Market Overview

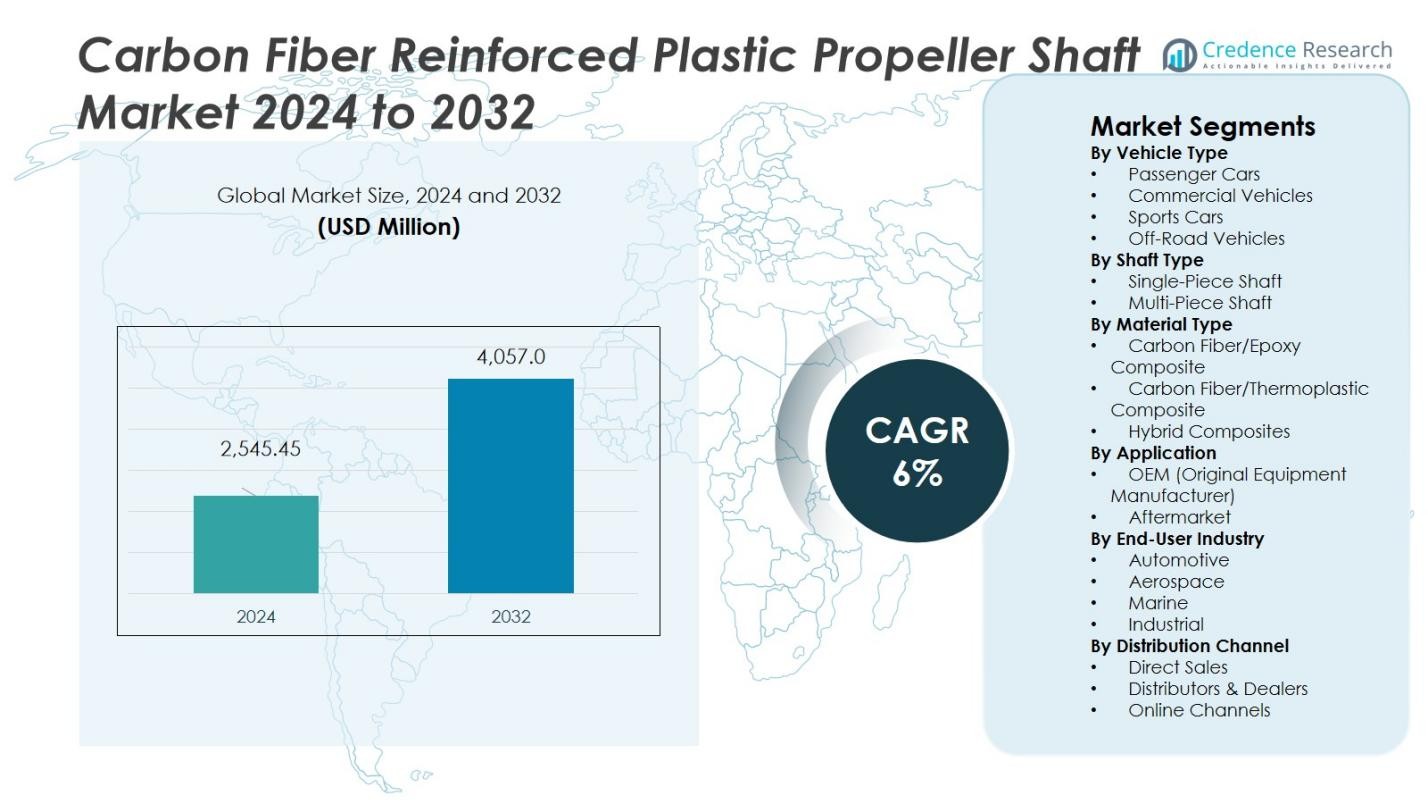

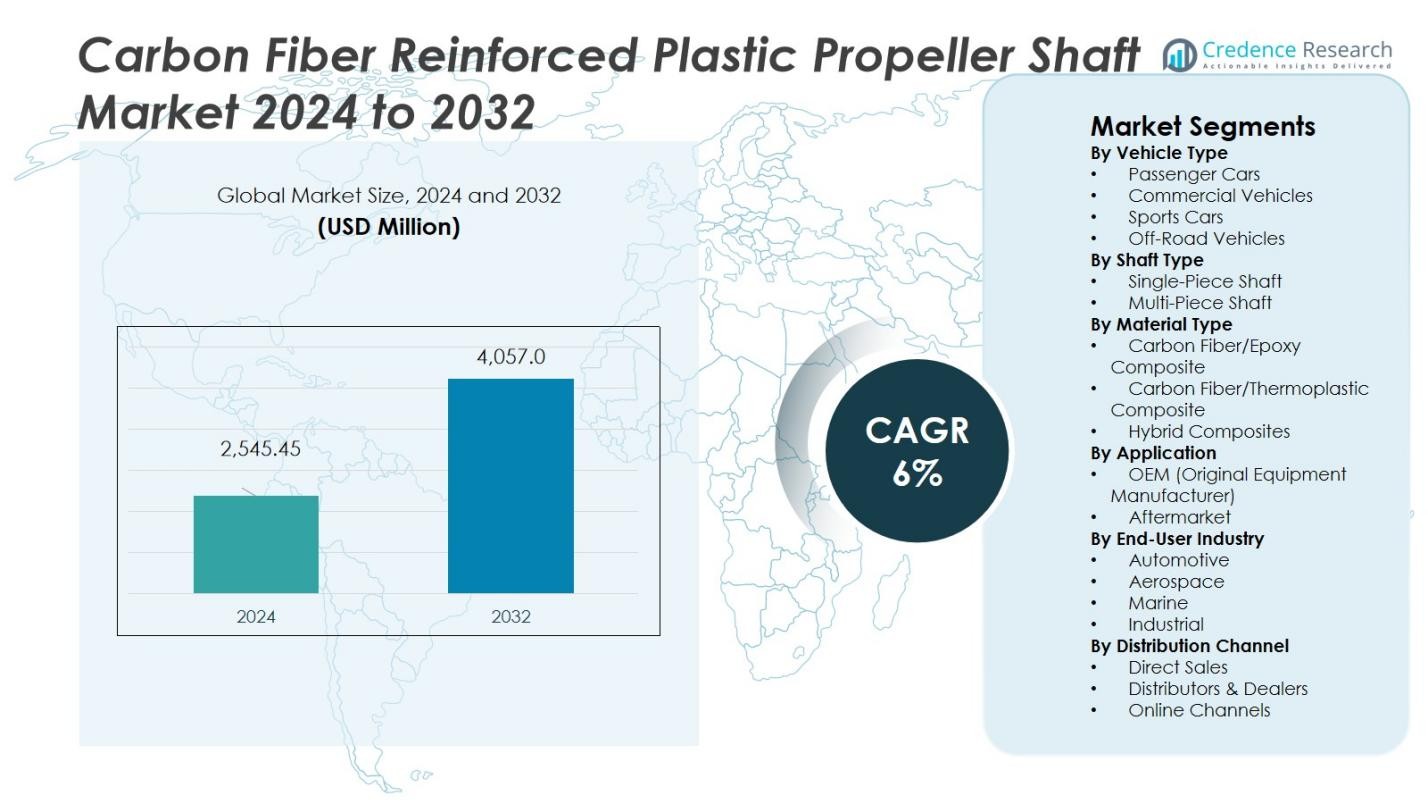

The Carbon Fiber Reinforced Plastic Propeller Shaft Market size was valued at USD 2,545.45 million in 2024 and is anticipated to reach USD 4,057.06 million by 2032, growing at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Carbon Fiber Reinforced Plastic Propeller Shaft Market Size 2024 |

USD 2,545.45 Million |

| Carbon Fiber Reinforced Plastic Propeller Shaft Market, CAGR |

6% |

| Carbon Fiber Reinforced Plastic Propeller Shaft Market Size 2032 |

USD 4,057.06 Million |

The Carbon Fiber Reinforced Plastic Propeller Shaft Market is led by major players such as ZF Friedrichshafen AG, Dana Limited, AVANCO GmbH, JTEKT Corporation, Johnson Power Ltd, Lentus Composites Ltd, CENTA Antriebe Kirschey GmbH, ALFRED HEYD GmbH u. Co. KG, Amarillo Gear Company, and Nakashima Propeller Co., Ltd. These companies focus on developing high-performance, lightweight drivetrain components through advanced composite manufacturing and automation. Strategic collaborations with automotive OEMs and material technology firms strengthen innovation and product quality. North America leads the global market with a 34% share in 2024, supported by advanced automotive infrastructure, strong R&D capabilities, and early adoption of carbon fiber technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Carbon Fiber Reinforced Plastic Propeller Shaft Market was valued at USD 2,545.45 million in 2024 and is expected to reach USD 4,057.06 million by 2032, growing at a CAGR of 6%.

- Rising demand for lightweight and fuel-efficient vehicles drives market expansion, with passenger cars leading the segment at 42% share due to high adoption in advanced drivetrain systems.

- Increasing use of recyclable thermoplastic composites and automation in production marks a key trend, supporting sustainable and cost-efficient manufacturing.

- The market remains competitive with major players like ZF Friedrichshafen AG, Dana Limited, and AVANCO GmbH investing in R&D and partnerships to enhance product performance and expand global presence.

- Regionally, North America holds the largest share at 34%, followed by Europe with 28% and Asia-Pacific at 25%, driven by strong automotive manufacturing bases and growing electric vehicle production.

Market Segmentation Analysis:

By Vehicle Type

Passenger cars dominate the Carbon Fiber Reinforced Plastic Propeller Shaft Market, accounting for 42% of the total share in 2024. Rising demand for lightweight and fuel-efficient vehicles drives the preference for carbon fiber shafts in this segment. Automakers adopt these shafts to enhance torque capacity and reduce vibration, improving overall driving comfort. Commercial vehicles follow, supported by expanding logistics and fleet modernization efforts. Sports and off-road vehicles also contribute, benefiting from performance upgrades and superior power transmission capabilities enabled by advanced composite materials.

- For instance, BMW equips its M3 Sedan and M4 Coupe with CFRP (carbon fiber reinforced plastic) propeller shafts, benefiting from high rigidity and low weight for enhanced performance and reduced rotational mass.

By Shaft Type

The single-piece shaft segment holds the largest share, representing 58% of the Carbon Fiber Reinforced Plastic Propeller Shaft Market in 2024. Its dominance stems from structural simplicity, lower maintenance needs, and better rotational balance compared to multi-piece designs. The lightweight structure reduces drivetrain losses, improving vehicle efficiency and handling. Multi-piece shafts remain preferred in heavy commercial and long-wheelbase applications due to flexibility in installation and cost-effectiveness. Continuous innovations in coupling systems and joint materials are expanding adoption across various vehicle classes.

- For instance, Fuji Racing’s single-piece carbon fiber propshaft is designed for performance enthusiasts, enhancing torque delivery and reducing rotational mass in Subaru 6-speed models.

By Material Type

Carbon fiber/epoxy composite leads the market with a 51% share in 2024, driven by its high strength-to-weight ratio, corrosion resistance, and durability. This material type ensures superior torque transfer and improved fuel efficiency, making it the preferred choice among OEMs. Carbon fiber/thermoplastic composites gain traction for their recyclability and faster processing, aligning with sustainability goals. Hybrid composites, combining carbon and glass fibers, offer balanced performance and cost benefits, expanding usage in mid-range and commercial vehicles seeking affordable lightweight alternatives.

Key Growth Drivers

Rising Demand for Lightweight and Fuel-Efficient Vehicles

The increasing focus on vehicle weight reduction to meet global emission norms drives demand for carbon fiber reinforced plastic propeller shafts. Automakers prefer these shafts due to their superior strength-to-weight ratio, which enhances fuel efficiency and vehicle dynamics. The growing adoption of electric and hybrid vehicles further boosts demand, as lightweight components support better battery performance and extended driving range. This trend aligns with sustainability goals and regulatory pressure to improve vehicle efficiency across key automotive markets.

- For instance, BMW extensively uses CFRP components in its i3 electric vehicle, leveraging the material’s lightweight characteristics to boost battery performance and extend driving range.

Advancements in Composite Manufacturing Technologies

Technological progress in resin transfer molding and automated fiber placement enhances production efficiency and design flexibility of carbon fiber shafts. These innovations lower manufacturing costs and ensure consistent quality, making advanced composites viable for mass-market vehicles. Automotive manufacturers increasingly collaborate with material science companies to integrate high-performance carbon fiber solutions. Improved processing speeds and precision engineering also help scale production, meeting the rising demand from both OEMs and performance vehicle manufacturers globally.

- For instance, Trelleborg’s Advanced Composites division employs automated fiber placement (AFP) technology using narrow UD tape and precision compaction rollers, allowing the manufacture of complex fiber geometries on smaller structures with improved throughput and laminate quality, facilitating broader application of high-performance carbon fiber components in automotive manufacturing.

Growing Adoption in High-Performance and Commercial Vehicles

The expanding market for sports, luxury, and high-torque commercial vehicles drives increased integration of carbon fiber reinforced propeller shafts. These vehicles require components that can withstand higher rotational speeds while reducing vibration and noise. OEMs leverage these shafts to enhance power transmission efficiency and overall vehicle performance. Fleet operators and logistics firms also adopt them to reduce fuel consumption and maintenance costs. The growing focus on durability and long-term reliability strengthens demand across heavy-duty and performance-oriented applications.

Key Trends & Opportunities

Integration of Sustainable and Recyclable Composites

Sustainability is shaping material innovation, with manufacturers developing recyclable thermoplastic-based carbon fiber composites. These materials offer lower environmental impact, shorter production cycles, and improved end-of-life recyclability. Companies are exploring closed-loop manufacturing systems to recover and reuse fibers, aligning with circular economy principles. This trend presents opportunities for market players to strengthen their ESG positioning while meeting rising consumer demand for eco-friendly vehicle components.

- For instance, Complam has pioneered a closed-loop recycling system for thermoplastic carbon fiber composites used in bicycle components. Their process recovers fibers from thermoset carbon fiber waste, producing compression-molded structural parts with 100% recycled carbon fiber content, thereby reducing landfill disposal and meeting strict sustainability standards.

Expansion into Aerospace and Marine Applications

The use of carbon fiber reinforced plastic shafts is expanding beyond automotive applications into aerospace and marine sectors. These industries seek lightweight, corrosion-resistant materials that enhance propulsion efficiency and reduce operational costs. Manufacturers are leveraging their automotive expertise to develop customized shafts for aircraft, drones, and ships. This diversification into adjacent sectors provides a strong growth opportunity, supported by government-backed innovation programs and the rising demand for advanced composite solutions.

- For instance, Pratt & Whitney’s PW1100G-JM engine for the Airbus A320neo features the world’s first engine structural guide vane made from thermoplastic CFRP, delivering high impact resistance and durability even under bird strike conditions.

Key Challenges

High Production Costs and Material Prices

The high cost of carbon fiber materials and complex manufacturing processes limits widespread adoption, particularly in low-cost vehicles. Production involves precise temperature and pressure controls, driving up energy and equipment expenses. Although automation reduces labor costs, the overall capital investment remains significant. Manufacturers face pressure to balance quality with affordability while maintaining profitability. Ongoing research into low-cost carbon fibers and resin alternatives aims to address this challenge and improve scalability.

Limited Repairability and Recycling Infrastructure

Repairing or recycling damaged carbon fiber components remains difficult due to the material’s thermoset nature. The lack of standardized recycling processes increases waste and limits circular economy initiatives. Automotive service networks often lack expertise and equipment for repairing composite shafts, resulting in full replacements. This raises maintenance costs and hinders aftermarket penetration. Expanding infrastructure for recycling and training service professionals can help overcome this challenge and support sustainable market expansion.

Regional Analysis

North America

North America leads the Carbon Fiber Reinforced Plastic Propeller Shaft Market with a 34% share in 2024, driven by strong demand for lightweight and high-performance vehicles. The United States dominates regional sales, supported by advanced automotive R&D facilities and the presence of major OEMs. Stringent emission standards encourage automakers to adopt carbon fiber solutions to improve efficiency. Investments in electric vehicle production and technological innovation in composite materials further strengthen market growth. Canada and Mexico also contribute through expanding automotive manufacturing clusters and supportive trade policies promoting lightweight materials.

Europe

Europe holds a 28% share of the global Carbon Fiber Reinforced Plastic Propeller Shaft Market, supported by strict carbon emission regulations and growing adoption of electric mobility. Germany, the UK, and France remain key contributors due to their strong automotive and aerospace sectors. Leading automakers in the region integrate advanced composites to achieve superior performance and fuel economy. Government-backed sustainability initiatives and R&D collaborations accelerate innovation in recyclable carbon composites. The region’s focus on premium and sports car manufacturing continues to create strong demand for lightweight drivetrain components.

Asia-Pacific

Asia-Pacific accounts for a 25% share of the Carbon Fiber Reinforced Plastic Propeller Shaft Market, with rapid industrialization and automotive expansion in China, Japan, and South Korea. Rising vehicle production and growing consumer preference for fuel-efficient cars drive adoption. Japanese and South Korean manufacturers lead in integrating carbon composites into both passenger and performance vehicles. China’s focus on electric vehicle manufacturing and government incentives for sustainable materials further enhance regional growth. Expanding domestic composite production capacities reduce import dependence and strengthen Asia-Pacific’s position as a key growth hub.

Latin America

Latin America represents a 7% share of the Carbon Fiber Reinforced Plastic Propeller Shaft Market in 2024, supported by gradual modernization of automotive manufacturing. Brazil and Mexico lead regional demand due to increasing adoption of lightweight technologies among OEMs. Growing awareness of energy efficiency and emission reduction strengthens interest in carbon fiber components. Limited production capabilities and higher import costs remain challenges, but ongoing foreign investments and partnerships with global suppliers are improving regional access to advanced composites. The market shows steady growth potential through rising EV and commercial vehicle production.

Middle East & Africa

The Middle East & Africa hold a 6% market share in the Carbon Fiber Reinforced Plastic Propeller Shaft Market, with growth fueled by expanding automotive assembly plants and rising investments in lightweight material technologies. The UAE and South Africa serve as key markets due to their developing industrial infrastructure and regional logistics networks. Demand for durable and heat-resistant components in extreme climates supports adoption. Although market penetration remains low, government initiatives encouraging industrial diversification and local manufacturing are expected to improve long-term opportunities across the region.

Market Segmentations:

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Sports Cars

- Off-Road Vehicles

By Shaft Type

- Single-Piece Shaft

- Multi-Piece Shaft

By Material Type

- Carbon Fiber/Epoxy Composite

- Carbon Fiber/Thermoplastic Composite

- Hybrid Composites

By Application

- OEM (Original Equipment Manufacturer)

- Aftermarket

By End-User Industry

- Automotive

- Aerospace

- Marine

- Industrial

By Distribution Channel

- Direct Sales

- Distributors & Dealers

- Online Channels

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Carbon Fiber Reinforced Plastic Propeller Shaft Market features leading players such as ZF Friedrichshafen AG, Dana Limited, AVANCO GmbH, JTEKT Corporation, Johnson Power Ltd, Lentus Composites Ltd, CENTA Antriebe Kirschey GmbH, ALFRED HEYD GmbH u. Co. KG, Amarillo Gear Company, and Nakashima Propeller Co., Ltd. Competition centers on innovation, lightweight material integration, and enhanced torque transmission efficiency. Companies focus on expanding production capabilities and adopting automation to lower manufacturing costs while maintaining quality. Strategic collaborations between automotive OEMs and composite manufacturers accelerate product development, particularly for electric and high-performance vehicles. Mergers and acquisitions strengthen global presence and broaden product portfolios across multiple end-use industries. Continuous investments in R&D, recyclable materials, and performance testing ensure competitive advantage, while expanding aftermarket offerings and regional supply networks further enhance market penetration and long-term growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ZF Friedrichshafen AG

- Dana Limited

- AVANCO GmbH

- JTEKT Corporation

- Johnson Power Ltd

- Lentus Composites Ltd

- CENTA Antriebe Kirschey GmbH

- ALFRED HEYD GmbH u. Co. KG

- Amarillo Gear Company

- Nakashima Propeller Co., Ltd.

Recent Developments

- In October 2024, American Axle & Manufacturing (AAM) announced a definitive agreement to sell its commercial vehicle axle business in India to Bharat Forge Limited for $65 million.

- In February 2025, SGL Carbon SE announced a restructuring of its Carbon Fibers business unit, refocusing operations toward high-value composite materials and core segments. This strategic move strengthened the company’s position in the CFRP market for automotive and other applications.

- In March 2025, Teijin Limited introduced the “Tenax IMS65 E23 36K” carbon fiber, engineered for industrial use in pressure vessels, automotive components, and construction applications. This new carbon fiber variant expanded material options for propeller shaft manufacturers.

- In March 2025, Hexcel Corporation entered a strategic partnership with FIDAMC in Spain to accelerate innovation in sustainable CFRP manufacturing and next-generation composite materials.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Shaft Type, Material Type, Application, End User Industry, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness strong growth driven by rising adoption of lightweight automotive components.

- Electric and hybrid vehicle production will boost demand for high-strength carbon fiber shafts.

- Manufacturers will focus on cost reduction through automation and scalable composite technologies.

- Sustainability goals will encourage the use of recyclable thermoplastic-based carbon fiber materials.

- OEM partnerships will expand to develop custom propeller shaft designs for specific vehicle platforms.

- Increasing application in aerospace and marine sectors will diversify revenue streams.

- Advanced simulation and testing tools will improve product performance and design accuracy.

- Government regulations on fuel efficiency and emissions will accelerate material substitution.

- Aftermarket services and replacement parts will gain traction with growing vehicle ownership.

- Asia-Pacific will emerge as the fastest-growing region with strong automotive manufacturing expansion.