Market Overview

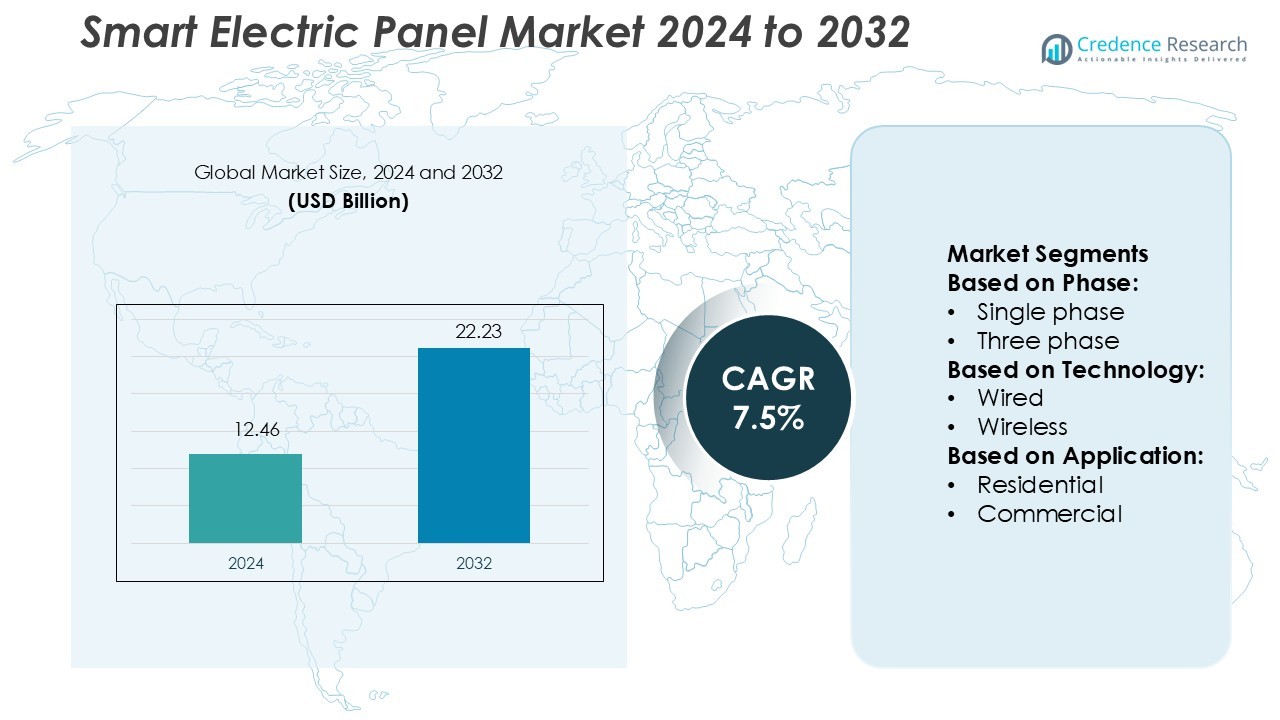

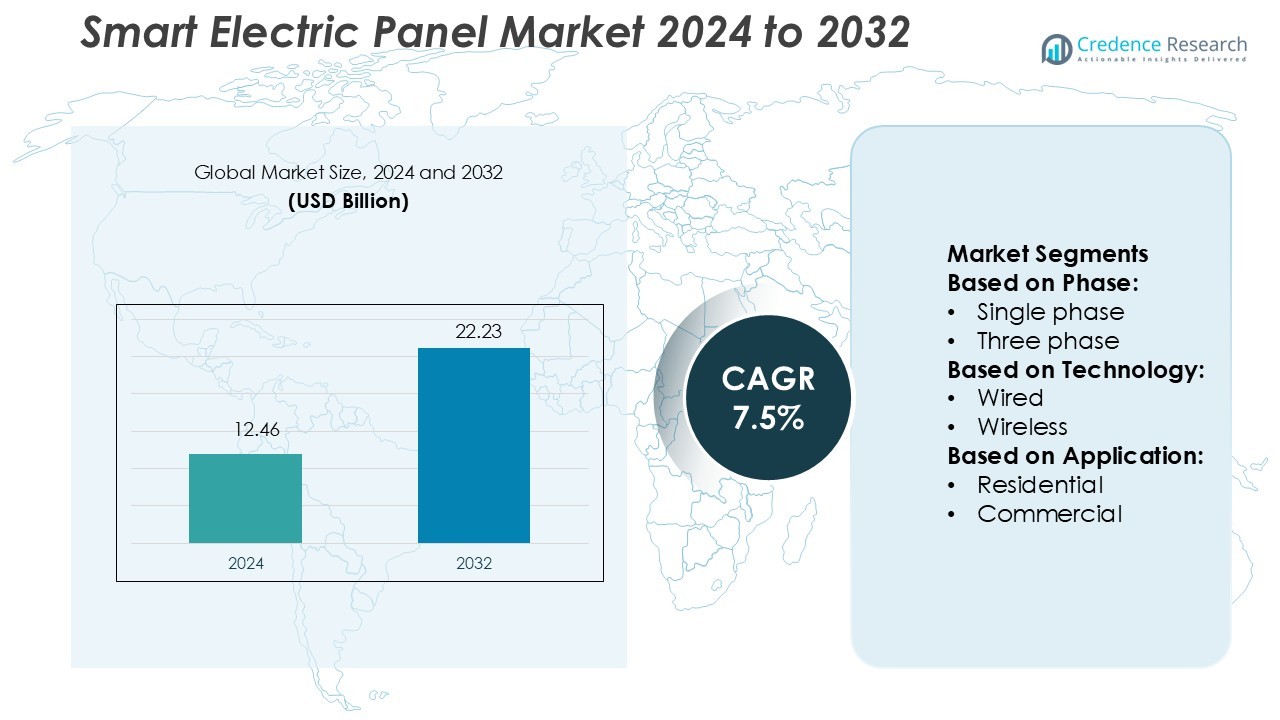

Smart Electric Panel Market size was valued USD 12.46 billion in 2024 and is anticipated to reach USD 22.23 billion by 2032, at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Electric Panel Market Size 2024 |

USD 12.46 Billion |

| Smart Electric Panel Market, CAGR |

7.5% |

| Smart Electric Panel Market Size 2032 |

USD 22.23 Billion |

The smart electric panel market is shaped by major players such as EcoFlow Technology, Havells India, Emerson Electric, Hager Group, ABB, Chint Group, Eaton, Accu Panels, Honeywell International, and General Electric. These companies are driving technological innovation through smart grid integration, IoT-enabled monitoring, and advanced energy management solutions. Their strategies focus on product diversification, R&D investments, and regional expansion to strengthen market presence. Asia-Pacific leads the market with a 33% share, supported by rapid urbanization, rising renewable energy capacity, and strong government initiatives. High adoption in commercial, residential, and industrial sectors positions the region as the key growth hub for future smart electric panel deployments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The smart electric panel market size was valued at USD 12.46 billion in 2024 and is anticipated to reach USD 22.23 billion by 2032, at a CAGR of 7.5%.

- Growing demand for energy efficiency, renewable integration, and smart infrastructure is driving steady market expansion.

- Companies are focusing on IoT-enabled monitoring, advanced control systems, and smart grid connectivity to enhance competitiveness.

- High installation costs and cybersecurity concerns act as key restraints, especially in developing economies.

- Asia-Pacific leads with a 33% share, followed by North America at 31% and Europe at 27%, with strong adoption across residential, commercial, and industrial segments.

Market Segmentation Analysis:

By Phase

Three-phase panels hold the largest market share due to their efficiency in handling higher loads. These panels are widely used in large residential complexes, commercial spaces, and industrial facilities. Their ability to support multiple high-demand appliances and maintain stable power flow drives adoption. They also reduce energy loss and improve system reliability, making them suitable for smart grid integration. Single-phase systems dominate smaller applications, but three-phase panels lead overall due to their capacity to handle complex energy demands in modern buildings.

- For instance, EcoFlow’s unit supports both 120 V and 240 V output, enabling hybrid load management across phases. Single-phase systems dominate smaller applications, but three-phase panels lead overall due to their capacity to handle complex energy demands in modern buildings.

By Technology

Wireless smart panels lead the market with strong demand from residential and commercial users. These systems offer real-time monitoring, remote access, and integration with smart home ecosystems. They reduce installation complexity and support upgrades without major rewiring. Their scalability makes them suitable for future energy management needs. Wired systems remain relevant in legacy setups, but wireless panels dominate as digitalization accelerates across building infrastructures. Improved communication protocols also strengthen wireless panel performance and network security.

- For instance, Tesla’s V3 Supercharger architecture, first announced in 2019, uses a 1 MW power cabinet and is designed to support peak charging rates of up to 250 kW per vehicle.

By Application

Residential applications account for the largest market share due to rising smart home adoption. Homeowners prefer intelligent panels for real-time energy monitoring, better load distribution, and integration with IoT devices. These panels enable energy savings, safety features, and easy control through mobile apps or voice assistants. Commercial and industrial sectors show strong growth, driven by energy efficiency regulations and facility modernization. However, the residential segment leads due to its broad user base and faster adoption of smart technologies.

Key Growth Drivers

Rising Demand for Energy Efficiency

The growing focus on reducing energy waste is driving smart electric panel adoption. Businesses and households use these panels to optimize power distribution, reduce losses, and monitor energy use in real time. Governments are also implementing energy-efficiency regulations that push consumers to upgrade traditional systems. Smart panels offer predictive maintenance and remote control features, improving overall power management. The rise of net-zero energy goals across industries further accelerates installations, especially in commercial and residential spaces.

- For instance, ABB’s Terra HP Generation III charger supports output voltages from 150 V to 920 V DC and a maximum current of 500 A via a CCS connector. A fully configured system can deliver up to 350 kW to a single vehicle.

Rapid Growth of Smart Infrastructure

Smart city projects and modern infrastructure developments boost the demand for intelligent energy systems. Smart electric panels are vital for integrating renewable power, managing peak loads, and supporting connected devices. They enable stable grid interaction and data-driven operations. Commercial buildings, factories, and utilities are installing smart systems to support automation and sustainability targets. This shift creates opportunities for manufacturers and service providers to expand their portfolios and enhance grid reliability.

- For instance, ChargePoint’s April 2025 announcements state that the new AC Level 2 architecture will support up to 80 amps, delivering 19.2 kW of power. This represents a significant increase over many existing Level 2 chargers, which typically operate between 30 and 50 amps.

Integration with Renewable Energy Sources

The expansion of solar and wind energy systems is a strong driver for the smart electric panel market. These panels allow users to balance energy from multiple sources, improving grid stability and operational control. Integration helps prevent overloads and maximizes renewable energy use, supporting green energy goals. Homes, businesses, and industrial sites increasingly deploy hybrid energy systems. Smart panels make these systems more efficient by ensuring safe distribution, intelligent switching, and real-time performance monitoring.

Key Trends & Opportunities

Adoption of IoT and AI-Based Solutions

Smart electric panels are evolving with IoT and AI technologies. Advanced sensors and analytics enable real-time monitoring, fault detection, and energy optimization. These capabilities improve user control and reduce maintenance costs. Integration with building management systems boosts operational flexibility. Companies see opportunities to offer AI-driven software platforms and predictive energy solutions. This trend is also opening space for collaborations between panel makers and energy management software providers.

- For instance, bp pulse’s hub in Kettering features ten 300 kW chargers, with each providing two charging points for a total of 20. The hub can charge 20 vehicles simultaneously at speeds of up to 150 kW per vehicle.

Expansion of Smart Homes and Buildings

The rise in smart home installations creates opportunities for manufacturers. Homeowners seek systems that automate power use and lower electricity bills. Smart electric panels allow appliance scheduling, load balancing, and remote control through mobile applications. The commercial sector is also shifting toward intelligent building systems to reduce energy costs and comply with sustainability norms. This shift opens new revenue streams for panel producers and service firms offering integrated solutions.

- For instance, Blink achieved OCPP 2.0.1 certification for its Series 7, Series 8, and Series 9 charger models. Blink stated this places them among a limited number of models worldwide with OCPP 2.0 certification.

Electrification of Transportation

The growing adoption of electric vehicles drives demand for smart load management. Smart electric panels help distribute charging loads efficiently and protect against power surges. They enable dynamic load shifting to support multiple charging stations. Commercial fleets and residential EV users benefit from lower costs and improved energy use. This trend offers new growth avenues for panel manufacturers in both private and public charging infrastructure markets.

Key Challenges

High Initial Investment

The cost of smart electric panels and associated infrastructure is a key barrier. Many consumers delay upgrades due to expensive hardware, software integration, and installation charges. Small businesses and residential users face budget constraints. Although long-term savings are notable, the upfront cost limits faster adoption, especially in developing regions. Government incentives and financing options are needed to ease this challenge and support broader market penetration.

Cybersecurity and Data Privacy Risks

Smart electric panels rely on interconnected systems, which increases exposure to cyberattacks. Unsecured networks can lead to power disruptions or data breaches. Utilities and commercial users face high risks if monitoring and control systems are compromised. Building trust requires strong cybersecurity measures, compliance with standards, and continuous software updates. These concerns can delay adoption, especially in critical infrastructure applications where security is a top priority.

Regional Analysis

North America

North America holds a 31% share of the smart electric panel market, driven by strong smart infrastructure adoption and renewable energy integration. The U.S. and Canada lead with large-scale residential and commercial installations. Government incentives for energy efficiency and carbon reduction boost deployment. The growing adoption of smart homes and EV charging networks also fuels market expansion. Utilities and industries are modernizing power distribution systems to improve grid reliability. The presence of advanced technology providers and strong regulatory support positions the region as a key hub for smart energy solutions.

Europe

Europe accounts for a 27% share of the smart electric panel market, supported by stringent energy efficiency regulations and climate targets. Countries like Germany, France, and the UK lead in smart grid modernization. High adoption of renewable energy sources and strict carbon neutrality goals accelerate panel installations. Industrial automation and smart building projects drive further demand. The EU’s sustainability programs and funding initiatives support large-scale infrastructure upgrades. Strong presence of established energy management companies enhances technological innovation, strengthening Europe’s position in the global market.

Asia-Pacific

Asia-Pacific leads with a 33% share, making it the largest regional market for smart electric panels. Rapid urbanization, rising electricity demand, and expanding renewable energy capacity are major drivers. China, Japan, India, and South Korea are investing heavily in smart city and infrastructure projects. Government policies promoting energy efficiency and solar adoption accelerate market growth. Residential and commercial users are shifting toward intelligent energy systems. The region’s strong manufacturing base and cost advantages support large-scale deployment and attract foreign investments in energy technology.

Latin America

Latin America holds a 5% share of the smart electric panel market, with growth driven by renewable energy integration and modernization of outdated power systems. Brazil and Mexico lead regional adoption due to increased solar and wind capacity. Government programs and private sector investments are improving grid reliability and energy management. Commercial and industrial applications dominate, while residential adoption grows steadily. Limited infrastructure and funding challenges slow down widespread implementation, but rising energy efficiency awareness offers strong potential for future expansion.

Middle East & Africa

The Middle East & Africa represent a 4% share of the smart electric panel market, supported by infrastructure modernization and renewable energy initiatives. The UAE, Saudi Arabia, and South Africa are key growth markets. Smart panel adoption is rising in commercial and utility-scale projects, particularly in solar-powered systems. Governments are investing in sustainable energy goals to reduce reliance on fossil fuels. Infrastructure gaps and lower residential adoption remain barriers, but ongoing smart city projects and international collaborations are expected to accelerate regional market growth.

Market Segmentations:

By Phase:

By Technology:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The smart electric panel market is driven by key players including EcoFlow Technology, Havells India, Emerson Electric, Hager Group, ABB, Chint Group, Eaton, Accu Panels, Honeywell International, and General Electric. The smart electric panel market is becoming increasingly competitive, with companies focusing on advanced technology integration, product differentiation, and smart grid compatibility. Manufacturers are investing heavily in R&D to enhance energy efficiency, improve connectivity, and support real-time monitoring. Many firms are expanding their product portfolios to serve both residential and commercial applications, while others target industrial automation and renewable energy integration. Strategic partnerships and collaborations are strengthening global market reach, enabling faster adoption of intelligent power solutions. Companies are also prioritizing cybersecurity, sustainability, and cost-effective production to gain a stronger competitive edge in the evolving energy ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- EcoFlow Technology

- Havells India

- Emerson Electric

- Hager Group

- ABB

- Chint Group

- Eaton

- Accu Panels

- Honeywell International

- General Electric

Recent Developments

- In February 2025, Schneider Electric introduced an innovative solution designed to meet the rising demand for home electrification while minimizing reliance on expansive and complex traditional electrical service upgrades. Unveiled at the 2025 NAHB International builders’ Show in Las Vegas, the new Smart Power Manger, a key feature within the Square D QO Smart Panel Solution enhanced residential energy control and efficiency.

- In December 2024, Legrand announced the acquisition of Power Bus Way, a Toronto-based leader in custom-engineered cable bus systems for data centers, industrial facilities, and commercial projects. This strategic acquisition strengthens Legrand’s position in the high-growth North American Market, where demand for digital infrastructure continue to surge.

- In June 2024, ABB launched the ReliaHome Smart Panel, its first residential energy management software platform for the U.S. and Canada market. Developed in partnership with Lumin, a prominent player in responsive load management technology, this advanced solution delivers superior user experience and seamless energy efficiency through an intuitive, easy-to-use interface.

- In March 2024, Rockwell Automation announced the regional rollout of its CUBIC product line. Specializing in IEC-61439-compliant modular enclosure systems, CUBIC enables efficient and flexible construction of power distribution and electrical panels. This product line is strategically positioned to support high-growth sectors including renewable energy, data centers, mining, food and beverage, chemical processing, and infrastructure development.

Report Coverage

The research report offers an in-depth analysis based on Phase, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily due to rising energy efficiency demands across sectors.

- Integration with renewable energy systems will drive smart panel installations.

- IoT and AI adoption will enhance real-time monitoring and grid optimization.

- Expansion of smart homes and buildings will boost residential demand.

- Increased EV charging infrastructure will accelerate deployment in commercial spaces.

- Governments will support adoption through energy efficiency policies and incentives.

- Manufacturers will focus on cybersecurity and data protection features.

- Modular and scalable designs will gain popularity for flexible energy systems.

- Emerging markets will experience rapid adoption through cost-effective solutions.

- Strategic collaborations will drive innovation and global market expansion.