Market Overview

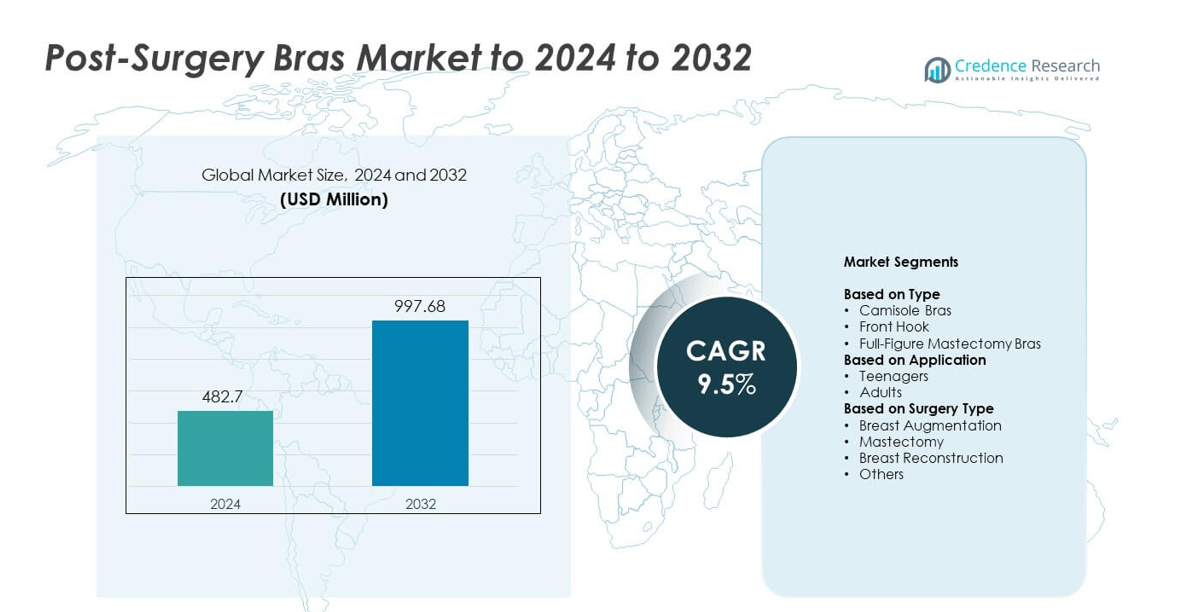

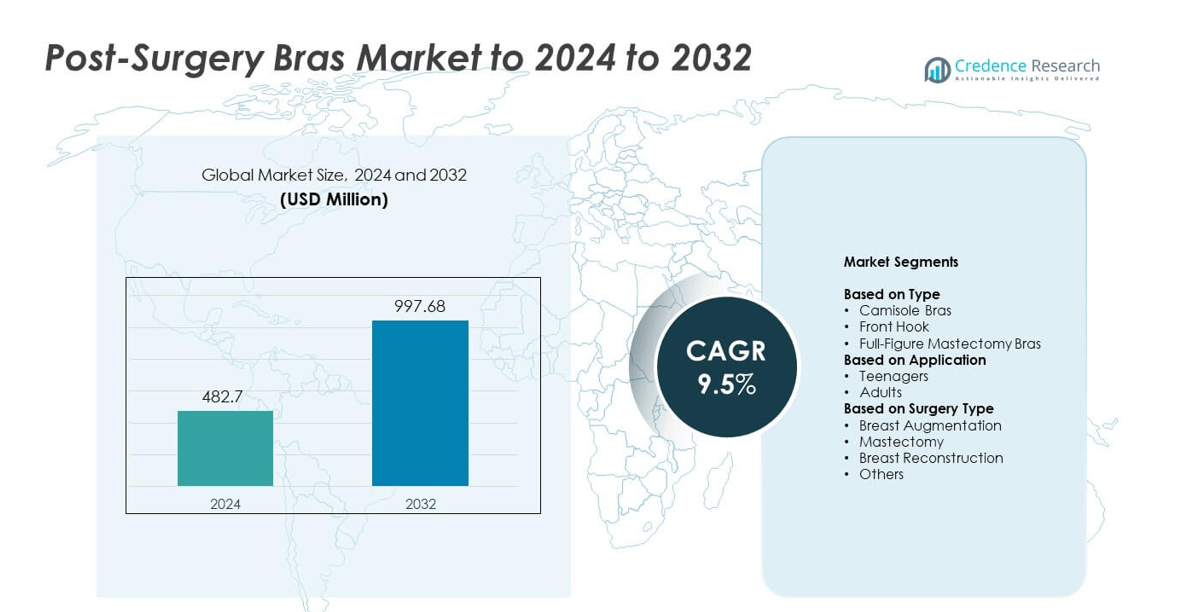

The Post-Surgery Bras Market size was valued at USD 482.7 million in 2024 and is anticipated to reach USD 997.68 million by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Post-Surgery Bras Market Size 2024 |

USD 482.7 million |

| Post-Surgery Bras Market, CAGR |

9.5% |

| Post-Surgery Bras Market Size 2032 |

USD 997.68 million |

The Post-Surgery Bras Market features leading players such as Leonisa, Jodee, Cosmo Lady, HAPARI, Nicola Jane, Anita, Can-Care Pte Ltd, Lands’ End and Amoena, each strengthening their position through medically structured designs and advanced fabric technologies. These companies focus on comfort, targeted compression and adaptive fittings to support recovery after augmentation, mastectomy and reconstruction procedures. North America leads the global market with about 38% share due to high surgical volumes and strong adoption of clinical-grade recovery garments. Europe follows with nearly 29% share, supported by established oncology networks and strong postoperative care standards.

Market Insights

- The Post-Surgery Bras Market reached USD 482.7 million in 2024 and is projected to hit USD 997.68 million by 2032, growing at a CAGR of 9.5%.

- Demand rises as clinical guidelines promote compression-focused bras after augmentation, mastectomy and reconstruction, driving higher adoption across hospitals and specialty retail.

- Trends include wider use of seamless designs, breathable medical fabrics and adjustable front-closure styles that support comfort and improve recovery outcomes.

- Competition strengthens as leading brands expand medically engineered product lines and partner with surgical centers to enhance patient support during healing.

- North America leads with 38% share, followed by Europe at 29% and Asia Pacific at 24%, while camisole bras hold the largest type-share at 41% and breast augmentation leads the surgery segment with 46%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Camisole bras lead this segment with about 41% share in 2024 due to strong comfort demand after procedures that cause chest tightness and skin sensitivity. Users choose camisole designs because the extended fabric panel supports dressings and reduces friction during early healing. Front-hook styles see steady use as surgeons recommend easier fastening for limited arm movement, while full-figure mastectomy bras grow among patients needing wider bands and soft inner pockets. Rising focus on breathable fabrics and seamless construction keeps camisole bras dominant across global recovery care.

- For instance, Anita Dr. Helbig GmbH confirms employing about 1,700 people worldwide across its global production operations, supporting large-scale supply of postoperative bras.

By Application

Adults dominate this segment with nearly 87% share in 2024 because breast surgeries, including augmentation and mastectomy, occur mostly in the adult population. Clinics report higher adoption of structured compression bras among adults seeking faster healing, better implant stabilization and reduced postoperative swelling. Teenagers hold a minor share due to lower surgical frequency, though awareness of corrective reconstruction boosts slow growth. Adult demand remains strong as surgeons recommend medically graded support garments for consistent pressure control and enhanced long-term shaping outcomes.

- For instance, the SIGVARIS Group verifies that it employs more than 1,600 staff worldwide across its global operations, including its production plants in Switzerland, France, Poland, the U.S. (in Peachtree City, Georgia), and Brazil.

By Surgery Type

Breast augmentation holds the largest share at about 46% in 2024, driven by high global procedure volumes and surgeon preference for controlled compression to stabilize implants. Patients choose structured post-surgery bras that limit movement, reduce swelling and improve implant settling. Mastectomy and reconstruction categories grow as cancer treatment centers expand access to soft-lined, pocketed bras designed for prosthesis support. Other procedures such as reduction and corrective symmetry surgeries add moderate demand, but the augmentation segment stays dominant due to rising cosmetic surgery acceptance and improved surgical outcomes.

Key Growth Drivers

Rising global breast surgery volume

Growing demand for cosmetic and reconstructive breast procedures drives steady adoption of post-surgery bras. Higher procedure counts in augmentation, mastectomy and reconstruction increase the need for medically graded support garments that aid healing, reduce swelling and stabilize implants. Hospitals and surgical centers recommend specialized bras as standard postoperative care, which boosts consistent sales. With strong awareness of faster recovery outcomes and physician guidance, the rising global surgery volume remains a primary growth driver for the market.

- For instance, Essity states that it operates around 70 production facilities and employs about 36,000 people, supporting worldwide distribution of medical-grade compression textiles.

Shift toward compression-focused recovery care

Surgeons increasingly emphasize controlled compression to reduce discomfort, limit tissue movement and enhance shaping results after breast procedures. This shift boosts demand for bras engineered with consistent pressure zones, seamless interiors and soft medical-grade fabrics. Patients adopt compression bras to support implants, prevent postoperative fluid buildup and improve long-term aesthetic outcomes. As clinical guidelines highlight the benefits of compression support, the market experiences strong growth from ongoing upgrades in medical recovery protocols.

- For instance, LIPOELASTIC a.s. confirms over 20 years of continuous manufacturing experience in medical compression garments since its establishment in 2002.

Growing preference for comfort and advanced materials

Patients seek bras designed with breathable, hypoallergenic and stretch-balanced fabrics that reduce irritation during healing. Manufacturers introduce moisture-wicking textiles, wide underbands and seamless structures to improve comfort for sensitive postoperative skin. This shift toward high-comfort designs attracts both surgical centers and end users who prioritize faster recovery and reduced friction. The growing preference for premium materials acts as a major growth driver, strengthening product adoption across global recovery markets.

Key Trends and Opportunities

Expansion of mastectomy–focused product lines

Brands expand ranges tailored for mastectomy and reconstruction patients by offering pocketed cups, soft inner linings and adaptive straps. Rising cancer treatment volumes and improved access to reconstruction procedures create strong opportunities for specialized bra designs that support prosthesis use. Many healthcare providers now integrate these bras into post-mastectomy care pathways, boosting visibility. The expansion of mastectomy-focused lines stands as a key trend reshaping product diversification in the market.

- For instance, Amoena confirms global operations in over 70 countries with approximately 400 employees, producing specialized mastectomy and reconstruction support garments.

Increasing adoption of adjustable and front-access designs

Demand grows for front-closure and fully adjustable bras that improve usability for patients with temporary arm mobility limitations. Manufacturers expand offerings with multi-level hooks, extended straps and customizable compression settings to support different recovery stages. These innovations help patients maintain comfort while ensuring surgical sites remain stable. The rising adoption of adjustable and front-access designs remains a key opportunity driven by patient-centered engineering and post-surgery convenience requirements.

- For instance, Wear Ease Inc. is a company headquartered in Boise, Idaho, where it designs and manufactures post-surgical and compression garments for breast and chest surgery recovery. The business was established around the early 2000s, with some sources listing the start date as June 1, 2001, and others indicating 2000.

Integration of digital sizing and personalized fitting

Brands use digital tools and virtual fitting platforms to ensure correct postoperative sizing, which reduces complications and improves healing comfort. Surgical centers collaborate with manufacturers to offer pre-surgery sizing consultations, enhancing patient satisfaction and reducing return rates. Personalized fit recommendations support better compression distribution and long-term shaping outcomes. This integration of digital fitting solutions represents an emerging trend with strong market potential.

Key Challenges

Limited awareness in developing regions

In several emerging markets, patients and clinics have low awareness about the importance of medically structured postoperative bras. Many rely on regular lingerie or basic elastic garments, which reduces compliance with proper recovery protocols. Limited surgeon training and weak retail availability further slow market expansion. This awareness gap remains a key challenge as manufacturers attempt to strengthen penetration in developing healthcare systems.

High product cost and limited reimbursement

Post-surgery bras often use specialized fabrics, medical-grade compression zones and advanced stitching, which raises product cost. In many countries, insurance or public health systems do not cover these purchases, creating a financial burden for patients undergoing expensive surgeries. Limited reimbursement options restrict adoption, especially in low-income groups. This financial barrier stands as a key challenge slowing broader acceptance of medically engineered postoperative bras.

Regional Analysis

North America

North America holds about 38% share in 2024, driven by high surgical volumes and strong adoption of medically graded bras. The region benefits from advanced healthcare systems and broad access to cosmetic and reconstructive procedures. Clinics recommend structured garments that support faster healing and better implant stabilization. Rising reconstruction cases after cancer treatment also increase demand for pocketed and soft-lined designs. Consumer preference for premium, breathable fabrics strengthens retail sales. Growth continues as hospitals integrate post-surgery bras into standard recovery protocols across the United States and Canada.

Europe

Europe accounts for nearly 29% share in 2024 due to strong adoption of compression garments across surgical centers. Growing awareness of medically recommended support bras drives higher compliance among patients. The region sees steady mastectomy and reconstruction procedures supported by well-established oncology networks. Demand rises for seamless, adjustable and hypoallergenic designs suited for sensitive skin. Surgeons widely recommend structured bras for swelling control and shaping stability. Favorable reimbursement for certain reconstruction-related garments in select countries helps expand access, keeping Europe a strong market.

Asia Pacific

Asia Pacific holds around 24% share in 2024, supported by rising cosmetic surgery acceptance across urban populations. Breast augmentation and reconstruction procedures grow quickly, increasing demand for compression-focused recovery wear. Expanding private healthcare facilities improve availability of medically engineered bras. Consumers show growing interest in soft, breathable fabrics suited for warm climates. International brands expand distribution through hospitals and specialty stores. Awareness campaigns on cancer care and reconstruction further support adoption. Rapid urbanization and rising disposable income drive strong future growth in key markets such as China, Japan and India.

Latin America

Latin America represents about 5% share in 2024, shaped by increasing cosmetic surgery trends in countries like Brazil and Mexico. Postoperative care standards improve as clinics promote structured recovery bras for swelling control and implant stability. Demand grows among reconstruction patients who need soft, pocketed garments for prosthesis support. Access remains uneven between major cities and smaller regions, which limits full-scale adoption. Expanding private clinics and rising comfort-driven preferences enhance long-term potential. Growing awareness of medical-grade fabrics contributes to wider acceptance across the region.

Middle East and Africa

Middle East and Africa hold roughly 4% share in 2024, supported by growing investment in private healthcare and rising interest in cosmetic procedures. Uptake increases in major cities where access to specialized surgical centers expands. Patients adopt compression bras to improve postoperative comfort, reduce swelling and support healing. Limited product availability in lower-income areas slows wider adoption. Awareness campaigns on breast cancer recovery help increase use of mastectomy and reconstruction-focused bras. As healthcare infrastructure improves, the region shows steady but gradual market growth.

Market Segmentations:

By Type

- Camisole Bras

- Front Hook

- Full-Figure Mastectomy Bras

By Application

By Surgery Type

- Breast Augmentation

- Mastectomy

- Breast Reconstruction

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Post-Surgery Bras Market features key players such as Leonisa, Jodee, Cosmo Lady, HAPARI, Nicola Jane, Anita, Can-Care Pte Ltd, Lands’ End and Amoena. Companies compete by expanding medically engineered designs that improve compression control, comfort and postoperative usability. Manufacturers focus on seamless interiors, soft fabrics and adjustable structures tailored for different recovery stages. Many brands invest in advanced materials that reduce friction and support sensitive skin. Hospitals and surgical centers increasingly partner with suppliers offering clinically tested garments, strengthening their presence in professional care channels. Digital fitting tools, broader size ranges and patient-centric product lines help brands differentiate as demand grows for reliable recovery support solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Nicola Jane held a customer “Empowerment Day” in the UK where attendees previewed brand-new pieces from the upcoming 2025 post-surgery lingerie and swimwear collection, focused on comfort and confidence after breast cancer surgery.

- In 2023, Amoena completed its CuraLymph lymph-care range by adding CuraLymph Compression products, including specially designed bras with wide padded straps and soft finishes to support lymph flow after breast surgery.

- In 2023, Anita Care added new “Crystal” and “Sky Gray” fashion colors to its bestselling Lynn and Lotta pocketed mastectomy bras, keeping these front-closure recovery styles current while preserving post-surgery fit and comfort features.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Surgery Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as breast augmentation, mastectomy and reconstruction procedures increase worldwide.

- Demand will rise for compression-focused bras that support faster healing and implant stability.

- Manufacturers will adopt advanced, breathable and hypoallergenic materials to improve comfort.

- Digital sizing tools and virtual fitting support will enhance personalized postoperative care.

- Mastectomy-focused designs with pocketed and soft-lined interiors will see wider adoption.

- Front-closure and adjustable bras will gain traction due to easier usability during recovery.

- Hospitals will integrate medically graded bras into standard postoperative protocols more consistently.

- Premium and seamless construction styles will expand in both hospital and retail channels.

- Awareness programs in emerging markets will boost patient education and product compliance.

- Growing oncology care networks will increase demand for specialized bras for reconstruction patients.