Market Overview

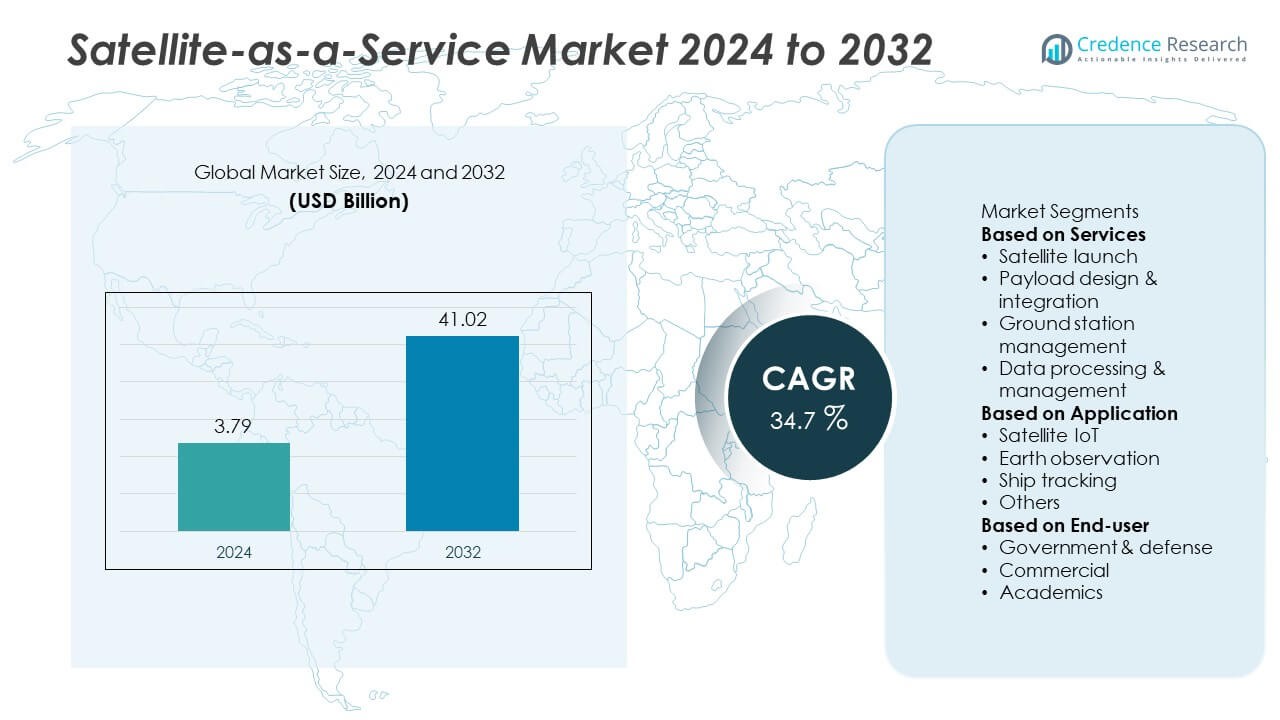

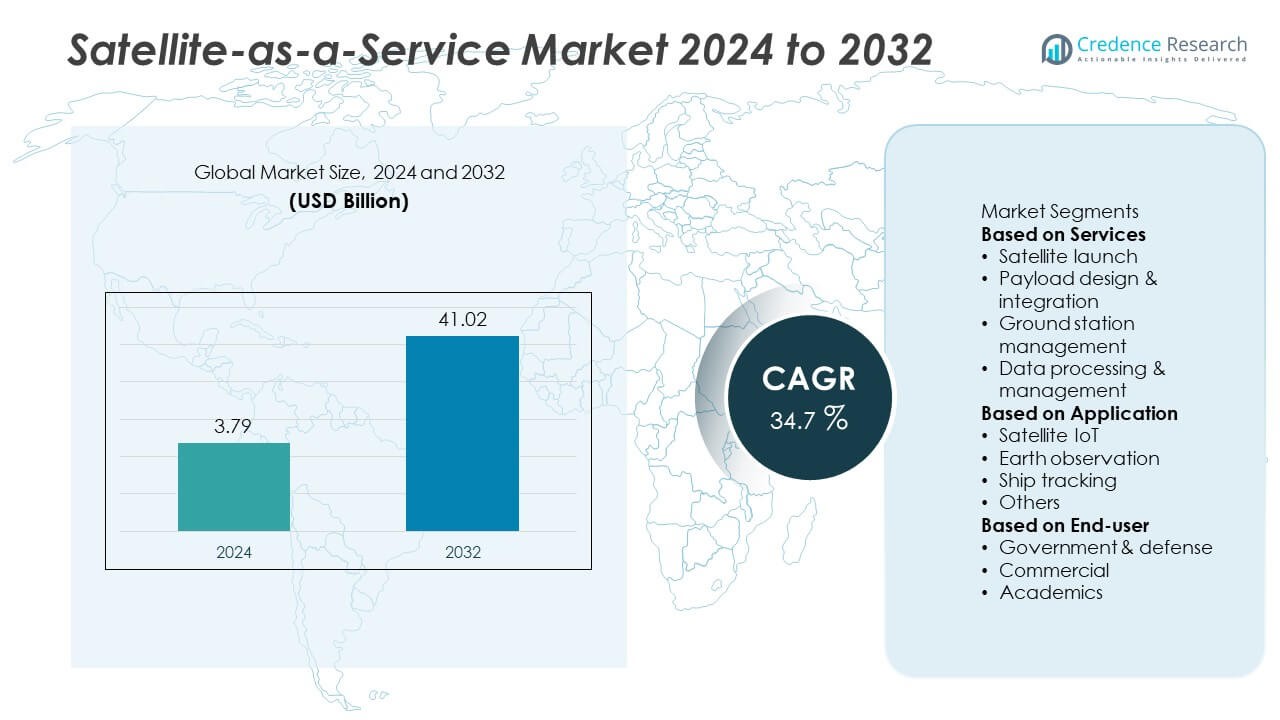

The Satellite-as-a-Service market was valued at USD 3.79 billion in 2024 and is projected to reach USD 41.02 billion by 2032, expanding at a CAGR of 34.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Satellite-as-a-Service Market Size 2024 |

USD 3.79 Billion |

| Satellite-as-a-Service Market, CAGR |

34.7% |

| Satellite-as-a-Service Market Size 2032 |

USD 41.02 Billion |

The Satellite-as-a-Service market is led by major players including SpaceX, Planet Labs PBC, Amazon Web Services (AWS), Airbus Defence and Space, Arianespace, Northrop Grumman Corporation, Lockheed Martin Corporation, Thales Alenia Space, Maxar Technologies, and SES S.A. These companies drive market growth through advanced satellite networks, data processing services, and cloud-integrated analytics. North America dominates the global market with a 37.9% share in 2024, supported by strong technological infrastructure and high investment in defense and communication satellites. Europe follows with a 28.6% share, led by active space programs and partnerships under the European Space Agency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Satellite-as-a-Service market was valued at USD 3.79 billion in 2024 and is projected to reach USD 41.02 billion by 2032, growing at a CAGR of 34.7%.

- Market growth is driven by rising demand for real-time Earth observation data, AI-based analytics, and cloud-enabled satellite operations across government, defense, and commercial sectors.

- Key trends include the expansion of small satellite constellations, adoption of Satellite IoT applications, and increasing data monetization through subscription and pay-per-use models.

- Leading players such as SpaceX, Planet Labs, Airbus Defence and Space, AWS, and Maxar Technologies dominate the competitive landscape with integrated data and launch service offerings.

- Regionally, North America holds 37.9% share, followed by Europe with 28.6%, while the data processing and management segment leads the market with 42.3% share due to growing demand for analytics-driven satellite data services.

Market Segmentation Analysis:

By Services

The data processing and management segment dominated the Satellite-as-a-Service market in 2024, holding around 42.3% share. Its leadership stems from the growing demand for high-resolution data analytics for weather forecasting, disaster monitoring, and precision agriculture. Organizations increasingly rely on satellite-derived insights for real-time decision-making and predictive modeling. Advancements in cloud-based platforms and AI-driven image analysis further enhance data utility. Meanwhile, satellite launch and ground station management services are expanding rapidly as small satellite constellations and private space missions increase, boosting service outsourcing among commercial operators.

- For instance, Planet Labs PBC’ Tanager-1 hyperspectral satellite captures approximately 424 spectral bands at 30 m spatial resolution across the 400-2500 nm range, enabling finer classification of vegetation and emissions datasets.

By Application

The earth observation segment accounted for the largest share of approximately 47.8% in 2024. Its growth is driven by increasing use in environmental monitoring, land mapping, and urban planning. Governments and private firms leverage satellite imagery for resource tracking and disaster response. Rising investments in geospatial intelligence and climate monitoring further strengthen this segment. Satellite IoT applications are also gaining traction, enabling remote monitoring of assets across logistics, agriculture, and oil & gas industries, but earth observation continues to lead due to its diverse and mission-critical applications.

- For instance, Airbus Defence and Space operates the Pléiades Neo constellation, delivering optical imagery with 30-centimeter resolution and capable of covering up to 500,000 square kilometers per day, supporting precision mapping and rapid disaster assessment.

By End-user

The government and defense segment led the Satellite-as-a-Service market in 2024 with a 51.6% share. Defense agencies increasingly depend on satellite-based intelligence, surveillance, and communication systems for security and border management. Growing global emphasis on national defense modernization and space situational awareness drives steady adoption. The commercial segment is also expanding, supported by demand from telecom, energy, and maritime sectors for reliable connectivity and asset monitoring. However, government and defense remain the dominant end-user due to higher investment capacity and the need for secure satellite communication infrastructure.

Key Growth Drivers

Rising Demand for Real-Time Earth Observation Data

The growing reliance on real-time Earth observation data is a major driver of the Satellite-as-a-Service market. Industries such as agriculture, defense, and environmental monitoring increasingly use satellite data for predictive insights and operational efficiency. Governments also depend on satellite imagery for disaster response, climate tracking, and urban planning. The expansion of small satellite constellations enhances revisit rates and data accuracy. This surge in continuous monitoring needs supports rapid adoption of subscription-based satellite data services across both public and private sectors.

- For instance, ICEYE operates a constellation of over 50 synthetic aperture radar (SAR) satellites capable of capturing imagery with a 1-meter resolution, with next-generation satellites offering up to 16 cm resolution, and providing revisit times measured in hours for continuous monitoring through cloud cover and darkness.

Expansion of Commercial Space Operations

The commercialization of space operations significantly boosts market growth. Private companies are launching small satellites and constellations for communication, imaging, and navigation services. This shift reduces dependency on government-owned satellites and enables cost-efficient access to space-based solutions. Growing collaborations between satellite operators and data analytics firms expand service offerings, including analytics-as-a-service and integrated mission management. Increased private investment and the entry of start-ups are further driving innovation in launch services, payload design, and on-demand satellite capabilities.

- For instance, SpaceX’s Falcon 9 has completed over 550 successful orbital launches, deploying more than 10,000 Starlink satellites that collectively provide low-latency internet connectivity with speeds often exceeding 150 megabits per second across over 130 countries and territories.

Integration of AI and Cloud Technologies

The integration of artificial intelligence and cloud computing is transforming Satellite-as-a-Service operations. AI algorithms enhance image recognition, predictive analysis, and automated mission control. Cloud platforms allow seamless storage, processing, and distribution of satellite data to end-users globally. This combination reduces latency and operational cost while improving data accuracy. Growing adoption of cloud-based satellite management systems by commercial and defense sectors accelerates innovation and efficiency. The convergence of AI and cloud capabilities is thus a critical enabler of the market’s scalability and accessibility.

Key Trends & Opportunities

Growing Adoption of Satellite IoT Applications

Satellite IoT is emerging as a key trend, offering global connectivity for industries with limited terrestrial networks. Sectors such as logistics, agriculture, and energy use satellite IoT for real-time tracking and remote asset monitoring. Advancements in low Earth orbit (LEO) satellites enhance coverage and data transmission speed. Integration with 5G networks and edge computing improves data responsiveness. This trend creates new opportunities for service providers to deliver customized connectivity solutions and expand their reach into rural and maritime regions.

- For instance, Orbcomm operates a global network of low Earth orbit satellites supporting IoT connectivity for over a million assets worldwide, enabling cargo monitoring and fleet tracking across more than 160 countries, with average AIS data refresh rates as short as one minute.

Expansion of Data Monetization Models

The market is witnessing growing opportunities through data monetization. Companies are commercializing satellite imagery and analytics by offering subscription-based or pay-per-use models. This approach reduces capital barriers for small and medium enterprises seeking satellite insights. The availability of open data platforms and partnerships between data analytics and satellite operators enhances accessibility. As organizations increasingly seek decision-ready insights rather than raw data, service providers that offer end-to-end analytics stand to capture greater value and recurring revenue streams.

- For instance, Spire Global generates a high volume of satellite-derived weather and aviation data daily from a fleet of more than 100 nanosatellites, monetizing analytics through its subscription-based enterprise clients worldwide.

Key Challenges

High Deployment and Maintenance Costs

Despite technological progress, high deployment and maintenance costs remain a key challenge. Launching and maintaining satellites require significant capital investment and technical expertise. Small operators struggle to compete with established players offering end-to-end services. Costs related to launch logistics, orbital positioning, and ground infrastructure further limit new market entrants. Though reusable launch vehicles reduce expenses, financial constraints still hinder broader adoption, especially among developing economies.

Regulatory and Spectrum Management Issues

Complex regulatory frameworks and spectrum management pose ongoing challenges for market participants. Satellite operators must comply with international licensing, orbital slot allocation, and frequency coordination rules. Delays in approvals or cross-border disputes can affect deployment timelines. Data privacy and cybersecurity regulations also add layers of compliance. As satellite networks expand, managing interference and ensuring secure communication become increasingly critical. Harmonized global standards are essential to support the market’s sustainable growth and operational efficiency.

Regional Analysis

North America

North America held the largest share of 37.9% in the Satellite-as-a-Service market in 2024. The region’s dominance is supported by strong government and private investments in space technologies. Companies such as SpaceX, Amazon, and Planet Labs lead advancements in satellite communication, imaging, and data analytics. The U.S. defense sector remains a major user of satellite services for intelligence and surveillance. Rapid adoption of AI-enabled data analytics and cloud-based platforms also supports market expansion. Canada contributes with growing demand for Earth observation data in environmental monitoring and resource management.

Europe

Europe accounted for 28.6% share of the global Satellite-as-a-Service market in 2024. Growth is driven by the presence of key space agencies and private operators like Airbus Defence & Space and Arianespace. The region focuses on Earth observation, navigation, and communication services through programs such as Copernicus and Galileo. Increasing collaborations between European Space Agency (ESA) and private firms enhance service innovation. Rising adoption of small satellite constellations for agricultural monitoring and climate research further boosts demand. Sustainable satellite operations and data-sharing frameworks strengthen Europe’s leadership in advanced satellite ecosystems.

Asia Pacific

Asia Pacific captured 24.1% share of the Satellite-as-a-Service market in 2024. The region’s growth is propelled by expanding space programs in China, India, and Japan. China’s growing constellation launches and India’s cost-effective missions by ISRO enhance regional competitiveness. Rapid digitalization across sectors like agriculture, defense, and telecom fuels demand for satellite-based data and connectivity. Japan’s focus on disaster management and maritime surveillance also drives adoption. Start-ups in South Korea and Australia are emerging as new players offering analytics and satellite IoT solutions, strengthening regional technological capabilities.

Latin America

Latin America represented 5.4% share of the Satellite-as-a-Service market in 2024. Countries such as Brazil, Mexico, and Argentina are expanding their use of satellite data for environmental and agricultural monitoring. Governments increasingly invest in Earth observation programs to manage deforestation, water resources, and natural disasters. Growing collaborations with U.S. and European operators are improving access to satellite-based analytics. Rising telecom and maritime connectivity needs are further supporting market growth. However, limited infrastructure and funding challenges restrict large-scale adoption compared to developed regions.

Middle East & Africa

The Middle East & Africa accounted for 4% share in the Satellite-as-a-Service market in 2024. The region’s growth is supported by increasing investment in communication and defense satellites. The UAE and Saudi Arabia are leading initiatives to develop indigenous satellite capabilities. Africa’s demand centers around connectivity, weather forecasting, and agricultural monitoring. Partnerships with international operators provide technical expertise and data access. Expansion of smart city and oilfield monitoring projects in the Gulf region also contributes to adoption. However, limited local manufacturing capacity remains a barrier to faster market expansion.

Market Segmentations:

By Services

- Satellite launch

- Payload design & integration

- Ground station management

- Data processing & management

By Application

- Satellite IoT

- Earth observation

- Ship tracking

- Others

By End-user

- Government & defense

- Commercial

- Academics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Satellite-as-a-Service market features leading players such as SpaceX, Planet Labs PBC, Amazon Web Services (AWS), Airbus Defence and Space, Arianespace, Northrop Grumman Corporation, Lockheed Martin Corporation, Thales Alenia Space, Maxar Technologies, and SES S.A. These companies dominate through advanced satellite constellations, cloud-based data services, and integrated analytics solutions. They focus on expanding service portfolios across Earth observation, communication, and IoT applications. Strategic partnerships and mergers are driving technology integration and global reach. For instance, collaborations between satellite operators and cloud providers enhance real-time data delivery and analytics efficiency. Market leaders are also investing in reusable launch technologies and small satellite deployments to reduce operational costs and accelerate turnaround time. Intense competition encourages continuous innovation in AI-based data processing, spectrum management, and on-demand satellite services, strengthening the market’s evolution toward scalable, subscription-driven business models.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SpaceX

- Planet Labs PBC

- Amazon Web Services (AWS)

- Airbus Defence and Space

- Arianespace

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Thales Alenia Space

- Maxar Technologies

- SES S.A.

Recent Developments

- In July 2025, Amazon Web Services (AWS) announced an expansion of its Ground Station as a Service Partner Program undertaken with Kongsberg Satellite Services (KSAT), integrating KSAT’s 40+ ground-station network and 200+ multi-mission antennas into AWS’s cloud footprint.

- In September 2024, Planet Labs PBC released the first light images from its “Tanager-1” hyperspectral satellite, capturing over 420 spectral bands from an altitude of 522 km, demonstrating its shift toward data-as-a-service offerings.

- In April 2024, SES S.A. announced that its O3b mPOWER medium Earth orbit satellite system was operational with six satellites in place, accelerating rollout of its satellite-service network.

Report Coverage

The research report offers an in-depth analysis based on Services, Application, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly due to rising demand for real-time satellite data services.

- AI and cloud integration will enhance data accuracy and processing efficiency.

- Small satellite constellations will drive cost reduction and faster data delivery.

- Government and defense sectors will continue dominating service adoption.

- Commercial demand for Earth observation and IoT connectivity will increase steadily.

- Strategic partnerships between satellite operators and analytics firms will strengthen global coverage.

- Reusable launch technologies will lower operational costs and increase mission frequency.

- Data-as-a-Service and subscription-based models will become the primary revenue streams.

- Asia Pacific will emerge as a high-growth region with rising space investments.

- Enhanced regulatory collaboration will improve global coordination and spectrum management.