Market Overview

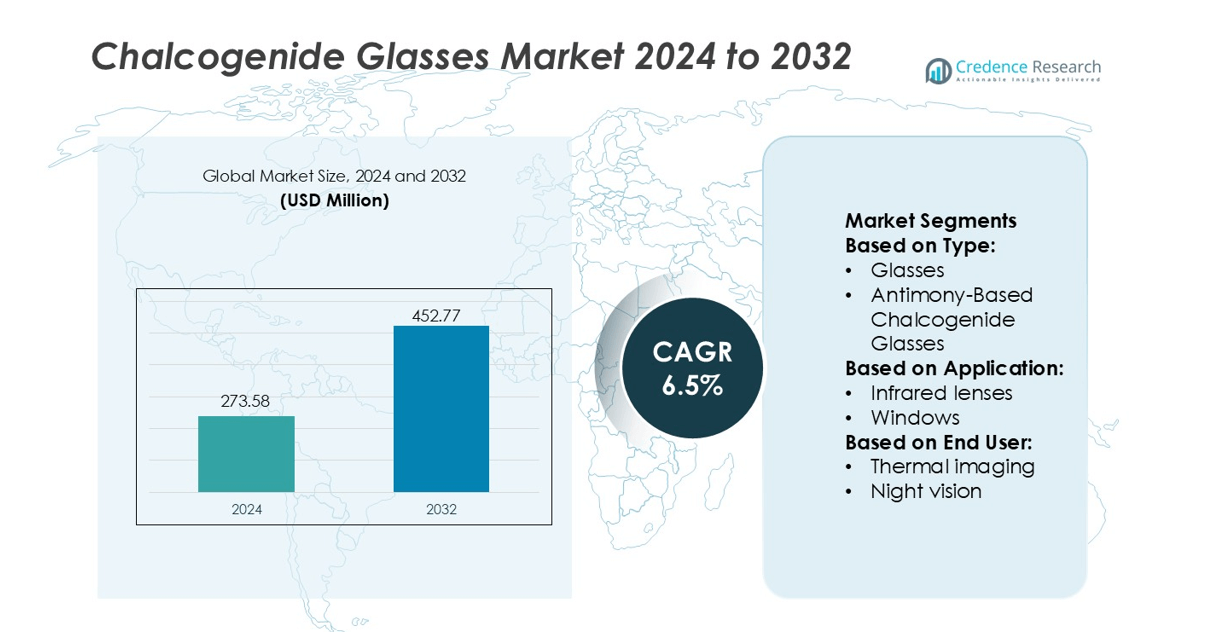

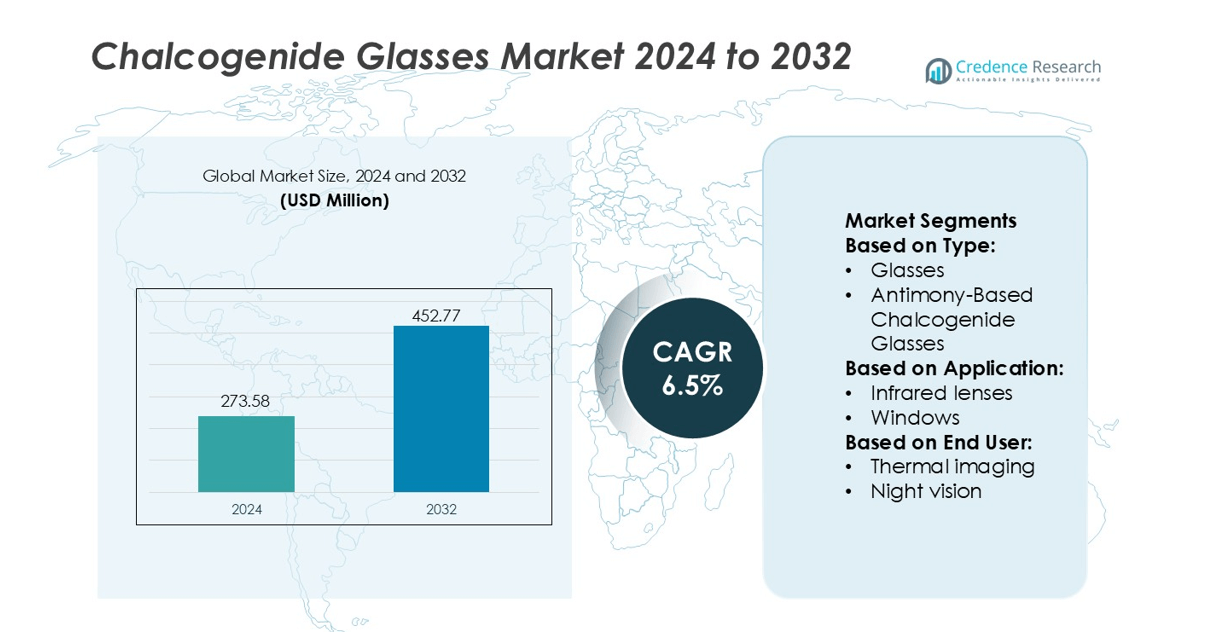

Chalcogenide Glasses Market size was valued USD 273.58 million in 2024 and is anticipated to reach USD 452.77 million by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chalcogenide Glasses Market Size 2024 |

USD 273.58 million |

| Chalcogenide Glasses Market, CAGR |

6.5% |

| Chalcogenide Glasses Market Size 2032 |

USD 452.77 million |

The chalcogenide glasses market includes major participants such as De Rigo Vision S.p.A., HOYA Corporation, Johnson & Johnson Vision Care Inc., CHARMANT INC., Marchon Eyewear Inc., Fielmann AG, CooperVision Limited, ESSILORLUXOTTICA, JINS Inc., and CHEMIGLAS CORPORATION. These companies focus on advanced optical materials, infrared components, and fiber technologies used in defense, medical devices, spectroscopy, and photonic systems. Leading manufacturers invest in precision molding, thin-film coatings, and high-purity glass formulations to enhance transmission performance and thermal stability. Strategic partnerships with research institutes and semiconductor companies support development of custom glass compositions for sensors, lasers, and integrated photonics. Asia-Pacific remains the leading region with 34% market share, driven by strong electronics production, expanding telecom infrastructure, and adoption of IR imaging across automotive, industrial, and surveillance applications.

Market Insights

- The Chalcogenide Glasses Market was valued at USD 273.58 million in 2024 and will reach USD 452.77 million by 2032 at a 6.5% CAGR, driven by growing demand for infrared optics and photonics.

- Rising deployment of infrared cameras, fiber sensors, spectroscopy tools, and medical imaging devices is a major market driver, supported by advanced manufacturing and strong R&D funding.

- Key players focus on thin-film coatings, precision molding, custom wavelength designs, and semiconductor partnerships to strengthen competitive positioning across industrial and defense sectors.

- High material cost, complex fabrication, and dependence on specialized raw materials act as restraints, mainly affecting small-scale producers and limiting production flexibility.

- Asia-Pacific leads with 34% market share, followed by North America and Europe, while fiber-optic components hold a significant segment share due to expanding telecom networks, data-center growth, and adoption of mid-IR photonics in autonomous and industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Among type segments, Glasses dominate the market with a strong preference for As-Se due to its superior infrared transmission and thermal stability. As-Se glasses are widely used in high-performance optical and fiber applications because they maintain low optical loss across 1–15 µm wavelengths. For instance, commercial suppliers report that As-Se fibers achieve attenuation as low as 0.5 dB/m at 10.6 µm, supporting precise infrared imaging and sensing. Antimony- and gallium-based glasses show growth in specialized applications like photonic devices, but As-Se retains the largest market share due to its versatility and scalability in industrial production.

- For instance, Johnson & Johnson Vision reported that their ACUVUE OASYS MAX 1-Day for Astigmatism lenses showed that 62% of wearers preferred the lens for overall vision versus 18% preferring the competitor lens in a head-to-head study.

By Application

In applications, Optical components lead the market, with Infrared lenses being the dominant sub-segment. Infrared lenses made from chalcogenide glasses provide high refractive indices, low dispersion, and excellent thermal stability, crucial for defense and industrial imaging systems. For instance, suppliers such as Umicore report lens fabrication achieving surface roughness below 2 nm, enhancing infrared clarity. Fiber optics follow closely, with infrared fibers expanding for sensing and communication, while phase change memory and photonic integrated circuits grow in niche electronics sectors. The dominance of optical components is driven by demand for high-precision imaging and sensor technologies.

- For instance, CHARMANT INC. uses titanium alloy frames engineered through its EXCELLENCE TITANIUM process, achieving elastic recovery of up to 98% after mechanical flex tests and maintaining frame weight as low as 9.1 g.

By End User

The Defense and Security sector leads end-user adoption, primarily through Thermal Imaging applications. Chalcogenide-based infrared lenses and fibers improve night vision and surveillance capabilities by providing high sensitivity in the 3–12 µm range. For instance, manufacturers like Lumerical achieve infrared sensor arrays with 15 µm pixel pitch, enhancing detection resolution. Healthcare and industrial users adopt chalcogenide glasses for imaging, diagnostics, and process monitoring, but defense remains dominant due to continuous investment in advanced thermal and optical technologies. This drives consistent demand for large-scale production and innovation in chalcogenide materials.

Key Growth Drivers

Rising Adoption in Infrared Optics and Defense

Defense and homeland security agencies use chalcogenide glasses for thermal imaging, night-vision systems, and advanced infrared optics. These glasses deliver high refractive index, wide transparency range, and lower processing temperatures than germanium, which helps reduce system cost. Growth in border surveillance, drones, and smart weapon systems boosts demand for precision IR lenses and windows. Increasing deployment of thermal cameras in firefighting, industrial inspection, and automotive safety further accelerates commercial volumes.

- For instance, Edmund Optics and other optics suppliers offer high-purity sapphire optical components, which can achieve very low surface roughness (below 0.3 nm RMS with super-polishing) and high transmittance (over 99.8% with appropriate anti-reflective coatings) at wavelengths such as 1,064 nm.

Advancements in Integrated Photonics

Expanding need for faster and energy-efficient data transmission accelerates the use of chalcogenide glasses in photonic integrated circuits. Their high nonlinearity and fast optical response enable compact waveguides, resonators, and modulators for telecom and data center networks. The material supports on-chip light routing and phase change functionality, helping reduce size and power use compared to traditional photonic components. Ongoing R&D in silicon-compatible processes supports mass-production strategies and wider commercial scalability.

- For instance, CooperVision clariti® 1 day multifocal 3 Add lens is available in power ranges from +8.00 D to −12.00 D. It also achieved a fitting success rate of 98%, with patients using two lens pairs or fewer in a clinical trial.

Growing Use in Phase Change Memory Devices

Chalcogenide materials play a central role in non-volatile phase change memory. Electronics and computing companies invest in these materials to support high-speed switching and greater endurance for next-generation storage hardware. Their reversible solid-to-amorphous transitions deliver faster read-write cycles than flash technology and support long data retention. Expanding AI servers, edge computing, and IoT devices increase demand for memory architectures with low power draw and stable performance, strengthening industrial adoption.

Key Trends & Opportunities

Miniaturization and 3D Sensing Technologies

Consumer electronics and autonomous systems adopt miniaturized IR sensors, compact LiDAR, and depth-sensing modules, creating opportunities for chalcogenide-based lenses and waveguides. Smartphone OEMs use these materials in facial recognition and AR systems that operate under low-light conditions. Compact manufacturing methods enable thin-film designs suited for high-resolution thermal cameras. Growth in gesture control, robotics, and machine vision increases long-term commercial demand.

- For instance, Encirc, a leading glass manufacturer, collaborated with Belu Mineral Water to optimize their packaging. Through new techniques and the production of lighter containers, Encirc produced a 750ml bottle that was 70g lighter than the previous Belu design.

Shift Toward Sustainable Manufacturing

Producers focus on cleaner melting processes, recycling of glass scrap, and controlled volatile emissions. Research centers test low-energy fabrication techniques and additive manufacturing to reduce waste and improve yield. Industries adopt precision molding and roll-to-roll processing to cut production time and improve uniformity in optical components. These improvements lower cost barriers for consumer applications, expanding usage across healthcare imaging, industrial monitoring, and smart city infrastructure.

- For instance, Ardagh commissioned its NextGen hybrid furnace in Obernkirchen, achieving a 64 % reduction in emissions per bottle at that line.It built a hydrogen electrolyser in Limmared (Sweden) to feed low-carbon hydrogen into its glass melting system.

Key Challenges

High Material and Production Costs

Chalcogenide glass fabrication requires strict thermal control and advanced purification steps. Specialized coatings, molding equipment, and toxic-element handling add cost for producers and end-users. Limited large-scale manufacturing capacity restricts economies of scale, increasing product prices for cameras, sensors, and photonics modules. These issues make low-cost alternatives like germanium, silicon, and polymers more attractive in some applications, especially in consumer markets with price sensitivity.

Handling and Environmental Regulations

Some chalcogenide glasses contain elements such as arsenic and selenium that require safe disposal and restricted workplace exposure. Compliance with environmental standards raises operational complexity and waste-management costs for manufacturers. Regulatory scrutiny is growing as markets expand into medical imaging, consumer electronics, and automotive sectors. Producers must invest in safer formulations and improved processing technologies to maintain long-term adoption in regulated industries.

Regional Analysis

North America

North America holds 29% share of the chalcogenide glasses market, driven by strong investment in infrared optics, defense imaging, and sensor technologies. The region benefits from advanced aerospace programs and strict military specifications that require high-performance infrared materials. U.S. research labs and photonics companies continue to develop mid-wave and long-wave IR components for thermal cameras, night-vision systems, and space-grade sensors. Canada supports demand with growing fiber-optic sensing and geological monitoring needs. Strong collaboration between universities, defense agencies, and photonics firms supports faster commercialization of new chalcogenide glass compositions with improved thermal stability and transmission efficiency.

Europe

Europe accounts for 24% share and remains a key hub for fiber-optic innovations, laser technologies, spectroscopy instruments, and precision imaging. Demand increases across Germany, France, the U.K., and Switzerland due to advanced research investments and industrial automation. European photonics companies use chalcogenide glasses in medical diagnostics, atmospheric gas detection, and machine-vision systems. Rising semiconductor research and chip-level optical components support stronger adoption for integrated photonics. Aerospace and automotive manufacturers also deploy IR sensors for autonomous systems, emissions analysis, and engine diagnostics. EU-backed funding programs strengthen local manufacturing capacity and reduce dependence on imported infrared materials.

Asia-Pacific

Asia-Pacific leads the global market with 34% share, supported by rapid expansion of electronics manufacturing, fiber-optic communication networks, and semiconductor fabrication. China, Japan, and South Korea invest in infrared imaging, LiDAR, and photonic integrated circuits for consumer electronics, automotive, and industrial automation. Manufacturers scale production of mid-IR fibers and lenses for security surveillance and smart-city systems. India and Southeast Asian regions adopt chalcogenide-based fiber sensors for oil, gas, and chemical industries. Growing demand for low-loss materials in telecom and data-center networks strengthens regional consumption. Strong government research initiatives accelerate development of new chalcogenide compositions for advanced photonics.

Latin America

Latin America holds 6% share and shows steady growth, mainly driven by expanding industrial automation, mining, and energy infrastructure. Governments across Brazil, Argentina, and Chile deploy infrared sensing systems for safety monitoring, pipeline inspection, and geological surveys. Research institutions increase adoption of mid-IR spectroscopy for chemical, agricultural, and environmental analysis. Import dependence remains high, leading to limited domestic production; however, partnerships with U.S. and European photonics suppliers support access to high-precision components. Rising fiber-optic network deployment and data-center expansion are expected to increase demand for chalcogenide-based optical fibers and infrared connectors.

Middle East & Africa

The Middle East & Africa region holds 7%, supported by solid demand for infrared surveillance, oil-field monitoring, and border security systems. The UAE, Saudi Arabia, and Israel invest in thermal imaging, fiber-optic sensing, and gas detection technologies for industrial safety and defense. Chalcogenide glasses gain traction in infrared spectroscopy for petrochemical analysis and pipeline leakage monitoring. African nations adopt fiber-optic sensors in mining and power infrastructure. Although local manufacturing capacity is limited, rising defense spending and smart-infrastructure projects create a high-value market for imported mid-IR lenses, fibers, and photonic components.

Market Segmentations:

By Type:

- Glasses

- Antimony-Based Chalcogenide Glasses

By Application:

By End User:

- Thermal imaging

- Night vision

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Chalcogenide Glasses Market includes De Rigo Vision S.p.A., HOYA Corporation, Johnson & Johnson Vision Care Inc., CHARMANT INC., Marchon Eyewear Inc., Fielmann AG, CooperVision Limited, ESSILORLUXOTTICA, JINS Inc., and CHEMIGLAS CORPORATION. The chalcogenide glasses market remains highly competitive due to strong innovation, rising demand for infrared optics, and the push toward integrated photonic solutions. Manufacturers invest in advanced glass formulations with wider transmission windows, improved chemical durability, and higher thermal stability to meet the needs of defense imaging, spectroscopy, fiber sensing, and medical equipment. Many companies focus on scalable manufacturing, including precision molding, automated casting, and thin-film coating technologies, to reduce production costs and deliver consistent optical quality. Partnerships with semiconductor foundries and research institutes accelerate development of chalcogenide-based components for data centers, LiDAR, and space instruments. Several producers expand global footprints with new R&D centers, distribution networks, and acquisitions in Asia-Pacific and North America. Customization for wavelength-specific applications strengthens competitive positioning, while sustainability goals encourage eco-friendly material processing and waste reduction. Overall, competition is driven by technology upgrades, specialty glass performance, and the ability to supply high-precision infrared components at commercial scale.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- De Rigo Vision S.p.A.

- HOYA Corporation

- Johnson & Johnson Vision Care Inc.

- CHARMANT INC.

- Marchon Eyewear Inc.

- Fielmann AG

- CooperVision Limited

- ESSILORLUXOTTICA

- JINS Inc.

- CHEMIGLAS CORPORATION

Recent Developments

- In April 2025, Bruker Corporation has developed the world’s first 1.3 GHz high-resolution Nuclear Magnetic Resonance (NMR) spectrometer, which features a 30.5 Tesla superconducting magnet with a new ReBCO high-temperature superconductor (HTS) insert.

- In February 2025, EssilorLuxottica announced plans to increase its smart glasses production capacity to 10 million units annually by the end of 2026, expanding manufacturing in China and Southeast Asia. The company aims to enhance its collaboration with Meta and integrate additional third-party brands and features into its smart eyewear platform.

- In February 2025, Innovative Eyewear unveiled its Reebok Smart Eyewear line at MIDO 2025 in Milan, introducing sport-focused frames with open-ear audio, voice assistant integration, and customizable lenses. The collection features upgraded hi-fi speakers and amplifiers for enhanced sound quality, catering to active lifestyles

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise for infrared imaging systems used in defense, aerospace, and surveillance.

- Telecom and data-center expansion will boost adoption of chalcogenide-based fiber optics.

- Photonic integrated circuits will create new opportunities for compact, chip-level optical devices.

- Growth in LiDAR and autonomous vehicles will increase need for mid-infrared components.

- Medical imaging and spectroscopy applications will drive investment in high-purity glass formulations.

- Manufacturers will expand automated casting, molding, and coating processes to scale production.

- Research partnerships will accelerate development of glasses with higher thermal stability.

- Asia-Pacific will remain a major production and consumption hub due to strong electronics manufacturing.

- Custom, wavelength-specific glass designs will support niche industrial and scientific uses.

- Sustainability targets will encourage cleaner processing and lower-waste material engineering.