Market Overview

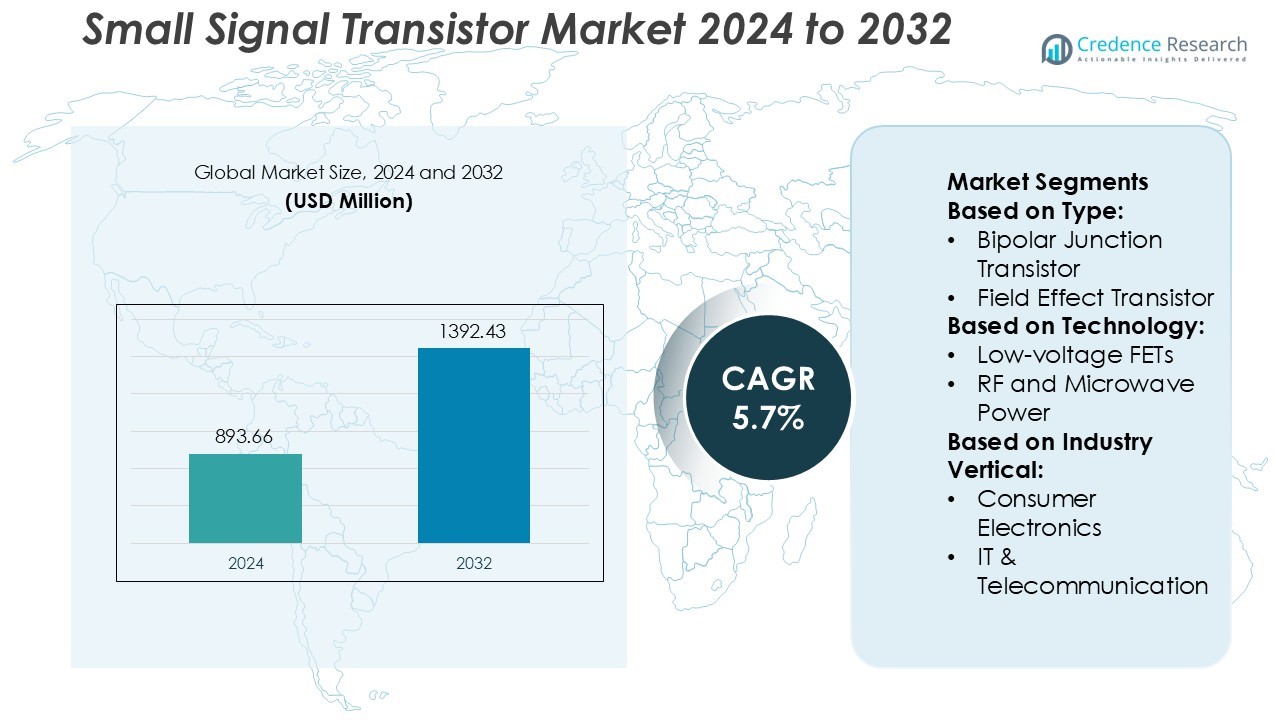

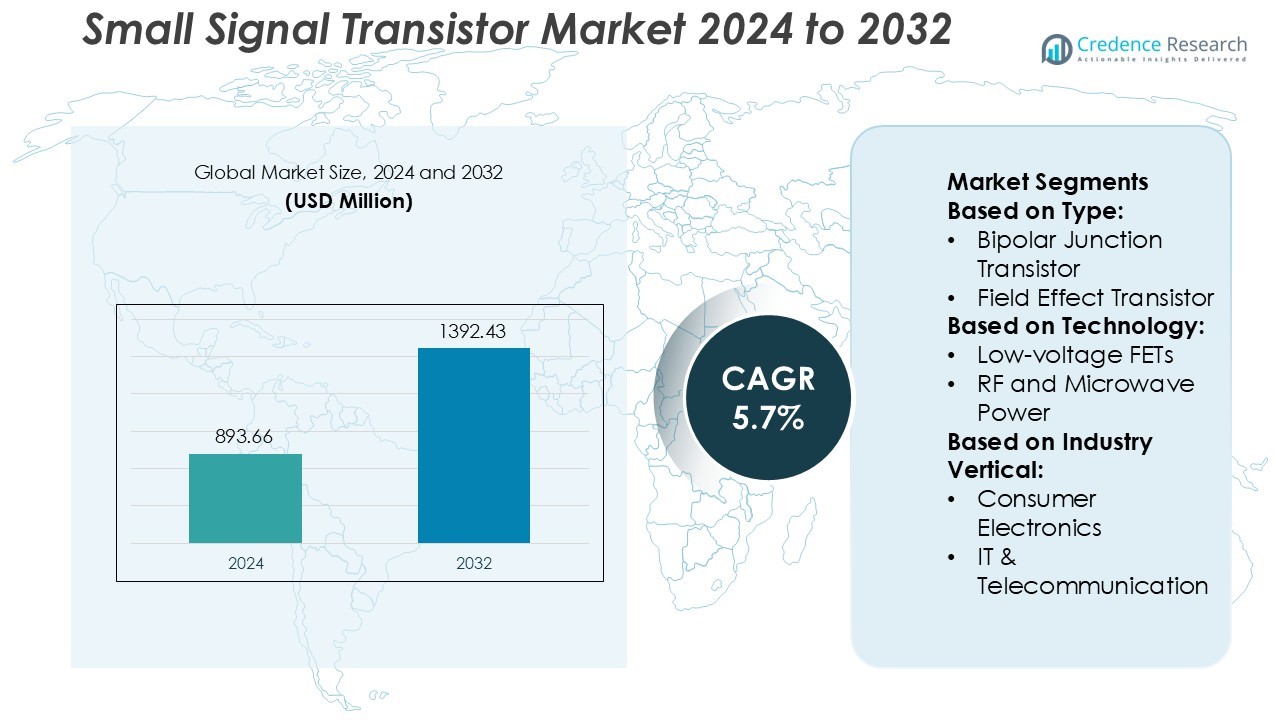

Small Signal Transistor Market size was valued USD 893.66 million in 2024 and is anticipated to reach USD 1392.43 million by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Small Signal Transistor Market Size 2024 |

USD 893.66 Million |

| Small Signal Transistor Market, CAGR |

5.7% |

| Small Signal Transistor Market Size 2032 |

USD 1392.43 Million |

The Small Signal Transistor Market is characterized by strong competition among leading players such as Toshiba Corporation, Texas Instruments Inc., Infineon Technologies AG, STMicroelectronics N.V., NXP Semiconductors N.V., Renesas Electronics Corporation, Mitsubishi Electric Corporation, Linear Integrated Systems Inc., Champion Microelectronics Corp, and Fairchild Semiconductor International Inc. These companies focus on technological advancements, miniaturization, and power efficiency to meet growing demand across consumer electronics, automotive, and telecommunications sectors. Asia-Pacific leads the global market with a 42% share, supported by its robust electronics manufacturing base and government incentives for semiconductor production. Continuous R&D and capacity expansions by regional manufacturers ensure sustained market growth and global supply reliability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Small Signal Transistor Market was valued at USD 893.66 million in 2024 and is projected to reach USD 1392.43 million by 2032, growing at a CAGR of 5.7%.

- Rising demand for low-power electronic components in automotive, consumer, and telecommunication sectors is driving market expansion globally.

- Ongoing trends include the adoption of miniaturized, high-frequency transistors and the integration of silicon–germanium materials for enhanced performance.

- The market faces restraints due to complex fabrication processes, high production costs, and raw material supply fluctuations affecting scalability.

- Asia-Pacific dominates with a 42% market share, driven by large-scale semiconductor manufacturing in China, Japan, and South Korea, while the consumer electronics segment leads with a 38% share supported by rapid technological innovation.

Market Segmentation Analysis:

By Type

The Bipolar Junction Transistor (BJT) segment dominates the Small Signal Transistor Market with a 44% share in 2024. BJTs are preferred for their high current gain, linear amplification, and stability in low-frequency applications. Their extensive use in analog circuits, audio amplifiers, and switching systems drives their strong market position. Ongoing developments in miniaturization and low-power designs further enhance adoption in compact consumer devices. The segment continues to benefit from the steady demand across industrial automation and communication sectors, where precise signal control and amplification are essential.

- For instance, Toshiba Corporation introduced its 2SC3326 transistor for muting and switching applications. This NPN epitaxial type transistor features a maximum collector current rating of 300 mA and a typical transition frequency) of 30 MHz.

By Technology

The Low-Voltage FETs segment holds the largest share of 39% in the Small Signal Transistor Market. These transistors offer superior switching speed, low on-resistance, and minimal power consumption, making them ideal for portable electronics. Their integration in smartphones, wearables, and IoT devices supports market expansion. Manufacturers are developing advanced MOSFETs with improved thermal efficiency and reduced leakage current to optimize performance. The growing emphasis on energy-efficient and high-frequency electronics sustains demand for low-voltage FETs in both consumer and industrial applications.

- For instance, Champion Microelectronics’ CMT2N7002E MOSFET features an on-state resistance (R DS(on)) of 2.6 Ω at V_GS = 10 V”. According to the official datasheet for the CMT2N7002E.

By Industry Vertical

The Consumer Electronics segment leads the market with a 41% share in 2024. Small signal transistors are critical components in smartphones, laptops, televisions, and audio systems, enabling efficient signal amplification and switching. The surge in demand for compact, high-performance electronic devices continues to drive this segment. Increasing integration of transistors in IoT-enabled home devices and smart appliances further strengthens growth. Additionally, advancements in low-power transistor technologies enhance product reliability and extend device lifespan, reinforcing their dominance across consumer electronics manufacturing.

Key Growth Drivers

Expanding Use in Consumer Electronics

The demand for small signal transistors is increasing due to their vital role in compact electronic devices such as smartphones, wearables, and IoT modules. These transistors are essential for signal amplification, switching, and low-noise performance in sensitive circuits. Miniaturization and improved efficiency make them ideal for portable devices with power constraints. The growing integration of 5G and smart sensors in consumer electronics further accelerates adoption. Manufacturers emphasize high-frequency, low-leakage designs to meet the evolving needs of compact, power-optimized devices worldwide.

- For instance, NXP’s BFU520 transistor (part of the BFU5x family) delivers a transition frequency (fₜ) of 10.5 GHz at IC = 10 mA, VCE = 8 V, and a noise figure NFmin of 0.65 dB at 900 MHz.

Advancements in Automotive Electronics

The shift toward electric and hybrid vehicles has driven the adoption of small signal transistors for efficient current regulation and sensing applications. These components enhance the reliability of automotive infotainment, safety systems, and motor control units. Rising implementation of ADAS and EV battery monitoring requires transistors with superior temperature stability and switching speed. The move toward vehicle electrification has encouraged manufacturers to produce automotive-grade components that meet AEC-Q101 standards. This trend strengthens the role of transistors in advanced vehicle electronics.

- For instance, Texas Instruments specifies its CSD17381F4 MOSFET with a drain-to-source voltage rating of 30 V, a continuous drain current of 3.1 A at 25 °C, and a junction-to-ambient thermal resistance (RθJA) of 90 °C/W when mounted on a 1 inch² copper board.

Increasing Adoption in Industrial Automation

Growing automation in manufacturing, energy, and process industries fuels the need for precise signal control. Small signal transistors support automation equipment such as PLCs, sensors, and motor drivers by ensuring signal accuracy under varying load conditions. The adoption of Industry 4.0 technologies and connected factory systems demands energy-efficient components with higher switching reliability. Manufacturers are developing rugged, high-gain transistor variants to handle harsh environments, boosting adoption in smart manufacturing setups.

Key Trends & Opportunities

Shift Toward Energy-Efficient and High-Frequency Designs

Manufacturers are focusing on developing transistors with improved energy efficiency and reduced power dissipation. Low-voltage and high-frequency FETs are gaining prominence in RF communication, IoT nodes, and portable devices. The growing preference for gallium nitride (GaN) and silicon carbide (SiC) materials enhances thermal performance and frequency response. Companies investing in these materials can meet rising demand for high-speed, power-sensitive applications in telecom and consumer electronics sectors.

- For instance, Mitsubishi Electric’s GaN high-frequency device lineup includes the model MGFS52G40MB supporting the 3.6–4.0 GHz band with an output power rating of 16 W and a power-added efficiency of 41% in the 400 MHz band.

Integration with IoT and Smart Devices

The proliferation of IoT networks presents new opportunities for small signal transistor manufacturers. These transistors enable low-power connectivity, precise signal modulation, and seamless data transmission in IoT modules. As device miniaturization and long battery life become crucial, demand for low-leakage, high-reliability transistors is expanding. Companies integrating these components into wearables, home automation systems, and remote monitoring sensors are capturing new market segments.

- For instance, Renesas offers the 2SA673 small-signal PNP transistor rated at a collector current of 0.5 A and a collector-emitter breakdown voltage of 35 V.

Emergence of Advanced Semiconductor Packaging

The industry is witnessing a transition toward smaller, more thermally efficient packaging techniques like wafer-level and 3D packaging. These innovations reduce parasitic effects and improve performance in compact assemblies. The growing use of advanced encapsulation supports higher transistor density and reliability. This trend benefits manufacturers targeting high-performance computing, automotive, and telecom applications that require compact, durable transistor integration.

Key Challenges

Fluctuating Raw Material Prices

The semiconductor industry faces cost instability due to fluctuations in raw material prices such as silicon and gallium. Supply chain disruptions and geopolitical tensions amplify this challenge, affecting production costs. Manufacturers are compelled to optimize designs and adopt cost-effective materials while maintaining performance standards. Such volatility limits profit margins and impacts smaller players with limited procurement flexibility.

Complex Manufacturing and Miniaturization Limitations

Achieving high performance in increasingly smaller transistor designs is technically challenging. Precision fabrication requires advanced lithography and stringent quality control, which raise production costs. The miniaturization process also increases heat density and leakage risks, complicating circuit integration. These challenges demand continuous R&D investments and slow down the scalability of emerging transistor technologies.

Regional Analysis

North America

North America leads the Small Signal Transistor Market with a 36% share in 2024. The region benefits from a strong presence of semiconductor manufacturers and high adoption of IoT devices. Growing demand for energy-efficient consumer electronics and communication systems supports continuous transistor innovation. The U.S. dominates regional growth due to advanced R&D activities and the presence of key players like Texas Instruments and ON Semiconductor. Canada’s investments in automotive and telecommunications electronics further boost the market. Strategic government initiatives promoting domestic semiconductor production enhance North America’s technological self-reliance and competitiveness.

Europe

Europe holds a 27% market share in the Small Signal Transistor Market, driven by its robust automotive and industrial sectors. The region’s focus on electrification, renewable energy, and automation increases transistor usage in control systems and electric vehicles. Germany, the U.K., and France are major contributors due to their expanding EV production and advanced electronics design ecosystems. Companies such as Infineon Technologies and STMicroelectronics continue to enhance transistor performance for power management and RF applications. Supportive EU policies promoting sustainable electronics manufacturing further strengthen Europe’s market position.

Asia-Pacific

Asia-Pacific dominates global demand with a 42% market share, making it the fastest-growing region in the Small Signal Transistor Market. The region’s strong electronics manufacturing base, led by China, Japan, South Korea, and Taiwan, fuels production scale and innovation. Rising demand for smartphones, 5G infrastructure, and electric vehicles accelerates transistor adoption. Major companies like Toshiba, Renesas Electronics, and NXP Semiconductors contribute to advancements in compact, high-efficiency transistors. Government incentives for semiconductor production and technological localization initiatives further enhance Asia-Pacific’s industry leadership and export potential.

Latin America

Latin America accounts for a 7% market share in the Small Signal Transistor Market, supported by emerging industrial and consumer electronics applications. Brazil and Mexico lead the regional growth due to expanding automotive electronics and telecommunications infrastructure. The increasing adoption of IoT-based systems in manufacturing and smart cities drives steady transistor demand. Regional governments’ efforts to attract semiconductor investments and improve manufacturing capabilities contribute to gradual market expansion. Despite moderate growth, Latin America presents long-term opportunities as electronic component localization gains traction in regional supply chains.

Middle East & Africa

The Middle East & Africa hold a 5% share of the Small Signal Transistor Market, showing gradual growth through industrial modernization. Rising investments in smart infrastructure, renewable energy, and communication technologies support transistor demand. Countries like the UAE, Saudi Arabia, and South Africa drive regional progress through technology adoption and automation projects. The growing use of semiconductor components in industrial machinery, defense systems, and consumer electronics fuels market expansion. Partnerships between regional distributors and global suppliers improve product accessibility and encourage technology transfer within emerging markets.

Market Segmentations:

By Type:

- Bipolar Junction Transistor

- Field Effect Transistor

By Technology:

- Low-voltage FETs

- RF and Microwave Power

By Industry Vertical:

- Consumer Electronics

- IT & Telecommunication

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Small Signal Transistor Market includes key players such as Toshiba Corporation, Champion Microelectronics Corp, NXP Semiconductors N.V., Texas Instruments Inc., Mitsubishi Electric Corporation, Renesas Electronics Corporation, Linear Integrated Systems Inc., STMicroelectronics N.V., Infineon Technologies AG, and Fairchild Semiconductor International Inc. The Small Signal Transistor Market features strong competition driven by innovation, miniaturization, and performance efficiency. Manufacturers focus on developing low-power, high-frequency transistors that support next-generation electronic devices and communication systems. Continuous advancements in materials such as silicon–germanium and gallium arsenide enhance signal amplification and switching precision. Companies invest heavily in research and automation to improve production yield and reduce energy consumption. Strategic partnerships with original equipment manufacturers and integrated circuit designers strengthen global supply networks. The growing emphasis on compact designs and eco-friendly semiconductor fabrication further intensifies competition across established and emerging players in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Toshiba Corporation

- Champion Microelectronics Corp

- NXP Semiconductors N.V.

- Texas Instruments Inc

- Mitsubishi Electric Corporation

- Renesas Electronics Corporation

- Linear Integrated Systems Inc.

- STMicroelectronics N.V.

- Infineon Technologies AG

- Fairchild Semiconductor International Inc.

Recent Developments

- In June 2025, ZF India entered into a partnership agreement with an Indian commercial vehicle manufacturer to supply a large quantity of 9-speed transmissions designed for vehicles with over 300 horsepower, manual and automatic transmissions for trucks in the heavy-duty segment.

- In October 2024, Larsen & Toubro (L&T) secured new orders for its Power Transmission & Distribution vertical in the Middle East and Africa, which includes the implementation of an Energy Management System for a country-wide electricity network and the construction of high-voltage transmission lines in Saudi Arabia, along with a National System Control Centre in Kenya.

- In April 2024, Infineon Technologies AG, a prominent player in power systems and IoT on a global scale, is bolstering its outsourced backend manufacturing presence in Europe. The company has unveiled a strategic, multi-year collaboration with Amkor Technology, Inc., focusing on a dedicated packaging and testing facility at Amkor’s Porto manufacturing site.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Industry Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for small signal transistors will rise with expanding 5G and IoT infrastructure.

- Advancements in miniaturization will drive their integration into compact consumer electronics.

- Increasing adoption of electric and hybrid vehicles will boost transistor use in control systems.

- Growing focus on energy-efficient components will enhance production of low-power transistors.

- The shift toward automation and smart manufacturing will strengthen industrial applications.

- Integration of AI and machine learning in semiconductor design will improve performance precision.

- Emerging economies in Asia-Pacific will become major production and export hubs.

- Strategic partnerships between device makers and foundries will ensure supply chain stability.

- Continuous R&D in semiconductor materials will lead to faster and more durable transistors.

- The push for sustainability will encourage adoption of eco-friendly manufacturing processes globally.