Market Overview:

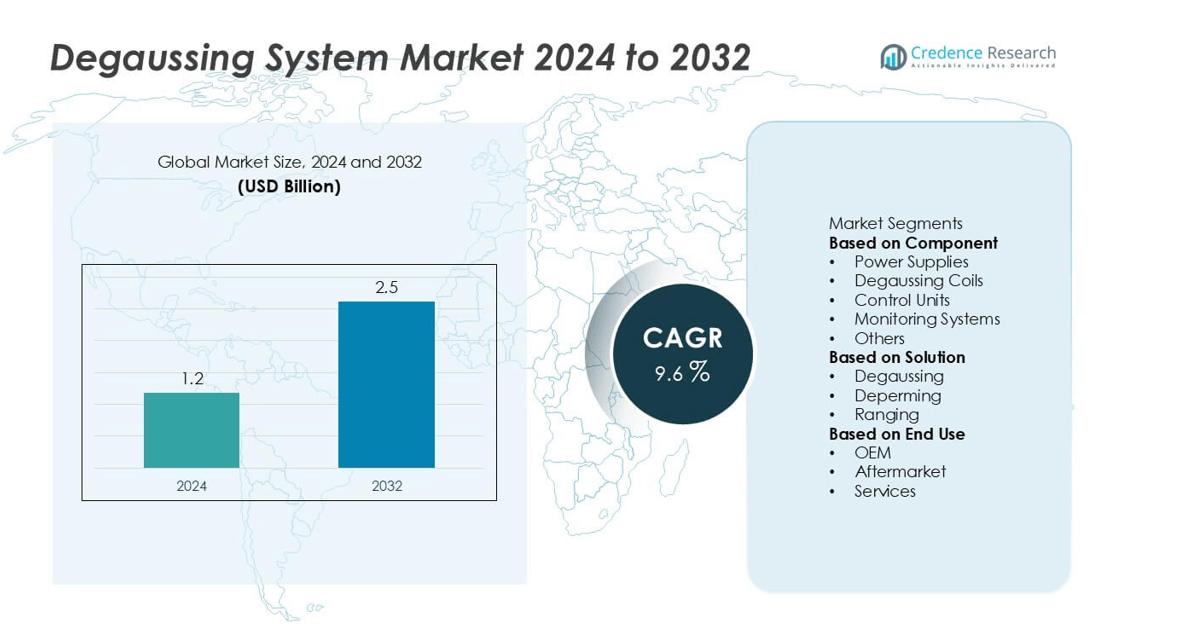

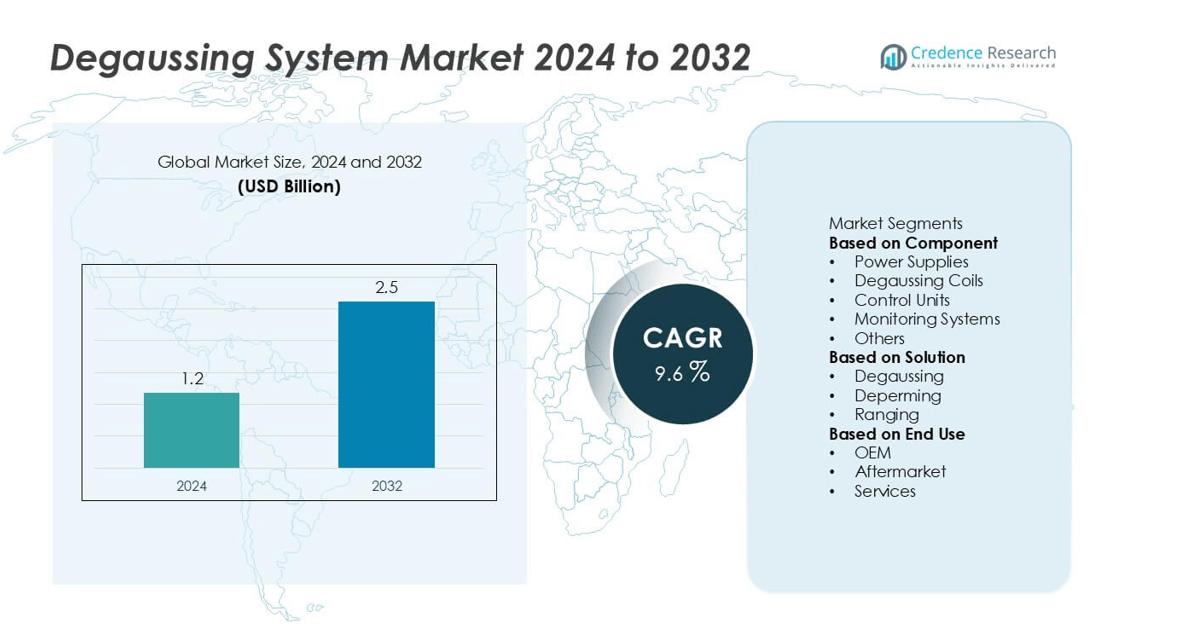

The global degaussing system market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.5 billion by 2032, growing at a CAGR of 9.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Degaussing System Market Size 2024 |

USD 1.2 billion |

| Degaussing System Market, CAGR |

9.6% |

| Degaussing System Market Size 2032 |

USD 2.5 billion |

The degaussing system market is led by prominent players such as L3Harris Technologies Inc, Ultra Electronics Holdings plc, Wärtsilä, Larsen & Toubro Limited, ECA Group, American Superconductor Corporation, IFEN SpA, Polyamp AB, STL Systems AG, and DA Group. These companies dominate through technological expertise, extensive product portfolios, and strong global partnerships with naval defense agencies. North America leads the market with a 32% share, driven by significant U.S. defense investments and modernization initiatives. Asia-Pacific, holding 29%, follows closely due to expanding naval programs in China, India, and Japan, while Europe, with a 27% share, benefits from advanced shipbuilding capabilities and ongoing fleet upgrades across NATO countries.

Market Insights

- The global degaussing system market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.5 billion by 2032, registering a CAGR of 9.6% during the forecast period.

- Market growth is driven by rising naval modernization programs and the increasing demand for vessel stealth and magnetic signature reduction, particularly in defense sectors across major economies.

- Key trends include the integration of AI and digital monitoring systems, automation in control units, and the growing use of compact, energy-efficient degaussing coils, which hold a 38% segment share in 2024.

- The market is moderately competitive, with leading players such as L3Harris Technologies, Wärtsilä, Ultra Electronics, and Larsen & Toubro Limited focusing on innovation, partnerships, and defense contracts, though high installation costs remain a restraint.

- Regionally, North America leads with a 32% share, followed by Asia-Pacific (29%) and Europe (27%), supported by strong naval investments and shipbuilding activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The degaussing coils segment dominated the market in 2024, accounting for approximately 38% of the global share. Degaussing coils are critical in minimizing a vessel’s magnetic signature and preventing detection by magnetic sensors and mines. Their widespread adoption in naval and commercial vessels, coupled with technological advancements in coil materials and configurations, drives this segment’s growth. Power supplies and control units also show steady demand, driven by modernization initiatives and integration of automated systems for improved efficiency and operational reliability in naval applications.

- For instance, L3Harris Technologies developed degaussing systems that provide precise, controlled direct current to independent degaussing coils embedded throughout a ship’s hull. These systems use Bipolar Amplifier (BPA) power supplies with an output power rating of 8.7 kW and an output current of up to ±24 amperes per amplifier, operating in parallel for redundancy or increased power requirements

By Solution

The degaussing segment held the largest market share of around 45% in 2024, owing to its essential role in reducing magnetic interference and enhancing vessel stealth capabilities. Naval defense forces worldwide are investing heavily in advanced degaussing systems to protect ships and submarines from magnetic mines and detection threats. The deperming and ranging segments are gaining traction as support solutions, particularly in retrofitting programs and performance verification, but degaussing remains the core technology underpinning maritime magnetic signature control.

- For instance, Wärtsilä Defense developed an automated degaussing control system that integrates with shipboard combat management networks and delivers magnetic compensation within 0.1 µT accuracy. The system can process magnetic field data from up to 24 onboard sensors simultaneously, optimizing coil currents in real time

By End Use

The OEM segment led the market with a 50% share in 2024, supported by increased production of new naval vessels and integration of advanced magnetic treatment systems during shipbuilding. Defense modernization programs in countries such as the U.S., India, and China have strengthened OEM demand, as governments emphasize stealth technologies in naval design. The aftermarket and services segments are also expanding, driven by system upgrades, maintenance contracts, and lifecycle management needs, particularly among fleets aiming to extend operational efficiency and compliance with modern naval standards.

Key Growth Drivers

Rising Naval Modernization and Fleet Expansion

Global naval forces are increasingly investing in modernizing their fleets to enhance defense capabilities, fueling demand for advanced degaussing systems. Many countries are commissioning new submarines, frigates, and destroyers equipped with low-magnetic-signature technologies to counter underwater mine threats. The integration of digital control systems and energy-efficient components in degaussing systems further accelerates adoption. This modernization trend, driven by defense budgets and strategic maritime security initiatives, remains a primary growth driver for the degaussing system market worldwide.

- For instance, BAE Systems is the prime contractor for the U.K. Royal Navy’s Type 26 Global Combat Ships, also known as the City-class frigates, which are designed for anti-submarine warfare and other multi-mission roles. The ships are being built at BAE Systems’ shipyards in Glasgow, Scotland.

Growing Emphasis on Vessel Stealth and Magnetic Signature Reduction

The need to reduce vessel detectability has intensified as naval warfare becomes more technology-driven. Degaussing systems play a crucial role in minimizing a ship’s magnetic footprint, making them essential for stealth operations. Increased use of advanced sensors and magnetic mines has prompted defense organizations to invest in next-generation degaussing and deperming technologies. As stealth becomes a defining factor in naval superiority, demand for magnetic treatment systems continues to rise across both new-build and retrofit applications.

- For instance, Ultra Electronics, now Ultra Maritime, has supplied numerous navies with advanced, automated degaussing systems. The systems employ a combination of technologies including some with fluxgate magnetometers and adaptive real-time compensation for the reduction of a vessel’s magnetic signature.

Technological Advancements and Automation in Degaussing Systems

Rapid advancements in automation, real-time monitoring, and control technologies are transforming degaussing systems. Modern systems now feature intelligent control units, compact coils, and predictive maintenance capabilities, improving efficiency and reducing operational downtime. Integration with digital ship management platforms enhances system accuracy and responsiveness, supporting fleet readiness. These innovations not only improve system performance but also lower lifecycle costs, encouraging widespread adoption among naval and commercial vessel operators seeking smarter, energy-efficient degaussing solutions.

Key Trends & Opportunities

Integration of AI and Digital Monitoring Systems

The integration of artificial intelligence (AI) and IoT-based monitoring is emerging as a major trend in the degaussing system market. Smart monitoring platforms enable real-time magnetic field analysis, predictive maintenance, and automated calibration. This digital shift enhances operational reliability, reduces human intervention, and supports data-driven decision-making. As navies and shipbuilders adopt AI-driven automation for performance optimization, the demand for intelligent degaussing and control systems is expected to create new growth opportunities in the coming years.

- For instance, the Chinese People’s Liberation Army (PLA) Navy has integrated an AI-assisted decision-making system within its degaussing support operations, which improved operational efficiency by 60% during a simulated emergency drill.

Rising Adoption in Commercial and Research Vessels

While defense remains the primary application, degaussing systems are increasingly used in commercial and research vessels to ensure magnetic safety and compliance with maritime standards. Offshore survey ships, oceanographic research vessels, and subsea exploration platforms are adopting compact, cost-effective systems. This expansion beyond defense applications opens new revenue streams for manufacturers. As maritime activities diversify, the commercial sector’s growing awareness of magnetic risk mitigation is expected to significantly contribute to market growth.

- For instance, Polyamp AB deployed its lightweight modular degaussing system on oceanographic research vessels operated by the Swedish Maritime Administration. Each system supports 18 magnetic coil zones and provides magnetic field stabilization below 0.3 µT during continuous survey operations.

Key Challenges

High Installation and Maintenance Costs

The high cost associated with installing and maintaining degaussing systems remains a major challenge. Advanced systems require complex integration with onboard electrical infrastructure, specialized components, and periodic recalibration. These expenses can deter smaller shipbuilders and commercial operators from adoption. Additionally, maintenance requires skilled technicians and frequent testing, increasing lifecycle costs. Manufacturers are focusing on developing cost-effective modular systems to address these concerns, but affordability continues to be a limiting factor in broader market penetration.

Limited Standardization and Technical Compatibility Issues

The lack of uniform standards for degaussing system design and integration creates compatibility challenges across different vessel types and naval fleets. Variations in magnetic field requirements, power configurations, and vessel materials complicate system standardization. This fragmentation often leads to longer installation timelines and customization costs. Furthermore, older vessels may face integration barriers due to outdated onboard electrical systems. To overcome these issues, manufacturers are increasingly investing in flexible, interoperable solutions that can adapt to diverse platform requirements.

Regional Analysis

North America

North America held a market share of 32% in 2024, driven by strong naval modernization initiatives and the presence of leading defense contractors in the United States. The U.S. Navy’s continuous investment in advanced degaussing and signature management technologies to enhance fleet stealth capabilities significantly supports regional growth. Additionally, the replacement of legacy systems with automated, digital degaussing units contributes to sustained demand. Canada’s focus on upgrading its naval fleet under defense procurement programs further strengthens the market outlook, ensuring North America remains a key hub for degaussing system innovation and deployment.

Europe

Europe accounted for 27% of the global degaussing system market in 2024, supported by robust naval expansion and modernization projects across the United Kingdom, France, Germany, and Italy. European shipyards are increasingly integrating advanced deperming and degaussing solutions into new naval platforms to meet NATO operational standards. The rise in cross-border defense collaborations and R&D investments in stealth technologies also fuels regional demand. Additionally, the emphasis on maritime security in the Baltic and North Seas reinforces Europe’s position as a prominent market for magnetic signature management solutions.

Asia-Pacific

Asia-Pacific captured 29% of the degaussing system market in 2024, driven by extensive naval development programs in China, India, Japan, and South Korea. Rising geopolitical tensions and increased defense budgets have accelerated procurement of technologically advanced vessels equipped with magnetic signature reduction systems. Domestic manufacturing capabilities, supported by government initiatives promoting defense indigenization, further boost regional production. Emerging shipbuilding hubs and modernization of existing fleets are expanding opportunities for both OEMs and aftermarket service providers, positioning Asia-Pacific as the fastest-growing regional market during the forecast period.

Middle East & Africa

The Middle East and Africa region held a 7% market share in 2024, primarily driven by defense investments aimed at enhancing naval surveillance and security in strategic maritime zones. Countries such as Saudi Arabia and the United Arab Emirates are focusing on fleet expansion and upgrading naval defense infrastructure. Growing maritime trade activities and the protection of offshore assets also stimulate demand for degaussing systems. However, budget constraints in some African nations and limited domestic manufacturing capabilities may slightly restrain regional growth compared to other global markets.

Latin America

Latin America accounted for 5% of the global degaussing system market in 2024, with growth supported by increasing naval procurement programs in Brazil, Mexico, and Chile. Regional governments are investing in strengthening maritime defense capabilities to safeguard coastal borders and trade routes. Brazil’s focus on modernizing its naval fleet, particularly submarine and surface vessel programs, contributes significantly to demand. Although limited defense spending in smaller economies poses a challenge, the gradual adoption of advanced ship technologies and regional shipbuilding initiatives are expected to drive steady market growth.

Market Segmentations:

By Component

- Power Supplies

- Degaussing Coils

- Control Units

- Monitoring Systems

- Others

By Solution

- Degaussing

- Deperming

- Ranging

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the degaussing system market includes major players such as L3Harris Technologies Inc, Ultra Electronics Holdings plc, Larsen & Toubro Limited, Wärtsilä, ECA Group, American Superconductor Corporation, IFEN SpA, Polyamp AB, STL Systems AG, and DA Group. These companies compete on technological innovation, product reliability, and strategic partnerships with naval forces and shipbuilders. The market is moderately consolidated, with established players focusing on expanding their portfolios through automation, digital control systems, and AI-integrated monitoring solutions. Strategic collaborations and government defense contracts remain crucial for sustaining market leadership. Additionally, growing investments in R&D to develop compact, energy-efficient degaussing solutions are enhancing competitiveness. Companies are also strengthening regional footprints by aligning with modernization programs and offering customized systems for both new-build and retrofit vessels, thereby ensuring long-term growth and market stability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, L3Harris Technologies Inc won a contract from Austal USA as the single-system vendor for the U.S. Navy’s T-AGOS-25 class ocean surveillance ships, which includes degaussing system solutions.

- In May 2024, Fincantieri Marinette Marine (FMM), the U.S. subsidiary of Fincantieri was awarded a contract exceeding USD 1 billion for the construction of the fifth and sixth Constellation-class frigates for the U.S. Navy.

- In August 2023, the Indonesian Navy added two Fani-class mine countermeasure vessels to its fleet. These vessels feature non-magnetic steel construction and include degaussing systems that help reduce magnetic signatures during mine-hunting operations. The ships also use electric propulsion systems, which help keep their acoustic signatures low

Report Coverage

The research report offers an in-depth analysis based on Component, Solution, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The degaussing system market will continue to grow steadily, driven by increased investments in naval modernization and stealth technologies.

- Rising global defense budgets will support the deployment of advanced magnetic signature reduction systems across naval fleets.

- Integration of AI, IoT, and digital monitoring systems will enhance automation and predictive maintenance capabilities.

- Demand for compact and energy-efficient degaussing coils will increase as shipbuilders prioritize space and power optimization.

- OEM installations will remain dominant, supported by the development of new submarines, destroyers, and surface vessels.

- Aftermarket and service segments will expand as older vessels undergo system upgrades and maintenance programs.

- Asia-Pacific will emerge as the fastest-growing region due to expanding defense industries and shipbuilding capacities.

- Collaborations between technology providers and naval defense agencies will strengthen innovation and system customization.

- Manufacturers will focus on developing modular, cost-effective degaussing systems to overcome installation challenges.

- Growing adoption in commercial and research vessels will diversify applications beyond traditional defense use.