Market Overviews

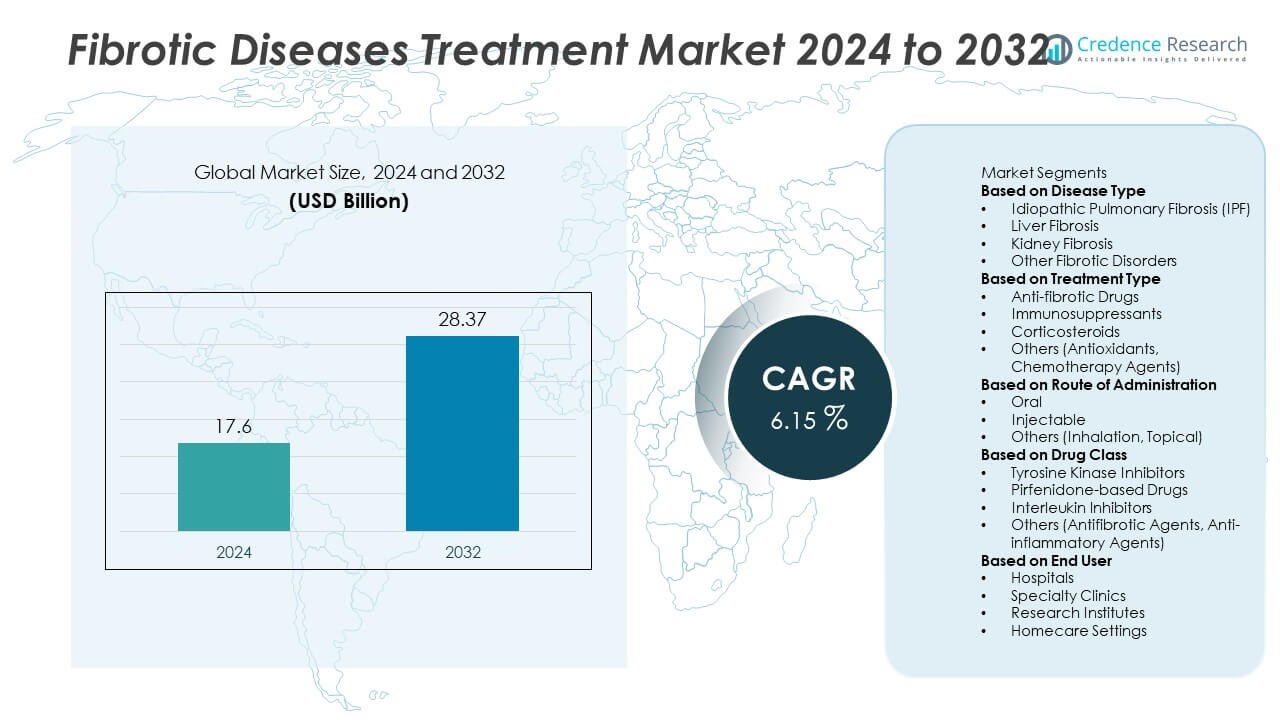

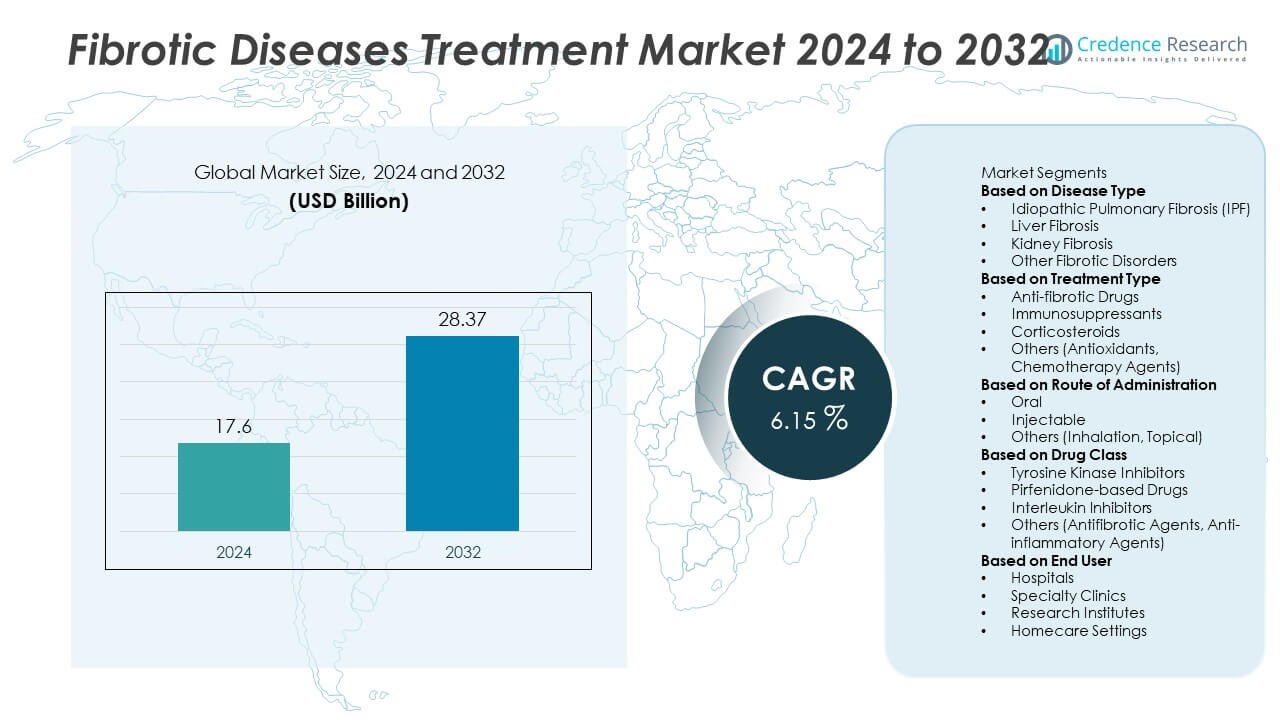

The Fibrotic Diseases Treatment market was valued at USD 17.6 billion in 2024 and is projected to reach USD 28.37 billion by 2032, growing at a CAGR of 6.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fibrotic Diseases Treatment Market Size 2024 |

USD 17.6 Billion |

| Fibrotic Diseases Treatment Market, CAGR |

6.15% |

| Fibrotic Diseases Treatment Market Size 2032 |

USD 28.37 Billion |

The Fibrotic Diseases Treatment market is led by key players such as Roche Holding AG, Bristol-Myers Squibb Company, Boehringer Ingelheim International GmbH, Gilead Sciences, Inc., FibroGen, Inc., Novartis AG, Merck & Co., Inc., AstraZeneca plc, Sanofi S.A., and AbbVie Inc. These companies dominate through strong R&D pipelines, extensive clinical trials, and advancements in anti-fibrotic and biologic therapies. North America leads the global market with a 39.6% share, supported by advanced healthcare infrastructure and high adoption of novel therapeutics. Europe follows with 28.4%, driven by favorable regulatory frameworks and increasing prevalence of chronic fibrotic disorders across major economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fibrotic Diseases Treatment market was valued at USD 17.6 billion in 2024 and is expected to reach USD 28.37 billion by 2032, growing at a CAGR of 6.15% during the forecast period.

- Rising prevalence of idiopathic pulmonary fibrosis, liver fibrosis, and kidney fibrosis is driving strong demand for targeted and combination therapies worldwide.

- Advancements in anti-fibrotic drug development, regenerative medicine, and personalized treatment approaches are shaping key market trends.

- The market is moderately consolidated, with major players like Roche, Boehringer Ingelheim, Gilead Sciences, and Novartis focusing on R&D, strategic collaborations, and late-stage clinical trials.

- North America leads with a 39.6% share, followed by Europe at 28.4% and Asia-Pacific at 21.7%, while the idiopathic pulmonary fibrosis (IPF) segment dominates with a 46.3% share due to high disease incidence and strong availability of approved therapeutic options.

Market Segmentation Analysis:

By Disease Type

The idiopathic pulmonary fibrosis (IPF) segment dominated the Fibrotic Diseases Treatment market in 2024, holding a 46.3% share. This dominance is driven by rising disease prevalence, increasing awareness, and availability of approved anti-fibrotic drugs such as pirfenidone and nintedanib. The growing number of clinical trials for IPF-specific therapies and strong R&D funding by pharmaceutical firms further support this segment. Enhanced diagnostic methods and targeted drug development are also helping expand the treatment scope and improve patient outcomes across developed and emerging healthcare markets.

- For instance, Boehringer Ingelheim’s nintedanib demonstrated a 125 mL reduction in annual forced vital capacity (FVC) decline compared to placebo over 52 weeks in Phase III INPULSIS trials, confirming its efficacy in slowing IPF progression and improving patient lung function stability.

By Treatment Type

The anti-fibrotic drugs segment held the largest 51.7% share of the Fibrotic Diseases Treatment market in 2024. These drugs are increasingly prescribed due to their ability to slow disease progression and improve lung function in patients with IPF and other fibrotic conditions. Continuous advancements in drug formulations and the introduction of combination therapies are expanding therapeutic options. Major pharmaceutical players are investing in next-generation anti-fibrotic compounds targeting multiple signaling pathways, enhancing efficacy and patient compliance. Rising FDA approvals and clinical success rates are strengthening this segment’s market dominance.

- For instance, Roche’s pirfenidone therapy in the multicenter ASCEND trials reduced the risk of death or disease progression by 43% (hazard ratio 0.57) compared to placebo. This was supported by a statistically significant difference in FVC decline, with the mean change from baseline to one year being a loss of 235 mL in the pirfenidone group versus a loss of 428 mL in the placebo group, for an absolute difference (preservation) of 193 mL.

By Route of Administration

The oral segment accounted for a 58.4% share of the Fibrotic Diseases Treatment market in 2024, making it the leading route of administration. Oral drugs offer convenience, improved adherence, and easy distribution compared to injectable or inhaled forms. Widespread use of oral anti-fibrotic agents like pirfenidone has boosted this segment’s demand. Pharmaceutical companies are focusing on developing orally active molecules with higher bioavailability and fewer side effects. As home-based treatment adoption increases, the preference for oral administration continues to grow, supporting wider access and better disease management outcomes.

Key Growth Drivers

Rising Prevalence of Fibrotic Disorders

The growing incidence of chronic diseases such as idiopathic pulmonary fibrosis, liver fibrosis, and kidney fibrosis is fueling market demand. Aging populations and lifestyle-related conditions like obesity and diabetes are major contributing factors. Increased awareness and early diagnostic screening have led to higher treatment rates. Healthcare systems are prioritizing fibrotic disease management through dedicated research and government funding. This rising disease burden continues to strengthen the need for effective and long-term treatment solutions globally.

- For instance, FibroGen’s pamrevlumab had a mean decline of 260 mL in forced vital capacity (FVC) over 48 weeks in the Phase III ZEPHYRUS-1 trial, compared with a mean decline of 330 mL in the placebo group

Advancements in Drug Development and Therapeutics

Ongoing innovation in anti-fibrotic drug development is a key driver for market expansion. Pharmaceutical companies are focusing on targeted therapies and next-generation molecules that modulate multiple fibrosis pathways. Increased clinical trial success and regulatory approvals are improving treatment accessibility. Research collaborations between biotech firms and academic institutions are accelerating discovery. The development of safer, more potent drugs with fewer side effects is enhancing patient outcomes and driving adoption worldwide.

- For instance, Bristol Myers Squibb’s BMS-986278, a selective lysophosphatidic acid receptor 1 antagonist, achieved a 62% relative reduction in the rate of decline in percent predicted forced vital capacity (ppFVC) at week 26 in Phase II IPF trials, highlighting its potential as a next-generation anti-fibrotic therapy targeting multiple molecular pathways.

Growing Investments in Research and Clinical Studies

Global investments in fibrosis research are increasing due to the high unmet medical need. Governments and private organizations are funding projects aimed at identifying novel biomarkers and treatment targets. Clinical studies are exploring gene-based and cell therapies, offering new opportunities for disease reversal. The use of advanced diagnostic tools like imaging and molecular profiling supports precision medicine. These investments are improving understanding of disease mechanisms and fostering the development of innovative therapeutic pipelines.

Key Trends & Opportunities

Emergence of Precision and Personalized Medicine

The shift toward personalized medicine is reshaping fibrotic disease treatment strategies. Genomic profiling and biomarker analysis allow for more accurate diagnosis and customized therapy selection. This approach enhances treatment efficacy and minimizes side effects. Pharmaceutical developers are increasingly adopting patient-specific drug models to improve clinical outcomes. Precision medicine offers new opportunities for tailored anti-fibrotic solutions, particularly in complex and treatment-resistant cases.

- For instance, Roche Diagnostics introduced its Elecsys® PRO-C3 test for liver fibrosis, which delivers results in 18 minutes and distinguishes fibrosis stages (≥F2, ≥F3, F4) using the ADAPT algorithm.

Expansion of Combination and Regenerative Therapies

Combination treatments using anti-fibrotic and anti-inflammatory agents are gaining traction for improving patient response rates. Regenerative medicine approaches, including stem cell and gene therapies, show promise in repairing damaged tissues. These therapies address the root cause of fibrosis rather than just managing symptoms. Ongoing research and rising clinical success are expected to expand their commercial viability. Such innovations offer long-term opportunities for breakthrough treatment models in the global market.

- For instance, a recent real-world cohort of 80 patients with Idiopathic Pulmonary Fibrosis treated with either nintedanib or pirfenidone therapy saw a reduction in annual forced vital capacity (FVC) decline from -484 mL/year before therapy to -154 mL/year during therapy.

Key Challenges

High Treatment Costs and Limited Accessibility

The cost of anti-fibrotic medications and advanced therapies remains a major barrier, especially in developing regions. Many treatments require long-term administration, increasing financial strain on patients and healthcare systems. Limited reimbursement coverage further restricts access. Pharmaceutical companies face challenges in balancing pricing strategies with innovation costs. Addressing affordability through generic development and policy reforms will be crucial for broader market penetration.

Complex Disease Mechanisms and Drug Development Risks

Fibrotic diseases involve multiple biological pathways, making drug development complex and time-consuming. Clinical trials often face high failure rates due to unpredictable responses and safety concerns. Identifying reliable biomarkers for early-stage diagnosis and treatment monitoring remains difficult. These challenges delay approvals and increase R&D expenses. Overcoming these scientific hurdles is essential for accelerating innovation and ensuring sustainable market growth.

Regional Analysis

North America

North America dominated the Fibrotic Diseases Treatment market in 2024 with a 39.6% share, driven by high disease prevalence, advanced healthcare infrastructure, and strong R&D investment. The United States leads the region with growing demand for targeted anti-fibrotic drugs and supportive government funding for rare disease research. Presence of key pharmaceutical companies and availability of advanced diagnostic technologies further boost treatment adoption. Continuous clinical trials and regulatory approvals by the FDA strengthen innovation and patient access, positioning North America as the leading regional contributor to global market growth.

Europe

Europe accounted for 28.4% of the Fibrotic Diseases Treatment market share in 2024. The region benefits from extensive clinical research networks, robust reimbursement systems, and rising awareness of chronic fibrotic diseases. Countries like Germany, the United Kingdom, and France are investing heavily in advanced biologics and personalized therapies. Supportive policies for orphan drug development encourage innovation and accessibility. The growing geriatric population and collaborative R&D between academia and the pharmaceutical industry continue to enhance Europe’s leadership in developing safe and effective fibrotic disease treatments.

Asia-Pacific

Asia-Pacific held a 21.7% share of the Fibrotic Diseases Treatment market in 2024, driven by increasing healthcare expenditure and expanding patient awareness. Rising incidences of liver and kidney fibrosis in densely populated countries such as China and India are fueling treatment demand. Governments are promoting healthcare infrastructure improvements and encouraging international collaborations for clinical trials. Japan and South Korea are advancing in anti-fibrotic drug research and biomarker discovery. Rapid urbanization and lifestyle-related health risks further accelerate disease prevalence, supporting strong market growth across the region.

Middle East & Africa

The Middle East and Africa region captured a 6.1% share of the Fibrotic Diseases Treatment market in 2024. Market growth is supported by rising healthcare investments in Gulf countries and growing awareness of chronic disease management. The UAE, Saudi Arabia, and Qatar are focusing on enhancing access to advanced therapeutics through hospital modernization and partnerships with global pharmaceutical firms. However, limited diagnostic infrastructure and low affordability in several African nations restrict broad treatment adoption. Efforts to improve clinical access and early screening are expected to support gradual market expansion.

Latin America

Latin America represented 4.2% of the Fibrotic Diseases Treatment market share in 2024. Countries such as Brazil, Mexico, and Argentina are leading the region with increasing awareness of fibrosis-related conditions. Improving healthcare policies and rising participation in international research initiatives are driving gradual market penetration. However, limited reimbursement policies and uneven access to specialty drugs pose challenges. Ongoing government efforts to strengthen healthcare systems and expand treatment availability are expected to boost regional growth, particularly through collaborations with multinational pharmaceutical manufacturers.

Market Segmentations:

By Disease Type

- Idiopathic Pulmonary Fibrosis (IPF)

- Liver Fibrosis

- Kidney Fibrosis

- Other Fibrotic Disorders

By Treatment Type

- Anti-fibrotic Drugs

- Immunosuppressants

- Corticosteroids

- Others (Antioxidants, Chemotherapy Agents)

By Route of Administration

- Oral

- Injectable

- Others (Inhalation, Topical)

By Drug Class

- Tyrosine Kinase Inhibitors

- Pirfenidone-based Drugs

- Interleukin Inhibitors

- Others (Antifibrotic Agents, Anti-inflammatory Agents)

By End User

- Hospitals

- Specialty Clinics

- Research Institutes

- Homecare Settings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Fibrotic Diseases Treatment market features major players such as Roche Holding AG, Bristol-Myers Squibb Company, Boehringer Ingelheim International GmbH, Gilead Sciences, Inc., FibroGen, Inc., Novartis AG, Merck & Co., Inc., AstraZeneca plc, Sanofi S.A., and AbbVie Inc. These companies are actively investing in the development of novel anti-fibrotic drugs and biologics to address unmet clinical needs. Strategic initiatives such as mergers, acquisitions, and research collaborations are strengthening their global market presence. Leading firms are focusing on expanding their therapeutic portfolios through advanced clinical trials targeting multi-organ fibrosis. The introduction of combination therapies, personalized medicine approaches, and accelerated FDA approvals are reshaping competition. Continuous R&D in precision medicine and early-stage diagnostics is helping companies enhance treatment efficacy. Overall, competition remains innovation-driven, with global pharmaceutical leaders leveraging partnerships and technological advancements to maintain their dominance in the fibrotic diseases treatment landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Roche Holding AG

- Bristol-Myers Squibb Company

- Boehringer Ingelheim International GmbH

- Gilead Sciences, Inc.

- FibroGen, Inc.

- Novartis AG

- Merck & Co., Inc.

- AstraZeneca plc

- Sanofi S.A.

- AbbVie Inc.

Recent Developments

- In October 2025, Boehringer Ingelheim International GmbH announced that its drug JASCAYD® (nerandomilast) secured U.S. FDA approval for adults with Idiopathic Pulmonary Fibrosis (IPF), marking the first new treatment option for IPF in over a decade.

- In May 2025, Boehringer Ingelheim reported Phase III trial data for JASCAYD showing a significantly slower decline in forced vital capacity (FVC) over 52 weeks compared to placebo in IPF patients.

- In May 2025, Roche Holding AG introduced the Elecsys PRO-C3 biomarker test for assessing liver fibrosis severity in patients showing signs of metabolic dysfunction-associated steatohepatitis (MASLD).

- In 2025, Gilead Sciences, Inc. relaunched its HANDLE PBC research programme to study fibrosis regression in Primary Biliary Cholangitis, inviting proposals for studies including non-invasive fibrosis marker evaluation.

Report Coverage

The research report offers an in-depth analysis based on Disease Type, Treatment Type, Route of Administration, Drug Class, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing global awareness of fibrotic disorders will drive early diagnosis and treatment adoption.

- Development of next-generation anti-fibrotic drugs will enhance treatment effectiveness and patient outcomes.

- Combination and personalized therapies will become more common in managing complex fibrotic diseases.

- Growing investment in clinical research will expand the pipeline for novel drug candidates.

- Technological advances in biomarkers and molecular diagnostics will improve disease monitoring.

- Strategic collaborations between pharmaceutical companies and research institutions will accelerate innovation.

- Regulatory support for orphan drug approvals will boost the introduction of targeted treatments.

- Expansion of healthcare infrastructure in emerging markets will improve treatment accessibility.

- Focus on regenerative medicine and gene therapy will open new possibilities for disease reversal.

- North America, Europe, and Asia-Pacific will remain the key regions driving global market growth.