Market Overview

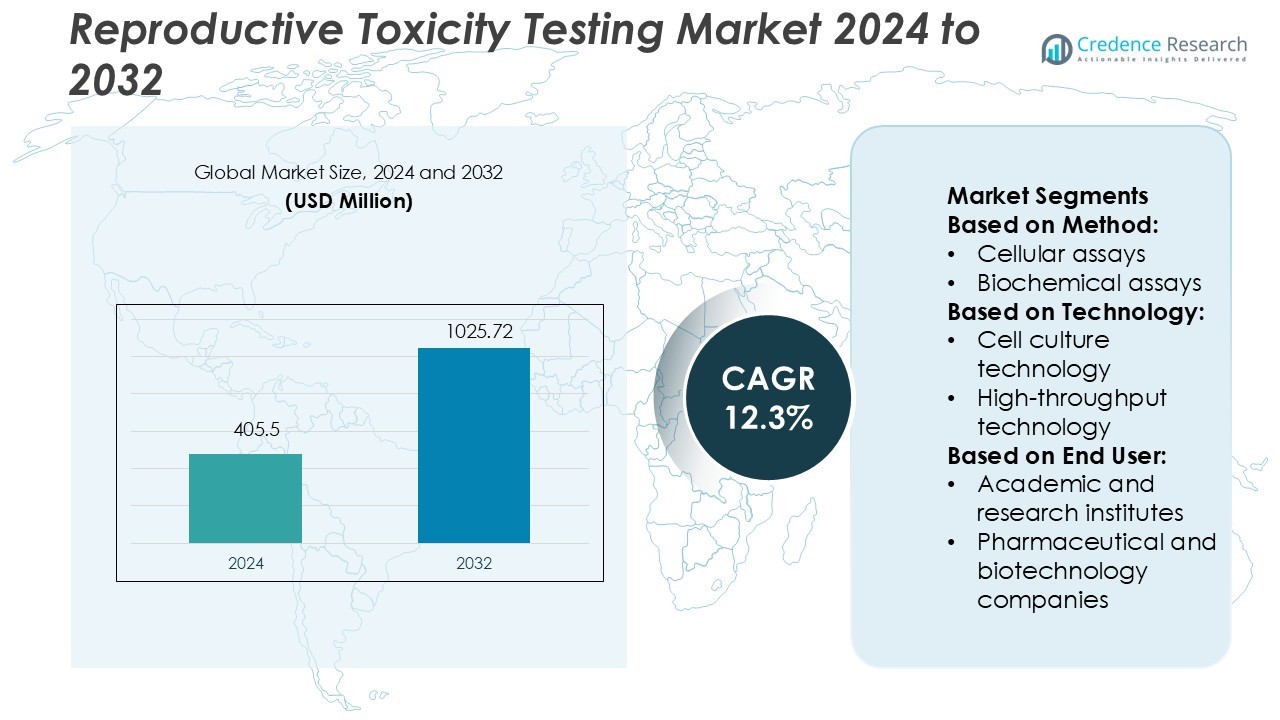

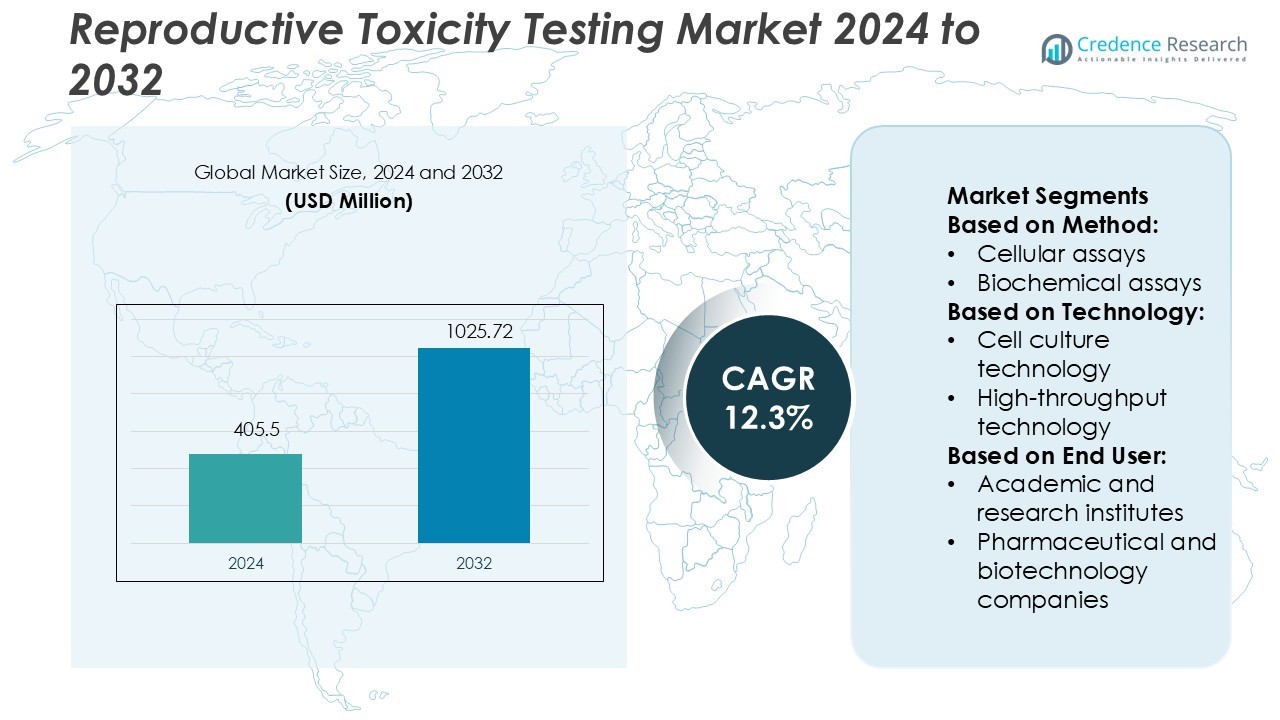

Reproductive Toxicity Testing Market size was valued USD 405.5 million in 2024 and is anticipated to reach USD 1025.72 million by 2032, at a CAGR of 12.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Reproductive Toxicity Testing Market Size 2024 |

USD 405.5 Million |

| Reproductive Toxicity Testing Market, CAGR |

12.3% |

| Reproductive Toxicity Testing Market Size 2032 |

USD 1025.72 Million |

The reproductive toxicity testing market is shaped by major players such as Eurofins Scientific, Inotiv Inc, Gentronix Ltd, Creative Bioarray, Syngene International Limited, Thermo Fisher Scientific, Jubilant Life Sciences Limited, MB Research Laboratories, Laboratory Corporation of America Holdings, and Charles River Laboratories International. These companies focus on expanding their testing portfolios through advanced in-vitro, in-silico, and toxicogenomic technologies to meet rising regulatory standards. North America leads the global market with a 38% market share, supported by strong R&D investments, advanced laboratory infrastructure, and strict regulatory frameworks. Strategic partnerships, technological innovation, and expansion of service capabilities are strengthening the competitive edge of these top players and driving global market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The reproductive toxicity testing market was valued at USD 405.5 million in 2024 and is projected to reach USD 1025.72 million by 2032, growing at a CAGR of 12.3%.

- Strong regulatory support and rising adoption of alternative testing methods are driving global demand, with advanced in-vitro and in-silico models gaining wider acceptance.

- North America holds the leading position with a 38% share, followed by Europe at 29% and Asia Pacific at 21%, supported by growing R&D investments and expanding CRO presence.

- Key players focus on technological innovation, toxicogenomics, and strategic collaborations to strengthen market position and service capabilities.

- High implementation costs and lack of global testing standardization remain key restraints, while rising demand from pharmaceutical, cosmetics, and chemical industries fuels strong growth potential.

Market Segmentation Analysis:

By Method

Cellular assays hold the largest market share in the reproductive toxicity testing segment. Their dominance stems from their accuracy in detecting developmental and reproductive toxicants at the cellular level. The growing use of human and animal cell lines improves the predictive value of in-vitro studies. These assays offer high sensitivity and reduce the need for animal testing, aligning with ethical research standards. Demand is further supported by regulatory bodies encouraging alternative testing methods. Biochemical assays, in-silico, and ex-vivo models are gaining traction but remain secondary segments in terms of adoption.

- For instance, Inotiv Inc. has developed a dedicated “Cell and Molecular Biology” service line that supports in vitro cell-based assays including Caco-2, MDCK and other transporter assays for human and animal origins.

By Technology

Cell culture technology dominates the technology segment, driven by its strong compatibility with advanced in-vitro methods. This approach allows controlled testing conditions and consistent data generation, making it a preferred choice for regulatory and preclinical studies. The rise in 3D culture models enhances the physiological relevance of results. High-throughput technology follows closely, supported by the need for faster and cost-effective screening of multiple compounds. Toxicogenomics is expanding steadily with the growing integration of molecular data into toxicity assessment workflows.

- For instance, Creative Bioarray offers over 2,000 human and animal primary cell lines spanning 17 species for high-fidelity research. This broad cell-line collection supports controlled testing conditions and consistent data generation.

By End-user

Pharmaceutical and biotechnology companies account for the largest market share among end users. These companies heavily invest in reproductive toxicity testing to meet regulatory compliance and reduce late-stage clinical failures. Their extensive use of in-vitro and computational models accelerates drug discovery and safety evaluations. Academic and research institutes contribute significantly to innovation but operate at smaller scales. Contract research organizations support the industry through outsourcing services, while other end users represent a minor share of the overall market.

Key Growth Drivers

Rising Adoption of Alternative Testing Methods

The increasing focus on non-animal testing methods is driving market growth. Regulatory agencies and research institutions support in-vitro and in-silico models for faster, cost-efficient, and ethical testing. These approaches provide high reproducibility and help meet global regulatory standards for reproductive safety. Pharmaceutical and chemical industries are investing in advanced cellular and biochemical assays to reduce reliance on animal models. This shift is expanding commercial opportunities for test developers and contract research organizations.

- For instance, Jubilant’s CRO arm (Jubilant Biosys Limited) opened a new Chemistry Innovation Research Center (CIRC) at Greater Noida with capacity for 500 full-time equivalents (FTEs) to support expanded in-vitro ADME and biology services.

Strengthening Regulatory Frameworks

Global regulatory bodies are tightening guidelines on reproductive safety assessments. Regulatory frameworks from the U.S. FDA, OECD, and European Chemicals Agency encourage standardized reproductive toxicity testing protocols. This has increased demand for reliable, validated, and scalable testing methods across industries. Companies in pharmaceuticals, biotechnology, and chemicals are enhancing compliance capabilities to meet these requirements. This trend is pushing laboratories to adopt automated and high-throughput technologies to ensure faster reporting and improved accuracy.

- For instance, Charles River Laboratories (CRL) develops and utilizes advanced humanized in vitro platforms, such as 3D tumoroids and assays using human primary cells, to accelerate target identification in drug discovery.

Expanding R&D in Drug Development and Toxicology

The rising R&D spending by pharmaceutical and biotechnology firms supports wider use of reproductive toxicity testing. Drug developers integrate advanced toxicogenomics and cell culture technologies during early-stage development to predict potential reproductive risks. This proactive approach improves decision-making and reduces costly late-stage failures. Academic institutions and CROs are also collaborating to create predictive models. Such partnerships foster the development of precise and scalable testing solutions.

Key Trends & Opportunities

Integration of High-Throughput and AI-Driven Technologies

Automation and artificial intelligence are transforming reproductive toxicity testing. High-throughput platforms allow simultaneous analysis of multiple samples, reducing testing time. AI tools enhance predictive accuracy by analyzing complex data patterns from toxicology studies. Companies integrating these technologies can offer faster and more reliable test outcomes. This creates opportunities for service providers and technology vendors.

- For instance, SGS announced the expansion of its biopharmaceutical testing centre in Lincolnshire, Illinois, with a 60,000 square-foot facility, adding new instrumentation for cell-bank safety assessment, method development/validation, and finalproduct release.

Growing Demand from Cosmetic and Chemical Industries

Non-animal testing models are gaining traction in cosmetics and chemical safety assessments. Global bans on animal testing for cosmetics have accelerated this demand. Advanced in-vitro and ex-vivo models provide cost-effective, rapid, and ethical solutions. Companies in these industries are adopting these methods to comply with international regulatory requirements. This trend offers a major growth opportunity for specialized testing solution providers.

- For instance, Bio-Rad’s QX700 series instruments support seven-colour multiplexing, process over 700 samples per day, and include a “continuous loading” capability.

Strategic Collaborations and Funding Support

Public-private partnerships and funding initiatives are fueling innovation in reproductive toxicity testing. Governments and NGOs are funding projects to develop validated alternative testing methods. Industry players are forming strategic collaborations with research institutes to accelerate test development. This ecosystem is driving new product launches and expanding the application scope across industries.

Key Challenges

High Initial Investment and Technology Costs

The adoption of advanced testing technologies requires significant investment. High-throughput screening platforms, AI systems, and automated equipment involve high setup and maintenance costs. Small and medium laboratories may face budget constraints in adopting these solutions. This cost barrier limits technology penetration in low- and middle-income countries.

Lack of Standardization Across Testing Methods

A major challenge is the lack of harmonized protocols across different testing platforms. Variability in methods and data interpretation reduces the reliability and regulatory acceptance of results. This inconsistency affects global market adoption and slows validation of new testing models. Standardization is essential to ensure accuracy, reproducibility, and global compliance.

Regional Analysis

North America

North America holds a 38% market share in the reproductive toxicity testing market, driven by strong regulatory frameworks and advanced research infrastructure. The U.S. leads the region with high investments from pharmaceutical and biotechnology companies. The presence of key CROs and strict FDA guidelines accelerates the adoption of non-animal testing models. Advanced technologies such as toxicogenomics and high-throughput screening are widely used in preclinical research. Canada contributes through academic research collaborations and government funding. High awareness of reproductive safety and ethical testing practices further supports steady market expansion across industries in this region.

Europe

Europe accounts for a 29% market share, supported by stringent EU regulations and the REACH framework. Countries like Germany, France, and the U.K. lead with strong investment in in-vitro and in-silico testing. The region is a pioneer in animal testing bans, which drives adoption of advanced alternative models. Academic and government-funded research initiatives enhance innovation in reproductive toxicity testing. Strategic collaborations between industry players and research institutes foster technology standardization. The growing cosmetics and chemical industry compliance with EU safety directives strengthens demand for validated and reproducible testing solutions in the European market.

Asia Pacific

Asia Pacific captures a 21% market share, reflecting rapid growth supported by increasing pharmaceutical R&D spending. China, Japan, and India are key contributors due to expanding drug development activities and CRO presence. Governments in the region are investing in modern laboratory infrastructure and encouraging regulatory harmonization. Cost-effective testing solutions attract global outsourcing from Western markets. The rising focus on non-animal testing methods and growing collaborations with global biotech firms strengthen the market position. Expanding biotechnology clusters and supportive policy frameworks are enabling faster adoption of toxicogenomics and AI-based testing platforms.

Latin America

Latin America holds a 7% market share, supported by improving research infrastructure and regulatory advancements. Brazil and Mexico lead with growing pharmaceutical manufacturing and safety testing initiatives. Government agencies are aligning regulations with international reproductive toxicity standards to attract foreign investments. The region’s cost-effective operational environment encourages outsourcing of preclinical testing. Academic partnerships are expanding, supporting innovation and workforce development. Although adoption of advanced technologies is slower than in developed markets, rising demand from the cosmetics and chemical sectors is creating opportunities for market expansion in the coming years.

Middle East & Africa

The Middle East & Africa region represents a 5% market share, with growth mainly driven by healthcare modernization and increasing focus on clinical research. Countries like the UAE, Saudi Arabia, and South Africa are investing in research infrastructure and toxicology testing capabilities. Growing interest from multinational pharmaceutical companies is boosting local collaborations and CRO development. However, limited skilled workforce and low awareness of alternative testing methods remain challenges. Regulatory improvements and investments in advanced technologies are expected to accelerate adoption, particularly in high-income Gulf countries aiming to diversify their biomedical research capabilities.

Market Segmentations:

By Method:

- Cellular assays

- Biochemical assays

By Technology:

- Cell culture technology

- High-throughput technology

By End User:

- Academic and research institutes

- Pharmaceutical and biotechnology companies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the reproductive toxicity testing market features prominent players such as Eurofins Scientific, Inotiv Inc, Gentronix Ltd, Creative Bioarray, Syngene International Limited, Thermo Fisher Scientific, Jubilant Life Sciences Limited, MB Research Laboratories, Laboratory Corporation of America Holdings, and Charles River Laboratories International. The reproductive toxicity testing market is shaped by increasing technological innovation, regulatory alignment, and strategic expansion. Leading service providers focus on enhancing testing accuracy through advanced in-vitro, in-silico, and toxicogenomic approaches. High-throughput platforms and AI-driven analytics are enabling faster data interpretation and predictive modeling. Many companies are investing in R&D infrastructure and forming partnerships with pharmaceutical and biotechnology firms to strengthen their service capabilities. Global expansion through new facilities, strategic collaborations, and acquisitions is common. Strong emphasis on compliance, ethical testing, and cost efficiency helps maintain a competitive edge in this growing market.

Key Player Analysis

- Eurofins Scientific

- Inotiv Inc

- Gentronix Ltd

- Creative Bioarray

- Syngene International Limited

- Thermo Fisher Scientific

- Jubilant Life Sciences Limited

- MB Research Laboratories

- Laboratory Corporation of America Holdings

- Charles River Laboratories International

Recent Developments

- In December 2024, Case Western Reserve University’s Begun Center for Violence Prevention Research and Education collaborated with the Cuyahoga County Medical Examiner’s Office (CCMEO) to introduce the pilot program made to restrain fatal overdose trends.

- In November 2024, Manchester venue The Warehouse Project and London superclub DRUMSHEDS launched the new year-round drug testing programs. The initiative is taken by Loop, the UK drug checking and harm reduction charity, which is responsible for analyzing all services at both venues beginning this autumn.

- In October 2024, Kingston University partnered with the specialist laboratory service to introduce a high-specification toxicology testing facility for supporting the work of coroners and pathologists across Whales and England.

- In May 2023, Charles River Labs to utilize RightSource, a flexible biologic testing lab, at its Oklahoma City facility. This partnership aimed to enhance Wheeler Bio’s quality control without the need to establish its own lab, ultimately benefiting its biologic products and potential clients.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Method, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for non-animal testing methods will continue to rise across major industries.

- Advanced in-vitro and in-silico models will gain stronger regulatory acceptance.

- AI and machine learning will enhance predictive accuracy in toxicity assessments.

- High-throughput screening platforms will become more accessible to CROs and research labs.

- Strategic collaborations will increase between industry players and academic institutions.

- Emerging markets will witness stronger investments in laboratory infrastructure.

- Standardized global testing protocols will improve cross-border regulatory compliance.

- R&D spending will expand to support innovative reproductive safety solutions.

- Ethical and sustainable testing practices will drive industry-wide adoption.

- Integrated digital platforms will streamline workflows and reduce testing time.