Market Overview

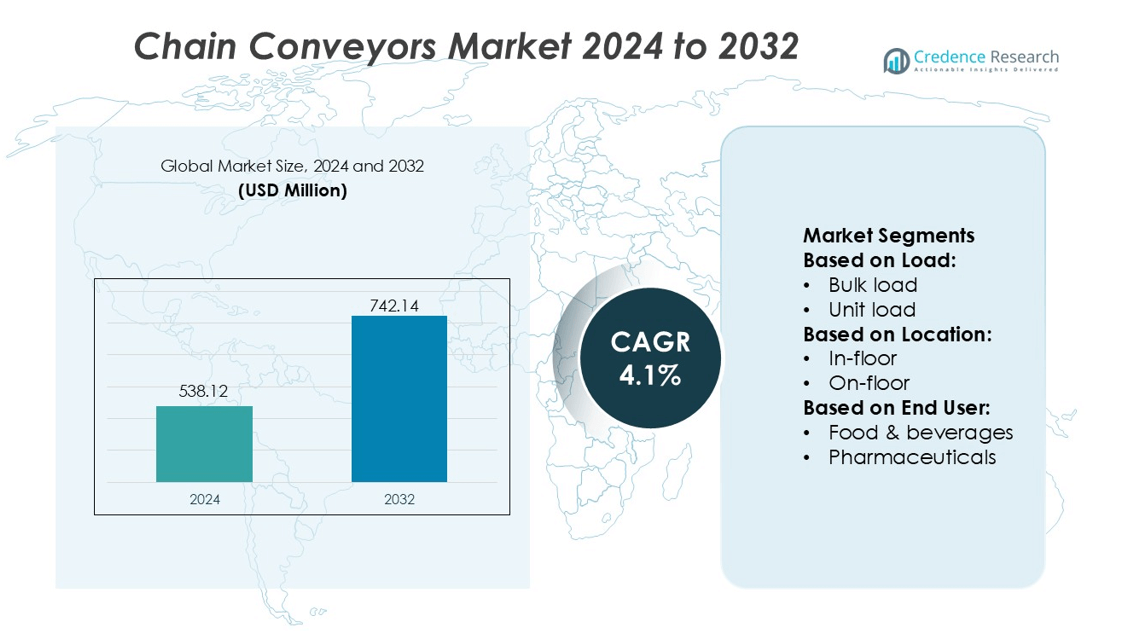

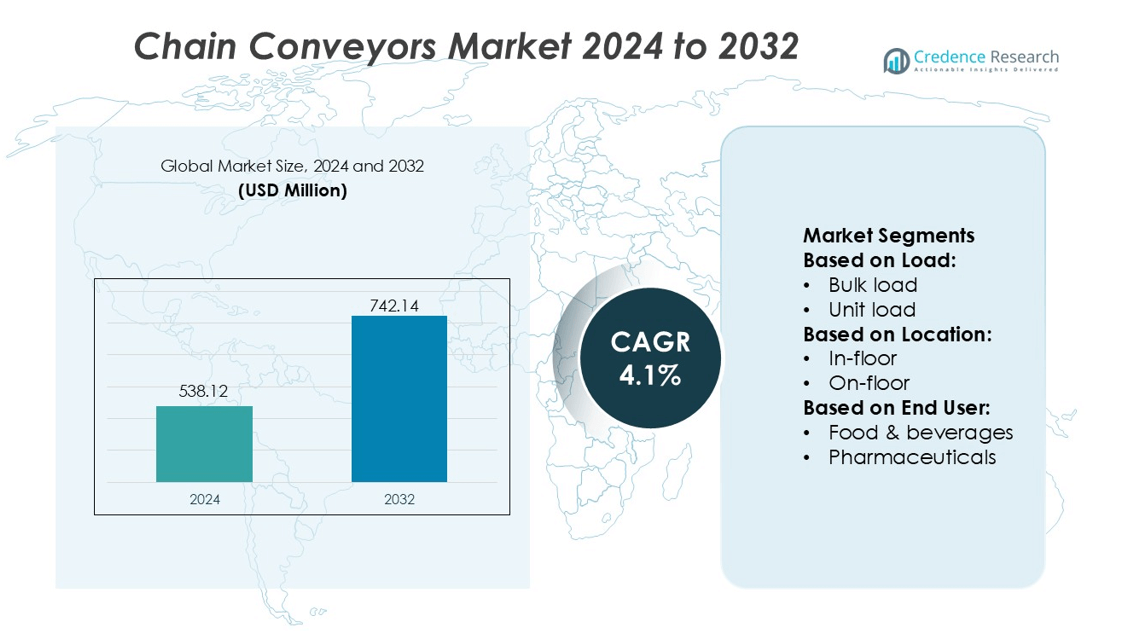

Chain Conveyors Market size was valued USD 538.12 million in 2024 and is anticipated to reach USD 742.14 million by 2032, at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chain Conveyors Market Size 2024 |

USD 538.12 million |

| Chain Conveyors Market, CAGR |

4.1% |

| Chain Conveyors Market Size 2032 |

USD 742.14 million |

The chain conveyors market is dominated by leading companies such as Hytrol Conveyor Company, Inc., Fives, Daifuku Co., Ltd., Interroll Group, Honeywell International Inc, BEUMER Group, Regal Rexnord Corporation, FlexLink, Kardex, and Dematic. These players focus on innovation, automation, and customized solutions to meet diverse industrial requirements across manufacturing, food processing, logistics, and e-commerce sectors. High-speed, durable, and energy-efficient systems, combined with IoT integration and predictive maintenance, strengthen their competitive positioning. Asia-Pacific emerges as the leading region, holding 35% of the global market share, driven by rapid industrialization, expanding e-commerce, and growing warehouse infrastructure in China, India, and Southeast Asia. The region’s adoption of smart conveyors and high-capacity systems further reinforces its dominance, while global players continue investing in technology upgrades, regional expansions, and partnerships to capitalize on increasing demand in industrial and logistics applications.

Market Insights

- The chain conveyors market was valued at USD 538.12 million in 2024 and is expected to reach USD 742.14 million by 2032, growing at a CAGR of 4.1% during the forecast period.

- Demand is driven by increasing industrial automation, e-commerce growth, and the need for efficient material handling across manufacturing, food processing, and logistics sectors.

- High-speed, durable, and energy-efficient systems with IoT integration and predictive maintenance are emerging trends, improving operational efficiency and reducing downtime.

- The market is highly competitive, led by Hytrol Conveyor Company, Inc., Fives, Daifuku Co., Ltd., Interroll Group, Honeywell International Inc, BEUMER Group, Regal Rexnord Corporation, FlexLink, Kardex, and Dematic, who focus on innovation, regional expansions, and customized solutions.

- Asia-Pacific holds 35% of the market share, supported by China, India, and Southeast Asia, while Europe and North America follow. Modular on-floor and overhead conveyors dominate the market segments, catering to high-capacity industrial and warehouse operations.Top of Form

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Load

The bulk‑load segment leads the chain conveyors market with a 42.5 % share. This dominance stems from the systems’ strength in handling heavy, abrasive or loose materials — key in mining, cement and large‑scale manufacturing environments. Demand grows as operators invest in robust chain systems with reinforced chains, wear‑resistant linings and modular designs to minimize material loss and downtime.

- For instance, Hytrol Model 190-E24EZ zero-pressure accumulating live roller conveyor supports a maximum unit load of 75 lbs (pounds) per zone and a maximum distributed load of 37 lbs per foot of conveyor length.

By Location

The on‑floor segment holds the largest share (exceeding 48 %) in the chain conveyors market. On‑floor installations dominate because they are cost‑efficient, easier to install and scale, and integrate well with existing manufacturing layouts. Growth is driven by manufacturers seeking flexible, high‑throughput material flow solutions that require minimal structural alteration.

- For instance, Fives’ EASY‑Stream belt conveyor system handles loads up to 80 kg and reaches belt speeds of 180 m/min, enabling rapid material flow across factory floors.

By End‑User

The food & beverages end‑user segment accounts for around 27.5 % of the chain conveyors market. Its lead is supported by highly automated processing and strict hygiene requirements, pushing demand for corrosion‑resistant, easy‑clean chain systems. Another major driver is the rise in e‑commerce and fast‑turn packaging lines, which amplify need for efficient conveyor integration across ingredients, packing and sorting stages.

Key Growth Drivers

Increasing Industrial Automation

Rising adoption of industrial automation drives demand for chain conveyors across manufacturing sectors. Automated systems enhance material handling efficiency, reduce labor costs, and minimize human error. Industries such as automotive, food processing, and pharmaceuticals integrate conveyor systems for faster production cycles and consistent output quality. For instance, automotive assembly plants use chain conveyors with precise motorized controls to transport heavy components, improving throughput by up to 25% while reducing manual handling risks. This trend fuels investments in high-speed, durable, and programmable chain conveyor solutions globally.

- For instance, Daifuku’s “Unibilt Power & Free” overhead chain conveyor supports loads up to 3,000 lb (1,361 kg) per trolley in its four‑trolley load bar configuration.

Growing E-commerce and Warehousing Needs

Expansion of e-commerce and warehouse operations boosts the chain conveyors market. High-volume order fulfillment requires seamless transportation of goods across distribution centers, reducing turnaround time. Chain conveyors enable efficient sorting, loading, and storage of heavy pallets and products, enhancing logistics efficiency. For instance, leading e-commerce warehouses employ overhead and on-floor chain conveyors capable of handling 1,500–2,000 kg pallets per hour, optimizing space utilization and labor allocation. This rising demand in logistics and retail sectors underpins market growth across regions.

- For instance, Interroll’s Chain Conveyor PM 9720 is available in dual- or triple-chain run versions and supports a maximum distributed load capacity of 1,875 kg per meter of conveyor length.

Demand for Durable and Customized Solutions

Manufacturers increasingly seek durable, customizable chain conveyors to meet specific operational needs. Heavy-duty chains, corrosion-resistant materials, and modular designs ensure long service life in harsh industrial environments. For instance, food processing plants adopt stainless steel conveyors with adjustable pitch chains to handle high-moisture products without contamination, enhancing hygiene and operational efficiency. Customizable conveyor layouts allow seamless integration with existing production lines, reducing downtime. This focus on performance, longevity, and flexibility drives adoption across manufacturing, mining, and automotive industries worldwide.

Key Trends & Opportunities

Integration of Smart Technologies

Chain conveyors increasingly incorporate IoT sensors, automated monitoring, and predictive maintenance tools. Smart conveyors provide real-time data on load, speed, and system health, enabling proactive maintenance and minimizing downtime. For instance, pharmaceutical facilities use chain conveyors equipped with vibration sensors and load detectors to anticipate component wear, reducing service interruptions by 20%. The integration of digital monitoring and automation offers growth opportunities for suppliers offering advanced, connected conveyor systems across industrial applications.

- For instance, Rexnord 1533 Series MatTop® chain features an 8 mm transfer gap, which the company advertises as among the smallest on the market. It also supports approximately 4,600 rollers per square meter, offering improved product stability and safety during conveyance.

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East present significant growth opportunities. Rapid industrialization, rising manufacturing output, and infrastructure expansion drive chain conveyor adoption in automotive, food, and logistics sectors. For instance, Southeast Asian manufacturing hubs implement modular on-floor chain conveyors handling up to 3,000 kg per hour, improving efficiency in high-volume operations. Expanding industrial parks and logistics networks create avenues for local and international suppliers to penetrate untapped markets and establish long-term contracts.

- For instance, FlexLink’s modular plastic chain conveyor system X300X supports a maximum individual item load of approximately 15 kg. The system is rated for a maximum total weight of 200 kg across the entire conveyor length, and is capable of running speeds up to 80,000 mm/min (approximately 1,333 mm/s or 80 m/min).

Key Challenges

High Initial Capital Investment

The upfront cost of chain conveyor systems poses a challenge, especially for small and medium enterprises. Installation, customization, and integration with existing production lines require significant capital outlay. For instance, installing an overhead chain conveyor system in a medium-scale automotive plant may cost several hundred thousand dollars, limiting adoption among budget-constrained manufacturers. Companies must weigh long-term efficiency gains against high initial investment, slowing adoption rates in price-sensitive segments despite operational benefits.

Maintenance and Operational Downtime

Chain conveyors require regular maintenance to prevent mechanical failures, chain wear, and motor breakdowns, impacting operational continuity. Unexpected downtime can disrupt production schedules and increase maintenance costs. For instance, food processing facilities using high-capacity chain conveyors experience up to 8–10 hours of annual downtime due to chain tension adjustments or motor replacement. This operational vulnerability necessitates skilled maintenance staff and increases total cost of ownership, presenting a barrier to market expansion.

Regional Analysis

North America

North America holds 30% of the global chain conveyors market, driven by its advanced industrial base and strong logistics infrastructure. Automotive, food processing, and e-commerce industries increasingly rely on chain conveyors to improve production efficiency and reduce manual labor. Companies in the United States and Canada are adopting modular, high-speed conveyor systems with automated controls to optimize material handling and minimize downtime. Integration of smart sensors and predictive maintenance enhances operational reliability. The region’s mature manufacturing sector and focus on Industry 4.0 solutions continue to support steady growth and high demand for advanced conveyor systems.

Europe

Europe accounts for approximately 25% of the chain conveyors market, with Germany, France, and the UK leading adoption. Growth is driven by stringent regulatory standards, automation in manufacturing, and increasing demand in automotive and food industries. Western Europe is pioneering advanced material handling solutions that include IoT-enabled conveyors and predictive maintenance systems, enhancing production efficiency and reducing downtime. Eastern Europe is gradually catching up as manufacturing investments expand into countries like Poland and the Czech Republic, creating opportunities for conveyor suppliers. The combination of technological adoption and industrial modernization reinforces Europe’s strong market position.

Asia-Pacific

Asia-Pacific holds the largest share at 35% of the global chain conveyors market, supported by rapid industrialization and expanding e-commerce and warehousing sectors. China, India, and Southeast Asia are major contributors, where manufacturers deploy high-capacity, automated conveyor systems to handle large-scale production and logistics operations. Adoption of smart conveyors with sensors and automation is increasing to improve efficiency, reduce labor costs, and enable real-time monitoring. Rising investments in industrial infrastructure, manufacturing parks, and logistics hubs further drive demand. Asia-Pacific remains the fastest-growing market due to its combination of high production needs and modernization of supply chains.

Latin America

Latin America contributes around 5% of the global chain conveyors market, reflecting moderate industrial development. Brazil and Mexico lead the region in the adoption of chain conveyors, driven by warehouse expansion, manufacturing modernization, and growing e-commerce demand. Companies are investing in on-floor and overhead conveyors to improve material handling and productivity. However, economic volatility, lower automation levels, and limited infrastructure in some countries slow overall market growth. Despite these challenges, rising investments in industrial facilities and logistics centers offer opportunities for conveyor suppliers in key urban and industrial hubs across the region.

Middle East & Africa

The Middle East & Africa region holds approximately 5% of the global chain conveyors market. Growth is fueled by logistics hubs in Gulf countries, industrial projects, and demand in oil, gas, mining, and construction sectors. Manufacturers deploy heavy-duty chain conveyors for transporting bulk materials and improving operational efficiency. Adoption of automated and modular systems is increasing in industrial zones to optimize material handling. However, regional instability, low automation penetration, and infrastructure gaps limit faster expansion. Long-term opportunities exist as investments in industrial and logistics projects increase across Africa and the Middle East, supporting gradual market growth.

Market Segmentations:

By Load:

By Location:

By End User:

- Food & beverages

- Pharmaceuticals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The chain conveyors market players such as Hytrol Conveyor Company, Inc., Fives, Daifuku Co., Ltd., Interroll Group, Honeywell International Inc, BEUMER Group, Regal Rexnord Corporation, FlexLink, Kardex, and Dematic. The chain conveyors market is highly competitive, driven by continuous innovation, technological advancements, and growing demand for automation. Companies focus on developing high-speed, durable, and energy-efficient conveyor systems tailored to diverse industrial applications such as manufacturing, food processing, logistics, and e-commerce. Integration of smart sensors, IoT monitoring, and predictive maintenance enhances operational efficiency and reduces downtime. Market players also prioritize modular designs and customizable layouts to meet specific client requirements while ensuring quick installation and minimal disruption. Strategic initiatives, including regional expansion, partnerships, and after-sales support, further strengthen competitiveness. Rising emphasis on sustainability, automation, and digital solutions continues to shape the market, pushing companies to differentiate through advanced technologies, improved efficiency, and cost-effective solutions to capture growing industrial demand globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, African mine will be among the first adopters of the innovative rail-running conveyor (RRC) technology, commercialized by full flowsheet provider FLS in collaboration with the University of Newcastle, Australia.

- In April 2025, NTPC’s Pakri Barwadih coal mining project made operational a 21-kilometre-long conveyor belt system to transport coal to Hazaribag railway station. The PSU claims that the conveyor belt was Asia’s longest and significant advancement of coal transportation infrastructure.

- In July 2023, Dematic announced the global launch of its Noise Reduction Portfolio, a comprehensive solution specifically designed to address loud work environments in supply chain facilities. The service offering included essential features like before and after 3D noise mapping audits.

Report Coverage

The research report offers an in-depth analysis based on Load, Location, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of automated and smart chain conveyor systems will increase across industries.

- Integration of IoT and predictive maintenance will enhance operational efficiency and reduce downtime.

- Demand for energy-efficient and modular conveyors will grow in manufacturing and logistics sectors.

- E-commerce expansion will drive higher adoption of high-capacity conveyors in warehouses.

- Customizable conveyor solutions will gain popularity to meet specific industrial requirements.

- Emerging markets will see steady growth due to industrialization and infrastructure development.

- Focus on sustainable materials and eco-friendly designs will influence product development.

- Increased use of conveyors in food, pharmaceutical, and automotive industries will continue.

- Digital monitoring and automation technologies will become standard in new installations.

- Strategic partnerships and regional expansions will strengthen market presence globally.