Market Overview

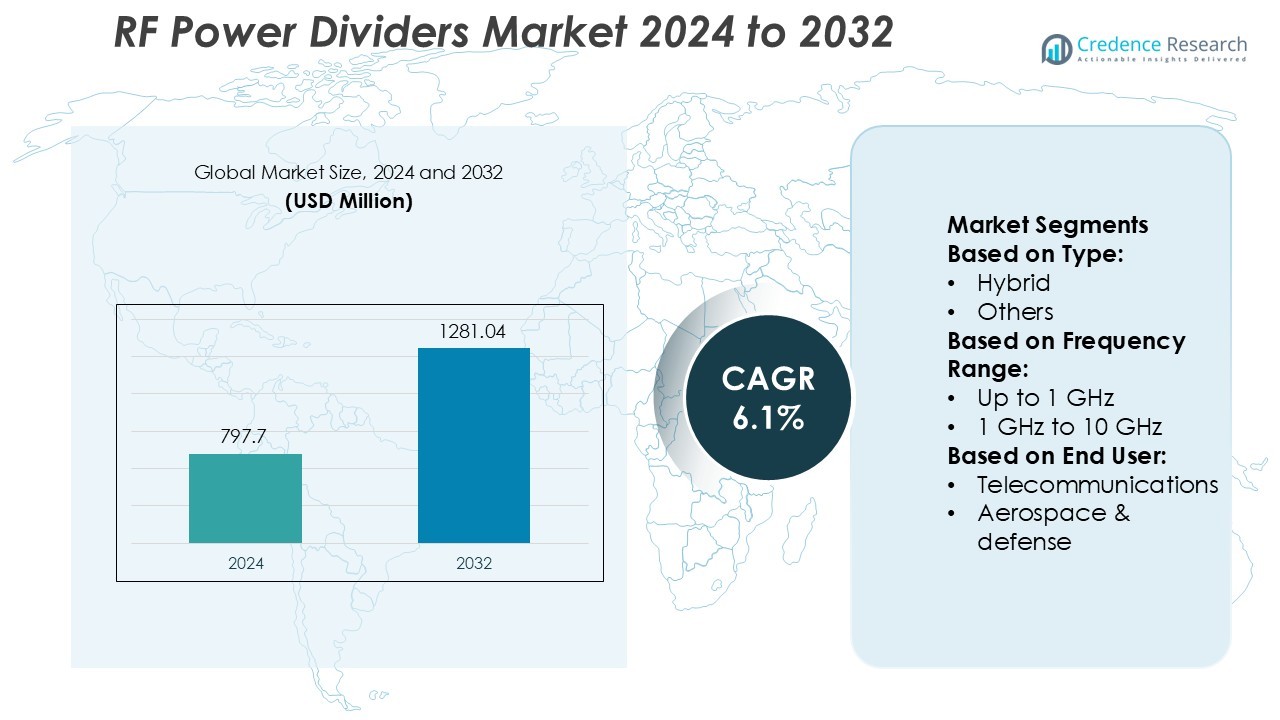

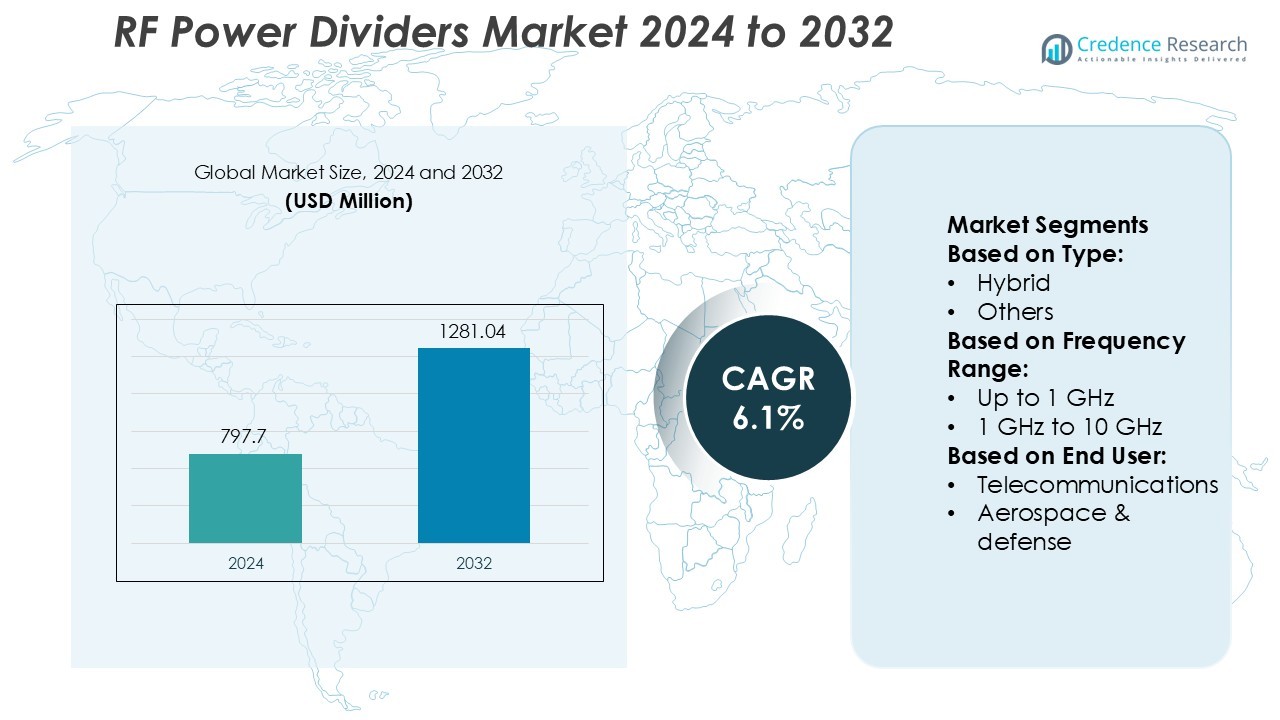

RF Power Dividers Market size was valued USD 797.7 million in 2024 and is anticipated to reach USD 1281.04 million by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| RF Power Dividers Market Size 2024 |

USD 797.7 Million |

| RF Power Dividers Market, CAGR |

6.1% |

| RF Power Dividers Market Size 2032 |

USD 1281.04 Million |

The RF power dividers market features strong competition among specialized RF and microwave component manufacturers focused on high-frequency performance and compact designs. Companies continue to expand portfolios with Wilkinson, hybrid, and resistive dividers that support telecom, aerospace, defense, and satellite communication systems. Players emphasize low insertion loss, stable phase tracking, and wideband capability to address rising mmWave adoption. Strategic moves include product catalog expansion, custom engineering services, and partnerships with OEMs for 5G and radar programs. Asia Pacific leads the global market with a 36% share due to dense telecom deployment, rapid 5G rollout, and strong electronics manufacturing ecosystems across China, South Korea, and Japan, which drive high-volume demand for precision RF components.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- RF Power Dividers Market size reached USD 797.7 million in 2024 and will grow to USD 1281.04 million by 2032 at a 6.1% CAGR, supported by demand from high-frequency communication systems.

- Growth is driven by 5G rollout, rising mmWave adoption, and expanding radar and satellite networks, which require power dividers with low insertion loss, high isolation, and stable phase performance.

- Key trends include compact Wilkinson and hybrid designs, wideband operation, and increasing use of custom-engineered dividers for telecom, aerospace, and defense applications.

- Competition remains strong as manufacturers expand catalogs, offer quick delivery, and partner with OEMs; however, high design complexity and pricing pressure in high-frequency segments limit adoption among small users.

- Asia Pacific dominates with a 36% share due to strong electronics manufacturing and telecom upgrades, while the telecom segment leads the market with the largest share as network operators invest in dense infrastructure for 5G and advanced wireless systems.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Reactive (Wilkinson) power dividers held the largest share due to their low insertion loss, high isolation, and excellent impedance matching for high-frequency applications. These dividers are widely used in radar systems, 5G base stations, and RF test setups, which demand signal accuracy and phase stability. Resistive power dividers serve low-frequency and broadband applications but deliver higher loss, limiting adoption in precision systems. Hybrid and other types target niche areas such as custom multi-port solutions and high-power RF chains in military and satellite communication environments.

- For instance, MegaPhase offers standard 2-way, 3-way, 4-way, 6-way and 8-way power divider configurations covering 0.5 GHz to 40 GHz bandwidth. These dividers are widely used in radar systems, 5G base stations, and RF test setups, which demand signal accuracy and phase stability.

By Frequency Range

The 1 GHz to 10 GHz segment dominated the market, supported by rapid 5G deployment, advanced radar development, and growing satellite communication networks. Manufacturers design compact, temperature-stable dividers for mid-band and high-band spectrum requirements. The up to 1 GHz segment addresses VHF and UHF broadcasting, while the 10 GHz to 30 GHz range expands with Ka-band satellite links and high-resolution radar. Products above 30 GHz gain traction in millimeter-wave communication and automotive sensing, aligning with next-generation connectivity needs.

- For instance, Rohde & Schwarz’s R&S®NRP-Z221 power sensor offers measurement coverage up to 18 GHz, with an uncertainty of 0.063 dB at +20 °C in the 100 MHz to 4 GHz band.

By End User

Telecommunications accounted for the highest market share due to heavy adoption in 4G and 5G infrastructure, small-cell networks, and RF testing. Power dividers support antenna arrays, signal distribution, and phased-array systems in mobile communication. Aerospace and defense follow, driven by radar modernization, electronic warfare, and secure satellite communication needs. Consumer electronics use compact dividers for wireless devices and IoT modules, while automotive demand grows with ADAS, radar sensors, and V2X systems. Medical and other industrial users apply RF dividers in imaging and diagnostic systems.

Key Growth Drivers

- Rising Deployment of 5G and Advanced Communication Networks

The rapid expansion of 5G networks drives significant demand for high-frequency RF power dividers. Telecom operators deploy these components in base stations, small cells, and massive MIMO systems to ensure accurate signal splitting with low insertion loss and stable phase balance. Network densification across urban and rural areas accelerates unit consumption. Advancements in millimeter-wave technology and massive IoT connectivity also increase adoption. High-frequency dividers support faster data transfer, reduced latency, and improved spectrum efficiency, pushing manufacturers to deliver compact, high-performance models suited for harsh outdoor environments.

- For instance, Pasternack’s PE2082 2-way divider operates from 0.5 GHz to 18 GHz, supports 30 W input power, and maintains a maximum insertion loss of 2.2 dB across the band, as specified in its datasheet.

- Increased Adoption in Aerospace & Defense Systems

Aerospace and defense platforms rely on RF power dividers for radar, satellite communication, electronic warfare, and navigation systems. Defense modernization programs in North America, Europe, India, and China boost procurement of high-precision RF components with wide bandwidth tolerance and rugged design. Growing investment in phased-array radar and space missions strengthens demand for Wilkinson and hybrid dividers due to excellent isolation and high power handling. Long product lifecycle, stringent reliability standards, and defense-grade testing create strong value for premium manufacturers offering radiation-hardened and temperature-stable solutions.

- For instance, Analog Devices offers the HMC912LM3C, which is a 2-way passive power divider (splitter) that covers 0.5 GHz to 18 GHz, provides typical isolation of 20 dB, and maintains an insertion loss of approximately 2.5 dB (including 3 dB power division loss), as specified in its official datasheet.

- Growth of Automotive Radar and ADAS Integration

Modern vehicles use radar sensors for adaptive cruise control, collision avoidance, and autonomous functions. Power dividers help split and route RF signals across multi-antenna radar modules, supporting frequency bands like 24 GHz and 77 GHz. The rising penetration of Level 2 to Level 4 automation drives OEM and Tier-1 investments in compact, lightweight, and thermally stable RF components. Electric vehicle platforms also integrate advanced communication modules, further expanding usage. As countries mandate ADAS features, demand increases from both passenger and commercial vehicle manufacturers worldwide.

Key Trends & Opportunities

- Miniaturization and Integration of High-Frequency Divider Designs

Manufacturers focus on smaller and lighter RF power dividers that meet high-frequency demands without sacrificing signal accuracy. New ceramic-based substrates, MMIC integration, and thin-film fabrication help achieve better phase balance and reduced insertion loss. Compact models support 5G small cells, drone communication links, and IoT edge devices where space constraints are strict. This trend creates opportunities for chip-scale dividers and multi-port architectures used in portable and millimeter-wave applications, especially in telecommunication and defense electronics.

- For instance, Mini-Circuits’ EP2C+ 2-way MMIC divider measures 4 mm × 4 mm × 1 mm and operates from 1.8 GHz to 12.5 GHz, with approximately 1.85 W input power handling and typical insertion loss of 1.8 dB (above 3 dB split loss) at the high end of its frequency range, as specified in its datasheet.

- Expansion of Satellite Broadband and Space Communication Networks

Low-Earth-orbit (LEO) satellite constellations increase adoption of RF signal distribution hardware, including multi-way power dividers. Space-rated components must deliver high isolation, thermal stability, vibration resistance, and radiation tolerance. Growth in commercial satellite internet, Earth-observation systems, and defense-grade space communication creates strong demand. RF power dividers supporting Ku-, Ka-, and V-bands offer significant opportunities for suppliers focused on high-frequency and high-power applications.

- For instance, Marki Microwave’s MPD-0226CH covers 2 GHz to 26.5 GHz with typical isolation of 20 dB and an insertion loss of approximately 1.5 dB (above 3 dB split loss) at 18 GHz, as verified in its published datasheet.

- Increasing Use of Gallium Nitride and Advanced Materials

High-power RF systems benefit from GaN-based designs due to superior thermal efficiency and high breakdown voltage. Material innovations, such as low-loss dielectric substrates and advanced metal finishes, improve device reliability in harsh environments. Manufacturers that adopt GaN, silicon carbide, and miniaturized PCB technologies gain advantages in aerospace, industrial IoT, telecom, and automotive radar markets.

Key Challenges

- High Manufacturing Costs and Precision Requirements

RF power dividers require tight tolerance, stable impedance matching, and precise phase characteristics. High-frequency units demand premium substrates, advanced fabrication, and specialized testing, which raise production costs. Small-batch defense and aerospace orders also limit economies of scale. Price sensitivity among telecom operators and consumer electronics manufacturers restricts investment in high-end units, making cost-optimization a major challenge for suppliers.

- Performance Degradation in Extreme Environmental Conditions

Temperature swings, vibration, and humidity can affect insertion loss, isolation, and overall signal accuracy. Outdoor telecom sites, automotive radar modules, and space hardware expose RF dividers to harsh conditions. Manufacturers face challenges maintaining thermal stability and long-term reliability, especially in miniaturized components. Product failures can disrupt communication, reduce equipment lifespan, and create liability risks, pushing suppliers to meet strict qualification and environmental testing standards.

Regional Analysis

North America

North America holds the largest share in the RF power dividers market, accounting for nearly 35% of global revenue. Strong demand arises from 5G rollouts, aerospace and defense programs, and satellite communication networks. The United States leads adoption due to extensive deployment of high-frequency infrastructure and radar modernization in military fleets. Growth in autonomous vehicles and industrial IoT also increases consumption of compact and microwave-band dividers. Major manufacturers and research institutes drive innovation in wideband and low-loss designs, supporting local production. High investment in space missions and communication satellites further strengthens regional dominance.

Europe

Europe captures close to 25% of the global market share, driven by continuous upgrades in telecom networks and rising defense procurement. Countries such as Germany, France, and the United Kingdom invest in 5G infrastructure, electronic warfare systems, and aerospace engineering. The region’s automotive industry, known for early ADAS integration, increases demand for millimeter-wave power dividers used in radar modules. Satellite communication programs and space exploration initiatives provide additional growth scope. Strong regulatory frameworks and advanced testing facilities support high-precision manufacturing. Local companies focus on compact, thermally stable solutions suited for harsh industrial environments and military platforms.

Asia-Pacific

Asia-Pacific holds nearly 30% of the market share and stands as the fastest-growing region. China, Japan, South Korea, and India invest heavily in telecom expansion, semiconductor manufacturing, and space communication projects. Rapid 5G rollout, digital connectivity, and IoT device penetration sharply increase demand for RF signal distribution components. The automotive sector’s shift toward autonomous driving technologies boosts radar-based sensing systems, creating more opportunities for high-frequency power dividers. Lower manufacturing costs and strong supply chains attract global OEMs. Governments also support satellite broadband and defense modernization, strengthening long-term regional growth.

Latin America

Latin America accounts for roughly 5% of global share, supported by gradual telecom upgrades and adoption of IoT-enabled industrial infrastructure. Brazil, Mexico, and Argentina lead deployment of RF components in broadcast systems, military communication, and network densification. The region sees rising interest in 5G trials and satellite-based connectivity for remote regions. However, budget constraints and import dependency slow adoption of premium power divider technologies. Despite limited manufacturing presence, the growing automotive and aerospace sectors offer long-term potential. Partnerships with North American and European equipment suppliers are expected to improve availability of advanced RF devices.

Middle East & Africa

The Middle East & Africa region holds nearly 5% of the global market share, driven by expanding telecom investments and modernization of military communication networks. Gulf nations deploy RF power dividers in radar systems, satellite uplinks, and secure communication infrastructure. In Africa, growing mobile penetration and broadcast expansion boost low-frequency divider demand. Limited domestic manufacturing leads to reliance on imports from the U.S., Europe, and Asia. Space programs in the UAE and Saudi Arabia create small but growing opportunities in high-frequency dividers. Government-backed digital transformation efforts are expected to increase adoption over the forecast period.

Market Segmentations:

By Type:

By Frequency Range:

- Up to 1 GHz

- 1 GHz to 10 GHz

By End User:

- Telecommunications

- Aerospace & defense

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The RF power dividers market players such as MegaPhase, Rohde and Schwarz, Werlatone, Pasternack, Analog Devices, Mini-Circuits, Marki Microwave, TTM Technologies, ETL Systems, and MACOM. The RF power dividers market features intense competition driven by performance, size reduction, and application expansion across telecom, aerospace, defense, and test and measurement industries. Companies focus on developing compact, high-frequency dividers with low insertion loss and strong phase stability to support 5G rollout, radar upgrades, satellite links, and electronic warfare systems. Product innovation centers on Wilkinson and hybrid topologies that offer higher isolation and improved power handling for multi-path RF architectures. Manufacturers also invest in high-reliability designs capable of operating in harsh environments, including space and military platforms. Partnerships with OEMs, catalog expansion, and rapid delivery models support strong sales channels, while custom engineering services help meet niche frequency and packaging demands. Growing demand for mmWave-capable solutions and the shift to software-defined radio platforms drive continuous R&D investment to enhance bandwidth, linearity, and temperature tolerance.

Key Player Analysis

- MegaPhase

- Rohde and Schwarz

- Werlatone

- Pasternack

- Analog Devices

- Mini-Circuits

- Marki Microwave

- TTM Technologies

- ETL Systems

- MACOM

Recent Developments

- In November 2024, Mini-Circuits announced the launch of their new SPL-2G42G50W4+ active 4-way RF splitter, which is specially designed for operation in the 2.4-2.5 GHz ISM band. It is targeted toward industrial applications such as RF energy and plasma generation as well as industrial heating.

- In February 2024, Infineon Technologies launched its next-generation GaN-based power amplifiers, which aim to improve energy efficiency in 5G base stations and IoT infrastructure. The new series offers higher power density and lower system costs, enabling faster data transmission and better thermal management in compact designs.

- In January 2024, Texas Instruments expanded its automotive-grade power amplifier portfolio with high-efficiency Class-D amplifiers tailored for electric and hybrid vehicles. These amplifiers support advanced driver-assistance systems (ADAS) and infotainment applications, meeting the growing demand for energy-efficient and high-performance solutions in EV platforms.

- In April 2023, Pasternack released a new line of RF power dividers and RF couplers. Their applications span research labs, test and instrumentation, telecommunications, satellite communications, wireless communications, and others.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Frequency Range, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for compact and high-frequency power dividers will grow due to 5G expansion.

- Adoption of millimeter-wave dividers will increase across telecom, radar, and satellite links.

- Defense programs will boost orders for ruggedized dividers with high isolation and low loss.

- More manufacturers will invest in advanced Wilkinson and hybrid designs to improve stability.

- Custom engineering services will gain importance for niche bandwidth and packaging needs.

- Test and measurement companies will use high-precision dividers in R&D labs and production lines.

- Semiconductor integration will lead to smaller, smarter RF front-end architectures.

- Space and aerospace missions will require radiation-tolerant dividers with extended temperature limits.

- Automated production and faster delivery models will support high-volume commercial telecom demand.

- Continuous R&D will focus on wider bandwidth, improved return loss, and thermal efficiency.

Market Segmentation Analysis:

Market Segmentation Analysis: