Market Overview:

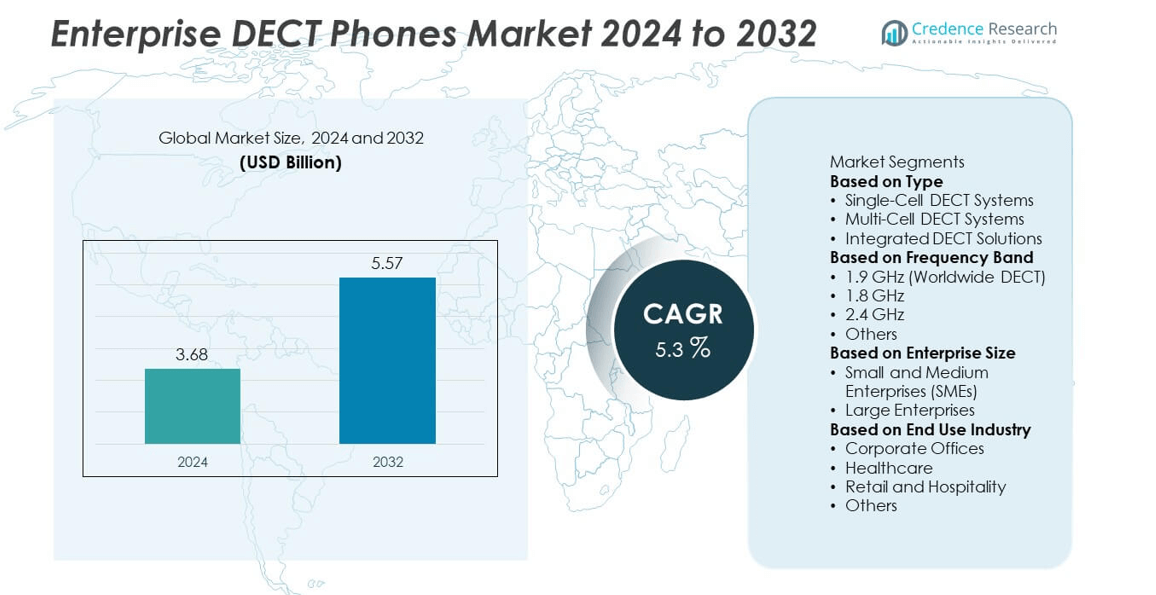

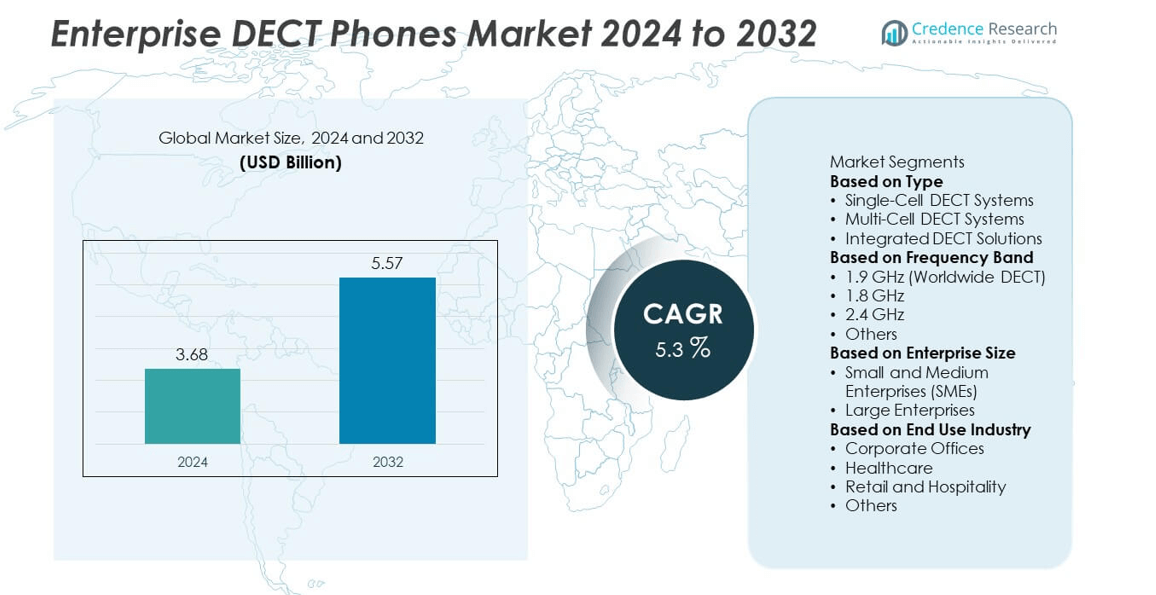

The Enterprise DECT Phones market was valued at USD 3.68 billion in 2024 and is projected to reach USD 5.57 billion by 2032, growing at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Enterprise DECT Phones Market Size 2024 |

USD 3.68 billion |

| Enterprise DECT Phones Market, CAGR |

5.3% |

| Enterprise DECT Phones Market Size 2032 |

USD 5.57 billion |

The Enterprise DECT Phones market is led by key players such as Cisco Systems, Inc., Avaya LLC, Ascom Holding AG, Spectralink Corporation, Gigaset Communications GmbH, Panasonic Holdings Corporation, Yealink Network Technology Co., Ltd., Unify (Atos SE), RTX Telecom A/S, and Mitel Networks Corporation. These companies dominate through advanced IP-DECT solutions, multi-cell connectivity, and seamless integration with unified communication systems. North America led the market in 2024 with a 38.5% share, driven by rapid enterprise digitalization and strong adoption across healthcare and manufacturing sectors. Europe followed with a 32.1% share, supported by sustainability initiatives, industrial automation, and the growing deployment of DECT-over-SIP communication systems.

Market Insights

- The Enterprise DECT Phones market was valued at USD 3.68 billion in 2024 and is projected to reach USD 5.57 billion by 2032, growing at a CAGR of 5.3%.

- Market growth is driven by increasing enterprise mobility needs, demand for secure wireless communication, and adoption of IP-DECT systems integrated with unified communication platforms.

- Key trends include the transition to cloud-connected DECT solutions, AI-based call management, and energy-efficient eco-DECT technologies enhancing sustainability.

- Major players such as Cisco, Avaya, Ascom, Spectralink, and Panasonic focus on innovation, product durability, and strategic partnerships to strengthen market positioning.

- Regionally, North America leads with 38.5% share, followed by Europe at 32.1%, while the multi-cell DECT systems segment holds 46.2% share, supported by growing use in healthcare, manufacturing, and corporate environments for reliable long-range communication.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The multi-cell DECT systems segment dominated the Enterprise DECT Phones market in 2024, holding a 46.2% share. Its dominance is driven by growing demand from large enterprises and healthcare facilities that require wide coverage and seamless handover across multiple access points. Multi-cell systems enable uninterrupted communication within large buildings and multi-floor environments, improving mobility and operational efficiency. Increasing adoption in logistics, manufacturing, and corporate offices further supports market growth. In contrast, single-cell DECT systems remain popular among small offices for their cost-effectiveness and easy installation.

- For instance, Ascom Holding AG deployed over 9,000 multi-cell DECT units across the Karolinska University Hospital in Sweden, covering an area of 320,000 square meters. The deployment ensured uninterrupted internal communication between 15 medical departments, improving staff response times by an average of 18 seconds per call.

By Frequency Band

The 1.9 GHz (Worldwide DECT) segment led the market in 2024 with a 52.7% share, owing to its widespread regulatory approval and superior interference-free performance. This frequency band offers reliable and secure communication across diverse enterprise environments. The 1.9 GHz spectrum’s dedicated channel allocation ensures consistent audio quality, making it a preferred choice in corporate and healthcare sectors. Its compatibility with global DECT standards and low power consumption further enhance adoption. Other frequency bands, including 1.8 GHz and 2.4 GHz, serve regional applications and niche use cases where regulatory variations exist.

- For instance, Gigaset Communications GmbH introduced the N870 IP PRO DECT system, optimized for the 1.9 GHz band, supporting up to 250 handsets and 60 simultaneous calls within a single installation. The system utilizes dynamic channel allocation technology that reduces interference by 20 dBm and enhances voice clarity in high-density office environments.

By Enterprise Size

The large enterprises segment accounted for the largest 57.8% share of the Enterprise DECT Phones market in 2024. This dominance is attributed to the extensive communication infrastructure requirements of multinational corporations, hospitals, and manufacturing plants. Large enterprises prioritize DECT systems for their scalability, reliability, and ability to integrate with unified communication platforms. Continuous operations and high call volumes make DECT systems vital for internal coordination and workforce mobility. Meanwhile, small and medium enterprises (SMEs) are increasingly adopting compact DECT solutions for cost-efficient and secure communication in office and retail environments.

Key Growth Drivers

Rising Demand for Reliable Wireless Communication in Enterprises

The increasing need for uninterrupted and secure voice communication is a major driver for the Enterprise DECT Phones market. Businesses rely on DECT systems for their superior call quality, long range, and immunity to Wi-Fi interference. With growing workplace mobility and hybrid work models, DECT phones ensure dependable voice connectivity in warehouses, hospitals, and offices. Their dedicated spectrum and enhanced security make them preferred over traditional VoIP or Wi-Fi phones, particularly in mission-critical and industrial environments.

- For instance, Spectralink Corporation deployed over 200 enterprise-grade DECT handsets at a major healthcare system like Dignity Health, with such devices offering enterprise-class security, reliable voice quality, and seamless handover capabilities to enable uninterrupted voice communication during patient care operations.

Expansion of Unified Communication and Collaboration Platforms

The integration of DECT systems with unified communication (UC) platforms is significantly fueling market growth. Enterprises are adopting DECT solutions compatible with IP-PBX, SIP, and cloud-based communication systems to streamline voice and data operations. This convergence supports seamless collaboration between on-site and remote employees. Leading manufacturers are developing IP-DECT solutions that align with digital workplace transformation. The trend enhances operational efficiency, allowing organizations to achieve higher productivity while maintaining flexibility across distributed workforces.

- For instance, Cisco Systems, Inc. integrated its DECT 6823 and 6853 handsets with the Webex Calling platform, and in a multi-cell environment using the DBS-210 base stations, the system supports up to 1000 SIP registrations and 2000 concurrent calls across up to 254 base stations.

Growth of Healthcare and Manufacturing Sectors

Rising adoption of DECT phones in healthcare and manufacturing industries drives market expansion. Hospitals use DECT systems for nurse-patient communication and emergency coordination due to their reliability and low latency. Similarly, manufacturing plants deploy rugged DECT handsets to support communication in noisy or hazardous environments. The combination of mobility, durability, and stable connectivity supports operational safety and efficiency. Increasing automation and the need for real-time voice communication in industrial settings further amplify demand for enterprise-grade DECT systems globally.

Key Trends & Opportunities

Shift Toward IP-DECT and Cloud-Enabled Solutions

The transition from traditional analog systems to IP-DECT and cloud-based solutions is a key trend shaping the market. Enterprises are deploying IP-enabled DECT phones integrated with VoIP infrastructure to enhance flexibility and reduce operational costs. Cloud connectivity enables centralized management and scalability, ideal for multi-site organizations. This shift also allows integration with collaboration tools and CRM systems, improving workflow efficiency. The trend aligns with digital transformation initiatives and the growing preference for Software-as-a-Service (SaaS) models in enterprise communications.

- For instance, Avaya LLC offers the Avaya G450 Media Gateway for medium to large branch locations, a modular chassis that works in conjunction with an Avaya S8300 Server or external Avaya Aura® Communication Manager servers.

Rising Focus on Energy Efficiency and Sustainability

Manufacturers are increasingly designing energy-efficient DECT phones to align with corporate sustainability goals. Low-power standby modes, smart charging technologies, and eco-DECT features reduce power consumption and extend battery life. These innovations help enterprises minimize operational costs and environmental impact. As sustainability becomes a key purchasing criterion for large organizations, vendors emphasizing green technologies gain a competitive edge. The trend also reflects the broader push toward sustainable communication infrastructure in corporate environments.

- For instance, Panasonic Holdings Corporation offers the KX-TGP700 DECT phone series featuring an Eco Mode that reduces the base unit’s transmission power when the handset is close by, which helps extend battery life and reduce energy usage.

Key Challenges

Competition from VoIP and Mobile Communication Systems

The growing adoption of VoIP-based softphones and mobile communication apps poses a challenge to the Enterprise DECT Phones market. Smartphones with integrated collaboration tools offer mobility and flexibility at lower costs. However, DECT systems maintain an edge in terms of reliability and dedicated bandwidth. To stay competitive, DECT manufacturers are focusing on hybrid solutions that combine DECT’s stability with IP communication features. Balancing cost-efficiency with advanced functionality remains a key challenge for market participants.

High Installation and Maintenance Costs

The deployment of enterprise-grade multi-cell DECT systems involves substantial installation and maintenance costs. Large-scale facilities require multiple base stations, repeaters, and network integration, which can increase upfront investment. Regular firmware updates and compatibility management with evolving IP platforms further add to operational expenses. This cost factor can deter small and medium-sized enterprises from adopting advanced DECT systems. Manufacturers are addressing this issue by introducing modular and scalable solutions that minimize installation complexity and reduce total cost of ownership.

Regional Analysis

North America

North America held the largest share of 38.5% in the Enterprise DECT Phones market in 2024. The region’s growth is driven by high adoption of advanced communication systems in corporate, healthcare, and manufacturing sectors. U.S. enterprises prioritize secure and interference-free voice solutions, boosting the demand for IP-DECT and multi-cell systems. The presence of key vendors such as Cisco, Spectralink, and Avaya strengthens regional competitiveness. Increasing hybrid work culture and enterprise digitalization further fuel demand for reliable cordless communication systems with cloud and unified communication integration.

Europe

Europe accounted for 32.1% share of the Enterprise DECT Phones market in 2024, driven by widespread use across healthcare, retail, and industrial facilities. Countries such as Germany, the U.K., and France lead adoption due to well-established communication infrastructure and strict workplace efficiency standards. The growing transition toward IP-DECT systems and DECT over SIP networks enhances connectivity in large organizations. European enterprises favor energy-efficient and eco-DECT solutions aligned with sustainability goals. Expansion of smart manufacturing and healthcare digitization projects continues to support steady market growth across the region.

Asia Pacific

Asia Pacific captured 21.7% share of the Enterprise DECT Phones market in 2024. The region’s rapid industrialization, expanding enterprise sector, and rising awareness of communication efficiency are fueling demand. Countries like China, Japan, and India are experiencing strong growth in manufacturing, logistics, and education sectors where DECT phones enhance mobility and coordination. The shift toward IP-based systems and affordable multi-cell deployments supports market expansion. Increasing investment in smart buildings and corporate digital infrastructure further drives the adoption of enterprise-grade DECT communication technologies across the region.

Latin America

Latin America represented 4.6% share of the Enterprise DECT Phones market in 2024. Growth is supported by expanding retail, hospitality, and small business sectors in Brazil, Mexico, and Chile. Enterprises are increasingly adopting cost-effective DECT systems to replace analog cordless phones, improving internal communication reliability. The introduction of multi-cell solutions tailored for mid-sized enterprises and healthcare facilities is enhancing market penetration. However, limited IT infrastructure and higher deployment costs continue to restrain widespread adoption, though gradual digitization efforts promise steady long-term growth.

Middle East & Africa

The Middle East & Africa accounted for 3.1% share of the Enterprise DECT Phones market in 2024. The region’s demand is primarily driven by growing enterprise communication needs across the UAE, Saudi Arabia, and South Africa. Increasing investment in commercial infrastructure and smart city projects accelerates adoption of IP-DECT systems. The healthcare and hospitality sectors are emerging as key end users, seeking reliable voice coverage and mobility. While limited awareness and high installation costs hinder faster penetration, expanding cloud connectivity and regional enterprise modernization initiatives are expected to create new growth opportunities.

Market Segmentations:

By Type

- Single-Cell DECT Systems

- Multi-Cell DECT Systems

- Integrated DECT Solutions

By Frequency Band

- 1.9 GHz (Worldwide DECT)

- 1.8 GHz

- 2.4 GHz

- Others

By Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By End Use Industry

- Corporate Offices

- Healthcare

- Retail and Hospitality

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Enterprise DECT Phones market includes major players such as Cisco Systems, Inc., Avaya LLC, Ascom Holding AG, Spectralink Corporation, Gigaset Communications GmbH, Panasonic Holdings Corporation, Yealink Network Technology Co., Ltd., Unify (Atos SE), RTX Telecom A/S, and Mitel Networks Corporation. These companies compete through innovation in IP-DECT systems, multi-cell connectivity, and cloud integration to enhance enterprise mobility and communication efficiency. Leading vendors focus on developing scalable and secure DECT solutions compatible with unified communication platforms. Strategic partnerships with telecom providers and enterprise software companies strengthen their market reach. Investments in product durability, long-range communication, and eco-DECT technologies help address industrial and healthcare demands. Continuous advancements in voice quality, network stability, and energy efficiency remain central to sustaining competitiveness in this evolving communication landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cisco Systems, Inc.

- Avaya LLC

- Ascom Holding AG

- Spectralink Corporation

- Gigaset Communications GmbH

- Panasonic Holdings Corporation

- Yealink Network Technology Co., Ltd.

- Unify (Atos SE)

- RTX Telecom A/S

- Mitel Networks Corporation

Recent Developments

- In March 2025, Spectralink Corporation expanded its APAC distribution footprint via a strategic partnership with InTechnology Distribution, positioning its enterprise DECT portfolio for regional growth.

- In December 2024, Yealink Network Technology Co., Ltd. announced forthcoming next-gen AI-empowered workspace solutions, which include updates to its DECT handset portfolio for enterprise use.

- In October 2023, Mitel Networks Corporation completed its acquisition of Unify (Atos SE), thereby combining their enterprise UC and DECT offerings to serve over 75 million users in more than 100 countries.

- In September 2023, Spectralink launched its new S Series DECT handsets (three models) designed to integrate with Cisco, Microsoft Teams, RingCentral and Zoom platforms, enhancing enterprise DECT mobility options

Report Coverage

The research report offers an in-depth analysis based on Type, Frequency Band, Enterprise Size, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with increasing enterprise demand for reliable wireless communication.

- Integration of DECT systems with unified communication platforms will enhance productivity and collaboration.

- IP-DECT and cloud-based solutions will dominate future enterprise deployments.

- Healthcare, manufacturing, and logistics sectors will remain key adopters of multi-cell DECT systems.

- Advancements in encryption and network security will improve system reliability and data protection.

- Eco-DECT and energy-efficient technologies will gain traction amid sustainability initiatives.

- North America and Europe will continue leading due to strong technological adoption and infrastructure.

- Asia Pacific will emerge as a high-growth region driven by expanding enterprise networks.

- Partnerships between telecom providers and DECT manufacturers will support hybrid communication ecosystems.

- Ongoing R&D in voice clarity, battery performance, and scalability will define the market’s next phase.