Market Overview

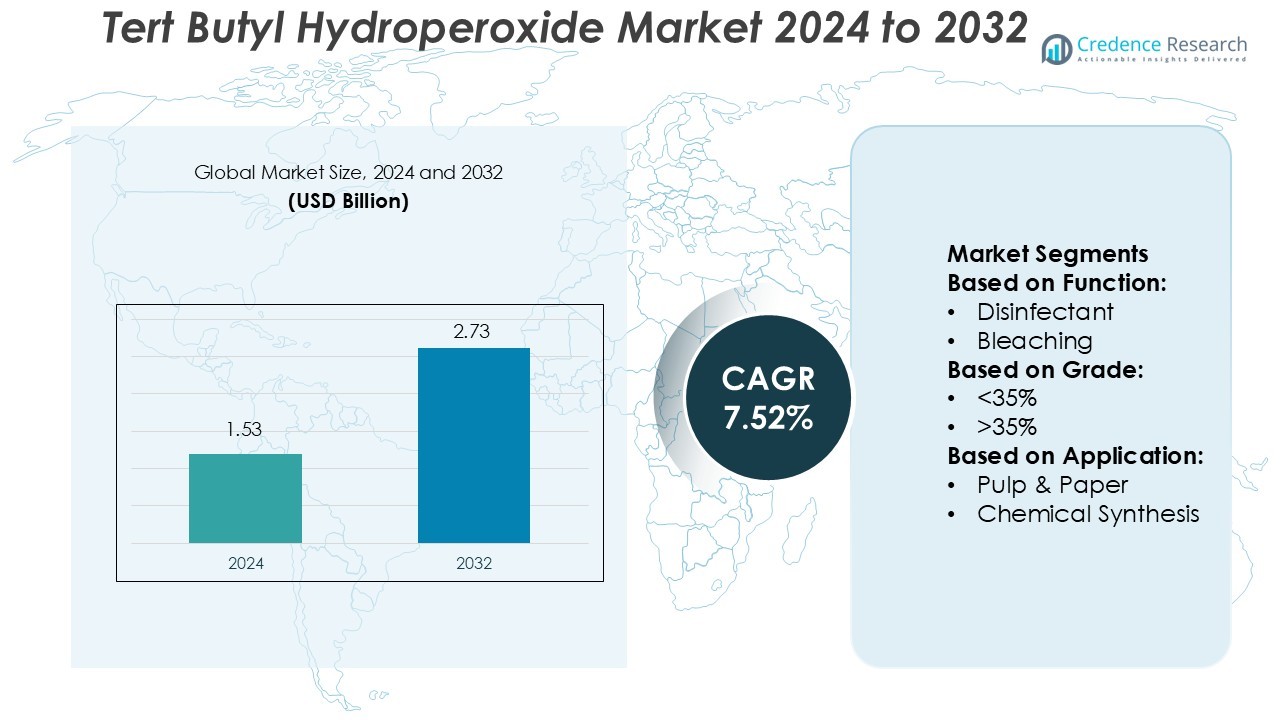

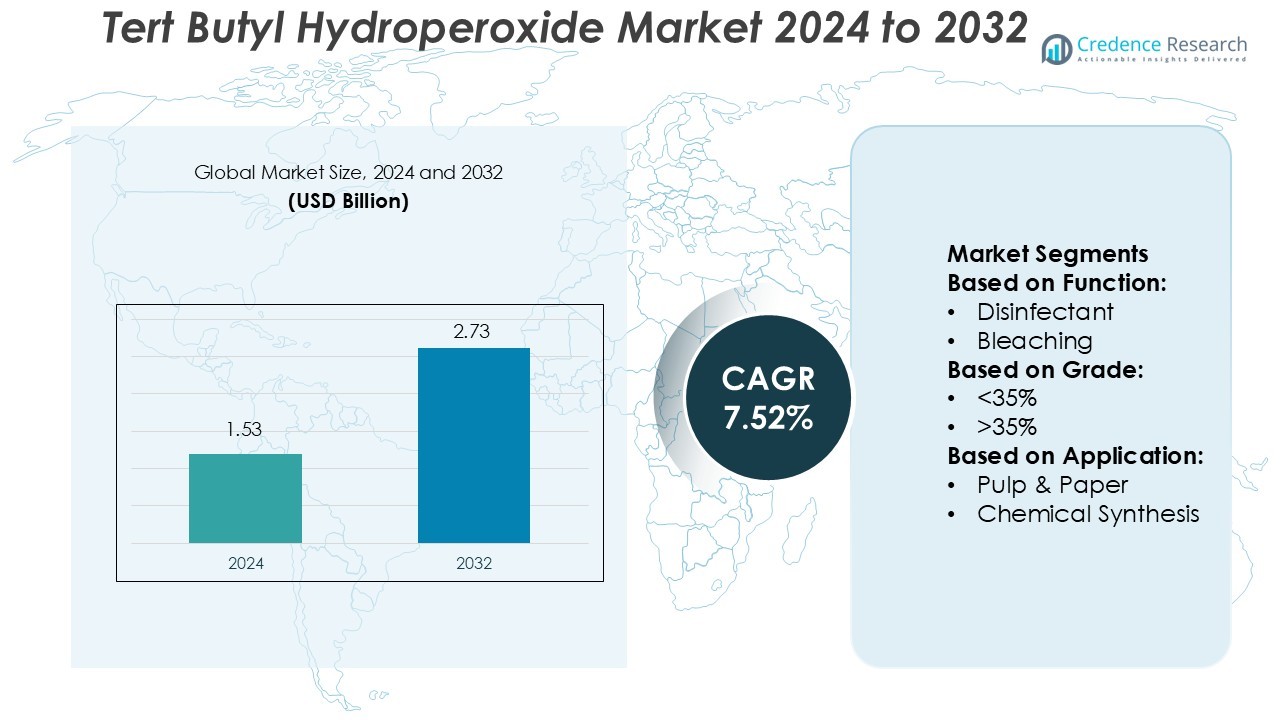

Tert Butyl Hydroperoxide Market size was valued USD 1.53 billion in 2024 and is anticipated to reach USD 2.73 billion by 2032, at a CAGR of 7.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tert Butyl Hydroperoxide Market Size 2024 |

USD 1.53 Billion |

| Tert Butyl Hydroperoxide Market, CAGR |

7.52% |

| Tert Butyl Hydroperoxide Market Size 2032 |

USD 2.73 Billion |

The Tert Butyl Hydroperoxide market is shaped by leading players including Thai Peroxide Ltd, Evonik Industries A.G, Hansol Chemical Co. Ltd., Arkema S.A., Merck, Kemira Oyj, Mitsubishi Gas Chemical Company Inc., Taekwang Industrial Co., Ltd., Tokyo Chemical Industries, and Solvay S.A. These companies focus on expanding capacity, improving oxidation technology, and developing safer, high-purity formulations. Strategic alliances and R&D investments are common to enhance efficiency and regulatory compliance. Asia-Pacific leads the global market with a 38% share, driven by strong industrial infrastructure, rising polymer production, and growing demand for fine chemical synthesis. Continuous technological upgrades and sustainable peroxide manufacturing strengthen the region’s dominance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Tert Butyl Hydroperoxide Market was valued at USD 1.53 billion in 2024 and is projected to reach USD 2.73 billion by 2032, growing at a CAGR of 7.52% during the forecast period.

- Demand growth is driven by increasing use in polymerization, resin production, and fine chemical synthesis, supported by expanding applications in pharmaceuticals and wastewater treatment.

- Rising adoption of high-purity grades and automation in oxidation processes is a key trend, improving efficiency and safety standards across industries.

- Market growth faces restraints from stringent safety regulations, storage risks, and fluctuating raw material costs impacting production stability.

- Asia-Pacific dominates with a 38% share, followed by North America at 32% and Europe at 27%, while the oxidant segment leads the market with over 40% share, driven by wide industrial use and process reliability.

Market Segmentation Analysis:

By Function

The oxidant segment holds the dominant share in the Tert Butyl Hydroperoxide market, accounting for over 40% of total demand. Its wide use as an initiator and catalyst in polymerization, resin curing, and oxidation reactions drives strong adoption. The segment benefits from the compound’s high reactivity and stability, which enhance conversion efficiency in industrial chemical processes. For instance, Arkema employs tert-butyl hydroperoxide in controlled radical polymerization systems to improve polymer uniformity, supporting increased demand from specialty chemical manufacturers. Growth also stems from the rising use of oxidants in refining and coatings applications.

- For instance, Hansol Chemical expanded its semiconductor-grade hydrogen peroxide production capacity by 30 % to reach 127 000 tonnes per annum, with the expansion set to start full operations in 2019.

By Grade

The >35% concentration grade dominates the market, capturing the largest share due to its effectiveness in industrial synthesis and controlled oxidation processes. This high-concentration grade provides better initiation control and reduces reaction time, making it ideal for large-scale chemical production. For instance, Nouryon’s high-purity TBHP formulations above 35% are widely used in polymer and coatings manufacturing to ensure consistent yield and minimal residue formation. The segment’s growth is also supported by its extensive adoption in the pharmaceutical and fine chemical industries, where process precision and product quality are critical.

- For instance, Arkema announced a 2.5-fold increase in organic peroxide production capacity at its Changshu (China) site, representing the installation of its most efficient technology for such grades.

By Application

The chemical synthesis segment leads the Tert Butyl Hydroperoxide market with a share exceeding 45%, driven by its extensive use in polymerization, oxidation, and epoxidation processes. TBHP’s strong oxidizing properties and compatibility with metal catalysts make it essential in producing intermediates, coatings, and fine chemicals. For instance, Evonik utilizes TBHP in epoxidation of propylene and butene to manufacture specialty oxides with enhanced stability and purity. Rising demand for synthetic resins, specialty chemicals, and catalysts continues to strengthen the segment’s dominance, supported by increasing industrial output in Asia-Pacific and Europe.

Key Growth Drivers

Expanding Use in Polymer and Resin Production

The growing demand for polymers and resins in construction, packaging, and automotive industries is a major driver for the Tert Butyl Hydroperoxide (TBHP) market. TBHP serves as a crucial initiator and catalyst in polymerization reactions, improving yield and quality. For instance, Arkema’s use of TBHP in acrylic resin manufacturing enhances polymer chain control and surface finish consistency. The expansion of global polymer production capacity, especially in Asia-Pacific, continues to fuel TBHP consumption in synthetic material manufacturing.

- For instance, Kemira will invest in an expansion of paper and board chemical capacity at its Wellgrow site in Thailand, with the total estimated annual capacity reaching approximately 100 000 tonnes after completion.

Rising Adoption in Fine Chemical Synthesis

The market benefits from TBHP’s increasing use as an oxidizing agent in fine chemical synthesis and pharmaceutical intermediates. Its high purity and strong oxidation efficiency make it valuable for controlled reactions in laboratory and industrial settings. For instance, Evonik employs TBHP in oxidation processes to produce high-value organic compounds with superior selectivity. Growing R&D activities and demand for specialty chemicals are further accelerating adoption in this segment, supporting sustained market growth across multiple chemical industries.

- For instance, TCI lists a catalogue of 31,000 organic reagents for benchtop-to-bulk chemistry on their site.The company reports the ability to supply custom & bulk chemicals globally.

Increasing Applications in Environmental Treatment

TBHP is gaining traction in wastewater treatment and environmental remediation applications due to its strong oxidation capability and eco-friendly degradation. It enables effective decomposition of organic pollutants and industrial effluents, aligning with global environmental regulations. For instance, Nouryon’s TBHP formulations are integrated into advanced oxidation processes (AOPs) to improve pollutant breakdown efficiency in municipal systems. The rising focus on sustainable chemical solutions and stricter emission standards are encouraging industries to adopt TBHP for cleaner and safer operations.

Key Trends & Opportunities

Shift Toward High-Purity Grades

Manufacturers are increasingly developing high-purity TBHP formulations to meet stringent performance standards in pharmaceuticals and electronics. These grades enable consistent reaction control and reduce impurities in final products. For instance, PERGAN GmbH’s high-purity TBHP portfolio targets polymer and fine chemical producers seeking greater precision and safety in oxidation processes. The growing demand for controlled chemical reactions in advanced manufacturing presents significant opportunities for suppliers offering enhanced product quality and safety compliance.

- For instance, Shandong Huatai Interox joint venture with Solvay announced it will produce 48 kilotons of photovoltaic-grade hydrogen peroxide annually by 2025.

Integration of Continuous Flow Production Systems

Continuous flow systems are transforming TBHP manufacturing by improving process safety and reaction efficiency. This trend reduces peroxide decomposition risks and allows better temperature management. For instance, United Initiators integrates continuous flow oxidation units for TBHP production, enhancing process reliability and minimizing waste. As chemical manufacturers adopt automation and digital control technologies, continuous processes provide scalability, consistent output, and reduced operational costs, creating growth opportunities for TBHP producers worldwide.

- For instance, OCI’s hydrogen peroxide production capacity is distributed between its Iksan plant (85,000 metric tons) and the Gwangyang plant (50,000 metric tons), which was formerly part of the P&O Chemical joint venture.

Key Challenges

Safety Concerns and Handling Risks

TBHP is highly reactive and flammable, posing significant safety challenges during storage and transportation. Strict handling protocols and explosion-proof infrastructure increase operational costs for manufacturers and users. For instance, Evonik implements multi-layer containment systems and temperature-controlled logistics to mitigate peroxide instability risks. Regulatory compliance requirements and safety audits further complicate supply chain operations, restricting smaller firms from large-scale TBHP production and distribution.

Fluctuating Raw Material Costs

Volatility in the prices of raw materials such as isobutane and hydrogen peroxide affects TBHP production economics. These fluctuations disrupt supply stability and narrow profit margins for chemical producers. For instance, Arkema and Nouryon have adjusted production cycles to mitigate feedstock cost spikes and ensure contract stability. The dependency on petrochemical-derived inputs also exposes the market to oil price variations, creating uncertainty in long-term planning and investment for TBHP manufacturers.

Regional Analysis

North America

North America holds a 32% share of the Tert Butyl Hydroperoxide market, driven by strong demand from polymer, coating, and pharmaceutical industries. The U.S. leads regional consumption, supported by large-scale chemical synthesis and polymer manufacturing facilities. For instance, Arkema and Nouryon maintain robust TBHP production capacities in the U.S. to meet rising domestic and export demand. The region benefits from advanced infrastructure, strict quality standards, and innovation in fine chemical applications, ensuring steady growth. Environmental regulations promoting oxidation-based wastewater treatment also contribute to increasing TBHP utilization across industrial sectors.

Europe

Europe accounts for a 27% market share, led by Germany, France, and the Netherlands, where strong industrial bases support chemical manufacturing. European producers such as Evonik and PERGAN GmbH use TBHP extensively in resin, coatings, and fine chemical production. The region’s focus on sustainable and high-purity oxidation processes enhances adoption in pharmaceutical and specialty chemical industries. For instance, PERGAN’s advanced TBHP formulations meet REACH compliance standards, ensuring safety and quality consistency. The growing demand for environmentally safe oxidizing agents positions Europe as a key hub for TBHP innovation and regulatory advancement.

Asia-Pacific

Asia-Pacific dominates the global market with a 38% share, fueled by expanding industrialization and rising polymer output in China, India, and Japan. Strong growth in the coatings, plastics, and fine chemicals sectors drives large-scale TBHP consumption. For instance, United Initiators operates advanced TBHP production plants in China to cater to regional demand across polymer and oxidation industries. Increasing investments in chemical infrastructure and supportive government policies enhance regional competitiveness. The region’s rapid shift toward high-purity and high-performance oxidizing agents further strengthens its leadership in global TBHP production and consumption.

Latin America

Latin America captures an 8% share of the market, with Brazil and Mexico leading due to growing industrial applications in chemical synthesis and environmental treatment. Regional demand is supported by expanding polymer production and rising wastewater treatment initiatives. For instance, TBHP is increasingly used in oxidation-based effluent management across Brazil’s manufacturing sector. Collaborations with global suppliers are improving regional access to high-quality TBHP formulations. Growing industrial modernization and focus on sustainability are expected to drive further market expansion in the coming years.

Middle East & Africa

The Middle East & Africa region holds a 5% market share, primarily supported by petrochemical and refining industries in Saudi Arabia, the UAE, and South Africa. TBHP is used in oxidation and polymerization reactions across local chemical manufacturing facilities. For instance, regional players collaborate with international chemical firms to ensure steady TBHP supply for refining catalysts and specialty synthesis. The adoption of advanced wastewater treatment solutions also supports moderate growth. Increasing industrial diversification and ongoing investments in chemical processing are expected to enhance TBHP demand over the forecast period.

Market Segmentations:

By Function:

By Grade:

By Application:

- Pulp & Paper

- Chemical Synthesis

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Tert Butyl Hydroperoxide market features strong competition among key players such as Thai Peroxide Ltd, Evonik Industries A.G, Hansol Chemical Co. Ltd., Arkema S.A., Merck, Kemira Oyj, Mitsubishi Gas Chemical Company Inc., Taekwang Industrial Co., Ltd., Tokyo Chemical Industries, and Solvay S.A. The Tert Butyl Hydroperoxide (TBHP) market is defined by continuous innovation, safety enhancement, and strategic regional expansion. Leading manufacturers focus on improving process efficiency, product purity, and sustainability to strengthen market positioning. Companies invest in advanced oxidation technologies and automation to enhance reaction control and ensure consistent quality. Strategic collaborations and capacity expansions across Asia-Pacific and Europe are helping producers meet rising global demand from polymer, coatings, and specialty chemical sectors. The market also witnesses growing emphasis on safer handling, eco-friendly formulations, and compliance with international safety standards, which drive differentiation and long-term competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2024, ARLANXEO announced that its Butyl plant in Singapore, EPDM plant in Geleen (The Netherlands), and EVM facility in Dormagen (Germany) had received ISCC PLUS certifications. This development is expected to help the company boost the production of sustainable synthetic rubber solutions under its ‘Eco’ label, with ARLANXEO currently producing Eco grades for X_Butyl, Keltan, Levamelt, and standard Levapren.

- In January 2024, Solvay announced the extension of its hydrogen peroxide production capacity at the Shandong Huatai Interox Chemical site in China. With this strategic investment, the company aims to significantly increase its annual production of photovoltaic-grade hydrogen peroxide by 2025 to meet China’s growing renewable energy sector demand.

- In December 2023, Evonik announced the full acquisition of Thai Peroxide Company Limited, enhancing its hydrogen peroxide and peracetic acid production capabilities in Asia. This strategic move, finalized on December 15, strengthens Evonik’s specialty chemicals portfolio, which is crucial for microchip and solar cell manufacturing, wastewater treatment, and food safety applications.

- In September 2023, Shinsol Advanced Chemicals, a partnership between Solvay and Shinkong Synthetic Fibers Corporation, started operations for a new production plant in Tainan, Taiwan.

Report Coverage

The research report offers an in-depth analysis based on Function, Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for high-purity TBHP will grow due to increased use in specialty and fine chemicals.

- Polymer and resin manufacturers will continue adopting TBHP as a preferred oxidation initiator.

- Asia-Pacific will remain the leading production hub driven by expanding chemical infrastructure.

- Environmental applications such as wastewater oxidation will gain stronger market traction.

- Automation and digital monitoring in TBHP manufacturing will enhance process safety and yield.

- Producers will focus on eco-friendly and low-emission peroxide formulations to meet regulations.

- Strategic collaborations and technology licensing will expand global production capabilities.

- Pharmaceutical and laboratory-grade TBHP will see rising demand from precision chemical synthesis.

- Supply chain optimization and regional distribution centers will reduce transportation risks.

- Ongoing R&D will focus on safer storage, handling systems, and improved catalyst performance.