Market Overview:

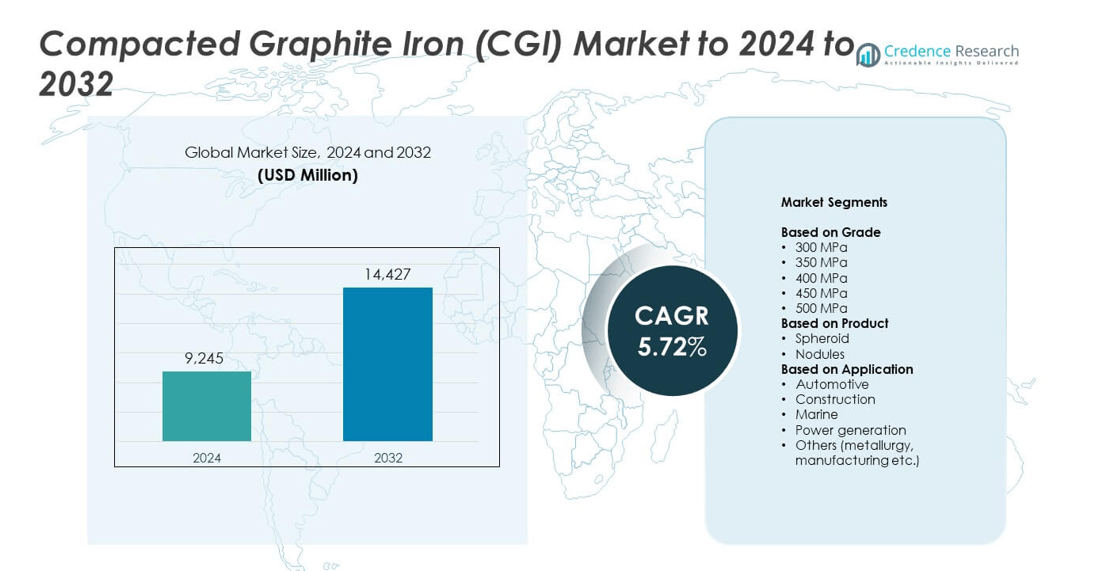

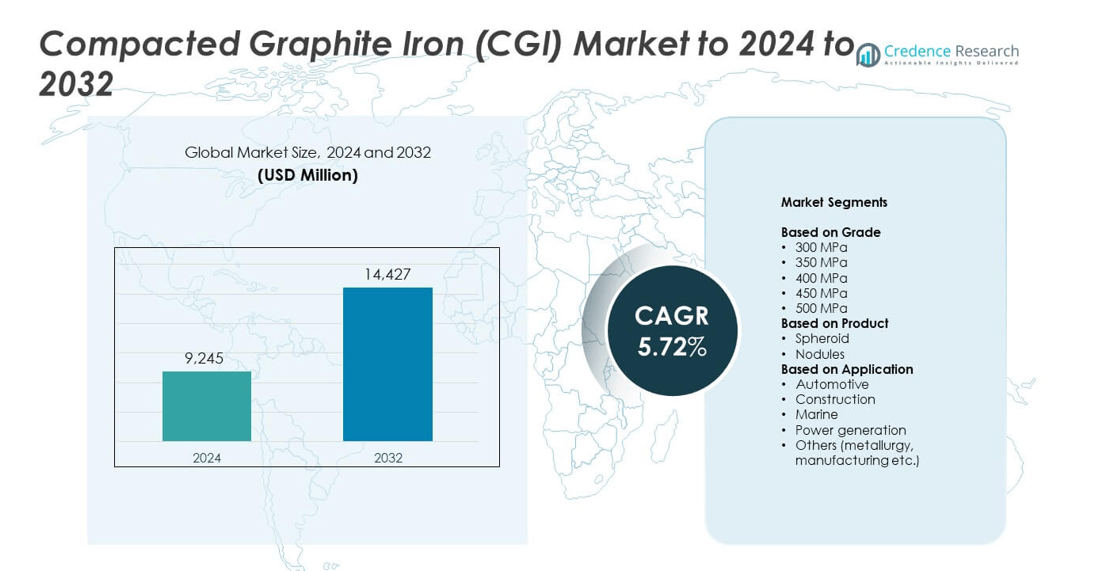

Compacted Graphite Iron (CGI) Market size was valued USD 9,245 million in 2024 and is anticipated to reach USD 14,427 million by 2032, at a CAGR of 5.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compacted Graphite Iron (CGI) Market Size 2024 |

USD 9,245 million |

| Compacted Graphite Iron (CGI) Market, CAGR |

5.72% |

| Compacted Graphite Iron (CGI) Market Size 2032 |

USD 14,427 million |

The compacted graphite iron (CGI) market is led by major players such as Tupy SA, Fritz Winter Eisenwerk GmbH, Waupaca Foundry, and Sintercast AB, which collectively hold a significant share of global production. These companies focus on advanced casting technologies, sustainability, and strategic collaborations with automotive OEMs to enhance product performance and efficiency. Asia-Pacific emerged as the leading region in 2024, accounting for 34.8% of the total market share, driven by robust automotive manufacturing and expanding power generation industries in China, Japan, and India. Europe followed with a 29.1% share, supported by stringent emission norms and strong adoption of high-strength materials across vehicle and machinery applications.

Market Insights

- The compacted graphite iron market was valued at USD 9,245 million in 2024 and is expected to reach USD 14,427 million by 2032, growing at a CAGR of 5.72%.

- The market is driven by rising demand from the automotive sector, particularly for lightweight and high-strength engine components that improve fuel efficiency and reduce emissions.

- Advancements in metallurgical control and casting technology are enhancing product consistency, leading to wider CGI applications in heavy machinery and power generation.

- The competitive landscape is moderately consolidated, with global manufacturers focusing on R&D, process automation, and sustainable production practices to strengthen market presence.

- Asia-Pacific dominated with a 34.8% share in 2024, followed by Europe at 29.1% and North America at 27.4%, driven by strong automotive, industrial, and energy sector growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Grade

The 400 MPa segment dominated the compacted graphite iron market with a 34.6% share in 2024. This grade is widely used in automotive engine blocks, cylinder heads, and heavy machinery components due to its balance of tensile strength, thermal conductivity, and machinability. Its durability supports high-performance engines under extreme temperatures and pressure. The rising demand for lightweight yet strong materials in vehicle manufacturing continues to drive the use of 400 MPa CGI. Growing production of commercial vehicles further strengthens the segment’s leadership in global applications.

- For instance, SinterCast reports CGI delivers at least 75% higher tensile strength and 45% higher stiffness than gray iron, supporting ~400 MPa class engine blocks in series production.

By Product

The nodules segment held the largest share of 59.2% in 2024. Its dominance is driven by the superior strength and elasticity that nodular structures provide, enhancing performance under cyclic stress and vibration. Nodular CGI products are preferred in diesel and gasoline engine parts due to better fatigue resistance compared to spheroid forms. Increasing engine downsizing trends and the shift toward higher power densities in automotive design are fueling demand for nodular CGI. This structure also offers improved casting properties, enabling cost-efficient production for mass manufacturing.

- For instance, Impro Precision produces CGI sand-cast components weighing 40–300 kg and consistently achieves over 90% vermicular graphite, matching nodular performance needs.

By Application

The automotive segment led the compacted graphite iron market with a 67.8% share in 2024. CGI’s high stiffness, thermal fatigue resistance, and reduced weight make it ideal for engine blocks, exhaust manifolds, and brake components. The material enables improved fuel efficiency and lower CO₂ emissions, aligning with stringent emission norms in Europe and North America. Rapid electrification and hybrid vehicle manufacturing are further promoting CGI adoption in motor housings and structural parts. Expanding production by global OEMs across China and Germany continues to reinforce automotive sector dominance.

Key Growth Drivers

Rising Adoption in Automotive Engine Manufacturing

The growing use of compacted graphite iron in engine blocks and cylinder heads is a major driver of market growth. Automakers favor CGI for its high strength, thermal resistance, and lightweight properties, improving fuel efficiency and engine durability. Its compatibility with both diesel and gasoline engines supports its integration in hybrid and internal combustion vehicles. Increasing demand for efficient, low-emission engines is further accelerating its adoption across the automotive sector.

- For instance, Ford’s 6.7 L PowerStroke diesel with a CGI block reached 400 hp and 1,085 Nm after a software update, underscoring durability for higher outputs.

Expanding Use in Power Generation Equipment

The power generation industry is increasingly utilizing compacted graphite iron for turbine housings, engine components, and heat exchangers. Its ability to handle high pressure and temperature while maintaining structural integrity enhances operational reliability. As global power demand rises, especially in developing economies, the use of CGI components is expanding in both conventional and renewable power plants. This material’s long service life and low maintenance needs strengthen its role in energy infrastructure.

- For instance, Rolls-Royce Power Systems cast CGI engine frames weighing 9–17 tons, demonstrating thermal-fatigue resistance for heavy-duty power units.

Growth in Heavy Machinery and Construction Equipment

Heavy-duty machinery and construction equipment manufacturers are adopting CGI for components that require enhanced fatigue strength and vibration resistance. Its performance in load-bearing applications such as engine blocks, crankcases, and structural supports ensures longer lifespan and reduced downtime. The ongoing expansion of infrastructure projects and industrialization in Asia-Pacific further drives demand. CGI’s superior mechanical characteristics compared to gray iron make it a preferred choice for high-stress applications in construction machinery.

Key Trends & Opportunities

Shift Toward Lightweight and Sustainable Materials

The global focus on sustainability and fuel efficiency is encouraging manufacturers to use CGI as a substitute for heavier metals. Its lighter weight without compromising strength supports carbon reduction initiatives in transportation and industrial sectors. The combination of recyclability and reduced energy consumption in production enhances its environmental appeal. These factors position CGI as a vital material for future green manufacturing trends across industries.

- For instance, Audi’s CGI diesel blocks achieved about a 10% weight reduction versus conventional cast iron while maintaining strength for efficiency gains.

Integration of Advanced Casting Technologies

The adoption of advanced casting and metallurgical control technologies is improving the consistency and mechanical performance of CGI. Automation and real-time process monitoring are enabling higher precision in production. Manufacturers are investing in digital foundry systems and thermal management techniques to enhance yield and reduce defects. These technological advances are opening new opportunities for high-performance CGI components in automotive and industrial sectors.

- For instance, Tupy has demonstrated the capability to produce Compacted Graphite Iron (CGI) engine blocks with a production cylinder-block nominal wall thickness of 3.5 mm, but has also achieved a minimum wall thickness of 2.5 mm in high-volume series production for specific gasoline V6 engines (e.g., Ford Nano V6 engine program).

Expansion in Electric Vehicle Applications

The transition toward electric vehicles presents new opportunities for CGI in motor housings, battery casings, and structural frames. Its thermal conductivity and strength make it suitable for managing heat and mechanical stress in EV systems. Automakers are exploring CGI to optimize efficiency while maintaining durability. The growing EV production in China, the U.S., and Europe is expected to expand its market scope over the coming years.

Key Challenges

High Production and Processing Costs

Producing compacted graphite iron requires precise metallurgical control and specialized equipment, leading to higher manufacturing costs. The complexity of maintaining graphite morphology adds to process expenses compared to gray iron. Smaller foundries face challenges in scaling CGI production economically. These factors limit widespread adoption, particularly in cost-sensitive industries, affecting market penetration in developing regions.

Limited Awareness and Technical Expertise

The market faces a shortage of technical know-how regarding CGI processing and applications. Many manufacturers lack the specialized training required to maintain production consistency and quality standards. This knowledge gap restricts wider utilization across smaller enterprises. Developing global training programs and industry collaborations remains essential to support the long-term growth and industrial acceptance of CGI materials.

Regional Analysis

North America

North America held a 27.4% share of the compacted graphite iron market in 2024. The region’s dominance is driven by strong automotive production in the United States and Canada, particularly in heavy-duty and light commercial vehicles. Major manufacturers are integrating CGI into high-performance engines to enhance fuel efficiency and reduce emissions. The presence of advanced foundry infrastructure and R&D investments further support market growth. Rising demand for durable materials in power generation and industrial machinery applications also strengthens CGI adoption across North American industries.

Europe

Europe accounted for a 29.1% share of the compacted graphite iron market in 2024. The region benefits from a well-established automotive industry, led by Germany, France, and Italy, focusing on lightweight and high-strength materials. Strict emission regulations are driving manufacturers to adopt CGI for efficient and low-emission engine components. European foundries are investing in advanced metallurgical processes to improve product quality and reduce carbon footprints. The demand for CGI in renewable energy and marine applications continues to expand, supported by technological innovation and sustainability-focused manufacturing initiatives.

Asia-Pacific

Asia-Pacific dominated the compacted graphite iron market with a 34.8% share in 2024. Rapid industrialization and strong automotive production in China, Japan, India, and South Korea drive market expansion. The region’s growing power generation and construction equipment sectors further boost demand for CGI components. Local foundries are increasingly adopting advanced casting technologies to enhance production efficiency and quality. Expanding investments in electric vehicle manufacturing and industrial machinery create additional growth opportunities. Favorable government initiatives supporting manufacturing modernization continue to strengthen Asia-Pacific’s leadership in the global CGI market.

Latin America

Latin America captured a 5.7% share of the compacted graphite iron market in 2024. The region’s growth is supported by rising automotive manufacturing in Brazil and Mexico, along with the expansion of mining and construction sectors. Increasing infrastructure development and industrial activities are driving demand for durable materials like CGI. Although regional production capabilities remain limited, collaborations with international foundries are enhancing local expertise. Growing adoption of lightweight materials for vehicle engines and powertrain components further supports market development across Latin America’s emerging economies.

Middle East & Africa

The Middle East & Africa region held a 3.0% share of the compacted graphite iron market in 2024. The demand is primarily driven by investments in power generation, oil and gas, and construction industries. Rising industrialization in Gulf countries and infrastructure projects across Africa are creating opportunities for CGI applications in heavy machinery and energy systems. Limited local foundry capacity remains a challenge, but regional modernization programs are promoting industrial material innovation. Partnerships with global manufacturers are helping improve technical capabilities and accelerate the adoption of CGI in key sectors.

Market Segmentations:

By Grade

- 300 MPa

- 350 MPa

- 400 MPa

- 450 MPa

- 500 MPa

By Product

By Application

- Automotive

- Construction

- Marine

- Power generation

- Others (metallurgy, manufacturing etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The compacted graphite iron market features a moderately consolidated competitive landscape, with key participants including Tupy SA, Fritz Winter Eisenwerk GmbH, Saguenay Foundry, Silbitz Group, Durham Foundry, Waupaca Foundry, Sintercast AB, ASI International, Ltd., Teksid Iron, and Eisengiesserei Baumgarte GmbH. The competition is driven by advancements in casting technologies, material innovation, and process automation. Manufacturers are focusing on enhancing mechanical strength, thermal performance, and lightweight properties to meet the growing needs of automotive and industrial sectors. Strategic collaborations with OEMs and foundry expansions are strengthening global production capabilities. Companies are investing in energy-efficient processes and recycling techniques to align with environmental regulations. The integration of digital foundry solutions, such as real-time quality monitoring and predictive analytics, is improving production consistency and cost efficiency. Continuous R&D investment and technological differentiation remain critical to maintaining market share and addressing rising demand for high-performance CGI components.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tupy SA

- Fritz Winter Eisenwerk GmbH

- Saguenay Foundry

- Silbitz Group

- Durham Foundry

- Waupaca Foundry

- Sintercast AB

- ASI International, Ltd.

- Teksid Iron

- Eisengiesserei Baumgarte GmbH

Recent Developments

- In February 2025, Saroj Group in India became the first SinterCast licensee in India, planning CGI cylinder head production.

- In 2024, Tupy announced it would expand its Compacted Graphite Iron (CGI) production in Mexico to meet rising demand from the heavy-duty commercial vehicle sectors in Europe and North America.

- In 2024, Fritz Winter Eisenwerk GmbH & Co. KG Continued to leverage advancements in CGI production with enhanced properties, improved production processes, and expanded applications, driving the market through high-performance materials demand.

Report Coverage

The research report offers an in-depth analysis based on Grade, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The global compacted graphite iron market will continue expanding due to increasing automotive and industrial demand.

- Engine downsizing trends will drive wider adoption of CGI for lightweight yet durable components.

- Growth in electric and hybrid vehicles will create new applications for CGI in motor housings and casings.

- Advanced casting and metallurgical innovations will improve manufacturing efficiency and quality consistency.

- Rising infrastructure development will boost the use of CGI in heavy machinery and construction equipment.

- Power generation projects will continue adopting CGI for high-temperature and high-pressure engine components.

- Stringent emission regulations will encourage automakers to integrate CGI in low-emission and efficient engines.

- Expansion of foundry capacities in Asia-Pacific will strengthen regional dominance and supply stability.

- Increased collaboration between manufacturers and research institutions will enhance process optimization and material innovation.

- Sustainability goals and circular economy initiatives will accelerate the transition toward recyclable and energy-efficient CGI products.