Market Overview

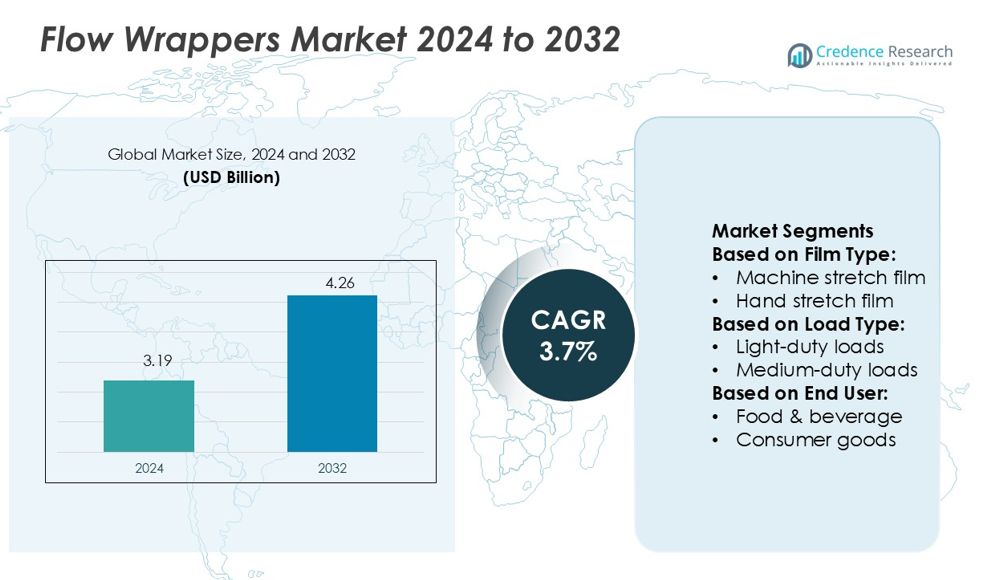

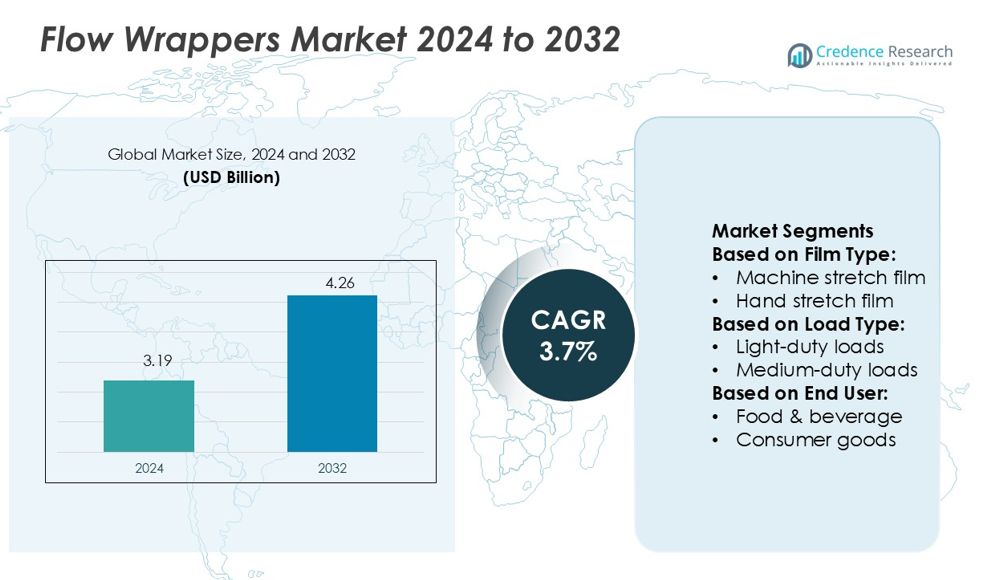

Flow Wrappers Market size was valued USD 3.19 billion in 2024 and is anticipated to reach USD 4.26 billion by 2032, at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flow Wrappers Market Size 2024 |

USD 3.19 billion |

| Flow Wrappers Market, CAGR |

3.7% |

| Flow Wrappers Market Size 2032 |

USD 4.26 billion |

The Flow Wrappers Market is driven by prominent players such as MesPack, Fuji Machinery, PAC Machinery, IMA Group, MULTIVAC Group, Ilapak International, Hayssen Flexible Systems, Gebo Cermex, Nichrome India, and Matrix Packaging Machinery. These companies focus on advanced automation, energy-efficient technologies, and sustainable packaging solutions to strengthen their global market positions. North America leads the market with a 34.2% share in 2024, supported by strong food processing industries, rapid e-commerce expansion, and high adoption of automated wrapping systems. The region’s well-established manufacturing infrastructure and focus on recyclable materials further reinforce its leadership in the global market.

Market Insights

- The Flow Wrappers Market was valued at USD 3.19 billion in 2024 and is expected to reach USD 4.26 billion by 2032, growing at a CAGR of 3.7%.

- Market growth is driven by increasing automation in food, beverage, and logistics sectors, along with rising demand for efficient, sustainable packaging solutions.

- Advanced automation, smart technologies, and eco-friendly films are key trends shaping competition, with leading players investing in energy-efficient and high-speed systems.

- High initial investment costs and raw material price fluctuations act as restraints, affecting adoption among small and medium manufacturers.

- North America holds a 34.2% regional share, leading the market, while machine stretch film dominates the film type segment with a 41.3% share, supported by strong manufacturing infrastructure and sustainability initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Film Type

Machine stretch film leads the Flow Wrappers Market with a 41.3% share in 2024. This dominance is driven by its high tensile strength, consistent wrapping quality, and compatibility with automated packaging lines. The segment supports faster production rates and reduces material waste, improving operational efficiency. Pre-stretched and high-performance films are also growing due to their eco-friendly characteristics and reduced film consumption. Hand stretch film continues to serve small-scale operations. However, machine stretch film remains the preferred option for large-volume packaging across food processing, logistics, and consumer goods industries, due to its durability and cost-effectiveness.

- For instance, PAC Machinery offers its FW 450S servo flow wrapper capable of up to 200 packages per minute in twin-jaw configuration, with a maximum film width of 17″ and film roll diameter up to 12.5″ O.D., enabling high throughput and efficient use of film material.

By Load Type

Medium-duty loads account for 47.5% of the Flow Wrappers Market, holding the dominant share in 2024. This sub-segment benefits from strong demand in food, beverage, and consumer goods packaging, which requires balanced film strength and flexibility. Medium-duty loads offer secure containment for products without excessive material usage, supporting cost efficiency. Light-duty loads serve smaller items and niche applications, while heavy-duty loads are expanding in construction and automotive packaging. The rising use of modular wrapping machines in mid-scale production facilities continues to strengthen medium-duty load applications.

- For instance, MULTIVAC’s W 500 flowpacker — launched in 2022 — supports film speeds up to 30 metres per minute and achieves pack outputs up to 120 units per minute under ideal conditions.

By End User

The food and beverage segment leads the Flow Wrappers Market with a 36.8% share in 2024. This dominance is fueled by the growing demand for flexible packaging in snacks, bakery products, dairy, and confectionery. Flow wrappers ensure high-speed sealing, freshness retention, and attractive presentation, making them essential for large production lines. Pharmaceuticals and consumer goods segments follow, driven by hygiene standards and efficient distribution. Logistics, automotive, textiles, and chemical industries are also increasing adoption. Food and beverage manufacturers prefer automated flow wrapping to reduce labor costs and enhance shelf appeal.

Key Growth Drivers

Rising Demand for Automated Packaging

The growing shift toward automated packaging lines is a major driver for the Flow Wrappers Market. Manufacturers use flow wrappers to increase packaging speed, reduce labor costs, and improve product shelf life. This technology allows consistent sealing and wrapping for high-volume production in sectors such as food, beverage, and pharmaceuticals. Automated systems also minimize material waste and ensure packaging uniformity. As companies focus on operational efficiency and hygiene standards, the demand for high-speed flow wrapping solutions continues to accelerate globally.

- For instance, IMA Ilapak offers its DELTA 6000 flow-wrapper, capable of up to 200 cycles per minute. The machine handles standard product lengths up to 650 mm and widths up to 300 mm.

Expanding Food and Beverage Sector

The strong growth of the food and beverage sector supports widespread adoption of flow wrappers. Rising demand for packaged bakery, confectionery, and ready-to-eat products drives investments in modern packaging equipment. Flow wrappers offer airtight sealing and enhanced shelf presentation, which meet regulatory and branding requirements. Companies prefer flow wrapping for its cost efficiency and ability to maintain product freshness during distribution. This demand is particularly strong in emerging markets with expanding urban populations and increasing consumer preference for packaged goods.

- For instance, Hayssen’s R300 horizontal flow wrapper supports up to 150 packages per minute, accommodates product lengths of 40 mm to 500 mm and widths of 25 mm to 235 mm.

Growing Focus on Sustainable Packaging

Sustainability initiatives are driving the adoption of eco-friendly flow wrapping solutions. Manufacturers are investing in recyclable and biodegradable films to meet tightening environmental regulations and consumer expectations. High-performance films reduce material use while maintaining strength and clarity. Brands also prefer energy-efficient flow wrapping machines that lower operational emissions. This sustainability push encourages innovation in film formulations and machine designs, positioning eco-friendly packaging as a key growth catalyst across industries such as food, consumer goods, and pharmaceuticals.

Key Trends & Opportunities

Integration of Smart Packaging Technologies

The integration of smart packaging features is emerging as a major trend. Flow wrappers are increasingly equipped with sensors, IoT modules, and automated monitoring systems to track film use and machine performance. These smart solutions improve line efficiency, reduce downtime, and support predictive maintenance. Companies also use connected packaging for better product traceability and inventory management. This technology-driven transformation opens strong opportunities for equipment manufacturers and film suppliers to offer advanced, data-driven solutions to end users.

- For instance, Gebo Cermex’s “AQFlex®” conveying/accumulation system supports a speed range from 1,000 to 100,000 containers per hour and reports an equipment availability of 99.5%.

Rapid Growth of E-Commerce and Logistics

The expansion of e-commerce is creating new opportunities for flow wrapping applications. The need for secure and efficient packaging in logistics and warehousing is rising sharply. Flow wrappers offer consistent sealing for various product sizes, reducing damage during transit and improving supply chain efficiency. This demand is particularly strong among third-party logistics providers and consumer goods companies. The trend also drives the development of flexible machine designs capable of handling diverse packaging formats in high-volume environments.

- For instance, Nichrome’s “Flexiwrap 700” horizontal flow-wrap machine supports roll widths up to 700 mm and operates at speeds up to 60 bags per minute (depending on pouch length).

Advancements in High-Performance Film Materials

Innovations in high-performance films present strong growth opportunities for the Flow Wrappers Market. New film formulations offer enhanced tensile strength, barrier protection, and printability. These features support extended product shelf life and improved branding. High-performance films also reduce consumption, lowering overall packaging costs. The shift toward lightweight, recyclable materials aligns with global sustainability goals and strengthens the adoption of advanced flow wrapping solutions across industries.

Key Challenges

High Initial Capital Investment

The high upfront cost of advanced flow wrapping machines remains a significant challenge. Small and medium-sized enterprises often face financial barriers when adopting fully automated packaging solutions. These machines require not only capital investment but also skilled operators and maintenance resources. High entry costs can slow down adoption rates, especially in developing markets. To overcome this, manufacturers are exploring leasing models and compact machine designs to make automation more accessible.

Volatility in Raw Material Prices

Fluctuating prices of packaging films pose a major challenge for manufacturers and end users. Variations in the cost of raw materials such as polyethylene and polypropylene affect overall production costs. These fluctuations can disrupt pricing strategies and profit margins. Additionally, regulatory shifts toward sustainable materials add pressure on procurement and supply chain planning. Companies must adopt flexible sourcing strategies and innovative material solutions to reduce the impact of price volatility on operations.

Regional Analysis

North America

North America leads the Flow Wrappers Market with a 34.2% share in 2024. The region benefits from advanced packaging automation, strong food processing industries, and rising demand for sustainable packaging films. The U.S. and Canada are major contributors, with large-scale adoption of high-speed flow wrapping lines across bakery, confectionery, and logistics sectors. Companies invest in energy-efficient machinery and recyclable films to align with strict environmental standards. The mature retail sector and growing e-commerce also support packaging innovations. Strong R&D capabilities and the presence of global packaging leaders further strengthen regional market growth.

Europe

Europe holds a 28.6% share in the Flow Wrappers Market in 2024. The region’s strong regulatory framework drives the shift toward recyclable and biodegradable packaging materials. Germany, France, and Italy lead the adoption of advanced wrapping systems in food, pharmaceuticals, and consumer goods industries. Manufacturers focus on sustainable packaging technologies to meet EU emission and waste directives. Modern production facilities emphasize automation, supporting efficiency and material savings. The growing popularity of clean-label and convenience products drives demand for reliable wrapping solutions with high sealing precision and extended shelf life.

Asia Pacific

Asia Pacific accounts for 25.4% of the Flow Wrappers Market in 2024, driven by rapid industrialization and expanding food manufacturing capacity. China, India, and Japan lead regional growth through large investments in modern packaging lines. Rising urbanization, increasing consumption of packaged foods, and the expansion of e-commerce significantly boost demand. Regional producers adopt cost-efficient machines to meet high-volume production needs. Governments also encourage the use of sustainable materials to address plastic waste challenges. The region shows strong growth potential, supported by large consumer bases and developing packaging infrastructure.

Latin America

Latin America represents 6.9% of the Flow Wrappers Market in 2024. Brazil and Mexico lead regional growth with rising investments in food processing, logistics, and consumer goods packaging. The demand for cost-effective and flexible wrapping machines is increasing as companies modernize production lines. The shift toward packaged snacks, beverages, and ready-to-eat meals is driving adoption. Regional manufacturers are also exploring eco-friendly film options to align with sustainability goals. While the market remains price-sensitive, growing retail networks and export-oriented production offer strong expansion opportunities for packaging suppliers.

Middle East & Africa

The Middle East & Africa holds a 4.9% share of the Flow Wrappers Market in 2024. The region is witnessing steady adoption of flow wrapping solutions across food, logistics, and construction material packaging. The UAE and South Africa lead the market with modern manufacturing facilities and rising retail activity. Growth is driven by expanding food processing capacity, rising disposable incomes, and increasing demand for hygienic, shelf-stable packaging. Companies are also exploring investments in flexible, sustainable films. While market penetration remains lower than other regions, the sector shows strong long-term growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Film Type:

- Machine stretch film

- Hand stretch film

By Load Type:

- Light-duty loads

- Medium-duty loads

By End User:

- Food & beverage

- Consumer goods

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Flow Wrappers Market is shaped by strong competition among MesPack, Fuji Machinery, PAC Machinery, IMA Group, MULTIVAC Group, Ilapak International, Hayssen Flexible Systems, Gebo Cermex, Nichrome India, and Matrix Packaging Machinery. The Flow Wrappers Market is characterized by intense competition, rapid innovation, and rising investment in advanced packaging technologies. Manufacturers focus on improving machine efficiency, production speed, and energy performance to meet the growing demand from industries such as food, pharmaceuticals, and logistics. Automation and digital integration are becoming central to product differentiation, with many companies adopting IoT-enabled monitoring systems to optimize operations. Sustainability is also a key competitive factor, driving the development of recyclable and biodegradable film solutions. Modular designs, flexible configurations, and enhanced service offerings further strengthen competitiveness and expand market reach.

Key Player Analysis

- MesPack

- Fuji Machinery

- PAC Machinery

- IMA Group

- MULTIVAC Group

- Ilapak International

- Hayssen Flexible Systems

- Gebo Cermex

- Nichrome India

- Matrix Packaging Machinery

Recent Developments

- In April 2025, Syntegon introduced the Pack 103 flow wrapping machine for food, non-food, and pharmaceutical applications. The flow wrapper packs at speeds of up to 175 packs per minute and is well suited for small- and medium-sized enterprises.

- In December 2024, Movopack successfully secured in funding to enhance their development of sustainable packaging solutions aimed at reducing ecommerce waste.

- In April 2024, Cox & Co, a single origin chocolate brand, introduced a new paper flow wrap packaging for its chocolates, aiming to eliminate all plastic from its products. This innovative packaging is designed to be kerbside recyclable, addressing consumer demand for sustainable options.

- In November 2023, Coveris, an Austrian packaging company, launched new sustainable stretch films called Unterland R and Unterland Crystal for wrapping silage bales. These films are made entirely from renewable resources to improve sustainability.

Report Coverage

The research report offers an in-depth analysis based on Film Type, Load Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see faster adoption of automated and high-speed flow wrapping systems.

- Sustainable and recyclable film materials will gain wider usage across industries.

- Digital integration and IoT features will enhance packaging line efficiency.

- E-commerce growth will increase demand for flexible and secure wrapping solutions.

- Compact and modular machine designs will support small and medium manufacturers.

- Advancements in smart sensors will improve accuracy and reduce packaging waste.

- Global regulatory pressure will accelerate the shift to eco-friendly packaging technologies.

- Emerging markets will experience strong expansion due to rising packaged goods consumption.

- Customized packaging solutions will become a key focus for brand differentiation.

- Strategic collaborations and technological innovation will drive competitive advantage.