Market Overview

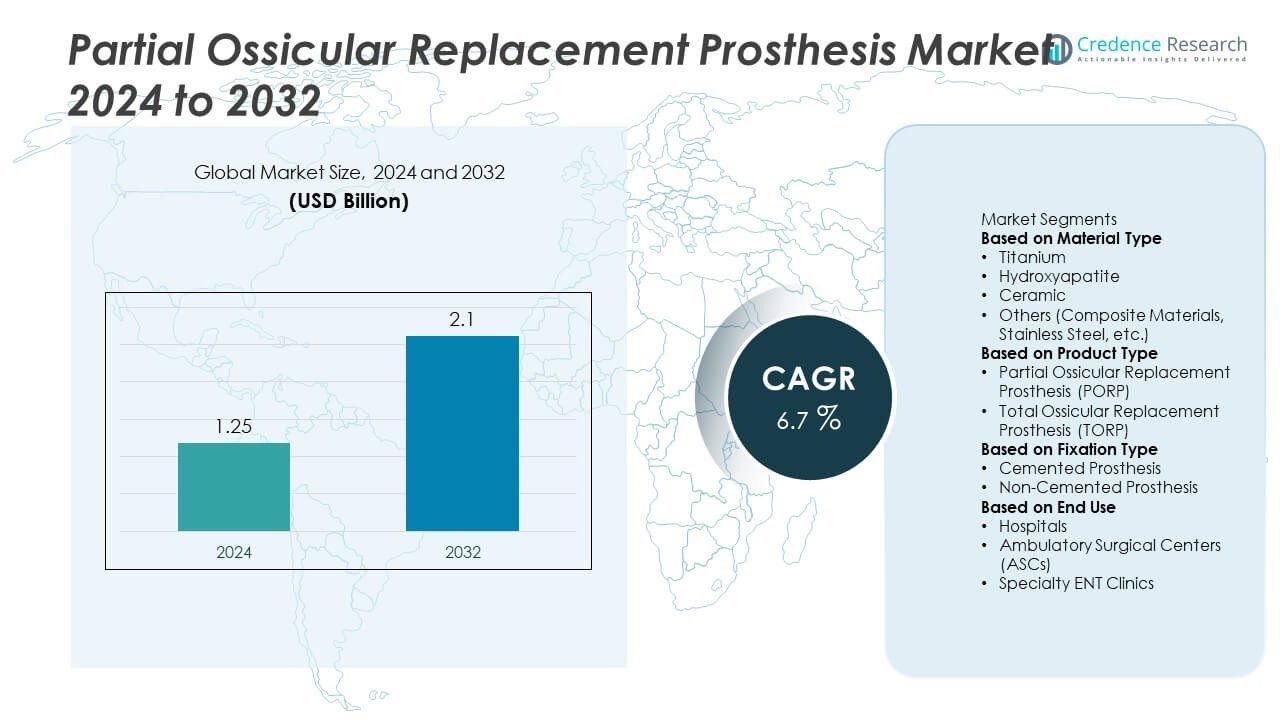

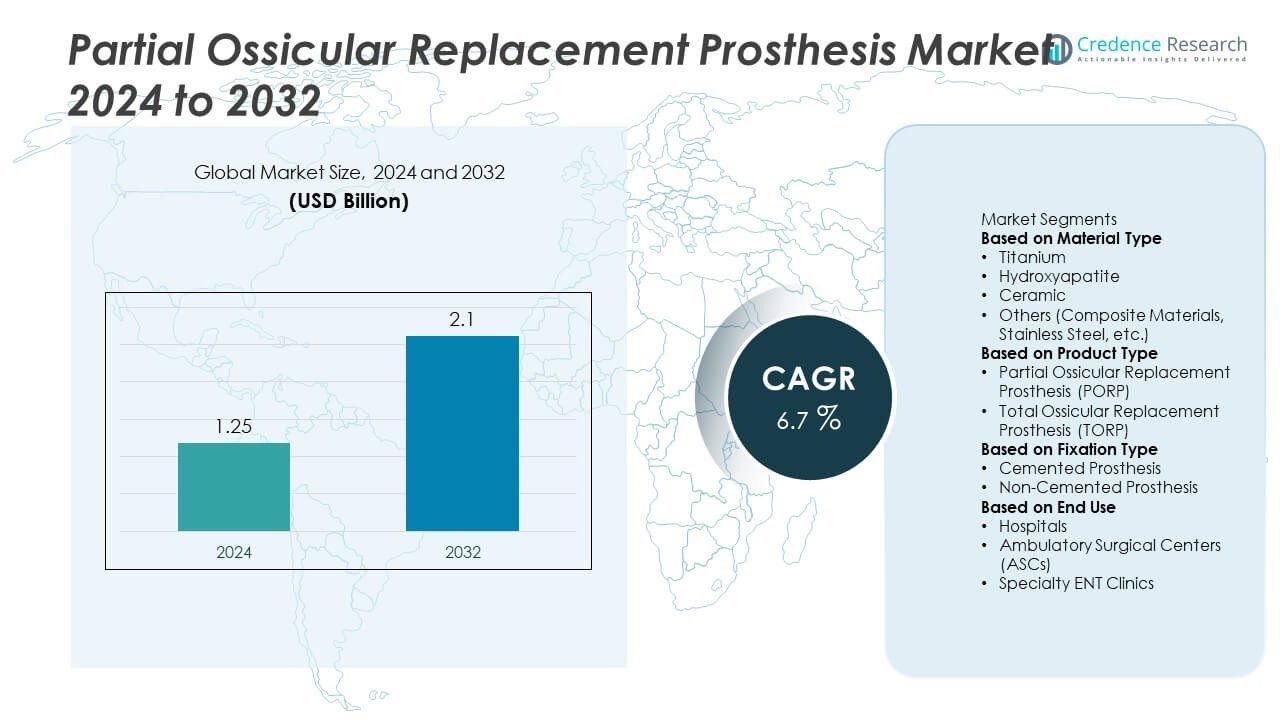

The Partial Ossicular Replacement Prosthesis market was valued at USD 1.25 billion in 2024 and is projected to reach USD 2.1 billion by 2032, growing at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Partial Ossicular Replacement Prosthesis Market Size 2024 |

USD 1.25 Billion |

| Partial Ossicular Replacement Prosthesis Market, CAGR |

6.7% |

| Partial Ossicular Replacement Prosthesis Market Size 2032 |

USD 2.1 Billion |

The Partial Ossicular Replacement Prosthesis market is led by major players including Medtronic plc, Olympus Corporation, Karl Storz SE & Co. KG, Grace Medical, Inc., Heinz Kurz GmbH Medizintechnik, Stryker Corporation, Spiggle & Theis Medizintechnik GmbH, Embody Medical Devices, Boston Medical Products, Inc., and OtoMedics Ltd. These companies emphasize product innovation, advanced implant materials, and precision engineering to enhance surgical success rates and patient outcomes. North America dominated the global market with a 37.2% share in 2024, driven by high adoption of titanium-based implants, strong ENT surgical infrastructure, and favorable reimbursement systems, followed by Europe with a 28.5% share supported by advanced healthcare facilities and rising focus on minimally invasive otologic procedures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Partial Ossicular Replacement Prosthesis market was valued at USD 1.25 billion in 2024 and is projected to reach USD 2.1 billion by 2032, expanding at a CAGR of 6.7% during the forecast period.

- Rising cases of chronic otitis media and hearing loss are driving demand for advanced titanium and hydroxyapatite-based prostheses in surgical reconstruction.

- Increasing adoption of 3D-printed and patient-specific implants is shaping market trends, improving precision and post-surgical hearing outcomes.

- Key players such as Medtronic, Olympus, and Stryker lead the market through R&D, product innovation, and strategic collaborations with ENT specialists.

- North America held a 37.2% share, followed by Europe (28.5%) and Asia-Pacific (22.8%), while titanium materials dominated with a 47.8% share and PORP devices led the product segment with a 58.6% share in 2024.

Market Segmentation Analysis:

By Material Type

Titanium dominated the Partial Ossicular Replacement Prosthesis market in 2024 with a 47.8% share, owing to its superior biocompatibility, light weight, and excellent acoustic transmission properties. Its resistance to corrosion and ability to integrate well with middle ear tissues make it the preferred material among surgeons. Hydroxyapatite and ceramic materials follow, offering natural bone-like properties suitable for specific anatomical reconstructions. The growing demand for durable and precise implants in complex ossiculoplasty procedures continues to strengthen titanium’s dominance across hospitals and specialty ENT centers globally.

- For instance, Heinz Kurz GmbH Medizintechnik’s TTP-VARIAC® System provides pure-titanium partial prostheses with functional lengths down to 3.0 mm and available shaft diameters of 0.2 mm, enabling precision matching in tight-space ossiculoplasty cases.

By Product Type

Partial Ossicular Replacement Prosthesis (PORP) accounted for the largest 58.6% share in 2024, driven by its widespread use in reconstructing partial ossicular chain discontinuities. PORP provides improved sound conduction and stability, particularly in patients with intact stapes structures. Total Ossicular Replacement Prosthesis (TORP) follows, used in cases of complete ossicular erosion. Advancements in prosthesis design, such as adjustable length and microtextured surfaces, have improved surgical precision and long-term hearing outcomes, further supporting the steady growth of the PORP segment.

- For instance, Grace Medical, Inc.’s ALTO Concise Partial prosthesis offers a functional length range from 0.75 mm to 5.75 mm in quarter-millimetre increments and comes pre-packaged with disposable sizers, facilitating intraoperative fit for PORP surgeries.

By Fixation Type

Non-cemented prostheses held a 62.1% share in 2024, emerging as the dominant fixation type due to their ease of insertion, reduced surgery time, and lower complication risk. These prostheses allow secure mechanical coupling with the ossicular chain, eliminating the need for additional bonding materials. Cemented types remain relevant for complex or revision surgeries requiring enhanced stability. The increasing preference for minimally invasive procedures and quicker recovery among patients is accelerating the adoption of non-cemented fixation techniques in modern otologic practices worldwide.

Key Growth Drivers

Rising Prevalence of Hearing Disorders and Middle Ear Diseases

The growing incidence of chronic otitis media, ossicular chain damage, and age-related hearing loss is driving demand for partial ossicular replacement prostheses. An increasing number of patients are opting for surgical reconstruction to restore hearing quality and reduce dependency on external devices. The expanding elderly population and improved awareness of advanced hearing restoration techniques further boost adoption. As ENT specialists focus on early diagnosis and minimally invasive surgical solutions, the demand for biocompatible and efficient prosthetic implants continues to rise globally.

- For instance, studies of various titanium ossicular replacement prostheses have demonstrated an average air–bone gap (ABG) of around 14 dB. A review of ossiculoplasty cases reported a postoperative ABG level of 14.0 dB in ears with recurrent conductive hearing loss, and large surgical series consistently report closure of the ABG to within 10–15 dB in over 90% of cases.

Advancements in Implant Materials and Design

Technological innovation in implant materials such as titanium, hydroxyapatite, and PEEK has significantly improved the performance and safety of ossicular prostheses. Enhanced biocompatibility, acoustic transfer efficiency, and lightweight structures have increased clinical success rates. Manufacturers are developing customizable and 3D-printed implants to ensure anatomical precision. These advancements reduce postoperative complications and improve sound transmission, encouraging more healthcare providers to adopt next-generation ossicular prostheses in both primary and revision ear reconstruction surgeries.

- For instance, a recent in-vitro study demonstrated that a titanium scaffold coated with bone-extracellular-matrix supported adhesion and osteogenic differentiation of human adipose-derived mesenchymal stem cells, with markers Alp, Runx2, Col1a1, Osx and Bglap all expressed on the surfaces.

Growth in ENT Surgical Infrastructure and Access to Care

Expanding ENT care facilities and growing investments in specialized surgical equipment are supporting market growth. Hospitals and ambulatory surgical centers are increasingly equipped with advanced microscopes, imaging tools, and otologic instruments that enhance procedural accuracy. Rising healthcare expenditure, especially in developing regions, is improving patient access to middle ear reconstruction surgeries. Furthermore, the availability of skilled otologic surgeons and reimbursement policies for hearing restoration procedures are fostering steady market expansion across key global healthcare systems.

Key Trends & Opportunities

Adoption of 3D Printing and Patient-Specific Implants

3D printing technology is transforming ossicular prosthesis design, enabling patient-specific customization for improved anatomical compatibility. This innovation enhances prosthesis alignment, reduces rejection risks, and improves post-surgical hearing outcomes. Medical device companies are integrating imaging data with CAD modeling to create precision implants. As regulatory approvals for customized implants accelerate, healthcare providers are increasingly adopting these solutions to optimize surgical success and patient satisfaction, presenting a strong opportunity for innovation-led growth in the PORP market.

- For instance, a study demonstrated the feasibility of using high-resolution computed tomography (CT) data to design patient-specific titanium prosthetic incus models, which can be custom 3D-printed to reflect anatomical variations.

Increasing Demand for Minimally Invasive and Endoscopic Procedures

The shift toward minimally invasive ear surgeries is promoting the use of advanced ossicular replacement prostheses. Endoscopic ear surgery techniques allow better visualization, reduced incision size, and faster recovery times. These procedures complement lightweight and flexible implant designs that offer superior stability and sound transmission. Rising patient preference for less invasive treatments and shorter hospital stays continues to create opportunities for medical device manufacturers to develop next-generation prosthetic solutions tailored for endoscopic applications.

- For instance, a multicenter retrospective study from three university hospitals covering 292 endoscopic ossiculoplasty cases reported a reduction in mean air–bone gap from 26.88 dB pre-op (SD ±12.73) to 19.94 dB at mean 20.7-month follow-up, with prosthesis extrusion rate of 8.4% and dislocation rate of 4.2% for titanium PORP.

Key Challenges

High Cost of Advanced Implants and Surgical Procedures

The high cost of titanium and customized implants poses a challenge to widespread adoption, particularly in low- and middle-income countries. Surgical expenses, combined with the need for specialized equipment and skilled surgeons, increase overall treatment costs. Limited insurance coverage in certain regions further restricts patient access to advanced ossicular replacement surgeries. Manufacturers and healthcare providers must balance innovation with affordability to expand market penetration and ensure accessibility of high-quality prostheses across different income groups.

Postoperative Complications and Lack of Standardization

Inconsistent surgical outcomes and prosthesis displacement remain major challenges in ossicular reconstruction. Variations in implant design, fixation methods, and surgeon expertise can lead to suboptimal hearing restoration. The absence of standardized surgical protocols and limited long-term performance data also hinder consistent clinical results. Strengthening training programs, establishing procedural guidelines, and enhancing implant testing standards are crucial to improving patient safety, reliability, and the long-term success of partial ossicular replacement prosthesis procedures worldwide.

Regional Analysis

North America

North America led the Partial Ossicular Replacement Prosthesis market in 2024 with a 37.2% share, supported by strong healthcare infrastructure, advanced ENT surgical technologies, and high adoption of titanium-based implants. The region benefits from a large patient base with hearing impairments and favorable reimbursement policies for reconstructive ear surgeries. The United States remains the key revenue contributor due to its high surgical volumes, skilled specialists, and robust R&D activities. Ongoing clinical research on 3D-printed and customized implants continues to strengthen market dominance in North America.

Europe

Europe held a 28.5% share in 2024, driven by a growing prevalence of chronic ear disorders and expanding use of biocompatible prosthetic materials. Countries like Germany, the U.K., and France have advanced ENT care networks and established training programs for otologic surgeons. Increasing awareness of hearing restoration procedures and the adoption of regulatory-approved, innovative implant materials are fueling regional growth. Government-backed healthcare initiatives and collaborations between research institutions and device manufacturers further enhance Europe’s position as a key contributor to global market development.

Asia-Pacific

Asia-Pacific accounted for a 22.8% share in 2024, emerging as one of the fastest-growing markets for partial ossicular replacement prostheses. The region’s growth is driven by rising healthcare investments, improving surgical access, and a large untreated population with hearing impairments. Countries such as China, India, and Japan are increasing adoption of cost-effective and locally produced implants. Expanding ENT specialty hospitals, growing medical tourism, and government initiatives promoting early diagnosis are accelerating market expansion. Technological collaborations with Western manufacturers are also supporting innovation in implant design and production.

Latin America

Latin America captured an 6.3% share in 2024, supported by the gradual expansion of ENT surgical infrastructure and improving access to advanced medical devices. Brazil and Mexico lead regional demand due to rising awareness of ear reconstruction procedures and availability of trained specialists. Market growth is further encouraged by public health initiatives addressing hearing loss. However, limited reimbursement frameworks and cost barriers still constrain adoption rates. Increasing partnerships between local distributors and global implant manufacturers are expected to enhance product availability and affordability across the region.

Middle East & Africa

The Middle East & Africa region represented a 5.2% share in 2024, driven by growing healthcare modernization and rising prevalence of ear infections. The Gulf Cooperation Council (GCC) countries are leading adoption through investments in advanced surgical centers and ENT training programs. South Africa and Egypt also show growing potential with increasing private healthcare spending. Despite lower penetration compared to developed markets, continuous government focus on hearing care and partnerships with international device suppliers are expected to improve accessibility and stimulate steady market growth in the coming years.

Market Segmentations:

By Material Type

- Titanium

- Hydroxyapatite

- Ceramic

- Others (Composite Materials, Stainless Steel, etc.)

By Product Type

- Partial Ossicular Replacement Prosthesis (PORP)

- Total Ossicular Replacement Prosthesis (TORP)

By Fixation Type

- Cemented Prosthesis

- Non-Cemented Prosthesis

By End Use

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty ENT Clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Partial Ossicular Replacement Prosthesis market features key players such as Medtronic plc, Olympus Corporation, Karl Storz SE & Co. KG, Grace Medical, Inc., Heinz Kurz GmbH Medizintechnik, Stryker Corporation, Spiggle & Theis Medizintechnik GmbH, Embody Medical Devices, Boston Medical Products, Inc., and OtoMedics Ltd. These companies focus on innovation in biocompatible materials, precise implant design, and enhanced acoustic performance to improve surgical outcomes. Market leaders are expanding their product portfolios through continuous R&D and collaborations with ENT specialists and research institutions. Titanium and hydroxyapatite prostheses remain the most competitive product categories, with growing adoption of patient-specific and 3D-printed implants. Regional expansion strategies, mergers, and partnerships with hospitals and surgical centers strengthen distribution networks. Rising competition among established and emerging players is driving cost optimization and technological innovation, positioning the market for steady long-term growth across advanced and developing healthcare systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Medtronic plc

- Olympus Corporation

- Karl Storz SE & Co. KG

- Grace Medical, Inc.

- Heinz Kurz GmbH Medizintechnik

- Stryker Corporation

- Spiggle & Theis Medizintechnik GmbH

- Embody Medical Devices

- Boston Medical Products, Inc.

- OtoMedics Ltd.

Recent Developments

- In September 2025, Olympus Corporation announced the U.S. launch of its VISERA S video-imaging platform for ENT applications, enhancing visualization during ossicular chain reconstruction procedures and aiding in partial prosthesis placement accuracy.

- In August 2024, Grace Medical, Inc. expanded its ALTO Titanium line of ossicular prostheses—both partial and total—with a patented measuring‐device system allowing length adjustment intra-operatively and trimming of the shaft to match patient anatomy.

- In July 2023, Embody Medical Devices (via academic partner) reported a novel passive middle-ear prosthesis featuring a ball-joint between headplate and shaft, showing comparable sound transmission to rigid designs.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Product Type, Fixation Type, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will increase due to the rising prevalence of hearing loss and middle ear disorders.

- Titanium and hydroxyapatite prostheses will continue leading the market because of superior biocompatibility.

- 3D printing and patient-specific implant design will enhance surgical precision and outcomes.

- Hospitals will remain the primary end users owing to the availability of advanced ENT surgical infrastructure.

- Technological innovations will focus on lightweight materials and improved acoustic performance.

- North America will retain its dominance with strong adoption rates and advanced healthcare systems.

- Asia-Pacific will witness the fastest growth due to expanding ENT care and medical tourism.

- Companies will strengthen collaborations with surgeons for product development and clinical validation.

- Cost reduction and broader reimbursement coverage will enhance accessibility in emerging markets.

- Regulatory support for biocompatible and customized implants will encourage global product approvals.