.

- Technological advancements in coal tar refining will enhance yield efficiency and product consistency.

- Increasing use of naphthalene derivatives in performance coatings will boost long-term demand.

- Regional producers in Asia-Pacific will expand capacity to meet export opportunities.

- Integration of automation in refining operations will reduce costs and improve process control.

- Strategic partnerships and mergers will help companies access new markets and technologies.

- Rising focus on bio-based substitutes may influence product innovation and diversification.

- Continuous R&D in specialty applications will broaden refined naphthalene’s role across emerging industries.