Market Overview

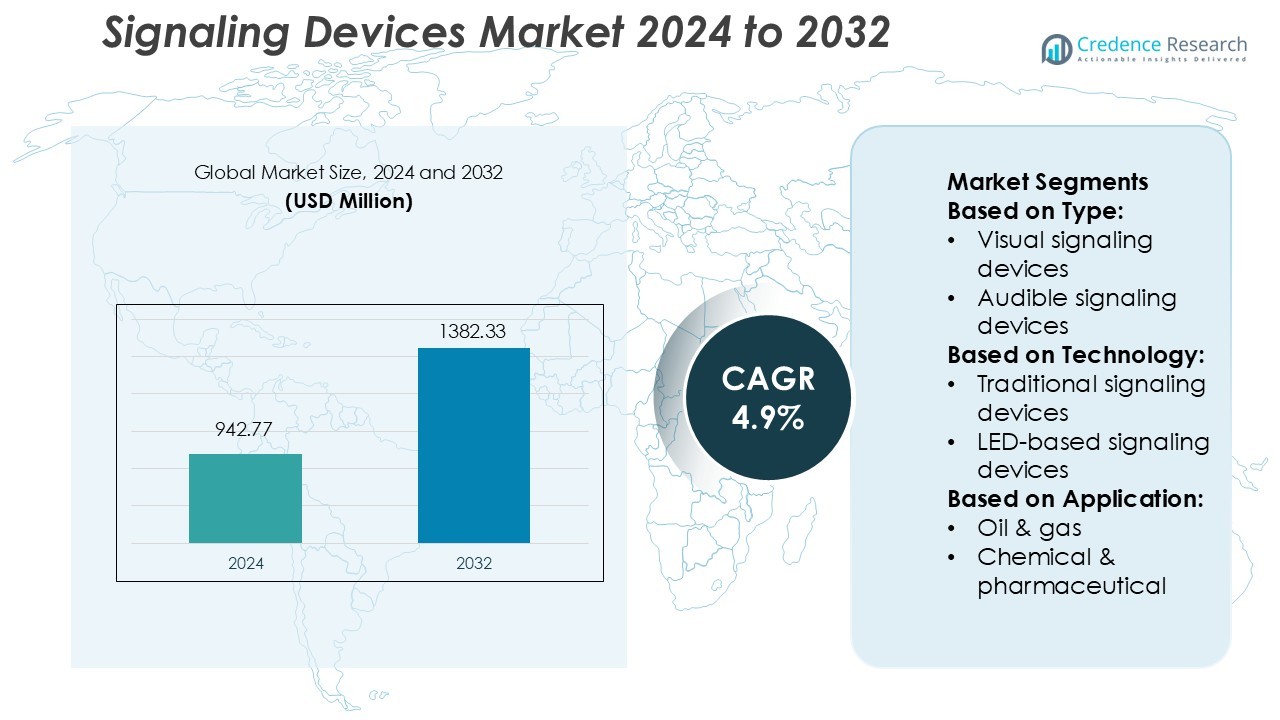

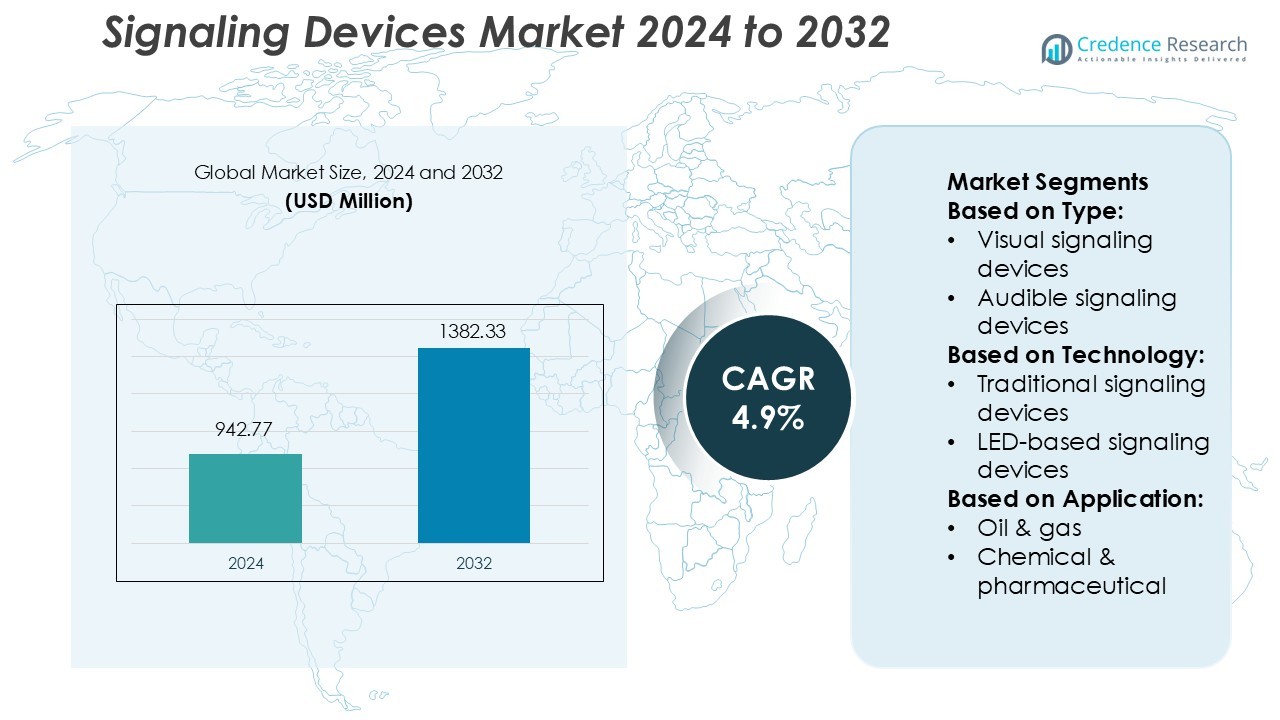

Signaling Devices Market size was valued USD 942.77 million in 2024 and is anticipated to reach USD 1382.33 million by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Signaling Devices Market Size 2024 |

USD 942.77 Million |

| Signaling Devices Market, CAGR |

4.9% |

| Signaling Devices Market Size 2032 |

USD 1382.33 Million |

The signaling devices market is dominated by leading players such as Honeywell International Inc., Siemens AG, ABB Ltd., Emerson Electric Co., Eaton Corporation, Rockwell Automation Inc., R. Stahl AG, E2S Warning Signals, Patlite Corporation, and WERMA Signaltechnik GmbH + Co. KG. These companies focus on developing advanced signaling technologies, including LED-based and IoT-integrated systems, to meet rising industrial safety demands. Strategic initiatives such as product innovation, regional expansion, and partnerships strengthen their market positions. Asia-Pacific leads the global signaling devices market with a 38% share, driven by rapid industrialization, strong manufacturing growth, and expanding safety regulations across industries such as oil and gas, power, and manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The signaling devices market was valued at USD 942.77 million in 2024 and is expected to reach USD 1382.33 million by 2032, growing at a CAGR of 4.9% during the forecast period.

- Growing demand for industrial safety systems and automation solutions is driving consistent market expansion.

- Integration of IoT, LED-based indicators, and wireless technologies continues to shape market trends.

- Competitive intensity remains high as global players focus on R&D, product innovation, and sustainability-driven designs.

- Asia-Pacific dominates the market with a 38% share, followed by North America and Europe, driven by strong manufacturing bases and safety regulations.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

The visual signaling devices segment holds the dominant share of the signaling devices market, accounting for 47% of total revenue in 2024. These devices are widely used in industrial and commercial environments for their ability to deliver instant visual alerts, reducing response times during emergencies. Demand is driven by stringent safety regulations and growing automation in manufacturing facilities. The rising integration of multi-color LED indicators and modular light towers enhances flexibility and visibility across production floors, supporting compliance with international safety standards such as OSHA and IEC.

- For instance, Rockwell Automation’s Allen-Bradley Bulletin 854J stack lights support a diameter of 40 mm and the Bulletin 854K stack lights support a diameter of 60 mm, with an IP66 rating for both (suitable for indoor/outdoor use).

By Technology

LED-based signaling devices dominate the market with a 54% share, driven by their long operational life, low power consumption, and superior brightness. Their durability and maintenance-free performance make them ideal for high-demand sectors such as oil & gas and power generation. Manufacturers are developing smart LED systems with programmable features, wireless connectivity, and self-diagnostic capabilities. These advancements allow efficient monitoring, energy savings, and real-time fault detection, which strengthen adoption across modern industrial automation and safety management systems.

- For instance, E2S’s D2xB1LD2 “Haz Loc LED Beacon” uses an array of high-power Cree® LEDs, delivering 87 candela in steady high power mode and up to 180 candela in flashing mode.

By Application

The oil & gas segment leads the signaling devices market, capturing 32% of total revenue in 2024. The sector’s emphasis on worker safety, explosion-proof equipment, and real-time hazard communication fuels demand for robust signaling systems. Offshore and onshore facilities increasingly deploy integrated audible and visual alarms for process monitoring and emergency alerts. Additionally, investments in digital oilfield automation and asset protection systems further accelerate the need for intelligent signaling technologies capable of operating under harsh and hazardous environmental conditions.

Key Growth Drivers

- Rising Industrial Safety Regulations

Governments and safety organizations are enforcing stricter workplace safety regulations across industries. This has increased the adoption of signaling devices to ensure early warning and hazard communication. In sectors such as oil and gas, mining, and chemical processing, companies rely on visual and audible alarms for worker safety and process control. The integration of smart signaling solutions with automated monitoring systems helps detect equipment malfunctions and hazardous leaks, reducing downtime and preventing accidents.

- For instance, PATLITE Corporation 60 mm modular LED signal tower (model LR6) is rated at IP65 (NEMA Type 4X), and offers insulation resistance > 1 MΩ at DC 500 V between power input lead and chassis.

- Rapid Industrial Automation and Smart Manufacturing Adoption

Expanding industrial automation and Industry 4.0 initiatives are boosting demand for intelligent signaling systems. Smart factories use networked alarms and visual indicators for real-time process control and remote monitoring. These systems help improve operational efficiency and response time during equipment failures. Manufacturers are also integrating IoT-enabled signaling devices for predictive maintenance and system diagnostics. This technological shift enhances productivity while ensuring compliance with modern safety standards in automated facilities.

- For instance, Eaton’s Intelligent Notification Controller (INC) supports 4 digital NACs (notification appliance circuits) and up to 32 Sub-NAC modules on the same wiring trunk, enabling advanced supervision of branch circuits for current-limiting and ground fault detection.

- Expansion of Energy and Infrastructure Projects

Growing investments in energy, construction, and infrastructure sectors drive signaling device deployment. Power generation plants, renewable energy installations, and transportation systems require reliable signaling solutions for safety and communication. Visual beacons and sounders are used in substations, railways, and tunnels to prevent operational hazards. The rise in large-scale industrial projects, especially in emerging economies, strengthens demand for durable and weather-resistant signaling devices tailored for harsh environmental conditions.

Key Trends & Opportunities

- Growing Use of LED and Wireless Signaling Technologies

Manufacturers are shifting toward energy-efficient LED-based and wireless signaling devices. LED technologies provide higher brightness, longer life, and reduced maintenance costs. Wireless systems eliminate complex wiring, simplifying installation and enabling flexible deployment across industrial sites. These advancements cater to smart infrastructure projects and enhance communication reliability. The trend also supports sustainability goals by lowering energy consumption and carbon footprints.

- For instance, WERMA’s KombiSIGN 72 CO2 monitoring traffic light (Part No. 649.000.10) features an LED light source with a service life of 50,000 hours and is available in a configuration with a diameter of 70 mm and height of 287 mm, and connects via a plug-in cable of length 1,500 mm.

- Integration with IoT and Cloud-Based Monitoring Systems

The integration of IoT and cloud technologies is transforming signaling systems into connected safety networks. IoT-enabled devices allow real-time data transmission, system diagnostics, and remote management. Cloud connectivity enhances predictive maintenance and fault detection capabilities. This trend helps industrial operators minimize unplanned downtime while improving overall safety visibility. The increasing adoption of smart ecosystems across factories, oil rigs, and transport systems represents a major opportunity for signaling device manufacturers.

- For instance, ABB’s “Pilot Devices – Signal Towers & Beacons” series supports modular stacking of up to 5 elements on a single-sided bracket and up to 10 elements with a two-sided bracket.

Key Challenges

- High Installation and Maintenance Costs

Deploying advanced signaling systems involves significant upfront costs, particularly in large industrial environments. Wireless and IoT-enabled devices require infrastructure upgrades, skilled labor, and continuous maintenance. For small and medium enterprises, these expenses can limit adoption rates. Additionally, replacement and calibration needs in harsh environments increase operational costs, posing financial constraints for long-term maintenance strategies.

- Integration Complexity Across Legacy Systems

Many industries still operate with outdated control systems that are incompatible with modern signaling technologies. Integrating new devices into legacy setups often requires customized interfaces, increasing time and expense. This challenge slows digital transformation in safety systems. The lack of standardized communication protocols between old and new systems further complicates data synchronization and performance reliability across large-scale operations.

Regional Analysis

North America

The North America region holds approximately 28 % market share of the global signaling devices market. The region leads due to high deployment in manufacturing, oil & gas and chemical sectors, and stringent safety regulations driving advanced audible and visual signals. Significant investment in smart industrial safety systems further elevates demand across the U.S. and Canada. In addition, strong presence of major suppliers and high automation levels sustain the region’s dominance and support steady growth in near-term years.

Europe

Europe accounts for around 22 % of the global signaling devices market. Growth in this region stems from regulatory pressure for workplace safety, retrofit of plants in mature industrial markets, and rising adoption of wireless and IoT-enabled signals. Key markets include Germany, France and Italy where chemical and pharmaceutical industries are expanding. The European region maintains moderate growth as technologies spread and industrial modernization continues.

Asia-Pacific

Asia-Pacific commands the largest share at about 38 % of the global signaling devices market. Rapid industrialisation, expansion of manufacturing hubs in China and India, and infrastructure development in Southeast Asia drive strong demand. Furthermore, increasing safety awareness and global manufacturers establishing production in the region underpin robust growth. The region remains the fastest-growing segment as emerging markets adopt advanced signaling technologies.

Latin America

Latin America accounts for about 6 % of the global signaling devices market. Growth in Brazil, Mexico and other key markets is spurred by industrial automation, mining operations and public safety infrastructure upgrades. However, slower pace of investment and less mature regulatory drivers limit share relative to other regions. The region’s market will expand steadily as older installations get modernised and multinational suppliers enter local markets.

Middle East & Africa (MEA)

The Middle East & Africa region holds roughly 6 % of the global signaling devices market. While baseline demand remains lower, significant infrastructure investments, oil & gas expansions in the Gulf, and rising safety compliance are creating new opportunities. Many MEA countries are upgrading industrial facilities and adopting international safety standards, which gradually elevates the signaling device market. Growth prospects are moderate but improving as awareness and regulatory frameworks advance.

Market Segmentations:

By Type:

- Visual signaling devices

- Audible signaling devices

By Technology:

- Traditional signaling devices

- LED-based signaling devices

By Application:

- Oil & gas

- Chemical & pharmaceutical

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Signaling Devices Market features prominent players such as Honeywell International Inc., R. Stahl AG, Rockwell Automation Inc., E2S Warning Signals, Siemens AG, Patlite Corporation, Eaton Corporation, WERMA Signaltechnik GmbH + Co. KG, Emerson Electric Co., and ABB Ltd. The signaling devices market is highly competitive, driven by continuous innovation and strict safety regulations across industries. Companies are focusing on developing energy-efficient, durable, and smart signaling systems that integrate with industrial automation and IoT frameworks. Advancements in wireless connectivity, LED technology, and modular design have reshaped product development, improving reliability and cost efficiency. Manufacturers are also expanding production capabilities and investing in regional partnerships to strengthen global distribution networks. The focus on workplace safety, predictive maintenance, and real-time monitoring has led to the adoption of advanced signaling solutions across sectors such as oil and gas, manufacturing, energy, and transportation.

Key Player Analysis

Recent Developments

- In December 2024, Electrocore, which is headquartered in New Jersey, announced that it had entered into a definitive agreement to acquire NeuroMetrix and its neuromodulation platform. The acquired product, called Quell, is a solution presented to treat fibromyalgia and lower extremity chronic pain.

- In August 2024, Renata Medical launched a U.S. FDA-approved Minima stent system. This medical device is specially designed for young patients suffering from severe artery narrowing. It offers a life-saving solution for infants, neonates and children having a weight of at least 3.3 pounds.

- In June 2023, Siemens AG announced a USD 2.11 billion investment in new manufacturing facilities, innovation labs, educational centers, and other locations. The company also disclosed plans to build a state-of-the-art factory in Singapore to cater to the increasing demand from markets in Southeast Asia and is expected to unveil further investments in the U.S. and Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for IoT-enabled signaling devices will rise with increasing industrial automation.

- Adoption of wireless and smart signaling systems will enhance operational safety efficiency.

- Integration of AI-based monitoring will improve fault detection and predictive maintenance.

- LED-based signaling devices will dominate due to energy efficiency and longer lifespan.

- Growing focus on worker safety regulations will drive upgrades across industrial sectors.

- Manufacturers will expand product lines for hazardous and remote operating environments.

- Cloud-based connectivity will support real-time monitoring and centralized control systems.

- The transportation and energy sectors will experience high deployment of visual and audible alarms.

- Strategic partnerships and mergers will strengthen technological capabilities and market reach.

- Emerging economies will witness rapid adoption driven by expanding manufacturing infrastructure.

Market Segmentation Analysis:

Market Segmentation Analysis: