Market Overview:

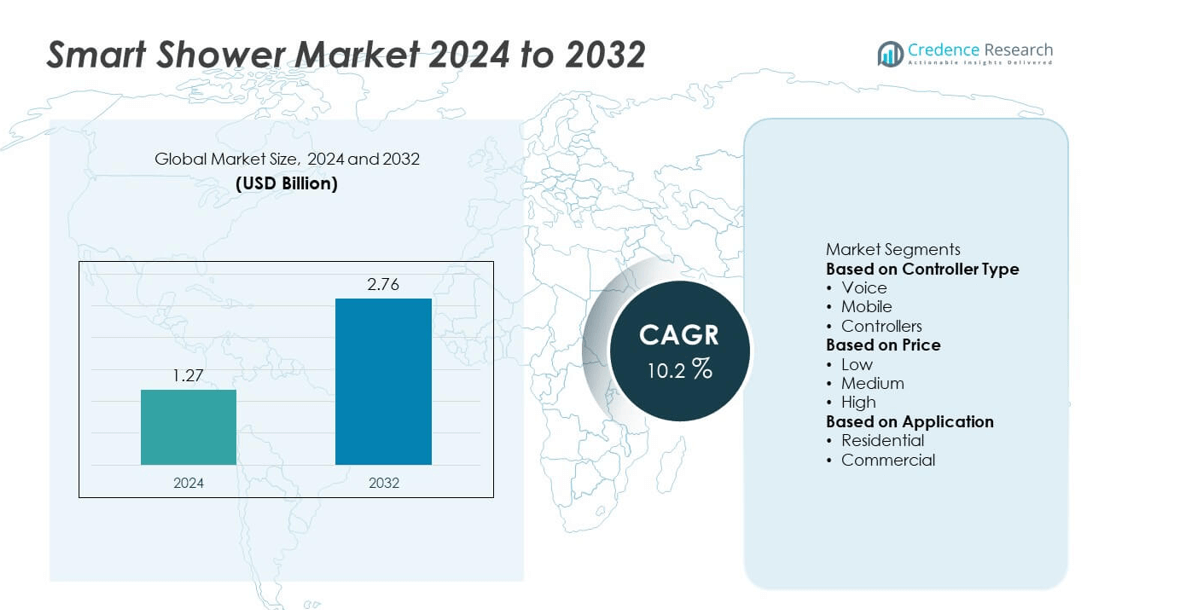

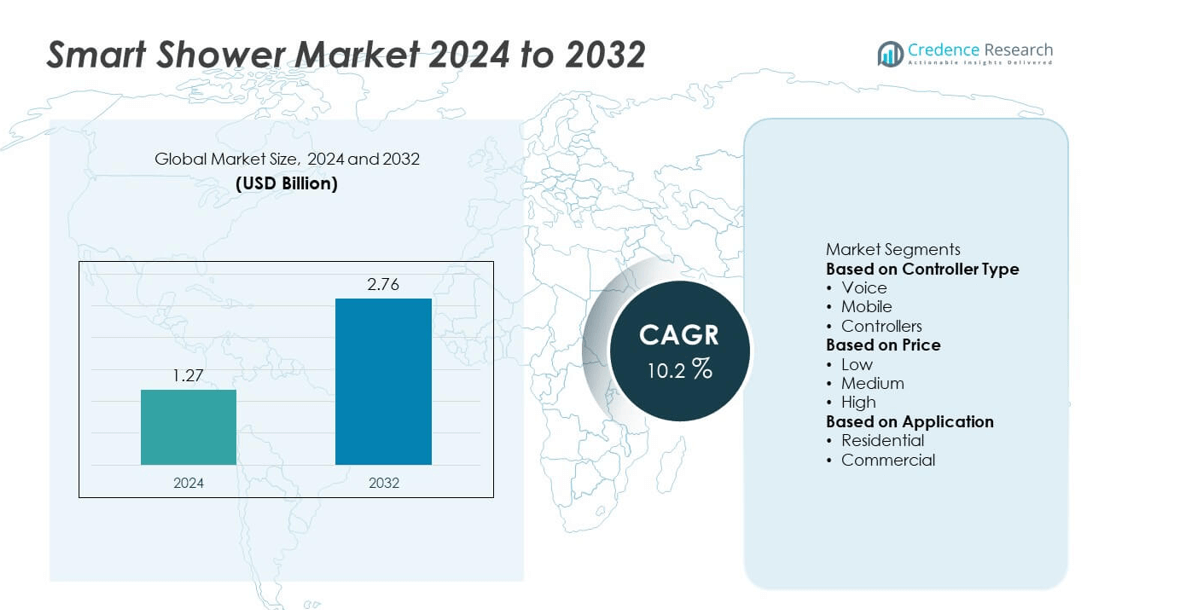

The Smart Shower market was valued at USD 1.27 billion in 2024 and is projected to reach USD 2.76 billion by 2032, registering a CAGR of 10.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Shower Market Size 2024 |

USD 1.27 billion |

| Smart Shower Market, CAGR |

10.2% |

| Smart Shower Market Size 2032 |

USD 2.76 billion |

The smart shower market is led by major companies such as Hansgrohe, Moen Incorporated, Jaquar, GetHai Inc., Dornbracht Deutschland GmbH & Co. KG, Kohler Co., Masco, LIXIL Corporation, Grohe, and Cera. These players focus on digital innovation, smart connectivity, and energy-efficient design to strengthen their market presence. Product development emphasizes voice and app-based controls, water conservation, and enhanced user customization. Regionally, North America dominated the market in 2024 with a 34.2% share, supported by high adoption of smart home systems and sustainability initiatives, followed by Europe with 29.8% and Asia-Pacific with 25.7%, driven by rapid urbanization and smart infrastructure growth.

Market Insights

- The smart shower market was valued at USD 1.27 billion in 2024 and is projected to reach USD 2.76 billion by 2032, growing at a CAGR of 10.2%.

- Rising demand for connected home technologies and water-efficient solutions drives market expansion, with voice-controlled systems holding a 47.6% share in 2024.

- Increasing integration of IoT, AI, and smartphone applications enhances customization, comfort, and energy efficiency, shaping market trends.

- Leading players such as Hansgrohe, Moen Incorporated, Jaquar, Kohler Co., and LIXIL Corporation focus on innovation, sustainability, and smart automation to strengthen their global presence.

- Regionally, North America leads with a 34.2% share, followed by Europe at 29.8% and Asia-Pacific at 25.7%, supported by rapid urbanization and growth in smart city infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Controller Type

The voice-controlled segment dominated the smart shower market in 2024 with a 47.6% share. Growth is driven by the integration of AI assistants such as Alexa and Google Home, which enhance user convenience and energy efficiency. Voice-enabled systems allow hands-free operation for temperature, water flow, and duration adjustments, supporting accessibility and smart home automation. Increasing consumer demand for luxury and personalized bathing experiences is accelerating adoption, while mobile app–based controls continue to gain traction among tech-savvy households seeking remote shower management and usage analytics.

- For instance, Moen’s TS3302TB Smart Shower allows users to customize settings like temperature and water flow through voice commands with Alexa or Google Assistant, providing hands-free control.

By Price

The medium-priced segment held the largest share of 52.3% in 2024, balancing affordability and advanced functionality. Consumers increasingly prefer mid-range smart showers that offer digital temperature control, water-saving features, and smartphone compatibility without premium costs. Manufacturers focus on energy-efficient models with smart sensors and Wi-Fi integration to attract middle-income households. The segment benefits from growing awareness of sustainable water use and expanding availability through online retail channels, making smart shower systems more accessible for residential renovations and new urban developments.

- For instance, Aqualisa’s Quartz Touch Smart Shower integrates Wi-Fi with voice control via Amazon Alexa or Google Assistant, offering personalized temperature and water flow settings, and emphasizing water-saving features.

By Application

The residential segment accounted for a dominant 68.4% share of the smart shower market in 2024. Rising adoption of smart home ecosystems and connected bathroom technologies is fueling demand among homeowners. Enhanced hygiene, water efficiency, and customizable comfort settings are key drivers of residential installations. Expanding urban housing projects and the trend toward modern, energy-efficient bathrooms further support growth. The commercial segment, including hotels and wellness centers, is also increasing adoption to improve guest experiences and reduce operational costs through automated water management systems.

Key Growth Drivers

Rising Integration of IoT and Smart Home Ecosystems

The growing adoption of IoT-enabled home automation is a major driver for the smart shower market. Integration with voice assistants and mobile apps allows users to customize temperature, water pressure, and duration settings. These features enhance comfort, safety, and energy efficiency. As connected homes gain popularity, manufacturers expand interoperability with platforms like Alexa and Google Home. The increasing demand for seamless connectivity and personalized experiences continues to accelerate smart shower installations across residential and commercial projects.

- For instance, U by Moen Smart Shower,” featuring a mobile app that allows users to set precise water temperatures and use features like a “warm up and pause” function to conserve water in residential settings.

Growing Demand for Water and Energy Conservation

Sustainability concerns and global water scarcity are fueling demand for smart showers equipped with efficient flow and temperature control systems. These showers use built-in sensors to minimize water wastage while maintaining comfort. Government incentives and green certification programs encourage adoption of eco-friendly plumbing technologies. Real-time monitoring and consumption data further support sustainable use. This shift toward conservation-focused design strengthens the role of smart showers in smart homes and environmentally responsible construction.

- For instance, Hansgrohe’s EcoSmart technology enables its showers to use up to 60% less water than conventional models, significantly reducing energy consumption and CO2 emissions.

Rising Consumer Inclination Toward Luxury and Wellness

Increasing disposable income and lifestyle upgrades are driving consumer interest in high-end, wellness-oriented bathroom technologies. Smart showers deliver spa-like experiences through digital temperature control, LED lighting, and aromatherapy functions. They blend convenience, hygiene, and comfort, appealing to modern households. Hotels and wellness resorts are adopting these systems to enhance guest satisfaction. As luxury living and wellness awareness grow, demand for intelligent shower systems continues to rise globally.

Key Trends & Opportunities

Integration with Artificial Intelligence and Predictive Controls

Manufacturers are incorporating AI-based systems to enhance personalization and operational efficiency. These solutions learn user preferences and automatically adjust settings for temperature, pressure, and flow. Predictive maintenance alerts minimize service disruptions, improving reliability. The integration of AI aligns with the broader shift toward intelligent, data-driven home systems. As advancements continue, AI-enabled smart showers will deliver adaptive performance and superior water management.

- For instance, Aquaelite has developed digital showers with smart sensors that automatically regulate temperature and water flow, preventing scalds and reducing waste with features like anti-drip technology.

Expansion in Hospitality and Commercial Infrastructure

The hospitality industry presents strong growth opportunities for smart shower adoption. Hotels, gyms, and wellness centers are investing in intelligent water systems to improve sustainability and guest comfort. Centralized management platforms enable remote temperature control and usage monitoring. These systems help reduce water and energy costs while aligning with eco-certification standards. The trend supports wider adoption in commercial infrastructure and luxury real estate projects.

- For instance, the Sheraton Tel Aviv implemented SmarTap’s fully automated smart shower system, achieving a 30% reduction in water use and 8% energy savings, which translates to significant cost reductions and improved guest experience.

Key Challenges

High Installation and Maintenance Costs

High upfront costs remain a major barrier to smart shower adoption, especially in developing markets. Advanced sensors, electronic controls, and IoT integration raise installation expenses. Skilled labor is also required for setup and maintenance. Over time, software updates and system calibration add to ownership costs. To overcome this, manufacturers are developing affordable and modular designs that balance performance with cost efficiency.

Connectivity and Compatibility Limitations

Compatibility issues with diverse smart home systems and inconsistent internet infrastructure hinder widespread adoption. Some devices struggle to integrate seamlessly with regional networks or outdated plumbing setups. Connectivity failures can interrupt automated functions, impacting user satisfaction. Manufacturers are addressing these limitations through improved cross-platform support and secure wireless protocols. However, ensuring consistent performance across varied environments remains a technical and infrastructural challenge.

Regional Analysis

North America

North America held a 34.2% share of the smart shower market in 2024, driven by high adoption of connected home technologies and sustainability initiatives. The U.S. leads regional demand due to strong consumer preference for luxury bathroom products and integration with IoT platforms such as Alexa and Google Home. Water conservation regulations and green building certifications further support market expansion. Major manufacturers focus on advanced, energy-efficient designs tailored for premium housing and hotel renovations, while increasing renovation activities across Canada and the U.S. continue to boost regional market growth.

Europe

Europe accounted for a 29.8% share of the smart shower market in 2024, supported by rising investments in smart homes and eco-friendly infrastructure. Countries such as Germany, the UK, and France lead adoption due to strong sustainability policies and energy efficiency standards. Growing awareness of water conservation and rising disposable incomes in urban areas enhance market penetration. Leading manufacturers focus on hybrid systems combining water-saving features with digital comfort controls. Continuous R&D in smart bathroom technologies and increasing consumer preference for advanced home automation strengthen Europe’s market position.

Asia-Pacific

Asia-Pacific captured a 25.7% share of the smart shower market in 2024 and is projected to record the fastest growth through 2032. Rapid urbanization, expanding middle-class income, and government-backed smart city programs drive demand across China, India, and Japan. Rising construction of modern residential complexes and hospitality infrastructure supports strong market potential. Local and international brands are focusing on cost-effective and energy-efficient smart showers to meet growing consumer expectations. Technological innovation and expanding awareness of water-saving solutions further accelerate regional adoption, positioning Asia-Pacific as a key growth hub.

Latin America

Latin America represented a 6.1% share of the smart shower market in 2024, driven by growing modernization of residential and hospitality infrastructure. Brazil and Mexico lead regional demand due to expanding urban housing projects and rising adoption of smart home technologies. Increasing focus on water conservation and eco-friendly living also supports market growth. However, high installation costs and limited consumer awareness restrict widespread adoption. Manufacturers are collaborating with regional distributors to improve accessibility, while smart bathroom innovations continue to gain traction among upper-middle-income households.

Middle East & Africa

The Middle East & Africa region accounted for a 4.2% share of the smart shower market in 2024, supported by large-scale real estate developments and luxury housing projects. Countries such as the UAE, Saudi Arabia, and South Africa are integrating smart showers into premium residential and commercial spaces. Rising tourism and hotel construction stimulate product demand, particularly for water-efficient and temperature-controlled systems. Harsh climatic conditions drive interest in advanced water management technologies. Despite limited affordability in some areas, strong infrastructure investments and sustainability goals continue to support steady market expansion.

Market Segmentations:

By Controller Type

By Price

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The smart shower market is dominated by key players such as Hansgrohe, Moen Incorporated, Jaquar, GetHai Inc., Dornbracht Deutschland GmbH & Co. KG, Kohler Co., Masco, LIXIL Corporation, Grohe, and Cera. These companies compete through continuous innovation, expanding product portfolios, and integration of advanced technologies like IoT, AI, and voice control. Leading manufacturers focus on enhancing user experience through energy-efficient, water-saving, and customizable smart shower systems. Strategic collaborations, digital connectivity, and sustainable design are central to their growth strategies. Global players invest heavily in R&D to develop AI-driven temperature regulation and eco-friendly materials, while regional participants target affordability to expand in emerging markets. Growing competition and evolving consumer preferences for connected bathroom systems drive ongoing product differentiation and market consolidation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hansgrohe

- Moen Incorporated

- Jaquar

- GetHai, Inc.

- Dornbracht Deutschland GmbH & Co. KG

- Kohler Co.

- Masco

- LIXIL Corporation

- Grohe

- Cera

Recent Developments

- In September 2025, Kohler Co. launched its Anthem+ smart showering system integrated with Control4’s home automation platform, enabling users to manage shower settings through voice commands and mobile app control.

- In March 17 2025, GROHE introduced at ISH 2025 its new shower innovations including the “Purefoam” foam shower technology and the “Rapido Heat Recovery” smart shower system reinforcing its push into smart/wellness-centric showering experiences.

- In February 24 2025, TOTO LTD. unveiled next-generation smart bathroom technology, focusing on smart showers, sustainability and luxury design at the KBIS 2025 show.

- In October 2024, Kohler Co. partnered with Samsung Electronics to integrate its smart showers into the SmartThings ecosystem, allowing users to monitor and control water usage via SmartThings and the SmartThings Map View feature

Report Coverage

The research report offers an in-depth analysis based on Controller Type, Price, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for smart, connected bathroom systems will continue to grow globally.

- Integration of AI and IoT will enhance personalization and water efficiency.

- Voice and app-based controls will become standard in residential installations.

- Eco-friendly and water-saving technologies will dominate product development.

- Manufacturers will focus on hybrid designs combining luxury and sustainability.

- The hospitality sector will increasingly adopt smart showers for guest comfort.

- Affordable smart shower models will expand market reach in emerging economies.

- Advancements in sensor technology will improve precision and user experience.

- Partnerships between tech firms and sanitary manufacturers will drive innovation.

- Asia-Pacific will emerge as the fastest-growing market due to smart city expansion.