Market Overview

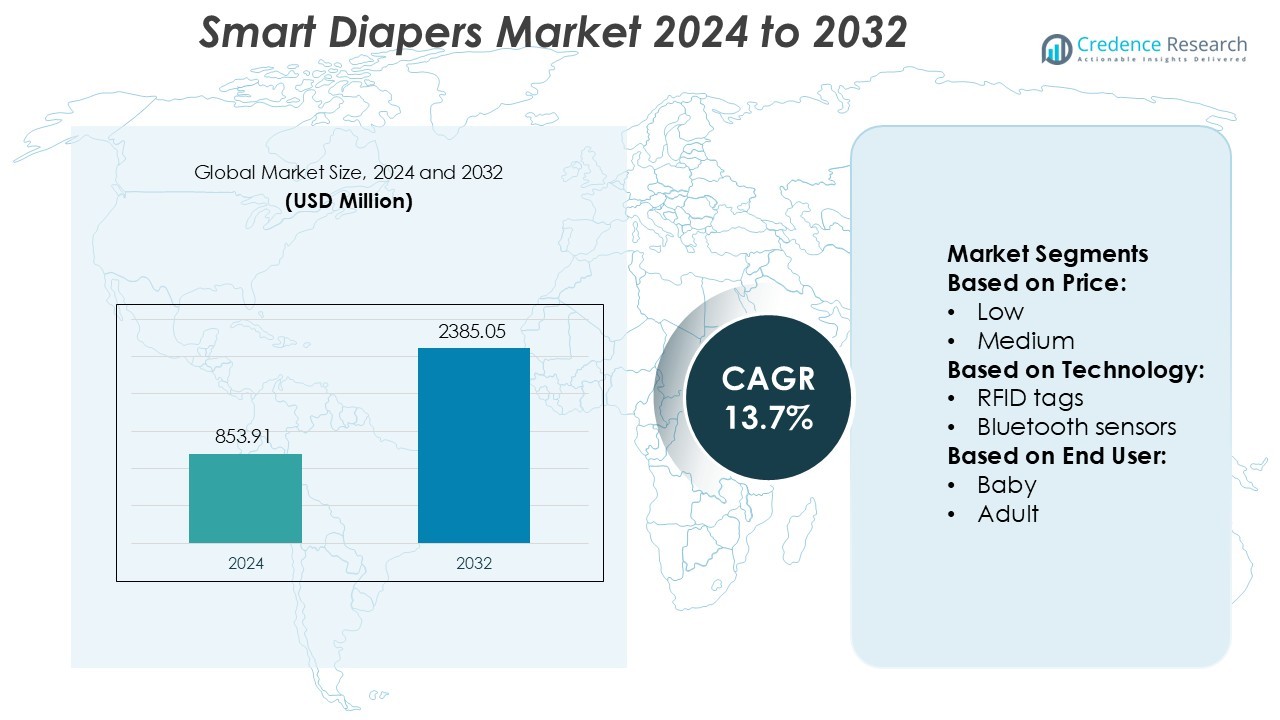

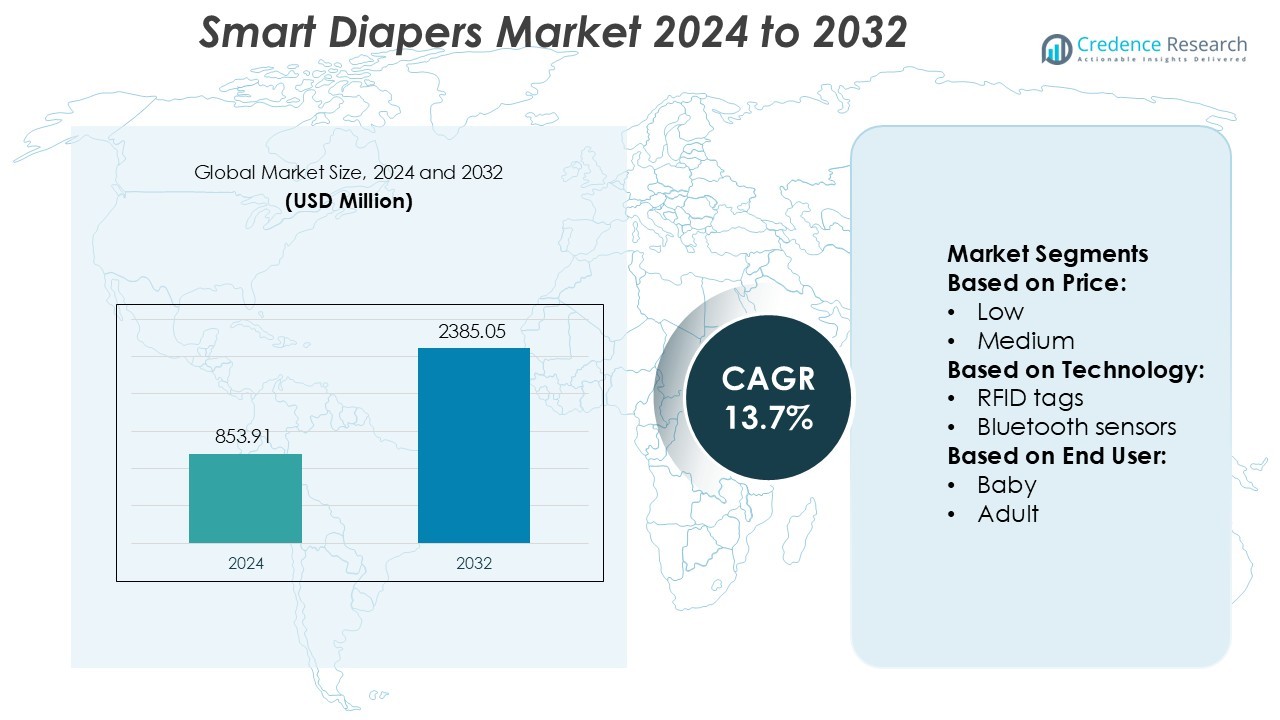

Smart Diapers Market size was valued USD 853.91 million in 2024 and is anticipated to reach USD 2385.05 million by 2032, at a CAGR of 13.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Diapers Market Size 2024 |

USD 853.91 Million |

| Smart Diapers Market, CAGR |

13.7% |

| Smart Diapers Market Size 2032 |

USD 2385.05 Million |

The smart diapers market is led by major companies including Drylock Technologies, Medline Industries, Kimberly Clark, Monit, Attends Healthcare Products, Pixie Scientific, HARTMANN, Ontex, Essity, and Abena. These players emphasize product innovation, AI-enabled sensors, and sustainable materials to enhance performance and comfort. Kimberly Clark and Essity dominate the baby care segment with advanced sensor-based diapers, while Monit and Pixie Scientific focus on Bluetooth-enabled monitoring solutions. Ontex and HARTMANN strengthen their presence in adult care applications through incontinence management innovations. Regionally, North America leads the global market with a 37% share in 2024, supported by high technology adoption, strong consumer awareness, and robust healthcare infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Smart Diapers Market size was valued at USD 853.91 million in 2024 and is projected to reach USD 2385.05 million by 2032, registering a CAGR of 13.7% during the forecast period.

- Rising awareness of connected baby care and increasing adoption of smart health monitoring systems are major growth drivers in this market.

- The market trend focuses on integrating AI and Bluetooth-enabled sensors that provide real-time moisture detection and hygiene tracking for infants and adults.

- Competition remains strong among key players such as Kimberly Clark, Essity, Monit, and Pixie Scientific, who emphasize innovation, sustainability, and smart data connectivity.

- North America dominates the market with a 37% share in 2024, supported by advanced healthcare infrastructure and digital adoption, while the baby care segment leads overall demand with superior sensor-based performance and consumer trust in premium brands.

Market Segmentation Analysis:

By Price

The medium-priced segment dominated the Smart Diapers Market with a 46% share in 2024. This segment attracts most consumers due to a balanced mix of affordability and smart features such as leak alerts, moisture sensors, and mobile app connectivity. Manufacturers like Pampers and Huggies have introduced mid-range products that integrate Bluetooth-based monitoring while maintaining cost efficiency. The growing middle-class population and rising awareness of digital baby care solutions support the demand for medium-priced smart diapers. In contrast, low-priced variants focus on basic alert systems, while high-end products target premium users with advanced analytics and extended battery life.

- For instance, Monit Corp’s MECS PRO smart-diaper-care solution uses IoT and AI to monitor diaper contamination in real time, and in a clinical case achieved a moisture-detection sensitivity of approximately 0.1 mL with a Bluetooth Low Energy signal range up to 10 m.

By Technology

Bluetooth sensors accounted for 58% of the market share in 2024, leading the technology segment. These sensors enable real-time alerts, continuous moisture monitoring, and integration with smartphone applications. Their strong adoption stems from high reliability and longer connectivity range compared to RFID tags. Brands such as Monit and Simavita leverage Bluetooth technology to enhance user experience through health tracking and data synchronization. RFID-based smart diapers remain relevant in institutional settings, particularly in adult care facilities, where batch monitoring is more practical than individual tracking.

- For instance, Ontex reported a 42% reduction in daytime leaks, a more than 50% reduction at night, and a 75% reduction in bed-linen changes related to urinary leakages.

By End User

The baby segment held a dominant 65% market share in 2024, driven by growing demand for connected parenting tools and hygiene monitoring. Parents increasingly prefer smart diapers for early detection of infections, skin irritation, and hydration levels. Companies like Pampers Lumi and Opro9 Baby Diapers lead innovations with AI-enabled sensors and mobile alerts. Rising birth rates in emerging economies, coupled with expanding e-commerce availability, strengthen this segment’s growth. However, the adult segment shows steady expansion due to rising elderly populations and increasing awareness about smart hygiene solutions in healthcare and nursing centers.

Key Growth Drivers

- Rising Adoption of Smart Baby Care Solutions

The growing preference for connected parenting tools is a major driver of the smart diapers market. Parents increasingly use sensor-equipped diapers to monitor hydration, sleep, and health patterns. Brands like Pampers Lumi and Monit provide real-time notifications through mobile apps, reducing infection risks. The convenience of automatic wetness detection and data tracking encourages adoption among tech-savvy parents. This shift toward intelligent baby monitoring systems supports sustained growth, especially in urban households with higher disposable income and awareness of digital health technologies.

- For instance, Essity’s TENA SmartCare Change Indicator features a transmitter measuring 51.8 mm × 34.5 mm × 13 mm and weighing 12.6 g, which communicates via 2.4 GHz BLE and has an open-environment range of at least 10 m.

- Increasing Geriatric Population and Healthcare Demand

The rising elderly population globally drives demand for adult smart diapers. Hospitals and nursing facilities adopt sensor-based solutions to track moisture levels and prevent skin conditions. Products integrated with Bluetooth and RFID technologies improve hygiene and comfort for dependent adults. Companies such as Simavita and ElderSens focus on patient-centered innovation, enabling caregivers to manage incontinence efficiently. The demand for smart incontinence management systems continues to rise due to higher healthcare spending and the focus on improving patient dignity and care quality.

- For instance, ABENA’s ABENA Nova system uses integrated wetness sensors plus a detachable clip that transmits via Bluetooth LE and 4G. Its trials at a Dutch nursing home showed the number of wet beds fell by 76 %, and the average product changes per resident per day dropped from 3.5 to 2.4.

- Technological Advancements in Sensor Integration

Continuous innovation in moisture, temperature, and pressure sensors enhances product reliability and usability. Smart diapers now feature low-energy Bluetooth chips and AI-driven analytics that interpret usage data for caregivers. This advancement supports personalized health monitoring and predictive maintenance of hygiene routines. Manufacturers invest in compact, washable sensor modules for reusability and cost efficiency. These improvements make smart diapers more sustainable and accurate, strengthening market penetration across both baby and adult care categories.

Key Trends & Opportunities

- Expansion of IoT and Mobile Health Ecosystems

Integration with Internet of Things (IoT) and mobile health platforms creates significant growth opportunities. Smart diapers linked with mobile apps provide insights on hydration and urinary health, aiding proactive healthcare. Developers are building ecosystems that connect wearable data to pediatric or elder care monitoring systems. Partnerships between diaper manufacturers and tech firms accelerate innovation, making smart hygiene solutions more accessible. This IoT-based evolution supports broader applications in home healthcare, remote monitoring, and clinical data tracking.

- For instance, Simavita (Smartz AG)’s Smartz® pod Model 9000 uses a CR2016 coin cell battery and clips onto a sensor-brief to log wetness data and transmit alerts to a caregiver’s monitor or app.

- Growing Focus on Sustainable and Reusable Designs

Sustainability is emerging as a key trend in the smart diapers market. Manufacturers develop biodegradable materials and detachable sensor modules to reduce waste. Companies are investing in eco-friendly production using plant-based fibers and recyclable packaging. Reusable smart inserts lower long-term costs and appeal to environmentally conscious consumers. This trend aligns with global sustainability initiatives and growing consumer awareness of ecological impact, encouraging innovation in durable, washable, and energy-efficient smart diaper systems.

- For instance, Abena’s sustainability report for 2021/ 2022, 87.7% of waste at their Danish production facility was recycled, demonstrating a circular-economy commitment.

- Expansion Across Emerging Economies

The market is witnessing rapid growth in emerging economies driven by improving healthcare infrastructure and rising disposable incomes. Countries across Asia-Pacific and Latin America are adopting smart baby care products due to increased awareness of hygiene and digital health monitoring. Local manufacturers are partnering with technology startups to launch affordable smart diapers. Government programs promoting child health and elderly care also stimulate adoption, presenting long-term opportunities for market expansion in cost-sensitive regions.

Key Challenges

- High Product Cost and Limited Affordability

The high price of smart diapers remains a major barrier to mass adoption, especially in developing regions. Advanced sensors, data connectivity, and app integration increase production costs. While premium consumers adopt these products, many households still rely on traditional disposable diapers. Manufacturers face the challenge of balancing technology integration with cost efficiency. Achieving competitive pricing without compromising quality or sensor performance is crucial for broader market penetration and sustained demand.

- Data Privacy and Connectivity Concerns

Smart diapers collect sensitive personal data related to health and hygiene, raising privacy concerns. Insecure wireless connections or poor data encryption can lead to potential misuse or breaches. Compliance with data protection laws such as GDPR is essential for consumer trust. Moreover, inconsistent connectivity in low-network areas limits real-time monitoring efficiency. Companies must enhance cybersecurity measures, provide transparent data policies, and develop offline functionality to maintain credibility and ensure consistent product performance across regions.

Regional Analysis

North America

North America held a dominant 37% share of the global smart diapers market in 2024. The region benefits from high technology adoption, strong consumer awareness, and advanced healthcare infrastructure. Leading companies such as Pampers Lumi, Simavita, and ElderSens drive innovation through AI-enabled monitoring and wireless sensor integration. The presence of major baby care and geriatric product manufacturers enhances product accessibility across retail and online channels. Rising healthcare spending, coupled with a growing aging population, continues to drive demand for adult smart diapers, positioning North America as the leading regional market for connected hygiene solutions.

Europe

Europe accounted for 29% of the market share in 2024, supported by growing health consciousness and adoption of sustainable diaper technologies. Countries such as Germany, France, and the U.K. lead due to strong demand for eco-friendly and reusable smart diaper systems. European manufacturers emphasize biodegradable materials and data privacy compliance under GDPR. The region also benefits from a well-developed healthcare network and government initiatives promoting elderly care innovations. Increasing product launches in the adult care segment further strengthen Europe’s position as a major contributor to the global smart diapers market.

Asia-Pacific

Asia-Pacific captured 24% of the global market share in 2024 and is projected to witness the fastest growth through 2032. Expanding middle-class populations in China, Japan, and India are driving demand for smart baby care products. Regional players are partnering with tech startups to develop affordable sensor-integrated diapers suited for local markets. Rising birth rates, improving healthcare infrastructure, and growing awareness of hygiene monitoring technologies support this expansion. The region’s increasing digital connectivity and smartphone penetration also enhance adoption of mobile-linked smart diaper systems for both infants and adults.

Latin America

Latin America held a 6% market share in 2024, with Brazil and Mexico leading adoption due to rising disposable incomes and expanding e-commerce penetration. Awareness of advanced baby care technologies is gradually increasing among urban consumers. Global brands are entering the region through online platforms, offering mid-priced smart diaper solutions. While adoption remains moderate compared to developed regions, government healthcare programs and urbanization are driving steady market expansion. Continued investment in healthcare digitization and partnerships with local distributors are expected to accelerate regional growth in the coming years.

Middle East & Africa

The Middle East & Africa region accounted for 4% of the global smart diapers market in 2024. Market growth is primarily concentrated in the Gulf countries, where higher income levels and modern healthcare infrastructure support adoption. Hospitals and elder care facilities increasingly use sensor-enabled diapers for patient monitoring. However, limited awareness and higher costs restrict widespread use in several African nations. Ongoing digital transformation in healthcare and gradual expansion of retail networks are expected to improve accessibility, positioning the region for moderate but consistent growth during the forecast period.

Market Segmentations:

By Price:

By Technology:

- RFID tags

- Bluetooth sensors

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The smart diapers market is shaped by leading players including Drylock Technologies, Medline Industries, Kimberly Clark, Monit, Attends Healthcare Products, Pixie Scientific, HARTMANN, Ontex, Essity, and Abena. The smart diapers market is highly competitive, driven by continuous innovation and rapid technological advancement. Companies are focusing on integrating sensors, Bluetooth connectivity, and AI algorithms to provide real-time health insights and enhanced user convenience. Manufacturers emphasize features such as moisture detection, temperature monitoring, and mobile app integration to improve hygiene management for infants and adults. Strategic collaborations between healthcare providers and technology developers are accelerating product development and expanding distribution networks. Sustainability also plays a vital role, with increasing investment in biodegradable materials and reusable sensor modules. The market competition continues to intensify as players seek differentiation through design innovation, data security, and personalized monitoring solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Drylock Technologies

- Medline Industries

- Kimberly Clark

- Monit

- Attends Healthcare Products

- Pixie Scientific

- HARTMANN

- Ontex

- Essity

- Abena

Recent Developments

- In May 2024, Woosh introduced a new recyclable diaper developed in collaboration with Ontex. With this initiative, the company continues to support sustainability and reduce harmful impacts on the environment.

- In May 2024, Pampers introduced the new Swaddlers 360° Diapers, combining the trusted softness and skin protection of Swaddlers with an innovative pull-on waistband design for easier diaper changes. The new product is designed to simplify the diapering experience for parents, particularly during active baby stages when conventional diaper changes can be challenging.

- In May 2024, Huggies brand launched the Skin Essentials Diaper, designed to address common causes of diaper rash and promote healthier skin for babies. These diapers feature advanced technologies to manage moisture effectively and reduce friction, the two leading causes of rash.

- In February 2023, A Penn State-led research team developed a new sensor, which is placed in between the absorbent layers of smart diapers and can detect wetness and signal for a change. This technology is developed to assist workers in hospitals, daycares, and other environments to offer quicker care to those they are responsible for.

Report Coverage

The research report offers an in-depth analysis based on Price, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness strong growth due to increasing adoption of connected baby care solutions.

- Advancements in sensor accuracy and battery efficiency will enhance product reliability.

- Integration with mobile health platforms will enable real-time data sharing with caregivers and doctors.

- Demand for adult smart diapers will rise with the expanding elderly population.

- Companies will focus on cost reduction to make smart diapers affordable for wider consumers.

- Sustainable and biodegradable materials will gain traction to address environmental concerns.

- Expansion in emerging markets will be driven by improving healthcare infrastructure and digital access.

- Partnerships between tech startups and healthcare firms will boost product innovation.

- AI and predictive analytics will play a major role in health monitoring and early detection.

- E-commerce growth and digital marketing will strengthen product visibility and consumer reach globally.