Market Overview

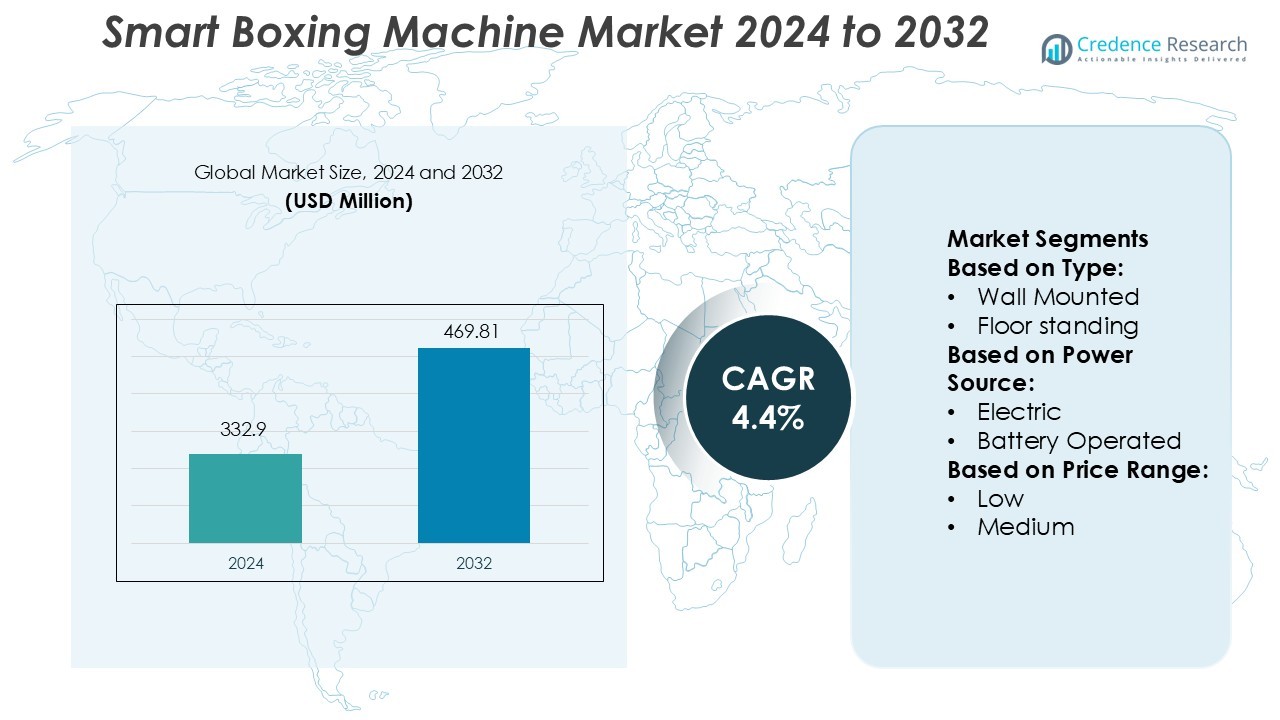

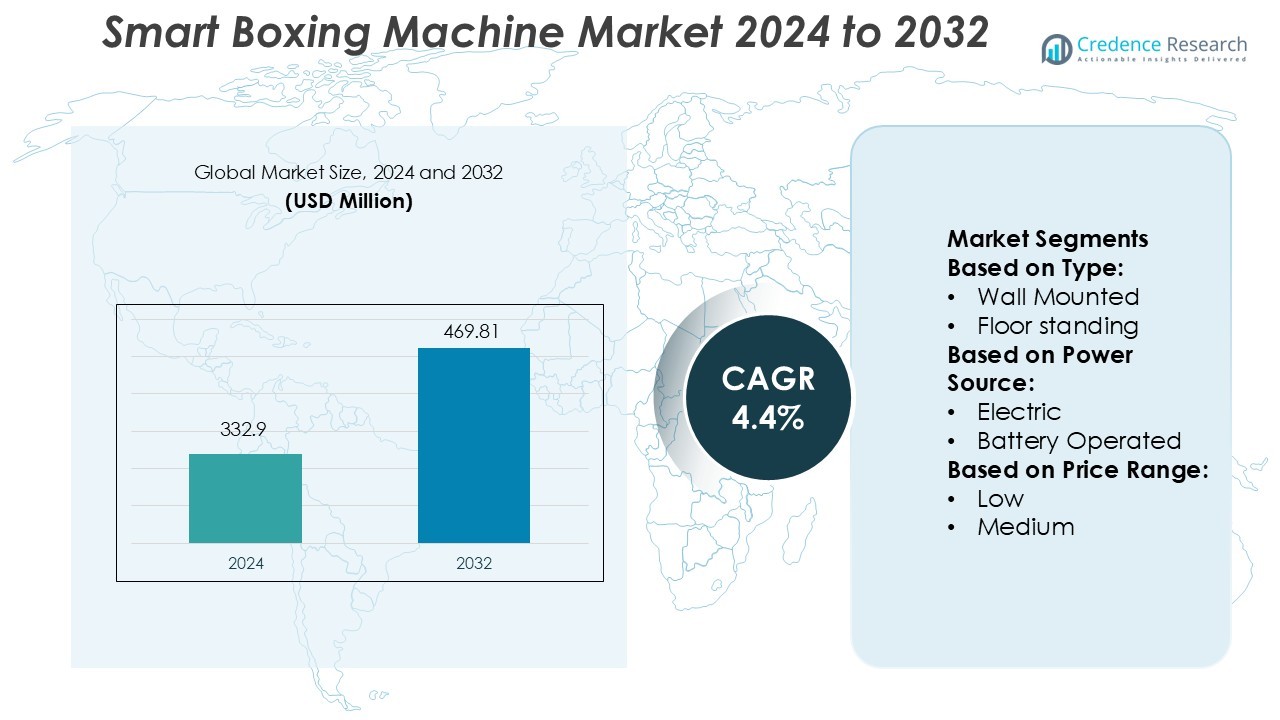

Smart Boxing Machine Market size was valued USD 332.9 million in 2024 and is anticipated to reach USD 469.81 million by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Boxing Machine Market Size 2024 |

USD 332.9 Million |

| Smart Boxing Machine Market, CAGR |

4.4% |

| Smart Boxing Machine Market Size 2032 |

USD 469.81 Million |

The smart boxing machine market is dominated by key players such as FightCamp, Liteboxer, Nexersys, StrikeTec, Everlast Worldwide Inc., Hykso, PIQ, SkyTechSport Inc., Ringside, and Corner Boxing. These companies compete through innovation in AI-based motion sensing, real-time analytics, and IoT connectivity to enhance workout efficiency and engagement. Brands like FightCamp and Liteboxer lead in delivering app-integrated, subscription-based training experiences that combine entertainment with performance tracking. North America holds the largest market share at 38%, driven by strong adoption of connected fitness solutions, advanced digital infrastructure, and consumer preference for personalized home workout technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The smart boxing machine market was valued at USD 332.9 million in 2024 and is projected to reach USD 469.81 million by 2032, registering a CAGR of 4.4% during the forecast period.

- Increasing adoption of AI-driven and connected fitness solutions is a major market driver, with demand growing for personalized and data-based workout tracking.

- Advancements in motion sensors, gamified interfaces, and cloud connectivity are shaping key market trends and expanding opportunities in home and commercial fitness sectors.

- Competition remains strong as brands focus on integrating IoT and app-based training, though high equipment costs and limited affordability in developing regions act as restraints.

- North America dominates the market with a 38% share, followed by Europe and Asia-Pacific, while the floor-standing and electric-powered segments lead due to enhanced performance and user engagement.

Market Segmentation Analysis:

By Type

The floor-standing smart boxing machine segment dominates the market with a 63% share. These machines offer enhanced stability, larger interactive displays, and advanced sensors for performance tracking, making them ideal for gyms and training centers. They support higher impact tolerance and real-time data visualization, improving training accuracy and engagement. Increased adoption in commercial fitness facilities and smart gyms drives segment growth. Compact models with integrated digital analytics further support professional training and entertainment use, contributing to the strong demand for floor-standing variants.

- For instance, FightCamp launched its Trackers 3.0 motion sensors that capture over 1,000 data points per second to measure punch velocity and power output. The system connects with the FightCamp App, providing real-time performance analytics and adaptive coaching.

By Power Source

Electric-powered smart boxing machines hold the dominant 71% share due to consistent performance and high-power output. These machines ensure uninterrupted operation during intensive training sessions, making them suitable for both fitness centers and home setups. Electric models often feature touchscreens, AI-based feedback, and cloud connectivity for progress monitoring. Their ability to deliver steady force levels enhances training precision and endurance building. Rising integration of AI-driven scoring and interactive workouts continues to boost demand for electric-powered smart boxing systems.

- For instance, PIQ’s multi-sport sensor is capable of measuring over 3,000 data points per second, utilises a 13-axis inertial sensor array and encrypts data via Bluetooth for cloud sync.

By Price Range

The medium-priced smart boxing machine segment leads the market with a 58% share. This category balances affordability with advanced features such as digital scoring, motion sensors, and mobile app integration. Consumers prefer mid-range models for their durable build and access to premium functionalities without high costs. The growing popularity of connected home fitness and gamified workout solutions supports steady adoption. Manufacturers focusing on ergonomic design and Bluetooth-enabled data tracking further strengthen the market position of medium-priced smart boxing machines.

Key Growth Drivers

- Rising Adoption of Connected Fitness Solutions

The growing shift toward smart fitness ecosystems is driving demand for smart boxing machines. These machines integrate IoT, Bluetooth, and mobile applications, enabling real-time performance tracking and AI-based feedback. Consumers are adopting them for personalized workouts, gamified challenges, and data-driven progress reports. Fitness studios and home users prefer these connected systems for interactive training. The growing interest in virtual coaching and remote fitness monitoring continues to accelerate this segment’s expansion across developed and emerging markets.

- For instance, Nexersys’ N3 Commercial model supports up to 200 unique user profiles stored in-machine, and offers a performance summary that tracks strike accuracy, reaction time, strike count and power at the end of each round.

- Integration of Artificial Intelligence and Data Analytics

AI and data analytics are transforming boxing machines into intelligent fitness tools. AI algorithms analyze punch speed, reaction time, and endurance to offer customized training plans. Machine learning enables adaptive resistance and automated performance scoring, improving skill development and motivation. This technology-driven feedback attracts both amateur and professional athletes. Manufacturers are investing in advanced sensors and analytics platforms, strengthening market growth through innovation and data-driven user engagement.

- For instance, Everlast’s collaboration with PIQ Sport Intelligence produced a wearable sensor system that utilises an accelerometer capable of measuring ±200 g on impact, a 3-axis 16-bit IMU plus a 9-axis (±16 g accel, ±2000°/s gyro) sensor array, and an embedded ARM M4 processor clocked at 100 MHz with 512 KB flash and 128 KB RAM.

- Increasing Popularity of Home-Based Fitness Equipment

The expanding home fitness trend is a key driver of the smart boxing machine market. Consumers prefer compact, interactive equipment that supports efficient workouts without gym access. Smart boxing machines cater to this demand by combining cardio, strength, and reflex training in one device. Integration with virtual trainers and mobile apps enhances convenience and motivation. Rising awareness of physical wellness and smart home adoption continues to fuel sales of home-oriented smart boxing systems.

Key Trends & Opportunities

- Expansion of Gamified and Immersive Training Experiences

Gamification is reshaping the user experience in smart boxing machines. Manufacturers are integrating augmented reality (AR) and competitive leaderboards to enhance engagement and retention. These features create a stimulating, game-like environment that motivates consistent exercise. Fitness brands are also launching virtual tournaments, linking global users in real time. The blend of entertainment and physical training opens opportunities for digital fitness platforms and subscription-based services.

- For instance, Corner’s wearable Tracker modules capture punch speed up to 20 m/s, punch count in real time, and a peak intensity score per session. Their mobile app shows global leaderboards with session-to-session ranking updates every 10 seconds, and supports community competitions across over 30 countries.

- Growing Use of Cloud and App-Based Ecosystems

Cloud integration allows users to store performance data, access personalized analytics, and sync progress across devices. Smart boxing machines connected through mobile apps enhance accessibility and customization. This integration supports remote coaching, social sharing, and AI-guided programs. The rising use of subscription models for advanced training plans and data storage is creating recurring revenue opportunities for manufacturers.

- For instance, Liteboxer’s hardware incorporates a punching-pad system with six illuminated target zones and more than 200 built-in LED light indicators to cue user strikes.

- Collaboration Between Fitness and Technology Companies

Strategic partnerships between fitness equipment manufacturers and tech firms are creating innovative products. Collaborations enable the integration of advanced sensors, AI analytics, and cloud computing into compact designs. These alliances help brands expand market reach and deliver holistic fitness ecosystems. Opportunities lie in partnerships with sports analytics and wearable technology firms to offer unified, data-centric fitness experiences.

Key Challenges

- High Initial Cost and Limited Affordability

The advanced features of smart boxing machines—such as AI sensors, touchscreen displays, and connectivity modules—make them costly. This limits adoption among budget-conscious consumers, especially in emerging markets. High upfront costs and limited financing options slow penetration into the home fitness segment. Manufacturers face the challenge of balancing affordability with innovation to reach a broader consumer base.

- Data Privacy and Security Concerns

As smart boxing machines rely on data collection and cloud connectivity, privacy and security risks have increased. Unauthorized access to user data or workout profiles can erode consumer trust. Manufacturers must comply with stringent data protection standards and cybersecurity frameworks. The challenge lies in developing secure systems that ensure confidentiality while maintaining real-time analytics and connectivity features.

Regional Analysis

North America

North America leads the smart boxing machine market with a 38% share. The region’s dominance is driven by strong consumer spending on connected fitness and advanced home gym equipment. High adoption of AI-enabled workout devices and app-integrated training programs supports market expansion. The United States, in particular, benefits from an active fitness culture and high penetration of digital fitness subscriptions. Collaborations between fitness technology brands and gyms further strengthen the region’s growth. Manufacturers continue to focus on innovations that enhance user engagement and personalized training experiences.

Europe

Europe accounts for 27% of the global market share, supported by the rising popularity of smart and gamified fitness devices. Countries such as Germany, the U.K., and France are witnessing increased adoption of compact and home-friendly equipment. The growing influence of digital wellness platforms and corporate fitness programs promotes demand. European consumers value sustainability, driving interest in energy-efficient smart boxing systems. Integration of virtual reality (VR) and AI-driven training modules further supports regional growth. The expanding e-commerce distribution network also facilitates broader product accessibility across Europe.

Asia-Pacific

Asia-Pacific holds a 24% market share, driven by rapid urbanization, fitness awareness, and digital transformation in consumer lifestyles. Countries like China, Japan, and South Korea are leading adopters due to their strong technology infrastructure. Growing middle-class income levels and interest in home fitness contribute to rising sales. Regional manufacturers are introducing affordable, feature-rich machines tailored for local markets. The increasing influence of online fitness communities and smart app ecosystems supports further growth. Partnerships between regional electronics brands and fitness startups are boosting innovation across the sector.

Latin America

Latin America represents an 8% market share, with growth fueled by the rising fitness culture and improving digital connectivity. Brazil and Mexico dominate the regional landscape due to increasing gym memberships and the popularity of home fitness solutions. Consumers are gradually shifting toward interactive and app-based training experiences. Local distributors are expanding availability through online retail platforms, improving accessibility. However, higher equipment costs and economic disparities limit large-scale adoption. Manufacturers focusing on mid-range and cost-effective models are expected to gain traction in the coming years.

Middle East & Africa

The Middle East & Africa region holds a 3% share of the smart boxing machine market. Growth is supported by rising investments in sports infrastructure and health awareness campaigns. The UAE and Saudi Arabia lead adoption through smart fitness centers and premium gym installations. High-income consumers are driving demand for connected home fitness devices. However, limited digital infrastructure in some African nations constrains market penetration. Expanding smart city initiatives and government-backed fitness programs are expected to enhance market opportunities in the forecast period.

Market Segmentations:

By Type:

- Wall Mounted

- Floor standing

By Power Source:

- Electric

- Battery Operated

By Price Range:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The smart boxing machine market features strong competition among key players such as FightCamp, StrikeTec, PIQ, Nexersys, Everlast Worldwide Inc., Corner Boxing, SkyTechSport Inc., Ringside, Liteboxer, and Hykso. The smart boxing machine market is highly competitive, driven by rapid innovation and technological integration. Companies are focusing on AI-enabled systems, real-time performance analytics, and IoT connectivity to enhance user engagement and training accuracy. The market is witnessing increased demand for personalized and data-driven workouts, leading to the development of interactive, app-connected, and gamified platforms. Manufacturers are adopting subscription-based business models to provide ongoing content and virtual coaching. Strategic partnerships between fitness tech developers and digital platforms are further expanding product reach. Continuous R&D efforts in motion tracking, sensor precision, and immersive user interfaces are shaping future growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- FightCamp

- StrikeTec

- PIQ

- Nexersys

- Everlast Worldwide Inc.

- Corner Boxing

- SkyTechSport Inc.

- Ringside

- Liteboxer

- Hykso

Recent Developments

- In January 2025, ARBURG displayed its latest injection molding machines, including the electric Allrounder 720 E Golden Electric and the hybrid Allrounder 470 H. The 720 E Golden Electric, featuring a 2,800 kN clamping force and compact design, demonstrated efficient production for the mobility sector.

- In December 2024, One Punch, a leading brand in music boxing machines, launched the One Punch V2. This device integrates advanced technology with sleek design, offering features such as synchronization of music and lights to enhance the workout experience. The One Punch V2 combines fitness, entertainment, and motivation, providing users with an engaging and effective exercise solution.

- In December 2024, GROWL launched an innovative AI-powered interactive boxing and fitness coach that integrates advanced technology to enhance at-home workouts. This system features a multi-camera 3D motion tracking setup that captures user movements, providing real-time, personalized feedback.

- In October 2024, Milacron unveiled the eQ180-MSW, an all-electric injection molding machine featuring innovative monosandwich technology. This design allows multi-layer parts to be produced using up to 60% post-consumer recyclable (PCR) materials in the core.

Report Coverage

The research report offers an in-depth analysis based on Type, Power Source, Price Range

and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow with rising demand for smart and connected fitness equipment.

- Integration of AI and machine learning will enhance personalized workout feedback and real-time analytics.

- Gamified fitness platforms will attract younger consumers seeking interactive and engaging workouts.

- Cloud-based ecosystems and app connectivity will drive user retention through performance tracking.

- Manufacturers will focus on compact, space-saving designs to meet home fitness needs.

- Strategic partnerships between fitness brands and tech companies will accelerate innovation.

- Demand for sustainable and energy-efficient machines will increase among eco-conscious consumers.

- Virtual reality and augmented reality training systems will reshape the digital fitness experience.

- Subscription-based models offering online coaching and training programs will gain strong adoption.

- Expansion into emerging markets will create new growth opportunities for affordable smart boxing systems.