Market Overview

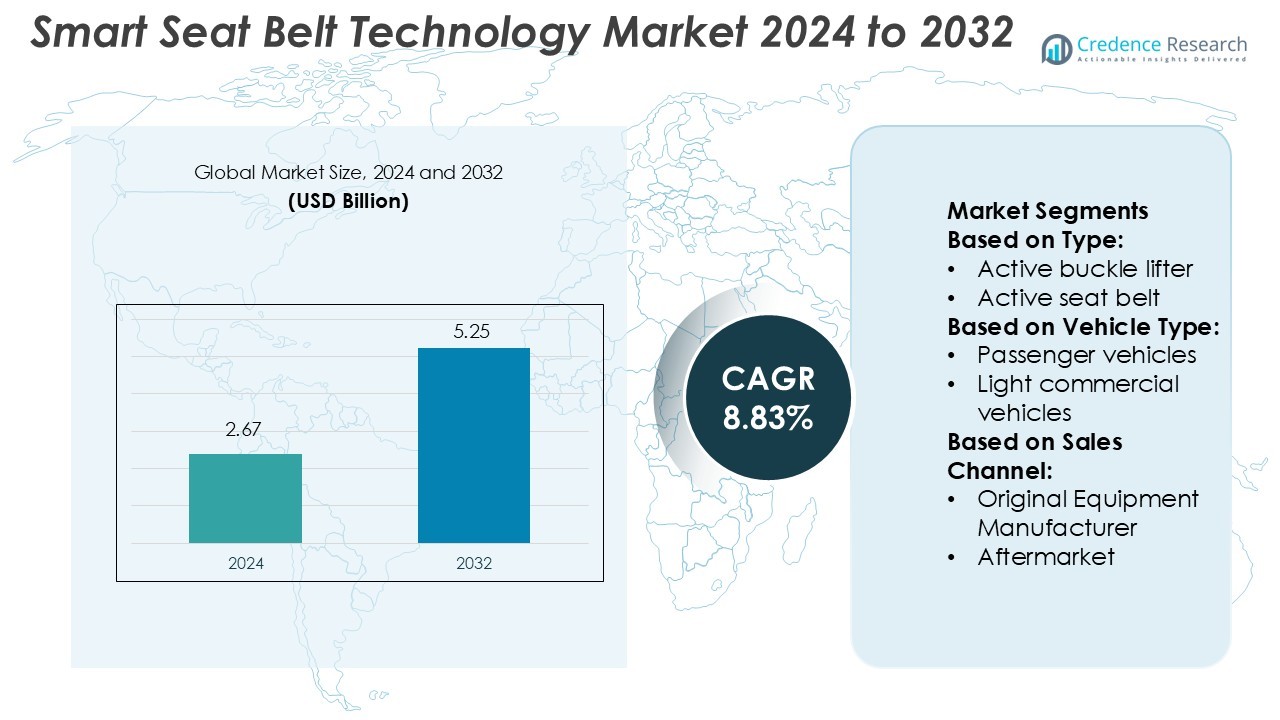

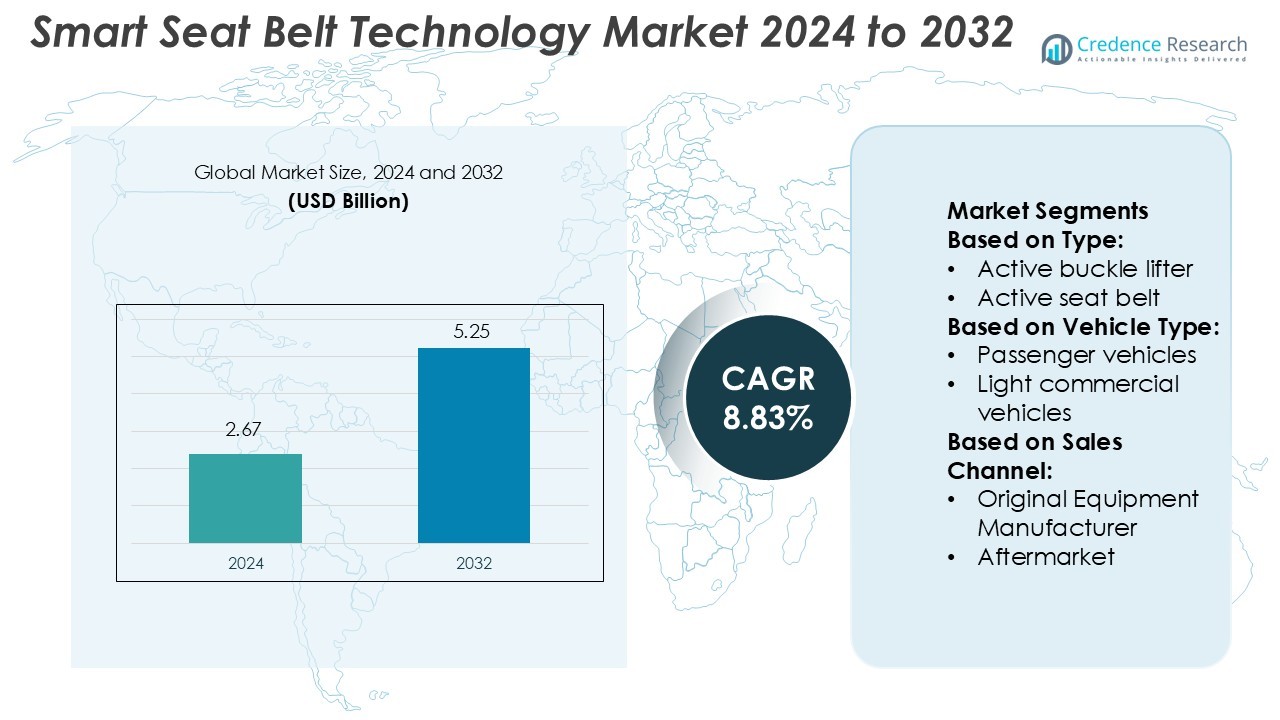

Smart Seat Belt Technology Market size was valued USD 2.67 billion in 2024 and is anticipated to reach USD 5.25 billion by 2032, at a CAGR of 8.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Seat Belt Technology Market Size 2024 |

USD 2.67 Billion |

| Smart Seat Belt Technology Market, CAGR |

8.83% |

| Smart Seat Belt Technology Market Size 2032 |

USD 5.25 Billion |

The Smart Seat Belt Technology Market is driven by major players such as ZF Friedrichshafen AG, Continental AG, Joyson Safety Systems, GWR Safety Systems (U.S.), Holmbergs Safety System Holding AB (Sweden), FinDreams (BYD), ITW Safety, Samsong, and Ashimori Industry Co., Ltd (Japan). These companies focus on developing advanced restraint systems with AI-based tension control, predictive sensors, and integration with vehicle safety electronics. Continuous R&D investments and partnerships with OEMs strengthen their global presence. North America leads the market with a 32% share, supported by strict regulatory frameworks, high adoption of connected vehicles, and early integration of smart restraint technologies by major automakers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Smart Seat Belt Technology Market was valued at USD 2.67 billion in 2024 and is projected to reach USD 5.25 billion by 2032, registering a CAGR of 8.83% during the forecast period.

- Growing vehicle safety regulations and the integration of AI-driven restraint systems are key market drivers, enhancing real-time occupant protection across passenger and commercial vehicles.

- Advancements in predictive sensors, IoT connectivity, and lightweight materials are shaping industry trends, with manufacturers focusing on comfort, customization, and autonomous vehicle compatibility.

- High implementation costs and complex sensor integration remain major restraints, particularly for small and mid-range vehicle manufacturers in developing markets.

- North America leads with a 32% share, followed by Europe at 28% and Asia Pacific at 26%, while the active seat belt segment dominates product adoption due to its efficiency in accident prevention and compliance with advanced safety standards.

Market Segmentation Analysis:

By Type

The active seat belt segment holds the dominant share in the Smart Seat Belt Technology Market. This segment leads due to its ability to automatically tighten the belt during sudden braking or collision detection, enhancing passenger safety. Technologies integrating sensors and control units ensure instant response, reducing injury risks. Demand grows as automakers integrate advanced safety systems with electronic stability control. For instance, Continental AG’s active seat belt retractor features a pyrotechnic tensioning system capable of retracting up to 150 mm of belt slack within milliseconds, improving occupant restraint efficiency.

- For instance, DHL partnered with Daimler and Hylane to rent 30 Mercedes-Benz eActros 600 electric trucks, transitioning its heavy transport operations toward zero-emission freight.

By Vehicle Type

Passenger vehicles dominate the market with the largest share, driven by growing adoption of smart safety systems in mid-range and premium cars. Increasing consumer awareness and stricter vehicle safety regulations encourage the use of intelligent seat belt systems in sedans and SUVs. Automakers focus on improving occupant protection through advanced restraint technologies. For instance, Bosch integrates intelligent seat belt pre-tensioners with airbag control units in passenger cars, enabling precise tension adjustments that improve crash survivability and minimize chest compression injuries.

- For instance, Ryder System, Inc. operates over 260,000 commercial vehicles and manages 55 million annual deliveries, offering OEMs advanced logistics with integrated telematics covering 100% fleet visibility for predictive routing and maintenance.

By Sales Channel

The Original Equipment Manufacturer (OEM) segment accounts for the major market share owing to factory integration of smart safety systems in new vehicles. Leading automakers prefer OEM-supplied solutions to ensure quality compliance and seamless connectivity with onboard electronic control systems. OEMs invest heavily in R&D to align with evolving automotive safety standards. For instance, Autoliv supplies OEM-grade smart seat belt systems featuring load limiters calibrated to 4 kN–6 kN, offering optimized protection during high-impact collisions while maintaining occupant comfort in normal driving conditions.

Key Growth Drivers

Rising Focus on Vehicle Safety Regulations

Stringent government safety mandates drive adoption of smart seat belt technologies across passenger and commercial vehicles. Regulatory bodies in the U.S., Europe, and Asia enforce advanced restraint systems to reduce road fatalities. Automakers increasingly integrate active buckle lifters and intelligent seat belt pretensioners to meet NCAP and UNECE standards. For instance, ZF Friedrichshafen AG’s Active Control Retractor aligns with Euro NCAP’s 2025 protocols, offering millisecond-level tension control to improve protection during frontal and side collisions, boosting technology penetration globally.

- For instance, Kuehne + Nagel inaugurated its new air logistics hub in the Cargo City at Paris Charles-de-Gaulle (CDG) airport in October 2023. The new hub is 12,900 m², as stated in the claim. The hub is capable of handling 300 airfreight pallets per week.

Increasing Adoption of ADAS and Connected Systems

Integration of Advanced Driver Assistance Systems (ADAS) with smart seat belts supports predictive safety functions. Sensors and AI algorithms detect risky maneuvers, triggering pre-crash seat belt adjustments. Automakers leverage data fusion from radar, lidar, and cameras to enhance occupant safety. For instance, Bosch’s predictive restraint control works with adaptive cruise and collision avoidance systems, automatically tightening the seat belt before impact, thereby synchronizing passive and active safety technologies to reduce injuries and support next-generation autonomous driving platforms.

- For instance, CEVA has launched a reverse logistics solution for EV batteries designed to cover 80 % of European volumes by 2030, with battery logistics centers already tested in Ghislenghien, Belgium.

Growing Demand for Comfort and Customization

Consumer preference for personalized and comfort-driven automotive systems accelerates adoption of smart seat belts. These systems automatically adjust tension based on occupant posture, weight, and movement. Manufacturers focus on combining safety with ergonomic design for premium vehicles. For instance, Continental AG’s Comfort Fit smart seat belt technology uses micro-motors and pressure sensors to regulate strap tension dynamically, reducing chest pressure by up to 20% while maintaining optimal restraint, appealing to both luxury and mid-segment vehicle buyers globally.

Key Trends & Opportunities

Integration of AI and IoT in Smart Restraint Systems

The integration of AI and IoT enhances real-time seat belt responsiveness and data-driven safety analytics. Cloud connectivity allows continuous system updates and predictive maintenance. For instance, Autoliv’s IoT-enabled seat belt sensors transmit usage data to centralized platforms, enabling manufacturers to assess seat belt wear patterns and occupant behavior. This connectivity trend opens opportunities for fleet safety monitoring, insurance telematics, and adaptive safety systems that evolve through machine learning and over-the-air software updates.

- For instance, UPS has equipped its entire van fleet, numbering over 100,000 vehicles, with its AI-driven ORION system, achieving significant annual fuel and cost savings that have surpassed initial estimates through continuous upgrades.

Advancements in Material and Sensor Technologies

Lightweight, durable materials and advanced sensors are transforming smart seat belt performance. Companies innovate with stretchable conductive fabrics, miniaturized load cells, and pressure sensors for precision control. For instance, Toyoda Gosei’s sensor-embedded webbing integrates pressure-sensitive fibers capable of detecting 0.5 N force variations, ensuring real-time adjustment to occupant movement. This trend enhances both comfort and reliability while supporting sustainability goals through recyclable materials and reduced component weight in modern vehicle designs.

- For instance, GXO Logistics is actively transitioning its UK warehouse network toward renewable electricity as part of its sustainability strategy, which aims for 100% coverage.

Expansion Across Emerging Automotive Markets

Emerging economies such as India, China, and Brazil present growth opportunities due to rising vehicle production and evolving safety standards. Increasing consumer awareness and government programs promoting advanced safety technologies boost demand. For instance, the Indian government’s Bharat NCAP initiative mandates smart restraint systems in new vehicles from 2026, encouraging automakers to adopt active seat belt solutions. Expanding manufacturing bases and localization strategies by global suppliers further accelerate adoption in cost-sensitive markets.

Key Challenges

High Implementation and Integration Costs

Smart seat belt systems require complex sensor integration and electronic control units, increasing production costs. Small and mid-range automakers face financial challenges adopting these technologies at scale. For instance, incorporating Bosch’s predictive seat belt system adds several hundred dollars per vehicle, limiting use in entry-level models. Cost barriers hinder widespread penetration in developing markets, compelling manufacturers to balance between affordability and compliance with evolving safety norms.

Reliability and Maintenance Concerns

Dependence on sensors and electronic components raises reliability and maintenance challenges. System malfunctions can compromise occupant safety or trigger false activations. Environmental factors such as humidity and temperature fluctuations impact sensor accuracy. For instance, laboratory tests by ZF revealed that prolonged exposure to 60°C ambient temperatures reduced sensor responsiveness by nearly 15%, emphasizing the need for durable electronics. Ensuring long-term system reliability remains crucial to maintain consumer trust and regulatory compliance.

Regional Analysis

North America

North America leads the Smart Seat Belt Technology Market with a 32% share in 2024, driven by strong regulatory enforcement and high vehicle safety awareness. The U.S. and Canada implement strict crash safety norms, encouraging adoption of active seat belt systems in passenger and commercial vehicles. Automakers integrate predictive restraint systems with ADAS features to enhance occupant protection. For instance, Autoliv’s North American operations supply advanced pyrotechnic retractors to major OEMs, improving response times during collisions. Continuous R&D investments and a high penetration of connected vehicles strengthen the region’s technological leadership in smart restraint systems.

Europe

Europe holds a 28% share of the Smart Seat Belt Technology Market, supported by stringent Euro NCAP standards and automaker emphasis on advanced passive safety. Countries like Germany, France, and the U.K. pioneer innovations in intelligent occupant protection and sensor-based tension systems. For instance, ZF Friedrichshafen AG and Bosch deploy active control retractors that integrate seamlessly with vehicle stability and collision mitigation systems. Rising demand for electric and autonomous vehicles further boosts adoption of adaptive seat belt solutions. The European Union’s Vision Zero initiative drives continuous advancements in smart restraint technologies across regional automakers.

Asia Pacific

Asia Pacific accounts for a 26% share of the Smart Seat Belt Technology Market, fueled by rising automotive production and growing road safety regulations in China, Japan, and India. Increasing consumer awareness and localization of safety component manufacturing strengthen market expansion. For instance, Toyota Motor Corporation and Hyundai Motor Group integrate AI-based tension control seat belts in mid-segment vehicles to meet new safety compliance norms. Rapid adoption of ADAS and connected technologies enhances system integration. Government incentives for vehicle safety upgrades and expanding OEM partnerships contribute to sustained regional growth.

Latin America

Latin America represents a 7% share of the Smart Seat Belt Technology Market, supported by gradual regulatory adoption and rising safety awareness. Countries such as Brazil and Mexico focus on improving crash safety standards in passenger vehicles. Local automakers collaborate with global suppliers to introduce semi-active restraint systems at affordable costs. For instance, Bosch’s Latin American unit provides intelligent buckle sensors for regional OEMs, enhancing compliance with emerging safety protocols. Growing demand for mid-range vehicles and urban mobility solutions fosters incremental adoption of smart seat belt technologies across the region.

Middle East & Africa

The Middle East & Africa region holds a 7% share of the Smart Seat Belt Technology Market, with increasing investments in automotive safety infrastructure and import of advanced vehicle models. Gulf Cooperation Council (GCC) nations enforce new regulations promoting smart restraint systems in luxury and commercial vehicles. For instance, Continental AG partners with regional distributors to supply adaptive belt tensioners for high-end SUVs. In Africa, safety awareness campaigns and partnerships between global OEMs and local assemblers are expanding technology penetration. Economic diversification and modernization of transport systems further stimulate regional market growth.

Market Segmentations:

By Type:

- Active buckle lifter

- Active seat belt

By Vehicle Type:

- Passenger vehicles

- Light commercial vehicles

By Sales Channel:

- Original Equipment Manufacturer

- Aftermarket

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Smart Seat Belt Technology Market is highly competitive, with key players including ZF Friedrichshafen AG, GWR Safety Systems (U.S.), Joyson Safety Systems, Holmbergs Safety System Holding AB (Sweden), FinDreams (BYD), ITW Safety, Ashimori Industry Co., Ltd (Japan), Continental AG, Samsong, and Ashimori Industry, Co., Ltd. The Smart Seat Belt Technology Market is characterized by rapid innovation, strong R&D investments, and growing integration of electronic safety systems. Manufacturers focus on developing intelligent restraint solutions featuring real-time monitoring, adaptive tension control, and AI-based occupant detection. Advanced materials and sensor technologies enhance comfort and precision in collision response. Companies are aligning with global safety standards such as Euro NCAP and NHTSA, promoting adoption in both premium and mid-range vehicles. Strategic collaborations between automakers and technology suppliers strengthen system interoperability, while expanding production capabilities across Asia and Europe support cost efficiency and scalability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ZF Friedrichshafen AG

- GWR Safety Systems (U.S.)

- Joyson Safety Systems

- Holmbergs Safety System Holding AB (Sweden)

- FinDreams (BYD)

- ITW Safety

- Ashimori Industry Co., Ltd (Japan)

- Continental AG

- Samsong

- Ashimori Industry, Co., Ltd

Recent Developments

- In Feburary 2024, ZF launched its new tech innovation smart seat belt system that self-adjusts to the size and stature of the occupant, especially important during a collision. ZF’s new system uses sensors to continually measure the pressure applied at different points of the incident and adjusts the tension appropriately.

- In June 2023, Apple Inc. unveiled Apple Vision Pro, a technologically advanced spatial computer that blends digital content into the physical world smoothly. Apple Vision Pro features an advanced, dual-chip design and an ultra-high-resolution display to ensure a real-world digital experience.

- In May 2023, Maruti Suzuki upgraded its Baleno model to feature a three-point seat belt for the middle rear passenger, alongside an adjustable headrest and seat belt reminder system. This improvement addresses the growing demand for comprehensive safety features for rear occupants and adheres to evolving safety standards.

Report Coverage

The research report offers an in-depth analysis based on Type, Vehicle Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-driven predictive restraint systems will enhance real-time occupant protection.

- Integration with autonomous and connected vehicle platforms will expand safety functionality.

- Demand for adaptive seat belt systems in electric and hybrid vehicles will increase steadily.

- Governments will strengthen safety regulations, encouraging wider use of smart restraint systems.

- Sensor miniaturization and lightweight materials will improve comfort and reduce system costs.

- OEM partnerships will focus on developing fully integrated, data-driven safety ecosystems.

- Aftermarket demand will rise as consumers upgrade vehicles with intelligent restraint solutions.

- Emerging markets in Asia and Latin America will witness faster adoption due to local production.

- Over-the-air software updates will enable continuous system enhancement and diagnostics.

- Focus on sustainability will drive development of recyclable and energy-efficient seat belt components.