Market Overview

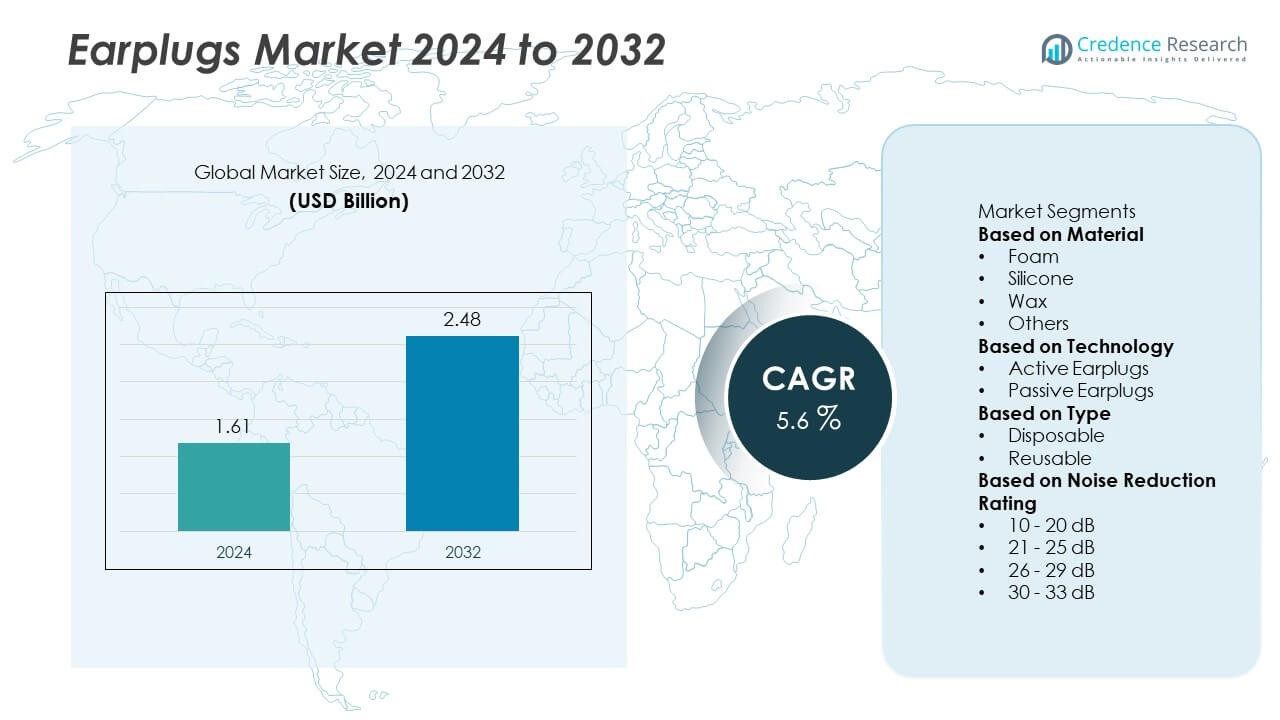

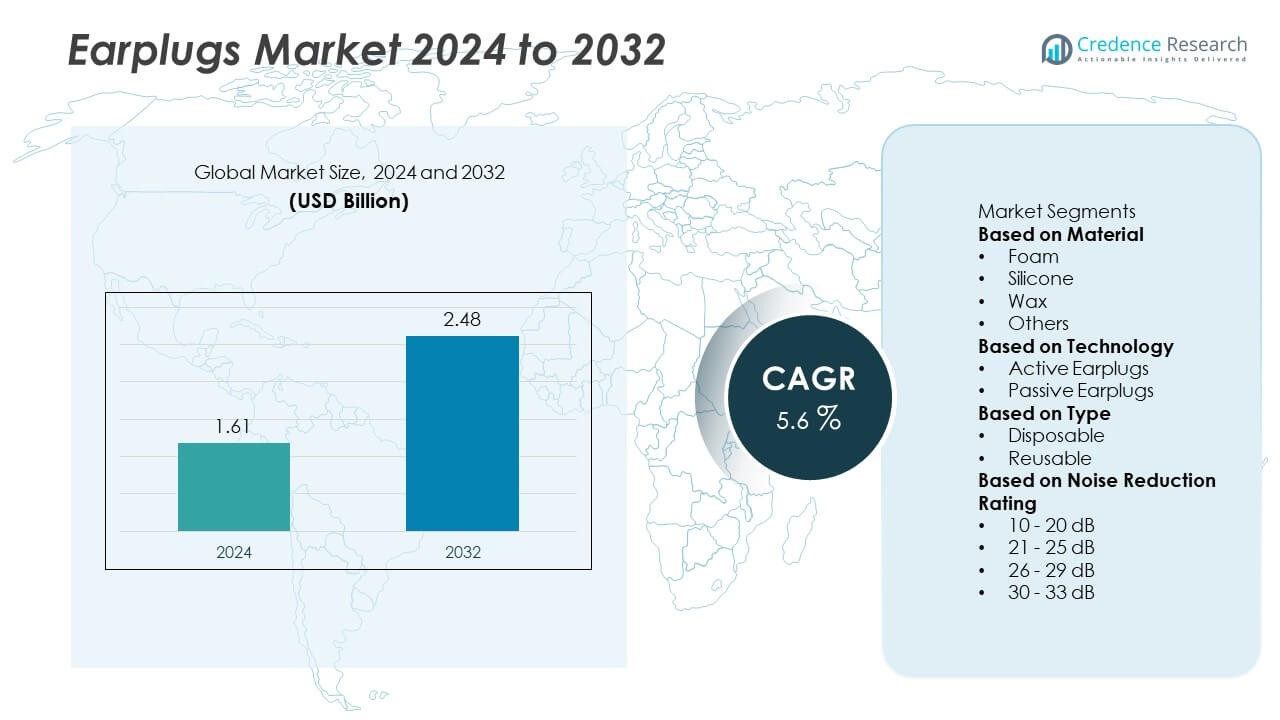

The Earplugs market was valued at USD 1.61 billion in 2024 and is anticipated to reach USD 2.48 billion by 2032, growing at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Earplugs Market Size 2024 |

USD 1.61 Billion |

| Earplugs Market, CAGR |

5.6% |

| Earplugs Market Size 2032 |

USD 2.48 Billion |

The top players in the earplugs market include 3M, Honeywell International Inc., Moldex-Metric, and UVEX SAFETY GROUP, who collectively hold a significant share of the market. 3M leads the market with its wide range of earplugs for both industrial and consumer use, supported by its strong distribution network and brand recognition. Honeywell International Inc. focuses on advanced ear protection solutions, including smart earplugs, gaining traction in industrial and professional markets. Moldex-Metric and UVEX SAFETY GROUP remain key players in industrial applications, known for their durable and high-performance products. North America dominates the global market, with a market share of 35.2%, driven by stringent safety regulations and growing consumer awareness. Europe follows closely with 28.7% market share, fueled by regulatory standards and a focus on eco-friendly products. Asia-Pacific, with 24.9% market share, is rapidly growing due to industrialisation and urbanisation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global earplugs market was valued at USD 1.61 billion in 2024 and is projected to reach USD 2.48 billion by 2032, growing at a CAGR of 5.6% during the forecast period.

- Key drivers include increasing awareness of noise-induced hearing loss, stringent occupational safety regulations, and rising urbanisation, contributing to higher demand across both industrial and consumer segments.

- Market trends highlight a growing shift towards reusable and comfort-oriented earplugs, with materials like silicone and wax gaining popularity, while technological innovations in smart earplugs provide new opportunities.

- The competitive landscape is marked by strong players such as 3M, Honeywell International, and Moldex-Metric, who leverage product innovation, brand recognition, and robust distribution channels to maintain market dominance.

- Regionally, North America leads with 35.2% market share, followed by Europe at 28.7%, and Asia-Pacific with 24.9%, driven by industrialisation, regulatory frameworks, and urbanisation in key markets.

Market Segmentation Analysis:

By Material

The foam sub‑segment held the largest share in the earplugs market, accounting for 43.0% of the total market in 2024. Foam earplugs continue to dominate due to their cost-effectiveness, ease of use, and superior noise reduction capabilities, particularly in industrial environments and loud workplaces. Additionally, foam’s soft and moldable nature offers increased comfort for extended wear. Silicone and wax materials, however, are gaining popularity, driven by the growing preference for reusable products. These materials are valued for their water-resistant properties, hygienic benefits, and comfort, making them ideal for travel and personal use. The shift towards eco-friendly alternatives also supports their growth.

- For instance, 3M, a leader in the earplug industry, has developed the 3M™ E-A-R™ Classic earplug, which is designed for high noise environments.

By Technology

The passive earplugs segment led the earplugs market, capturing 62.3% of the market share in 2024. Passive earplugs are favored for their simplicity, affordability, and broad application, especially in industrial and noisy environments where basic noise blocking is required. Their widespread use in occupational safety continues to support their dominance. However, the active earplugs segment is witnessing a higher growth rate. These earplugs, which feature adaptive noise-canceling technology, are gaining traction in professional and recreational sectors. Their popularity is rising among military personnel, athletes, and travelers seeking enhanced sound control, driving demand for more advanced and customizable solutions.

- For instance, Moldex has pioneered the development of the Moldex Pura-Fit earplugs, which provide consistent and reliable noise reduction for industrial environments.

By Type

The disposable earplugs segment dominated the market in 2024, owing to their high demand in industrial, construction, and manufacturing environments. Disposable earplugs are favored for their hygiene, single-use convenience, and ease of mass distribution, making them ideal for high-risk environments where safety and cleanliness are paramount. This segment’s growth is bolstered by regulations mandating hearing protection in certain workplaces. On the other hand, reusable earplugs are rapidly growing in popularity as consumers seek more sustainable and cost-effective solutions for personal use. Their increasing use in sleep, travel, and recreational activities reflects a shift towards more durable, eco-friendly options.

Key Growth Drivers

Increasing Awareness of Hearing Protection

Heightened awareness of noise‑induced hearing loss is fueling demand in the earplug market. Industrial workers and recreational consumers alike recognise the risk of prolonged exposure to loud environments and are increasingly choosing ear protection. This awareness translates into stronger uptake of earplugs across both workplace and leisure segments. In industrial sectors, safety programmes emphasise hearing conservation, while in consumer markets travel, entertainment and urban noise drive personal usage. As a result, manufacturers can expand their reach beyond traditional occupational applications and capture growth in everyday settings.

- For instance, Peltor, a division of 3M, has designed the Peltor™ ProTac™ III, a line of earmuffs/headsets that combine hearing protection with active listening (level-dependent function), making them popular in environments like shooting ranges, where both noise protection and clear communication are crucial.

Stringent Occupational Safety Regulations

Regulatory frameworks around occupational noise exposure are prompting companies to invest in hearing protection devices, advancing the earplug market. Governments and industries enforce standards requiring protective equipment in construction, manufacturing, mining and oil & gas. Employers increasingly adopt earplugs to comply with mandates, reduce liability and boost worker welfare. This regulatory push generates consistent demand for industrial‑grade earplugs and fosters market stability. Manufacturers benefit from predictable procurement cycles and scale efficiencies, enabling expanded distribution and innovation within regulated industries globally.

- For instance, Honeywell’s Howard Leight brand produces a variety of earplugs that meet OSHA standards for noise reduction, which are used extensively in the manufacturing and construction industries.

Rising Urbanisation and Noise Pollution

Rapid urban growth, greater infrastructure development and workplace mechanisation elevate ambient noise levels in cities and industrial zones, expanding earplug usage beyond traditional settings. Consumers now seek ear protection for sleep, travel, social events and noisy public spaces, broadening market demand. Urbanites value earplugs not just for hearing safety but for comfort and wellness, which drives product diversification. Manufacturers respond with consumer‑friendly designs and reusable solutions tailored for lifestyle use, enabling penetration into non‑industrial segments and unlocking additional growth avenues.

Key Trends & Opportunities

Growth of Reusable and Comfort‑Focused Products

As consumers shift toward reusable earplugs for lifestyle and travel applications, the market sees rising demand for comfort‑oriented, premium materials and ergonomic designs. Silicone and wax materials gain traction because they offer better fit, hygiene and durability compared to traditional foam. This trend opens opportunities for brands to differentiate via premium pricing, sustainability credentials and direct‑to‑consumer channels. Innovations in comfort, custom‑fit capabilities and aesthetics appeal to leisure users and professionals alike, creating new segments and enhancing margin potential in a historically commoditised market.

- For instance, Alpine Hearing Protection’s “Alpine SleepSoft” earplugs are made from a soft, silicone-free thermoplastic material called AlpineThermoShape™ (ATS), designed to use body heat to mold to the shape of the ear for comfort during sleep, catering to consumers seeking noise reduction for a better rest.

Technological Innovation and Smart Earplugs

Technological advancement in earplug design, including active noise‑control, connectivity and acoustic filtering, presents a significant opportunity for market differentiation and value‑added products. Brands target premium users in areas like live events, travel, professional audio and military applications by offering smart earplugs that combine hearing protection with enhanced sound control. Such innovations support greater consumer engagement and justify premium pricing. For manufacturers, this opens new product categories, creates higher barriers to entry for competitors and enables strategic positioning in evolving hearing‑protection ecosystems.

- For instance, Bose has developed the Bose Noise-Masking Sleepbuds, a pair of smart earplugs that combine passive noise blocking with pre-loaded sound masking technology, helping users block disruptive sounds while traveling or sleeping.

Key Challenges

User Compliance and Comfort Issues

A persistent challenge in the earplug market is ensuring consistent usage among end‑users, especially in industrial environments where comfort, fit and convenience matter. If earplugs feel uncomfortable or interfere with communication, users may neglect or avoid them, reducing effectiveness and limiting market penetration. Manufacturers must address ergonomics, sound clarity and user behaviour to overcome this barrier. Failure to deliver comfortable, easy‑to‑use products can hinder uptake in both occupational and consumer settings, particularly where alternative protective solutions exist.

Price Sensitivity and Competitive Pressure

The earplug market faces strong competition from low‑cost alternatives and substitutes, placing pressure on margins and restricting differentiation for basic product lines. Especially in price‑sensitive regions and among commodity disposable offerings, manufacturers struggle to balance cost control with innovation. The abundance of low‑cost players makes it difficult to generate premium pricing or build brand loyalty. To thrive, companies must invest in value‑added features, branding or premium segments, as competing solely on price risks margin erosion and commoditisation.

Regional Analysis

North America

North America holds a significant share of the earplugs market, accounting for 35.2% in 2024. The region benefits from stringent occupational safety regulations, which drive demand for hearing protection devices, particularly in manufacturing, construction, and mining sectors. Additionally, increasing awareness of noise-induced hearing loss in both industrial and recreational environments fuels market growth. Consumer adoption of earplugs for travel and sleep further contributes to the market expansion. The presence of major manufacturers and a strong focus on product innovation and smart earplug technologies support North America’s dominant position in the market.

Europe

Europe is another leading market for earplugs, capturing 28.7% of the global market share in 2024. The region’s strong industrial base and rigorous health and safety standards propel demand for earplugs in occupational settings. Additionally, Europe’s focus on sustainability and environmental concerns drives the demand for reusable and eco-friendly earplugs. Rising urbanisation and noise pollution in cities also contribute to increased adoption of earplugs for personal use. The growing trend of active noise-cancelling earplugs in professional environments, particularly in music and entertainment sectors, creates new opportunities for growth in this region.

Asia-Pacific

Asia-Pacific holds a prominent position in the earplugs market, with a market share of 24.9% in 2024. The region’s rapid industrialisation, coupled with rising noise levels in urban areas, increases the demand for earplugs. Countries like China, India, and Japan experience high growth in both industrial and consumer segments. The expanding middle-class population, increased disposable income, and growing awareness of hearing protection contribute to market growth. The adoption of hearing protection devices in the manufacturing, construction, and transportation industries further supports the market’s expansion in Asia-Pacific, alongside rising interest in personal-use earplugs.

Latin America

Latin America accounts for 6.3% of the global earplugs market in 2024. The market growth in this region is primarily driven by expanding industries in countries like Brazil and Mexico, where industrial activities and noise exposure are prevalent. Occupational safety regulations in these countries are improving, which further boosts the demand for earplugs. Additionally, the rising urbanisation and increased awareness of hearing loss risks are encouraging more consumers to use earplugs for personal use in noisy environments. Growth in recreational activities such as concerts and travel also contributes to the market’s expansion in the region.

Middle East & Africa

The Middle East & Africa region holds a smaller share of the earplugs market, accounting for 5.0% in 2024. However, the region is witnessing steady growth, driven by increased industrial activities, particularly in oil, gas, and construction sectors. The demand for earplugs is rising as health and safety regulations improve in these industries. In addition, growing urbanisation and higher noise levels in cities such as Dubai and Johannesburg are pushing demand for consumer earplugs for sleep, travel, and entertainment. Market expansion in this region is also supported by rising awareness about the importance of hearing protection.

Market Segmentations:

By Material

By Technology

- Active Earplugs

- Passive Earplugs

By Type

By Noise Reduction Rating

- 10 – 20 dB

- 21 – 25 dB

- 26 – 29 dB

- 30 – 33 dB

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The earplugs market is highly competitive, with key players such as 3M, Honeywell International Inc., Moldex-Metric, and UVEX SAFETY GROUP leading the way. These companies dominate the market through strong product portfolios, innovation, and strategic partnerships. 3M, for instance, is known for its wide range of earplugs catering to both industrial and consumer segments, leveraging its well-established brand and extensive distribution networks. Honeywell International Inc. focuses on offering advanced hearing protection solutions, including smart earplugs with noise-canceling capabilities, catering to professional and industrial users. Moldex-Metric and UVEX SAFETY GROUP also remain significant players, known for their high-quality, durable products in industrial settings. Moreover, smaller players such as Loop Earplugs and Hearos are gaining market share by focusing on specialized consumer products, offering comfort and noise reduction for personal use. Competitive strategies include product innovation, mergers, acquisitions, and expanding distribution channels to strengthen market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lucid Hearing Holding Company, LLC

- Honeywell International Inc

- UVEX SAFETY GROUP

- Moldex-Metric

- Radians, Inc.

- Allens Industrial Products

- 3M

- Hearos

- Magid Glove & Safety Manufacturing Company LLC

- Loop Earplugs

Recent Developments

- In October 2024, Loop Earplugs introduced the “Switch 2” model, with enhanced comfort, design improvements and multiple adjustable noise‑cut modes for different environments.

- In October 2023, Loop Earplugs launched its “Switch” 3‑in‑1 earplug product, enabling seamless transitions between social, active and focused noise‑settings.

Report Coverage

The research report offers an in-depth analysis based on Material, Technology, Type, Noise Reduction Rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The earplugs market will expand as industrial noise regulations tighten and personal awareness of hearing health grows.

- Manufacturers will invest heavily in material innovation, improving comfort and custom fit to drive higher consumer adoption.

- Smart earplug technology will become more prevalent, offering active noise reduction and connectivity features to attract premium users.

- Reusable and eco‑friendly earplugs will capture a growing share, responding to sustainability concerns and shifting consumer preferences.

- Emerging markets in Asia‑Pacific and Latin America will experience strong growth due to rapid urbanisation and rising industrial activity.

- Brands will expand online and direct‑to‑consumer channels, improving reach and enabling personalised marketing strategies.

- Industrial applications will remain robust, with construction, manufacturing and oil & gas sectors continuing to demand earplug solutions.

- Lifestyle segments such as travel, concerts and sleep will present new opportunities for earplug usage and marketing.

- Price pressure from low‑cost competitors will force differentiation via premium features and branding rather than cost alone.

- Fit, comfort and user compliance will become critical success factors as manufacturers aim to improve retention and effectiveness.