Market Overview

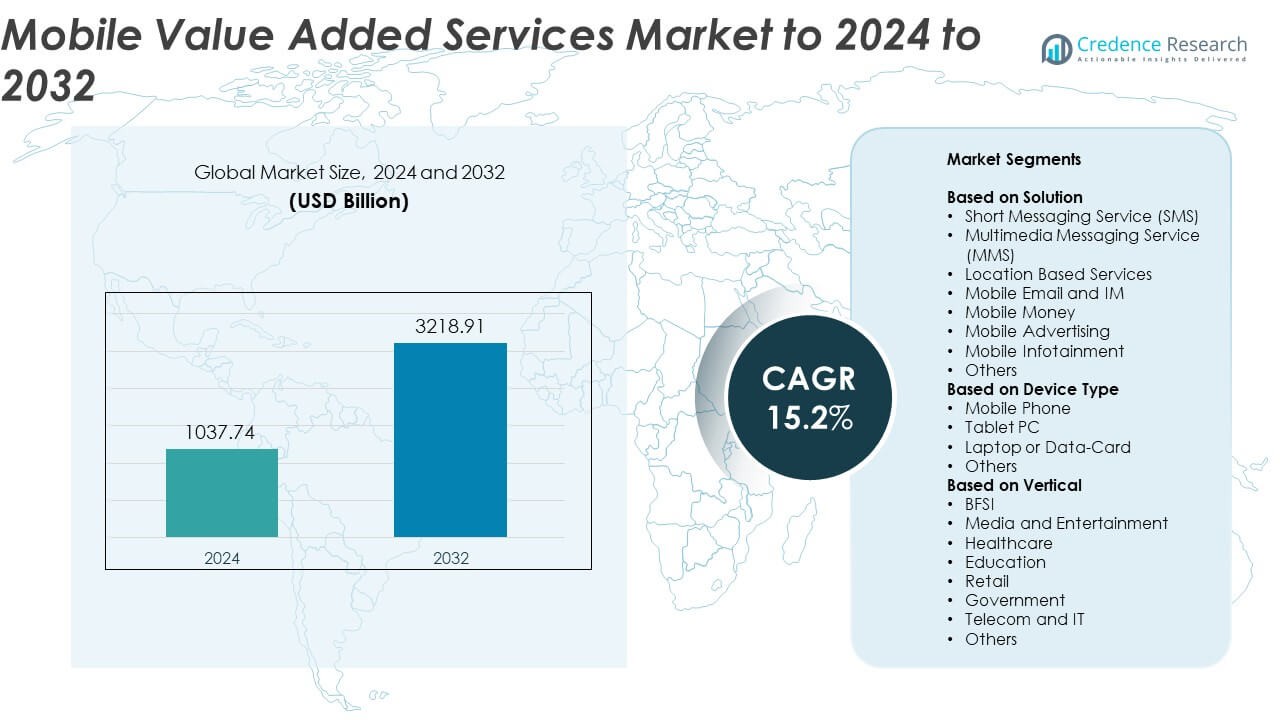

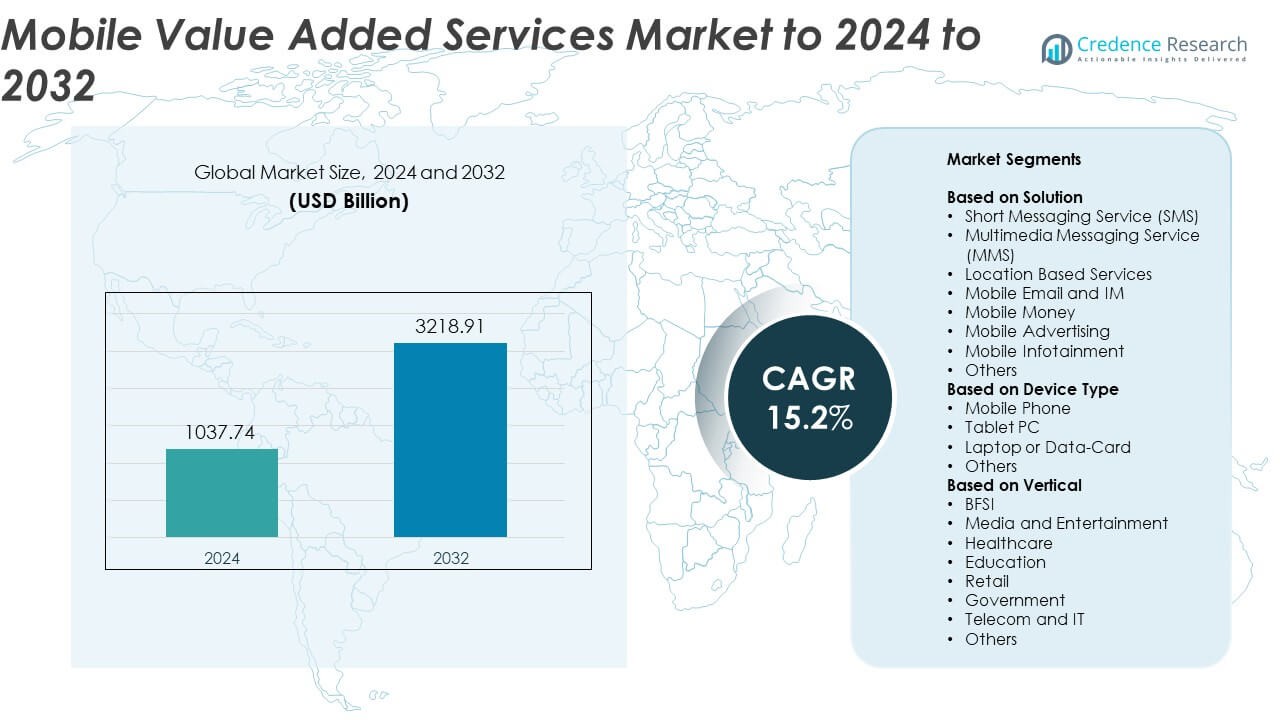

Mobile Value Added Services Market size was valued at USD 1037.74 billion in 2024 and is anticipated to reach USD 3218.91 billion by 2032, at a CAGR of 15.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mobile Value Added Services Market Size 2024 |

USD 1037.74 Billion |

| Mobile Value Added Services Market, CAGR |

15.2% |

| Mobile Value Added Services Market Size 2032 |

USD 3218.91 Billion |

The mobile value added services market is dominated by prominent players including Vodafone Group Plc, Apple Inc., Baidu Inc., Mahindra Comviva, Google LLC, Gemalto, InMobi, Amazon.com Inc., Mobily, One97 Communications Ltd., Alphabet Inc., AT&T, Gaana.com, OnMobile, Comverse Technology Inc., and Kongzhong Corp. These companies maintain strong positions through diversified digital offerings, extensive telecom partnerships, and advanced technology integration. North America leads the global market with a 37.2% share in 2024, supported by high smartphone penetration and early 5G adoption. Europe follows with 28.6%, driven by mobile payment and content services, while Asia Pacific holds 24.7% due to rapid digital expansion and rising mobile entertainment demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The mobile value added services market was valued at USD 1037.74 billion in 2024 and is projected to reach USD 3218.91 billion by 2032, growing at a CAGR of 15.2% during the forecast period.

- Rising smartphone penetration, expanding 5G connectivity, and increasing demand for mobile payments and infotainment services are key growth drivers of the market.

- Emerging trends include AI-powered personalization, IoT integration, and cloud-based mobile solutions enhancing user engagement and service efficiency.

- The market is highly competitive with major players investing in digital innovation, content diversification, and strategic collaborations to strengthen their global footprint.

- North America leads with a 37.2% share, followed by Europe at 28.6% and Asia Pacific at 24.7%, while the mobile money segment dominates by solution, holding 26.3% share due to the growing shift toward cashless transactions.

Market Segmentation Analysis:

By Solution

The mobile money segment dominates the mobile value added services market, accounting for around 26.3% share in 2024. Its leadership is driven by the growing adoption of digital payments, mobile wallets, and peer-to-peer transfers across emerging economies. Increasing smartphone penetration and government initiatives promoting cashless transactions further support this growth. Mobile money services enhance financial inclusion and provide secure, real-time transactions. Other key solutions such as mobile advertising and infotainment are also expanding rapidly, supported by targeted marketing campaigns, 5G deployment, and rising demand for streaming and gaming content.

- For instance, Safaricom reported 34.64 million one-month active M-Pesa customers in Kenya for the financial year 2024 (ending March 2024), an increase from the 32.41 million reported for FY2023.

By Device Type

Mobile phones lead the market, capturing nearly 68.5% share in 2024, owing to their extensive global usage and affordability. The proliferation of high-speed internet and 5G networks has strengthened mobile-based service delivery. Smartphones enable a seamless ecosystem for mobile payments, messaging, and content consumption. Tablets and laptops follow as secondary contributors, used mainly for business and educational applications. The rise of low-cost Android devices and enhanced app ecosystems across developing markets continue to drive strong adoption of mobile value added services through handheld devices.

- For instance, Samsung shipped 58 million smartphones in Q2 2025, leading quarterly volumes.

By Vertical

The media and entertainment sector holds the largest share, about 31.8% in 2024, driven by surging demand for digital content and mobile streaming platforms. The expansion of video-on-demand, gaming, and music services has increased reliance on mobile value added platforms. Telecom and IT also show strong growth due to integration with cloud and data analytics tools for user engagement. BFSI and retail sectors are rapidly deploying mobile-based loyalty programs, payments, and personalized marketing. Rising consumer inclination toward on-the-go digital entertainment continues to position media and entertainment as the dominant vertical.

Key Growth Drivers

Rising Smartphone Penetration and Internet Connectivity

Expanding smartphone ownership and affordable data plans have significantly boosted the adoption of mobile value added services. Growing access to 4G and 5G networks enables faster content delivery and seamless mobile experiences. Consumers in both developed and emerging regions are increasingly using smartphones for entertainment, banking, and shopping. The surge in connected users provides a strong foundation for service providers to introduce personalized mobile applications, enhancing customer engagement and driving steady market growth worldwide.

- For instance, Reliance Jio’s customer base crossed 500 million in the quarter ended September 2025.

Increasing Adoption of Mobile Payments and Digital Wallets

Mobile payments have become a major revenue source within mobile value added services. The widespread acceptance of mobile wallets and cashless payment systems across industries accelerates digital transformation. Financial inclusion programs and fintech partnerships are improving access to secure transaction platforms. Enhanced convenience, faster processing, and reduced dependency on physical cash encourage users to adopt mobile money solutions, reinforcing the segment’s dominance and driving the overall growth of the global market.

- For instance, India’s UPI handled 16.58 billion transactions in October 2024.

Expansion of Content-Based and Entertainment Services

Content-based services, including video streaming, gaming, and infotainment, are rapidly expanding. The growing appetite for digital entertainment, coupled with improved mobile broadband, has accelerated subscription-based service adoption. Mobile users now prefer on-demand and personalized content through dedicated applications. The rise of music streaming, mobile gaming, and social engagement platforms further enhances user time spent on devices. This trend drives revenue growth for telecom operators and content developers through integrated value added service models.

Key Trends & Opportunities

Integration of AI and Data Analytics in Service Delivery

Artificial intelligence and analytics are transforming mobile value added services through personalization and automation. AI-powered tools analyze user behavior to recommend tailored content, offers, and advertisements. Predictive analytics helps providers optimize customer engagement and retention. The integration of machine learning algorithms in mobile apps enhances interactive experiences while reducing churn. These intelligent technologies open new opportunities for service differentiation and improve operational efficiency across telecom and digital service providers.

- For instance, Duolingo reported 50.5 million daily active users in Q3 2025, an increase of 36% year-over-year.

Growth of 5G and IoT-Enabled Mobile Ecosystems

The rollout of 5G and the rise of connected devices are redefining the scope of mobile value added services. Ultra-low latency and high-speed networks support new applications in real-time streaming, augmented reality, and smart cities. Telecom operators are leveraging IoT connectivity to provide location-based and enterprise solutions. The combination of 5G and IoT expands opportunities for innovative services in healthcare, transportation, and digital commerce, driving continuous growth in the global market.

- For instance, T-Mobile says its 5G covers about 98% of Americans, with leadership in U.S. 5G coverage experience.

Key Challenges

Data Privacy and Security Concerns

Rising incidents of data breaches and cyber threats pose major challenges to mobile value added service providers. Consumers remain cautious about sharing personal information through digital platforms. Regulatory frameworks such as GDPR and data protection laws demand strict compliance, increasing operational costs. Maintaining robust encryption, secure transactions, and transparent policies is critical to building user trust. Addressing privacy risks remains a top priority to ensure sustainable market growth in a data-driven ecosystem.

High Competition and Pricing Pressure

The mobile value added services market faces intense competition among telecom operators, app developers, and OTT platforms. The abundance of free or low-cost applications limits revenue potential for premium services. Price-sensitive consumers often shift between platforms, affecting customer retention rates. Providers must continuously innovate and diversify their offerings to maintain profitability. Strategic partnerships and differentiated content models are essential to counter pricing challenges and sustain long-term business expansion.

Regional Analysis

North America

North America holds the leading position in the mobile value added services market, accounting for about 37.2% share in 2024. The region benefits from advanced telecom infrastructure, high smartphone penetration, and widespread 5G adoption. Consumers in the United States and Canada are increasingly using mobile payments, entertainment streaming, and cloud-based communication tools. Strategic collaborations between telecom operators and digital service providers strengthen service offerings. The presence of key technology players and early adoption of AI-based mobile applications continue to drive market expansion and sustained revenue growth across North America.

Europe

Europe accounts for nearly 28.6% of the global mobile value added services market in 2024, supported by strong demand for mobile content, financial services, and IoT-based connectivity. The United Kingdom, Germany, and France are major contributors due to widespread adoption of mobile payment and infotainment applications. Regulatory support for secure digital transactions and consumer data protection enhances user trust. Increasing investments in 5G deployment and digital entertainment platforms further boost market potential. Telecom operators in the region are focusing on personalized service delivery and subscription-based content strategies.

Asia Pacific

Asia Pacific captures approximately 24.7% share of the mobile value added services market in 2024, driven by massive smartphone usage and growing internet accessibility. Countries such as China, India, Japan, and South Korea are major growth engines. Expanding e-commerce ecosystems, mobile banking, and digital entertainment services fuel rapid adoption. The rising influence of social media and demand for localized content strengthen service diversification. Government-led initiatives promoting cashless economies and digital literacy programs further support the expansion of mobile-based financial and infotainment solutions in the region.

Latin America

Latin America holds around 6.1% market share in 2024, with steady growth supported by improving mobile connectivity and smartphone affordability. Brazil and Mexico dominate regional revenue generation through expanding telecom infrastructure and mobile payment platforms. Growing interest in digital entertainment, including music streaming and online gaming, adds momentum. Operators are partnering with fintech and media firms to enhance mobile service offerings. Increased focus on rural network coverage and localized digital content continues to foster adoption of mobile value added services across the region.

Middle East and Africa

The Middle East and Africa account for about 3.4% share of the global mobile value added services market in 2024. Expanding mobile networks and rising internet penetration are driving greater use of mobile money and infotainment services. Countries like the UAE, Saudi Arabia, and South Africa are leading adoption through advanced 4G and 5G rollouts. Growing financial inclusion efforts and government-led digital transformation initiatives enhance market prospects. Increasing consumer preference for affordable, data-driven services further supports the regional growth trajectory.

Market Segmentations:

By Solution

- Short Messaging Service (SMS)

- Multimedia Messaging Service (MMS)

- Location Based Services

- Mobile Email and IM

- Mobile Money

- Mobile Advertising

- Mobile Infotainment

- Others

By Device Type

- Mobile Phone

- Tablet PC

- Laptop or Data-Card

- Others

By Vertical

- BFSI

- Media and Entertainment

- Healthcare

- Education

- Retail

- Government

- Telecom and IT

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The mobile value added services market is highly competitive, with leading players such as Vodafone Group Plc, Apple Inc., Baidu Inc., Mahindra Comviva, Google LLC, Gemalto, InMobi, Amazon.com Inc., Mobily, One97 Communications Ltd., Alphabet Inc., AT&T, Gaana.com, OnMobile, Comverse Technology Inc., and Kongzhong Corp shaping the global landscape. The competition is driven by rapid innovation, diversified service portfolios, and strong regional presence. Companies are focusing on expanding mobile payment systems, personalized content, and digital entertainment services to attract broader audiences. Strategic alliances with telecom operators, fintech firms, and content providers enhance service delivery and consumer engagement. Increasing investments in AI, 5G, and cloud platforms are enabling providers to offer real-time, secure, and data-driven mobile experiences. Furthermore, ongoing emphasis on customer-centric solutions, subscription-based models, and seamless connectivity continues to define competitive differentiation and long-term growth strategies across the global mobile value added services ecosystem.

Key Player Analysis

- Vodafone Group Plc

- Apple Inc.

- Baidu Inc.

- Mahindra Comviva

- Google LLC

- Gemalto

- InMobi

- Amazon.com Inc.

- Mobily

- One97 Communications Ltd.

- Alphabet Inc.

- AT&T

- Gaana.com

- OnMobile

- Comverse Technology Inc.

- Kongzhong Corp

Recent Developments

- In 2025, Baidu launched its ERNIE 4.5 and ERNIE X1 AI models, which both possess advanced multimodal capabilities (processing text, images, audio, and video).

- In 2025, Amazon.com Inc. Amazon Pay launched “UPI Circle” for family payments and wearables. Announced at Global Fintech Festival 2025.

- In 2024, Tesla and Baidu announced a collaboration to integrate Baidu’s newly launched Version 20 mapping services into Tesla models in China.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Solution, Device Type, Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing integration of AI and machine learning will enhance personalization in mobile services.

- Expansion of 5G networks will enable faster delivery of high-quality mobile content.

- Mobile payment and digital wallet adoption will continue to rise across emerging markets.

- Cloud-based value added services will gain traction among enterprises and telecom operators.

- Increasing demand for mobile entertainment and gaming will drive content diversification.

- Partnerships between telecom providers and fintech firms will strengthen mobile ecosystems.

- Data analytics will play a central role in improving customer retention and engagement.

- IoT-driven mobile applications will expand opportunities in smart homes and connected devices.

- Regulatory support for digital transactions and privacy protection will foster market confidence.

- Continuous innovation in mobile platforms will sustain long-term market competitiveness.