Market Overview

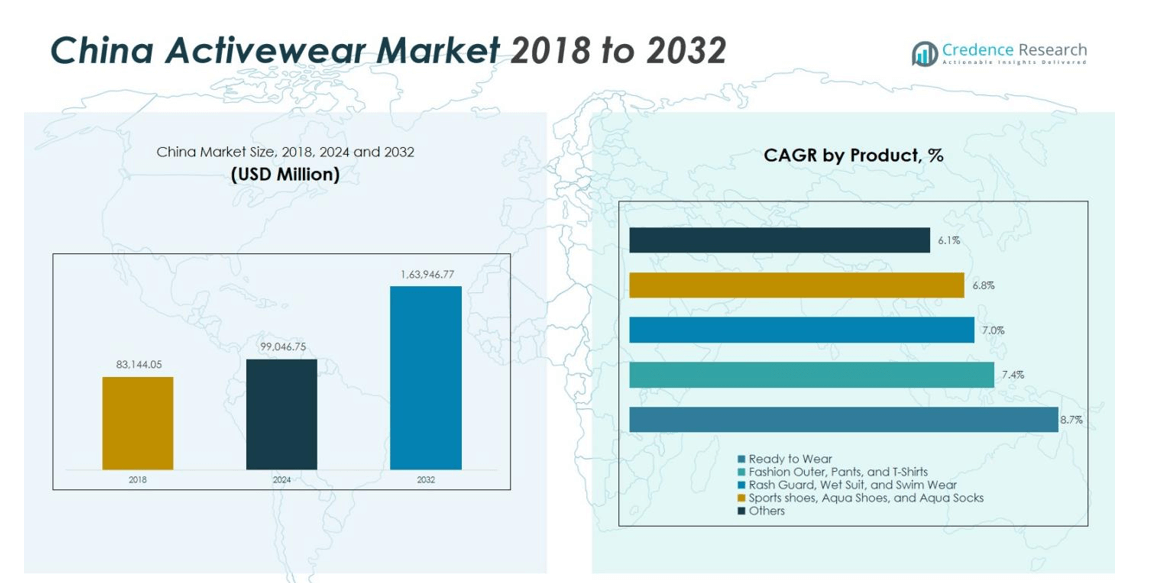

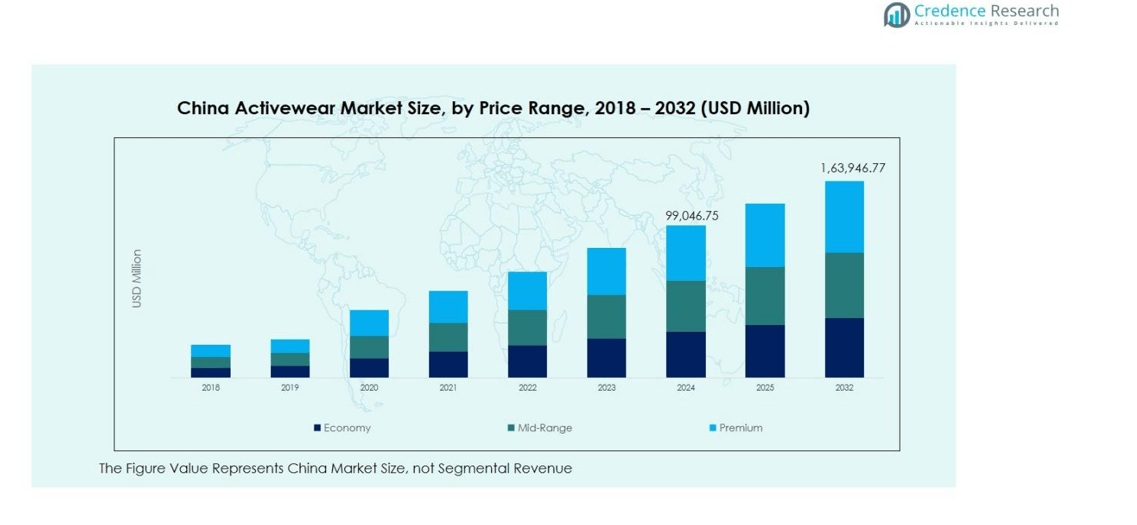

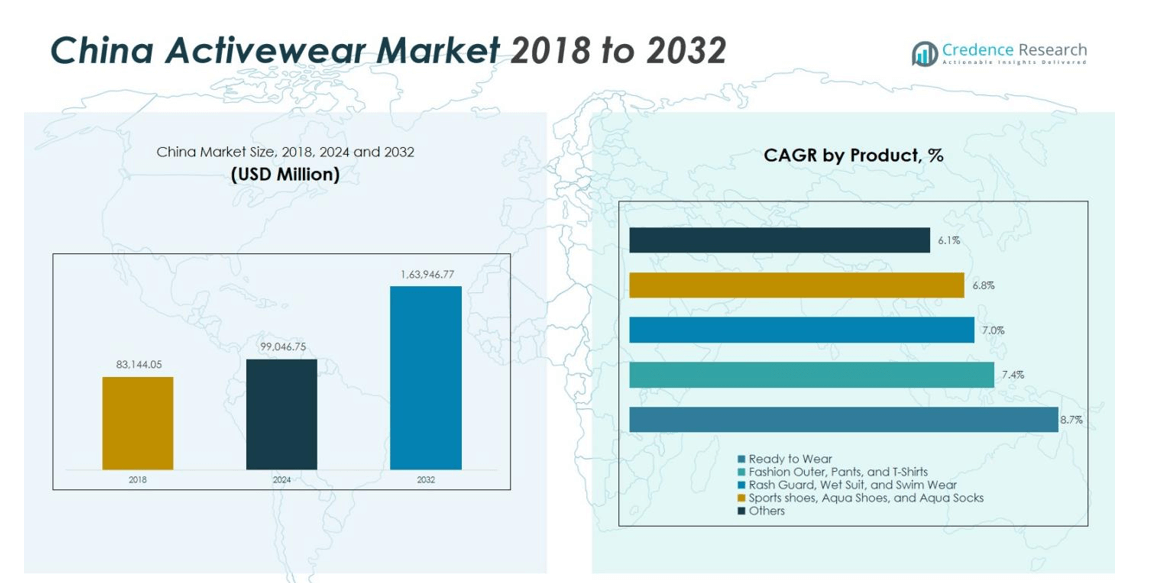

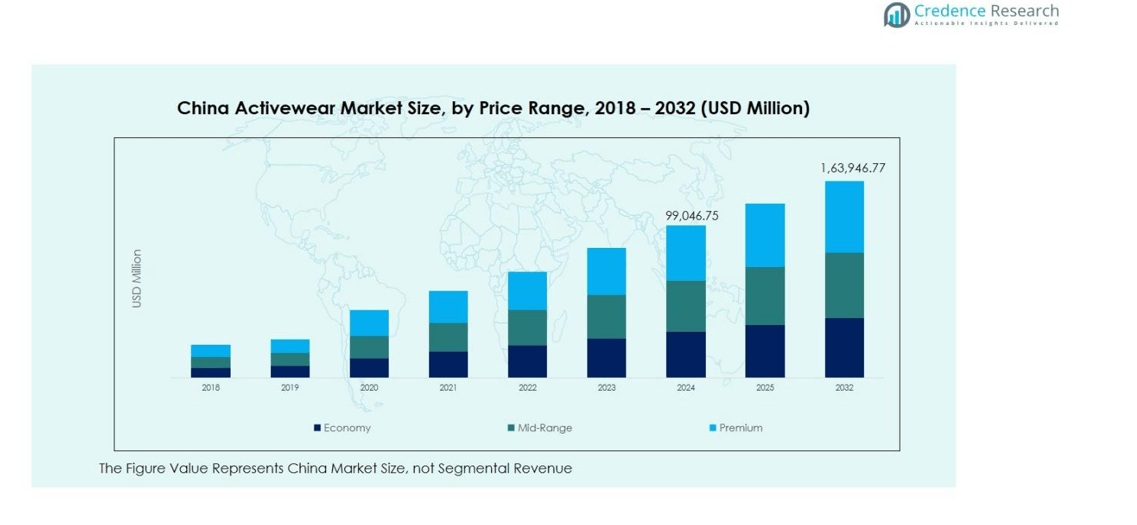

The China Activewear Market size was valued at USD 83,144.05 Million in 2018, increased to USD 99,046.75 Million in 2024, and is anticipated to reach USD 163,946.77 Million by 2032, at a CAGR of 6.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Activewear Market Size 2024 |

USD 99,046.75 Million |

| China Activewear Market, CAGR |

6.50% |

| China Activewear Market Size 2032 |

USD 163,946.77 Million |

The China Activewear Market is dominated by key players such as Anta Sports, Li-Ning, Nike China, Adidas China, and Under Armour China, who have established a strong presence through innovative products and extensive retail networks. Anta Sports and Li-Ning lead the domestic segment, catering to local preferences and offering performance-focused activewear. International giants Nike and Adidas continue to capture the premium segment with their global recognition and premium offerings. The market is also influenced by growing brands like Xtep International Holdings and Decathlon China, which are expanding their footprint in the region. In 2024, Eastern China holds the largest market share of 40%, driven by rapid urbanization, higher disposable incomes, and a strong fitness culture, particularly in cities such as Shanghai, Beijing, and Hangzhou. This region remains pivotal in shaping the growth trajectory of the China Activewear Market.

Market Insights

- The China Activewear Market reached USD 99,046.75 million in 2024 and is projected to grow at a CAGR of 6.50% through 2032.

- Growing health awareness and athleisure trends in urban China drive the Ready to Wear segment to hold a 40% market share, while Polyester dominates the fabric segment with 45% market share.

- E‑commerce expansion, sustainable material adoption, and smart‑fabric innovations position the market to benefit from shifting consumer behavior and technology‑driven apparel.

- Intense rivalries among domestic giants such as Anta Sports and Li‑Ning and global leaders including Nike China and Adidas China raise barriers to entry, while counterfeit products and quality concerns restrain market expansion.

- Eastern China commands the largest regional share at 40% in 2024, supported by higher disposable incomes and fitness culture, with Southern China holding 25%, Northern China 18%, Western China 10%, and Central China 7%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The China Activewear Market is diverse, with key product categories including Ready to Wear, Fashion Outer, Pants, and T-Shirts, Rash Guard, Wet Suit, and Swim Wear, and Sports Shoes, Aqua Shoes, and Aqua Socks. Among these, the Ready to Wear sub-segment dominates the market, holding a substantial share of 40% in 2024. This segment’s growth is fueled by the increasing demand for versatile, stylish, and comfortable activewear suitable for both daily wear and fitness activities. The rising health and fitness awareness in China, along with the growing trend of athleisure, continues to propel the demand for ready-to-wear activewear.

- For instance, Xtep Group sponsored 44 marathons across China in 2024, promoting its running shoes and connecting with fitness enthusiasts nationwide.

By Fabric

In the fabric segment, Polyester leads with the largest market share, commanding 45% in 2024. Polyester is preferred for its durability, moisture-wicking properties, and affordability, making it an ideal fabric for activewear. The widespread use of polyester in various activewear items, from leggings to sports bras, is a key factor driving its market dominance. Furthermore, advancements in fabric technology, such as eco-friendly recycled polyester, are enhancing its appeal among environmentally conscious consumers seeking sustainable yet functional materials for their activewear.

- For instance, Under Armour has committed to increasing recycled polyester use, with over 300 products featuring recycled polyester last fiscal year, including their Tech Tee and Armour Fleece lines made from 100% recycled polyester.

By Material

The Synthetic material segment leads the market, holding 60% of the market share in 2024. Synthetic materials, particularly polyester and spandex, are favored for their stretchability, durability, and performance-enhancing features. These materials offer excellent flexibility, moisture management, and breathability, making them ideal for activewear. As consumers increasingly prioritize comfort and performance in their fitness apparel, the demand for synthetic materials continues to rise, further solidifying their dominance in the China Activewear Market.

Key Growth Drivers

Rising Health and Fitness Awareness

The increasing awareness of health and fitness among Chinese consumers is a key growth driver for the activewear market. As more individuals adopt fitness routines and prioritize a healthy lifestyle, demand for comfortable and performance-oriented activewear rises. This growing health consciousness, particularly among millennials and Gen Z, drives a shift toward athleisure as consumers seek versatile apparel that can transition from the gym to daily wear. The government’s focus on promoting physical activities through national health campaigns also supports the rise of fitness culture, further fueling market growth.

- For instance, Li-Ning integrates advanced moisture-wicking TurboDri technology in its Freestyle Tees to enhance comfort during workouts, catering to fitness enthusiasts seeking high-performance apparel.

Athleisure Trend and Fashion Integration

The blending of athletic and casual fashion, commonly known as athleisure, is a significant driver in the China Activewear Market. This trend has reshaped consumer perceptions of activewear, making it not only suitable for fitness but also for casual and work environments. As fashion-conscious consumers look for stylish yet functional clothing, activewear brands are increasingly offering versatile designs that cater to both performance and everyday wear. The widespread acceptance of athleisure in urban China, especially among young professionals, has contributed to substantial market growth.

- For instance, Nike’s localized product launches in China include the Spring Festival collection with styles inspired by traditional Chinese culture.

Technological Advancements in Activewear Fabrics

Innovations in fabric technology play a crucial role in driving the China Activewear Market. Advances in materials such as moisture-wicking, quick-drying fabrics, and eco-friendly options like recycled polyester enhance the performance and sustainability of activewear. Additionally, the use of smart fabrics that improve comfort and flexibility, along with the incorporation of features like UV protection and temperature regulation, attracts consumers who prioritize both performance and eco-conscious choices. These technological advancements make activewear more appealing and drive the demand for functional, high-performance apparel.

Key Trends & Opportunities

Rise of Online Retail Channels

The growth of e-commerce is rapidly reshaping the distribution landscape of the China Activewear Market. As more consumers turn to online platforms for convenience and variety, brands are increasingly focusing on expanding their online presence. The ease of browsing, personalized recommendations, and direct-to-consumer models offered by online retailers have become significant drivers of sales in the activewear sector. The rise of social media and influencer marketing further boosts online sales by reaching targeted, fitness-focused demographics and increasing consumer engagement with brands.

- For instance, Adidas uses augmented reality for virtual shoe try-ons and leverages live streaming on Tmall to launch new products, engaging millions of viewers effectively.

Sustainability and Eco-conscious Consumer Preferences

Sustainability is becoming a key trend in the China Activewear Market, as consumers increasingly prioritize environmentally friendly products. The growing preference for eco-conscious materials, such as recycled fabrics and organic cotton, is influencing purchasing decisions. Brands that incorporate sustainable practices, such as reducing carbon footprints and adopting circular economy models, are gaining a competitive edge. As more Chinese consumers demand transparency in production processes, the focus on sustainable manufacturing and product life-cycle management presents a significant opportunity for market growth.

- For instance, Ninghow Apparel, a sustainable clothing manufacturer in China, which partners with brands to produce eco-friendly activewear using GRS-certified recycled polyester and low-water dyeing technologies, delivering market-ready prototypes within a month.

Key Challenges

Intense Competition Among Domestic and International Brands

The China Activewear Market faces intense competition from both domestic and international brands, making it challenging for companies to establish a strong foothold. Domestic players such as Li-Ning and Anta Sports have a well-established presence, while international giants like Nike and Adidas continue to dominate the premium segment. This competitive landscape requires activewear companies to constantly innovate, differentiate their products, and engage in aggressive marketing campaigns to capture consumer attention. The pressure from both local and global brands complicates market entry and profitability for new players.

Counterfeit and Low-quality Products

The prevalence of counterfeit and low-quality activewear products is a significant challenge in the China market. Many consumers are attracted to cheaper alternatives, which are often sold through online platforms or unbranded retail stores. These counterfeit products not only undermine the profitability of legitimate brands but also pose a threat to consumer trust and brand reputation. To combat this issue, activewear brands must invest in authentication technology, strict quality control measures, and brand protection strategies, while also educating consumers about the risks of purchasing counterfeit goods.

Regional Analysis

Eastern China

Eastern China holds the largest share of the China Activewear Market, accounting for 40% of the total market in 2024. This region’s dominance is driven by the rapid urbanization, high disposable incomes, and a strong inclination toward fitness and wellness among consumers. Cities like Shanghai, Beijing, and Hangzhou are hotspots for activewear demand, where consumers increasingly adopt athleisure for both fitness and daily wear. The presence of key retail hubs and a growing middle-class population further contribute to the region’s market growth, making it a key player in shaping the overall market dynamics.

Southern China

Southern China represents a significant portion of the activewear market, holding 25% of the market share in 2024. This region benefits from a high concentration of affluent consumers in cities like Guangzhou and Shenzhen, who are increasingly adopting active lifestyles. The warm climate of Southern China also supports the demand for lightweight and breathable activewear. With growing health awareness and a shift towards more casual, functional apparel, the demand for activewear is expected to continue rising, particularly in the urban centers, where fitness culture and athleisure are gaining widespread popularity.

Northern China

Northern China holds 18% of the China Activewear Market share in 2024. The region’s market is characterized by a mix of traditional fitness culture and the rising trend of athleisure among younger populations. Cities such as Beijing and Tianjin are seeing an increasing number of fitness centers and activewear stores, contributing to the growth of the market. Additionally, the region benefits from a strong retail presence and a growing demand for both casual and performance-focused activewear. As disposable income continues to rise in the region, the market for activewear is expected to expand steadily.

Western China

Western China, though accounting for 10% of the market share in 2024, is showing rapid growth in activewear demand. The region’s market is primarily driven by emerging urban centers such as Chengdu and Xi’an, where there is a rising interest in fitness and wellness. The growing middle-class population and increased investment in infrastructure have made activewear more accessible. As the region continues to urbanize and more consumers adopt active lifestyles, the demand for activewear is expected to increase, albeit at a slower pace than in more developed eastern regions.

Central China

Central China holds 7% of the market share in 2024, with cities like Wuhan and Zhengzhou leading the activewear market in the region. While the market is smaller compared to other regions, it is experiencing steady growth due to the rise in health consciousness and fitness activities. The region benefits from its central location, which allows for easier distribution and retail expansion. As more consumers in central China adopt fitness-focused lifestyles, the demand for activewear, particularly affordable and versatile options, is expected to continue expanding, contributing to the overall growth of the market.

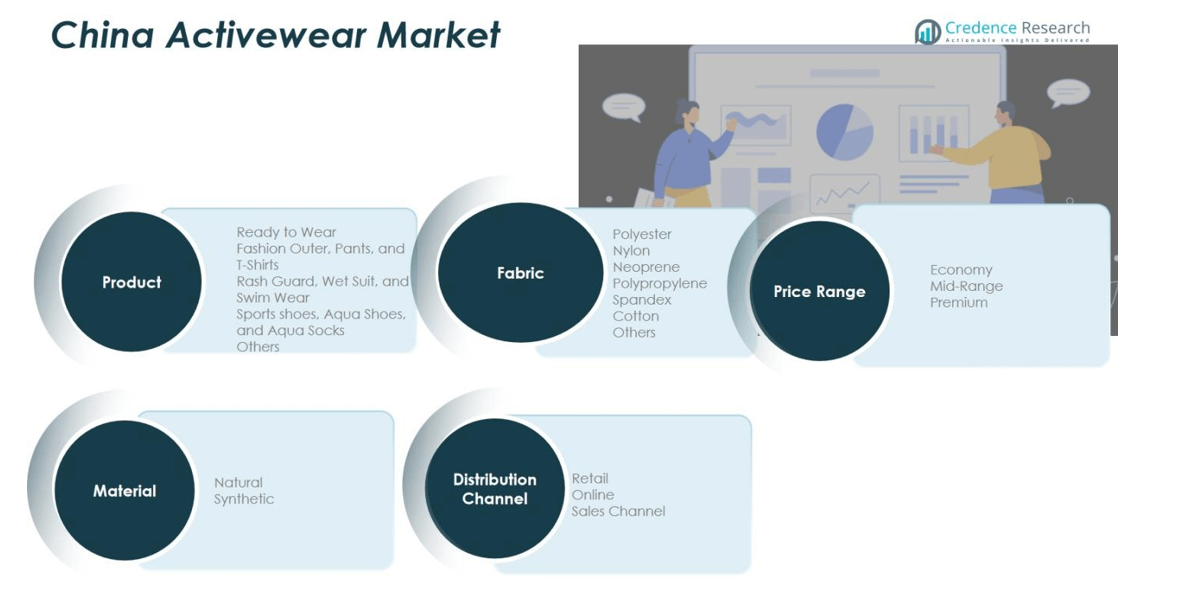

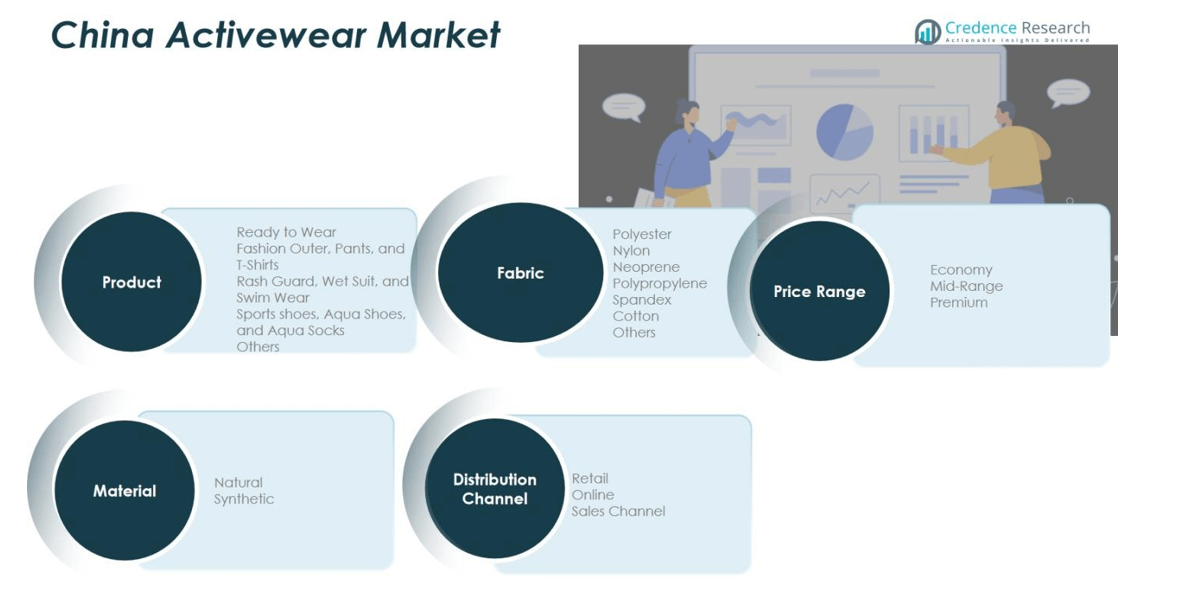

Market Segmentations:

By Product

- Ready to Wear

- Fashion Outer, Pants, and T-Shirts

- Rash Guard, Wet Suit, and Swim Wear

- Sports Shoes, Aqua Shoes, and Aqua Socks

- Others

By Fabric

- Polyester

- Nylon

- Neoprene

- Polypropylene

- Spandex

- Cotton

- Others

By Material :

By Price Range :

- Economy

- Mid-Range

- Premium

By Distribution Channel

By Region

- Eastern China

- Southern China

- Western China

- Northern China

- Central China

Competitive Landscape

Competitive analysis in the China Activewear Market is dominated by major players such as Anta Sports, Li-Ning, Nike, Adidas, and Under Armour, who hold a significant share of the market. These brands are leveraging strong retail networks, innovative product designs, and strategic partnerships to maintain their competitive edge. Domestic brands like Anta Sports and Li-Ning are particularly strong, focusing on high-performance activewear tailored to the local consumer’s needs, while global giants like Nike and Adidas continue to dominate the premium segment with their global presence and brand recognition. E-commerce platforms have become increasingly important, with companies investing in direct-to-consumer models and online sales channels to reach the growing number of digital shoppers. Furthermore, the market is also seeing the rise of niche players focusing on sustainable and eco-friendly products, catering to the growing demand for environmentally conscious activewear. As competition intensifies, product innovation, brand loyalty, and strategic marketing will play key roles in shaping the future dynamics of the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Anta Sports

- Li-Ning

- Xtep International Holdings

- ERKE (Hongxing Erke Group)

- Peak Sport Products

- MAIA Active

- Topsports International

- Decathlon China

- Under Armour China

- Nike China

- Adidas China

- Skechers China

- Lululemon China

- Bosideng Sports

Recent Developments

- In June 2025, CRAFT launched immersive pop‑up experiences in China (Shanghai and Nanjing) to strengthen its brand presence and high‑performance apparel offering.

- In August 2025, ANTA Sports Products Limited and Musinsa Co., Ltd announced the creation of a joint venture “Musinsa China”, with Musinsa holding 60 % and ANTA 40 %, for online/offline expansion of Musinsa in China.

- In April 2025, Decathlon Group announced it plans to sell about 30% stake in its China business, in a deal valued at around US $1 billion or more.

Report Coverage

The research report offers an in-depth analysis based on Product, Fabric, Material, Price Range, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The China Activewear Market is expected to continue its strong growth trajectory, driven by increasing health consciousness and the adoption of fitness lifestyles.

- Athleisure will remain a dominant trend, with consumers increasingly seeking versatile activewear that blends performance with style for both fitness and casual wear.

- E-commerce and online retail channels will experience rapid growth, as more consumers turn to digital platforms for convenience and a wider selection of products.

- Sustainable and eco-friendly activewear will gain significant traction, with brands focusing on using recycled materials and reducing their environmental impact.

- Innovations in fabric technology, such as moisture-wicking, temperature-regulating, and breathable materials, will drive product development and enhance consumer demand.

- The demand for premium and high-performance activewear will grow, especially among affluent and urban consumers seeking advanced features and quality.

- The increasing popularity of fitness-focused lifestyles, including outdoor and water sports, will contribute to a rise in demand for specialized activewear like wetsuits and sports shoes.

- Domestic activewear brands will strengthen their market positions through localized product offerings and improved brand strategies to compete with international players.

- The younger generation, particularly millennials and Gen Z, will continue to drive market growth, as they prioritize fitness, comfort, and fashion in their activewear purchases.

- Urbanization and rising disposable incomes in lower-tier cities will open new growth opportunities, expanding the market beyond the major metropolitan areas.