Market Overview

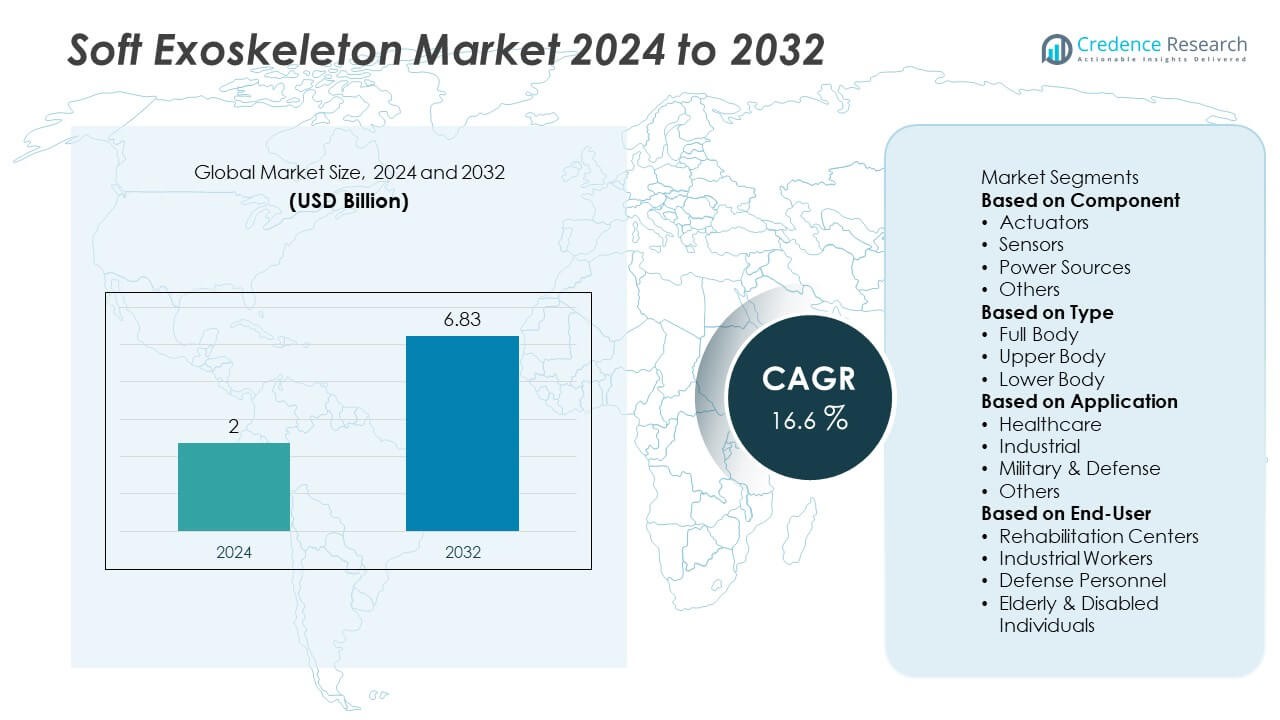

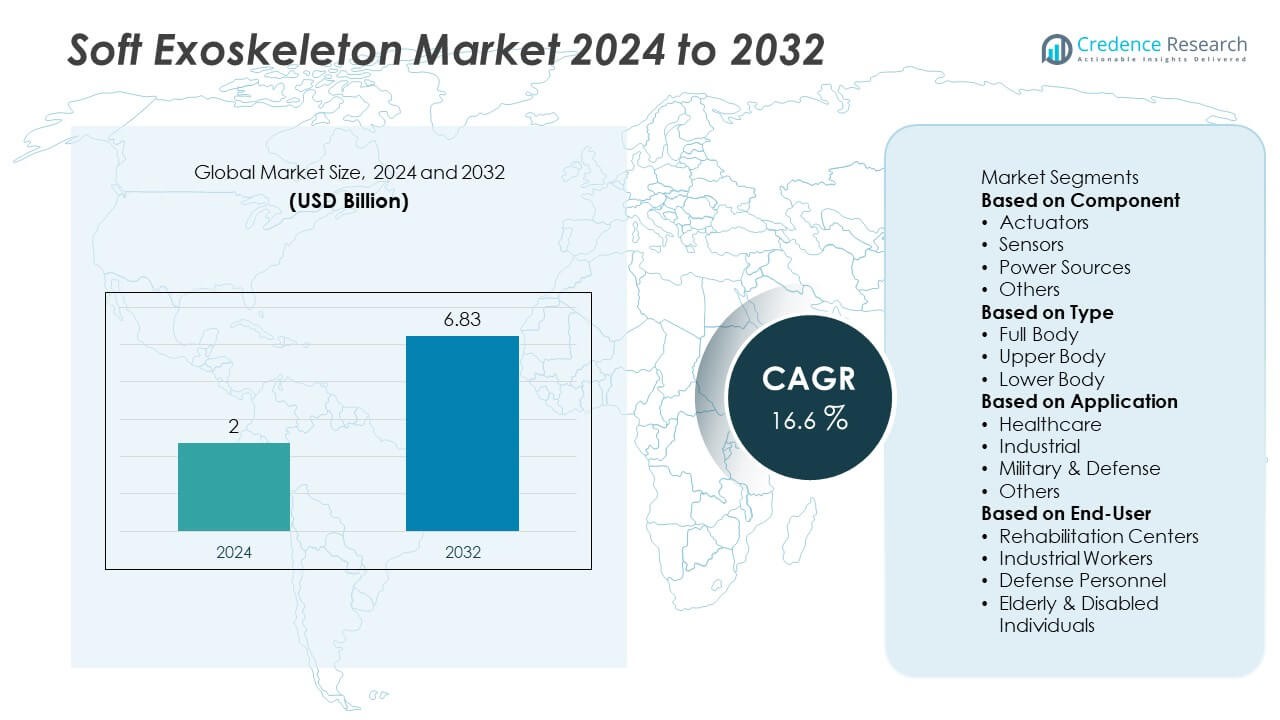

The Soft Exoskeleton Market was valued at USD 2 billion in 2024 and is projected to reach USD 6.83 billion by 2032, expanding at a CAGR of 16.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Soft Exoskeleton Market Size 2024 |

USD 2 Billion |

| Soft Exoskeleton Market, CAGR |

16.6% |

| Soft Exoskeleton Market Size 2032 |

USD 6.83 Billion |

The Soft Exoskeleton Market is led by key players including ReWalk Robotics Ltd., Ekso Bionics Holdings Inc., Bionik Laboratories Corp., Ottobock SE & Co. KGaA, Honda Motor Co. Ltd., Cyberdyne Inc., Samsung Electronics Co. Ltd., Roam Robotics, Daiya Industry Co. Ltd., and Lockheed Martin Corporation. These companies dominate the market through continuous innovation in wearable robotics, AI-based motion assistance, and ergonomic exosuit design. North America led the market with a 39.4% share in 2024, supported by strong R&D investments and healthcare adoption. Europe followed with a 27.8% share, driven by rehabilitation and industrial demand, while Asia-Pacific accounted for 24.6%, fueled by technological advancements and rising elderly populations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Soft Exoskeleton Market was valued at USD 2 billion in 2024 and is projected to reach USD 6.83 billion by 2032, growing at a CAGR of 16.6%.

- Rising adoption in healthcare and rehabilitation applications drives market growth, with the healthcare segment holding a 48.9% share in 2024 due to increasing use in mobility recovery and therapy.

- Technological advancements such as AI integration, soft robotics, and lightweight actuators are key trends enhancing device comfort and energy efficiency.

- Leading players including ReWalk Robotics, Ekso Bionics, and Cyberdyne Inc. focus on innovation, partnerships, and product launches to strengthen their global presence.

- North America led the market with a 39.4% share, followed by Europe (27.8%) and Asia-Pacific (24.6%), driven by strong R&D investments, industrial automation, and expanding healthcare infrastructure.

Market Segmentation Analysis:

By Component

The actuators segment dominated the soft exoskeleton market in 2024 with a 42.7% share. Actuators play a vital role in converting electrical energy into mechanical motion, enabling precise movement assistance. The growing use of compact, lightweight actuators in wearable robotics enhances flexibility and comfort for users. Ongoing advancements in pneumatic, hydraulic, and electroactive polymer-based actuators further improve power efficiency and responsiveness. Meanwhile, the sensors segment is gaining traction due to rising integration of motion, pressure, and biofeedback sensors for real-time performance monitoring and adaptive control.

- For instance, Roam Robotics developed the “Ascend” soft knee orthosis powered by a proprietary air compression system that uses a compliant air actuator made of woven fabrics to deliver support, with an internal engineering requirement of providing >7 Nm of torque at extension and >17 Nm at flexion to reduce strain on quadriceps and provide pain relief during daily activities like walking and climbing stairs.

By Type

The lower body soft exoskeleton segment held the largest share of 51.2% in 2024, driven by its widespread use in mobility assistance and rehabilitation applications. These devices aid patients with spinal cord injuries, stroke recovery, and muscle weakness by improving gait and stability. Demand is also increasing in industrial settings to reduce lower-limb fatigue during manual labor. Upper body and full-body types are also expanding, supported by their growing use in logistics, construction, and defense for load lifting and endurance enhancement.

- For instance, Lifeward Ltd. (formerly ReWalk Robotics) has developed personal exoskeletons like the ReWalk Personal 6.0 and the newer ReWalk 7, which clinical research has shown can enable users to achieve walking speeds up to 0.71 m/s and whose battery can support continuous walking sessions of over 1.5 hours

By Application

The healthcare segment led the soft exoskeleton market with a 48.9% share in 2024, fueled by increasing adoption in rehabilitation centers and hospitals for patient mobility restoration. These devices assist individuals with neurological disorders and post-surgery recovery, improving physical therapy outcomes. The industrial segment follows closely, supported by ergonomic applications that reduce worker fatigue and injury. Military and defense applications are growing steadily as soft exosuits enhance soldier endurance, strength, and agility without compromising flexibility, reflecting their strategic importance across sectors.

Key Growth Drivers

Rising Adoption in Rehabilitation and Healthcare

The increasing use of soft exoskeletons in rehabilitation and physical therapy drives market growth. These devices assist patients recovering from neurological disorders, spinal cord injuries, or strokes by improving mobility and muscle strength. Hospitals and rehabilitation centers are adopting wearable robotics to enhance patient outcomes and reduce caregiver strain. The demand for non-invasive, comfortable, and lightweight solutions continues to expand as populations age and the incidence of mobility impairments rises globally.

- For instance, Ekso Bionics Holdings, Inc. integrated adaptive gait training in its EksoNR model, capturing more than 500 data samples per second to dynamically adjust movement assistance in stroke recovery.

Technological Advancements in Soft Robotics and AI Integration

Continuous improvements in soft robotics, materials science, and artificial intelligence are transforming soft exoskeleton performance. AI-driven control systems enable real-time motion adaptation, improving user comfort and energy efficiency. The integration of lightweight actuators and smart sensors enhances natural movement and precise support. These technological innovations reduce weight, increase flexibility, and expand usability across healthcare, industrial, and defense applications, positioning soft exoskeletons as a key innovation in wearable robotics.

- For instance, Cyberdyne Inc.’s HAL® system uses proprietary signal processing to detect bioelectrical signals generated from the user’s central nervous system in real time, enabling voluntary motion through synchronized robotic assistance. This establishes an interactive bio-feedback (iBF) loop that facilitates functional improvement.

Growing Industrial Demand for Ergonomic Solutions

Industries such as manufacturing, logistics, and construction are increasingly deploying soft exoskeletons to enhance worker safety and efficiency. These systems reduce fatigue and musculoskeletal injuries by supporting repetitive and physically demanding tasks. The rising focus on occupational health, productivity, and worker well-being drives adoption in large-scale operations. Companies view wearable assistive devices as cost-effective tools to reduce downtime and improve workforce sustainability, strengthening the industrial application segment’s growth trajectory.

Key Trends & Opportunities

Expansion of Wearable Robotics in Defense and Military Applications

Soft exoskeletons are gaining traction in military applications to enhance soldier endurance, load-bearing capacity, and agility. Defense agencies are investing in lightweight, energy-efficient exosuits that improve mobility and reduce fatigue during extended missions. The use of soft materials ensures comfort and adaptability in combat environments. Increased funding for wearable defense technologies presents significant growth opportunities for global manufacturers and research institutions developing advanced motion-assist systems.

- For instance, Daiya Industry Co., Ltd. supplies the unpowered assist suit series (including models like the DARWING Hakobelude), which are used to aid logistics and load carriage operations during field activities and disaster relief.

Integration of Smart Materials and Energy-Efficient Designs

Advances in smart materials, such as electroactive polymers and shape-memory alloys, are enabling more efficient and flexible soft exoskeletons. These innovations reduce power consumption while improving responsiveness and user comfort. The trend toward energy recovery systems and compact battery designs supports longer operation times. Manufacturers focusing on eco-friendly materials and sustainable energy systems are well-positioned to capture emerging opportunities in both healthcare and industrial sectors.

- For instance, Samsung Electronics Co., Ltd. developed the hip-mounted Bot Fit wearable robot, which weighs approximately 2.9 kg and uses a rechargeable lithium-ion battery for walking assistance.

Key Challenges

High Cost and Limited Commercial Accessibility

The development and production of soft exoskeletons involve complex technology and expensive materials, leading to high costs. This limits widespread adoption, particularly in small clinics, emerging markets, and mid-scale industries. Maintenance and customization requirements further add to operational expenses. Manufacturers face pressure to reduce production costs through scalable designs and modular components while maintaining performance standards.

Power Limitations and Battery Life Constraints

Despite technological advancements, limited battery capacity remains a key challenge affecting long-duration applications. Continuous operation requires high energy efficiency and lightweight power systems, which are difficult to balance. Insufficient battery endurance restricts mobility and reduces practicality in industrial and defense uses. Research efforts are focused on developing compact, long-lasting energy storage solutions to enhance system reliability and user convenience.

Regional Analysis

North America

North America held the largest share of the soft exoskeleton market in 2024, accounting for 39.4%. The region’s dominance is driven by strong investments in healthcare robotics, defense innovation, and industrial automation. The United States leads adoption due to a mature rehabilitation infrastructure and extensive research funding from defense organizations such as DARPA. Increasing workplace safety regulations and demand for ergonomic wearables across industries are accelerating market expansion. Partnerships between medical institutions and robotics manufacturers further support commercialization and clinical use of assistive exoskeletons.

Europe

accounted for a 27.8% share of the soft exoskeleton market in 2024, driven by strong healthcare adoption and regulatory support for robotic rehabilitation devices. Countries such as Germany, France, and the United Kingdom are key markets, emphasizing mobility assistance technologies for aging populations. The European Union’s focus on workplace safety and investment in assistive robotics programs further strengthen growth. Industrial demand for wearable robotics to prevent worker injuries is increasing, while healthcare systems are integrating soft exosuits to improve patient mobility outcomes.

Asia-Pacific

Asia-Pacific captured a 24.6% share of the soft exoskeleton market in 2024, supported by rapid growth in healthcare infrastructure and industrial automation. China, Japan, and South Korea are leading adopters due to technological innovation and government funding for robotics development. Rising elderly populations and growing rehabilitation needs are fueling adoption in medical sectors. The presence of cost-efficient manufacturing hubs and increasing use of assistive technologies across industries are boosting regional competitiveness. Expanding R&D efforts in AI-driven soft robotics further strengthen market growth in the region.

Latin America

Latin America represented a 5.1% share of the soft exoskeleton market in 2024. Market growth is supported by expanding healthcare accessibility and increasing awareness of rehabilitation technologies. Brazil and Mexico are key contributors, focusing on affordable wearable robotics for medical and industrial use. Partnerships between global robotics firms and local distributors are helping accelerate product entry and adoption. Although cost and technology barriers persist, ongoing investments in healthcare modernization and worker safety initiatives are creating new opportunities across the region.

Middle East & Africa

The Middle East & Africa accounted for a 3.1% share of the soft exoskeleton market in 2024. Growth is driven by increasing demand for advanced rehabilitation systems in countries such as Saudi Arabia, the UAE, and South Africa. Rising healthcare investments and partnerships with global robotic solution providers are expanding access to soft exosuit technologies. The adoption of industrial exoskeletons is growing in oil, gas, and construction sectors to enhance worker safety and productivity. However, limited local manufacturing capacity and high equipment costs continue to restrict large-scale deployment.

Market Segmentations:

By Component

- Actuators

- Sensors

- Power Sources

- Others

By Type

- Full Body

- Upper Body

- Lower Body

By Application

- Healthcare

- Industrial

- Military & Defense

- Others

By End-User

- Rehabilitation Centers

- Industrial Workers

- Defense Personnel

- Elderly & Disabled Individuals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Soft Exoskeleton Market is defined by the strong presence of leading companies such as ReWalk Robotics Ltd., Ekso Bionics Holdings Inc., Bionik Laboratories Corp., Ottobock SE & Co. KGaA, Honda Motor Co. Ltd., Cyberdyne Inc., Samsung Electronics Co. Ltd., Roam Robotics, Daiya Industry Co. Ltd., and Lockheed Martin Corporation. These players are focusing on innovation in lightweight materials, advanced sensors, and AI-driven motion control systems to enhance user comfort and functionality. Strategic collaborations between robotics manufacturers, medical institutions, and defense agencies are accelerating product development and commercialization. Companies are investing heavily in R&D to create flexible, low-power, and ergonomic designs for healthcare rehabilitation and industrial support applications. Additionally, market leaders are expanding their global presence through mergers, partnerships, and government-funded projects aimed at advancing wearable robotics for mobility assistance, workforce productivity, and military endurance enhancement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ReWalk Robotics Ltd.

- Ekso Bionics Holdings, Inc.

- Bionik Laboratories Corp.

- Ottobock SE & Co. KGaA

- Honda Motor Co., Ltd.

- Cyberdyne Inc.

- Samsung Electronics Co., Ltd.

- Roam Robotics

- Daiya Industry Co., Ltd.

- Lockheed Martin Corporation

Recent Developments

- In June 2025, Ekso Bionics Holdings, Inc. announced its acceptance into the NVIDIA Connect Program, and disclosed an early proof‐of‐concept for an AI voice agent user interface intended to support exoskeleton device operation, motivation, training and safety.

- In April 2025, Lifeward Ltd. announced that a major U.S. health insurance company approved payment for the “ReWalk 7 Personal Exoskeleton” for a spinal‐cord‐injury beneficiary — marking the first payer coverage of that device in the U.S.

- In August 2024, Cyberdyne Inc.’s HYBRID ASSISTIVE LIMB (HAL®) soft‐exoskeleton technology continued advanced use in rehabilitation and industrial settings; Cyberdyne remains active in Japan and overseas clinics.

- In February 2024, Samsung indicated its plans to mass‐produce fewer than 100,000 units of its Bot Fit wearable robot in anticipation of mid-2024 production.

Report Coverage

The research report offers an in-depth analysis based on Type, Component, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with increasing adoption of wearable robotics in rehabilitation.

- Technological advancements in AI and soft robotics will enhance device performance and comfort.

- Healthcare applications will remain dominant due to growing demand for mobility assistance.

- Industrial usage will rise as companies prioritize worker safety and productivity.

- Defense sectors will adopt soft exosuits to improve soldier endurance and mobility.

- North America will maintain leadership supported by strong research and government funding.

- Asia-Pacific will emerge as the fastest-growing region with rising healthcare investments.

- Europe will expand through regulatory support for assistive and rehabilitation technologies.

- Manufacturers will focus on lightweight, energy-efficient, and user-friendly designs.

- Partnerships between robotics firms and healthcare institutions will accelerate commercialization.