Market Overview:

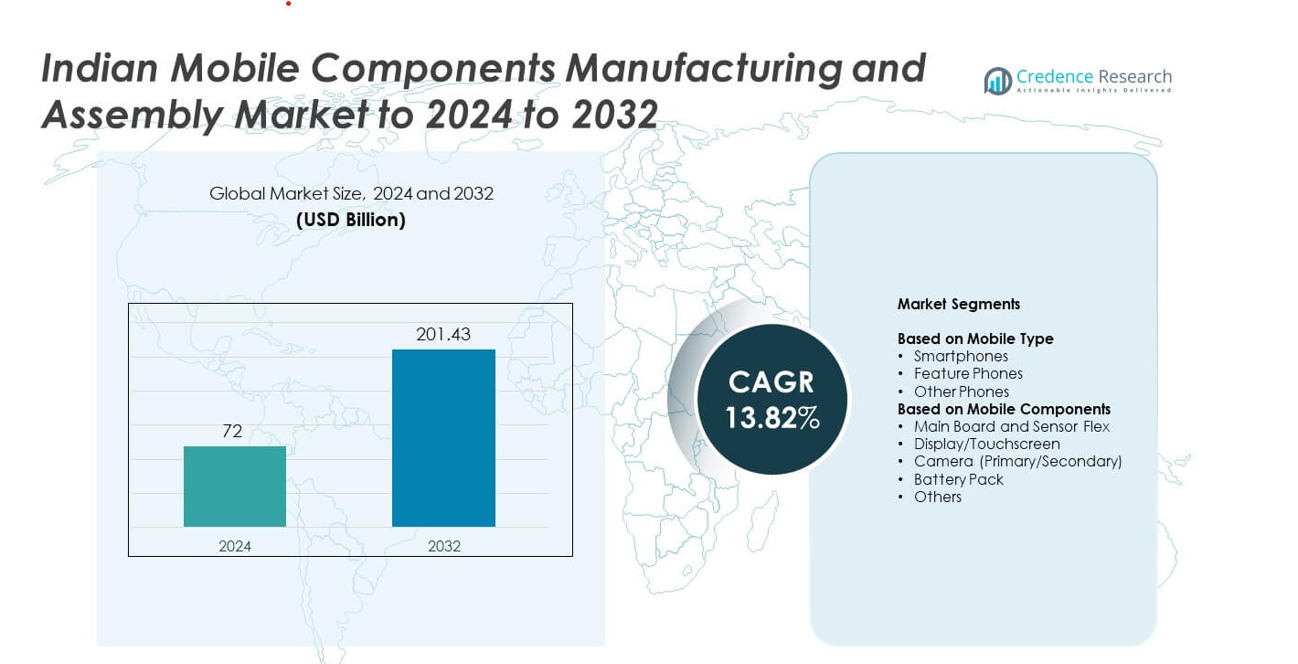

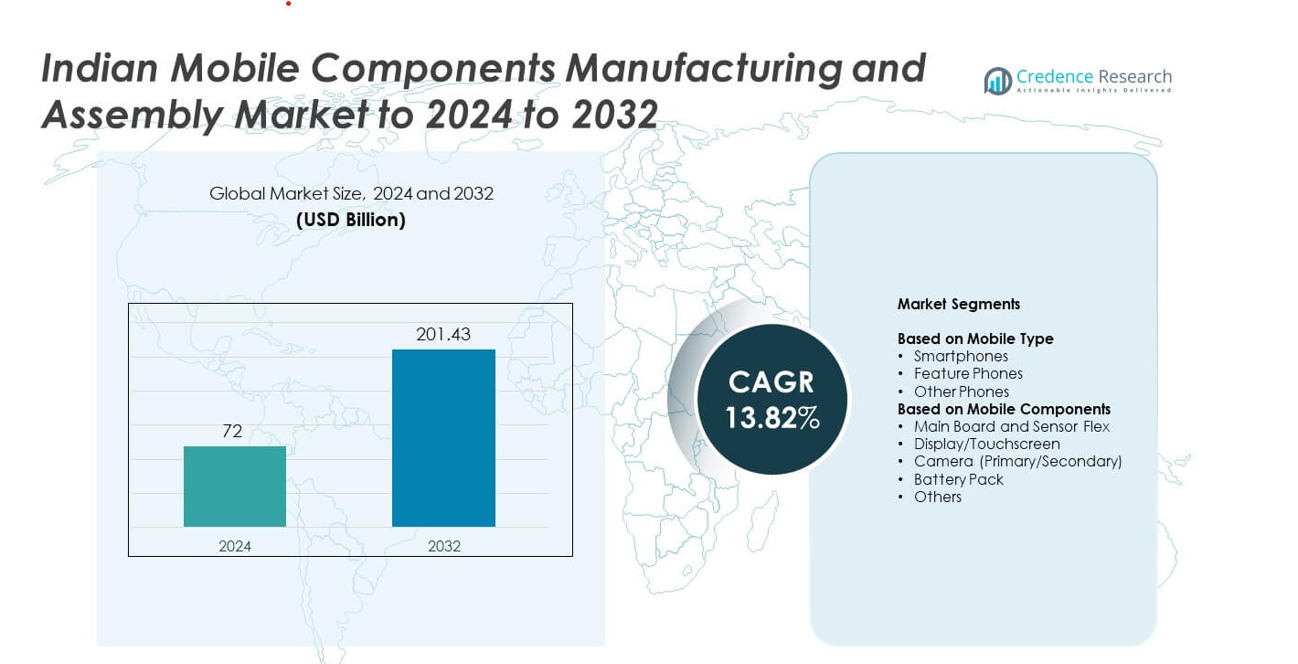

Indian Mobile Components Manufacturing and Assembly Market size was valued at USD 72 Billion in 2024 and is anticipated to reach USD 201.43 Billion by 2032, at a CAGR of 13.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Indian Mobile Components Manufacturing and Assembly Market Size 2024 |

USD 72 Billion |

| Indian Mobile Components Manufacturing and Assembly Market , CAGR |

13.82% |

| Indian Mobile Components Manufacturing and Assembly Market Size 2032 |

USD 201.43 Billion |

The Indian mobile components manufacturing and assembly market is led by key players such as Samsung Electronics Co. Ltd., Xiaomi Corporation, Vivo Mobile Communications Co. Ltd., Oppo Guangdong Mobile Communications Co. Ltd., and Lenovo Group Ltd., along with prominent domestic firms including Lava International Limited, Micromax Informatics Limited, Intex Technologies, and Karbonn Mobiles. These companies dominate production and assembly through strong local manufacturing bases and strategic partnerships. Uttar Pradesh leads the regional landscape with a 34.6% share, followed by Andhra Pradesh with 22.3% and Telangana with 18.7%. Tamil Nadu and Karnataka collectively contribute around 24.4%, supported by robust infrastructure, skilled labor, and proactive state policies driving large-scale component and device assembly operations across India.

Market Insights

- The Indian Mobile Components Manufacturing and Assembly Market was valued at USD 72 billion in 2024 and is projected to reach USD 201.43 billion by 2032, growing at a CAGR of 13.82%.

- Growth is driven by government incentives under the Production Linked Incentive (PLI) scheme, rapid smartphone adoption, and increasing localization of component manufacturing across key states.

- Emerging trends include automation, adoption of smart manufacturing technologies, and rising demand for 5G-enabled device components such as advanced sensors and chipsets.

- The market is competitive, with global and domestic players expanding local assembly lines and focusing on value-added components like displays, batteries, and camera modules.

- Uttar Pradesh leads with a 34.6% regional share, followed by Andhra Pradesh at 22.3% and Telangana at 18.7%, while smartphones dominate the mobile type segment with an 82.6% share, supported by strong production infrastructure and policy-driven expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Mobile Type

Smartphones dominate the Indian mobile components manufacturing and assembly market with an estimated 82.6% share in 2024. The dominance is fueled by rapid 5G rollout, rising digital adoption, and increasing demand for advanced camera and display technologies. Growing local manufacturing under the Production Linked Incentive (PLI) scheme has boosted domestic smartphone assembly, reducing dependence on imports. Feature phones continue to serve rural and low-income segments due to affordability and long battery life, while other phone categories remain niche, catering to industrial and specialized communication applications.

- For instance, Foxconn plans to assemble up to 30 million iPhones in India in 2025, which is more than double its 2024 output in India of approximately 12 million units.

By Mobile Components

Display and touchscreen components lead the market with around 34.2% share in 2024. The growth is driven by increasing adoption of AMOLED, OLED, and foldable display technologies in mid and premium smartphone segments. Expanding domestic panel assembly capabilities and strategic partnerships with global display manufacturers further enhance local value addition. Camera modules and battery packs follow as key growth areas supported by innovation in multi-sensor systems, high-resolution imaging, and longer-lasting lithium-polymer technologies to meet evolving consumer expectations.

- For instance, Salcomp makes about 100 million phone chargers per year in India, anchoring power components.

Key Growth Drivers

Government Incentives and Localization Push

Government initiatives such as the Production Linked Incentive (PLI) scheme and phased manufacturing programs are accelerating domestic production of mobile components. These policies encourage global and local firms to establish assembly units, reducing import reliance and promoting value addition within India. Rising investments in manufacturing clusters across states like Uttar Pradesh and Tamil Nadu have also expanded supply chain capabilities, enabling large-scale component integration and export competitiveness.

- For instance, the HCL–Foxconn JV won approval for a Noida fab to make 36 million display-driver chips monthly from 2027.

Rising Smartphone Penetration and Technological Advancements

The growing adoption of smartphones, supported by affordable data plans and expanding digital infrastructure, is driving component demand. Increasing consumer preference for 5G-enabled devices, advanced camera systems, and high-refresh-rate displays is pushing manufacturers to upgrade production technologies. This trend has stimulated domestic assembly for critical parts like chipsets, displays, and sensors, strengthening India’s position in the global electronics manufacturing ecosystem.

- For instance, Tata Electronics currently employs around 20,000 people at its Hosur factory (as of September 2024), and plans to hire an additional 20,000 workers to double the workforce to 40,000 within the next year.

Foreign Investments and Strategic Partnerships

Rising foreign direct investment from major technology companies has fueled growth in India’s mobile component ecosystem. Partnerships between global brands and Indian manufacturers are enhancing local capabilities in printed circuit boards, camera modules, and battery systems. Collaborative ventures are fostering skill development and advanced technology transfer, positioning India as a strategic hub for component manufacturing in Asia.

Key Trends and Opportunities

Expansion of 5G and IoT-Driven Component Demand

The rollout of 5G networks and increasing integration of IoT applications have created strong opportunities for advanced component manufacturing. Demand for high-performance processors, efficient antennas, and precision sensors is growing rapidly. Local suppliers are investing in automation and smart assembly lines to meet the evolving performance and connectivity standards required by next-generation mobile devices.

- For instance, Apple shifted approximately 20% of global iPhone production to India as of early 2025, with plans to increase this share further to around 25-32% by 2027.

Emergence of Smart Manufacturing and Automation

Automation and robotics are transforming mobile component assembly by improving precision and efficiency. The adoption of Industry 4.0 practices, including AI-based quality control and real-time process monitoring, is enhancing production output and reducing defects. This shift toward smart manufacturing enables scalability, cost optimization, and improved competitiveness for Indian manufacturers in global supply chains.

- For instance, the Pegatron facility acquired by Tata Electronics had around 10,000 employees at the time of the deal closure in late 2024/early 2025.

Growing Domestic Supply Chain Integration

India is witnessing greater collaboration among component makers, assemblers, and logistics providers to strengthen local value chains. This integration supports faster production cycles and reduced dependency on imported parts. Enhanced backward linkages in materials such as semiconductors, connectors, and display glass are paving the way for sustainable, end-to-end mobile manufacturing within the country.

Key Challenges

Dependence on Imports for Core Components

Despite strong domestic assembly growth, India remains reliant on imports for high-value components such as semiconductors, display panels, and camera sensors. This dependence limits local value addition and exposes the sector to global supply disruptions. Establishing indigenous capabilities in advanced manufacturing technologies is critical to reduce import dependency and enhance resilience.

Skill Gaps and Infrastructure Constraints

The shortage of skilled labor and limited availability of advanced manufacturing infrastructure pose major challenges. Many production units lack adequate automation systems, cleanroom environments, and testing facilities required for precision component fabrication. Strengthening vocational training programs and investing in infrastructure modernization are essential to sustain long-term industry competitiveness.

Regional Analysis

Uttar Pradesh

Uttar Pradesh leads the Indian mobile components manufacturing and assembly market with a 34.6% share in 2024. The state’s dominance is driven by large-scale manufacturing clusters in Noida and Greater Noida, hosting major assembly units of global brands. Supportive state policies, skilled workforce availability, and proximity to the National Capital Region enhance industrial growth. Continuous investments in component production, including displays, batteries, and camera modules, strengthen its supply chain. The region’s focus on infrastructure and logistics modernization further boosts its competitiveness in large-volume mobile manufacturing.

Andhra Pradesh

Andhra Pradesh holds about 22.3% share of the Indian mobile components manufacturing and assembly market in 2024. The state benefits from a strong industrial base, special economic zones, and favorable investment policies. Manufacturing hubs in Tirupati and Sri City attract both domestic and international electronics players. The presence of advanced logistics infrastructure and port connectivity supports export-oriented component production. Growing participation of small and medium enterprises in PCB assembly and power management modules continues to enhance the region’s contribution to the national electronics ecosystem.

Telangana

Telangana accounts for 18.7% share of the Indian mobile components manufacturing and assembly market in 2024. Hyderabad’s Electronics Manufacturing Cluster and dedicated industrial corridors have positioned the state as a leading destination for component manufacturing. Government incentives and partnerships with global technology firms are driving investments in semiconductor packaging, sensor modules, and battery systems. A strong digital infrastructure, skilled talent pool, and efficient supply networks support sustained growth. Telangana’s focus on high-value electronics and smart manufacturing ensures its strategic importance in India’s mobile production landscape.

Tamil Nadu

Tamil Nadu represents around 14.2% share of the Indian mobile components manufacturing and assembly market in 2024. The state’s established electronics ecosystem in Chennai and Sriperumbudur attracts major OEMs and component suppliers. Strong infrastructure, advanced industrial parks, and a skilled labor base make Tamil Nadu a preferred location for large-scale mobile assembly. Increasing production of printed circuit boards, connectors, and flexible displays contributes to local value addition. The state’s emphasis on sustainable manufacturing practices and export-oriented policies continues to reinforce its regional strength.

Karnataka

Karnataka holds an estimated 10.2% share in the Indian mobile components manufacturing and assembly market in 2024. Bengaluru’s strong base in electronics design, semiconductor R&D, and automation technologies drives its market growth. The region supports innovation-led component development, particularly in sensors, chipsets, and precision modules. Government initiatives under the Electronics System Design and Manufacturing (ESDM) policy promote start-ups and high-tech assembly operations. With strong IT integration and a robust innovation ecosystem, Karnataka remains a key contributor to India’s advanced mobile component production segment.

Market Segmentations:

By Mobile Type

- Smartphones

- Feature Phones

- Other Phones

By Mobile Components

- Main Board and Sensor Flex

- Display/Touchscreen

- Camera (Primary/Secondary)

- Battery Pack

- Others

By Geography

- Uttar Pradesh

- Andhra Pradesh

- Telangana

- Tamil Nadu

- Karnataka

Competitive Landscape

Vivo Mobile Communications Co. Ltd., Lava International Limited, Xiaomi Corporation, Samsung Electronics Co. Ltd., Intex Technologies, Lenovo Group Ltd., Oppo Guangdong Mobile Communications Co. Ltd., Micromax Informatics Limited, and Karbonn Mobiles are among the major participants shaping the competitive landscape of the Indian mobile components manufacturing and assembly market. The market is characterized by intense competition, with global brands expanding local assembly lines and domestic firms scaling operations under government incentive programs. Players are focusing on vertical integration, component localization, and supply chain optimization to reduce import dependence. Increasing automation, R&D investments, and partnerships with component suppliers enhance production efficiency and technological capability. The shift toward high-value components, such as advanced camera modules, batteries, and display panels, drives differentiation. Moreover, strategic collaboration with semiconductor and design solution providers is fostering innovation, while sustainable manufacturing practices and energy-efficient facilities are becoming key priorities to maintain competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Samsung significantly expanded its Indian manufacturing portfolio by beginning the production of laptops at its Greater Noida facility, which is also home to what was inaugurated in 2018 as the world’s largest mobile phone manufacturing factory.

- In 2025, Micromax announced plans to invest in display and camera module manufacturing with an official announcement expected in the April-June quarter of 2025.

- In 2025, Xiaomi began local manufacturing of its tablets with the launch of the Xiaomi Pad 7.

Report Coverage

The research report offers an in-depth analysis based on Mobile Type, Mobile Components and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with increasing domestic assembly of smartphones and electronic components.

- Rising adoption of 5G-enabled devices will boost demand for advanced semiconductor and sensor technologies.

- Local value addition will grow as India strengthens its component manufacturing ecosystem under the PLI scheme.

- Strategic collaborations between global and Indian firms will enhance technology transfer and skill development.

- Automation and smart manufacturing adoption will improve production efficiency and product quality.

- Regional manufacturing hubs will gain prominence through infrastructure modernization and policy support.

- Component diversification into displays, camera modules, and batteries will drive steady growth.

- Increasing focus on sustainable manufacturing will promote energy-efficient and recyclable materials.

- R&D investment will rise in areas such as flexible electronics and integrated circuit design.

- Strengthened export capabilities will position India as a key global hub for mobile component production.