Market Overview

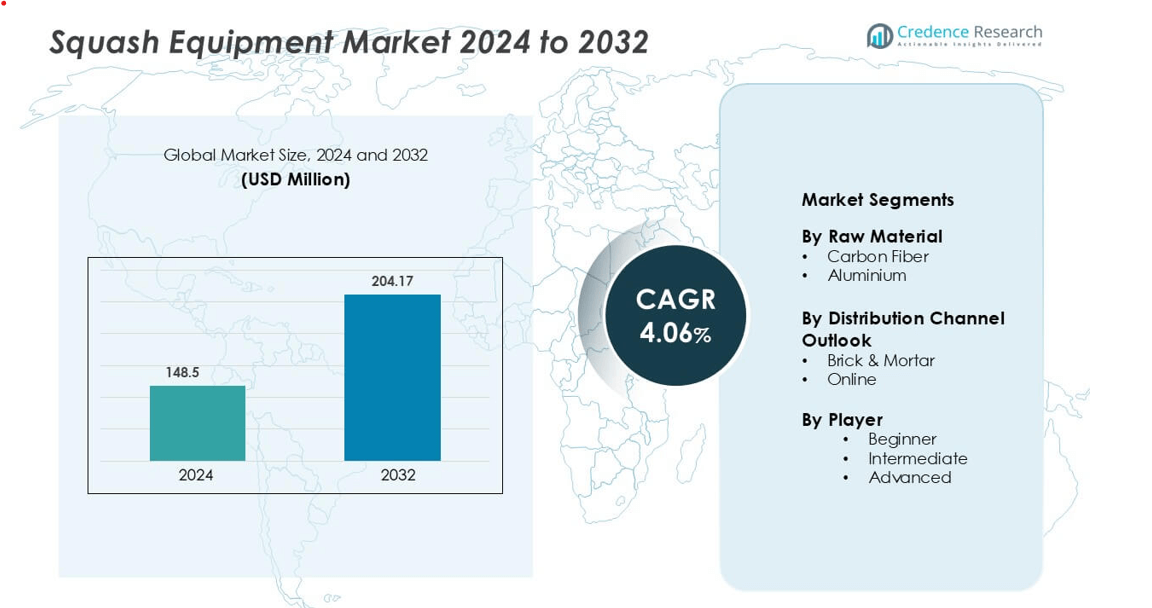

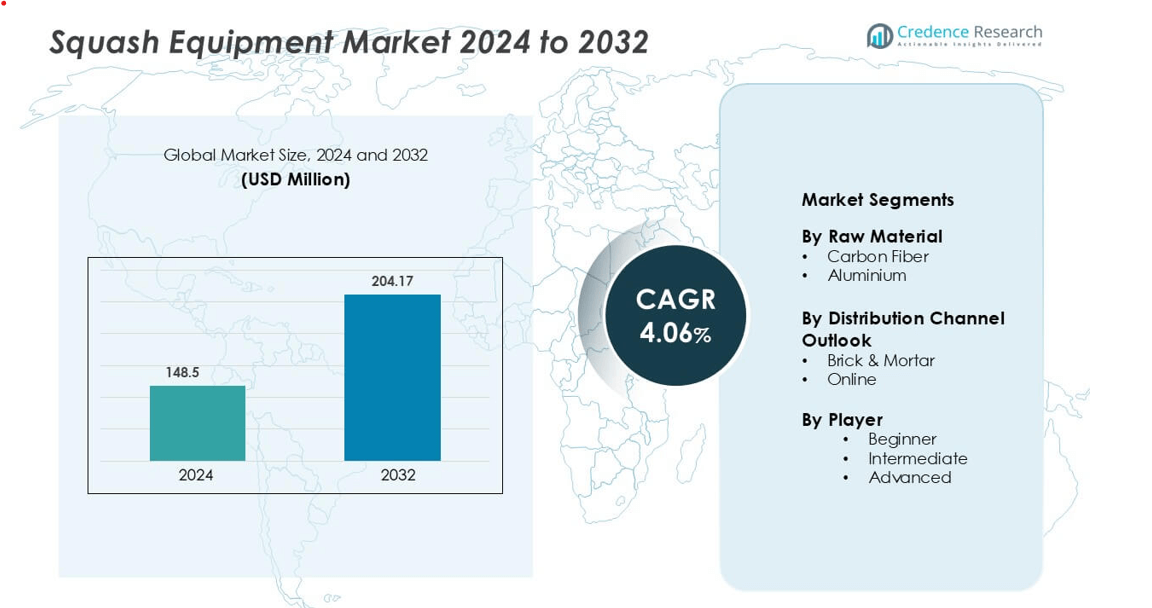

Squash Equipment market was valued at USD 148.5 million in 2024 and is anticipated to reach USD 204.17 million by 2032, growing at a CAGR of 4.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Squash Equipment Market Size 2024 |

USD 148.5 million |

| Squash Equipment Market, CAGR |

4.06% |

| Squash Equipment Market Size 2032 |

USD 204.17 million |

Major participants in the global squash equipment market include Dunlop, Tecnifibre, HEAD, Wilson and Babolat, each leveraging strong brand equity and innovation in rackets, balls and accessories. These players lead through product development and global distribution, shaping the market competitive landscape. Regionally, North America holds the largest share at 35.2 %, fueled by high consumer spending and established club networks.

Market Insights

- The global squash equipment market is projected to grow from USD 148.5 million in 2024 to USD 204.17 million by 2034, registering a CAGR of 4.06%.

- Rising health and fitness awareness drives demand as more consumers adopt squash for cardiovascular benefits, boosting purchases of rackets, balls and accessories.

- Product innovation such as lightweight carbon‑fibre rackets and performance balls accelerates uptake, while online retail enables faster, broader distribution and enhances segment share for premium gear.

- Competitive pressures limit pricing flexibility and restrict margin growth; the presence of substitute sports also restrains equipment demand in some regions.

- North America holds the largest regional share at 44.04% of total market revenue in 2025, followed by Europe at 23.63%, reflecting mature infrastructure and high per‑capita sports spending.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Raw Material

In the global squash equipment market for rackets, the carbon‑fiber material segment dominates with around 75.1% of total revenue in 2023. Its dominance stems from carbon‑fiber’s lightweight nature, high strength‑to‑weight ratio and enhanced durability, which appeal to serious players seeking premium performance. The aluminium segment, though smaller, appeals to beginner and recreational users due to its affordability and sufficient durability for entry‑level play; manufacturers leverage this to broaden market access.

- For instance, Tecnifibre’s Carboflex 125 X‑TOP V2 racket weighs 125 g and features a 500 cm² head size with X‑TOP aramid fibre reinforcement for increased stiffness and durability.

By Distribution Channel Outlook

The brick‑&‑mortar channel holds the largest share of the squash equipment market, capturing roughly 68.8% of revenues in 2024. Physical stores remain critical because consumers prefer testing and handling equipment in‑person before purchasing. Meanwhile, the online channel is the fastest‑growing segment, driven by increasing e‑commerce adoption, wide product variety, and convenience, creating a significant growth opportunity for digital retail strategies.

- For instance, HEAD lists its “Cyber Tour” squash racket with a head size of 500 cm² and an unstrung weight of 160 g, which customers often test in‑store for feel and balance before buying.

By Player

Within the squash equipment market segmented by player skill level (Beginner, Intermediate, Advanced), the Beginner segment currently secures the highest share thanks to the largest base of new entrants and recreational players. The Intermediate and Advanced segments follow, with the Advanced sub‑segment growing steadily as competitive and higher‑skill players invest in premium gear. Drivers include rising global participation rates, expanded club infrastructure and the growing visibility of competitive squash events.

Key Growth Drivers

Rising Health and Fitness Awareness

Growing global interest in health and fitness significantly boosts demand for squash equipment. Players view squash as a high‑intensity sport offering cardiovascular benefits, agility improvement and weight management — priorities for modern fitness seekers. As more individuals integrate sports into lifestyle routines, manufacturers respond by promoting equipment tailored for both recreational users and competitive players, thereby driving revenue growth in the market.

- For instance, the French brand Tecnifibre offers its “Carboflex” series squash rackets in unstrung weights of 125 g, 130 g and 135 g, giving competitive and club players choice for tailored performance by weight class.

Expansion of Squash Facilities and Participation

Greater presence of squash courts, clubs and organized competitions expands the player base and stimulates equipment demand. Both grassroots initiatives and professional tournaments encourage new entrants, which in turn prompt equipment purchases by beginners and intermediates alike. This infrastructure build‑out creates a sustained pipeline of demand that supports long‑term market expansion for rackets, balls and accessories.

Technological Innovation and Premiumisation

Manufacturers increasingly use advanced materials (such as carbon fibre composites) and smart design to deliver higher performance gear. Premium rackets, specialized balls and high‑tech footwear command strong interest from skilled players and help elevate average selling prices. This move toward premiumisation not only enhances margins but also differentiates brand offerings, fuelling market growth.

Key Trends & Opportunities

E‑Commerce Growth and Online Distribution

Online retail channels are gaining ground rapidly in the squash equipment market due to convenience, broader product selection and competitive pricing. Players in regions with limited physical retail access particularly benefit from e‑commerce growth. The shift presents opportunities for brands to expand digitally, optimise direct‑to‑consumer strategies and tap into emerging markets outside traditional retail networks.

- For instance, The NIVIA Black Horn Squash Racket appears in large online stores with a stated weight of around 215g, which is typical for beginner or recreational models. This model supports global shipping into markets lacking brick-and-mortar showrooms.

Sustainability and Eco‑Friendly Materials

Consumers increasingly demand sports gear produced with recycled plastics, water‑based adhesives and sustainable manufacturing methods. In the squash equipment market, eco‑friendly rackets, balls and footwear provide a competitive edge and align with global sustainability agendas. Companies that embrace greener production practices can appeal to environmentally conscious players and better position themselves in growth segments.

- For instance, OrthoLite uses recycled rubber in its insoles, diverting 1,320,000 lbs of post-production waste rubber from landfills annually while using water-based glues and solar-heated water systems in its factories.

Emerging Regional Markets

Regions such as Asia‑Pacific, Latin America and the Middle East show strong potential for growth thanks to rising disposable incomes, expanding urban sports infrastructure and increasing interest in squash. Brands that establish early presence and adapt to local preferences (price sensitivity, entry‑level equipment) can capture market share ahead of saturation in mature regions.

Key Challenges

High Equipment Cost and Access Barriers

Premium squash equipment often carries high price points that limit uptake among budget‑conscious players. Additionally, the relatively limited number of squash courts in some regions presents a barrier to participation and thus suppresses equipment growth. These access and affordability issues constrain market expansion potential in many markets.

Intense Competition and Alternative Sports

The squash equipment market faces pressure from competing racquet sports (tennis, badminton) and fitness alternatives, which can divert potential players and shift equipment spend elsewhere. Furthermore, competition among equipment brands forces constant innovation and cost pressures, which may squeeze margins and slow growth unless differentiation remains strong.

Regional Analysis

North America

North America accounts for approximately 35.2 % of the global squash equipment market share. This region benefits from high levels of consumer spending on fitness and sports gear, a well‑developed retail ecosystem (both online and brick‑and‑mortar), and strong participation in recreational and competitive squash. Manufacturers exploit advanced materials and premium pricing strategies to address demand from both amateur and professional players. The presence of national and international tournaments further sustains equipment uptake and brand investment.

Europe

Europe commands an estimated 41.0 % share of the global squash equipment market. The region features mature club infrastructure in countries such as the UK, France and Germany, and a large base of both recreational and serious players. Demand for high‑performance equipment remains strong, and online retail penetration continues to rise. Despite saturation in some mature markets, innovation in design and materials helps maintain growth momentum across Europe.

Asia-Pacific

The Asia‑Pacific region holds roughly 20.0 % of the global market for squash equipment. Growth accelerates due to increasing fitness awareness, expansion of squash facilities especially in India, China and Southeast Asia, and rising disposable incomes. Brands are deploying more entry‑ and mid‑tier equipment to tap into the broad base of new players. While premium gear uptake is still lower than in developed regions, the region offers substantial opportunity for expansion.

Latin America

Latin America holds approximately 9.6 % of the global squash equipment market share. Growth in this region is driven by rising sports participation, the development of new clubs and courts in countries such as Brazil and Argentina, and increasing recreational use of squash. The market remains more price sensitive compared to mature regions, so manufacturers focus on entry‑level offerings and cost‑effective distribution to capture share.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for around 4.2 % of the global squash equipment market. The region’s growth is supported by investments in sports infrastructure (particularly in Gulf states and North Africa), along with increasing youth and recreational participation in squash. Manufacturers target value‑oriented equipment and flexible distribution models to adapt to the regional economic profile and evolving retail dynamics.

Market Segmentations:

By Raw Material

By Distribution Channel Outlook

By Player

- Beginner

- Intermediate

- Advanced

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global squash equipment market features a mix of established brands and agile challengers, each pursuing distinct strategies to capture market share. Leading manufacturers such as Dunlop Sports, HEAD Sport, Tecnifibre and Wilson Sporting Goods dominate through strong brand reputation, broad distribution networks and continuous product innovation (e.g., lightweight rackets, high‑performance balls). At the same time, niche players and regional manufacturers capitalise on cost‑effective production, tailored local marketing and e‑commerce channels. Competitive rivalry remains moderate but intensifying, as companies differentiate via advanced materials, sustainability credentials and direct‑to‑consumer models. With established players defending premium segments, newer entrants focus on affordable gear for recreational players to expand reach and diversify revenue streams

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rasna

- Tropicana (PepsiCo)

- Robinsons & Co. Pte

- Hamdard

- Suntory

- Coca Cola

- Kissan

- Nichols Plc

- Prigat

- Britvic plc

Recent Developments

- In April 2025, Capri-Sun relaunched its squash range with a new formula and two additions to its flavor lineup. Intended for families looking for low-sugar drinks without compromise on taste, the revamped range features a reformulated Double Strength Orange Squash as well as two new products: Double Strength Monster Alarm and Double Strength Jungle Drink.

- In April 2025, Robinsons launched a new 750ml price-marked pack with 33% extra free. The pack comes in single concentrate flavors, Orange and Apple, and Blackcurrant.

Report Coverage

The research report offers an in-depth analysis based on Raw material, Distribution Channel Outlook, Player and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will increasingly shift toward lightweight, high‑performance materials like carbon fibre to meet player demand.

- Online sales channels will grow faster than traditional retail, enabling direct‑to‑consumer models and broader geographic reach.

- Entry‑level equipment will expand strongly in emerging regions as infrastructure and fitness awareness rise among new players.

- Premium segment gear aimed at advanced and professional players will drive higher average selling prices and improve margins.

- Sustainability will play a larger role, with brands adopting eco‑friendly materials and manufacturing to appeal to environmentally conscious consumers.

- Product innovation will include smart connected equipment—such as rackets with performance sensors—which will attract tech‑savvy players.

- Collaborative partnerships with clubs, schools and fitness centres will increase to promote the sport and drive equipment adoption.

- Regional growth will accelerate in Asia‑Pacific and Latin America, supported by rising disposable income and sports infrastructure investment.

- The channel mix will further evolve as hybrid retail models merge in‑store trials with online fulfilment, improving consumer convenience.

- Intense competition will push brands to differentiate through brand endorsements, customisation options and bundled offerings tailored to skill levels.