Market Overview

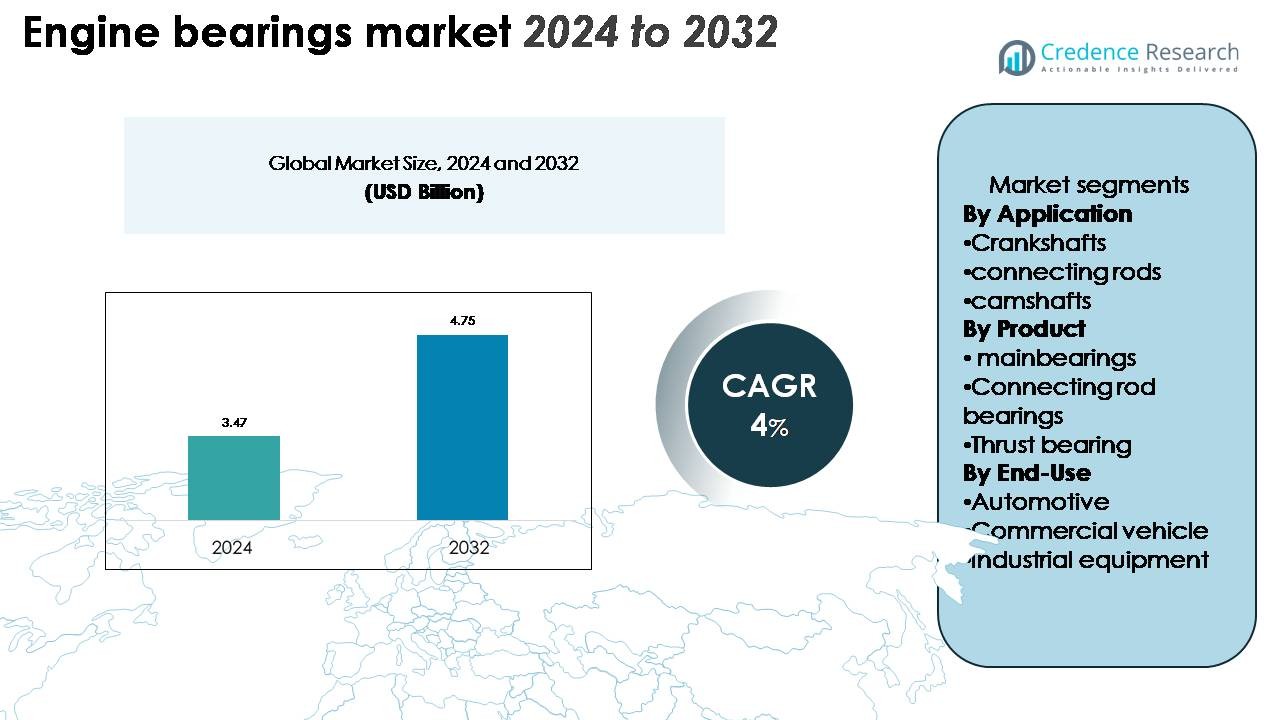

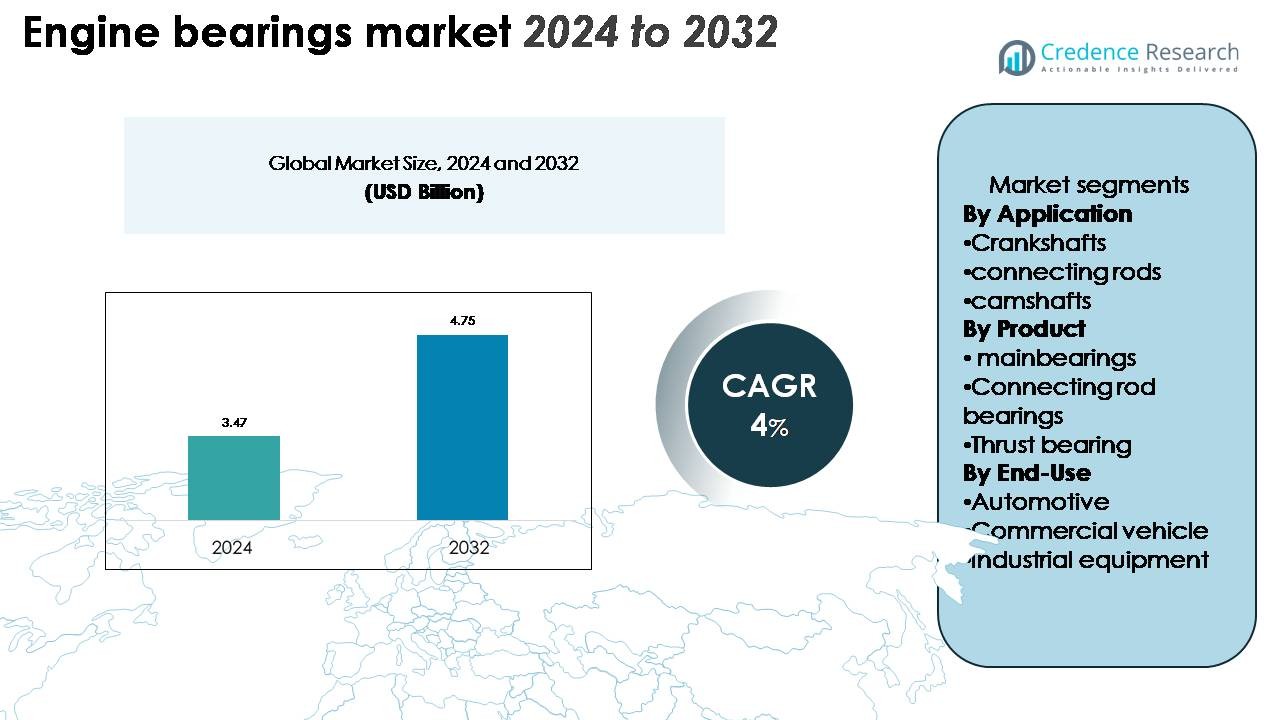

The Engine Bearings Market size was valued at USD 3.47 billion in 2024 and is projected to reach USD 4.75 billion by 2032, growing at a CAGR of 4% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Engine Bearings Market Size 2024 |

USD 3.47 Billion |

| Engine Bearings Market, CAGR |

4% |

| Engine Bearings Market Size 2032 |

USD 4.75 Billion |

The engine bearings market is led by major players such as MAHLE GmbH, SKF Group, Schaeffler AG, NTN Corporation, NSK Ltd., Daido Metal Co. Ltd., Federal-Mogul LLC, King Engine Bearings, and ACL Bearings. These companies focus on developing high-performance, wear-resistant, and lightweight bearing solutions to meet global emission and efficiency standards. Strategic R&D investments and partnerships with OEMs strengthen their market positioning across automotive and industrial applications. Asia Pacific dominates the global engine bearings market with a 38% share, followed by North America at 28% and Europe at 25%, reflecting strong manufacturing capabilities and expanding vehicle production in these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global engine bearings market was valued at USD 2.95 billion in 2024 and is projected to reach USD 3.85 billion by 2032, growing at a CAGR of 3.4% during the forecast period.

- Market growth is driven by rising automotive production, increasing aftermarket demand, and advancements in material science enhancing bearing performance and fuel efficiency.

- Key trends include the adoption of lightweight and low-friction coatings, integration of smart monitoring systems, and growing demand from hybrid and high-performance engines.

- The competitive landscape features MAHLE GmbH, Schaeffler AG, SKF Group, NTN Corporation, and Daido Metal Co. Ltd., focusing on innovation, partnerships, and eco-friendly product lines.

- Asia Pacific leads the market with a 38% share, followed by North America at 28% and Europe at 25%; crankshaft bearings remain the dominant segment with 42% share, driven by widespread application in passenger and commercial vehicles.

Market Segmentation Analysis:

By Application

Crankshafts dominate the engine bearings market with the largest share. They require bearings capable of handling high dynamic loads and rotational stress. Increasing automotive production and the rise in high-performance engines boost demand for precision-engineered crankshaft bearings. Connecting rods follow as a key segment, supporting piston motion and enhancing combustion efficiency. Meanwhile, camshaft bearings serve smaller markets but are critical for smooth valve operation in modern engines, particularly in high-speed and heavy-duty vehicles.

- For instance, SKF developed crankshaft bearings with special surface treatments that deliver improved wear resistance under high load conditions.

By Product

Main bearings hold the dominant market share due to their essential role in supporting crankshafts and ensuring stable rotation. Their high wear resistance and load-bearing capacity drive adoption across passenger and commercial vehicles. Connecting rod bearings rank second, favored for their role in reducing friction between moving components. Thrust bearings, though smaller in share, are growing steadily due to increased use in turbocharged engines where they manage axial loads efficiently, improving engine reliability and lifespan.

- For instance, Daido Metal Co., Ltd. manufactures main bearing shells with thickness as low as 3 mm that sustain compressive strength of approximately 304 MPa

Key Growth Drivers

Rising Vehicle Production and Aftermarket Demand

The steady rise in global automotive production, particularly in emerging economies, remains a primary driver for the engine bearings market. Passenger cars and commercial vehicles rely on precision bearings to maintain efficiency and performance. Growing replacement demand in the aftermarket, driven by increased vehicle lifespans and routine engine overhauls, further supports revenue growth. Manufacturers are focusing on cost-effective solutions using composite materials that extend bearing life and reduce friction losses. Countries such as India, China, and Mexico are witnessing strong growth in vehicle manufacturing, boosting OEM and aftermarket sales simultaneously.

- For instance, China recorded vehicle production of 30.161 million units in 2023, supporting strong OEM demand for precision crankshaft and main bearings.

Advancements in Bearing Materials and Coatings

Innovations in bearing materials, including copper-lead alloys, aluminum-tin, and polymer composites, enhance wear resistance and reduce engine friction. Advanced coatings such as diamond-like carbon (DLC) and polymer overlays are increasingly used to withstand higher loads and improve lubrication efficiency. These developments extend bearing lifespan and optimize energy performance, supporting compliance with stricter emission regulations. For instance, major bearing manufacturers have introduced eco-friendly coatings to meet Euro 6 and EPA standards. The ongoing push for enhanced durability and lightweight components continues to drive R&D investment in this sector.

- For instance, SKF Group’s DLC-based coating “NoWear®” achieves a hardness of approximately 1,200 HV on a bearing surface, compared with 650–850 HV for standard bearing steel.

Growing Adoption of Hybrid and High-Performance Engines

The increasing adoption of hybrid vehicles and high-performance engines has created demand for advanced bearing designs that can handle higher pressures and temperatures. Hybrid engines operate under variable load conditions, requiring bearings with superior fatigue resistance and thermal stability. Performance-focused vehicles also depend on low-friction bearings to deliver consistent torque and efficiency. Manufacturers are developing precision-engineered products using adaptive surface textures and improved lubrication systems to meet these demands. As automotive OEMs shift toward hybrid powertrains, specialized bearings are becoming integral to optimizing energy transfer and mechanical reliability.

Key Trends & Opportunities

Integration of Smart Monitoring Systems

Digitalization and IoT integration present new opportunities for predictive maintenance in the engine bearings market. Smart bearing systems equipped with sensors can track temperature, vibration, and load in real time, reducing unexpected breakdowns. These systems enhance operational safety and extend component lifespan. Automotive and industrial sectors are investing in connected maintenance solutions to minimize downtime. The integration of such systems aligns with the Industry 4.0 trend, enabling data-driven decision-making. This technological shift allows bearing manufacturers to offer value-added products with embedded intelligence, driving long-term growth opportunities.

- For instance, the Schaeffler Technologies AG & Co. KG’s SmartCheck system monitors vibration and temperature; its vibration sensor has a high measurement resolution of 24 bits and measures metrics like acceleration and velocity in user-defined frequency ranges, while the integrated temperature sensor has a measurement range of -20 to +70 °C (or -20 to +85 °C depending on the specific model).

Expansion in Electric and Hybrid Powertrains

While traditional ICE applications dominate, electrification trends are opening new opportunities for customized bearing designs. Electric and hybrid powertrains require bearings with superior precision, reduced noise, and lower friction coefficients. Lightweight and compact bearing assemblies improve overall energy efficiency, aligning with vehicle emission targets. Manufacturers are expanding R&D efforts to develop specialized bearings suitable for electric drivetrains and thermal management systems. As governments tighten emission norms and promote EV adoption, this transition will reshape material innovation and product portfolios within the bearing industry.

- For instance, SKF Group offers hybrid ceramic bearings combining steel rings with silicon-nitride rolling elements, enabling speeds up to approximately 25% higher than standard steel bearings in EV motors

Key Challenges

Rising Raw Material Costs and Supply Chain Instability

Fluctuations in raw material prices, particularly copper, steel, and aluminum, pose a major challenge for bearing manufacturers. Increased costs impact production margins and force manufacturers to explore alternative materials. Supply chain disruptions caused by geopolitical tensions and global logistics issues have further increased procurement uncertainty. These factors affect both OEM and aftermarket segments, leading to longer lead times and higher operational costs. Maintaining profitability while ensuring quality and consistency in bearing production has become increasingly difficult in such volatile conditions.

Shift Toward Electric Vehicles (EVs)

The global transition toward electric vehicles presents a long-term challenge for the engine bearings market. EVs have fewer moving components and do not require traditional crankshaft or connecting rod bearings used in ICE engines. This shift could significantly reduce demand in the automotive segment over time. Manufacturers are now diversifying into bearings for electric motors, wheel hubs, and transmission systems to mitigate this impact. However, adapting to the EV ecosystem requires heavy investment in new designs, manufacturing technologies, and partnerships with EV OEMs to maintain competitiveness in the evolving mobility landscape.

Regional Analysis

North America

North America holds a 28% share of the global engine bearings market, driven by strong automotive manufacturing and a well-established aftermarket sector. The U.S. and Canada lead regional growth, supported by rising demand for commercial vehicles and performance-oriented engines. Stringent emission norms encourage the adoption of low-friction, durable bearing materials. Leading manufacturers invest in R&D to enhance coating technologies and efficiency. The presence of key OEMs, such as General Motors and Ford, sustains demand for high-quality bearings in internal combustion and hybrid powertrains, ensuring consistent market expansion through the forecast period.

Europe

Europe accounts for 25% of the global engine bearings market, supported by advanced automotive engineering and stringent emission regulations. Germany, France, and the U.K. dominate due to established OEMs like BMW, Volkswagen, and Renault. The region’s focus on lightweight, low-emission vehicles boosts demand for precision bearings. Manufacturers invest in eco-friendly materials and advanced surface treatments to comply with EU standards. The shift toward hybrid powertrains creates new opportunities for high-performance and thermal-resistant bearings, while ongoing innovation in electric mobility moderates long-term dependence on internal combustion engine components.

Asia Pacific

Asia Pacific leads the global engine bearings market with a dominant 38% share, driven by rapid industrialization and expanding automotive production. China, India, Japan, and South Korea serve as major manufacturing hubs for both OEM and aftermarket bearings. Rising vehicle ownership, coupled with strong commercial vehicle demand, supports market growth. Regional players invest in cost-efficient production technologies and material innovation to meet international standards. Government initiatives promoting fuel efficiency and emission reduction also drive adoption of advanced bearing designs, positioning Asia Pacific as the central growth engine of the global market.

Latin America

Latin America holds a 5% share of the global engine bearings market, supported by growing vehicle production in Brazil, Mexico, and Argentina. The region benefits from increasing domestic manufacturing and automotive export activities. Demand for aftermarket bearings continues to rise due to aging vehicle fleets and expanding service networks. However, economic fluctuations and limited technological integration among local manufacturers slightly constrain market growth. Global suppliers are forming partnerships with regional distributors to strengthen supply chains and offer advanced bearing solutions that meet international performance and emission standards.

Middle East & Africa

The Middle East & Africa region captures a 4% share of the global engine bearings market, with demand driven primarily by the commercial vehicle and industrial sectors. Countries such as Saudi Arabia, the UAE, and South Africa are key markets, supported by infrastructure projects and logistics expansion. Growth in the aftermarket segment is fueled by extended vehicle lifespans and import reliance for replacement parts. Although the adoption of advanced bearing technologies remains limited, foreign investments and expanding regional assembly plants are expected to boost long-term market opportunities across this region.

Market Segmentations:

By Application

· Crankshafts

- connecting rods

- camshafts

By Product

- Main bearings

- Connecting rod bearings

- Thrust bearing

By End-Use

- Automotive

- Commercial vehicle

- Industrial equipment

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The engine bearings market is highly competitive, featuring global players such as MAHLE GmbH, SKF Group, Schaeffler AG, Daido Metal Co. Ltd., NTN Corporation, NSK Ltd., Federal-Mogul LLC, and King Engine Bearings. These companies focus on continuous innovation, advanced materials, and precision manufacturing to enhance durability and reduce friction losses. Strategic collaborations with automotive OEMs strengthen their global presence, while R&D efforts target lightweight alloys and eco-friendly coatings to meet emission standards. For instance, MAHLE and Schaeffler invest heavily in polymer-coated and lead-free bearings for hybrid engines. Regional manufacturers in Asia Pacific emphasize cost-efficient production, catering to aftermarket demand. Meanwhile, North American and European firms leverage technological expertise and long-term supply contracts to maintain dominance. The industry also witnesses increasing automation, digital inspection, and data-driven design integration, allowing manufacturers to improve quality consistency and efficiency in large-scale bearing production across diverse engine applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Schaeffler Technologies AG & Co. KG

- NSK Ltd.

- KS Kolbenschmidt GmbH

- King Engine Bearing, Inc.

- JTEKT Corporation

- MAHLE Aftermarket GmbH

- Hartford Technologies, Inc.

- Daido Metal Co., Ltd.

- Menon Bearings Ltd.

- ACL Race Series Performance Engine Bearing

Recent Developments

- In March 2023, NSK innovated a novel method for predicting the lifespan of steel rolling bearings. This approach relies on statistical data derived from ultrasonic testing of non-metallic inclusions in the steel, providing a more advanced and accurate means of assessing bearing longevity.

- In August 2022, Hartford Technologies inaugurated a new facility in Connecticut as part of its strategic expansion to enhance both service and product offerings.

Report Coverage

The research report offers an in-depth analysis based on Application, Product, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth driven by increased vehicle production and industrial applications.

- Advancements in bearing materials and coatings will enhance performance and durability.

- Hybrid and high-performance engine adoption will boost demand for precision-engineered bearings.

- Lightweight and eco-friendly materials will become central to product innovation.

- Digital monitoring and predictive maintenance technologies will improve operational efficiency.

- Expansion of the aftermarket sector will create long-term revenue opportunities.

- Asia Pacific will continue leading due to strong automotive manufacturing and exports.

- Electric vehicle growth will drive diversification toward e-motor and transmission bearings.

- Strategic partnerships between OEMs and bearing suppliers will strengthen supply chain resilience.

- Manufacturers will invest in automation and R&D to meet evolving emission and efficiency standards.