Market Overview

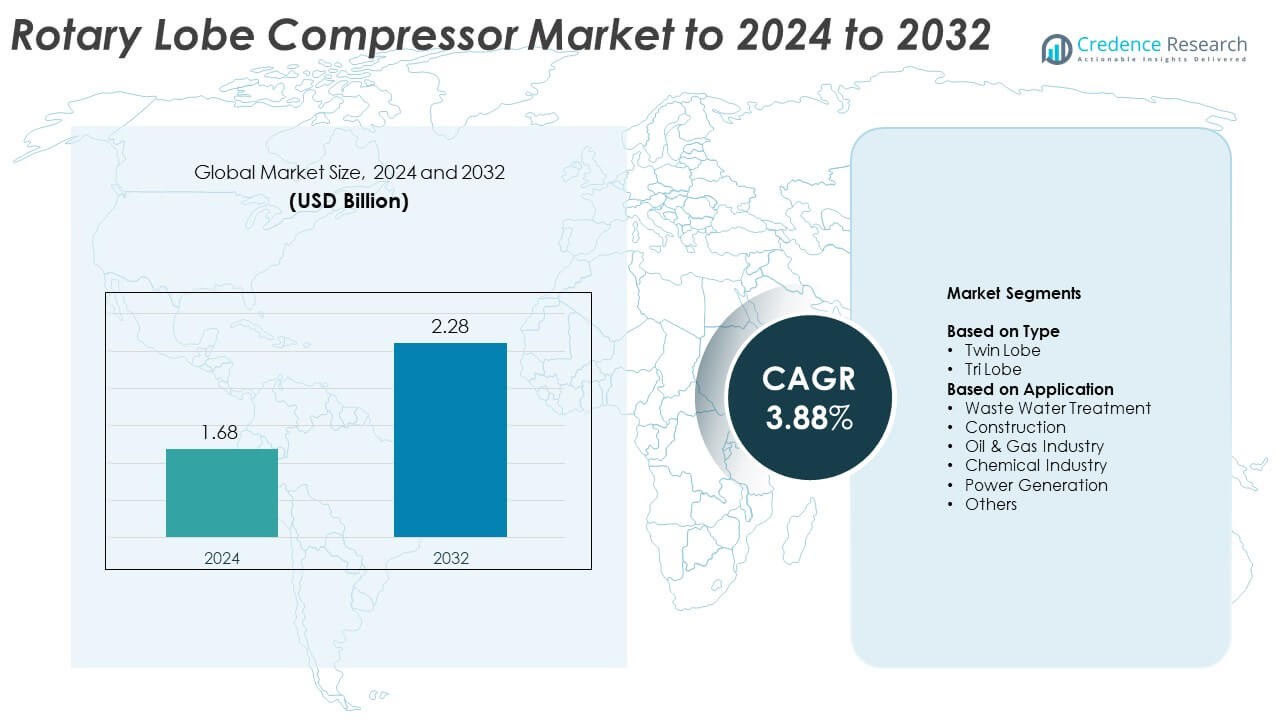

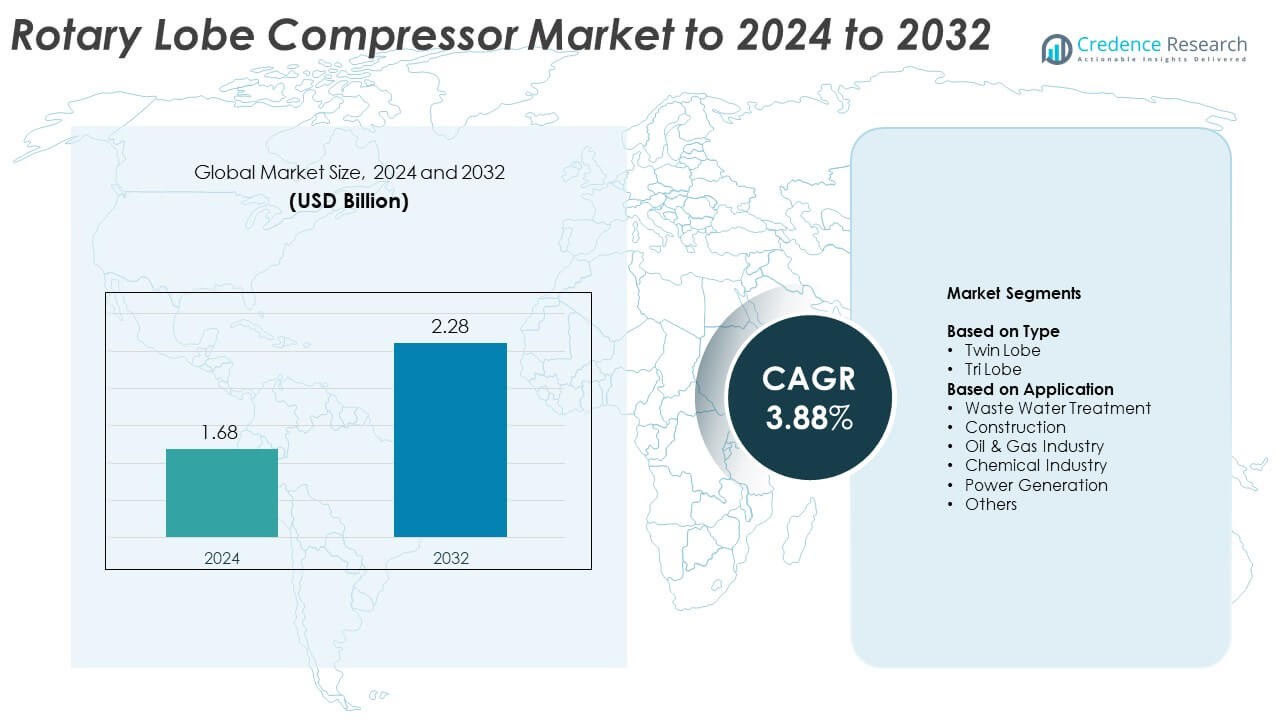

The Rotary Scroll Air Compressor Market size was valued at USD 4.55 billion in 2024 and is anticipated to reach USD 5.86 billion by 2032, at a CAGR of 3.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rotary Scroll Air Compressor Market Size 2024 |

USD 4.55 Billion |

| Rotary Scroll Air Compressor Market, CAGR |

3.2% |

| Rotary Scroll Air Compressor Market Size 2032 |

USD 5.86 Billion |

The Rotary Scroll Air Compressor Market is led by major companies including Ingersoll Rand, Atlas Copco, Kaeser Kompressoren AG, Gardner Denver Holdings, Inc., and Hitachi Global Air Power. These players focus on developing energy-efficient, low-noise, and oil-free compressor systems to meet rising industrial and healthcare demands. Continuous investment in R&D, digital integration, and after-sales support strengthens their global footprint. North America dominated the market in 2024 with a 40% share, driven by advanced industrial automation, strong healthcare infrastructure, and the presence of established compressor manufacturers enhancing regional competitiveness.

Market Insights

- The Rotary Scroll Air Compressor Market was valued at USD 4.55 billion in 2024 and is expected to reach USD 5.86 billion by 2032, growing at a CAGR of 3.2%.

- Rising demand for oil-free air systems in medical, dental, and food processing sectors is a key driver of market growth.

- Integration of IoT-enabled monitoring systems and focus on energy-efficient compressor designs are shaping future trends.

- The market is moderately competitive, with global players investing in R&D and expanding service networks to strengthen positions.

- North America led the market with a 40% share in 2024, followed by Europe at 30% and Asia Pacific at 23%, while the oil-free compressor segment held 61.5% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The oil-free rotary scroll air compressors segment dominated the market in 2024 with a 61.5% share. This dominance is attributed to their clean, contamination-free air output, making them ideal for medical, pharmaceutical, and food processing uses. These compressors also offer lower maintenance and reduced operating noise compared to oil-injected models. Demand continues to grow due to strict air quality standards in manufacturing and healthcare environments, promoting wider adoption across industries seeking energy-efficient, environmentally safe systems.

- For instance, Atlas Copco’s SF/SF+ oil-free scroll models deliver 4.02–87.03 cfm at 8–10 bar, with 1.5–22 kW motors and ISO 8573-1 Class 0 air.

By Application

The industrial segment held the largest market share of 44.7% in 2024, driven by broad usage across manufacturing, electronics, and automation sectors. Industries prefer rotary scroll compressors for their consistent airflow and low vibration, ensuring reliable performance in precision applications. Growth is further supported by automation trends and expansion of small-scale industries in Asia-Pacific. Rising demand for compact, durable compressors with reduced downtime also strengthens industrial adoption.

- For instance, Ingersoll Rand’s Helix platform provides 24/7 remote monitoring and real-time alerts to maximize industrial uptime.

By Capacity

The 5–10 CFM capacity segment accounted for the largest share of 38.2% in 2024, owing to its versatility in small- to medium-scale operations. These units offer a balance between efficiency and compactness, suitable for workshops, laboratories, and dental facilities. Increased demand for portable and energy-efficient systems fuels growth in this category. Additionally, manufacturers emphasize optimized motor design and advanced scroll mechanisms to enhance air delivery rates and operational stability.

Key Growth Drivers

Rising Demand for Oil-Free Air Systems

The growing preference for oil-free rotary scroll air compressors drives market expansion. Industries such as food and beverage, pharmaceuticals, and healthcare require clean, oil-free compressed air for safety and product integrity. Stringent air purity standards and the need to reduce contamination risks are accelerating the shift from oil-lubricated to oil-free models. Manufacturers are focusing on low-maintenance, energy-efficient designs, which further strengthen adoption across precision-driven applications.

- For instance, CompAir’s S-Series scroll compressors are certified ISO 8573-1 Class 0 and support 100% duty-cycle operation for contamination-free processes.

Expansion of Industrial Automation

The rapid industrial automation trend increases the need for reliable and continuous compressed air supply. Rotary scroll compressors are widely used in automated assembly lines, robotics, and pneumatic control systems due to their stable air output and low vibration. The growth of small- and medium-scale manufacturing, especially in Asia-Pacific, supports market demand. The integration of advanced controls and smart monitoring systems enhances operational efficiency and aligns with Industry 4.0 standards.

- For instance, Kaeser’s Sigma Air Manager 4.0 centrally controls up to 16 units and archives operating data for adaptive, optimized station control.

Growing Adoption in Healthcare and Dental Applications

The medical and dental sectors increasingly rely on rotary scroll air compressors for silent, vibration-free performance and contamination-free airflow. Their compact design and reliability make them suitable for hospitals, laboratories, and dental clinics. Rising healthcare infrastructure investment, coupled with growing dental care awareness, supports adoption globally. The ability to meet stringent hygiene and air quality regulations drives the market for oil-free, maintenance-efficient models.

Key Trends & Opportunities

Integration of Smart Monitoring and IoT

IoT-enabled rotary scroll compressors are transforming maintenance and performance optimization. Smart sensors allow real-time monitoring of temperature, pressure, and vibration, enabling predictive maintenance and minimizing downtime. This digital integration improves system efficiency and reduces energy losses. Manufacturers are increasingly investing in connected technologies to deliver enhanced control, reliability, and data-driven performance insights across industrial and medical uses.

- For instance, Atlas Copco’s SMARTLINK monitors 30+ data points continuously, providing predictive insights and connected maintenance actions

Emphasis on Energy Efficiency and Sustainability

Energy-efficient rotary scroll compressors are gaining traction as industries aim to reduce operational costs and carbon footprints. Manufacturers focus on variable speed drives and advanced scroll designs that lower power consumption without compromising output. Government policies supporting energy conservation in industrial processes create additional opportunities. The demand for sustainable, low-emission compressor systems continues to grow, especially in developed markets adopting green manufacturing practices.

- For instance, Hitachi’s SRL oil-free scroll compressors use Multi-Drive control, reducing energy use by up to 35% while operating at 8–10 bar.

Key Challenges

High Initial Investment and Maintenance Costs

The high upfront cost of rotary scroll compressors remains a major barrier for small enterprises. Although they offer lower lifecycle expenses, the initial purchase and installation require significant investment. Periodic maintenance and component replacement, such as scroll elements and seals, also add to operational costs. These financial factors limit adoption, particularly in cost-sensitive industrial sectors.

Limited Suitability for High-Capacity Operations

Rotary scroll compressors are ideal for low- and medium-capacity applications but face challenges in large-scale industrial setups. Their limited air output restricts usage in heavy-duty manufacturing or continuous high-demand environments. Competing technologies such as screw compressors often outperform scroll compressors in such cases. This operational limitation constrains their market penetration in heavy industries requiring large air volumes.

Regional Analysis

North America

North America accounted for approximately 40 % of the global rotary scroll air compressor market in 2024. The region’s strong share reflects a mature industrial and healthcare infrastructure demanding oil-free, low-noise compression solutions. U.S. regulatory standards for air purity and energy efficiency drive adoption of advanced scroll compressors. The presence of leading manufacturers and high automation levels in manufacturing also bolster market penetration. Growth in dental and medical applications further strengthens regional demand, supporting sustained expansion of the North American market.

Europe

Europe secured more than 30 % of the global rotary scroll air compressor market in 2024. The region benefits from stringent environmental regulations, robust industrial automation, and a large-scale food-and-beverage sector. European manufacturers favour oil-free compressor technologies to meet cleanliness and quality demands. Moreover, the shift toward sustainable plant operations and energy-efficient equipment adoption supports market growth. With advanced manufacturing bases in Germany, France, and the UK, Europe remains one of the key regional markets for scroll compressor systems.

Asia Pacific

Asia Pacific held around 23 % of the global rotary scroll air compressor market in 2024 and is expected to grow at the highest CAGR. Expansion of manufacturing, electronics, automotive and medical industries in China, India and Southeast Asia underpins this growth. The region’s large base of small- and medium-sized enterprises demands compact, efficient air compressors with minimal maintenance. Rapid urbanisation and infrastructure development further create opportunities for scroll compressor adoption across industrial and sanitary-critical applications.

Latin America

Latin America contributed approximately 5 % of the global rotary scroll air compressor market in 2024. Emerging manufacturing and food-processing activities in Brazil, Argentina and neighboring countries support the region’s modest growth. Demand stems from expanding base of industrial users seeking low-maintenance, oil-free compression systems. While the region lags North America and Europe in share, improving manufacturing infrastructure and rising regulatory focus on air contamination offer future upside for scroll compressor vendors.

Middle East & Africa

Middle East & Africa accounted for around 2 % of the global rotary scroll air compressor market in 2024. The region’s industrial growth and investments in energy and infrastructure sectors are driving demand for efficient and reliable air compression systems. GCC countries and South Africa are increasingly adopting oil-free, low-noise compressors for critical applications. Limited share today reflects slower industrialisation and higher cost sensitivity, but rising infrastructure deployment and greater focus on operational reliability present growth potential.

Market Segmentations:

By Type

- Oil-Free Rotary Scroll Air Compressors

- Oil-Injected Rotary Scroll Air Compressors

By Application

- Industrial

- Medical

- Dental

- Food and Beverage

By Capacity

- Less than 5 CFM

- 5-10 CFM

- 10-20 CFM

- 20-50 CFM

- More than 50 CFM

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Rotary Scroll Air Compressor market features key players such as Ingersoll Rand, Atlas Copco, Kaeser Kompressoren AG, Gardner Denver Holdings, Inc., Hitachi Global Air Power, Quincy Compressor, and others. Competition centers on technological innovation, efficiency improvement, and noise reduction capabilities. Companies are investing in product optimization, energy-efficient designs, and automation-ready systems to strengthen their market positions. Strategic collaborations, mergers, and expansions into emerging economies further enhance competitiveness. Manufacturers focus on improving service networks, extending operational lifespans, and offering customized solutions for industrial, medical, and food applications. The growing preference for oil-free and smart compressors drives product differentiation and brand positioning across the global market.

Key Player Analysis

- Ingersoll Rand

- Atlas Copco

- Kaeser Kompressoren AG

- Gardner Denver Holdings, Inc.

- Hitachi Global Air Power

- Quincy Compressor

- Boge Kompressoren Otto Boge GmbH Co. KG

- Mattei Compressors

- Thomas Pumps

- Airpol Machines S.R.L

- Rotorcomp

- Nuvair

- Kobelco Compressors Mexico S.A. de C.V.

- Compair

- S. Air Compressors

- CCM Industries

Recent Developments

- In 2024, Atlas Copco Launched new models in their SF and SF+ range of oil-free scroll air compressors, focusing on improved energy efficiency and lower noise levels for medical and laboratory applications.

- In 2024, Gardner Denver (an Ingersoll Rand brand) launched the updated PureAir T/TVS 90-355 kW Series of oil-free rotary screw compressors, which feature the new, integrated GD Governor™ Controller system

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption of oil-free rotary scroll compressors due to growing hygiene and safety needs in food and medical sectors.

- Energy-efficient compressor models will gain traction as industries focus on sustainability and reduced carbon emissions.

- Technological upgrades like IoT integration and remote monitoring will enhance maintenance efficiency and uptime.

- Asia Pacific will remain the fastest-growing region, supported by expanding manufacturing and healthcare sectors.

- Compact and portable compressor systems will find growing use in small workshops and laboratories.

- Industrial automation and robotics will boost demand for continuous, vibration-free air supply solutions.

- Manufacturers will emphasize advanced materials and optimized scroll design to improve durability and performance.

- OEM partnerships and after-sales service expansion will strengthen customer retention and market competitiveness.

- Government incentives for energy-efficient equipment will support market expansion in developed regions.

- Rising infrastructure investments in emerging economies will create new opportunities for compressor applications.