Market Overview:

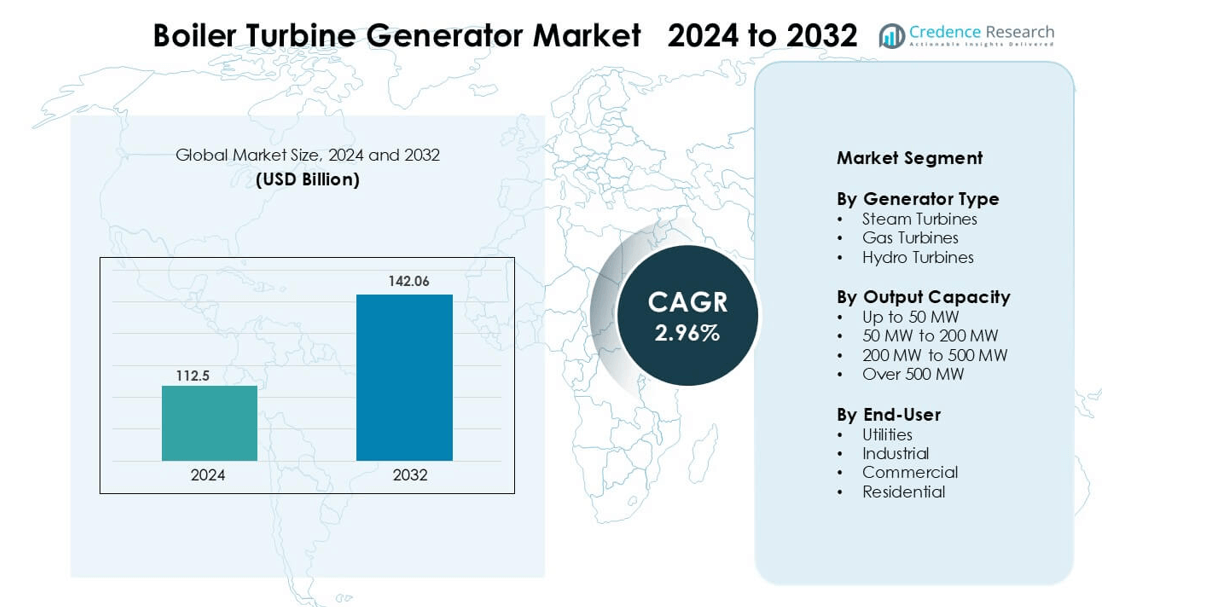

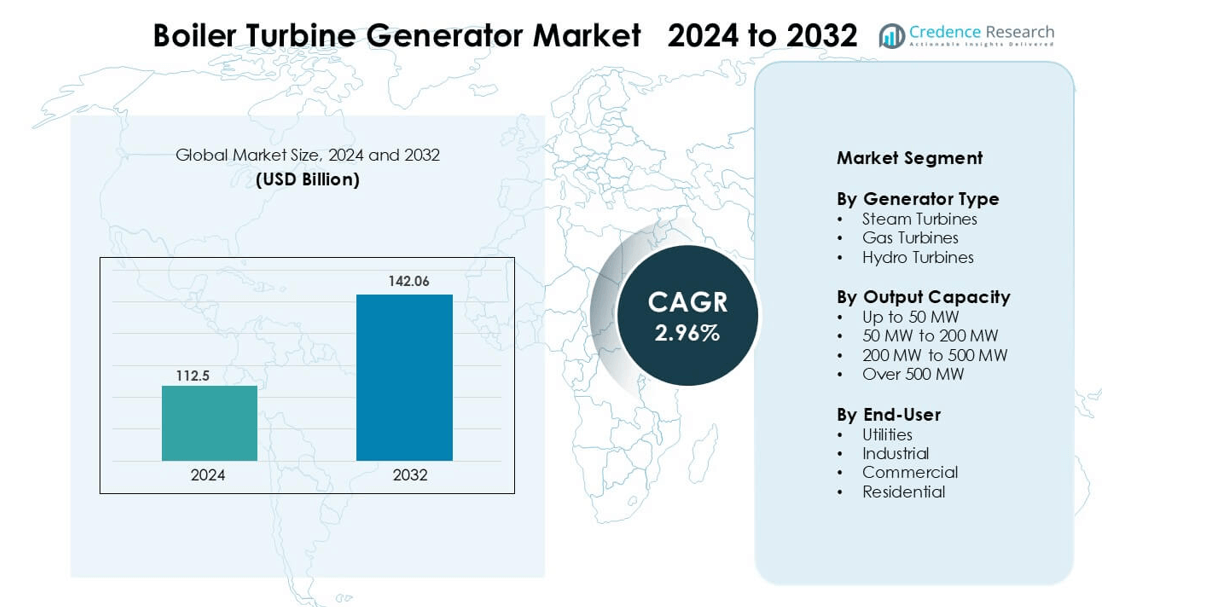

Boiler Turbine Generator Market was valued at USD 112.5 billion in 2024 and is anticipated to reach USD 142.06 billion by 2032, growing at a CAGR of 2.96% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Boiler Turbine Generator Market Size 2024 |

USD 112.5 billion |

| Boiler Turbine Generator Market, CAGR |

2.96% |

| Boiler Turbine Generator Market Size 2032 |

USD 142.06 billion |

The Boiler Turbine Generator market is shaped by major global players that supply high-capacity systems for coal, gas, and biomass power plants. Key companies include General Electric, Siemens AG, Mitsubishi Hitachi Power Systems, Doosan Heavy Industries & Construction, Dongfang Electric Corporation, Bharat Heavy Electrical Limited, Thermax, Babcock & Wilcox Enterprise, IHI Corporation, and John Wood Group. These firms compete through advanced boiler efficiency, supercritical steam technologies, and strong aftermarket service portfolios. Asia-Pacific remains the leading regional market with 42% share, driven by large thermal fleets, rising electricity demand, and continuous investments in supercritical and combined-cycle power projects.

Market Insights

- The Boiler Turbine Generator market recorded multi-billion-dollar revenue of USD 112.5 billion in 2024 and is projected to grow at a steady CAGR of 2.96% through 2032, supported by ongoing utility and industrial power expansions.

- Market drivers include rising electricity demand, modernization of aging fleets, and adoption of supercritical and combined-cycle systems that improve fuel efficiency and reduce emissions.

- Key trends focus on digital monitoring, predictive maintenance, and hybrid thermal setups that integrate biomass or waste-to-energy solutions for cleaner baseload output.

- Competitive activity is strong among General Electric, Siemens AG, Mitsubishi Hitachi Power Systems, Doosan Heavy Industries & Construction, and Bharat Heavy Electrical Limited, with companies investing in advanced turbines and high-pressure boiler upgrades.

- Asia-Pacific holds 42% share, making it the dominant region, while the boiler component segment leads with the highest share due to large deployment in coal, gas, and biomass plants; emission regulations and high capital investment remain the main restraints.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Component

The boiler segment holds the leading share in the Boiler Turbine Generator market due to high adoption in coal, gas, biomass, and waste-to-energy power plants. Boilers remain the dominant sub-segment with the highest market share, driven by demand for efficient steam production, large-capacity utility plants, and modern supercritical and ultra-supercritical technologies. Turbines gain traction as countries expand gas-based and combined-cycle projects to reduce carbon output. Generators grow steadily with digital monitoring, grid-stabilizing features, and higher voltage output. Rising electricity demand and replacement of old units drive component upgrades.

- For instance, the China Huaneng Group Yuhuan Power Plant features four ultra-supercritical coal-fired units of 1,000 MW each, equipped with steam conditions of 27.5 MPa and about 605 °C main steam temperature

By Capacity

The >300 MW segment commands the dominant share, as large-scale power stations and industrial utilities prefer high-capacity BTG setups for continuous baseload output. These systems support coal, nuclear, and large biomass facilities with long operating lifecycles. The 100–300 MW segment expands across mid-size industrial plants and regional utilities seeking efficient load control. Units below 100 MW find uses in captive power and waste-heat recovery. Growth in smart grids and renewable-thermal hybrids also encourages modern capacity additions.

- For instance, China’s Binchang/related projects delivered ultra-supercritical steam turbine units rated at 660 MW class, marking the deployment of 660 MW boiler-turbine-generator sets in recent large coal/CFB projects.

By Fuel Type

Coal-based BTG systems still hold the largest market share, especially in Asia-Pacific, due to high power demand and existing coal infrastructure. Gas-based BTG units grow faster as governments tighten emission norms and promote combined-cycle efficiency. Biomass and waste-to-energy plants rise as industries adopt clean-fuel boilers and decentralized power generation. Nuclear BTG use remains stable in countries investing in long-term baseload power. Fuel diversification supports operational reliability, cost control, and sustainability efforts across both public and private utilities.

Key Growth Drivers

Rising Demand for Reliable Grid Power Supply

Global electricity demand continues to rise due to industrial expansion, urbanization, and digital infrastructure. Many economies still depend on thermal and hybrid power plants to maintain stable baseload generation. Boiler turbine generator systems offer long operating life, high load-handling capacity, and steady output, making them vital for national grids. Fast-growing countries invest in large steam-based plants to avoid supply shortages and voltage instability. Grid operators also upgrade old BTG units to improve pressure ratios and steam flow efficiency. Modern systems deliver better safety, automated control, and lower operational downtime. As data centers, manufacturing clusters, and transport electrification expand, steady thermal power becomes critical for reliability. This drives procurement of utility-scale BTG units in both public and private power projects.

- For instance, Siemens Energy manufacture steam turbines (SST-6000 series) with power outputs up to 1,200 MW, which are used in power plants worldwide, including potentially in India.

Technological Advancements in High-Efficiency BTG Systems

Developers focus on supercritical and ultra-supercritical steam technologies to improve heat rate and fuel conversion. These systems operate at higher pressure and temperature, which increases efficiency and reduces emissions. Advanced turbines provide better blade aerodynamics and improved cycle performance. Digital monitoring platforms track temperature, vibration, and fuel use in real time. Plants use predictive maintenance to reduce forced shutdowns and repair costs. Modern generators also support flexible grid requirements and high load swings. Countries with aging fleets replace old subcritical units with advanced BTG systems to meet strict efficiency rules. Investments in hybrid setups combine BTG plants with solar or biomass to balance cost and sustainability. These improvements create long-term demand for high-output and low-emission systems.

- For instance, Mitsubishi Hitachi Power Systems installed a 1,050 MW ultra-supercritical BTG unit in Japan operating at 25 MPa and 600°C, achieving optimized thermal efficiency and lower fuel consumption.

Expansion of Waste-to-Energy and Biomass Power Projects

Many cities face rising industrial and municipal waste volumes. Waste-to-energy plants convert refuse into steam and power using boiler turbine generator systems. Biomass plants also burn agricultural residues and wood pellets, creating low-carbon baseload electricity. Governments offer incentives for waste recovery, landfill reduction, and renewable heat production. Industries adopt captive biomass plants to offset fuel costs and meet sustainability goals. BTG systems handle varied fuel compositions and deliver continuous supply even in off-grid regions. These projects provide stable output compared with intermittent renewables. Emerging economies view biomass and waste-to-energy as solutions for rural electrification and clean city operations. As green targets tighten, these facilities create attractive investment pipelines for plant operators.

Key Trends & Opportunities

Shift Toward Gas-Based and Hybrid Power Plants

Gas-based BTG plants grow due to lower emissions and flexible ramp-up rates. Combined-cycle facilities raise overall efficiency by reusing exhaust heat to produce additional steam. This supports grids with high renewable penetration where balancing and fast startup are essential. Hybrid plants combine gas turbines, steam turbines, and renewables to deliver cost control and improved fuel diversity. Countries with new LNG terminals invest in gas-based utility plants to replace old coal units. Developers also expand district heating and cogeneration systems in industrial zones. These shifts open opportunities for advanced BTG solutions that support multi-fuel and thermal hybrid designs.

- For instance, Siemens commonly enters into long-term maintenance or service agreements (LTP/FlexLTP) for the turbines it supplies to various power plants globally.

Modernization and Digitalization of Old Power Assets

A large share of global BTG plants operate beyond their design life. Utilities replace boilers, upgrade turbines, and install digital control units to improve efficiency and environmental compliance. Predictive maintenance platforms cut unplanned downtime and extend operating life. Retrofitting offers lower capital cost than building a new plant, creating a strong aftermarket. Remote diagnostics, smart valves, improved sealing, and advanced feedwater systems save fuel and reduce heat losses. Governments also mandate emission reductions, which drives installation of advanced burners and heat recovery systems. This trend creates strong demand for service contracts, spare parts, and engineering upgrades.

- For instance, Bharat Heavy Electricals (BHEL) is extensively involved in the renovation and modernization (R&M) of various power plants, including 500 MW units, to improve efficiency and reliability.

Key Challenges

Strict Emission Regulations and Environmental Concerns

Boiler turbine generator systems, especially coal-fired plants, face strong scrutiny due to air pollution and greenhouse emissions. Many countries impose carbon taxes, stricter air quality limits, and renewable energy mandates. Utilities must install expensive pollution-control units and invest in cleaner fuels to remain compliant. These upgrades increase capital and operating costs for plant owners. Public opposition to coal plants and landfill-based waste projects also affects new approvals. Investors shift toward renewables and gas assets, slowing coal-based BTG deployment. Companies must innovate across combustion, heat recovery, and filtration technologies to meet regulatory expectations.

High Capital Investment and Long Payback Period

Building a utility-scale BTG plant requires heavy upfront investment in boilers, turbines, generators, control systems, and construction. Financing becomes difficult in markets with volatile fuel prices or uncertain policy frameworks. Long payback cycles increase risk for private developers. Small and medium industries prefer smaller turbines, cogeneration, or renewable alternatives to reduce cost exposure. Delays in project approvals and grid access also impact commercial viability. To stay competitive, BTG suppliers focus on modular designs, faster installation, and efficient maintenance models. However, capital constraints continue to limit growth in several regions.

Regional Analysis

Asia-Pacific

Asia-Pacific holds 42% share, making it the largest region in the Boiler Turbine Generator market. High electricity demand from manufacturing, urban growth, and data center expansion drives continuous BTG installation. China and India invest in supercritical and ultra-supercritical boilers to replace aging coal fleets and improve fuel efficiency. Countries also expand LNG-based combined-cycle projects and biomass facilities for cleaner baseload output. Rapid industrialization and grid expansion create sustained demand for large-capacity turbines and generators. Strong government support for waste-to-energy and emission-controlled plants keeps Asia-Pacific the key revenue hub for BTG manufacturers and service providers.

Europe

Europe accounts for 23% share, driven by modernization of aging thermal assets and strict energy-efficiency regulations. Utilities invest in gas-based combined-cycle plants with advanced steam turbines to replace coal units. Germany, the U.K., and Italy prioritize retrofits, digital monitoring platforms, and predictive maintenance to reduce heat loss and improve reliability. Biomass-fired BTG facilities support renewable heat and power targets. Service and maintenance contracts generate stable aftermarket revenue. Policy-driven decarbonization keeps Europe focused on high-efficiency boilers, emission-control equipment, and hybrid setups that balance cost, sustainability, and grid stability.

North America

North America holds 18% share, supported by large utility-scale projects and industrial cogeneration. The U.S. continues to retire coal plants and replace them with efficient gas-fired combined-cycle assets using advanced turbines. Canada expands waste-to-energy and biomass projects to support circular economy targets. Digital control platforms, smart valves, and turbine upgrades boost operational flexibility and reduce downtime. Many plants extend operational life through boiler refurbishment and emission-control systems. Strong service and maintenance activity ensures recurring revenue, while rising electricity consumption in industrial zones strengthens long-term BTG demand.

Latin America

Latin America captures 9% share, led by Brazil and Mexico. The region adopts gas-fired BTG projects to improve system efficiency and reduce dependence on older coal assets. Mining, cement, sugar mills, and petrochemical facilities invest in mid-capacity BTG units for reliable captive power. Governments encourage biomass and waste-to-energy systems, creating a niche market for modern boilers and generators. Urban expansion increases load requirements, pushing utilities to upgrade turbines and control systems. Despite slower capital spending compared to developed regions, demand for maintenance services and retrofitting solutions continues to rise.

Middle East & Africa

Middle East & Africa hold 8% share, driven by rapid industrialization, refinery expansion, and desalination power needs. Gulf countries install high-capacity BTG systems for district cooling, metals production, and chemical plants. Many African nations deploy coal and biomass units to support remote grids and reduce power shortages. LNG imports encourage gas-based BTG projects with flexible load handling. Aging facilities require boiler upgrades, turbine servicing, and emission-control solutions, strengthening aftermarket potential. Infrastructure expansion and energy security strategies support long-term BTG deployment across industrial and utility applications.

Market Segmentations:

By Generator Type

- Steam Turbines

- Gas Turbines

- Hydro Turbines

By Output Capacity

- Up to 50 MW

- 50 MW to 200 MW

- 200 MW to 500 MW

- Over 500 MW

By End-User

- Utilities

- Industrial

- Commercial

- Residential

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Boiler Turbine Generator market features a mix of global engineering firms, regional manufacturers, and specialized service providers. Major players such as Siemens AG, General Electric, Mitsubishi Hitachi Power Systems, and Dongfang Electric focus on large-capacity supercritical and ultra-supercritical BTG solutions with advanced steam cycle efficiency and low-emission technologies. Companies enhance turbine blade design, boiler pressure performance, and boiler-feed systems to improve heat rate and reduce fuel costs. Aftermarket services, including digital monitoring, predictive maintenance, and component retrofitting, create recurring revenue opportunities. Regional leaders like Bharat Heavy Electrical Limited and Thermax supply solutions for coal, gas, and biomass-based utility and industrial facilities. Strategic partnerships, long-term EPC contracts, and government-supported power projects strengthen competitive positioning. Investments in combined-cycle plants, waste-to-energy facilities, and cogeneration units continue to widen the addressable market, pushing vendors to innovate across multi-fuel capability, automation, and flexible power generation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thermax (India)

- Dongfang Electric Corporation (China)

- Siemens AG (Germany)

- General Electric (U.S.)

- John Wood Group (U.K.)

- Mitsubishi Hitachi Power Systems (Japan)

- Bharat Heavy Electrical Limited (India)

- Babcock & Wilcox Enterprise (U.S.)

- IHI Corporation (Japan)

- Doosan Heavy Industries & Construction (South Korea)

Recent Developments

- In November 2025, Dongfang Electric Corporation (China). The 26-MW offshore wind turbine entered operation on Oct 29. It is billed as the world’s largest single-unit turbine.

- In February 2025, Siemens AG (Germany). Siemens Energy agreed to supply steam turbines and generators for Rolls-Royce SMR. The deal covers the SMR conventional island equipment.

Report Coverage

The research report offers an in-depth analysis based on Generator Type, Output Capacity, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as utilities add high-efficiency thermal units to support baseload power.

- More plants will install supercritical and ultra-supercritical boilers to cut fuel consumption.

- Gas-based combined-cycle facilities will expand as countries shift toward cleaner thermal power.

- Digital monitoring and predictive maintenance will reduce downtime and extend equipment life.

- Biomass and waste-to-energy BTG projects will increase in cities and industrial zones.

- Turbine upgrades will replace older units to improve heat rate and output reliability.

- Hybrid plants combining BTG with solar or wind will support flexible grid operations.

- Service contracts and aftermarket components will create recurring revenue for suppliers.

- Emission-control systems will gain adoption as regulations tighten on coal-fired plants.

- Modular BTG designs will help industries and regional utilities install faster and at lower cost.